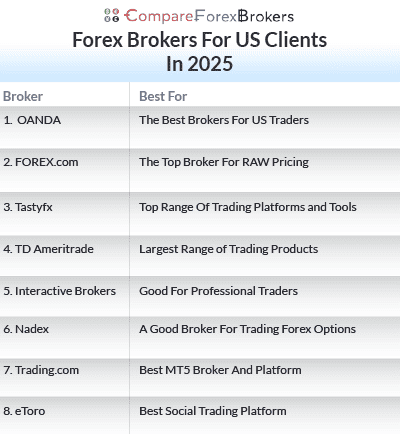

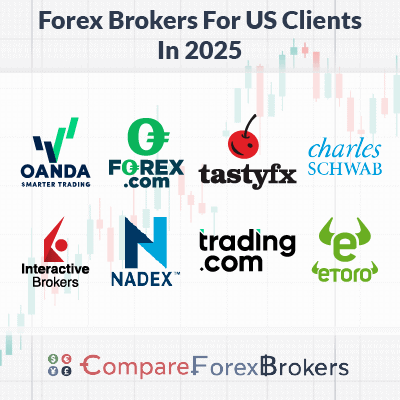

Forex Brokers Accepting US Clients

Forex Brokers Accepting US Clients should be regulated by the NFA or CFTC. These brokers allow spot trading when forex trading with leverage up to 1:50. We look at the best brokers one can choose from.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Not all forex brokers accept US clients, we list the best options

- OANDA - The Best Brokers For US Traders

- FOREX.com - The Top Broker For RAW Pricing

- Tastyfx - Top Range Of Trading Platforms and Tools

- Charles Schwab - Largest Range of Trading Products

- Interactive Brokers - Good For Professional Traders

- Nadex - A Good Broker For Trading Forex Options

- Trading.com - Best MT5 Broker And Platform

- eToro - Best Social Trading Platform

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 | NFA/CFTC | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 68+ (Spot) | - | 50:1 | 100:1 |

|

|

Read review ›

Read review ›

|

84 |

NFA/CFTC FCA,CIRO |

0.0 | 0.2 | - | $7.00 | 1.50 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ (Spot) | - | 50:1 |

|

|

Read review ›

Read review ›

|

71 | NFA/CFTC | - | - | - | $6.00 | 1.2 | 1.9 | 1.4 |

|

|

|

174ms | $450 | 80+ (Spot) | - | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

43 |

SEC, NFA/CFTC FINRA |

- | - | - | - | 1.4 | 1.3 | 1.2 |

|

|

|

110ms | $2000 | 70+ (Spot) | 1 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

50 | NFA/CFTC | - | - | - | - | 1.2 | 1.8 | 1.2 |

|

|

||||||||

Read review ›

Read review ›

|

43 |

ASIC, FCA CYSEC |

- | - | - | - | - | - | - |

|

|

|

120ms | $10 | - | 24 (Spot) |

|

What Are The Best Forex Brokers Accepting US Clients?

The best Forex Brokers In the USA offer American clients trading conditions and trading costs on par with those for international account holders. We’ve chosen OANDA as the best of the US-regulated forex brokers due to its accessible trading platform, excellent reputation and competitive trading fees.

1. OANDA - The Best Brokers For US Traders

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA is our top choice for Americans looking for an online broker to spot trade forex. This forex brokerage excels in market research, offers robust charting and technical analysis tools, and has an award-winning mobile app. It also boasts a strong reputation due to an impressive commitment to transparency.

With seven licenses from Tier-1 regulators, OANDA is the only broker we reviewed to earn a 100/100 trust score per our methodology. Crucially, for U.S. traders, OANDA Corporation holds licenses from the National Futures Association and is registered with the Commodities Futures Trading Commission.

Pros & Cons

- Extensive regulatory oversight for maximum investor protections

- Advanced charting with TradingView

- Powerful, intuitive mobile trading app

- 24/7 customer support by traders, for traders

- Risk management tools could be stronger

- Fewer forex pairs to trade than comparable brokers

- MetaTrader 4 offering not as comprehensive as OANDATrade trading platform

Broker Details

Key Strengths Of OANDA:

- Low spreads and competitive trading costs

- Wide variety of assets to trade

- 24/7 customer support by traders, for traders

OANDA Trading Accounts & Products

If you’re an American forex trader, OANDA offers you a single, straightforward account. The Spread Only Pricing account functions much like other brokers’ Standard accounts: rather than paying a commission to execute the trade and a separate fee to cover the spread, you pay a single lump sum that includes execution costs.

Beginner traders and those who play the markets casually may prefer the convenience of OANDA’s Spread-only pricing account, while those with more experience may appreciate the commission-based structure of the Core Pricing account.

- Spread Only Pricing. Variable spreads start at 0.6 pips, and traders pay no commission on round-turn trades of a standard lot.

- Core Pricing. Traders pay a commission of USD 10.00 per round-turn trade of a standard lot but enjoy tighter variable spreads that start as low as 0.1 pips.

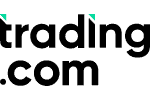

OANDA Active Trader Rebate Programs

If you’re a professional investor or a trader comfortable working with significant sums of money, OANDA offers an attractive rebate program to reward high-volume trades.

Qualifying account holders can select between a reduction in commissions or a cash rebate ranging from USD 5.00 and USD 15.00 per million dollars traded.

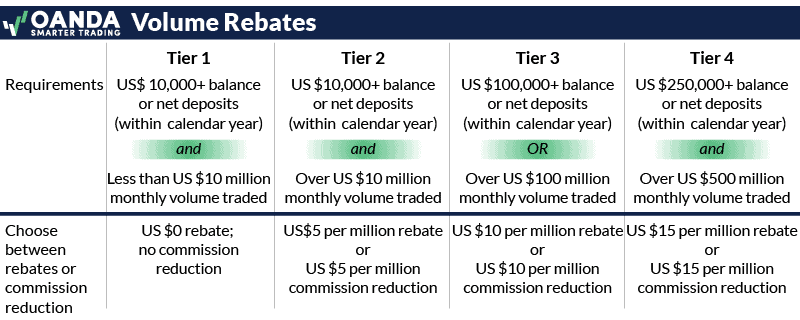

OANDA limits American traders to forex only but offers a comprehensive selection of pairs to trade. The broker’s ten major currency pairs include EUR, GBP, USD, JPY, NZD, AUD and CHF. It also offers 58 minor, exotic and cross pairs for a total of 68 currency combinations for trading.

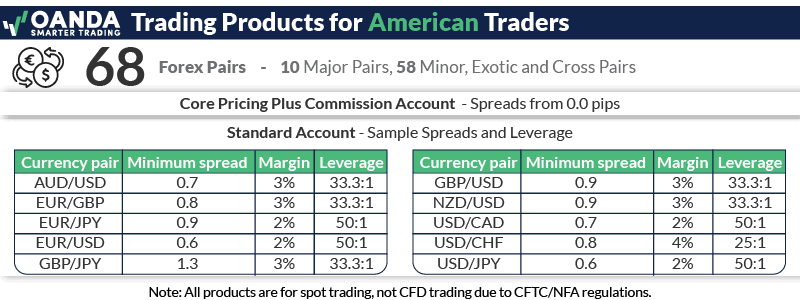

OANDA Trading Platforms

If you’re trading forex with OANDA, you have a choice between two good options when it comes to Forex trading platforms: MetaTrader 4 or OANDA Trade, the broker’s own in-house web and mobile interface.

Powered by TradingView, OANDA’s proprietary platforms have all the tools a trader might want, including performance analytics, personalized watchlists and advanced charting options. Technical traders accustomed to MetaTrader and cTrader might find themselves pleasantly surprised at how powerful OANDA’s offerings are.

For those who prefer the Meta family of trading platforms and tools, OANDA allows MetaTrader 4 users to access additional tools, including advanced indicators, mini charts, alert trading, EAs, alert trading and one-cancels-the-other orders, keyboard trading and tick trading via MetaTrader Premium.

For automated trading, OANDA offers US traders a private API, OANDA v20 REST, which allows for automated trades via the OANDA Trade platforms.

OANDA: Our Verdict

With a solid selection of currency pairs available to trade, powerful trading tools and competitive trading costs, OANDA covers all the bases for a quality trading experience, regardless of experience level, budget or preferred strategy.

Straightforward funding with no hidden costs and high-quality customer support round out the profile and earn this broker our highest endorsement.

Exclusive 10% Cashback Offer Available (Terms and Conditions Apply)

2. FOREX.com - The Top Broker For RAW Pricing

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com for its robust trading environment built around the MetaTrader 4, MetaTrader 5, TradingView and Forex.co, trading platforms, sophisticated technical trading tools and advanced analytical capabilities. A solid selection of currency pairs ensures that you have ample opportunities across the foreign exchange markets, while competitive trading costs help you stay within budget.

Pros & Cons

- Excellent range of trading platforms, including MetaTrader 5

- Over 80 forex pairs to trade

- Average spreads of 1.86 pips for major currency pairs

- Powerful trading tools

- Educational content for US traders is less robust than for other countries

- No copy trading or social trading tools

- No crypto spot trading

Broker Details

Key Strengths:

- Powerful trading platforms

- Sophisticated technical trading tools

- Great variety of currency pairs

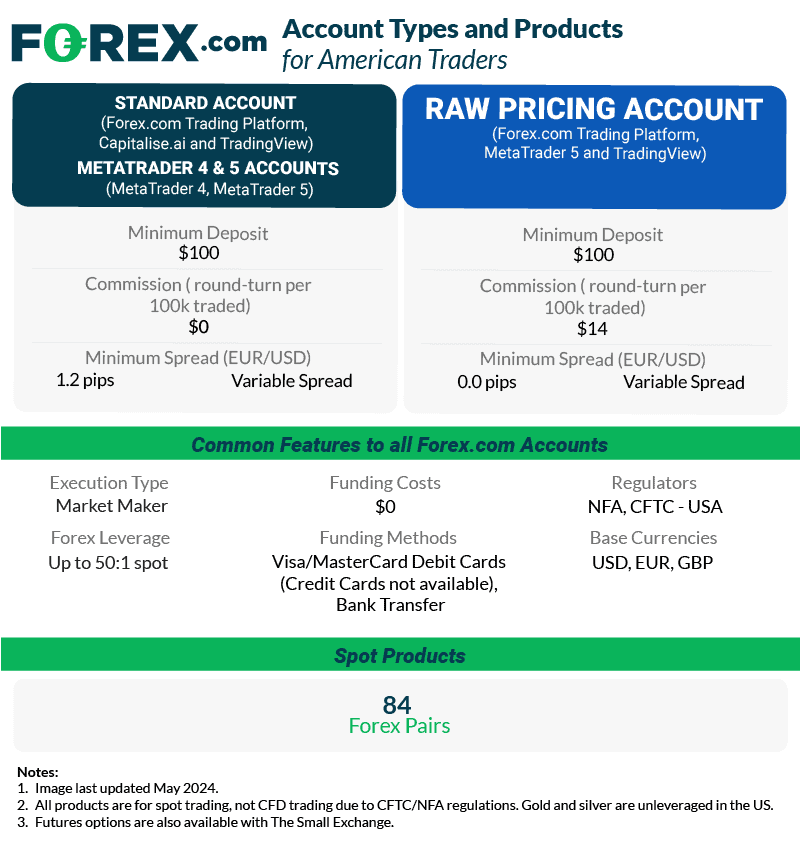

FOREX.com Trading Accounts & Products

Choose wisely – your trading costs with FOREX.com depend on the type of account you choose:

- Standard account with spreads as low as 1.2 pips for EUR/USD.

- RAW Pricing account with EUR/USD spreads as low as 0.0 pips plus USD$7 in commissions each way per standard 100k lot traded (USD$14 round-turn commission).

FOREX.com requires a minimum deposit of USD 100 to open an account but makes up for it with the maximum Leverage allowed for retail clients. (That’s 1:50 under CFTC rules.)

In terms of markets, you can trade more than 80 major, minor and exotic currency pairs, as well as unleveraged gold and silver.

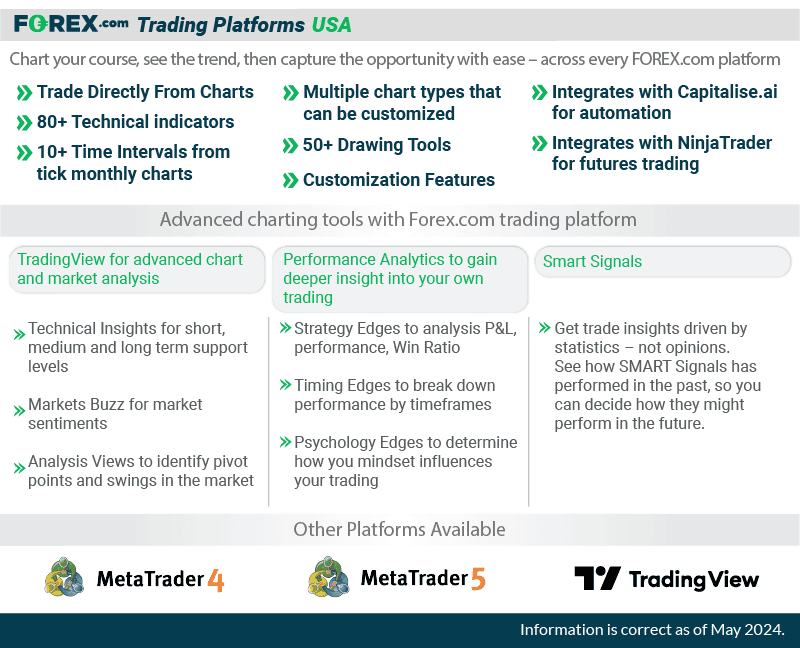

FOREX.com Trading Platforms

In addition to the platform’s own mobile, web and desktop trading interfaces, you have the option to trade with MetaTrader 4, MetaTrader 5 and TradingView. If you’re interested in using Capitalise.ai for automation or NinjaTrader for futures, however, you’re better off with FOREX.com’s proprietary platform.

3. Tastyfx - Top Range Of Trading Platforms and Tools

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, tastyfx Web Platform, tastyfx Mobile App, ProRealTime

Minimum Deposit

$250

Why We Recommend Tastyfx

We recommend Tastyfx as a top choice for US traders, thanks to its award-winning proprietary trading platform, competitive trading fees, fast order execution, and excellent customer support. Formerly known as IG Markets, Tastyfx continues to offer a robust trading experience with these standout features.

Pros & Cons

- Exceptionally trustworthy – multiple Tier 1 licenses and almost double the required level of capitalisation

- A powerful in-house platform that scales from beginner traders to advanced users

- A comprehensive range of forex pairs to trade

- Futures trading available

- No MetaTrader 5

- Less Comprehensive MetaTrader 4 Offering

- Limited Deposit Options

Broker Details

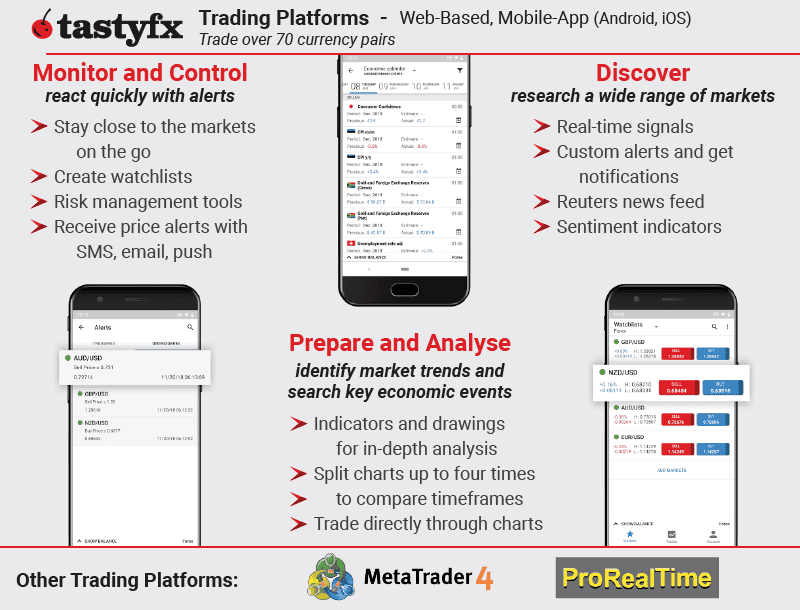

Tastyfx has 4 platforms and useful tools for better trading

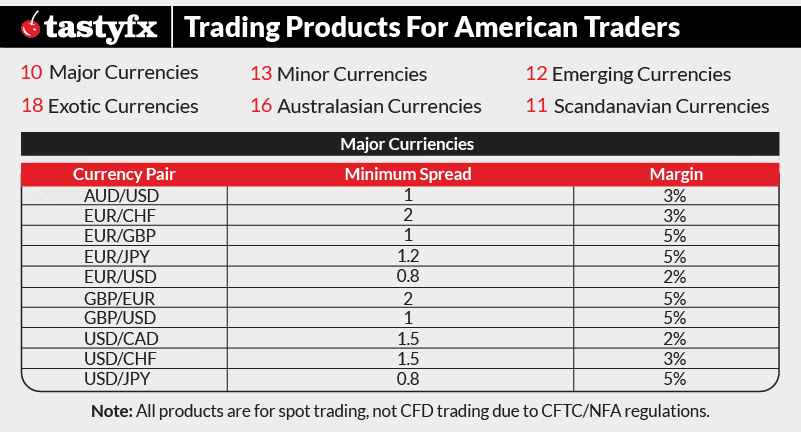

Tastyfx offers a comprehensive range of trading products, including over 80 forex trading pairs, stocks, ETFs, commodities, and futures. The platform is known for its competitive spreads and low pips, providing traders with cost-effective options and efficient trading. With a focus on advanced tools and robust customer support, Tastyfx delivers a strong trading experience for both novice and experienced traders.

We consider Tastyfx one of the best Forex brokers for US traders based on:

- Trading costs

- Fast Order Execution

- Platform offerings and features

- Award-Winning Platform

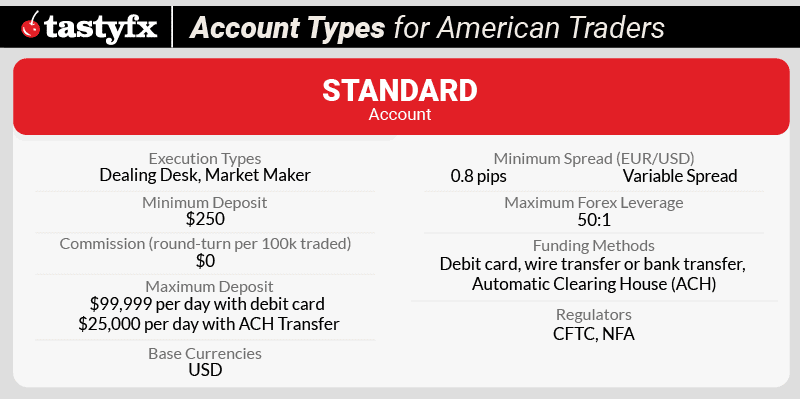

Tastyfx Trading Accounts & Products

Since Tastyfx operates a Market Maker model, its Forex trading spreads tend to be a bit wider compared to ECN and STP brokerages. Unlike an ECN or STP account, there are no commission costs you need to pay in addition to the spread.

Tastyfx provides competitive pricing on a diverse range of over 80 currency pairs, including major, minor, and exotic pairs. Traders benefit from leverage options up to 50:1, though leverage is commonly set at 30:1 or 20:1 for most pairs, allowing for flexibility in trading strategies while managing risk effectively.

Tastyfx Trading Platforms

The Forex brokerage offers a combination of in-house and third-party trading platforms to cater to various trader preferences.

Tastyfx Proprietary Trading Platform

Tastyfx offers 3 versions of their signature platform built from the ground up for the needs of clients. These versions are web-based, as a mobile app and as a tablet app.

The web-based Tastyfx platform requires no downloads, so you can access it from any device with a web browser. It offers standard charting features found on most trading platforms but stands out with its HTML5-based charts, which run quickly and can be split into up to four timeframes, with unlimited indicators available.

While the platform includes basic risk management tools like stop loss and take profit, it does not offer guaranteed stop loss or trailing stop loss options—features that are available on Tastyfx’s international platforms.

Additionally, Tastyfx provides proprietary mobile apps for both Android and iOS, which have earned multiple industry awards. The Android app features real-time charts, advanced trading options such as partial fills and real-time updates. US clients can set price alerts and receive trading signals via email, SMS, or push notifications.

4. Charles Schwab - Largest Range of Trading Products

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

We recommend Charles Schwab (formerly TD-Ameritrade) for its extensive range of trading products. Unlike many international brokers, Charles Schwab offers access to a variety of financial markets. With Schwab, you can trade forex, cryptocurrency, stocks, ETFs, and mutual funds. The user-friendly platform and strong customer support enhance the overall trading experience.

Pros & Cons

- A wide range of financial markets are available

- Easy transfer between other Charles Schwab investment accounts

- Mobile trading app specifically designed for beginners

- Great educational materials

- Limited Forex Pairs

- Less Competitive Margin Rates

Broker Details

Key Strengths:

- Industry-leading educational materials;

- A mobile trading app designed particularly for beginners.

- Access to thinkorswim trading platforms on desktop, web trader, and mobile app

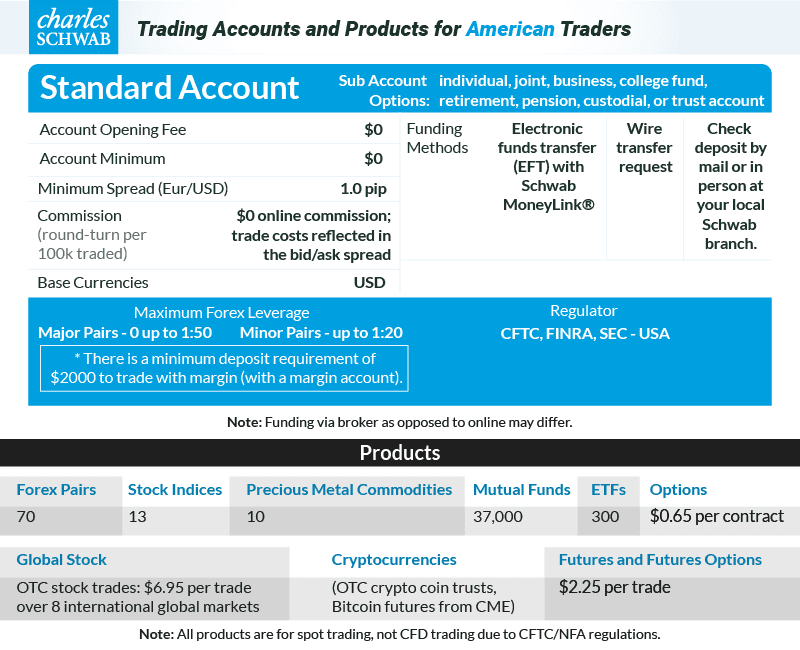

Charles Schwab Trading Accounts & Products

Charles Schwab clients will need to open a brokerage accounts to trade forex and other instruments.

Charles Schwab’s Standard brokerage account has $0 commission on most trades, but fees apply for OTC equities, mutual funds, and options ($0.65 per contract). The Satisfaction Guarantee refunds eligible fees within 90 days. No account maintenance fees, but other charges may apply.

Regardless of which account you choose you can trade a very diverse range of products whether this be spot or actual. With some 65 forex pairs, Charles Schwab’s US-based customers can spot-trade stocks, ETFs, cryptocurrencies, precious metals, indices and commodities.

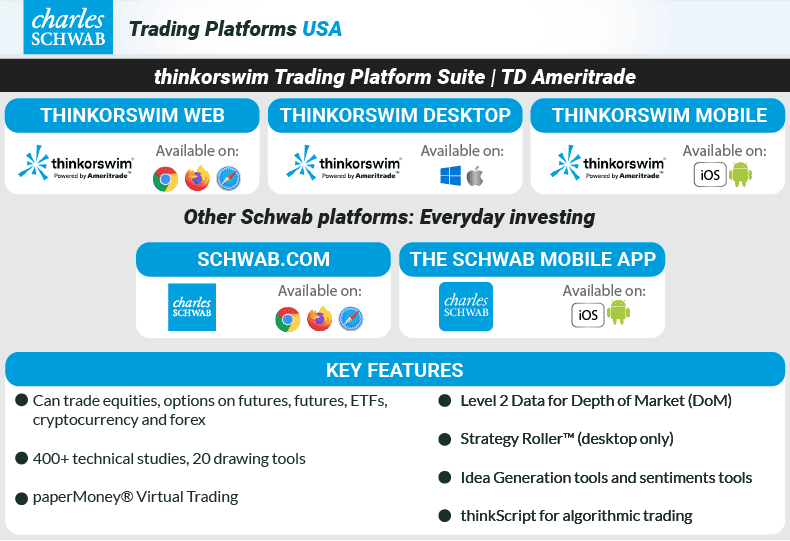

Charles Schwab Trading Platforms

Charles Schwab provides a range of trading platforms to suit different needs. Their thinkorswim desktop platform offers advanced charting and analysis tools for serious traders, while thinkorswim web and mobile versions ensure you can manage your trades and monitor markets from any device. Schwab.com and Schwab Mobile also offer robust features for trading, account management, and research, making it easy to stay connected and in control whether you’re at your desk or on the go.

For traders familiar with MetaQuotes platforms like MT4 or MT5, thinkorswim offers comparable features. It provides Level 2 market depth data, over 400 technical studies, and 20 drawing tools. Thinkorswim also supports algorithmic trading through thinkScript and offers detailed sentiment analysis for social trading.

5. Interactive Brokers - Good For Professional Traders

Forex Panel Score

Average Spread

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

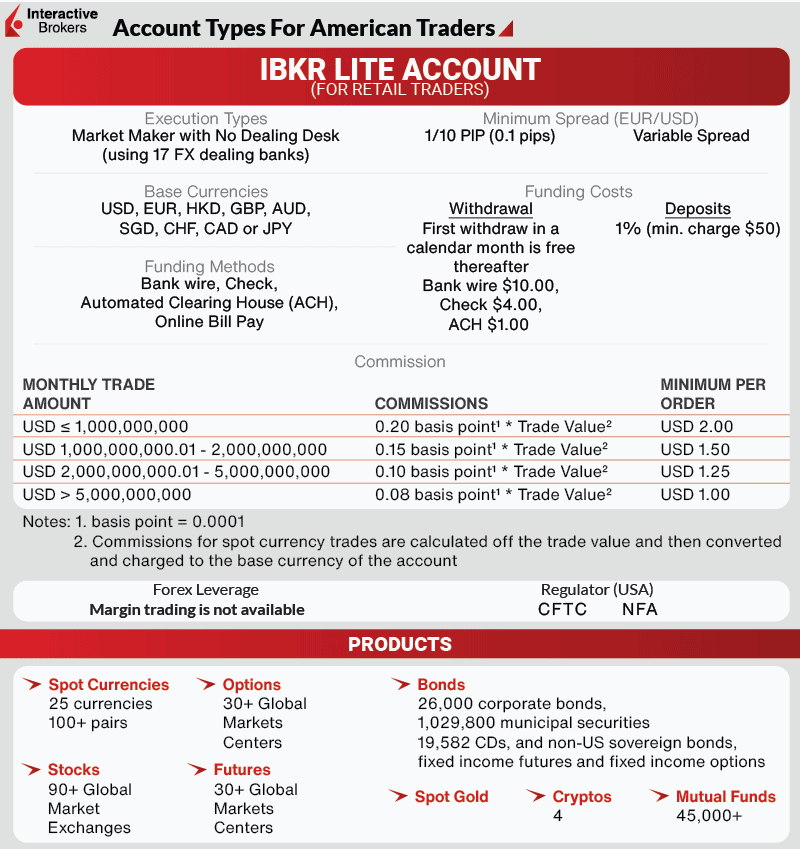

Why We Recommend Interactive Brokers

We recommend Interactive brokers – IB for short – particularly for professional traders based on their powerful trading tools and extensive range of order types – more than any other broker we reviewed. The complex pricing structure and absence of other platform options may make it a less-than-ideal option for beginners, however.

Pros & Cons

- TraderWorkstation platform offers professional-grade trading tools

- Low trading costs

- Sophisticated order types

- Complicated pricing structure

- No platform alternatives

- A Steep learning curve for the TraderWorkstation platform

Broker Details

Because Interactive Brokers sources its pricing from over 17 FX dealers, account holders have access to spreads as tight as 0.1 pips on major currency pairs. You will, however, pay a commission on every trade, though the amount will vary based on the size of your trade. This can make managing your costs difficult, and we would’ve liked an in-built calculator or similar tool. On the other hand, the low trading costs – even with commissions – more than tip the scale.

We also enjoyed experimenting with the broker’s proprietary trading platform. Aptly named TraderWorkstation, it offers professional-grade trading conditions. We also took note of the range of order types, which includes Basket orders and One-cancels-all.

6. NADEX - A Good Broker For Trading Forex Options

Forex Panel Score

Average Spread

N/A

Trading Platforms

NADEX Trading Platform

Minimum Deposit

$0

Why We Recommend Nadex

We recommend NADEX for anyone interested in trading forex options. While not, strictly speaking, a brokerage, it occupies a unique space in the US market as the only licensed platform for forex options trading available to Americans. With NADEX, you can trade binary options, knockouts and call spreads based on COMEX/NYMEX futures.

Pros & Cons

- Easy-to-use binary options trading tools

- Straightforward trading platform

- Good educational materials

- Minimal regulation

- Operates through a European intermediary

- US $250 minimum deposit

- US $25 withdrawal fee

Broker Details

Key Strengths:

- Dedicated to binary options and other exotic derivatives

- Fully regulated and CFTC-compliant

- Easy funding and low fees.

NADEX Trading Products

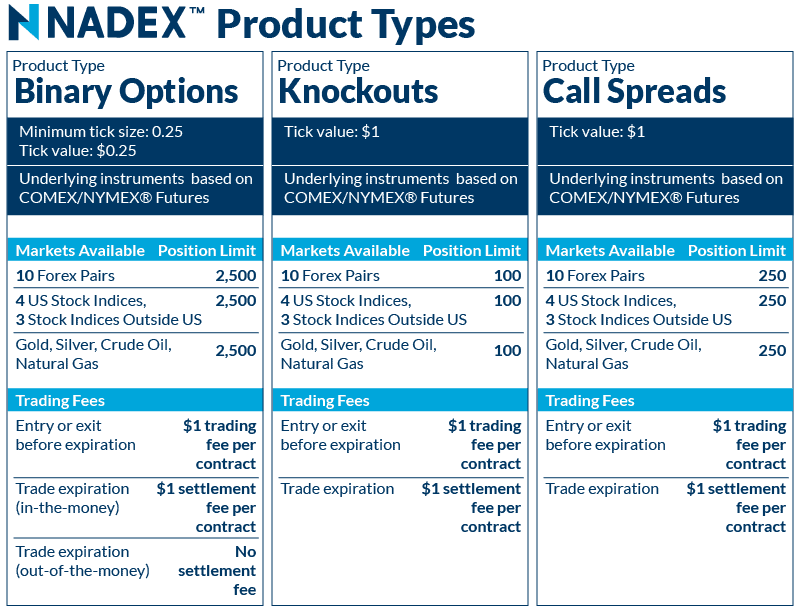

Americans using NADEX have the choice to trade in binary options, call spreads and knockouts. Position limits start at 100 for knockouts and extend to 25 for Call Spreads and 2,500 for Binary options. Trading fees are set at $1 to enter or exit any contract before expiration, regardless of instrument, and $1 to settle a contract at the expiration of trading. If you’re out of the money when your binary option contract expires you’ll pay no settlement fee.

Traders accustomed to a balanced portfolio with a variety of instruments may find NADEX offering too limited. The exchange offers only 10 forex pairs, seven stock indices and three commodities.

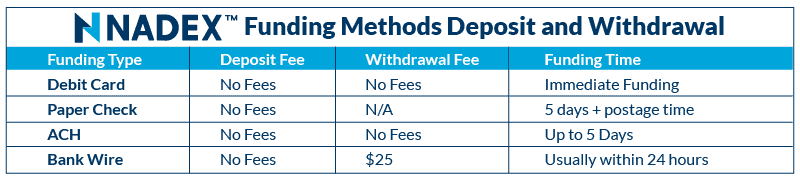

NADEX allows customers to fund their accounts via debit card, paper check and ACH or wire transfers at no fee. Note that credit cards are not available, which means traders must have cash on hand to trade. Withdrawals are likewise inexpensive, as NADEX does not charge a fee unless customers opt for a wire transfer.

NADEX Trading Platforms

With a proprietary trading platform adapted for mobile and desktop, NADEX allows customers to access markets at any time. The trading tools, particularly charts and technical indicators may feel lightweight to professional traders. For a niche investment platform, however, they’re perfectly adequate.

NADEX does stand out for its risk management tools. Traders enjoy negative balance protection. The platform will automatically exit losing positions if the market turns against a trader, preventing catastrophic losses.

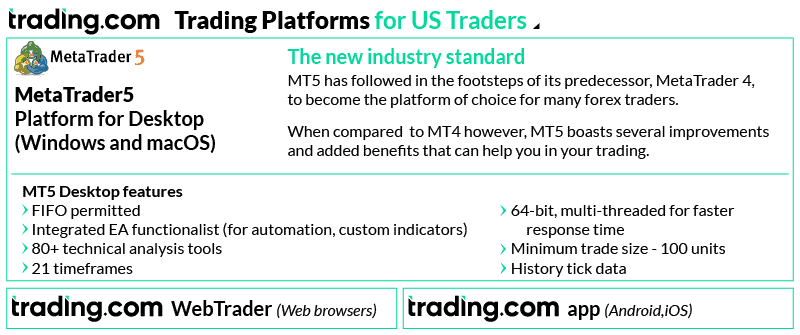

7. TRADING.com - Best MT5 Broker And Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1.3

AUD/USD = 1

Trading Platforms

MT5

Minimum Deposit

$50

Why We Recommend Trading.com

We recommend Trading.com for its dedication to the MetaTrader 5 trading platform. The successor to MetaTrader 4 offers a similarly high-quality trading experience but includes access to centralised exchanges. Trading.com is the only regulated Forex broker to offer MT5 to American traders. It also stands out for its selection of forex pairs, 24/5 customer support and competitive trading costs.

Pros & Cons

- Solid selection of over 70 currency pairs to trade

- Only broker offering the MT5 trading platform for Americans

- Straightforward account opening experience

- The proprietary app lacks advanced charting and some important trading tools

- Automated trading isn’t segregated through a dedicated VPS server

Broker Details

Trading.com has trading with MetaQuotes MT5 Trading Platform

For automated traders and those with an interest in centralised exchanges, a broker like Trading.com stands out for its commitment to the MetaTrader 5 platform. The successor to MetaTrader 4 provides a similarly high-quality trading environment, with several innovative features.

Key Strengths:

- Wide range of available instruments to trade

- Straightforward trading environment

- Round-the-clock, live customer support

Trading.com Trading Accounts & Products

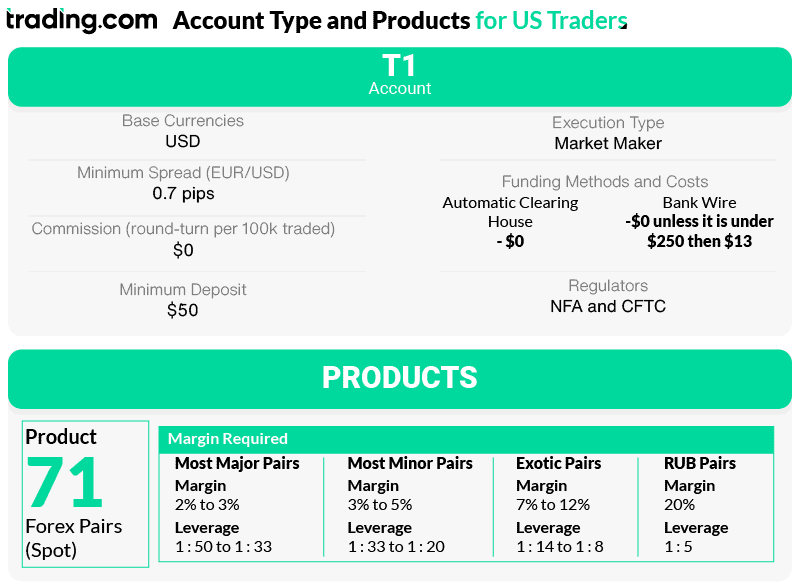

US-based forex traders can open a T1 account with Trading.com after making a minimum deposit of USD$50 via wire or ACH transfer. Payment by credit or debit card is also an option but will incur a fee.

Trading.com acts as a market-maker for customers. While this does ensure the execution of customer trades, it also means wider spreads. Variable spreads start at 0.7 pips, however, traders pay no commission on round-turn trades of standard lots.

Trading.com offers 71 pairs total, including all major, minor and exotics, as well as RUB pairs. Leverage extends 1:50 for major pairs and 1:33 for minor pairs – the maximum allowed under US regulations.

Trading.com Trading Platforms

Trading.com is, hands down, the best broker for traders interested in exploring MT5. The newest version of the platform has many of the same features as MetaTrader 4, plus some new additions that make it an ideal platform for automated trading.

The platform has reported impressive execution speeds and offers users access to some sophisticated charting tools. Users can pen up to 100 charts at a time with 21 timeframes and 80 technical analysis tools.

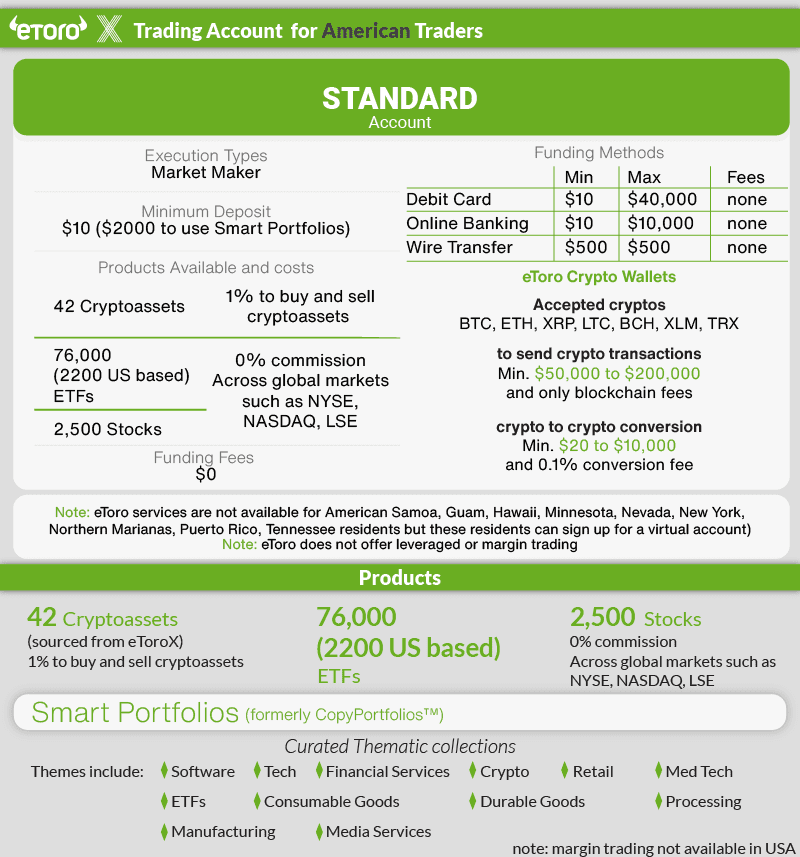

8. eToro - Best Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

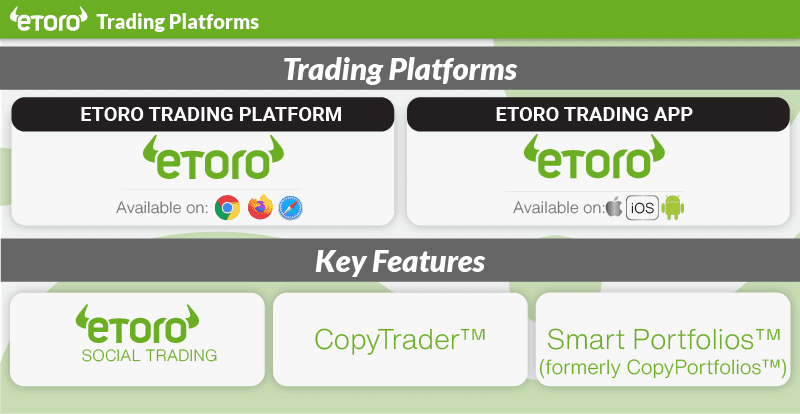

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro for anyone interested in casual day trading or social and copy trading. With a gamified approach to investing and a business strategy devoted to making trading accessible, you’ll find an impressive selection of tools for social and copy trading.

Pros & Cons

- Great selection of cryptocurrencies

- Intuitive trading platform

- Excellent, accessible educational tools

- Advanced traders may find the trading platform lacking

- Does not support algorithmic trading

- Not available in all US states

Broker Details

Key Strengths:

- Innovative, game-ified approach to investing

- Excellent selection of cryptocurrencies

- Supports social and copy-trading

eToro Trading Accounts & Products

eToro operates in a limited number of US states and offers only one account type to American customers: standard. Account holders will need to make a USD$10 minimum deposit to begin trading, however, accounts can be funded with a range of currencies, including crypto.

Because the broker acts as a market-maker, traders pay a ‘spread plus 1%’ fee per 100K standard lot on round-turn trades with a minimum spread of 1.0 pips. Users can trade stocks and ETFs at 0% commission, however, even for fractional shares.

US traders can access some of the most popular cryptocurrencies, like Bitcoin, Ethereum, Ripple, ADA, and Dogecoin. The broker currently allows trading in 39 cryptocurrencies, as well as ETFs and stocks.

eToro Trading Platforms

US clients seeking a copy trading solution will find eToro appealing. The broker’s proprietary platform allows users to identify top-performing traders, connect with them and directly replicate their trading activities.

eToro’s CopyTrader also enables users to pause or stop the copy, to add or to remove funds whenever they wish – without the need to pay any additional management fees or other hidden costs.

Note: Unlike others on this list, eToro is regulated by the Financial Industry Regulatory Authority or FINRA for short.

Ask an Expert