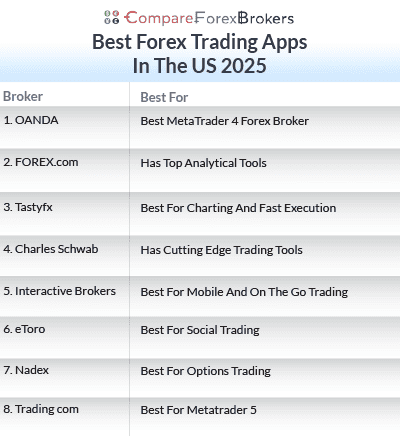

Best Forex Trading Apps In The US

The best Forex trading apps for US Traders offer a good UX for on-the-go mobile trading. Suitable for iOS and Android, these mobile trading platforms have a good range of charts and trading features.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Trade forex on the go with these great apps

- OANDA - Best Forex Trading App In USA

- FOREX.com - Best Broker For Low Spreads

- Interactive Brokers - Top Broker With Low Commissions

- Tastyfx - Great Range Of Trading Platforms

- Charles Schwab - Best For Diverse Markets Range

- Trading.com - Good Broker For MT5

- eToro - Best Broker For Social Trading Cryptos

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

|

Read review ›

Read review ›

|

52 | NFA/CFTC | 0.2 | 0.4 | 0.3 | 0.08%-0.2% | - |

|

|

|

120ms | $0 | 105+ (Spot) | - | 30:1 | - |

|

||

Read review ›

Read review ›

|

71 | NFA/CFTC | - | - | - | $6.00 | 1.2 | 1.9 | 1.4 |

|

|

|

174ms | $450 | 80+ (Spot) | - | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

43 |

ASIC, FCA CYSEC |

- | - | - | - | - | - | - |

|

|

|

120ms | $10 | - | 24 (Spot) |

|

||

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

50 | NFA/CFTC | - | - | - | - | 1.2 | 1.8 | 1.2 |

|

|

Whether you’re looking for real-time access to market movements to support your trading strategy or just prefer to do your forex trading on-the-go, you’ll need an account with a broker that offers a great mobile forex trading app. Below, we review the best mobile forex trading apps available in the United States.

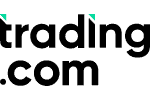

1. OANDA - Most Trusted Broker

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA based on its stellar global reputation, excellent customer support and collection of seven Tier-1 licenses from major global regulators. This broker scored 100/100 in the ‘Trust’ category in our independent analysis of major forex brokers, taking the top spot.

This broker offers more than just security, however. We also like OANDA for its competitive spreads and excellent selection of trading platforms. In addition to OANDA Trade, you can trade forex spot markets using MetaTrader 4 and TradingView.

Pros & Cons

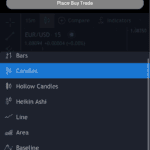

- Great mobile charting features

- TradingView for advanced charting

- No minimum deposit

- Inactivity fees

- Customer service can be slow

- Withdrawal fees

Broker Details

We recently rated OANDA as our most trusted broker, scoring them a perfect 100/100. The main reason was the fact that OANDA is regulated globally by several tier-1 regulators, including NFA/CFTC (USA), FCA (UK), CySEC (EU), and ASIC (Australia). OANDA has also been around since 1996 and helped create today’s online trading industry. With its age, experience, and regulated status, this gave us huge trust signals, which is why we scored them so highly.

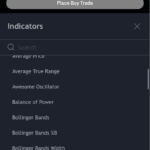

Even though OANDA offers popular platforms MetaTrader 4 and TradingView, it’s the OANDA Trade that gets our recommendation as the trading app of choice. While testing the app, we found it uses TradingView’s charting (a big plus), so you get all the same charting features from TradingView, including 100+ indicators and 50+ drawing tools.

What stood out on the OANDA Trade app was the settings you could use to set a default trade ticket. This allowed us to set up our trade size, stop-loss, and take profit levels and store them to be used by default every time we buy and sell, making the process faster. A hidden benefit is that it can also prevent mistakes by preventing you from adding extra zeroes, which are costly mistakes if you get filled.

In our live testing, we found that OANDA’s spreads were decent on the commission-free Standard account, averaging 1.4 pips on EUR/USD. These no-commission spreads are about average for US brokers.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

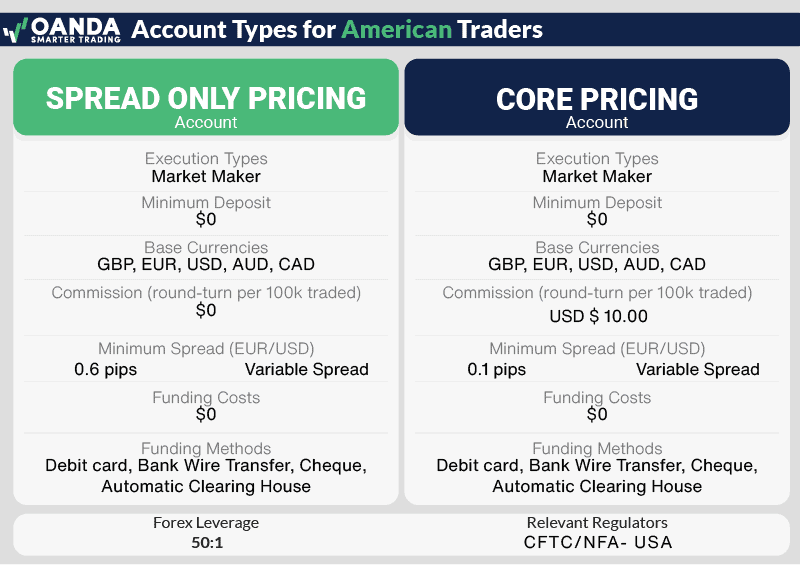

2. FOREX.com - Best Broker For Low Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com for competitive spreads for American traders. According to our tests, this broker offers spreads as low as 1.2 pips for the EUR/USD pair on the Standard Account. We appreciate that, unlike most NFA-licensed brokers, FOREX.com gives US clients a choice of two account types: Standard and RAW Spread.

FOREX.com also stands out for its selection of products to trade. You’ll have access to 83 currency pairs.

Pros & Cons

- Dedicated account manager

- Competitive spreads

- A wide range of currency pairs

- Limited customer service contact methods

- High minimum deposit

Broker Details

In our tests, we traded with a RAW account, as they are one of the few NFA-regulated brokers offering this account type. We found that the RAW account averages 0.0 pips on EUR/USD, with a commission of $7.00 per lot traded, which is competitive for NFA-regulated brokers. This pricing structure can suit you if you trade frequently, as the tight spreads and fixed commission costs can give you stable trading costs, even during volatile markets.

FOREX.com has a decent range of trading platforms catering to different traders, such as MetaTrader 5, MetaTrader 4, and TradingView. The integration of TradingView’s charting capabilities within the Web Trader platform caught our attention.

With over 80 technical indicators and 50+ drawing tools at your disposal, you gain access to comprehensive charting resources, enabling in-depth market analysis directly from your mobile device or desktop. This excellent experience across devices ensures you never miss a trading opportunity, regardless of your location.

Although not part of the trading app, we like that Forex.com offers two decent trading tools when you open a live account: Performance Analytics and SMART Signals.

The Performance Analytics tool stands out by analyzing your trading patterns in real time, highlighting your biggest strengths and weaknesses, and then recommending areas of improvement.

Meanwhile, the SMART Signals feature is an automated chart pattern scanner that automatically finds potential trade setups across multiple markets, which can be particularly useful for active day traders seeking new opportunities.

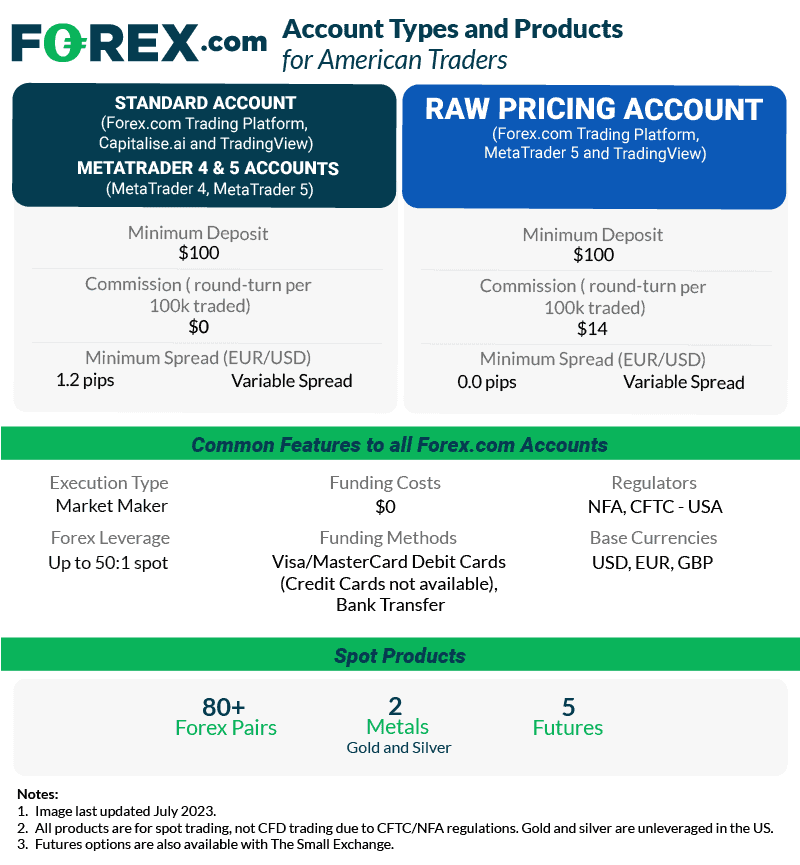

3. Interactive Brokers - Top Broker With Low Commissions

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We recommend Interactive Brokers (IBKR) for advanced traders in search of low commissions. Rather than charge a flat fee, this innovative broker bases your commission on the size of your trade with a cap of 0.8 basis points. Couple this with spreads as tight as 0.1 pips and IBKR stands out as a great choice for low trading costs.

We also appreciate IBKR’s proprietary trading platform, which includes tools and features uniquely suited to experienced traders. The customizable interface adds an extra layer of efficiency.

Pros & Cons

- $0 minimum deposit

- No inactivity fees

- No withdrawal fees

- Tight spreads

- Limited trading platform range

- Slow customer service

- Extended account opening process

Broker Details

Compared to most brokers, Interactive Brokers has a unique pricing model that charges commissions based on basis points rather than fixed fees. In our tests, we found the broker charges 0.20 basis points per lot traded, which equates to $2 per lot traded – one of the cheapest commissions we’ve seen. However, we noticed a $2.00 minimum commission, making trades smaller than one lot relatively expensive, which will put off traders with smaller accounts.

During our testing, we were impressed by Interactive Brokers’ tight spreads, starting from 0.1 pips on the EUR/USD pair, which is about average for US brokers with commission-based accounts. In our opinion, if you frequently trade at least one lot or higher, Interactive Brokers could be a top choice, potentially saving you substantial amounts in trading costs.

While reviewing Interactive Brokers, we utilized the IBKR Mobile App, their proprietary trading platform. The charts offer over 60 indicators and three chart types, providing plenty of choices for market analysis on a mobile device.

A standout feature was the trade settings, allowing us to set default trade sizes, stop-loss, and take-profit limits (e.g., 20 pips), streamlining the trade ticket completion process with your preferred settings. After setting this up, we found executing the trades on our phone much quicker.

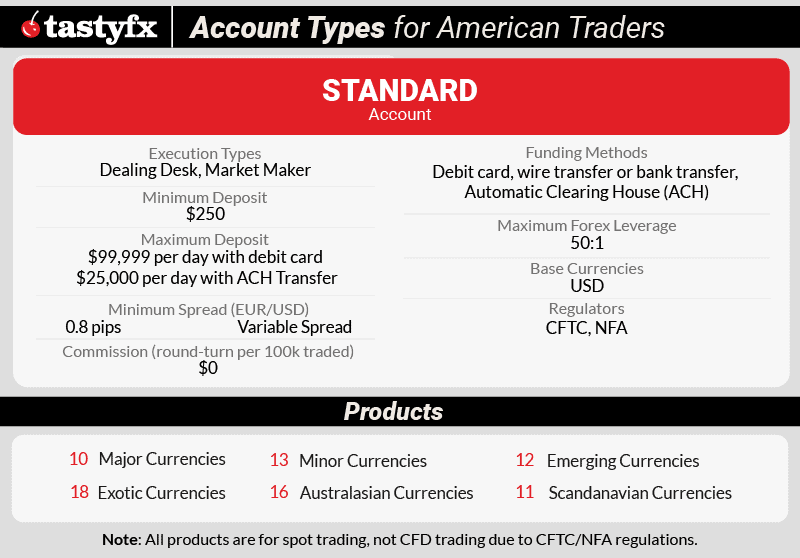

4. Tastyfx - Great Range Of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

We recommend Tastyfx for its impressive range of trading platforms. Whether you prefer an award-winning web trader with extensive features, an intuitive trading app, MetaTrader 4, or ProRealTime for advanced charting and automated trading, Tastyfx has options to suit various trading styles and experience levels.

Additionally, Tastyfx has a strong reputation in the industry. Formerly known as IG Markets, the broker has been a leader in retail investing and is now rebranded as Tastyfx. It is highly regulated, holding licenses from top-tier jurisdictions including the UK, US, and Australia, which adds to its credibility and trustworthiness.

Pros & Cons

- Tight spreads

- Fast execution speeds

- Top-Tier Platforms and Tools

- Slow customer support

- High minimum deposit

- Limited financial markets on MetaTrader 4

Broker Details

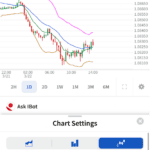

When testing tastyfx’s trading platforms, we found their suite of trading apps comprehensive. MetaTrader 4, ProRealTime, and tastyfx’s proprietary platform cater to different trader preferences.

The TASTYFX mobile app is fast, reliable, and always at your fingertips, letting you create watchlists, analyze charts, and trade with confidence from anywhere. Its intuitive interface is enhanced by over 40 technical indicators, including key tools like moving averages and MACD. Plus, it’s the only app that gives you access to tastyfx’s entire range of more than 17,000 products, making it a standout choice for traders in the US.

One feature we were drawn to was the built-in Signal Centre on the platform, which offered chart pattern recognition tools from Autochartist and PIA First services. We set our platform up to test these signals and liked that each signal given had commentary and analysis. Plus, tastyfx has a feature to copy the prices into an order ticket to execute the trade fast.

Most traders can go from “Create Live Account” to their first trade in under 10 minutes on tastyfx. The platform is user-friendly with consistent execution speed for trades from 0.01 to 1,000 standard lots. Frequent traders might even earn rebates on spreads, which we found to be highly competitive. For example, tastyfx’s average spread on EUR/USD was 1.13 pips, better than the 1.24-pip industry average.

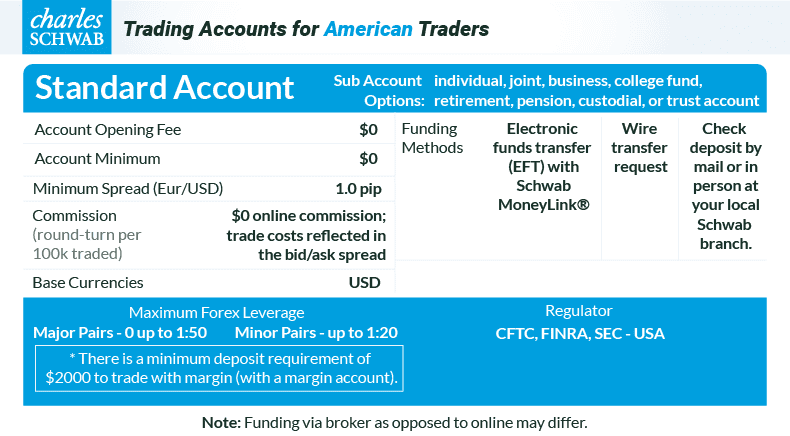

5. Charles Schwab - Best For Diverse Markets Range

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

Charles Schwab provides brokerage services for futures, commodities, and forex. Formerly known as TD-Ameritrade, Charles Schwab is highly recommended for its wide range of financial markets available to US traders, including stocks, ETFs, mutual funds, futures, bonds, and indices.

The broker’s proprietary platform, thinkorswim, offers advanced charting tools and high customization options. While it has a steep learning curve, it’s well-suited for traders seeking detailed analysis and flexible trading capabilities.

Pros & Cons

- $0 commissions for online listed trades

- Powerful trading platform

- Great range of markets to trade

- Limited Forex Pair

- Potential for Higher Fees on Some Services

- Complex Platform for Beginners

- No Direct Access to ECNs

Broker Details

Charles Schwab powered by TD-Ameritrade is a comprehensive multi-asset broker, offering access to 65 forex pairs and over 20,000 markets, including mutual funds. This makes it a convenient choice for consolidating all your investments with a single broker, from standard accounts for growth to traditional retirement accounts like Roth IRAs.

In forex trading, Charles Schwab provides competitive spreads starting at one pip for EUR/USD with no commissions. Traders can use leverage up to 1:50 for major pairs and 1:20 for exotic pairs, catering to both conservative and more aggressive strategies.

The Thinkorswim app by Charles Schwab is a versatile tool, featuring over 300 indicators for detailed market analysis. It includes advanced tools like the Simple Cloud (TSC), Schaff Trend Cycle (STC), and Standard Deviation Channel (SDC). Setting up these indicators is easy—just tap on the chart to add them, making it a strong choice for traders who rely on technical analysis.

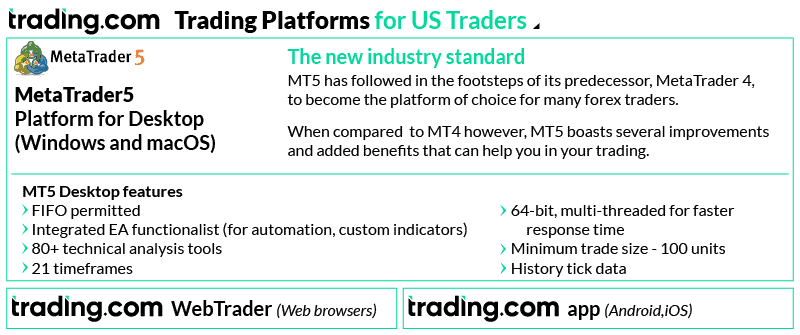

6. Trading.com - Good Broker For MT5

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.8 AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

Pros & Cons

- Comprehensive MetaTrader 5 offering

- Low minimum deposit

- 24-hour account activation

- No mobile app

- Newcomer to the market

- Limited products to trade

Broker Details

We appreciate MetaTrader 5’s extensive arsenal of technical indicators and analytical objects. With over 38 technical indicators, including trend-based and oscillation/momentum-based tools like Fractal Adaptive Moving Averages and Ichimoku Kinko Hyo, you have a comprehensive suite to dissect price action. The 44+ analytical objects further augment your market analysis capabilities. In our tests, we found this robust toolkit invaluable for identifying potential trade setups and refining entry/exit strategies.

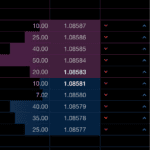

The Depth of Market (DOM) tool in MetaTrader 5 caught our attention. It can give you raw information on the current order flow and valuable knowledge if you are a scalper. Its real-time insights into market liquidity and order book dynamics enable swifter execution and more informed trading decisions.

By leveraging DOM’s order flow analysis, you can better gauge market sentiment, anticipate potential price movements, and fine-tune your entry/exit points for optimal risk management. In our opinion, this feature sets MT5 apart for traders seeking a competitive edge.

Trading.com’s spreads impressed us with their competitive pricing during our live testing. We observed an average one-pip spread on EUR/USD, undercutting the industry average of 1.24 pips.

Furthermore, when we compiled the spreads from the top 5 major pairs, Trading.com averaged 1.30 pips – once again, lower than the industry standard of 1.55 pips. These tight spreads can translate into substantial cost savings over time, especially for active traders executing high trade volumes.

| Broker | Major Pair Average Spread |

|---|---|

| OANDA | 0.70 |

| IC Markets | 0.76 |

| Fusion Markets | 0.99 |

| Admirals | 1.04 |

| Eightcap | 1.06 |

| Go Markets | 1.08 |

| OctaFX | 1.10 |

| TMGM | 1.16 |

| FIBO Group | 1.18 |

| Trading212 | 1.22 |

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| City Index | 1.24 |

| HYCM | 1.24 |

| eToro | 1.30 |

| FP Markets | 1.30 |

| Trading.com | 1.30 |

| CMC Markets | 1.35 |

| Exness | 1.36 |

| XTB | 1.36 |

| IG | 1.38 |

| Pepperstone | 1.40 |

| Blackbull Markets | 1.42 |

| HugosWay | 1.42 |

| Blueberry Markets | 1.46 |

| Saxo Markets | 1.48 |

| AccuIndex | 1.50 |

| MultiBank Group | 1.54 |

| Vantage FX | 1.54 |

| FXCM | 1.60 |

| Tickmill | 1.60 |

| FxPro | 1.62 |

| Axiory | 1.62 |

| Forex.com | 1.66 |

| Fair Markets | 1.70 |

| XM | 1.72 |

| HF Markets | 1.76 |

| Markets.com | 1.78 |

| Plus500 | 1.86 |

| Swissquote | 1.92 |

| Roboforex | 1.94 |

| TradersWay | 2.04 |

| FXTM | 2.12 |

| GCI Trading | 2.20 |

| IFC Markets | 2.20 |

| ADROFX | 2.32 |

| AMarkets | 2.52 |

| BlackWell Global | 2.52 |

| Industry Average | 1.52 |

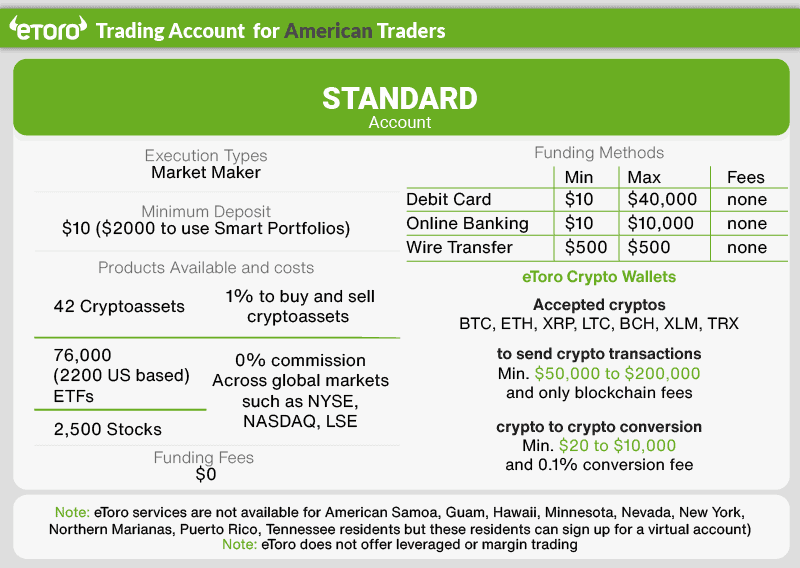

7. eToro - Best Broker For Social Trading Cryptos

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro for its unique range of trading products and commitment to copy and has the Best Social Trading Platforms. If you’re interested in trading Bitcoin or altcoins, eToro offers the most comprehensive selection of any US broker.

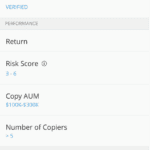

It also provides a straightforward, low-stress entry point to day trading for those not yet ready for advanced charting and technical analysis. The CopyTrader feature, for example, allows account holders to mirror vetted professional investors, while SmartPortfolios distribute your trading budget across ‘baskets’ of complementary products.

Pros & Cons

- Abundant educational resources

- Beginner-friendly interface

- A wide range of cryptocurrencies

- The trading platform lacks some features

- Not licensed in all US states

- Higher-than-average spreads

Broker Details

eToro is a popular broker in the US after it simplified the process of capitalizing on higher-risk assets like forex and crypto markets through its CopyTrader platform. The broker has an extensive market range, covering 3,000+ traditional markets like forex and stocks, but now includes 41 crypto markets, which is excellent if you want to test the water of the crypto markets with a trusted broker.

The CopyTrader platform allows you to mirror the positions of experienced traders, which is useful if you are a beginner or do not have the time to trade manually. By leveraging the expertise of successful traders, you can gain exposure to markets like Bitcoin and potentially profit from it without learning how to trade.

During our tests, we found eToro’s CopyTrader platform easy to set up, and accessing other traders was made simple through the filter tool. This allowed us to fine-tune the copy trader selection process by filtering traders who meet our specific trading criteria. This allowed us to narrow down over 30,000,000 options to just four, giving us an easier list of traders to validate.

Another feature we appreciated was the ability to choose traders based on their market specialization. We were able to find traders who specialize in cryptocurrencies and diversify our portfolio by allocating capital across the top three performers in this market. This approach allowed us to explore the crypto markets and mitigate the risk of copying a single trader.

Ask an Expert