Top CIRO Regulated Forex Brokers

The Canadian financial body is the CIRO (formerly IIROC) which regulates forex brokers across Canada. We reviewed the best CIRO-regulated forex brokers in 2025 based on features such as trading platforms and costs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The Canadian Investment Regulatory Organization (CIRO) regulates trading activity in Canada and was originally called the IIROC. On their corporate website, they state that dealer members are required to be a member of the Canadian Investors Protection Fund (CIPF) established in 1969.

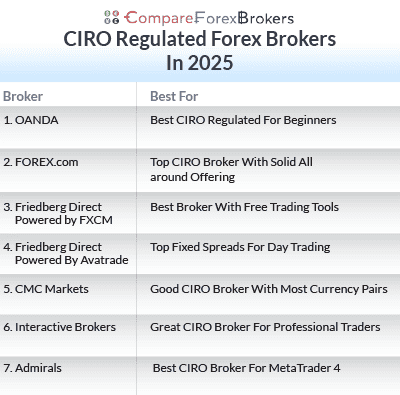

Our list of the top forex trading platforms is:

- OANDA - Best CIRO Regulated For Beginners

- FOREX.com - Top CIRO Broker With Solid All around Offering

- Friedberg Direct Powered by FXCM - Best Broker With Free Trading Tools

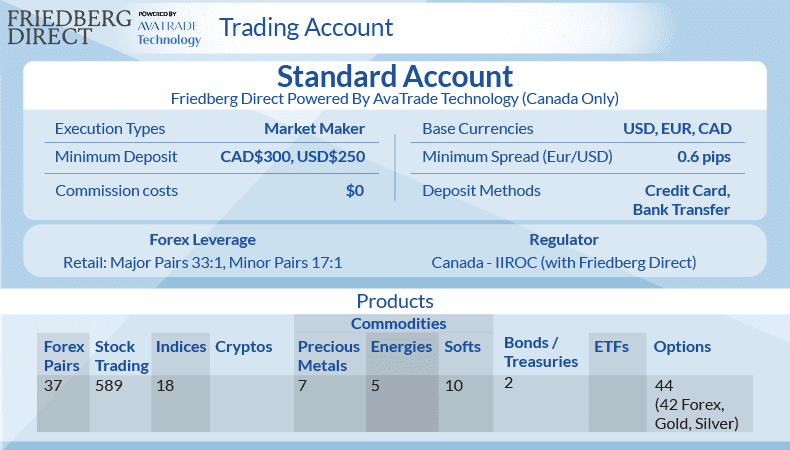

- Friedberg Direct Powered By Avatrade - Top Fixed Spreads For Day Trading

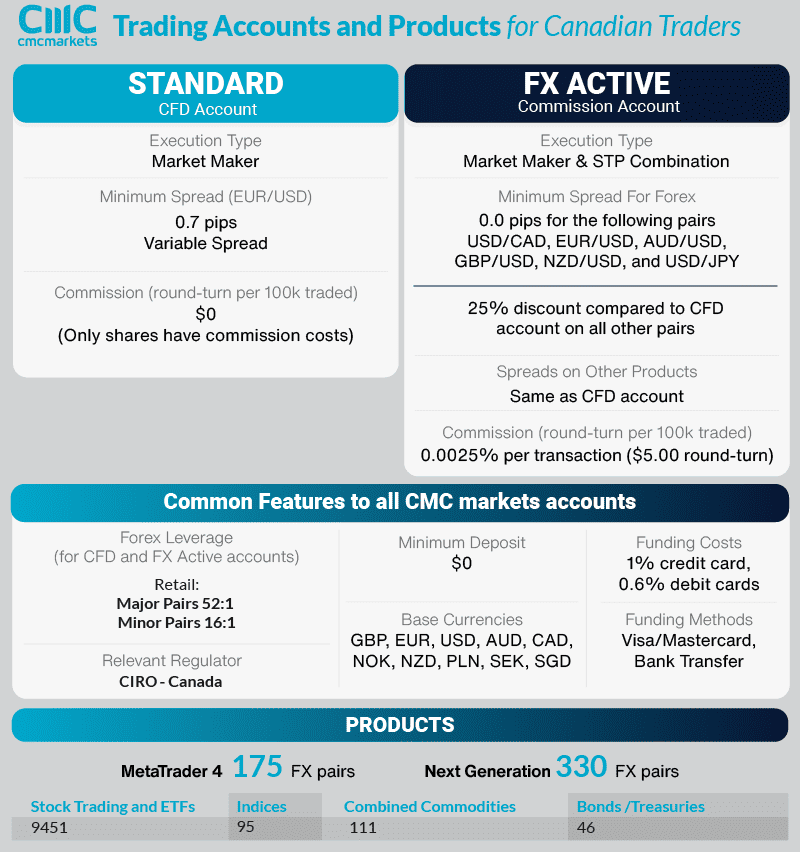

- CMC Markets - Good CIRO Broker With Most Currency Pairs

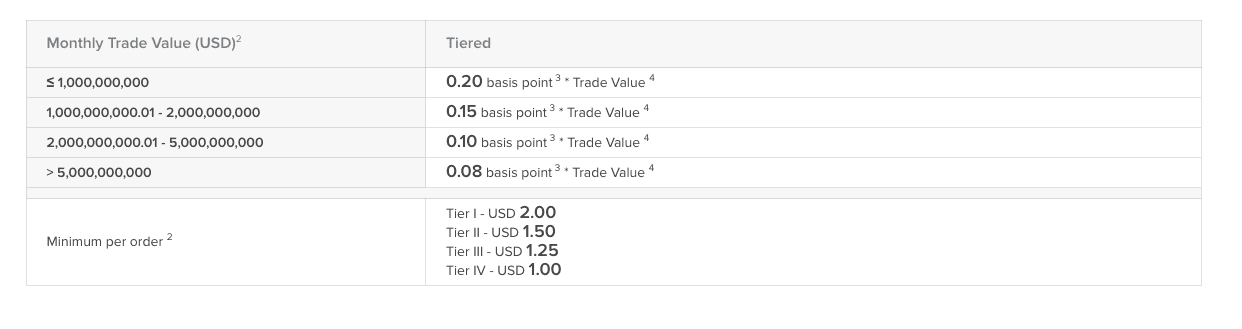

- Interactive Brokers - Great CIRO Broker For Professional Traders

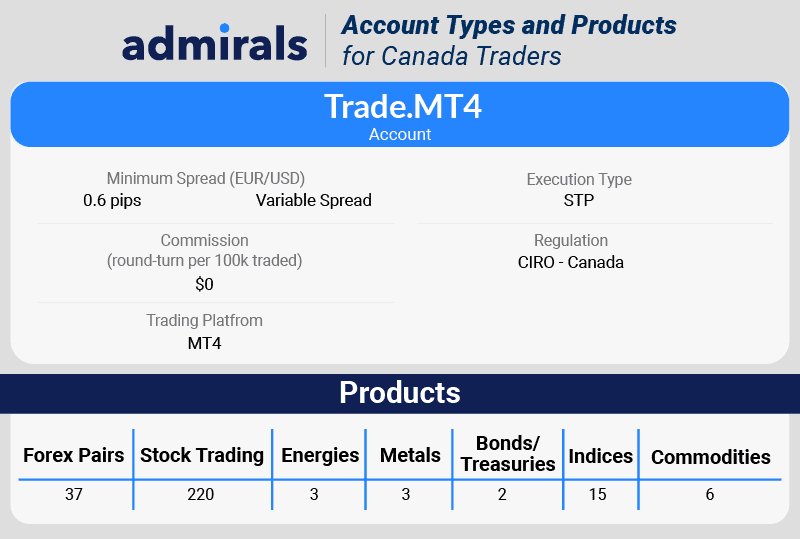

- Admirals - Best CIRO Broker For MetaTrader 4

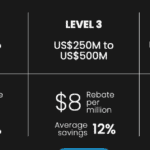

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

70 |

ASIC, FCA FSCA, CIRO |

0.22 | 0.80 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 39+ | - | 30:1 |

|

|

Read review ›

Read review ›

|

69 |

ASIC, FCA MAS, CIRO |

0.5 | 0.9 | 0.6 | $2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 339+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

52 |

CIRO NFA/CFTC,ASIC,FCA,MAS |

- | - | - | 0.08%-0.2% | - |

|

|

|

120ms | $0 | 100+ | - | 30:1 |

|

|||

Read review ›

Read review ›

|

73 |

ASIC, FCA, CySEC CIRO, FSA, EFSA |

0.1 | 0.7 | 0.6 | $3.00 | 0.8 | 1.0 | 1.0 |

|

|

|

132ms | $100 | 50 | 37 | 30:1 | 500:1 |

|

Who Are The Best CIRO Regulated Forex Brokers?

Based comparing fees, trading platforms, features and customer service levels we found the best CIRO regulated brokers by trading type. The list is updated regularly as newly published spreads and our own testing results of fees come through.

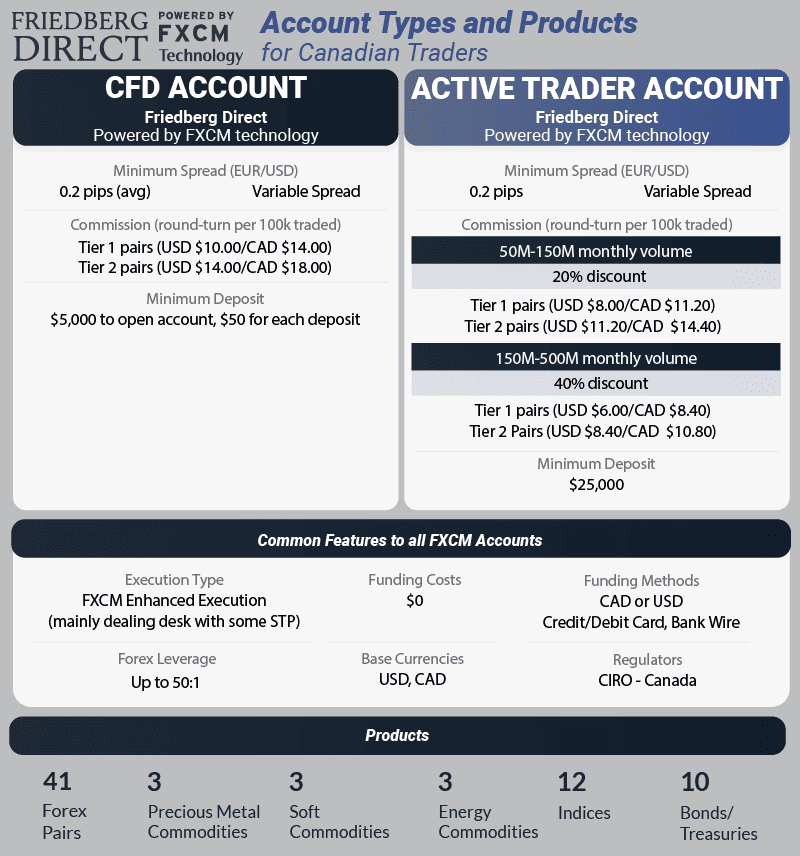

1. OANDA -

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

With a top score of 100/100 in our Trust category, OANDA’s long-standing reputation since 1996 and strict CIRO and FCA regulations ensure your trading is safe. We liked its OANDA Trade platform, which is remarkably user-friendly.

With OANDA Trade, you can start trading with small lot sizes, even less than a micro lot, as low as one currency unit. This flexibility offers a low-risk transition from demo to live trading, perfect for easing into risking your own funds.

Pros & Cons

- Highest trust score broker

- Requires no minimum deposit

- Trade lower lot sizes than micro-lots

- 24/7 customer support is not available

- Does not offer share CFDs

- No RAW Spread accounts

Broker Details

Based on our testing, we think OANDA is the best CIRO-regulated broker if you are a beginner, thanks to its OANDA Trade platform and low trading fees.

Specifically, when it comes to a trading platform, we like that OANDA Trade provides a solid overall experience thanks to its integration with TradingView’s charts. This allows you to use over 80+ indicators and drawing tools to perform technical analysis.

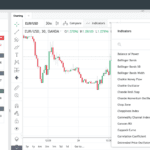

To help you transition from demo to live trading, we found that with OANDA Trade, you can select lower trade sizes than the default micro-lot sizes available with other brokers. This feature allows you to test your trading in a live environment without risking too much to begin with, helping you grow your confidence by risking your funds. As you can see in the image below, we have an order to open a EUR/USD position with one unit, requiring only a 0.07 CAD margin.

Another helpful feature is that the broker offers Autochartist, a third-party technical analysis service that generates potential trading ideas based on price action and chart patterns. We like how the tool is built into the OANDA Trade platform, giving you quick access to potential trading opportunities.

Even though OANDA Trade blends the charts from TradingView with the broker’s simplified platform, OANDA does offer other platforms. If you have experience with MetaTrader 4 or TradingView, we like that you can choose these platforms with OANDA – especially considering MetaTrader 4 allows you to automate your trades.

OANDA also impressed with its low trading costs, offering an average of 1.20 pips on EUR/USD, which is in line with the industry average for CIRO-regulated brokers.

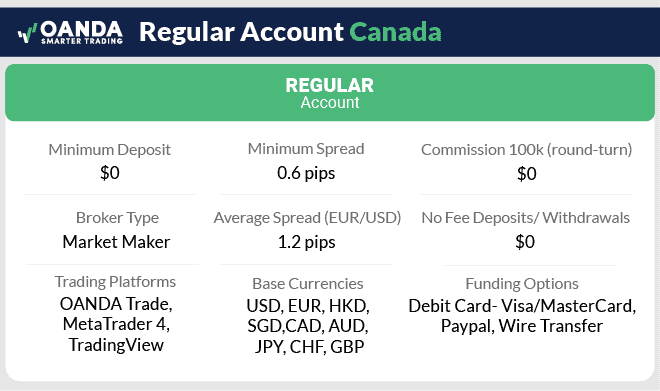

2. FOREX.com - Top CIRO Broker With Solid All-around Offering

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com as a top CIRO broker for its solid all-around offering. In our tests, it scored 60/100, showing strength in key areas like trading platforms and markets available.

You’ll benefit from low spreads, averaging one pip on EUR/USD, which means more of your money goes towards your trades, not fees.

Pros & Cons

- Great selection of FX pairs

- Provides decent market analysis for free

- Low average spreads

- Requires a minimum deposit

- No weekend customer support

- Lacks MetaTrader 4 platform

Broker Details

From our testing, we think FOREX.com offers a nice balance of services, a decent choice of markets and platforms, and low trading costs.

The broker is one of a handful that offers commission-based trading accounts in Canada through its Raw trading account, giving you much tighter spreads compared to the Standard account. We like it when brokers give you a choice of trading accounts, giving you more control over your trading conditions based on your trading style and experience.

With the standard account, you are much more exposed to expensive trading during volatile trading periods, while with a Raw account, your trading costs average out thanks to the fixed commissions, allowing you to trade without worrying about spreads widening too much.

We tested standard and Raw accounts spreads and found them decent. The standard account (variable spreads with no commissions) averaged 1.20 pips on EUR/USD, which is as competitive as OANDA.

FOREX.com’s Raw account, on the other hand, had tighter spreads from 0.0 pips on EUR/USD, but you had to pay $7.00 per lot traded, which is the norm for CIRO-regulated brokers.

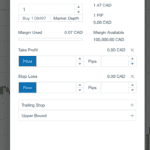

If you trade high volumes, we found that you can lower the Raw account’s costs through FOREX.com’s ActiveTrader programme via rebates, saving up to 15% on your commissions.

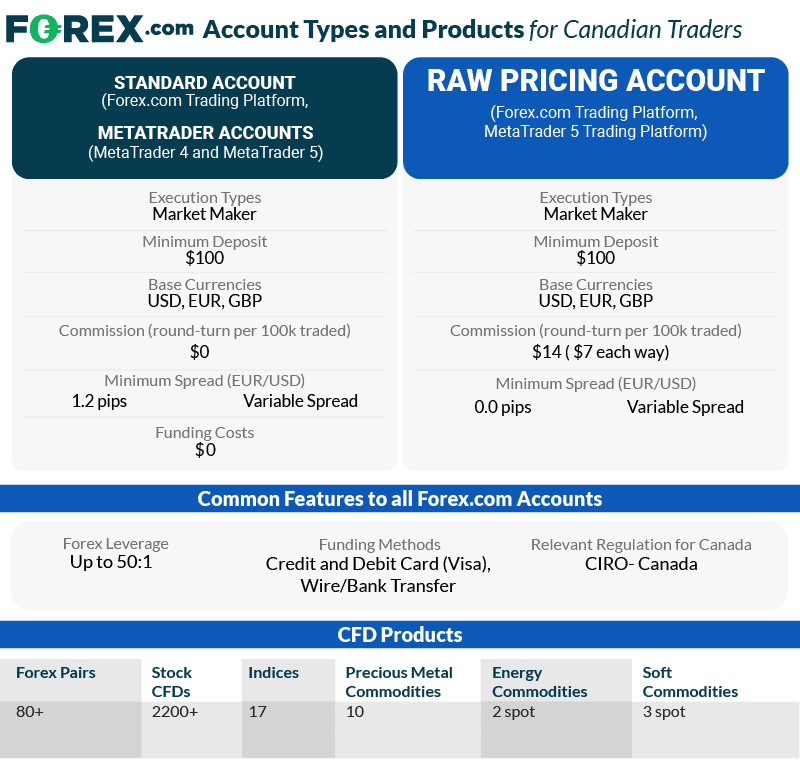

3. Friedberg Direct Powered by FXCM - Best Broker With Free Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

FXCM is a well-established forex broker, but what stands out for us is that FXCM offers over 50+ trading tools that can make your trading smoother. Among these tools, eFXPlus stands out, providing valuable FX picks and trade ideas from top major banks’ research desks.

With eFXPlus, you get access to insights from experts, helping you trade the forex market more confidently. You’re essentially getting access to investment bank-level research, and it’s all available to you for free.

Pros & Cons

- Small trade sizes available

- Wide choice of trading tools

- NDD execution

- Large minimum deposit

- Limited customer support hours

- No TradingView

Broker Details

While reviewing CIRO-regulated brokers, FXCM stood out for us with its selection of free trading tools with the live trading account we opened. You can download 30+ trading apps that can be used on Trading Station to enhance the platform with more features.

For example, we downloaded and installed the Daily Extremes indicator to test, which was easy to install and set up. This indicator allows us to see the previous days’ highs and lows through a dynamic support and resistance level, which is helpful for day trading as these are considered major levels.

The Trading Station platform is FXCM’s proprietary platform. It blends the features of MetaTrader 4 and TradingView and offers advanced charting tools, including 61 indicators and automated trading.

If you want to automate your trades, you can do so without coding knowledge through FXCM’s partnership with Capitalise.ai, which is a big plus in our books.

We like that you can use Capitalise.ai to test and automate your strategies by simply writing the rules for your strategy. The AI will develop the automation, which can be used for free on the MetaTrader 4 and Trading Station platforms.

While testing Capitalise.ai, we found setting up our first automated strategy easy after following its interactive tutorials. After specifying our rules and saving the strategy, we could backtest it to see how it performed over the past 90 days, which helps validate and optimise your strategy. In the image below, you can see our backtesting of the strategy we developed.

With FXCM offering excellent services for automating your trades, we decided to see how fast the broker’s execution speeds are and compared them to other CIRO-regulated brokers. In our testing, FXCM recorded competitive speeds with 108 ms for limit order execution (how fast your pending/stop-loss/take profit orders are executed) and 123 ms for market orders.

| Broker | Limit Order Speed | Market Order Speed |

|---|---|---|

| FXCM | 108 | 123 |

| OANDA | 86 | 84 |

| FOREX.com | 98 | 88 |

| Admiral Markets | 132 | 182 |

| CMC Markets | 138 | 180 |

| AvaTrade | 235 | 145 |

4. Friedberg Direct Powered By AvaTrade - Top Fixed Spreads For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade offers the best fixed spreads for day trading, which is why it’s our top pick. It’s a cost-effective choice with tight spreads starting from just 0.6 pips on EUR/USD and no commission.

These low spreads are great if you are a day trader, as they help keep your fees the same even during volatile market conditions (variable spreads get more expensive). AvaTrade also provides a decent range of markets, including forex, popular shares, commodities, and indices, offering you plenty of options for day trading.

Pros & Cons

- Tight fixed spreads

- Good range of markets

- Decent risk management tools

- No RAW spread pricing is available

- Has inactivity fees

- Support is limited to market hours

Broker Details

AvaTrade is one of the only CIRO-regulated brokers that offer fixed spreads. These can protect you from price spikes when the market becomes volatile, which is ideal if you day trade. In contrast, other brokers offer variable spreads, which can widen during these periods and increase your trading costs.

We opened a Standard account to test the fixed spreads and compared them with the other CIRO-regulated brokers to see how expensive fixed spreads are compared to variable spreads. Surprisingly, the broker offered its spreads at a competitive rate of 0.90 pips on EUR/USD, which is slightly cheaper than most variable spread brokers.

| Broker | Avg. EUR/USD Spreads* | Spread Type |

|---|---|---|

| Admirals | 0.60 | Variable |

| AvaTrade | 0.90 | Fixed |

| CMC Markets | 1.12 | Variable |

| OANDA | 1.20 | Variable |

| FOREX.com | 1.20 | Variable |

| FXCM | 1.30 | Variable |

To trade with AvaTrade, you can choose MetaTrader 4 and MetaTrader 5, giving you quick access to advanced charting and automated trading with fixed spreads. Alternatively, there is AvaTradeGO, which isn’t as advanced as the MetaTrader platforms but does have free signals and market sentiment indicators that can be helpful for day trading.

In our testing, we found that AvaTrade covers multiple markets with fixed spreads, with 55 currency pairs, 33 indices, 632 stocks, 27 commodities, and 59 ETFs. This is a solid selection as other fixed spread brokers tend to limit it to just the forex major pairs, so having fixed spreads on all these markets is excellent.

Compared to other brokers, the selection is lacking across the board, with most brokers like Forex.com and FXCM offering 2,000+ markets and 70+ forex pairs. Plus, if you use the MT4 platform on AvaTrade, you won’t have the option to trade shares as the platform doesn’t have the infrastructure for it.

5. CMC Markets - Good CIRO Broker With Most Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets is a top CIRO broker with many decent benefits, but what sticks out for us is it has the most currency pairs available, over 330+ in total.

CMC Markets has an impressive NGEN platform, the broker’s own user-friendly trading platform and comes equipped with advanced charts and tools that challenge TradingView’s charts. We like the market scanners, which help discover new trade ideas, making the trading process more efficient.

Pros & Cons

- The NGEN platform is excellent

- Most currency pairs

- Has low average spreads

- No social trading tools

- Support is limited over the weekend

- Can only automate trades with the MT4 platform

Broker Details

CMC Markets has one of Canada’s largest choices of markets, with over 13,000 CFD products to trade, covering every market from forex to fixed income. What stood out for us was the broker’s 330+ currency pairs, which are the most available for any CIRO-regulated broker. You can trade the majors, minors, and exotics, including taking advantage of inverse currency pairs if you are looking for more market volatility.

Another benefit we found with CMC Markets was its NGEN platform, a web platform that can be used across multiple devices.

For a proprietary platform, it comes with many features you’d expect from dedicated platforms like TradingView and MetaTrader 4, although it does lack automated trading capabilities. These features include 80+ technical indicators and pattern recognition tools that use chart patterns like channels and wedges to find potential breakout opportunities.

While testing the chart patterns on the NGEN platform, we were impressed that the indicator showed potential take profit levels based on the pattern after applying the indicator. We think this is a decent tool for beginners, giving you a clear idea of when to exit the breakout trade from the current pattern.

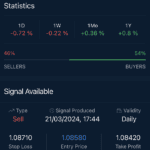

The image below shows how the triangle pattern suggests the take profit levels after hovering over the pattern.

Our findings also showed that CMC Market’s Standard account spreads were competitive. Our analyst, Ross Collins, found the broker’s EUR/USD spreads averaging 0.80 pips, one of the lowest among the CIRO-regulated brokers tested.

In fact, the CMC Market had the overall lowest spreads on the major pairs, averaging 1.11 pips, making it the cheapest standard account based on the results.

| Tested Standard Spreads | |

|---|---|

| Broker | Combined for major pairs AUDUSD, EUR/USD, GBPUSD, USD/CAD, USDCHF) |

| CMC Markets | 1.11 |

| Admirals | 1.31 |

| FXCM | 1.47 |

| OANDA | 1.54 |

6. Interactive Brokers - Great CIRO Broker For Professional Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Our top choice for professional traders is Interactive Brokers due to its advanced trading tools and platforms. While it may be complex for beginners, if you’re an experienced trader, you’ll appreciate the capabilities that can significantly enhance your analysis and trading speed.

Interactive Brokers’ access to various markets and exchanges is invaluable. It allows you to explore diverse markets and capitalize on volatility, potentially increasing risk and reward.

Pros & Cons

- Excellent trading tools and platforms for professionals

- It doesn’t require a minimum deposit

- Commissions are low if you trade 1-lot and above

- $2.00 minimum cost per trade (expensive for small trades)

- No third-party platforms like MT4 or TradingView

- IBKR has a steep learning curve

Broker Details

Out of all our tests, Interactive Brokers had the most advanced tools, pricing, and markets, making it a compelling choice for professional traders in Canada. This is especially true if you want to trade more complex markets like futures and options in addition to traditional CFD trading.

The flagship platform, IBKR Trader Workstation, offers a range of advanced tools, including market scanners and Level II pricing, which gives you access to liquidity providers’ order books.

Access to the liquidity provider’s price streams lets you see where other traders place their open orders and how much in lots is placed, giving you the best insights into where other traders think the price will move.

During our testing of the IBKR Trader Workstation, we found the platform had over 100+ indicators built in, but the charting felt basic with limited chart types, especially compared to TradingView.

For the professional tools, we found you could access Level II pricing through the BookTrader module, where you can also place your orders directly with the liquidity providers.

Our testing showed that interactive brokers offer low trading costs that improve with higher trading volumes, making it an ideal set-up for professionals. The broker only offers a commission with a tight spread account, and the highest commission rate is $2.00 per lot traded, which is the lowest out of the CIRO-regulated brokers.

This commission can be reduced if you meet the broker’s requirements for monthly trading volumes, reducing it to as low as $1.00 per lot traded.

7. Admirals - Best CIRO Broker For MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.6

AUD/USD = 0.5

Trading Platforms

MT4, MT5, Admirals Platform

Minimum Deposit

$100

Why We Recommend Admirals

We recommend Admirals as the top CIRO-regulated broker for MetaTrader 4. The broker’s MetaTrader Supreme Edition adds 15+ expert advisors to improve your overall trading workflow.

The additional utilities allow you to trade more efficiently, so you can focus on trading and finding new ideas instead of doing your account admin.

Pros & Cons

- Good selection of markets

- Offers free trading tools for MT4

- Low average spreads

- Limited customer support on weekends

- Charges an inactivity fee

- Demo accounts expire

Broker Details

When opening an Admirals account, we found that the broker offered MetaTrader 4 Supreme Edition, which consists of extra expert advisors and indicators packaged with the MT4 download. A nice touch we liked was the broker, which provides an extensive step-by-step tutorial on installing the extra features.

This enhances the default MT4 set-up, which is known to lack advanced trade management, by adding more popular indicators and fully integrating Trading Central with the platform. We found that the Supreme Edition added 8 EAs and 16 indicators, including the Admiral Gravity Indicator and the High-Low Indicator.

One of the EAs that stood out for us was the Mini terminal, which improves the order management of MT4 and one-click trading. We like that you can set your trade sizes, stop loss, and take profit orders in the Mini terminal, automatically executing all the orders with the one-click trading feature. This is something that the original one-click trading lacks, so it is a quality-of-life improvement if you are a scalper.

The broker offers a Standard account that averaged 0.60 pips on EUR/USD with no commission from our testing; however, Admirals advertised that its Raw account spreads were from 0.0 pips. With this in mind, we tasked our analyst Ross Collins to test if this was true and, if so, for how long during the trading session.

Ross found that Admirals offered its spreads at zero pips with AUD/USD, USD/CHF, and USD/JPY at 0.0 pips 100% of the time during the test. We were surprised to find that EUR/USD is just short of the 100% uptime in our testing, although, as you can see in our table below, it was very close.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Admiral Markets | 100.00% | 99.57% | 79.13% | 95.22% | 100.00% | 100.00% | 95.65% |

Zero pips means you just pay the commission, which is $3.00 per lot traded. This keeps your trading costs consistent, which is helpful if you want to automate your trades with the MT4 platform.

The Role Of CIRO

The Role Of CIRO

Ask an Expert