FXCM Review Of 2025

FXCM is a global forex provider trading with various FXCM entities in the UK, Europe, Australia and South Africa. We found that FXCM has a simple, helpful account type structure, a hybrid trading execution model and a good range of trading platforms.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

FXCM Summary

| 🗺️ Regulation | UK, Europe, Australia, South Africa |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MT4, Trading Station, ZuluTrade, TradingView, Capitalise.ai |

| 💰 Minimum Deposit | $50 |

| 💰 Deposit/Withdrawal Fee | $0 |

| 🛍️ Instruments Offered | Forex, CFDs |

| 💳 Credit Card Deposit | Yes |

Why Choose FXCM

FXCM is an international forex broker that offers leverage1 up to 30:1 for AU, EU, and UK clients while 400:1 for other clients, the choice of the forex trading platforms MetaTrader 4, NinjaTrader, or Trading station, spreads2 from 1.30.4 pips on EUR/USD and zero commissions.

Our review of FXCM found that the company offers a straightforward account structure, average spreads, a combination trading execution model, and a good selection of trading platforms.

FXCM Pros and Cons

- Trusted and safe broker

- MetaTrader 4 and Trading Station platforms

- Top automated trading solutions

- Limited range of CFD markets

- MetaTrader 5 not offered

- Spreads can't compete with industry

Open Demo AccountOpen Live Account

*Your capital is at risk ‘67% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

FXCM has a very simple account structure for its clients. The majority of clients will use their Standard Account, which is designed for retail traders’ high volume traders will prefer their Active Traders account to save on costs.

1. Raw Account Spreads

An FXCM No Dealing Desk Brokers determines the best execution means which can result in FXCM acting as a market maker or using a dealing desk.

|

FXCM Commission Account

|

|||||

|---|---|---|---|---|---|

|

0.30 | 0.90 | 0.70 | 0.40 | 1.10 |

|

0.90 | 1.40 | 1.40 | 1.30 | 1.70 |

|

0.70 | 1.10 | 1.10 | 2.20 | 2.20 |

|

1.20 | 1.80 | 1.50 | 0.90 | 1.80 |

|

1.50 | 1.80 | 1.60 | 1.50 | 2.30 |

|

0.82 | 1.03 | 1.27 | 0.83 | 1.50 |

|

1.46 | 1.76 | 1.52 | 2.06 | 3.35 |

|

0.10 | 2.00 | 0.60 | 0.50 | 0.70 |

|

1.12 | 1.30 | 1.30 | 1.64 | 1.80 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

When comparing the spreads to other brokers, FXCM at first glance appears to have only average spreads. While FXCM Active Traders Account is competitive when looking at the EUR/USD, USD/JPY and even AUD/USD currency pairs with other brokers and poor when comparing EUR/GBP, GBP/USD and EUR/JPY to the average, the following consideration needs to be kept in mind.

| Raw Account Spreads | FXCM | Average Spread |

|---|---|---|

| Overall | 0.82 | 0.72 |

| EUR/USD | 0.3 | 0.28 |

| USD/JPY | 0.6 | 0.44 |

| GBP/USD | 0.9 | 0.54 |

| AUD/USD | 0.4 | 0.45 |

| USD/CAD | 0.6 | 0.61 |

| EUR/GBP | 0.7 | 0.55 |

| EUR/JPY | 0.8 | 0.74 |

| AUD/JPY | 1.1 | 0.93 |

| USD/SGD | 2 | 1.97 |

2. Raw Account Commission Rate

FXCM Active Trader offers savings up to 62.4%. The Active Trader account uses a tiered commission structure which means the more you trade, the lower your commission cost will be.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| FXCM Commission Rate | $4.00 | $4.00 | N/A | N/A |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

To be able to take advantage of these discounted commissions, you will need a minimum of $25,0000 in equity in your trading account, so will not be a serious consideration for most retail traders.

Use the calculator below to compare FXCM’s trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

3. Standard Account Fees

FXCM standard spreads generally fall in the midrange when compared with other brokers with the most competitive spreads on offer appearing to be for AUD/USD and USD/JPY currency pairs.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| FXCM Average Spread | 1.3 | 1.1 | 1.8 | 0.7 | 1.3 | 1.1 | 1.9 | 2.6 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

FXCM Standard Account (Available To All Clients)

Most FXCM clients will be using FXCM’s standard account. This is FXCMs offering to all clients who don’t qualify as an Active Trader. This account is a commission-free account, which means the trading costs are included in the spreads. This explains why spreads are wider than commission-based accounts such as the Active Trader account.

New traders may appreciate a standard style account, as no commissions mean a simpler cost structure. Long-term or discretionary traders may also like this account as the simpler cost structure compared to a commission account can make trading easier. The FXCM Standard Account has a minimum requirement of $50 (depending on payment method) when making an account deposit. When trading, you will still need to meet initial margin requirements to open trading positions.

FXCM Active Trader – Good for High Volume Traders

If you are a high-volume investor, then the Active Trader account may be for you. This account offers FXCM’s lowest spreads with the added benefit of discounted commission, dedicated support, and depth of market.

FXCM can be compensated in several ways, which includes but are not limited to adding a mark-up to the spreads it receives from its liquidity providers, adding a mark-up to rollover, etc. Commission-based pricing is applicable to Active Trader account types.

4. Swap-Free Account Fees

An Interest-free account is targeted at Swap Free Islamic Accounts who are forbidden from earning (or paying interest) as it is forbidden by Sharia law. FXCM add an extra 0.4 pips to the spread for Standard accounts and a $2.00 commission per lot (per side for commission-based accounts in place of overnight fee or swap rates.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

5. Other Fees

There are no fees when you make a deposit or withdrawal at FXCM. However, they have an inactivity fee of $50 per year after 12 months.

Verdict on FXCM Fees

If you are looking for the best possible spreads , then Active Trader is the best choice. Spreads with FXCM’s active trader account are cheaper than they may appear when you compare with other brokers as FXCM offer lower commission fees. The overall lowest spreads are offered by IC Markets in our head-to-head comparison.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

Leverage FXCM Forex Broker Comparison

FXCM operates four subsidiaries around the world that are overseen by different financial authorities. The leverage you are able to trade with depends on whether you sign up to the UK, European, Australian or South Africa entity.

Leverage in the UK, Europe and Australia

FXCM in Australian (ASIC), European (CySEC), and UK (FCA) regulated territories offer a maximum leverage of 30:1 for major currency pairs and 20:1 for minor and exotic currency pairs. This is in line with the maximum amount most tier-1 regulated brokers will offer.

You can trade crypto with leverage of 2:1 with the ASIC regulated branch, and 4:1 with the FSCA regulated branch in South Africa. Cryptos are only available to professional traders in the UK, not retail traders.

Leverage in South Africa (and the rest of the world)

FXCM South Africa is regulated by the FSCA and permits maximum leverage of 400:1 for all forex pairs. Clients who have more than 20,000 CCY ($20,000) equity in their trading account will only be allowed to trade with 100:1 leverage.

When trading with a leveraged product, it is important to keep in mind that while leverage can be a powerful tool for profitable gains, High Leverage Forex Brokers can exaggerate your losses when currency movements don’t work in your favour and should be used responsibly.

Note: Leverage is a double-edged sword and can dramatically amplify your profits. It can also just as dramatically amplify your losses. Trading foreign exchange/CFDs with any level of leverage may not be suitable for all investors.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

FXCM’s Transparency and Trust Level

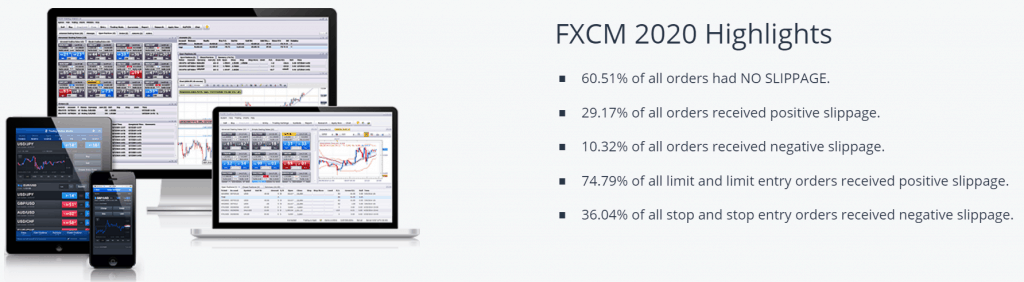

FXCM list statistic regarding their performance when it comes to execution and slippage. Transparency gives their clients a level of assurance and trust that the broker is meeting the client’s expectations when it comes to trading. FXCM to deliver on the client’s requirement of fast order execution with no slippage, competitive pricing and no re-quotes.

FXCM Slippage And Execution Speed

Slippage can make a big difference to your trading success. Lag time, which naturally occurs due to the time taken between placing your order and completing your order, can see prices change. The changes are called slippage and can be positive or negative. As a trader, you want pricing certainty and execution certainty.

In the first quarter of 2020, FXCM had the following performance highlights.

As per FXCM’s Spread Report

These stats show that FXCM completes your orders with no slippage more than 60% of the time. This is made possible thanks to an average execution speed of 28ms and good till cancelled market orders speed of 29 ms. When slippage does occur, FXCM trading infrastructure is generally favourable for traders, with slippage being positive nearly 30% of the time and over 70% of the time for limit orders.

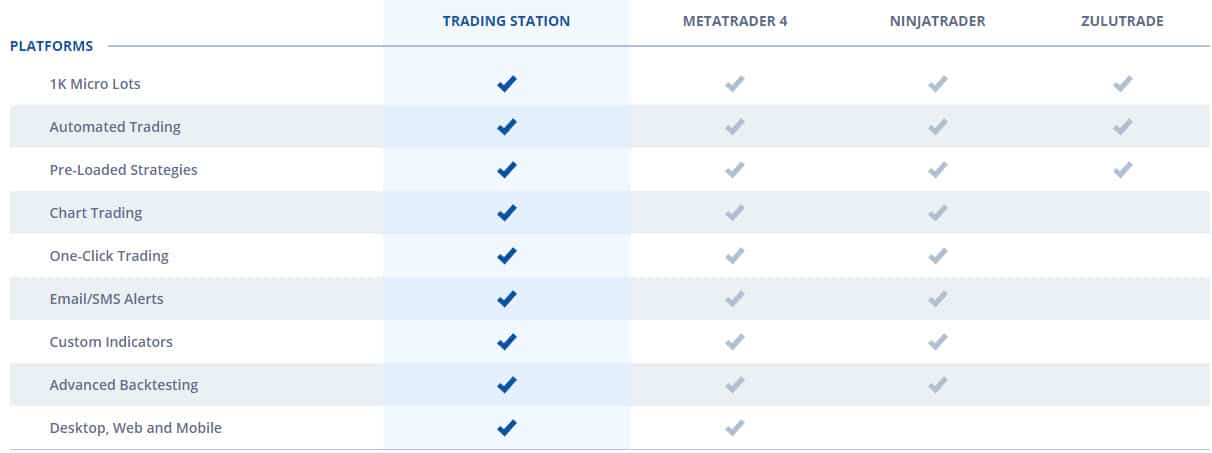

Trading Platforms

Our FXCM review found the forex broker offers one of the extensive choices of trading platforms from all online brokers. Not only does FXCM offers a choice of 4 trading platforms (2 of them the best social trading platforms) the broker also offers 7 speciality platforms.

| Trading Plaform | Available With FXCM |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

FXCM Trading Station

FXCM’s in-house developed proprietary trading platform built from feedback from FXCM traders and 10 years of trading data

Trading Station Desktop

FXCM is especially proud of their own Trading Station II (not to be confused with another platform TradeStation). It was built based on the feedback from FXCM traders and trading data accrued from over 10 years to meet the needs of their clients.

The FXCM Trading Station forex platform is generally hard to fault, it has a very user-friendly design and comes with has become FXCM’s hub for investment advice. One of the key features of the platform is the free professional charting tool known as Marketscope 2.0 which consists of price alerts, charts and a wide selection of indicators. One of the key features of Marketplace is the ability to open and manage all your trades directly from the charts. This means you can perform all your trading analysis, opportunity identification and order execution all in one place. This simplified trading process makes the platform a great tool for beginner traders.

The FXCM Trading Station forex platform is generally hard to fault, it has a very user-friendly design and comes with has become FXCM’s hub for investment advice. One of the key features of the platform is the free professional charting tool known as Marketscope 2.0 which consists of price alerts, charts and a wide selection of indicators. One of the key features of Marketplace is the ability to open and manage all your trades directly from the charts. This means you can perform all your trading analysis, opportunity identification and order execution all in one place. This simplified trading process makes the platform a great tool for beginner traders.

Trading Station Web

The recent upgraded Trading Station Web 2.0 migrated from Flash to HTML5 now offers a cleaner, more modern and intuitive user interface. The new platform incorporated many of the features found on Trading Central Desktop, including:

- FXCM Cloud: Ability to store profiles and chart settings in the cloud

- Chart – Detachable charts for use on second browsers

- 50 customisation technical indicators

- 20 advanced drawing tools

- Enhanced trading analytics tools available directly from the trading platform

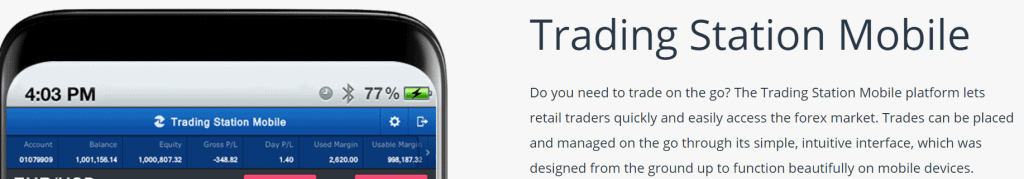

Trading Station Mobile

- Trade with 56 forex currency pairs

- Wide range of charts with the following timeframe – m1, m5, m15, m30, H1, H2, H3, H4, H6, H8, D1, W1, M1

- Chart Indicators

- Trend Lines

- Real-time Market News

- Economic Calendar

- Range of Order Types

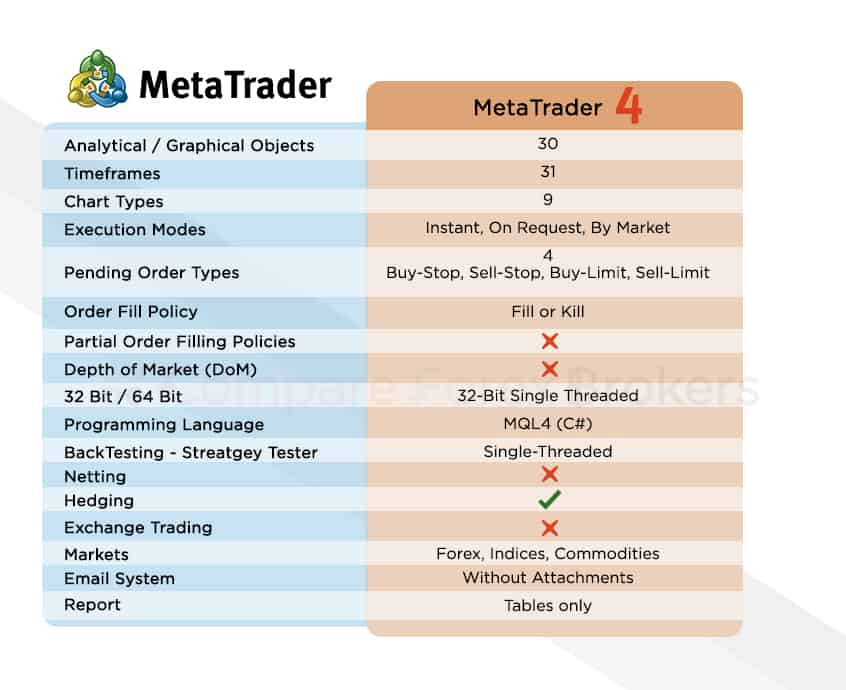

MetaTrader 4

This platform is the most widely used platform by traders and the most offered platform by brokers, many consider MetaTrader 4 to be the ‘gold’ standard when it comes to platforms. While you can find platforms with more indicators, more charts, faster speed, as a whole, MetaTrader 4 offers one of the most complete packages because it does everything really well. MetaTrader 4’s reputation and reliability make it a sound choice for all traders.

NinjaTrader 8

This platform is a worthy alternative to Trade Station and MetaTrader. NinjaTrader is perfect for scalpers thanks to its Advanced Trader Management feature (ATM) which allows semi-automated features so you can manage your positions through orders such as entries, stops, targets and exits and trading automation with C#.

It is also a great option for active traders who benefit from an abundance of technical analysis tools, including over 150 analytical tools and a wealth of customisable charts and drawing tools.

Zulu Trade

If you prefer social or copy trade, then Zulu Trader might be your preferred choice of the trading platform. This type of trading allows you to copy the trades of experienced traders, making it a great choice for beginner traders wanting to learn the trading strategies of successful traders. One of the key features of the Zulu trade is the social element. The feature gives users the ability of traders to share ideas and strategies and help other traders. Zulu Trader has over 1 million users, making it one of the larger social trading communities available.

FXCM also offers a range of speciality platforms to enhance your trading experience. Most of these tools are exceptionally useful for algorithmic traders and high-volume traders. These tools are useful for both forex and CFD and include:

- QuantConnect – This is a cloud-based and open-source algorithmic engine used for trading. It allows the client to build and test their algorithms directly via FXCM platforms.

- MotiveWave – This tool provides charting for both technical and also algorithmic traders.

- AlgoTerminal – Users can use a terminal for back-testing and execution of algorithmic trading approaches.

- AgenaTrader – This advanced trading tool gives professional traders access to 130 indicators along with 14 chart types for automated trading. AdenaScript(C#) allows for sophisticated automated trading.

- Sierra Chart – A multi-asset trading platform for financial markets that is compatible with external trading services

- SeerTrading – Another trading platform that can assist with automated trading.

- NeuroShell Trader – This is a point and clicks GUI that assists with technical analysis indicators.

- StategyQuant – This platform uses machine learning and genetic programming for automated trading. Its simplicity means no programming experience is needed.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

Is FXCM Safe?

FXCM has a trust score of 78, from its regulation, reputation, and reviews.

Regulation

The FXCM group is part of the Leucadia Investments group and has the following regulations:

The United Kingdom

- Forex Capital Markets Limited (“FCA”) is regulated in the United Kingdom by the Financial Conduct Authority (FCA) with the registration number 217689

South Africa

- FXCM South Africa (PTY) LTD (“FXCM ZA”) and is regulated by the Financial Sector Conduct Authority (FSCA) under FSP No 46534

Australia

- FXCM Australia Pty. Limited (“FXCM AU”) is regulated by the Australian Securities and Investments Commission (ASIC) under AFSL 309763

Europe

- FXCM EU LTD (“FXCM EU”) is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 392/20

Other FXCM entities

- FXCM Markets Limited (“FXCM Markets”) was incorporated in Bermuda. Bermuda does not require FXCM Markets to have a financial services license to offer its products or services.

FXCM does not accept residents of the following countries – the United States, the Russian Federation, Ukraine, Singapore, Turkey, Japan and the Virgin Islands.

| FXCM Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA CySEC CIRO BaFin |

| Tier-2 | FSCA ISA (Israel) |

| Tier-3 | X |

Reputation

FXCM was founded in 1999 with headquarters in New York, USA. They have around 38,100 monthly hits on Google.

Reviews

FXCM has a TrustPilot score of 4.5 out of 5.0 from 455 users.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

How Popular Is FXCM?

FXCM maintains a moderate presence in the global forex trading landscape despite its historical significance in the industry. With approximately 40,500 monthly Google searches, it ranks as the 30th most popular forex broker among the 65 brokers analyzed. Similarweb data from February 2024 shows a comparable positioning, with FXCM ranking as the 35th most visited broker with 365,000 global visits.

Founded in 1999, FXCM was once one of the largest retail forex brokers globally before regulatory issues in 2017 led to significant restructuring. While the broker doesn’t publicly disclose its current client numbers, it reported executing 153,000 trades daily as of Q4 2023. FXCM’s trading volume reached $203 billion in March 2024, showing that despite its mid-range positioning in online visibility metrics, it maintains substantial operational activity.

| Country | 2024 Monthly Searches |

|---|---|

| United States | 2,900 |

| India | 2,900 |

| United Kingdom | 2,900 |

| France | 1,600 |

| Australia | 1,300 |

| Malaysia | 1,300 |

| Japan | 1,300 |

| Indonesia | 1,000 |

| Thailand | 1,000 |

| South Africa | 1,000 |

| Pakistan | 1,000 |

| Germany | 1,000 |

| Colombia | 1,000 |

| Vietnam | 880 |

| Canada | 880 |

| Nigeria | 880 |

| Italy | 720 |

| Spain | 590 |

| Taiwan | 590 |

| Mexico | 480 |

| Turkey | 480 |

| Brazil | 480 |

| Singapore | 480 |

| Hong Kong | 480 |

| United Arab Emirates | 480 |

| Morocco | 480 |

| Philippines | 390 |

| Egypt | 390 |

| Netherlands | 390 |

| Venezuela | 390 |

| Poland | 320 |

| Argentina | 320 |

| Algeria | 260 |

| Saudi Arabia | 260 |

| Bangladesh | 260 |

| Kenya | 260 |

| Chile | 210 |

| Peru | 210 |

| Greece | 210 |

| Ecuador | 170 |

| Switzerland | 170 |

| Cambodia | 170 |

| Sweden | 170 |

| Dominican Republic | 140 |

| Cyprus | 140 |

| Sri Lanka | 110 |

| Portugal | 110 |

| Bolivia | 110 |

| Austria | 110 |

| Ghana | 110 |

| Tanzania | 90 |

| Uganda | 90 |

| New Zealand | 70 |

| Ireland | 70 |

| Uzbekistan | 70 |

| Jordan | 70 |

| Ethiopia | 70 |

| Mongolia | 50 |

| Panama | 50 |

| Botswana | 50 |

| Mauritius | 40 |

| Costa Rica | 30 |

2024 Average Monthly Branded Searches By Country

United States

United States

|

2,900

1st

|

India

India

|

2,900

2nd

|

United Kingdom

United Kingdom

|

2,900

3rd

|

France

France

|

1,600

4th

|

Australia

Australia

|

1,300

5th

|

Malaysia

Malaysia

|

1,300

6th

|

Japan

Japan

|

1,300

7th

|

Indonesia

Indonesia

|

1,000

8th

|

Thailand

Thailand

|

1,000

9th

|

South Africa

South Africa

|

1,000

10th

|

Deposit and Withdrawal

What is the minimum deposit at FXCM?

FXCM has the following minimum deposit requirement

- Standard Account – $50 CCY (depending on payment method)

- Active Trader Account account – $25,000 to open an account

Deposit Options and Fees

When making a deposit into your account with a credit card or debit card (Visa or MasterCard) there is a minimum of $50 per deposit and a limit of $30,000 per month for all FXCM clients.

All other deposit methods do not have a minimum deposit requirement however may have limits on how much can be deposited each month.

International Funding Options

- Bank Wire – No monthly limit

- Skrill / Neteller – 20,0000 CCY limit per month

Australia

- BPAY – no monthly limit

- POLi – 20,000 CCY limit per month

- Union Pay – 20,000 CCY limits per month

The UK and Europe

- Klarna – 5,000 CCY limit per month

- Rapid Transfer- 5,000 CCY limit per month

Most deposit methods take up to 1 business day to complete however bank wire can take 1-5 working days. FXCM charges no fees for deposits.

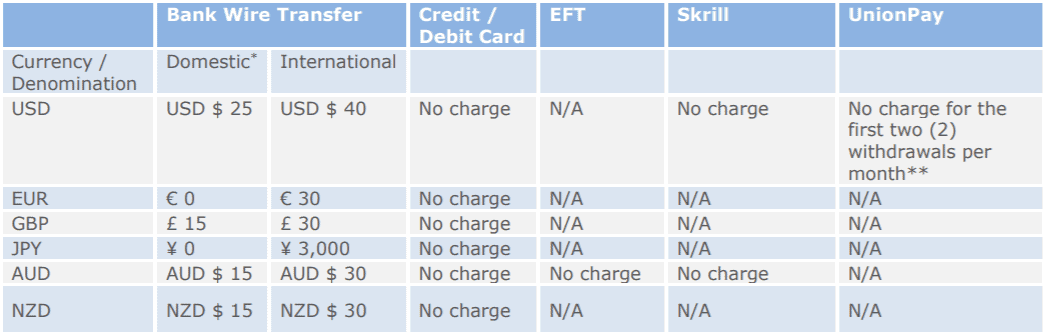

Withdrawal Options and Fees

Withdrawal can be done by card, Bank Wire or Skrill, Neteller and in Australia by Electronic Funds Transfer and Union Pay. While there are no withdrawal requirements, there are fees when using Bank Wire and Union Pay.

The table below summarises the fees:

Product Range

Clients of FXCM have the option of the following contracts for difference (CFD) products:

- 39 Forex currency pairs and 13 Stock indices

- Shares CFD and 9 Commodities

- 3 Metals and 3 Types of baskets (forex, stocks, cryptocurrency)

- 7 Cryptocurrencies (Bitcoin, Ethereum, Ripple, Litecoin and Bitcoin Cash, Stellar, EOS)

CFDs

All CFD option is commission-free, which means costs are included in the spread.

The range of markets available with FXCM is quite broad however you can find other brokers that offer more choices for each financial instrument. 39 currency pairs, for example, would put FXCM at the lower end of the broker for currency choices.

| More than 60 currency pairs | 40 to 59 currency pairs | Less than 40 currency pairs |

|---|---|---|

| Pepperstone | Admiral Markets | FXCM |

| IC Markets | XM | ThinkMarkets |

| City Index | XTB | HANTEC |

| easyForex | eToro | Traders' Way |

| Forex.com | FP Markets | |

| FxPro | Hugo's Way | |

| HYCM | ||

| Fusion Markets | ||

| IG | ||

| Oanda | ||

| Saxo | ||

| CMC Markets | ||

| Interactive Brokers | ||

| Plus500 |

Cryptocurrency

FXCM offers a choice of 5 cryptocurrencies. The broker claims to offer some of the tightest spreads on the market when it comes to trading BITCOIN.

Please note that due to FCA regulation, UK retail traders are not able to trade cryptocurrencies with UK brokers. If you want access to crypto markets, you will need to sign up for an FXCM subsidiary outside of the United Kingdom.

FXCM Specialised Baskets

One feature FXCM offers that is not commonly found with other brokers is the trading of specialised indices. FXCM offers 3 types of baskets of trading:

- 3 Forex trading baskets (Dow Jones FXCM Dollar Index Basket, JPYBasket (Yen), EMBasket (Emerging Markets Index)

- 6 Stock Baskets – BioTech, Cannabis, eSports, FAANG, CHN.ECOMM, CHN.TECH)

- Crypto Basket (Bitcoin, Ethereum, Ripple, Litecoin and BitCoil Cash)

Trading with Indices allows you to reduce the risk of your exposure when trading volatile instruments.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

Customer Service

FXCM offers 24/5 award-winning customer services with customer support contactable via live chat, email, phone and even SMS text message. If you wish to call FXCM, there are 42 country-based numbers one can call from. Countries range from South Korea, United Arab Emirates to Venezuela.

If you prefer to place orders by phone, FXCM offers a trading desk line that can be handy should you experience an interruption in your internet connection.

Should you prefer to solve your issues yourself, there is a search feature on their website that should be able to point you to relevant pages to solve your question however the website doesn’t have a devoted FAQ page.

Research and Education

FXCM has a knowledge section that consists of research or market analysis tools and education.

Education

The education section of a wide range of educational tools that help their clients understand forex better, navigate FXCM features and accounts, and master their trading platforms. Education tools include:

- A comprehensive guide explaining what Forex is

- A video library covering information topics such as the FXCM trading platforms, order types, forex trading and FXCM account features

- Free daily online trading course – a live webinar to enhance your trading skills and discuss economic events around the world and understand how they impact your trading decisions

- Trading guides – a learning course covering all topics about forex. The online content is split into 2 sections, for beginners and for successful traders.

While there is a wealth of material for forex, education is lacking when it comes to CFD education.

Research Tools

Market analysis tools consist of the standard tools most brokers offer. This includes an economic calendar, live forex charts, and the latest market news. Additional trading tools are available such as a market scanner and market data signal however to get to the really useful information such as trading signals, technical analyser and trading analytics requires a sign-up with FXCM.

*Your capital is at risk ‘67% of retail CFD accounts lose money’

Final Verdict On FXCM

As a global player, originally founded in America but now headquartered in the UK due to regulatory restrictions in the US, Forex Capital Markets (FXCM) has targeted market share in Australia for some time with a very competitive Australian forex broker offering, including standard accounts as well as an active trader account for those budding Forex enthusiasts.

Experienced Australian forex traders that require a very specific niche forex platform should consider FXCM. Those that require high leverage or are looking for low spreads/fees should review our Best Forex Brokers In Australia and a provider like Pepperstone for advanced traders.

FXCM FAQs

Is FXCM regulated and safe to use?

Yes, FXCM is a regulated broker in the UK, Europe, Australia, and South Africa, adhering to strict standards. Their global reach and regulation provide a high level of safety and security for traders.

What platforms does FXCM offer?

FXCM provides multiple trading platforms, including MetaTrader 4, Trading Station, NinjaTrader, and ZuluTrade, catering to different trading styles and preferences.

Does FXCM charge commission on trades?

FXCM’s Standard account is commission-free, with costs embedded in the spreads. However, the Active Trader account offers tiered commissions with potential savings for high-volume traders.

What is the minimum deposit required to start trading with FXCM?

The minimum deposit for FXCM is $50, though higher amounts may be required depending on the account type and trading conditions.

What leverage does FXCM offer?

Leverage depends on your location. In Europe and Australia, it is capped at 30:1, but in South Africa, it can reach up to 400:1 for forex pairs.

About Compare Forex Brokers

Compare Forex Brokers was created to help Australian forex traders find the right broker to suit their trading requirements. Our forex broker comparison tables were constructed from information from providers’ websites or actual trading accounts. We try to update our forex broker comparison tables periodically (including our FXCM reviews) but if you have any suggestions or areas that may need updating please feel free to contact the owners via our contact us form.

Compare FXCM Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to FXCM Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Is FXCM a prime broker?

No, FXCM is not a prime brokers

Which countries accept FXCM?

FXCM is accepted in most countries, but it does not accept residents from the United States, Russia, Ukraine, Singapore, Turkey, Japan, and the Virgin Islands.

Is FXCM API free?

FXCM offers the following APIs for free that connect to their trading servers: a Java API, a FIX API, and a ForexConnect API.