City Index Review Of 2025

The StoneX Group Inc owns forex broker City Index. With the MT4 trading platform and no commission trading, we look at what they offer the markets in Australia, The UK, and Singapore.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

City Index Summary

| 🗺️ Regulation Country | Australia, UK, Singapore |

| 💰 Trading Fees | Variable Spread with no commission |

| 📊 Trading Platforms | City Index Platform, MetaTrader 4 |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $25 |

| 🛍️ Instruments Offered | Forex, Shares, Forex, Crypto |

| 💳 Credit Card Deposit | Yes |

Why Choose City Index

We found City Index has low forex trading fees with no commissions outside the spread, a good choice of trading platforms and if using the City Index platform; the benefit of a guaranteed stop loss to protect your trades and unique 3rd party addons. With City Index, you will find that the account opening process is very simple, and the broker has excellent Forex education and research tools. We gave City Index a high trust score cause their parents is listed on the NYSE and they are multi-regulated.

City Index however is not without its downside, fees for stock CFDs are on the higher side, and its desktop trading platform could do with some improvement.

City Index Pros and Cons

- Easy account opening

- Low forex fees

- Extensive research tools

- High fees for stock CFDs

- Limited product portfolio

- Complex desktop platform

Open Demo AccountOpen Live Account

*Your capital is at risk ‘70% of retail CFD accounts lose money’

The overall rating is based on review by our experts

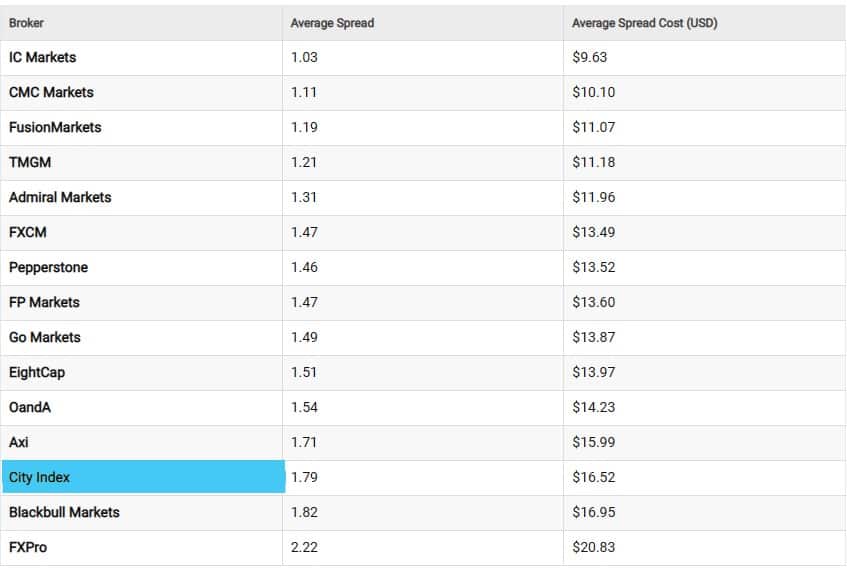

City Index Fees

When deciding on a broker, you can save on costs by choosing a broker with tight spreads. To give you an idea of what the spreads are like with City Index and how they compare with other Forex brokers, Ross Collins, our Forex expert at CompareForexBrokers tested 20 brokers to see how spreads perform over a 24-hour period. For this exercise, we used 6 major currency pairs and then averaged the spread result. By doing this we hoped to nullify variations in better and worse-performing pairs by each broker.

Overall we found that City Index performed poorly, a lowly 17th of the 20 brokers. To verify our results we did the test again one week later and the results were similar. With an average spread of 1.79 pips, your cost will be $16.52 per lot you trade. This contrasts significantly with what we found in our IC Markets Review which averages 1.03 pips or $9.63 per lot.

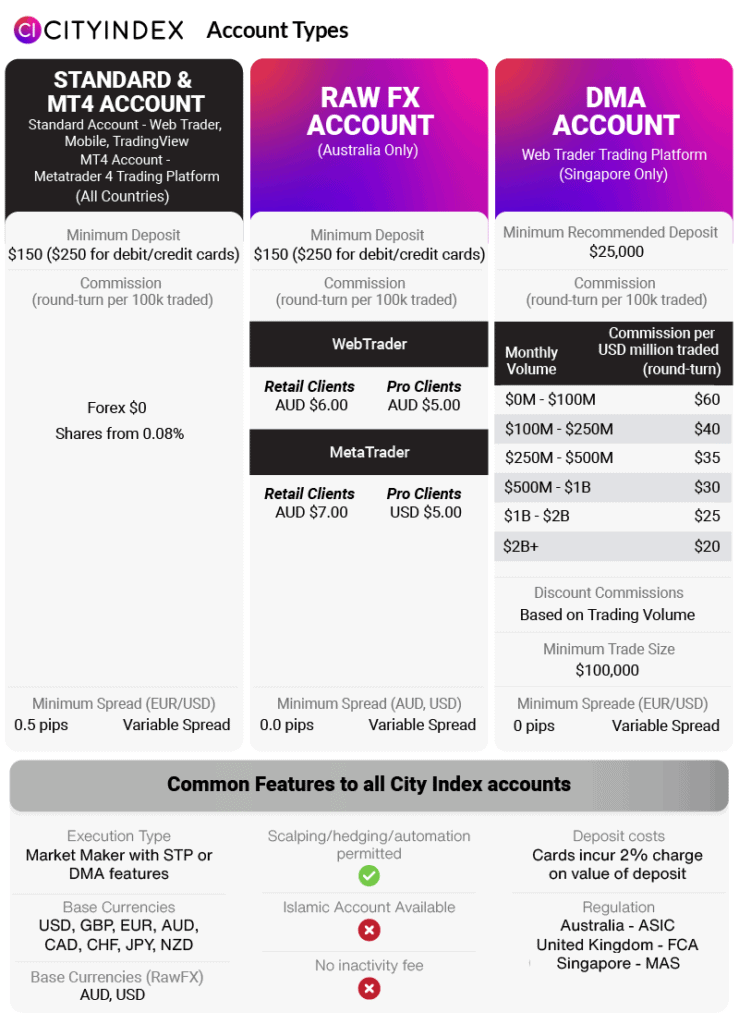

1. Account Types

Most City Index retail clients will use the Standard account or MT4. Both accounts have no commissions with spreads from 0.5 pips, the only difference is the trading platform you use.

Traders in Australia can also choose the RAW FX account type which has low commissions starting from just USD 5 or AUD 6 while Singapore traders have the option of a DMA account. With a minimum deposit of $25,000, this trading account would really appeal only to premium traders.

You can choose from 8 currency types but the RawFX in Australia can only be AUD or USD.

We tested the Execution Speeds and the account opening process for various forex brokers and scored City Index 8 out of 15. While a dedicated account manager was automatically assigned, the account opening process took days, and establishing an MT4 account required intervention from the account manager.

Use the calculator below to compare City Index’s trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

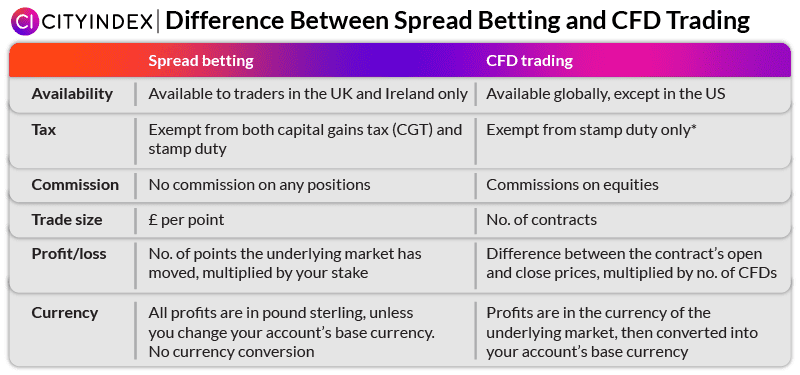

2. Spread Betting

City Index offers spread betting as an option for trading in the United Kingdom. Spread betting is similar to CFD trading in that it is a form of margin trading and most of the same instruments are available with the same leverage.

It’s important to point out, however, that traders do not buy contracts of the underlying instruments. Instead of contracts, clients are betting on the price movements of the financial asset.

Spread betting brokers are popular in the United Kingdom as there are no capital gains taxes, which means more profits. You can view our City Index Spread Betting review our our sister site spread-bet.co.uk.

While you can bet on the same products as you can trade with CFDs, there are some differences to note between CFDs and spread betting. The first is that CFDs quote in pips while when spread betting, the quote is in points. Regardless since these prices are both matched to the same underlying instrument, the price is the same, just to a different decimal. These spreads will usually be variable. However, at certain times of the day, select financial instruments are fixed.

And like CFD trading, when spread betting, there are no commission costs. To spread bet, you must use the City Index trading platform. Like with CFD traders, you will be able to use a guaranteed stop loss when using the City Index trading platform.

View our full City Index spread betting review on our sister site (spread-bet.co.uk) to compare their offering to the 16 other FCA regulated brokers

City Index Leverage Structure

As mentioned previously, City Index’s leverage structure is relatively low. This might be advantageous for beginners. However, more advanced traders might find this too restrictive.

Ultimately, each trader must weigh the pros and cons themselves and choose what is right for them.

| Retail Leverage | Retail Leverage (ASIC and FCA) | Pro Leverage (ASIC and FCA) | Singapore MAS Leverage |

|---|---|---|---|

| Forex Majors | 30:1 | 30:1 | 20:1 |

| Forex Minor and Exotics | 20:1 | 20:1 | 10:1 |

| Stocks | 5:1 | 5:1 | 10:1 |

| Cryptocurrency | 2:1 (not available in the UK) | Not Av | N/A |

| Indices Major | 20:1 | 20:1 | 20:1 |

| Indices Minor | 10:1 | 10:1 | 20:1 |

| Gold | 20:1 | 20:1 | 20:1 |

| Other Metals | 10:1 | 10:1 | 5:1 |

| Energy | 10:1 | 10:1 | 5:1 |

| Soft Commodities | 10:1 | 10:1 | 5:1 |

| Bonds | 5:1 | 5:1 | N/A |

| Options | 30:1 | 30:1 | N/A |

| Interest rates | 5:1 | 5:1 | N/A |

Risk Management

CFDs are risky instruments, especially when it comes to using leverage. For this reason, City Index offers various risk management tools including guaranteed stop-loss orders.

While using a guaranteed stop-loss order will increase your costs due to the premium you will need to pay, it does protect you from losses due to slippage.

This differs from a traditional stop loss which is not a fool-proof risk management strategy as during extreme volatility, slippage may occur resulting in losses exceeding an amount set. This happens when a forex broker can’t achieve the price set in the stop-loss order.

Order Types

Compared to other online CFD providers, we like that City Index supports multiple order types and has the ability to program your entry and exit points. To get some of these features, you will need to be using the City Index Trading Platform.

The most advanced order types offered by City Index include:

- One cancels the other (OCO) – a complex order that combines a stop order and a limit order at the same time

- Guaranteed stop-loss orders – a very powerful risk metric that guarantees no slippage, but comes with an extra cost

- The standard stop-loss orders, limit orders, and trailing stops can be found on the broker’s platform

Guaranteed Stop Loss Orders (GSLO)

Our team of experts felt the obligation to provide our readers with additional information on the guaranteed stop-loss order.

While the GSLO order comes as a handy solution to minimize losses, forex traders need to be aware that it can only be used under certain parameters. The GSLO order can be used as follows:

- Only available for 12,000 instruments and doesn’t include the full range of assets offered by City Index

- There is a minimum price distance within which the GSLO order can be placed

- There is a premium charged only when the GSLO order is triggered and traders can make changes to the GSLO without paying extra fees. However, this is only activated should the order be turned on.

Margin Call and Margin Close Out System

To help prevent negative balance protection from needing to be activated, a margin call system is also used. When your margin indicator level drops below 100%, you will be notified by email to top up your account balance or close some trading positions. This means you need enough balance in your account across open and closed positions to cover your required margin to hold your position.

Should your required margin fall below 50% a margin, closeout will be activated. At this point, the broker will automatically exit some trading position till the threshold is no longer crossed.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

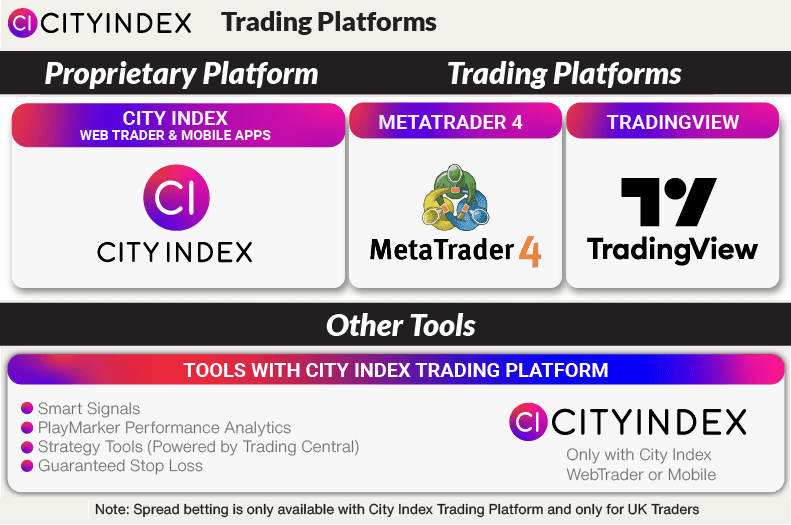

Trading Platforms

| Trading Plaform | Available With City Index |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

City Index offers MetaTrader4 and their proprietary City Index Desktop and WebTrader.

MetaTrader 4

Like with most forex brokers, we can confirm that City Index uses MetaTrader 4 (MT4) as its basic trading software. MT4 is the dominant platform used in the forex market and is available on both Windows and Mac devices.

Website browsers

City Index WebTrader

On City Index, the standard MT4 platform is upgraded with variable forex pricing and access to all of City Index’s market analytics. These upgrades, on top of an already well-proven system, give this version of the MT4 platform versatile function while keeping it relatively user-friendly.

MetaTrader 4 WebTrader

The standard MT4 platform is also available for traders to use on their web browsers using WebTrader.

Mobile

Both City Index Mobile and the MT4 mobile app are ideally suited for traders who are on the move, providing stop-loss orders, watchlists functionality, and Reuters news integration.

TradingView

We like that City Index integrates with TradingView, a powerful charting platform, and social network which offers traders access to a wealth of tools and information including strategy testers, indicators, and more. We note, that this integration is only available for Australian traders at this time.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

Is City Index Safe?

City Index has a trust score of 67, from its regulation, reputation, and reviews.

Regulation

City Index is regulated in Australia, Singapore, and the United Kingdom. All these regulators have very stringent requirements to ensure clients are protected through sound business practices. Requirements include:

- Good Business continuity and disaster recovery

- Top risk management practices

- Monitoring and oversight of its electronic trading systems (i.e. trading platforms)

- Information security (so your information is secure)

- Anti-money laundering

- An established customer complaint process

In Australia, City Index is registered as StoneX Financial Pty. LTD and is regulated by the Australia Securities and Investments Commission (ASIC) with licence number AFSL: 345646.

This division of City Index serves all clients in Australia and New Zealand.

In the UK, City Index is registered as StoneX Financial LTD and is regulated by the Financial Conduct Authority (FCA) using registration no. 446717.

This subsidiary serves all clients in the UK and Europe however most clients in Europe would be encouraged to join Forex.com which is also owned by the StoneX group Inc.

Lastly, City Index operates in Singapore and is registered as StoneX Financial Pte. Ltd (“SFP”). In Singapore, the broker is regulated by the Monetary Authority of Singapore (MAS) and accepts clients across most of Asia.

A couple of points to note:

- All these regulators require brokers to have negative balance protection for retail clients. This means you cannot lose more than you deposit with City Index.

- StoneX group also owns Forex.com. Forex.com has similar products to City Index and still serves in the UK. However, it no longer appears to operate in Singapore.

- City Index does not accept clients from Canada or the USA but Forex.com does operate in those countries.

- The FCA requires brokers to join their Financial Services Compensation Scheme (FSCS). Should City Index go into liquidation, you may be compensated up to £85,000 by the FSCS.

| City Index Safety | Regulator |

|---|---|

| Tier-1 | ASIC FCA MAS |

| Tier-2 | X |

| Tier-3 | X |

Reputation

City Index was founded in 1983 in London, UK. Despite its years in the industry, it seems to have a low search volume on Google with only 12,1200 monthly hits.

Reviews

City Index has a TrustPilot score of 4.3 out of 5 from 284 reviews.

How Popular Is City Index?

City Index maintains a modest online presence in the forex brokerage space. With approximately 9,900 monthly Google searches, it ranks as the 53rd most popular forex broker among the 65 brokers analyzed. Web traffic data from Similarweb in February 2024 shows a similar positioning, with City Index ranking as the 47th most visited broker with 216,000 global visits.

Like Forex.com, City Index is operated by StoneX Group Inc. (NASDAQ: SNEX), a Fortune 100 company with a 100+ year track record. StoneX is ranked #66 in the 2024 Fortune 500 list of the largest United States corporations by total revenue. StoneX serves more than 54,000 commercial, institutional, and payments clients, along with more than 400,000 active retail accounts across more than 180 countries.

Despite its relatively modest search visibility, City Index has established a significant operational footprint, serving over 1 million customers globally and employing approximately 800 staff members. Founded in 1983 in the UK, the broker has been operating for over 40 years.

| Country | 2024 Monthly Searches |

|---|---|

| United Kingdom | 4,400 |

| Australia | 1,000 |

| Singapore | 720 |

| India | 590 |

| United States | 390 |

| Germany | 140 |

| Malaysia | 110 |

| South Africa | 90 |

| Japan | 90 |

| Indonesia | 90 |

| Poland | 90 |

| Nigeria | 70 |

| France | 70 |

| Canada | 50 |

| Turkey | 50 |

| Spain | 50 |

| Italy | 50 |

| Taiwan | 50 |

| Pakistan | 40 |

| United Arab Emirates | 40 |

| Vietnam | 40 |

| Netherlands | 40 |

| Thailand | 40 |

| Brazil | 40 |

| Sweden | 40 |

| Hong Kong | 40 |

| Kenya | 30 |

| Philippines | 30 |

| Switzerland | 30 |

| Portugal | 30 |

| Ireland | 30 |

| Bangladesh | 20 |

| Colombia | 20 |

| Saudi Arabia | 20 |

| Morocco | 20 |

| Egypt | 20 |

| Greece | 20 |

| Cyprus | 20 |

| Mexico | 10 |

| Austria | 10 |

| Uzbekistan | 10 |

| Argentina | 10 |

| Ethiopia | 10 |

| Algeria | 10 |

| Ghana | 10 |

| Dominican Republic | 10 |

| Uganda | 10 |

| Peru | 10 |

| Sri Lanka | 10 |

| Venezuela | 10 |

| Chile | 10 |

| Tanzania | 10 |

| Ecuador | 10 |

| Cambodia | 10 |

| New Zealand | 10 |

| Botswana | 10 |

| Jordan | 10 |

| Mauritius | 10 |

| Bolivia | 10 |

| Costa Rica | 10 |

| Panama | 10 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

United Kingdom

United Kingdom

|

4,400

1st

|

Australia

Australia

|

1,000

2nd

|

Singapore

Singapore

|

720

3rd

|

India

India

|

590

4th

|

United States

United States

|

390

5th

|

Germany

Germany

|

140

6th

|

Malaysia

Malaysia

|

110

7th

|

South Africa

South Africa

|

90

8th

|

Japan

Japan

|

90

9th

|

Indonesia

Indonesia

|

90

10th

|

Deposit and Withdrawal

What is the minimum deposit at City Index?

Deposits on City Index CFD accounts start from as little as $150 (although $2,000 is their recommendation) and there are no funding costs with most methods. If using credit cards the minimum deposit is $250. Traders in Singapore will need $25,000 to open a DMA account.

Account Base Currencies

When setting up the account, we found the opening process to be easy and straightforward. City Index offers a multi-currency deposit solution and can accommodate 9 base currencies (EUR, GBP, USD, CHF, HUF, AUD, CHF, JPY, PLN).

Deposit Options and Fees

Below lists the main funding methods you can use.

- Credit Cards (Visa and MasterCard)

- Debit Cards

- Electronic Funds (EFT)

- BPay (not in the UK, Singapore)

- PayID (not in the UK, (Singapore)

- PayPal

- PayNow (Singapore only)

- Internet Banking / Fast (Singapore only)

- Bill Payment (Singapore only)

- Wire Transfer (Singapore only)

Withdrawal Options and Fees

Up to three debit or credit cards can be used for an account across Visa and MasterCard. When transferring funds from an Australian bank, no deposit fees are charged, and there are no charges for funding through a bank transfer when the account is based in Australia.

However, an overseas bank account will require an international bank transfer which may take longer with an extended transfer period.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

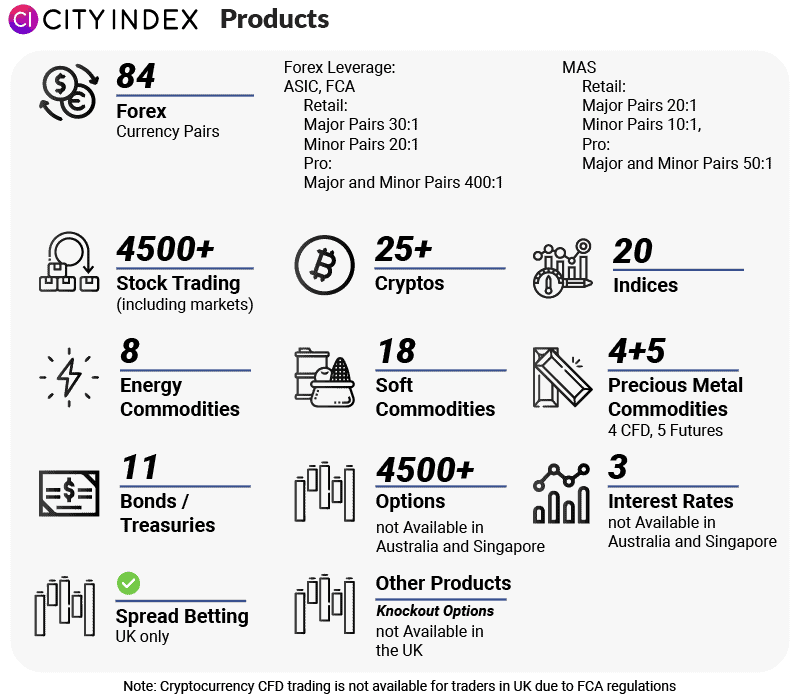

Product Range

Perhaps the single aspect we like most about City Index is the vast range of CFD trading options it offers.

CFDs

Traders have access in real-time to over 4,600 markets spanning forex, stocks, indices, cryptos, and more.

These markets are accessed via:

- Contract for Difference (CFDs)

- Spread Betting (only for UK traders)

- Knockout Options

Forex Trading

As we mentioned previously, minimum spreads start from 0.5 pips on EUR/USD and leverage (margin) is 30:1 for major pairs and 20:1 for minor pairs. In the forex spread section, we showed that our tests suggest that with an average spread of 1.79 pips, you may be better to look at other brokers.

Share Trading

City Index enables trading of over 4,500 global shares as CFDs where traders can speculate on long or short positions.

Within Australia, commissions start from 0.1% on Australian shares whilst leverage starts from 5:1 on standard accounts, increasing up to 30:1 for professional accounts.

Indices Trading

City Index offers 20 of the leading global indices including Australia 200, UK 100, Singapore, and Wall Street index for trading.

We like that City Index offers a wide range of markets, with fixed spreads starting from 0.6 points and leverage from 10:1 for standard accounts (increasing up to 300:1 for professional accounts).

Cryptocurrency Trading

City Index offers over 25 cryptocurrency markets for trading including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

Due to the volatile nature of cryptocurrencies, leverage is just 2:1 for retail traders. Professional traders can trade with 20:1.

We note that changes in FCA regulation in Nov 2021 mean that traders in the UK can no longer trade cryptocurrency.

Spreads start from 80 points but given the highly volatile nature of the cryptocurrency markets, they can fluctuate quite largely and rapidly.

Bonds and Interest Rate Trading

Traders are able to speculate on a broad array of bonds and interest rates including US T-notes, UK Long Guilts, Euro Bund markets, and Eurodollar and Euribor rates.

For traders across Australia, the UK, and Europe, leverage starts at 5:1 and can increase to 30:1 for professional accounts.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

Customer Support

We especially like that forex traders using City Index have multiple ways to reach out to the company’s support staff when they need to, including:

- Live chat assistance

- Email support

- Direct phone support based in Australia

In addition to these methods, traders can also find the answers to a range of frequently asked questions in the FAQ section of the brokerage’s website.

This set of common questions will provide answers and solutions for most issues. When more rigorous support is needed, however, City Index’s staff is there to help.

Customer Support is available 24/5 ready to answer all your inquiries directly on their website.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

Research and Education

City Index Trading Academy

When it comes to trading education, we think this is a big strong point for City Index. When you open an account you gain access to an impressive educational trading academy.

City index offers retail investors and professional traders hundreds of lessons available at their fingertips. The educational material encompasses a broad range of topics from lessons on how CFDs work and a trading strategy course that is valued at over $5,000.

You can learn to trade with City Index Training Academy and have access to the following types of educational material:

- Understand how CFDs work course

- Technical analysis and fundamental analysis guides

- Trading strategy guides

- City Index research tool guide

- Expert news and analysis

- Free webinars

- Earnings Report

- Economic calendar

The global research team at City Index has been awarded multiple times for their level of professionalism. The market analyses that can be found on City Index are constantly featured in mainstream media (MSM) publications including The Guardian, The Telegraph, BBC, and Sky News.

The weekly forex outlooks and forecasts published every Monday morning at 10.00 am is another insightful tool that will prepare forex traders for the week ahead.

Trader Development Program

City Index clients can also join the exclusive trader development program if they want to learn from an ex-Goldman Sachs professional trader. The program is run by Tony Sycamore from TECHFX TRADERS, who has over 20 years of trading experience.

The trading strategy course is divided into three main sections and is intended to accelerate the learning curve of a novice trader.

The first section provides an introduction to the forex market and outlines key concepts. This is followed by a dedicated section on the basics of fundamental and technical analysis. The final section focuses on teaching advanced concepts including trading strategies.

To access the trading strategy course, forex traders need to open an account with City Index and make a minimum deposit.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

Final Verdict on City Index

Overall, we think that City Index is a solid forex broker which offers robust customer support channels, plenty of insightful educational materials, and a wide range of financial markets.

Being regulated in multiple jurisdictions including Australia, Singapore, and the United Kingdom is a big plus for security, and the backing it receives from Nasdaq-listed parent StoneX, adds further weight to this view.

When it comes to leverage, City Index’s offering is fairly muted compared to other leading forex brokers. Additionally, its spreads are somewhat uncompetitive.

While we think City Index offers a lot of benefits to traders, we view these two factors as major disadvantages.

If you’re looking for a low-cost broker, then IC Markets may be more suited to you.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

City Index Review FAQ

Does City Index allow scalping?

Yes, City Index does allow scalping and hedging strategies for traders. Additionally, automated trading strategies are also permitted which in our view, positions City Index well for high-frequency and quant-style traders.

Other reputable Australian forex brokers which offer these types of strategies include IC Markets and Pepperstone, which both benefit from some of the lowest spreads in the forex industry.

Is City Index a market maker?

City Index runs a market-maker pricing model through its proprietary dealing desk. In other words, City Index creates its own market for retail traders to buy and sell financial instruments.

By comparison, ECN brokers operate through a no-dealing desk (NDD) where client orders are matched directly with various liquidity providers (LPs).

Compare the best ECN Brokers to get the best deal for your trading needs.

Compare City Index Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Go to City Index Website

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Can you trade options with City Index?

Yes, you can trade options with City Index. There are over 20 options markets to choose from and you will need to use the City Index desktop or Android, iOS mobile app. Options are spread-only products meaning there are no commissions.

Do I have to have trading experience to open an account with City Index?

No, you don’t but they may ask some question to ensure you understand the risks of CFD trading before accepting you as a client.