8 Best Forex Brokers in the USA for 2025

I compared all the forex brokers regulated by the USA’s two financial governing bodies – the CFTC and NFA. My aim was to find the best forex brokers in the USA for 2025. Trading conditions and fees primarily drove my rankings, followed by platform features and ease of trading.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Forex trading in the USA is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These organizations set strict rules and regulations to protect traders and ensure the market’s integrity.

Here are the best forex brokers for U.S. traders in 2025:

- OANDA - Best Forex Broker For U.S. Traders Overall

- FOREX.com - Top Forex Broker with the Lowest Spreads

- Tastyfx - Best Forex Brokers For Beginners

- Interactive Brokers - Top Broker For Low Trading Fees

- Charles Schwab - Good Broker For Customer Support

- Nadex - Great FX Broker For Options Trading

- Trading.com - Best MT5 Broker

- eToro - Best Copy Trading Broker

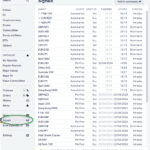

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

|

Read review ›

Read review ›

|

71 | NFA/CFTC | - | - | - | $6.00 | 1.2 | 1.9 | 1.4 |

|

|

|

174ms | $450 | 80+ (Spot) | - | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

50 | NFA/CFTC | - | - | - | - | 1.2 | 1.8 | 1.2 |

|

|

||||||||

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Who Are The Best Forex Brokers In The U.S. For 2025?

I have tested U.S.-regulated forex brokers according to their trading conditions, costs, range of markets, and variety of platforms. The 8 brokers I have included in this list performed well in each of these categories, and also offer unique features for different trading styles.

1. OANDA - Best Forex Broker For U.S. Traders

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 0.9 AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

I rated OANDA as my highest-scoring U.S. forex broker, giving it 91/100. The broker provides some of the lowest spreads available – averaging 1.12 pips with no commissions. This is combined with fast execution speeds of sub 90ms, acheiving industry-leading trading conditions in the U.S..

OANDA also scored highly because it is one of the most trusted brokers of any I tested. It holds 10 regulatory licenses, and boasts 25+ years of industry experience.

You can trade on 3 platforms – including MT4 and TradingView. The broker offers solid premium trading tools across each platform, as well as a VPS service, and trading signals through Autochartist.

Pros & Cons

- Advanced charting with TradingView

- Tight spreads with Standard account

- Elite Trader program with volume-based rebates

- Customer support is only 24/5

- Withdrawal and inactivity fees

- No price alerts on the OANDA Trade platform

Broker Details

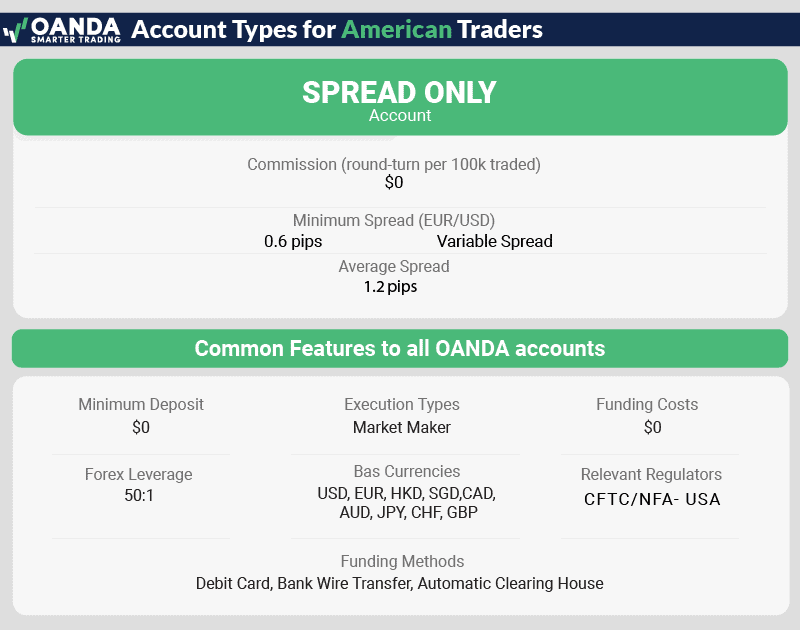

Best Spread Only Account With Low Fees

Across my time trading with OANDA, I found their EUR/USD spreads to be some of the most stable. I frequently clocked 1.40 to 1.50 pip spreads on this pair, which is very competitive for U.S. brokers.

Other brokers tested – such as Charles Schwab – exhibited quite a lot of drift in their spreads. This can be both frustrating and expensive for you as a trader.

| Broker | EUR/USD Spreads |

|---|---|

| OANDA | 1.40 |

| Tasyfx | 0.80 |

| eToro | 1 pip |

| Trading.com | 1.20 |

| Forex.com | 1.4 |

| Charles Schwab | 1.4 |

There are no minimum deposit requirements, so you can get started with as much or as little as you like. With leverage of up to 1:50, OANDA lets you open trades with just a 2% margin – or just $20 on a micro-lot of EUR/USD.

Fast Execution Speeds For Excellent Trading Conditions

Our analyst, Ross Collins, also tested the broker’s execution speeds against other U.S. brokers. OANDA was the fastest thanks to its Market Maker model, clocking in at 84 ms for market orders and 86 ms for limit orders.

| Broker | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|

| OANDA | 86 | 84 |

| FOREX.com | 98 | 88 |

| Trading.com | 114 | 138 |

| TastyFx (IG) | 174 | 141 |

Fast execution speeds are a must for me, so OANDA performing well in the tests made it a strong contender for best forex broker in the U.S. The quicker your orders execute, the less chance for slippage. You also get to avoid requotes, which can save you a lot of money.

Most Trusted Broker In 2025

During my broker review, I found OANDA was the most regulated forex broker, with 10 licenses across multiple jurisdictions. Although only the CFTC/NFA license will protect you in the U.S., it’s still good to see regulation from other Tier-1 regulators like ASIC (Australia) or the FCA (UK).

The broker has been providing online trading services since 1996. With almost 30 years of industry experience, it is evident that OANDA’s services are robust.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

2. FOREX.com - Top Broker With MT4

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.6 AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

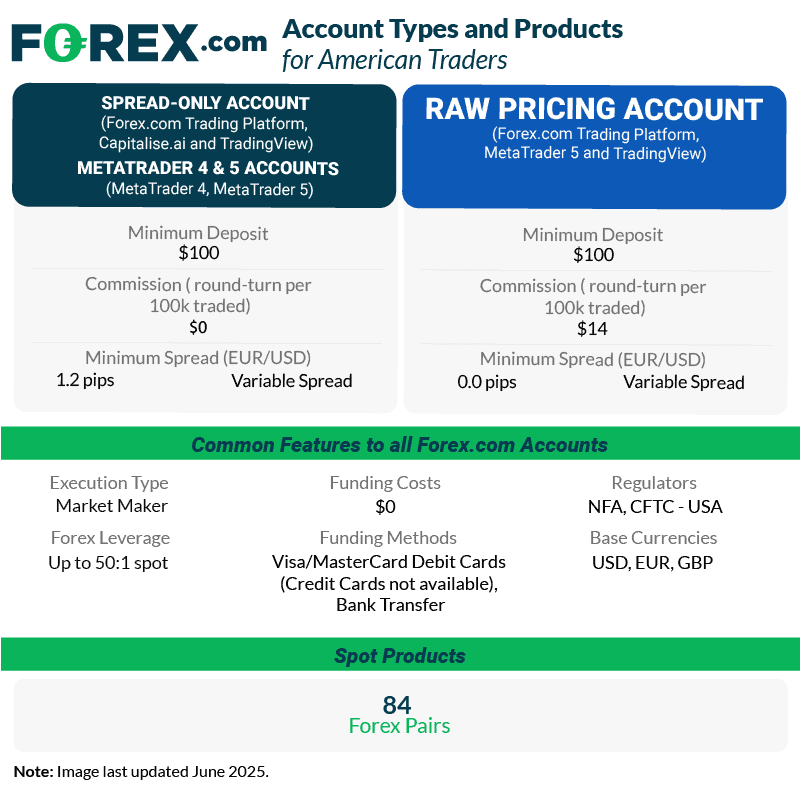

FOREX.com is my top pick if you want the tightest spreads, as its Raw account offers zero pip spreads plus commissions across its major pairs. The broker lets you trade more than 84 forex pairs and other instruments through its futures markets. These include crypto, commodities, and stock indices – a solid multi-asset experience.

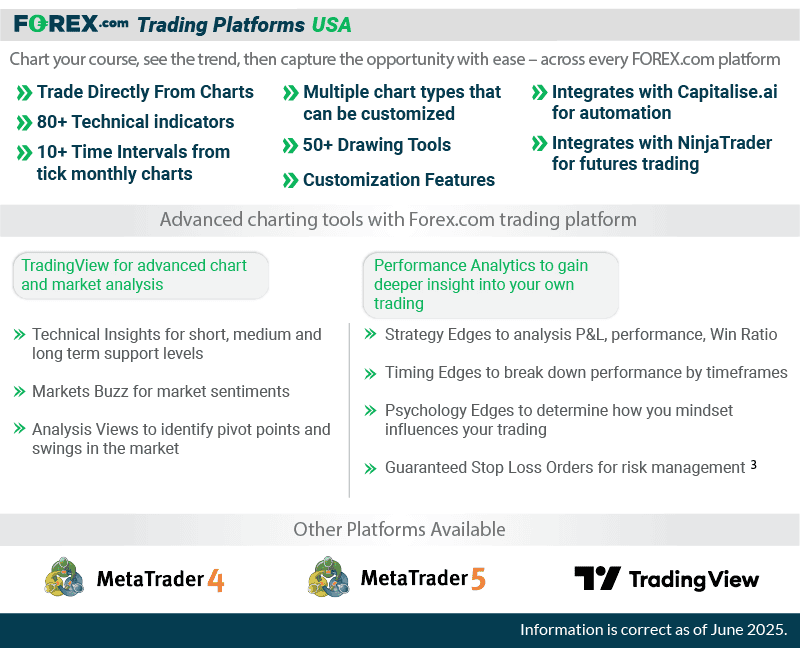

The broker supports the best collection of trading platforms I saw in the industry. You can trade on MT4, MT5, TradingView, and NinjaTrader, as well as FOREX.com’s own platform. This makes it highly likely that your favorite platform is supported.

Pros & Cons

- Access to deep liquidity for tight spreads

- A more comprehensive range of financial markets to trade – including stocks and futures

- Excellent educational resources

- Required minimum deposit – $100

- Demo account expires after 90 days (MT demos – 30 days)

- No copy trading or social trading

Broker Details

FOREX.com Has The Tightest Spreads With Raw Account

FOREX.com offers some of the tightest spreads through its Raw account. The broker advertises zero pip spreads on a lot of pairs, and I found this to be true in many cases.

On the EUR/USD, USD/JPY, and GBP/USD pairs, for example, I kept on finding these zero pip spreads.

Other pairs, like EUR/USD, average around 0.1 pips, while the AUD/USD and EUR/GBP pairs seem to start at 0.1 pips. These are all extremely competitive, and translate to some of the lowest costs in the industry.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

I find the Raw account is a top option for scalpers. You’re targeting minute price movements over a short timeframe, so you need those low spreads.

The slight drawback of the Raw account is its commission. You’ll pay $7.00 per lot traded, or $14 round-trade, which is quite a lot more than the industry average.

Alternatively, you can trade with no commissions using their Spread-only account. However, these accounts offer much wider spreads, starting from 1.40 pips on the EUR/USD pair.

As you can see, this is going to cost you a lot more on the spread, so you’ll need to analyze your own trading plan to decide which is worth more to you – zero-commissions, or tight spreads?

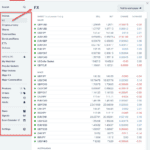

Excellent Range of Financial Markets

FOREX.com provides a multi-asset experience, allowing you to trade over 2,500+ markets. These include spot forex pairs, as well as stocks or indices, commodities, and crypto futures.

This makes the broker decent for day trading as you can trade all of these markets from a single account, allowing you to capture intraday volatility easily.

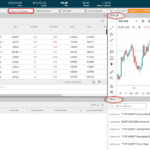

Trade with TradingView with FOREX.com

FOREX.com provides the most trading platform options of any broker I looked at. You’ve got their own Forex.com platform, as well as MT4, MT5, NinjaTrader, and TradingView – there’s basically a platform for every trading style.

TradingView platform is my top choice for technical analysis, thanks to its market screeners and 100+ indicators.

If you want to automate your trades, MT4 and MT5 are the best options, thanks to their Expert Advisor (EA) trading bots. You can also use Capitalise.ai to transform your manual strategies to automated ones using AI, meaning no coding knowledge, making forex automation more accessible for all.

FOREX.com stands out amongst the lowest spread US forex brokers for the variety of trading products available in the US, with nine major currency pairs, plus gold and silver and index futures.

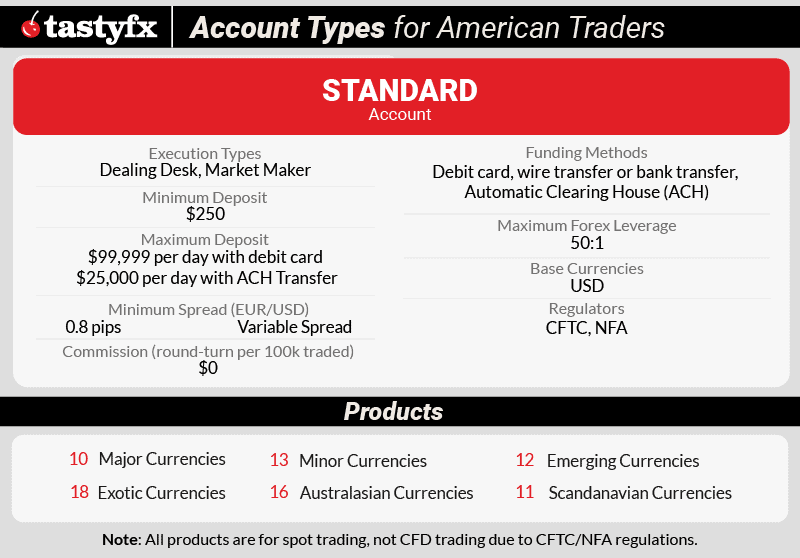

3. Tastyfx - Best Forex Brokers For Beginners

Forex Panel Score

Average Spread

EUR/USD 1.13 GBP/USD = 1.66 AUD/USD = 1.01

Trading Platforms

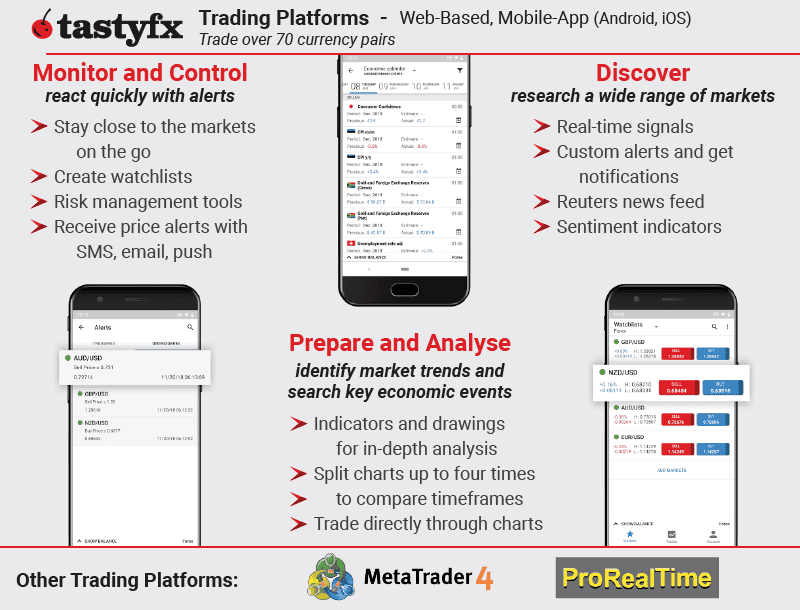

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

Tastyfx is my top choice for beginner forex traders thanks to its easy-to-open trading account, low spreads and solid customer support.

Standard spreads start at 0.80 pips, while the customer support is 24/7 – two of the most impressive showings in each category.

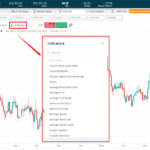

Out of the 4 platforms available, Tastyfx’s proprietary option is the best for beginners thanks to its user-friendly design. Despite the intuitive interface, the platform is still advanced enough to perform solid technical analysis through its 25+ indicators.

There are 20+ online lessons available on the platform, and a strong Signal Centre – I found this to be plenty of educational resources as you learn how to trade.

Pros & Cons

- Top-Tier Platforms and Tools

- Competitive trading costs

- Great customer support

- Limited forex pairs on MetaTrader 4

- No MetaTrader 5

- Has a minimum deposit

Broker Details

Beginner-Friendly Trading Account

I found Tastyfx’s Standard account easy to open, thanks to clear instructions across its multi-step application process. You also get access to excellent customer support, both during and after opening your account. There is a low minimum deposit too, at just $100 – a lower barrier to entry for new traders.

The spreads on the account are solid, averaging 0.80 pips for EUR/USD during the New York sessions. This should offer excellent value for beginners, with low spreads and no commissions.

This spread covers all your trading costs, so it simplifies your fees into one payment. With other brokers, payment structures are more complex, as they charge commissions and spreads.

Tastyfx Trading Platform Is Best For New Traders

Tasyfx Trading Platform is the broker’s proprietary option. I felt that it ticked all the boxes that most look for when they consider beginner platforms.

The interface is clear and easy to navigate, with on-chart trading and easy access to watchlists. The 25+ trading indicators like Ichimoku clouds or MACDs are great tools for high-quality technical analysis.

A feature that stands out to me is the Signal Centre, which provides automated trade alerts across the broker’s 80+ forex pairs. You can utilize this feature to learn how to trade in real-time, supported by market commentary and screenshots of the signal in action.

Tastyfx offers alternative platforms like MT4, TradingView, and ProRealTime. All have demo accounts, so you can try each one to find the platform that suits you best.

Top Educational Resources

Tastyfx has a solid selection of 20+ online lessons. I’m a big fan of anything that helps beginners learn the basics of forex trading and then progress to more advanced strategies.

Understanding risk management and building winning trading strategies are very important for me, and I was impressed that Tastyfx supports you as you do both.

I found these lessons were packed with information, and complete with excellent images to support each topic. However, I wish they provided videos for each lesson, as this can help improve knowledge retention in my opinion.

You can practice your trades with the Tastyfx demo trading account. Here, you’ll get $10,000 in virtual funds, offering a risk-free trading environment for learning.

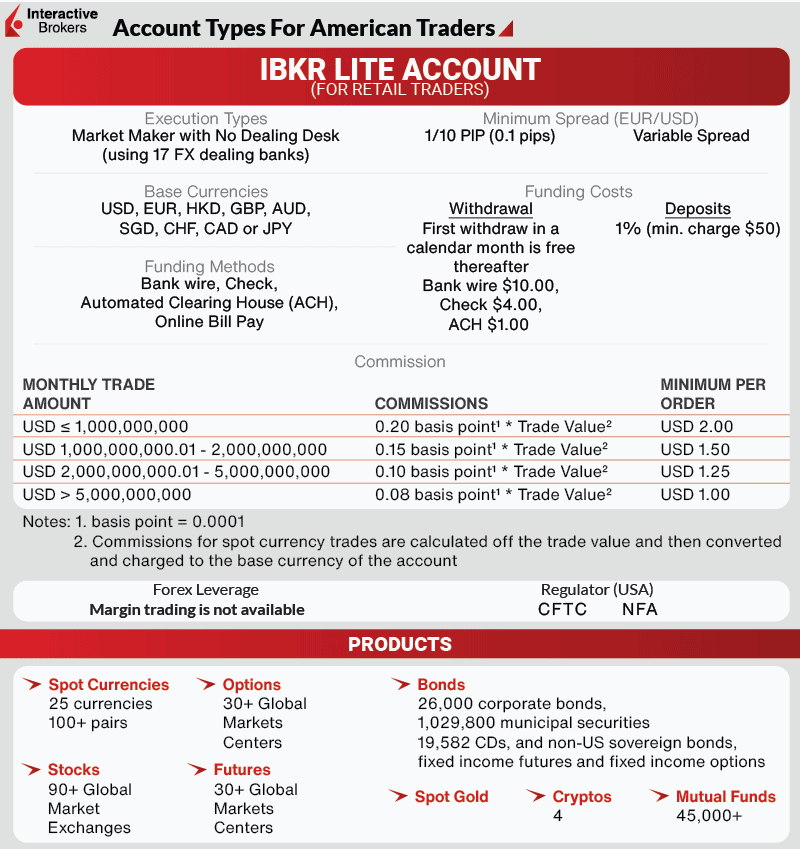

4. Interactive Brokers - Top Broker For Low Trading Fees

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

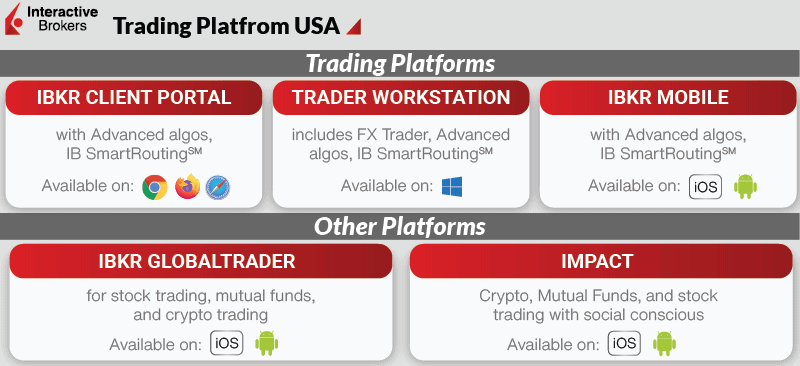

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Broker’s commissions are the lowest I tested, starting from $2.00 per lot. And that’s before the volume-based discounts kick in, which can reduce the costs even more.

I recommend the broker to anyone who trades with position sizes higher than 1 lot. This is because Interactive Brokers has a minimum charge of $2.00 for all position sizes – so larger trades are cheap, while smaller trades are relatively expensive.

The broker’s spreads are tight – starting from 0.1 pips – which makes it the best trading account for experienced traders in my opinion. You have access to professional market research with Zacks and Morningstar.

This helps to generate new trading ideas, which you can deploy across the broker’s 50,000+ markets (including 80+ forex pairs).

Pros & Cons

- Excellent selection of products for US clients, including stocks and ETFs

- Access to a network of deep liquidity providers

- Low commissions and tight spreads

- Complicated trading account structure

- Not suitable for those new to online trading

- Fee calculations are hard to understand

Broker Details

Low Commission Accounts

Out of the U.S. brokers I tested, Interactive Brokers provided me with the cheapest monthly trading volume-based commissions. The most expensive commission on forex is $2.00 per lot, which works out more than 70% cheaper than Forex.com’s Raw account and its $7 per lot.

| Broker | USD |

|---|---|

| Tastyfx (IG) | $6.00 |

| FOREX.com | $7.00 |

These commissions present a huge saving, regardless of whether you trade once a week or once an hour. However, they are most beneficial for high-volume traders, particularly scalping and algo traders. Spreads on forex instruments start from 0.10 pips, which matches Forex.com.

Interactive Brokers applies a minimum trading commission of $2.00, so you’ll pay this even if you are trading in micro lots. While this commission is very good on full-lot positions, you might find it a little expensive on these smaller lot sizes.

Largest Range of Financial Markets

When opening your IBKR account, you’ll realize just how many markets are available on Interactive Brokers. You can trade with 50,000+ financial instruments across 150 markets – more than OANDA, Forex.com, Trading.com, and Tastyfx combined.

The markets available include 80+ spot forex pairs, stocks, ETFs, warrants, options, futures, cryptocurrencies, commodities, and mutual funds. In other words, this is the most diverse range out of any of the brokers I tested.

Professional Research and Trading Tools

I used the IBKR Trade Workstation while testing and found the interface a little overloaded at first. While I was able to improve the trading environmnet after I customized it, I’d say the platform is not beginner-friendly.

It does have solid technical indicators, especially volume-based ones like VWAP and volume profiles. You won’t easily find these on other platforms, like MT4.

The broker gives access to top research companies such as Morningstar and Zacks for free, providing excellent fundamental and technical research within the platform.

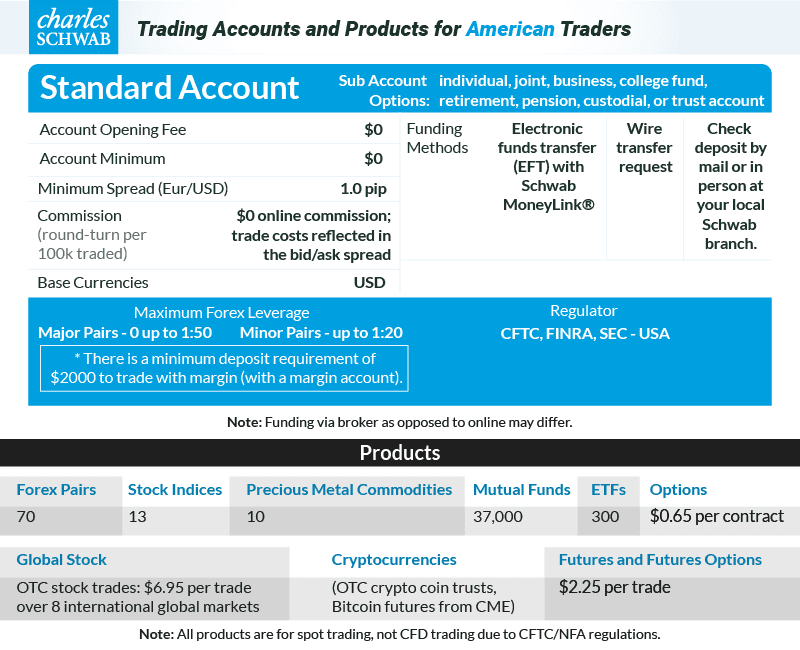

5. Charles Schwab - Good Broker For Customer Support

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

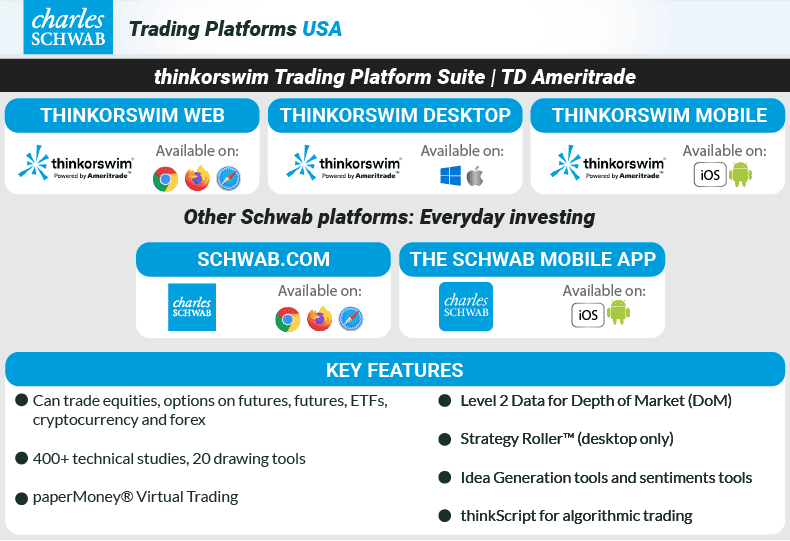

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

I chose Charles Schwab because it has a specialist customer service that focuses purely on forex trading. You also have a Trade Desk where you can discuss your trade ideas with the broker’s analysts.

Customer service is available 24/7, which is more coverage than most brokers offer. The Trade Desk is open 24/5 – weekdays only.

We’re focusing on forex here, so it’s important to mention the broker offers more than 80 currency pairs. Beyond this, you’ve got more than 60,000 markets, including crypto and stocks. Thinkorswim is my choice of platform as it provides a nice charting experience with 400+ technical indicators – more than Schwab’s proprietary platform.

Pros & Cons

- Most extensive range of trading products of any of the regulated forex brokers

- Easy-to-use trading platform

- Excellent forex-focused customer support

- Average trading fees

- Limited account funding options

- High trading account funding fee

Broker Details

Schwab Has Great Customer Support

Charles Schwab is one of the largest financial service providers in America, with 34.8 million brokerage accounts and $8.52 trillion in client assets under management. This makes sense, as I have found that Schwab is one of the best options around for customer support.

Because Schwab is such a big company, they are able to offer forex trading through their own entity – Charles Schwab Futures and Forex LLC.). This means they can provide their own forex specialists to answer your questions.

I found the level of knowledge and quality of the responses to be higher than I’d expect from most forex brokers. You can even talk through your trade idea with their experts if you want.

Like all the best brokers, Schwab offers 24/5 phone service for their Trade Desk, where you’ll find help with trading ideas or technical support. There’s also 24/7 support through live chat, but this won’t connect you to the Trade Desk.

Thinkorswim Is A Solid All-rounder Platform

You have only two trading platform options: the Schwab platform, and Thinkorswim. I find Thinkorswim to be pretty similar to MT4.

If you want to trade forex, Thinkorswim is the better option of the two. It offers more than 400 indicators, including options like Pivot Points and Fibonacci Retracement tools. This makes it a solid choice for technical analysis.

Similar to MT4’s Expert Advisors, Thinkorswim has thinkScript that allows you to automate your trading strategies. I actually found thinkScript easier to use than the Expert Advisors, as you can build your strategy, step by step, without learning how to code .

Trade Over 60,000 Markets With Schwab

Charles Schwab’s range of more than 60,000 markets is the largest I found in the US. You gain access to all of these financial instrument types within just a single account. Interestingly, I found that they don’t offer UK/EU/ or Asian stocks, which is a negative.

That said, Schwab gives you more than 65 forex pairs for spot trading, and you can access multiple futures markets on instruments like crypto and stock indices.

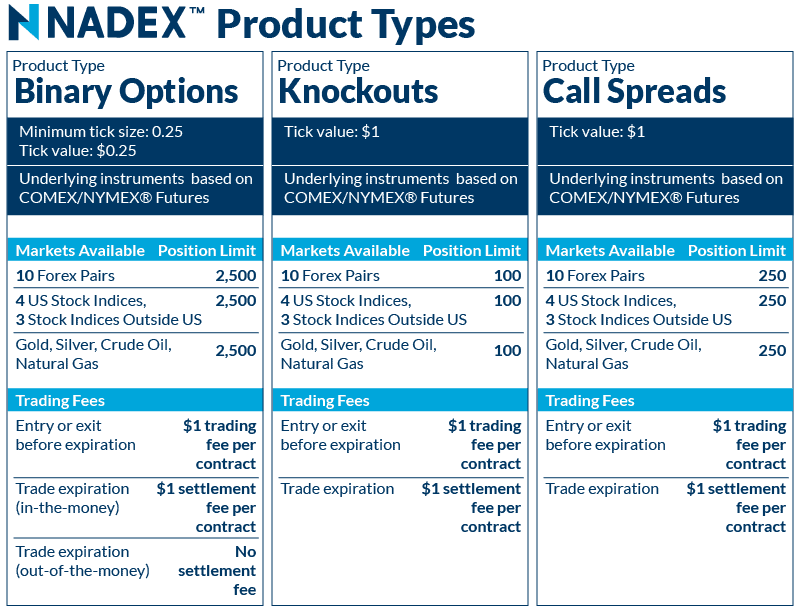

6. NADEX - Great FX Broker For Options Trading

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

NADEX Trading Platform

Minimum Deposit

$0

Why We Recommend Nadex

I added Nadex to my list as the broker offers an alternative (and simpler) way to speculate on forex through its options trading platform. If you’re a beginner, you can benefit from the built-in risk management of options. These instruments will cap your losses according to the option price, while still offering unlimited profit potential.

Nadex only has a small range of markets, covering forex, crypto, and commodities. However, the commissions are cheap – starting at $2 per contract (round-trip) with no spreads. The broker has a demo account which you can use to try options with $10,000 in virtual funds.

Pros & Cons

- Limited risk on productsproducts

- Binary options toolkit

- Good trading prices

- One base currency – U.S. dollar

- Lengthy account opening process

- $250 minimum deposit

Broker Details

Nadex Provides Options Trading With Forex Products

With spot forex trading becoming popular in the U.S., Nadex offers an alternative way to speculate on forex price movements – short-term options on foreign currency contracts.

These include binary options, call spreads, and knock-out options, each offering its own way to speculate on forex pairs.

Due to the fast-paced nature of Nadex’s options, the broker only offers these contracts on the most liquid markets. This means you can trade on 11 forex pairs, commodities like gold and oil, selected indices, and 19 cryptocurrencies.

Forex Options Offer Simplified Trading

Using Nadex’s forex options really simplifies your trading decisions. You’re effectively choosing “yes or no” on whether you believe an outcome will happen – hence the name “binary” option.

One big advantage I found with these options is that you’re only risking the amount of money you paid to open the position. Your potential winnings are basically unlimited, but your maximum loss is capped. This is a great example of beginner-friendly risk management.

For example, you might open a binary option on a specific forex pair, predicting that the market price will increase in the next thirty minutes. At the end of this thirty minute period, if you are correct, you will have won the option and scored a profit.

If you are wrong, you simply lose the price of you paid to open the option – no more than this.

Low Trading Fees With Nadex

NADEX’s trading fees are simple, as you pay fixed commissions instead of spreads. These commissions are $2 roundturn per binary option contract, which is cheaper than the traditional spot forex commission. You will have to pay a $1 settlement fee if you profit on your contact – you won’t pay this if your contract loses.

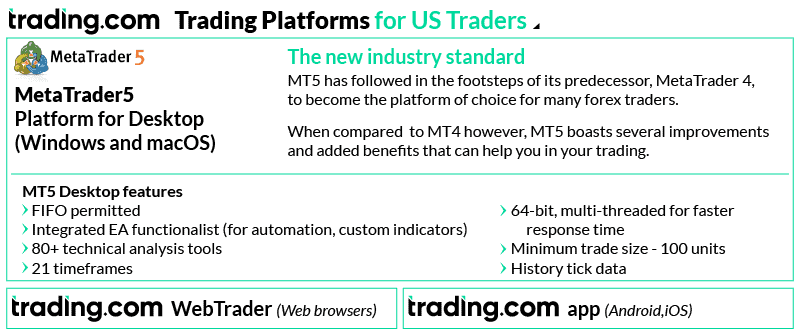

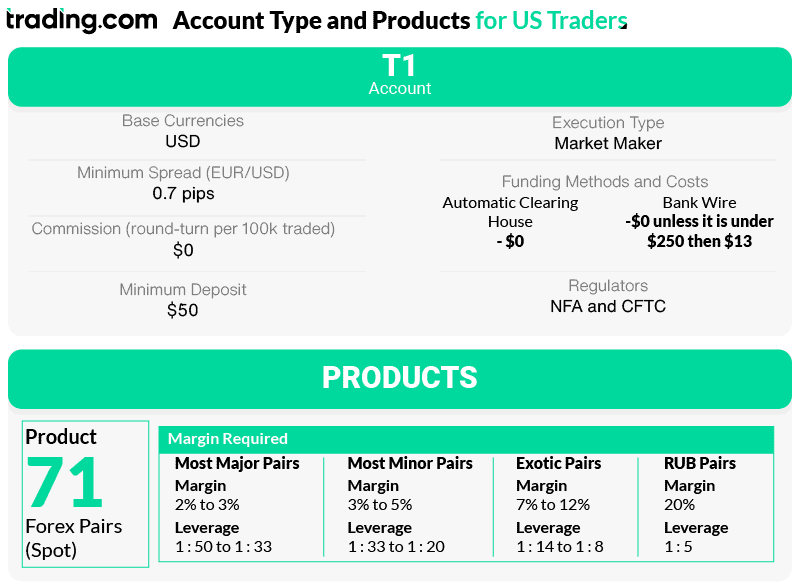

7. TRADING.com - Best MT5 Broker And Platform

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.8 AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

I rated Trading.com as the best broker for accessing MetaTrader 5 – the broker complements MT5 with solid trading tools like its sentiment indicator and trading signals. These tools are provided by Trading Central – so you’re getting free access to professional-grade tools.

Trading.com also offers competitive spreads on its T1 account, which average 1.20 pips with no commissions, as well as a solid range of more than 70 forex pairs. I also found the broker has one of the lowest minimum deposits at $50, making it easier to start trading.

Pros & Cons

- Low minimum deposit

- Demo account and paper trading competition

- Support for MetaTrader 5

- No MetaTrader 4

- No swap-free account

- No weekend customer support

Broker Details

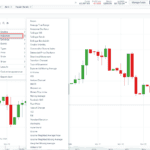

Trade Using MetaTrader 5 With Trading.com

I like seeing MetaTrader 5 as an option with brokers. I prefer this version over the older MT4, as the upgrade optimizes the speed of the software.

You’ll really notice this speed increase across the whole platform, from the data relay to the Expert Advisor processing speeds.

By default, the platform comes with over 38 indicators, including options like MACD and simple moving averages. Like MT4, you can create bespoke indicators using the platform’s own coding language – the only difference with MT5 is that you’re using MQL5, not MQL4.

Two features I really like about MT5 are the Depth of Markets tool and native economic calendar, adding new ways to perform market analysis. Depth of Markets is a solid tool if you day trade, giving you a way to view the order flow of Trading.com’s liquidity provider.

I think this is a decent tool for finding pockets of large pending orders. It’s highly effective in identifying hidden support and resistance levels across Trading.com’s 70+ forex pairs.

Trading.com Has Excellent Trading Tools

While testing the broker’s trading account, I found they gave you access to a collection of trading tools specially designed for MetaTrader 5. Trading.com’s in-house analysts provide real-time research through the Research Portal tab. Here, you receive a full chart breakdown, along with professional commentary – all of which is useful for day trading.

You can get trading signal alerts from Analyzer and Trading Central, giving you more intraday trade ideas to work with.

T1 Account Has Decent Spreads With No-Commission

Trading.com offers a spread-only (no-commission) account called T1. The spreads here start from 0.90 pips on EUR/USD. In my tests, the broker delivered spreads at 1.20 pips, which is more in line with the market average for U.S. forex brokers.

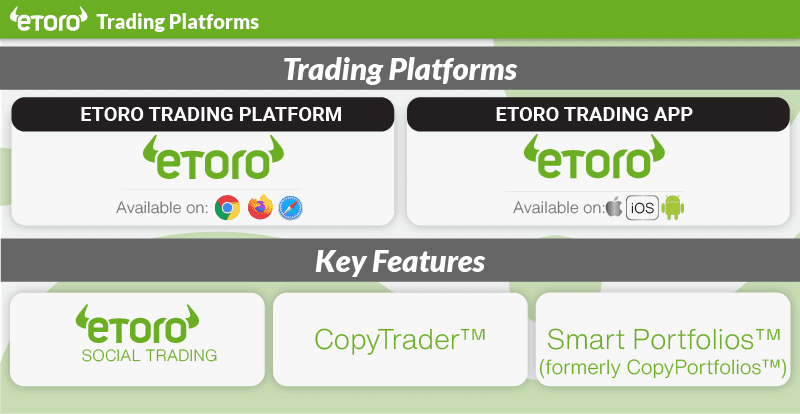

8. eToro - The Best Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

For copy trading, I think it’s hard to choose anyone other than eToro. Its CopyTrader platform lets you automatically mirror the trades of over 2 million copy traders. The platform also provides automated risk management features to protect your capital against poor performances.

The SmartPortfolios simplify this approach even further, letting you select and invest in themed portfolios. This is essentially a hands-off investment vehicle focused on growth in specific sectors, like AI or crypto.

You can trade the broker’s 3,500+ markets with 0% commission, including markets such as crypto and stocks.

Pros & Cons

- Excellent selection of cryptocurrency pairs

- Innovative copy trading tools like SmartPortfolios

- Largest community of copytraders worldwide

- Limited range of markets

- Higher-than-average trading costs

- Not suitable for professional traders or those with complex trading strategies

Broker Details

CopyTrader Is The Best Copy Trading Platform

I’ve used various copy trading platforms during my time testing brokers, and nothing compares to eToro’s CopyTrader platform in my opinion. The platform lets you easily manage your copy trades through its portfolio manager. You can also apply maximum drawdowns, which protect your money if your copy traders underperform.

CopyTrader provides a useful filter to narrow down eToro’s 2 million pro traders based on your requirements. You can view each trader’s profile, scanning performance and trade history data to gain a full picture of the trader’s performance before investing through them.

For example, I like to view the copy trader’s follower growth. It gives me an indication of how they are currently performing – if follower numbers are growing, that’s a sign of strong performance.

Engage with 35 Million Traders For Social Trading

If you prefer to trade manually, you can do so through eToro’s platform, which has TradingView’s advanced charting and decent social trading features.

You can join the broader conversation, or read other traders’ analysis on the markets. Finding other traders through the search function is easy, so you can hone in on the markets you care about.

Invest In Crypto And Other Markets With SmartPortfolios

eToro has SmartPortfolios, which are investments based on a specific theme – cryptocurrency firms, AI-based companies, or major forex pairs baskets, for example. This is a good feature for targeting growth in specific sectors.

I find this is the simplest way to invest and potentially grow your money, as it is fully managed once you make the initial investment. eToro provides a full fact sheet of the SmartPortfolio, with performance and asset allocation data, so you can gauge if it’s worth your investment.

Ask an Expert

I noticed that other sites list a lot more forex brokers for US traders compared to this list. Why is that?

If you are in the USA, then you must choose a forex broker that is regulated by the Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). Residents of the USA cannot legally trade with a broker that does not have this regulation. Most likely these other websites are including brokers that are not regulated by the CFTC or NFA, so cannot legally offer their services to US residents.

Can you trade Contracts for difference in the USA?

Hi Kelsey – The regulators in the USA- the NFA and NFTC forbid the trading of CFDs. You can trade using spot prices however

What is the maximum leverage for trading in the USA

If you are forex trading with a broker regulated by NFA or NFTC (the main regulators in the USA) then you can trade with a maximum leverage of 1:50 when trading spot forex

Excellent broker comparison analysis. Do you have any background info regarding trading.com which launched its NY operation around February 2022 and is one of the few Forex brokers supporting the MT5 trading platform?

Hi Pepi, that’s a great question. At this time we don’t intend to do a full review about Trading.com but we are planning to start adding them to some of our American review pages. Trading.com at first glance appears to be a decent broker and MetaTrader 5 is an excellent platform. Keep an eye on our US pages over next few weeks as we add the,

Hi Justin, – thank you for the comparison. Which of the above brokers can I use to trade stocks?

The following brokers offer share trading – Forex.com, eToro and TD-AmeriTrade

Who is the biggest forex broker in the US?

Not sure who is the biggest but OANDA, FOREX.com and IG would be among the largest and the ones we recommend

Why are some brokers still stuck in MT4?

Because MT4 is still a good trading platform in its own right and traders continue to use it. I agree it would be good if more brokers also offered MT5 in the USA.