Best Gold Trading Platforms in the UAE

Gold trading offers unique opportunities for portfolio diversification and inflation protection. We tested UAE-regulated brokers to find which platforms deliver the best conditions for trading XAU/USD, spot gold, gold futures, and gold ETFs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Best Gold Trading Platforms in the UAE

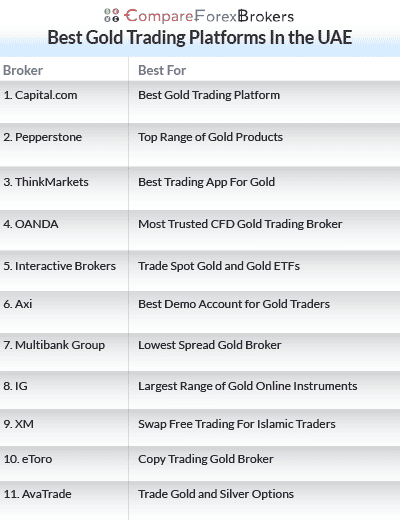

- Capital.com - Best Gold Trading Platform

- Pepperstone - Top Range of Gold Products

- ThinkMarkets - Best Trading App For Gold

- OANDA - Most Trusted CFD Gold Trading Broker

- Interactive Brokers - Trade Spot Gold And Gold ETFs

- Axi - Best Demo Account For Gold Traders

- Multibank Group - Lowest Spread Gold Broker

- IG Group - Largest Range Of Gold Online Instruments

- XM - Swap Free Trading For Islamic Traders

- eToro - Copy Trading Gold Broker

- AvaTrade - Trade Gold and Silver Options

What is the best gold trading broker in the UAE?

Capital.com is the best gold trading broker in the UAE, offering guaranteed stop-loss orders protecting you from slippage during volatile price swings. You get 0.6 pip spreads with zero commission and AI-powered insights helping identify opportunities. The broker provides 300:1 leverage via SCA regulation across 4,500 markets.

1. Capital.com - Best Gold Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

Why We Recommend Capital.com

I recommend Capital.com for their guaranteed stop-loss orders (GSLO) that eliminate slippage when gold gaps overnight or during major news events. A GSLO will ensures your position will close at the exact specified price regardless of market conditions. To use the GLSO, you will need to use Capital.com in-house developed web platform or mobile app and a small premium of 0.03% but this cost is only applied if the GSLO is put into action. The Capital.com platform also comes with top level charts and AI-Powered risk management tools making it a great choice for both analytical minded traders and new traders.

Gold spread start from 0.9 pip and have zero commission, making costs transparent and predictable. Capital.com’s SCA regulation provides 100:1 leverage versus the 20:1 DFSA limit, letting you control larger positions with less margin. Other platforms available for trading include MT4, MT5, and TradingView.

Pros & Cons

- Guaranteed stop-loss orders (GSLO) prevent slippage

- 0.9 pip gold spreads, zero commission

- 100:1 leverage gold via SCA regulation

- 4,500 markets across all asset classes

- AI risk management on proprietary platforms

- $0 minimum deposit, free deposits/withdrawals

- No raw spread ECN account option

- Single account tier

- GSLO only available on Capital.com platforms

- Professional account requires €500K portfolio

Broker Details

Trading Platforms

You trade across five platforms with different strengths. MT4 and MT5 suit automated trading with Expert Advisors and technical indicator customisation. TradingView provides advanced charting with 100+ indicators, social features, and Pine Script for custom tools. The last platform is their signature platform called Capital.com Trading platform and is a great choice for new traders.

Capital.coms Trading Platform includes A Guaranteed Stop-Loss Protection and AI Tools

The main platform in the brokers offering is their proprietary web and mobile platforms which offers guaranteed stop-loss feature plus AI risk alerts, it also comes with 100 technical indicators and 90+ smart drawing tools. The mobile app maintains full functionality, including charting, order management, and account monitoring.

If you use Capital.com’s proprietary platform, you can protect your gold positions from price gaps that may occur with weekend news, or central bank surprises. Regular stops become market orders during gaps resulting in slippage, but GSLOs execute at your exact price regardless of market conditions. To use the GSLO, you set your stop out level when you open your gold positions and if prices gap over your stop level, you exit at your specified price rather than wherever the market opens. To use the GSLO, you will pay a 0.03% premium, but this is only applied if the GSLO is activated.

The retail account provides $0 minimum deposit with 100:1 leverage through SCA regulation. Professional accounts require verification but maintain the same leverage and account structure.

AI-Powered Trading Insights

Capital.com’s proprietary platforms include AI-driven risk management analysing your trading behaviour in real time. The system alerts you to overtrading, revenge trading after losses, or excessive position sizing that exceeds safe risk parameters for your account balance.

You receive mobile notifications when the AI detects behaviorural patterns that typically lead to losses. The system tracks your win rates, average gains versus losses, maximum consecutive losses, and position hold times.

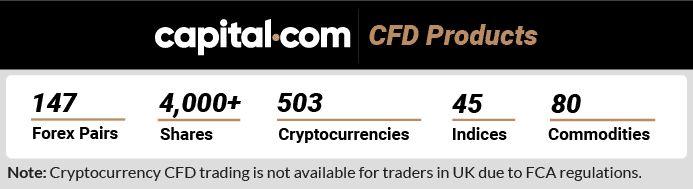

Beyond gold, you access 4,500 markets including 147 forex pairs, 5,527 share CFDs across global exchanges, 45 indices, 83 commodities covering metals, energies and agriculture, and 503 cryptocurrencies. This multi-asset coverage lets you build diversified portfolios or correlate gold movements with dollar strength, equity sentiment, or crude oil prices.

The platform supports multiple funding methods with free deposits and withdrawals. Customer service operates 24/7 via email, phone, chat, support center, and ticketing system.

Commission-free trading

Capital.com charges zero commissions on gold CFDs, forex, cryptos, or any other instruments, your only cost is the variable spread. Spreads on XAU/USD start from 0.30 pips and 0.6 pips for Silver. You can use leverage up to 100:1 for UAE traders under the SCA regulation. Should you trade Forex, spreads start from 0.6 pips also with 100:1 leverage.

| Instrument | Spread | Instrument | Spread |

|---|---|---|---|

| Gold | 0.3/30 | EUR/USD | 0.6 |

| Silver | 0.6/60 | AUD/USD | 0.6 |

| Platinum | 0.7/70 | GBP/USD | 0.13 |

| Palldium | 0.5/50 | Oil - Brent | 0.45 |

| Oil - Crude | 0.5/50 | Gas | 0.5/50 |

The minimum deposit is 80 AED for cards or 100 AED for LEAN transfers with no deposit or withdrawal fees. Their customer support runs 24/7 with Arabic language support available from their UAE office, which is helpful if you have an enquiry or need help urgently.

Great range of products

Beyond gold you can choose from 147 currency pair pairs which is one of the largest I’ve tested. Capital.com also gives you access to a massive 503 cryptocurrency CFDs including Bitcoin, Ethereum, and Ripple for trading alongside your gold positions. Other products include 4000+ shares, 45 indices and 80 other types of commodities including metals and energies.

2. Pepperstone - Top Range of Gold Products

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

I recommend Pepperstone for ultra-tight spreads from 0.0 pips on major pairs through the Razor Account with $3.50 per side commission, combined with 77ms execution speeds on gold trades.

You access multiple gold instruments including spot XAU/USD CFDs, gold futures, and gold ETF CFDs across four professional platforms. Pepperstone offers MT4 with Smart Trader Tools, MT5, cTrader with Level II pricing, and TradingView integration. You can trade 1,475 instruments with zero minimum deposit, accessing the top forex broker in the UAE for comprehensive precious metals coverage.

Pros & Cons

- RawForex spreads from 0.0 pips, $3.50 commission per side

- Five platforms: MT4, MT5, cTrader, TradingView, Pepperstone App

- 77ms execution speeds

- Multiple gold products: spot, futures, ETFs

- 1,475 instruments across all asset classes

- $0 minimum deposit

- Standard Account spreads start at 1.0 pips

- Commission-based pricing on Razor/Pro accounts

- Cannot fund directly with AED

- No guaranteed stop-loss orders

Broker Details

Ultra-Tight Gold Spreads and Fast Execution

The 77ms execution speeds matter when trading gold breakouts or key support and resistance levels. Pepperstone routes orders through Equinix data centers in New York, London, and Tokyo for direct market access without dealer intervention.

Gold leverage for retail traders can be up to 100:1, while Forex can be up to 20:1 for major pairs.. Active Trader Program participants get the ability to trade with leverage up to 500:1 and the added benefit of volume discounts reducing commission costs further as your monthly trading increases. All accounts support hedging, scalping, and automated Expert Advisors without strategy restrictions.

Comprehensive Platform Selection

MT4 includes Smart Trader Tools with Mini Terminal for one-click order management across multiple gold positions from a single interface. The Correlation Matrix displays real-time relationships between gold and currency pairs like EUR/USD, GBP/USD, and USD/JPY, showing when dollar strength drives gold lower or risk-off sentiment pushes both gold and yen higher.

MT5 provides 38 technical indicators versus MT4’s 30, expands timeframes to 21 options including 2-hour, 3-hour, and 8-hour charts, and includes an integrated Economic Calendar displaying scheduled FOMC meetings, NFP releases, and CPI announcements with historical impact data. You set alerts for high-impact events that spike gold volatility.

cTrader specialises in algorithmic trading with cTrader Automate for building custom robots using C# code. The platform displays Level II pricing showing full market depth with bid and ask volumes at each price level. You backtest strategies across historical gold data and forward-test on demo accounts before deploying live.

TradingView integration delivers 100+ indicators, Pine Script for creating custom analysis tools, and social features for sharing strategies with the trading community. The Pepperstone Trading Platform app provides mobile trading with full charting capabilities.

Multiple Gold Products

You trade spot gold CFDs (XAU/USD) for intraday speculation, gold futures for longer-term positions with set expiry dates, and gold ETF CFDs for exposure to physical gold without managing storage. Pepperstone offers 1,475 instruments total including 93 forex pairs, 1,162 share CFDs, 26 indices, 40 commodities covering precious metals like silver and platinum plus energies and agriculture, and 31 cryptocurrency CFDs.

| Instrument | Min Spread / AVG | Instrument | Min Spread / AVG |

|---|---|---|---|

| Gold | 0.5 / 0.15 | Gasoline | 3 / 3 |

| Silver | 0.016 / 0.02 | NatGas | 0.3 / 0.5 |

| Platinum | 1 / 3.91 | Brent | 2 / 2.5 |

| Palldium | 3.85 / 5.06 | Crude | 2 / 2.4 |

| Oil - Crude | 2 / 2.4 | Coffee | 3 / 3 |

The 93 forex pairs let you correlate gold with currency trends. Gold typically moves inverse to USD strength, so monitoring EUR/USD, GBP/USD, or DXY dollar index helps predict gold direction. Access to major, minor, and exotic pairs gives you complete forex market coverage.

When trading forex Pepperstone’s Razor Account delivers raw spreads from 0.0 pips on major pairs with $3.50 commission per side. If you prefer to not pay commissions, the Standard Account offers 1.0 pip spreads however your overall cost will be slightly higher..

| Instrument | Min Spread / AVG | Instrument | Min Spread / AVG |

|---|---|---|---|

| AUD/USD | 0 / 0.1 Razor 1 /1.1 Standard | BTC/EUR | 87.6 / 124.69 |

| EUR/USD | 0 / 0.1 Razor 1 / 1.1 Standard | ETH/USD | 2 / 2.74 |

| GBP/USD | 0/ 0.3 Razor 1 / 1.1 Standard | ETHEUR | 4.68 / 6.04 |

| USD/CAD | 0.1 / 0.4 Razor 1 / 1.1/ Standard | AUD200 | 1 / 1.6 |

| BTC/USD | 14 / 25.24 | UK100 | 1 / 1.4 |

Share CFDs include gold mining stocks like Newmont and Barrick Gold that amplify gold price movements. Miners often move 2-3x the percentage changes in gold itself. You build portfolios combining physical gold CFDs, mining stock CFDs, and currency positions for comprehensive precious metals strategies.

3. ThinkMarkets - Best Trading App For Gold

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

I recommend ThinkMarkets for their proprietary ThinkTrader app with 65 technical indicators, nine chart types including Heikin Ashi and Renko, and one-tap execution. With this app you get push notifications 15 minutes before major data releases like NFP and FOMC decisions, helping you prepare for volatility along with other tools like TrendRisk Scanner, Traders’ Gym and Signal Centre.

The ThinkTrader Account offers spreads from 0.6 pips on gold with zero commission and $50 minimum deposit. You access 42 forex pairs with 16 majors, 18 minors, and 8 exotics, plus 2,700+ stock CFDs across global excha3nges, 22 indices, 9 commodities including 6 metals and 3 energy products, and 19+ crypto CFDs.

ThinkMarkets integrates TradingView charts directly in the mobile app, and you can also access the best forex trading app with full desktop-level charting on your phone. The platform provides 24/7 multilingual customer support and educational resources including a Trading Academy with articles for beginners and experienced traders, financial events coverage, videos, and a trading glossary.

Pros & Cons

- 65 indicators on mobile with full charting

- Push notifications 15 minutes before events

- TradingView integration on mobile

- 2,700+ stock CFDs across global exchanges

- Zero commission on ThinkTrader Account

- 24/7 multilingual support

- No MT4/MT5 in UAE entity

- ThinkTrader Account: 0.6 pips spreads

- Offshore accounts not UAE-regulated

- $50 minimum deposit

4. OANDA - Most Trusted CFD Gold Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.89

GBP/USD = 1.54

AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

I recommend OANDA for their FxTrade platform that integrates TradingView charts directly for professional technical analysis without switching applications. You get commission-free gold trading with competitive spreads and guaranteed stop-loss orders (with premium) protecting positions from slippage during volatile movements.

The Trading Academy provides structured learning paths progressing from basics through advanced strategies, with educational content integrated into live market examples. You access the best CFD trading platform in the UAE with paper trading functionality mirroring live conditions exactly, helping you validate gold strategies before risking capital.

OANDA supports 68 forex pairs with algorithmic order execution through their API, trailing stops, and advanced order types. Funding and withdrawals are free with $0 minimum deposit requirement.

Pros & Cons

- FxTrade with integrated TradingView charts

- Commission-free trading

- Guaranteed stop-loss orders available

- Structured Trading Academy

- $0 minimum deposit

- No raw spread ECN pricing

- Standard spreads wider than ECN brokers

- Limited to MT4 and FxTrade (no MT5, cTrader)

- Educational resources focus on forex

5. Interactive Brokers - Trade Spot Gold And Gold ETFs

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

I recommend Interactive Brokers for combining gold trading with actual stock ownership rather than CFDs. You access 167 stock exchanges globally including gold mining stocks, plus the best forex and stock trading platform with comprehensive investment products.

Interactive Brokers offers IBKR Pro and IBKR LITE accounts. The tiered commission structure rewards volume with rates ranging from 0.20 basis points (Tier I) down to 0.08 basis points (Tier IV) as monthly trading volume exceeds $5 billion.

Trading platforms include IBKR Desktop with complete functionality, IBKR Mobile for on-the-go trading, Trader Workstation (TWS) for advanced analysis with all products, IBKR GlobalTrader for shares trading, and FX Trader for currencies.

Education resources include IBKR Campus with 16+ lessons in stocks, 7+ in options, 6+ in futures, 5+ in bonds, and other trading products, plus Traders’ Academy with 12 topics, Traders’ Insight, and IBKR Podcasts.

Pros & Cons

- Real stock ownership on 167 exchanges

- Tiered commissions decrease with volume

- Access to bonds, 42,000+ mutual funds, ETFs

- Multiple platforms: TWS, Mobile, GlobalTrader

- iBKR Campus education

- Steep learning curve

- Complex tiered commission structure

- Higher minimum deposits required

- Wire transfer deposit fees

6. Axi - Best Demo Account For Gold Traders

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

I recommend Axi for their unlimited demo account with prices that match live conditions. To trade gold average spreads are around 13c vs USD with no commissions but you can also trade vs AUD, GBP, EUR and CHF You test the best forex demo account using MetaTrader 4 and there are no time limits or expiry dates with this demo account.

Outside Gold, there is the Pro Account for Forex trading which offers 0.0 pip spreads with $3.50 per side commission, while the Standard Account provides 0.6 pip spreads with zero commission. Leverage with these accounts can be up to 30:1. Axi offers access to 82 Forex pairs, 4 Metals (bullion) in addition to gold), 9 Commodities, 30 Indices: 31 Cryptocurrencies: 31 and over 100 Share CFDs.

Axi provides MT4 with NexGen enhancements including advanced order management, correlation matrices, and sentiment indicators. The MT4 platform includes Autochartist pattern recognition identifying technical setups automatically across your watchlist. Educational resources cover a free eBook, Axi Academy, MT4 Video Tutorials, and comprehensive trading education.

Pros & Cons

- Pro Account: 0.0 pips with $3.50 commission

- 90ms execution speeds

- Unlimited demo with multiple sub-accounts

- Autochartist pattern recognition

- MT4 NexGen enhancement

- MT4 only (no MT5, cTrader, TradingView)

- Elite requires $500 minimum

- Limited educational resources

7. MultiBank Group - Lowest Spread Gold Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.5

AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why We Recommend MultiBank Group

I recommend MultiBank Group as one of the lowest-spread brokers for gold trading in the UAE, with ECN pricing from 0.02 points on XAU/USD and a $3.00 round-turn commission, which is roughly half what many ECN brokers charge. Traders also gain access to 14,000 share CFDs, including gold mining stocks, and up to 500:1 leverage under SCA regulation.

MultiBank offers three account types. The Standard account features spreads from 1.5 pips with no commission and a $50 minimum deposit. The Pro account reduces spreads to 0.8 pips, also commission-free, with a $1,000 minimum.

The ECN account is designed for active and gold-focused traders, offering spreads from 0.02 (on gold) with a $1.50 per side commission and a $10,000 minimum deposit. 500:1 leverage is available on the ECN account, while Standard and Pro accounts are capped at 20:1 retail leverage.

Across all accounts, you can trade 40 forex pairs, 23 indices, 14,000 share CFDs (the largest range among UAE brokers), 4 precious metals, 5 energy markets, and 11 cryptocurrency CFDs. The MultiBank-Plus app includes five-level market depth, integrated social trading, and free VPS hosting for automated strategies.

Education is extensive, with 15 structured courses covering Introduction (6 lessons), Learn the Basics (6), Trading Terms (5), Advanced Trading (7), Economics (6), ECN trading (4), plus MetaTrader tutorials (5 desktop and 6 mobile lessons) and 9 downloadable ebooks.

Pros & Cons

- $3.00 round-turn commission

- 14,000 share CFDs, 40 forex pairs

- 500:1 leverage via SCA regulation

- MultiBank-Plus App with VPS

- 20% deposit bonus up to $40,000

- 15 educational courses

- ECN requires $10,000 minimum

- Standard Account 1.5 pip spreads

- Limited crypto CFDs (11 only)

- No Islamic account option

8. IG Group - Largest Range Of Gold Online Instruments

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

I recommend IG Group for its extensive range of gold trading products, including spot gold, gold futures, gold options, and gold-related indices, with competitive, transparent pricing that closely tracks global gold markets. You typically pay spreads from around 0.3 points on spot gold, making IG well suited if you trade gold frequently and value tight pricing with reliable execution.

You can trade gold using IG’s proprietary web-based platform, MetaTrader 4, ProRealTime for advanced technical analysis, and TradingView integration, giving you flexibility to analyse gold prices with institutional-grade charting, custom indicators, and automated strategies. Futures and options are priced directly from the underlying exchanges, while spot gold CFDs use spread-based pricing.

You also gain access to broad commodities coverage beyond gold, including precious metals, energies, and agricultural markets, supported by professional research, real-time news, and education focused on key gold drivers such as inflation, interest rates, and central bank demand.

Pros & Cons

- Multiple gold instruments: spot, futures, options, indices

- Professional-grade trading platforms

- Decades of regulatory oversight globally

- Comprehensive market research and analysis

- Educational resources for commodities trading

- Higher minimum deposits than competitors

- Complex product range may overwhelm beginners

- Premium pricing structure

- Limited information on UAE-specific offerings

9. XM - Swap Free Trading For Islamic Traders

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

I recommend XM for swap-free Islamic accounts with zero overnight interest charges on gold positions. The XM App integrates TradingView charts directly for professional analysis on mobile, and you access both MT4 and MT5 platforms.

You start trading with $5 minimum deposit, the lowest among UAE brokers. XM offers three account types: Standard with 1.6 pips EUR/USD spreads and zero commission, Ultra Low with 0.8 pips and $1.60 commission, and Professional requiring verification. The accounts provide maximum leverage of 1000:1 USD/JPY, 1000:1 EUR/USD, and 500:1 for gold.

You trade 55 forex pairs, 1262 stock CFDs across global exchanges, 27 commodities including 11 futures and 23 cash instruments, 34 equity indices, and 8 thematic indices. XM provides comprehensive education through educational videos, webinars, and live education sessions.

Funding works via verified account using AE numbers, with deposit methods including international wire transfer for debit cards and Ultra Low Standard accounts showing 0.00 USD on system screenshots.

Pros & Cons

- Swap-free Islamic accounts

- $5 minimum deposit (lowest)

- MT4 and MT5 platforms

- XM App with TradingView integration

- 55 forex pairs, 27 commodities

- 148ms execution slower

- No crypto CFDs

- High inactivity fee after 1 year

- Limited forex pair selection

10. eToro - Copy Trading Gold Broker

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

I recommend eToro for copy trading experienced gold traders with verified performance statistics showing their monthly returns, maximum drawdowns, win rates, and trading history. You browse thousands of traders and allocate funds to automatically mirror their gold positions in real time.

The CopyTrader platform shows each trader’s asset allocation, average holding periods, and risk scores from 1-10 before you commit capital. You diversify by copying multiple traders simultaneously, splitting your account across scalpers, swing traders, and long-term investors with different gold strategies.

eToro provides 130 crypto assets (the largest crypto selection), 36 indices, 932 ETFs, and 65 currencies for portfolio diversification beyond gold. The social feeds show what 30 million users are buying and discussing, providing market sentiment insights during gold volatility.

You start with $100 minimum deposit and get a free $100,000 virtual account to test copy trading strategies.

Pros & Cons

- CopyTrader with verified stats

- 30 million users providing selection

- 932 ETFs (largest selection)

- Social feeds showing activity

- Web-based platform

- ADGM regulation

- No MT4/MT5 support

- Spreads wider than ECN (1.0+ pips)

- Proprietary platform only

- $100 minimum deposit

11. AvaTrade - Trade Gold and Silver Options

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

I recommend AvaTrade for trading 44 forex options plus gold and silver options, giving you defined-risk strategies unavailable at most UAE brokers. Automatic Islamic accounts for UAE residents eliminate swap fees for up to 5 days.

If using the AvaTradeGo or AvaOptions apps, AvaProtect insurance is available, letting you protect losing positions up to $50,000 for a premium of 3-10% based on trade duration. Other trading tools available include MT4 and MT5 mobile app along with AvaSocial copy trading and ZuluTrade integration.

Spreads with AvaTrade strart from 0.8 pips EUR/USD and the Professional account providing 0.6 pips with $1.60 commission if you meet qualification criteria. You trade 53 forex pairs, 36 indices, 19 commodities, 62 ETFs, and 27 crypto CFDs with 30:1 retail leverage and 400:1 professional leverage through ADGM regulation.

Pros & Cons

- 44 forex options, gold/silver options

- Automatic Islamic for UAE residents

- AvaProtect insurance for positions

- Multiple platforms: MT4, MT5, AvaOptions

- AvaSocial copy trading

- Islamic: swap fees after 5 days

- $100 minimum deposit

- 30:1 retail leverage (ADGM)

- Professional account requires qualification