Best Copy Trading Platforms In UAE

Copy trading lets you automatically replicate the trades of experienced traders in your account. We tested copy trading platforms available to UAE traders, evaluating the number of signal providers, platform accessibility, spreads, execution speeds, and integration with tools like MetaTrader Signals, MQL5, and social trading features.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

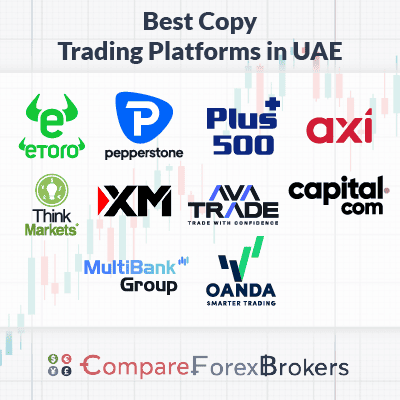

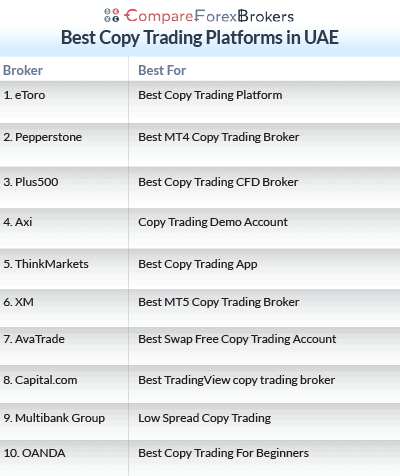

Best Copy Trading Platforms

- eToro - Best Copy Trading Platform

- Pepperstone - Top MT4 Copy Trading Broker

- Plus500 - Best Copy Trading CFD Broker

- Axi - Great Copy Trading Demo Account

- ThinkMarkets - Good Copy Trading App

- XM - Top MT5 Copy Trading Broker

- AvaTrade - Great Swap Free Copy Trading Account

- Capital.com - Best TradingView Copy Trading Broker

- MultiBank Group - Low Spread Copy Trading

- OANDA - Good Copy Trading For Beginners

What is the best broker for copy trading in the UAE?

eToro is the best copy trading broker in the UAE with over 30 million registered users, providing transparent performance data including monthly returns, maximum drawdowns, and win rates across over 2 million verified trader portfolios. Other copy trading platforms were shortlisted based on strategy diversity, performance transparency, and risk management controls for portfolio copying

1. eToro - Best Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

eToro delivers the most comprehensive copy trading experience through their web-based CopyTrader platform. You get access to over 2 million copy traders with verified performance statistics showing monthly returns, maximum drawdown percentages, win rates, average holding periods, and preferred assets before you allocate funds.

The platform lets you copy multiple traders simultaneously, diversifying your strategy across scalpers targeting 10-pip moves, swing traders holding positions for days, and long-term investors building portfolios.

You trade 68 forex pairs and 200+ crypto CFDs – the largest crypto selection among UAE brokers – with spreads around 1.0 pips EUR/USD, 2.0 pips GBP/USD, 1.0 pips AUD/USD.

eToro is ADGM-regulated with 130ms execution speeds and $100 minimum deposit. The social feeds show what 30 million registered users are buying, selling, and discussing in real-time, providing market sentiment insights. CopyPortfolios use AI algorithms to create diversified portfolios automatically.

Pros & Cons

- 30 million users providing trader selection

- CopyTrader with verified performance stats

- 200+ crypto CFDs (largest selection)

- CopyPortfolios with AI diversification

- Social feeds showing real-time activity

- Web-based platform

- ADGM regulation

- No MT4/MT5 platform support

- Spreads wider

- Proprietary platform only

- $100 minimum deposit

- Copy trading dependent on trader performance

- Withdrawal fees charged

Broker Details

CopyTrader Platform and Verified Statistics

eToro’s CopyTrader platform displays comprehensive statistics for each trader before you commit funds. You see verified monthly returns showing exactly how much each trader made or lost over the past 12 months, with red months clearly marked alongside green profitable periods.

Maximum drawdown percentages tell you the largest peak-to-valley decline each trader experienced. You might see one trader with 40% drawdown generating 80% annual returns, while another shows 10% drawdown with 30% returns – helping you decide whether you want aggressive growth or steadier performance.

Win rate displays what percentage of trades close profitably. Average holding period shows whether traders close positions within hours, exit by session end, or hold for days or weeks, helping you match copy traders to your preferred timeframe.

Risk score rates each trader from 1-10 based on leverage usage, position sizing, and volatility of returns. Lower scores (1-3) indicate conservative trading with lower leverage, mid-range scores (4-6) show moderate risk, while high scores (7-10) signal aggressive strategies using maximum leverage and accepting larger drawdowns.

Social Feeds and Market Sentiment

The social feeds show what 30 million users are discussing in real-time – when EUR/USD breaks above 1.1000, you see hundreds of posts analysing whether the breakout holds or fails. During Federal Reserve announcements, the feed fills with reactions helping you gauge market sentiment.

You follow specific traders reading their market analysis, trade rationales, and economic commentary. Top traders explain why they’re buying gold during geopolitical tensions or shorting GBP/USD ahead of Bank of England decisions, teaching you fundamental analysis through their reasoning rather than just copying positions blindly.

The newsfeed aggregates major economic releases, earnings announcements, and geopolitical events with community discussions attached. You see how experienced traders interpret NFP beats, inflation surprises, or central bank rate decisions, learning to connect economic data to price movements.

CopyPortfolios and Diversification

CopyPortfolios combine multiple top traders into single investment products managed by eToro’s algorithms. The “Top Trader” portfolio allocates your funds across 20-30 consistently profitable traders, automatically rebalancing monthly as performance changes. The “Crypto” portfolio focuses on traders specialising in Bitcoin, Ethereum, and altcoin CFDs.

Market-based CopyPortfolios group assets by sector or theme – the “Tech Giants” portfolio holds positions in Apple, Microsoft, Google, Amazon, and Tesla, while the “Gold & Precious Metals” portfolio concentrates on XAU/USD, silver, and mining stocks. These portfolios rebalance automatically maintaining target allocations as prices shift.

You invest in CopyPortfolios with single clicks, allocating $1,000 or $5,000 rather than manually copying 20 individual traders and managing each separately. The AI algorithms handle position sizing, risk balancing, and trader replacement when performance deteriorates, removing the active management burden.

2. Pepperstone - Best MT4 Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone provides the best MT4 copy trading experience through MetaTrader Signals integrated directly into the platform – you browse over 5,500 signal providers, analyse their performance statistics, and subscribe to copy their trades without downloading third-party software or managing separate accounts.

The Razor account delivers raw spreads from 0.10 pips EUR/USD with $3.50 commission per side and 77ms execution speeds – the fastest we tested among DFSA brokers – ensuring your copied trades execute at nearly identical prices as the signal provider rather than suffering slippage that erodes returns.

You can access MT4 Signals for manual traders or automated Expert Advisors, giving you flexibility to copy discretionary strategies or algorithmic systems.

Pepperstone is DFSA-regulated with $0 minimum deposit across 94 currency pairs and 44 crypto CFDs. The broker achieved a 98/100 rating in our testing for excellent trading services and low costs. You maintain full control over risk parameters, setting maximum lot sizes, stop-loss distances, and capital allocation per signal provider.

Pros & Cons

- 5,500+ MT4 signal providers available

- Ultra-tight spreads from 0.10 pips

- 77ms execution speeds

- Integrated directly in MT4 platform

- $0 minimum deposit

- DFSA regulation

- Copy manual traders or EAs

- Must keep MT4 running to copy trades

- Signal providers may charge subscription fees

- Some providers require minimum account sizes

- Limited to MT4 platform for copy trading

- No guaranteed stop-loss orders

Broker Details

MT4 Signals Integration and Provider Selection

MetaTrader Signals integrates directly into your MT4 platform under the “Signals” tab showing thousands of providers with detailed performance analytics updated after each trade.

You filter by growth percentage showing cumulative returns since inception, maximum drawdown revealing largest peak-to-valley declines, and trading style differentiating scalpers executing 50+ trades daily from swing traders holding positions for weeks.

The platform displays verified trading history showing every trade the signal provider took including entry prices, exit prices, profit/loss, and duration.

Each provider shows their trading approach – some manually analyse charts and fundamentals while others run Expert Advisors automating strategies.

Manual traders often provide market commentary explaining why they bought EUR/USD at 1.0950 support or shorted GBP/USD after dovish Bank of England comments, teaching you analysis skills. EA providers offer consistent execution following programmed rules without emotional interference.

Execution Speeds and Slippage Minimization

Pepperstone’s 77ms execution speeds matter enormously for copy trading because delays between the signal provider’s execution and your account’s mirrored trade directly impact returns.

The Razor account’s 0.10 pip raw spreads with $3.50 commission ($7 round-turn) keeps costs minimal when copying high-frequency traders executing 10-20 trades daily. Over 200 monthly trades, tight spreads save you $400-$600 versus brokers charging 1.5 pip spreads, significantly improving copy trading profitability.

The Standard account offers simpler 1.10 pip spreads with zero commission if you’re copying longer-term swing traders making 3-5 trades weekly where spread differences matter less than execution reliability. You avoid calculating commission costs per trade, keeping math straightforward when tracking copied performance.

Risk Management and Capital Allocation

MT4 Signals lets you set maximum lot sizes preventing signal providers from overleveraging your account – if the provider trades 10 lots on their $100,000 account and you set 0.1 lots maximum on your $5,000 account, your risk stays proportional.

You can pause copying instantly when market conditions turn volatile or the provider enters a drawdown period.

Stop-loss customisation adds your own protective stops beyond the signal provider’s settings. If they use 50-pip stops but you prefer tighter 30-pip risk, your positions close at 30 pips protecting capital even when the provider holds longer. This prevents scenarios where aggressive signal providers blow up your account chasing losing trades.

The platform shows real-time profit/loss for copied positions, total gains/losses from the signal subscription, and percentage returns comparing your account’s performance to the provider’s verified results. You track whether slippage, spread differences, or subscription fees erode the provider’s advertised returns, making informed decisions whether to continue or switch providers.

3. Plus500 - Best Copy Trading CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1.0

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

Plus500 doesn’t offer traditional copy trading like eToro or MT4 Signals, but excels as a CFD broker with 2,401 instruments and customisable trading alerts. You set price alerts when EUR/USD reaches key levels or crude oil breaks $80, following experienced traders’ publicly shared ideas and executing similar positions when alerts trigger.

The platform offers guaranteed stop-loss orders protecting positions from slippage across all CFD markets – during flash crashes or weekend gaps when regular stops slip 20+ pips, GSLO closes at your exact specified price.

Spreads start from 0.8 pips with zero commission across 78 forex pairs, 1622 shares, 43 indices, 30 commodities, 23 cryptocurrencies, 480 options, and 125 ETFs. Plus500 is regulated by both DFSA and SCA with $100 minimum deposit and 24/7 customer service.

Pros & Cons

- 2,401 instruments for diverse strategies

- Guaranteed stop-loss orders

- Price alerts for manual “copying”

- Zero commission (spread-only)

- DFSA and SCA dual regulation

- 24/7 customer service

- No automated copy trading

- Manual execution required

- $100 minimum deposit

- No MT4/MT5 platform

4. Axi - Best Copy Trading Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

Axi provides the best forex demo accounts for testing copy trading strategies with realistic conditions matching live execution. The demo shows the same 0.1 pips EUR/USD, 0.2 pips GBP/USD, 0.2 pips AUD/USD spreads you’ll see in the live Pro account with $3.50 commission, avoiding sanitised demo fills that create unrealistic expectations.

You can test MT4 Signals with virtual funds, validating signal provider performance before risking real capital. The 90ms execution speeds work across 72 currency pairs and 37 crypto CFDs. Axi is DFSA-regulated with $0 minimum deposit on live accounts, 30:1 retail leverage and 400:1 professional. The demo account never expires and mirrors live conditions helping you understand how copy trading performs during volatile sessions when spreads widen.

Pros & Cons

- Realistic demo matching live conditions

- Test MT4 Signals risk-free

- 90ms execution speeds

- 72 forex pairs, 37 crypto CFDs

- $0 minimum deposit live accounts

- DFSA regulated

- Demo limitations vs live experience

- Must transition to live for real returns

- Standard account 0.7 pips wider

- Only MT4 platform available

5. ThinkMarkets - Best Copy Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets’ ThinkTrader mobile app lets you monitor copy trading performance on the go with multi-screen charts, market scanners, real-time alerts, and position management directly from your phone. The app handles serious trading rather than just basic monitoring.

You get commission-free trading with spreads from 1.10 pips EUR/USD, 1.30 pips GBP/USD, 1.10 pips AUD/USD across 43 forex pairs, thousands of share CFDs, and 19+ crypto CFDs. The broker is DFSA-regulated with $0 minimum deposit and 161ms execution speeds. Push notifications alert you when copied trades open or close, keeping you informed without constantly checking screens.

ThinkMarkets offers 30:1 retail leverage and 500:1 professional, with swap-free Islamic accounts available. The app also provides daily trading signals helping you identify opportunities.

Pros & Cons

- ThinkTrader app for mobile monitoring

- Multi-screen charts on mobile

- Push notifications for trade updates

- Commission-free trading

- TradingView integration

- $0 minimum deposit

- DFSA regulated

- No MT4/MT5 in UAE entity

- 161ms execution slower

- Limited crypto CFDs (19+)

- 43 forex pairs (smaller selection)

6. XM - Best MT5 Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM provides MT5 copy trading through MQL5 Signals with 21 timeframes versus MT4’s 9 options, 38 technical indicators versus 30, and multi-threaded backtesting using all CPU cores simultaneously for faster strategy optimization. You can copy traders using advanced MT5 features unavailable on MT4.

You trade 55 forex pairs with spreads from 0.2 pips EUR/USD, 0.5 pips GBP/USD, 0.8 pips AUD/USD in the XM Zero account with $3.50 commission, or 1.6/1.8/2.3 pips Standard with zero commissions. The $5 minimum deposit is the lowest among UAE brokers, letting you test copy trading with minimal capital risk.

XM is DFSA-regulated with 148ms execution speeds, 30:1 retail leverage and 400:1 professional. The XM App integrates TradingView charts directly, and the broker offers swap-free Islamic accounts without additional fees.

Pros & Cons

- MT5 with 21 timeframes, 38 indicators

- MQL5 Signals integration

- $5 minimum deposit (lowest)

- XM App with TradingView

- Swap-free Islamic accounts

- DFSA regulated

- 148ms execution slower

- No crypto CFDs available

- 55 forex pairs (limited selection)

- High inactivity fee after 1 year

7. AvaTrade - Best Swap Free Copy Trading Account

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade offers swap free brokers for copy trading, letting you hold copied positions up to 5 days without overnight interest charges violating Shariah principles. Positions held longer incur administrative fees, so this works for copying short-term swing traders.

You access MQL5 Signals on MT4 and MT5 platforms copying traders across 53 forex pairs, 36 indices, 19 commodities, 62 ETFs, and 27 crypto CFDs. AvaTrade is ADGM-regulated with fixed spreads of 0.8 pips EUR/USD, 1.2 pips GBP/USD, 0.9 pips AUD/USD – the spreads stay constant during volatile markets when variable spreads widen.

The $100 minimum deposit is reasonable with 160ms execution speeds, 30:1 retail leverage and 400:1 professional. AvaSocial combines social features with copy trading, letting you follow and copy experienced traders while maintaining strong regulatory oversight.

Pros & Cons

- MQL5 Signals on MT4/MT5

- AvaSocial for social copy trading

- Fixed spreads provide certainty

- Four platforms available

- Islamic positions limited to 5 days

- $100 minimum deposit

- 160ms execution slower

- Fixed spreads higher than ECN (0.8 pips)

- Inactivity and currency conversion fees

8. Capital.com - Best TradingView Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

Why We Recommend Capital.com

Capital.com integrates TradingView directly with 0.60 pips spreads and zero commission, giving you professional charting with 100+ indicators for analysing signal providers’ strategies. You can follow traders sharing ideas on TradingView’s social network with millions of users, manually copying their positions when your alerts trigger.

The AI-powered risk management system analyses your trading patterns and alerts you to overtrading, excessive risk per position, or revenge trading after losses – behavioural issues that destroy copy trading accounts.

Capital.com is SCA-regulated with 141ms execution speeds, $20 minimum deposit, and 300:1 leverage for both retail and professional accounts – significantly higher than DFSA brokers capped at 30:1 retail. The platform supports AED as account currency, eliminating conversion fees for UAE traders.

Pros & Cons

- TradingView integration built-in

- AI risk management alerts

- 0.60 pips, zero commission

- 300:1 leverage available

- Supports AED currency

- SCA regulation

- No automated copy trading

- Manual execution required

- Spread-only pricing (no raw)

- $20 minimum deposit

9. Multibank Group - Low Spread Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.5

AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why We Recommend Multibank Group

Multibank Group delivers the lowest spread copy trading costs with $3.00 commission per side versus the $3.50 industry standard, saving you $1.00 per round-turn. Raw spreads start from 0.1 pips EUR/USD, 0.5 pips GBP/USD, 0.4 pips AUD/USD – when copying high-frequency signal providers executing 20+ trades daily, these savings compound.

The broker offers MT4 and MT5 platforms with MultiBank Social Trading features, plus 40 forex pairs, 23 indices, 14,000 share CFDs (the largest range among UAE brokers), 4 precious metals, 5 energies, and 11 crypto CFDs.

Multibank is SCA-regulated offering 20:1 retail leverage and 500:1 for professional traders with $50 minimum deposit. The broker provides 15 educational courses helping you understand copy trading strategies.

Pros & Cons

- $3.00 commission (lower than standard)

- 0.1 pips raw spreads

- 14,000 share CFDs available

- MT4 and MT5 support

- 500:1 professional leverage

- SCA regulation

- 20:1 retail leverage only

- $50 minimum deposit

- Execution speeds not disclosed

- Inactivity fee charged

10. OANDA - Best Copy Trading For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.89 GBP/USD = 1.54 AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA suits beginners exploring copy trading through their commission-free structure with 0.89 pips EUR/USD, 1.54 pips GBP/USD, 1.37 pips AUD/USD – one simple number per pair representing total costs without calculating separate commission fees.

The FxTrade platform provides guaranteed stop-loss orders protecting copied positions from slippage during volatile sessions when markets gap overnight or during flash crashes.

The Trading Academy provides structured courses helping you understand how to evaluate signal providers, manage copy trading risk, and set appropriate capital allocation before committing funds. Automated execution in copy trading helps reduce emotional bias, which is a major challenge if you’re a new trader.

Pros & Cons

- Commission-free, simple pricing

- Guaranteed stop-loss orders

- $0 minimum deposit

- Multiple regulatory oversight

- Trading Academy for learning

- 68 currency pairs

- No MT4 Signals support

- 0.89 pips wider than ECN

- Limited copy trading platforms

- Only 4 crypto CFDs

Ask an Expert