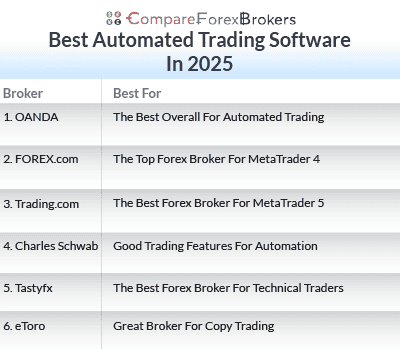

Best Automated Forex Trading Software

The best-automated forex trading software allows you to trade using algorithms or bots. Expert Advisers with MetaTrader 4 or 5 are recommended by there are other good options. See which trading platforms we recommend.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Here are some good forex trading platforms with automation tools

- OANDA - The Best Overall For Automated Trading

- FOREX.com - The Top Forex Broker For MetaTrader 4

- Trading.com - The Best Forex Broker For MetaTrader 5

- Charles Schwab - Good Trading Features For Automation

- Tastyfx - The Best Forex Broker For Technical Traders

- eToro - Great Broker For Copy Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

|

Read review ›

Read review ›

|

43 |

ASIC, FCA CYSEC |

- | - | - | - | - | - | - |

|

|

|

120ms | $10 | - | 24 (Spot) |

|

||

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

71 | NFA/CFTC | - | - | - | $6.00 | 1.2 | 1.9 | 1.4 |

|

|

|

174ms | $450 | 80+ (Spot) | - | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

50 | NFA/CFTC | - | - | - | - | 1.2 | 1.8 | 1.2 |

|

|

Who Are The Automated Forex Trading Software Providers?

Key features that matter when trading with automation include the broker’s spreads, execution speeds and software features. Based on the factors the top providers for trading platforms is the following.

1. OANDA - The Best Overall For Automated Trading

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA as the best overall choice for American forex traders based on its range of trading platforms and selection of 68 currency pairs.

We particularly appreciate OANDA’s extensive MetaTrader 4 offering, which provides excellent support for automated trading with EAs and advanced charting. Or TradingView charts on OANDA Trade.

Pros & Cons

- Comprehensive data on asset fundamentals

- Expert Advisors on MT4

- Demo account with trading platform tutorials

- No minimum deposit

- Customer support is 24/5

- Inactivity fees

- Website could be better designed

Broker Details

OANDA has MetaTrader 4 (MT4) Expert Advisors for trading automation

OANDA is one of the largest brokers on our list due to its large international presence. The broker’s offering for clients in the US differs slightly due to regulatory requirements, but the extensive array of MetaTrader 4 add-ons and integrations pushes it to the top spot.

Key Strengths:

Key Strengths:

- Access to quotes on 70 currency pairs with no dealer intervention

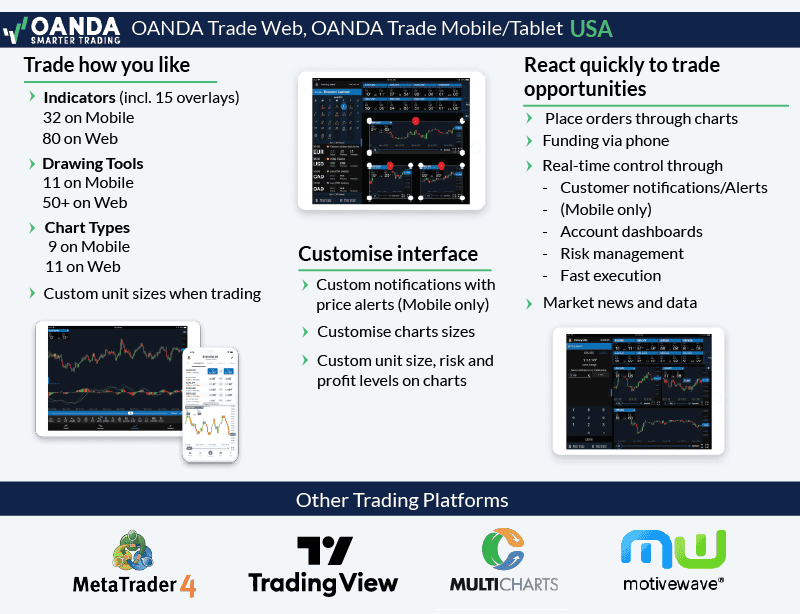

- Multiple trading platforms (OANDA Trade for web and mobile, as well as MT4)

- Powerful technical analysis tools powered by Autochartist

- Integrated economic announcements with the OANDA Trade platform

- Third-party software (MotiveWave and Dow Jones Forex Select)

- Risk management orders and transparent pricing models

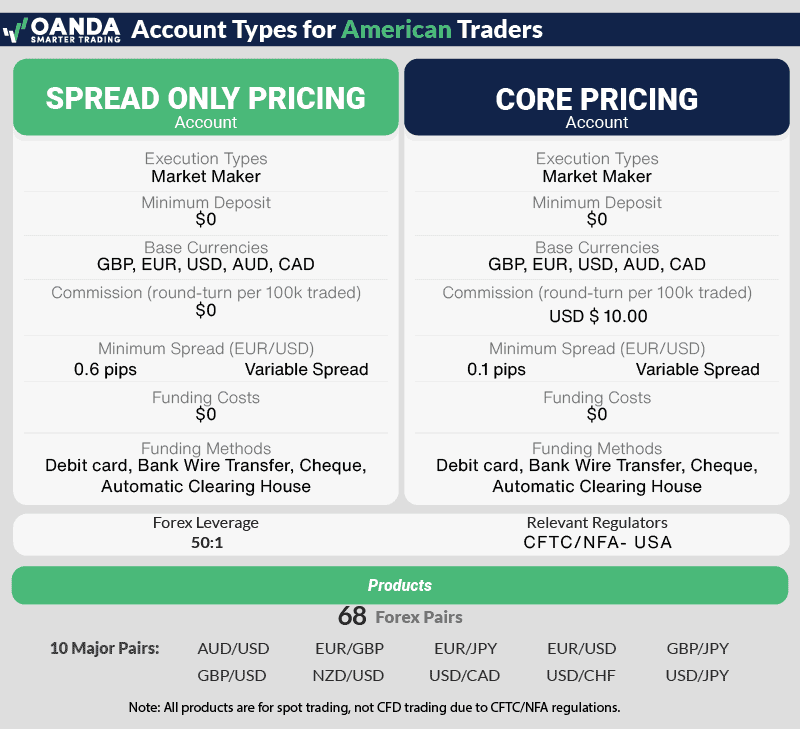

OANDA Trading Accounts and Products

If you’re in the US, OANDA offers a single, straightforward account type. While the broker does make use of a dealing desk, we found that the unique free structure and low commissions left plenty of opportunities for savings, provided you’re prudent. The Spread-Only account roughly parallels other brokers’ Standard Account offerings. Variable spreads start at 0.6 pips, and commission is included in round-turn trades for standard lots.

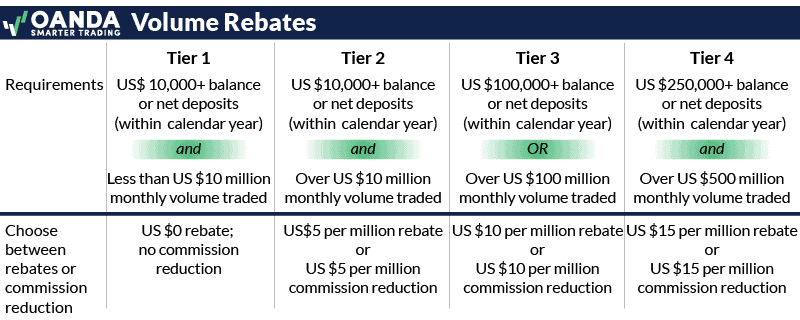

OANDA also offers an attractive rebate program that rewards high-volume traders. If you meet the minimum deposit requirements and exceed a monthly trade volume of US $10 million, you can choose between cash rebates and commission reductions ranging from US $5.00 and US $15.00 per million dollars traded.

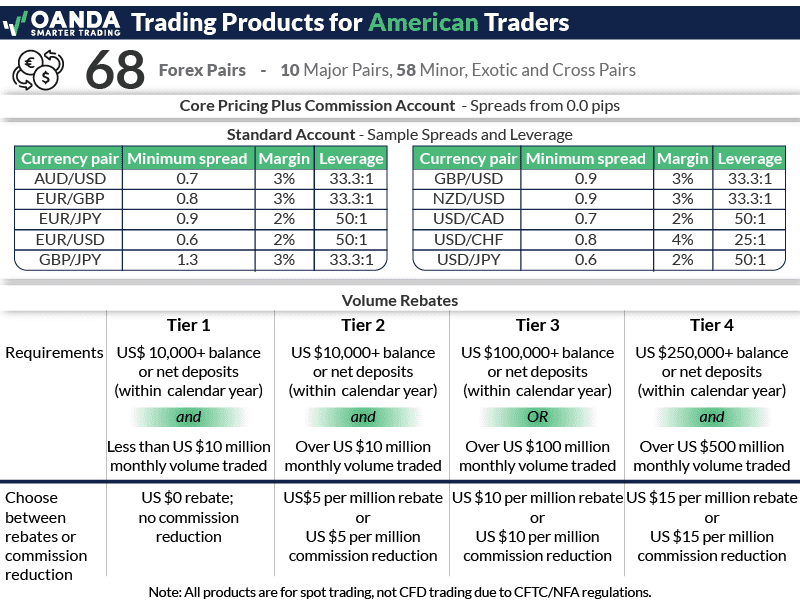

If you already know you intend to narrow-focus your day-trading activity on forex, OANDA will likely meet your needs. The broker limits American traders to the currency markets, but offers a respectable selection of pairs: 10 majors and 58 minors, exotics and crosses. That includes EUR, GBP, USD, JPY, NZD, AUD and CHF – all the major base currencies. While we find that’s more than enough to support even sophisticated strategies, we can understand why traders looking for a more diversified portfolio might balk.

OANDA Automated Trading Platforms

Between its proprietary web and mobile trading platforms and comprehensive suite of MetaTrader 4 integrations and premium tools, OANDA stands out for its support for automated trading. We personally trialled basic and more advanced algorithmic trading strategies and found that OANDA’s platforms provided the tools we needed.

That said, the integrations in question worked smoothing and gave us exactly what we needed. Between MultiCharts, which connected to OANDA Trade via API, and AutoChartist, for example, we had access to more tools and indicators than with other brokers.

Our OANDA Final Verdict

OANDA’s tight spreads, advanced technical analysis tools and extensive selection of trading instruments make it an excellent choice for US forex traders, regardless of experience level.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

2. FOREX.com - The Top Forex Broker For MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com for its excellent MT4 and MT5 platform options like MT4 which include advanced trading tools and charting abilities suitable for even experienced traders. If you intend to pursue automated trading for forex, this broker offers nine proprietary EAs, including Sentiment Trader.

The broker’s proprietary REST API allows you to connect your algorithmic strategy to 80 forex markets for deep liquidity access.

Pros & Cons

- Top interactive resources and trading ideas

- 80 currency pairs

- RAW Spread account available

- Required minimum deposit of US $100

- Inactivity fee

- Customer support response time could be faster

Broker Details

FOREX.com MT4 EAs allow for algo trading

FOREX.com is one of the largest brokers on this list due to its large international presence. While the offering for US account holders differs slightly due to regulatory requirements, it remains an excellent option for its low trading costs and powerful collection of trading tools.

Key Strengths:

- Sophisticated technical trading tools

- Great variety of currency pairs

- Fast trade execution

FOREX.com Trading Accounts and Products

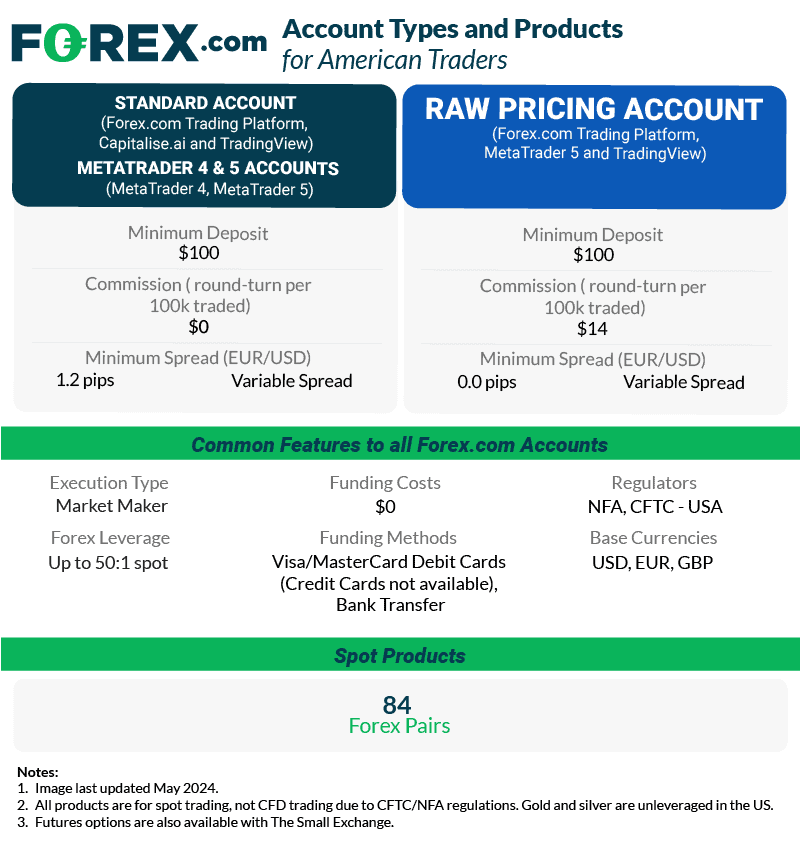

If you’re a beginning retail investor, the Standard and MetaTrader 4 and 5 accounts charge no commission or funding costs and a minimum spread of 1.2 pips. The main difference? Your trading platform. Standard account holders will execute trades via FOREX.com’s proprietary platform, while MT4 account users will, predictably, trade via the MetaTrader 4 trading platform.

If you’re a system trader or rely heavily on volume and speed to generate gains, you may prefer the RAW Spread Account. This account has variable spreads that start from 0.0 pips and a commission of $14.00 round-turn ($7.00 side ways) for each 100k lot you trade.

With over 80 currency pairs, plus unleveraged gold and silver, FOREX.com stands out among the best forex brokers in usa for the range of asset classes available to US-based forex traders.

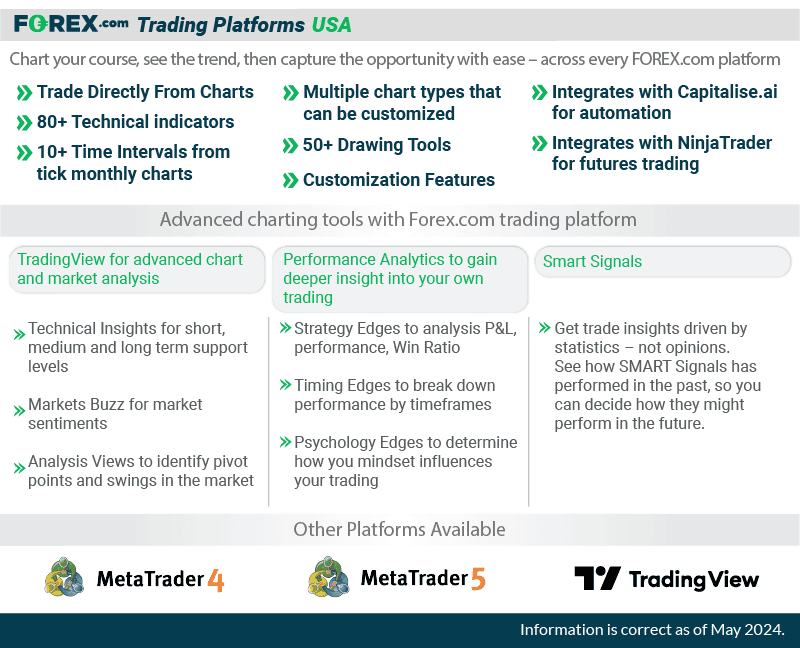

FOREX.com Automated Trading Platforms

Of all the brokers we reviewed, FOREX.com offers the most comprehensive range of trading tools and platforms to support your automated trading system.

If you prefer the classics, FOREX.com has a dedicated account type just for MetaTrader 4. In addition to advanced charting, hundreds of technical indicators and drawing tools, MetaTrader 4 allows forex traders to automate trading strategies using their own or third-party EAs.

MetaEditor, the internal code editor included in the MetaTrader 4 trading terminal, empowers you to develop and test your own Expert Advisors with custom technical indicators and scripts using the MQL4 programming language. Even better: because developer MetaQuotes has released the source code for MetaTrader 4, high-quality, professionally designed integrations apps and robots to facilitate automated trading abound. MetaTrader 4 also helps you safeguard your investment and outsource risk management with integrations designed to automatically hedge positions.

For those who prefer the look and feel of MetaTrader 4 but require access to the more powerful technical indicators and analytics of its younger sibling, MetaTrader 4’s Python package allows for integration with MetaTrader5.

Not convinced MetaTrader 4 is right for you? FOREX.com has other options available. In addition to MetaTrader 5, the broker’s proprietary REST API enables traders to connect an algorithmic trading strategy to over 80 forex markets, giving traders access to deep liquidity, as well as advanced order types and live-streaming prices.

FOREX.com also offers brokerage account holders the option to trade via NinjaTrader 8, which supports automated trading and EAs. The platform boasts access to thousands of third-party technical indicators to assist in developing trading apps, advanced charts, chart drawing tools and social trading services. Professional developers well-versed in C# can write and sell automation on an open market, while less advanced forex traders can take advantage of NinjaTrader’s “point and click” construction system to build, backtest and implement automation and indicators.

Finally, FOREX.com account holders have access to automated market analysis via Trading Central, FOREX.com’s proprietary expert advisor tool and advanced charts powered by Trading View.

In terms of trading tools, beginners developing the trading strategy to drive an EA will appreciate FOREX.com’s charting tools, particularly the ability to customize virtually every aspect of a chart – from indicators to colors to size – ensures maximum clarity and legibility for even novices trading on a demo account.

Suitable even for professional traders, FOREX.com’s advanced charting features an extensive array of chart types, timeframes and technical indicators and drawing tools. Users have the option to save preferred chart types and variables for future use, as well as compare multiple financial markets with overlays. As a leader in online trading for almost two decades, FOREX.com has developed some of the most powerful, flexible analytical tools available.

FOREX.com also allows brokerage account holders to purchase VPS hosting for an additional fee.

FOREX.com: Our Verdict

An easy-to-navigate trading environment, low trading costs and numerous trading platforms from which to choose make FOREX.com a good choice for intermediate and advanced traders hoping to control costs without sacrificing a quality trading experience.

3. TRADING.COM - The Best Forex Broker For MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.8 AUD/USD = 1.2

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

We recommend Trading.com based on its status as one of the few forex brokers offering US traders access to MetaTrader 5, along with specialized educational resources for those exploring automated trading with the upgraded MetaQuotes trading platform.

All told, we think Trading.com provides a straightforward trading environment with excellent options for trading with bots through EAS, competitive costs and a wide variety of instruments for trading.

Pros & Cons

- Competitive spread-only pricing

- Allows trading with micro lots

- MetaTrader 5 trading platform

- Education could be better

- Limited product range for US traders

- Market-making broker, which can lead to higher spreads in some cases

Broker Details

Trading.com MT5 has EAs for automated trading

One of the few forex brokers to offer US traders access to MetaTrader 5 (MT5), Trading.com has the customer support and educational resources for forex traders exploring the ‘upgraded’ automated trading platform from MetaQuotes.

Key Strengths:

- Straightforward trading environment

- Round-the-clock, live customer support

- Wide range of available instruments to trade

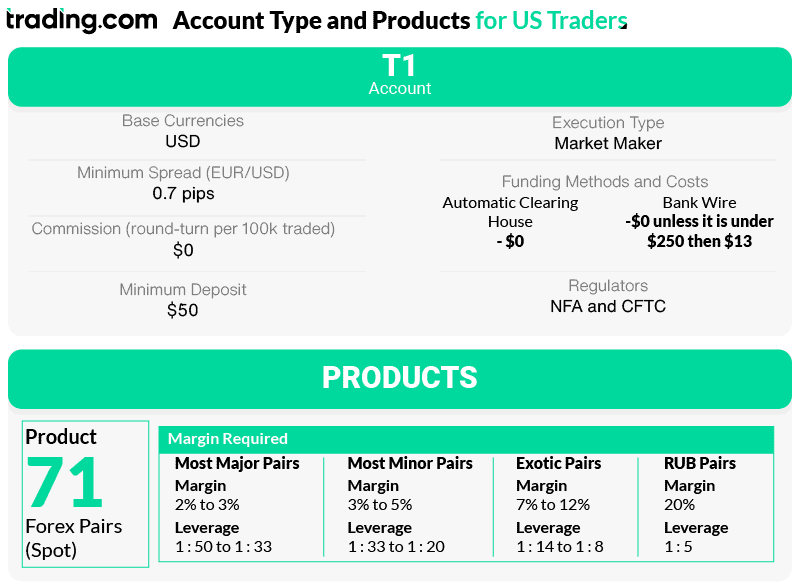

Trading.com Trading Account Types

Trading.com likes to keep things simple – very, very simple. This leading forex broker offers only one account type in a bid to increase transparency and eliminate confusion around what traders receive when opening an account with the broker.

A T1 account with Trading.com requires a minimum deposit of just USD$50, and offers variable spreads starting from 0.7 pips on major currency pairs, including EUR/USD and EUR/GBP. Trading.com charges no commissions on round-turn trades, meaning you pay only the spread.

Designed for US-based forex traders, Trading.com focuses on just that: forex. The broker deals in all major currency pairs, as well as several exotics, for a total of 70 currency pairs – but that’s the extent of its product range. Those interested in trading precious metals, indices or stocks may need to look elsewhere for a secondary brokerage account.

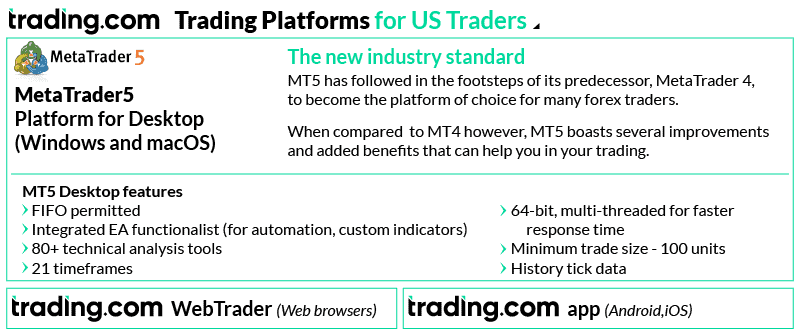

Trading.com Automated Trading Platforms

While Trading.com does offer forex traders the option to trade using the broker’s proprietary trading platform, those interested in an automated trading strategy may opt instead for MetaTrader5. Unlike MetaTrader 4, which relies on Expert Advisers (EAs), as well as third-party integrations and forex trading robots to support algorithmic trading, MetaTrader5 was designed specifically as an automated trading platform.

Of course, MetaTrader5 also supports EAs, but the trading platform goes further. In addition to more advanced technical indicators and advanced charting tools than MetaTrader 4, MetaTrader 5 also includes an unlimited number of pricing screens. The automated trading platform also supports mirror trading, which functions much like copy trading. Forex traders select a particular investor to follow, ‘mirroring’ his or her positions with the help of a trading program.

While MetaTrader 5 will charge a fee to mirror another trader, it also ensures that you follow a trader whose risk management style, trading strategy and market analysis match your own by giving you access to comprehensive metrics regarding previous performance, preferring financial instruments and timeframes.

For those already familiar with the MQL5 programming language, MetaTrader5 includes a proprietary code editor built into the platform that allows you to write, backtest and refine your own algorithm to support any trading style, from scalping to swing trading.

Trading.com: Our Verdict

Trading.com is a great choice for traders on a budget in need of low trading fees and competitive spreads. The broker’s powerful MT5 platform offers great support for algorithmic trading strategies.

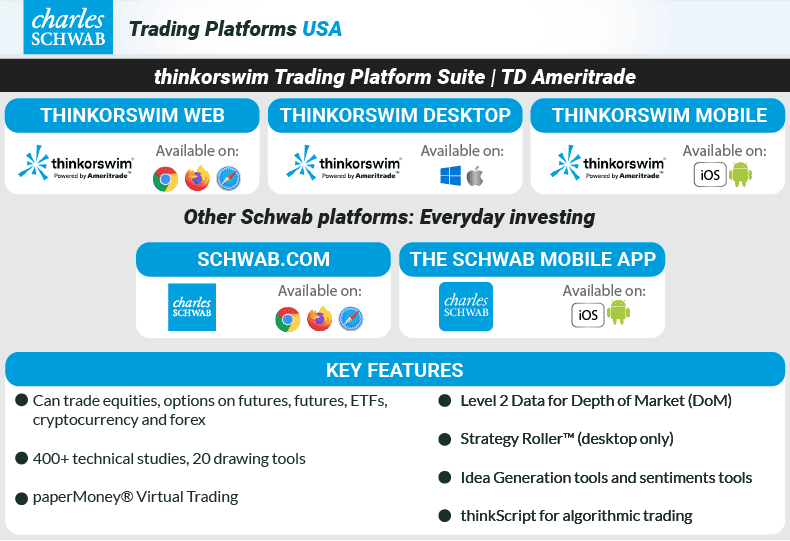

4. Charles Schwab - Good Trading Features For Automation

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

We recommend Charles Schwab powered by TD-Ameritrade for its advanced automated trading features available on the thinkorswim platform. This platform includes detailed charting and price alert tools as part of the INVESTools package, which can enhance trading accuracy.

For traders used to MetaTrader 4, thinkorswim offers a similar experience with additional features. In addition to the tools found in MetaTrader, thinkorswim provides extra calculators and customizable expert advisors (EAs), making it a strong choice for those who need a comprehensive trading platform.

Pros & Cons

- Impressive range of products

- Excellent, highly responsive customer support

- Comprehensive educational resources great for new traders

- No indirect trading costs

- Limited Forex Pairs

- Potential for Higher Fees on Some Services

- Complex Platform for Beginners

Broker Details

Charles Schwab has automation with thinkorswim

As part of the Charles Schwab group, the broker offers forex traders the benefits of automated trading alongside a diverse range of assets to help manage risk and boost potential gains.

Key Strengths:

- Top-tier market research and analysis tools

- Excellent customer service

- $0 commissions on online listed trades

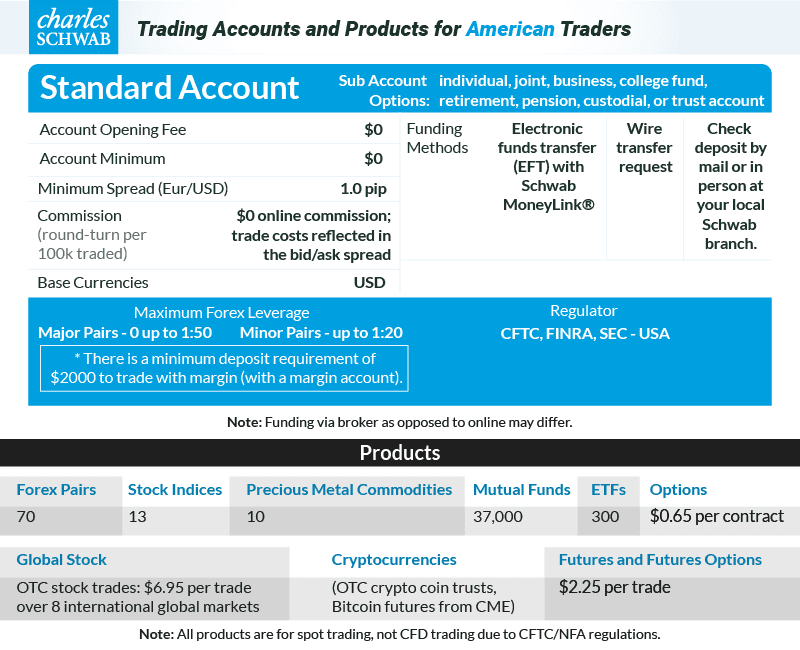

Charles Schwab Trading Accounts and Products

A standard brokerage account allows you to easily deposit funds and trade investments through a brokerage, with penalty- and restriction-free withdrawals, no contribution limits, and flexibility to adapt to market conditions. Charles Schwab enhances this experience with a broad range of investment products, exceptional customer support, and strong safety features.

For everyday traders who include forex in a diverse investment strategy, Charles Schwab is an appealing choice. As a full-service brokerage, Schwab provides a comprehensive range of trading products, including 65 forex pairs, precious metals, cryptocurrencies, stocks listed on U.S. exchanges, over-the-counter (OTC) stocks, futures and futures options, and ETFs. Keep in mind that commissions may vary depending on the specific product.

Charles Schwab Automated Trading Platforms

With Schwab, you can set up automatic investments in eligible mutual funds within your brokerage account by going to the Trade section and selecting Automatic Investing. While thinkorswim offers features similar to MetaTrader 4, it stands out with its advanced charts, calculators, and expert advisors (EAs), supporting a wide range of trading strategies.

For those new to automated trading, thinkorswim makes the transition easy with tools like Strategy Roller, which allows traders to ‘borrow’ the trading platform’s pre-defined criteria to roll forward a covered call strategy on a monthly basis.

Algorithmic traders have access to over 400 technical studies on which to base an automated trading strategy via thinkScript, and thinkorswim claims to have developed a social sentiment tool as powerful as that of any other broker, which traders can use to develop trading signals.

thinkScript provides savvy forex traders with a powerful tool for automating their trading strategies, though it requires some initial setup. With thinkScript, you can automate every aspect of your trading plan using the platform’s Condition Wizard and market movement monitors to scan for opportunities and execute trades when specific conditions are met.

For those with some extra cash to spend, forex trading robots developed explicitly for use with thinkorswim using tools like NinjaTrader are available for purchase on the open market.

Charles Schwab: Our Verdict

Supported by one of the most trusted names in US financial services, Charles Schwab provides new traders with extensive educational resources. Advanced traders benefit from the thinkorswim platform’s flexibility and the broad array of tradable assets available.

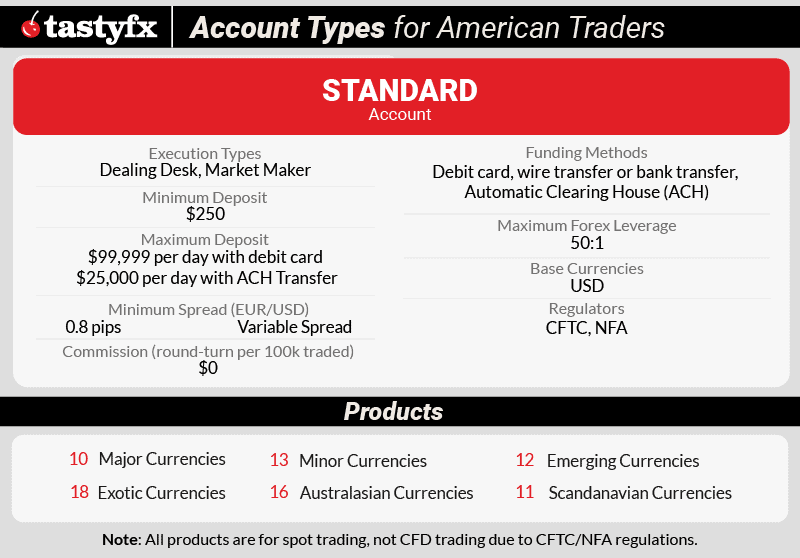

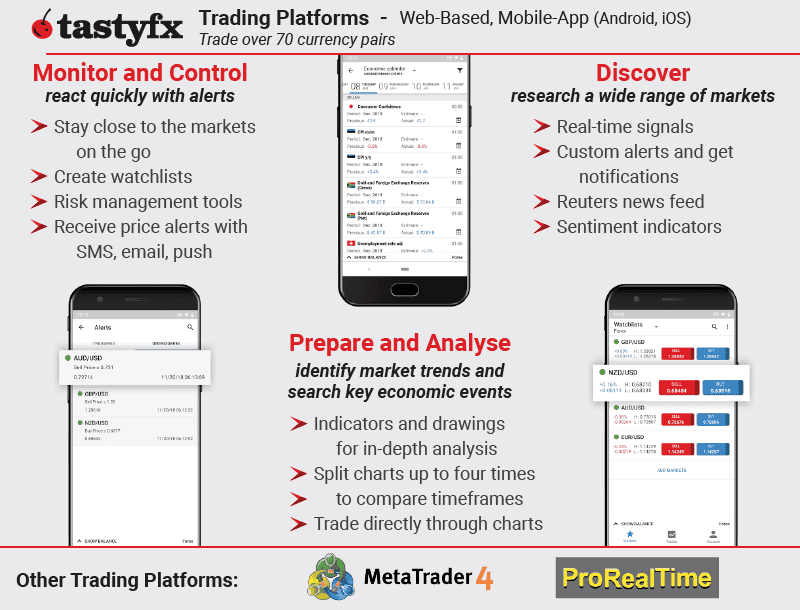

5. Tastyfx - The Best Forex Broker For Technical Traders

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

We recommend tastyfx, the rebranded version of IG Markets, for its unique platform options available to US traders. Particularly noteworthy is ProRealTime, which offers advanced charting capabilities and automated trading tools powered by machine learning. With ProRealTime, you can build custom algorithms and utilize a variety of technical indicators to enhance your trading strategies.

Additionally, for traders who are fans of MetaTrader 4, tastyfx provides access to this popular platform along with its extensive collection of expert advisors (EAs). This ensures that you have a comprehensive suite of tools to suit your trading preferences and strategies.

Pros & Cons

- Excellent range of currency pairs to trade

- Extensive selection of trading platforms

- Stellar global reputation

- Limited financial markets on MetaTrader 4

- Average trading costs

- Market-making broker

Broker Details

Tastyfx offer ProRealTime charting software with automation

Tastyfx stands out as one of the largest brokers on this list, with licenses in the UK, Australia, Singapore, and Japan. For US account holders, Tastyfx offers access to unique trading platforms not commonly found with other brokers, including ProRealTime, which is ideal for those who prefer advanced charting.

Key Strengths:

- Extensive research tools and trading strategy ideas

- Excellent educational tools and trading supports

- Great proprietary trading platforms

Tastyfx Trading Accounts and Products

Tastyfx offers US traders a single account type: the CFD account. With no commissions and good leverage, however, it has attractive features for novice forex traders and more experienced hands. Leverage for major currency pairs extends to 50:1, the maximum allowed, while minor pairs are capped at 20:1.

Spreads vary across currency pairs and can range from a tight 0.08 pips for EUR/USD to 3.2 pips for GBP/CHF. Tastyfx also claims to offer 20% lower spreads than the nearest competitors for EUR/USD pairs.

Tastyfx specializes in forex products, and the range of available currency pairs won’t disappoint. Over 80 currency combinations, including EUR/USD and EUR/GBP, as well as a collection of exotic and emerging currencies.

Tastyfx Automated Trading Platforms

In addition to MetaTrader 4, which affords forex traders the option to develop customized automations with the MQL4 programming language or integrate an independently-developed a third-party forex trading robot, Tastyfx account holders can also opt to automate their trading using ProRealTime.

ProRealTime is renowned for its powerful charting tools and also supports automated trading strategies through a range of advanced features. The platform leverages machine learning to enhance trading from charts, with tools like automated trend lines that can be set to redraw every five minutes and custom technical indicators that trigger specific order types.

For those interested in custom development, ProRealTime offers ProBuilder, its proprietary coding language, allowing traders to create personalized algorithms and technical indicators. This feature supports the development of tailored forex trading robots, providing an advanced level of customization for dedicated traders.

Tastyfx: Our Verdict

From advanced market research to a broad range of trading products and competitive spreads, Tastyfx offers everything an advanced trader needs to optimize their automated trading strategies.

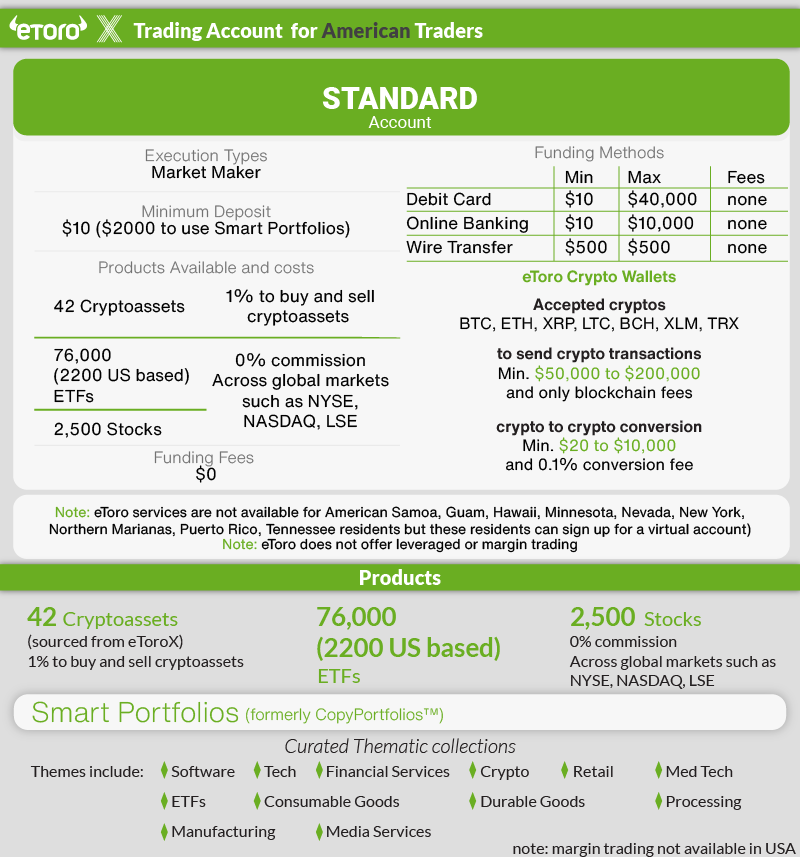

6. eToro - Great Broker For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

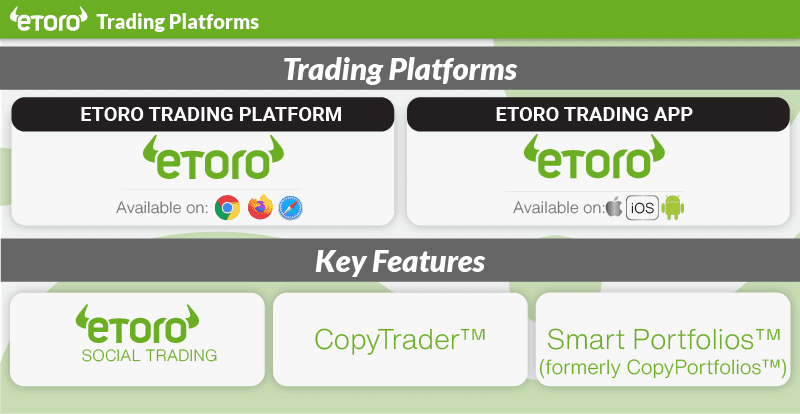

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro to American traders with an interest in automated social and copy trading, particularly for cryptocurrency. While experienced traders may find the platform too limited, beginners and casual traders will enjoy the features designed to make it simple to mirror professional strategies and open positions automatically. American traders should be aware, however, that Forex trading is not available.

Pros & Cons

- Excellent social and copy-trading tools

- Great selection of cryptos

- Fun, gamified interface with live feed

- Not available in all US states

- Higher than-average trading costs

- Only cryptocurrency for American traders

- No Forex pairs

Broker Details

eToro has copy trading to copy other traders

eToro doesn’t yet offer forex trading to US customers – Americans are limited to trading cryptocurrency and bitcoin – but we’ve included it here since its trading platform offers several automated trading supports.

Key Strengths:

- Supports social and copy trading

- Excellent selection of cryptocurrencies

- Innovative, game-ified approach to investing

eToro Trading Accounts and Products

While eToro continues to expand its presence in the US, residents of some states may find themselves eligible for only a virtual account. For other American traders, the brokerage currently offers a single account option and limits forex trading to cryptocurrencies.

An eToro Standard account operates on a dealing-desk model with a 1 pip spread and a ‘spread plus 1%’ fee round round-turn per lot. Leverage is capped at 30:1, slightly lower than other brokers we reviewed. The costs associated with trading stocks and ETFs are competitive, however, with 0% commission. Stock traders can buy and sell fractional shares, also at no commission.

As you might expect, given the emphasis on digital currency, eToro allows traders to fund accounts using cryptocurrency, including Bitcoin (BTC) and Ethereum (ETH).

In addition to 42 cryptocurrencies, eToro’s American account holders can trade in stocks and ETFs.

eToro Automated Trading Platforms

As the broker best known for going all-in on the Best Social Trading Platforms and copy trading, eToro stands out for its copy trading tools, designed to allow new or casual retail investors to easily follow the movements of more experienced and successful forex traders. The system operates on a similar logic as mirror trading, with eToro’s sentiment data collection tool for monitoring top traders on the platform and synthesizing their trading decisions into a broadly applicable series of trades executed on behalf of any user following those investors.

A wall-style feed of comments, tips and suggestions from eToro’s ‘community’ of investors takes pride of place in the platform interface, giving US clients insight into how successful eToro retail investors and professional traders around the world perceive the forex market in real-time.

More experienced traders may find the platform rather too restrictive, given the emphasis on copy trading and the focus on casual retail traders who lack the desire to develop their own trading strategies. In addition to the limited range of products, eToro’s trading platform also lacks third-party integrations for more powerful platforms, such as MetaTrader 4 or MetaTrader 5.

eToro: Our Verdict

For casual or beginner traders interested in exploring day trading and those who prefer to trade only crypto, eToro has much to offer. Regulatory restrictions and a limited range of automations may render it less appealing to experienced traders accustomed to coding their own bots or using custom robots.