CFDs are among the most versatile derivatives to trade. The following examples demonstrate how you can can use this unique product to profit in rising and falling markets.

Key Learnings

-

- CFDs are an attractive alternative to traditional day trading, allowing you to trade without purchasing assets

- CFDs enable you to profit in markets where price rises (by being long) or price falls (by short selling).

- The use of leverage in CFD trading allows for large, quick gains (and losses) with short-term market volatility.

- CFDs are available for a diverse array of global markets such as forex pairs, indices and shares.

- CFDs are also useful for risk management and hedging price moves.

What Is CFD Trading?

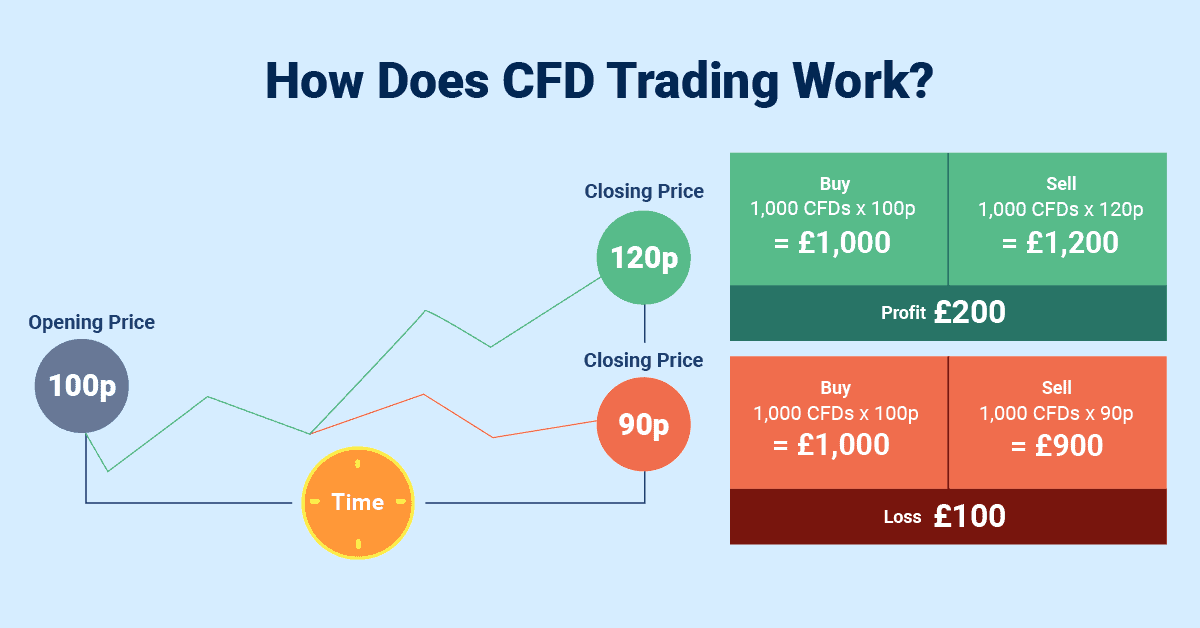

Contracts for difference, usually referred to as CFDs, are a type of financial derivative that allows you to speculate on financial markets without having to purchase the underlying asset. Instead, you profit by correctly predicting price movements.

In traditional asset trading, you buy and sell an actual financial asset, like stocks or currencies. You may not own much or for very long, but for a short period, you own a specific product.

With CFD trading, you never actually buy or sell the underlying assets, whether they’re shares, commodities, indices, or any other financial product that forms the basis of your chosen market.

Instead, you enter into an agreement with your CFD provider – usually a broker – to buy or sell a certain number of CFD contracts at a specific price. The price of the CFD corresponds to the price of a specific asset, and the contract doesn’t have an expiry date. If the market moves in your favour, you’ll profit when you close your position.

How Does CFD Trading Work?

Let’s look at an example to break down the mechanics of how a CFD trade works.

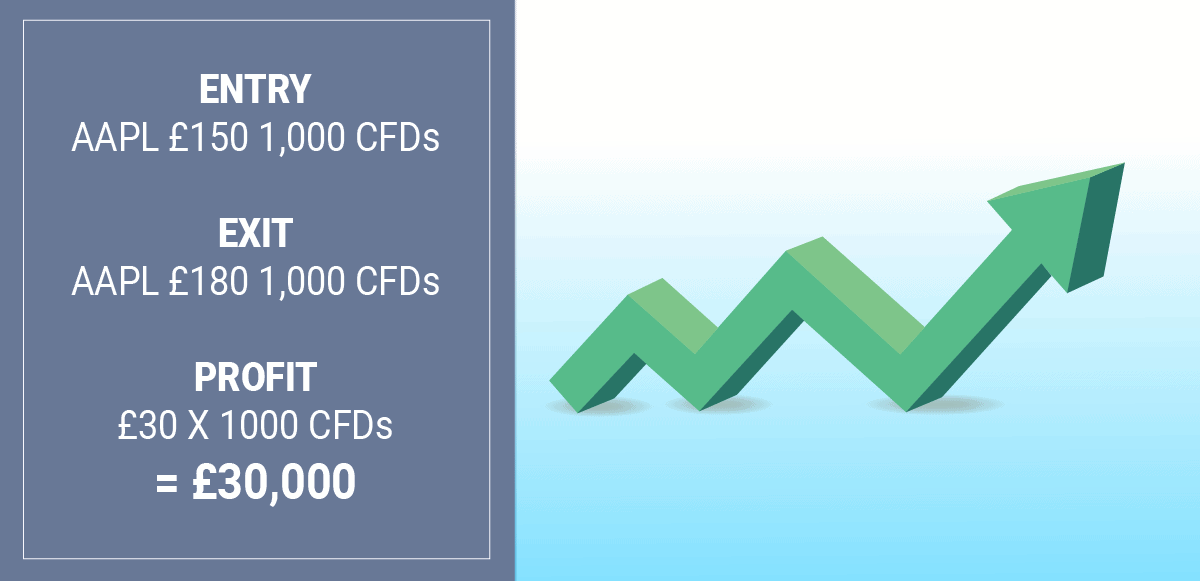

Alex, an experienced trader, decides to open a CFD position with his broker CMC Markets. He’s been closely monitoring the stock price of a well-known tech company, Apple, and strongly believes that the price will rise in the near term.

Alex logs into his CMC Markets trading account and selects the CFD product for Apple. The current price is £150 per share. As he’s decided to go long, he places an order to buy 1,000 CFDs. He’s also using leverage to enlarge his position at a margin of 10:1. That means he can put down £15,000 to open a CFD position with £150,000 (1,000 CFDs * £150 per share multiplied by a factor of ten).

Over the next few days, a positive earnings report and favourable market sentiment push the price of XYZ Inc.’s shares up to £180 per share. This is great news for Alex, who logs into his CMC Markets CFD account and places an order to sell his 1,000 CFDs.

By selling when the market is high, Alex nets himself a profit of £30,000. That’s the difference between the £100,000 he paid to buy his XYZ, Inc. CFDs and the £110,000 for which he sold them.

Notice that at no point did Alex ever buy any shares of Apple. He simply predicted that the price of its shares would rise and placed a bet with his broker. Because Alex correctly predicted the market movement, he was able to make a profit.

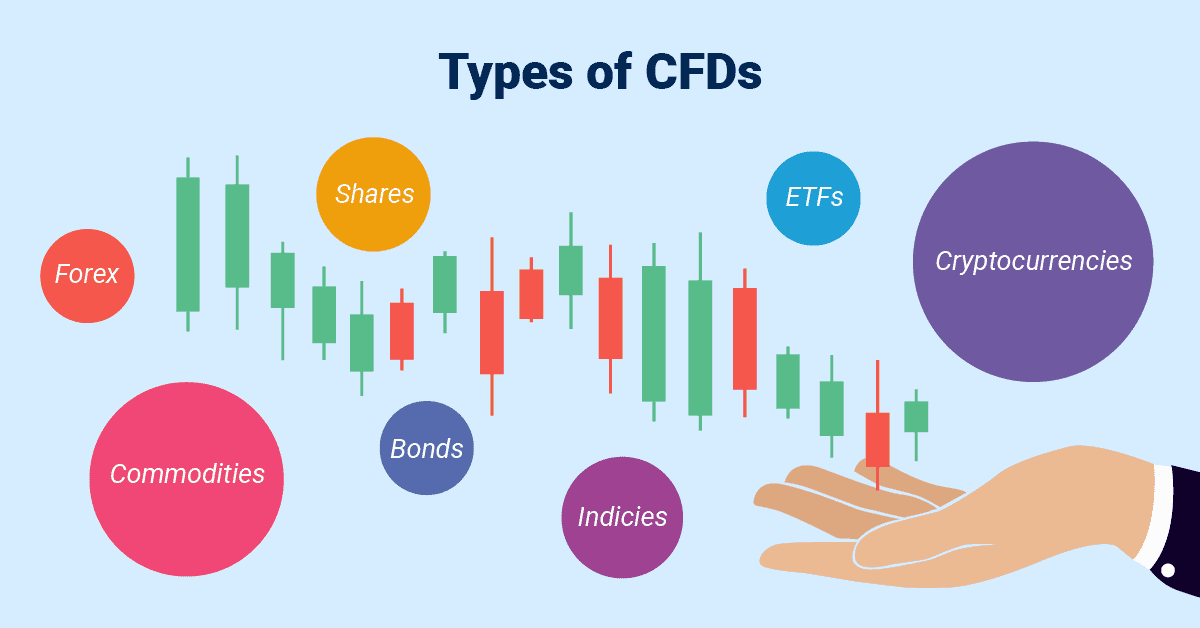

Types of CFDs (Contracts For Difference)

Because a CFD depends on market movement rather than a specific asset class or financial instrument, it’s a broad category of trading product. In other words, if a market exists where you can trade a financial asset, you can usually also purchase CFDs for that asset.

Popular CFDs amongst UK traders include:

- Cryptocurrency CFDs

- Commodity CFDs

- Share CFDs

- Forex (Currency Pair) CFDs

- Index CFDs

- Bond CFDs

- ETF CFDs

Whatever CFD you opt to trade, spend time learning the fundamentals of market analysis. Even better, focus on CFDs in markets you’re already familiar with. If you’ve spent years day trading shares, for example, stock CFDs make a natural choice. Forex traders who have insight into the movements of currency pairs might look into currency CFDS.

CFD Examples

Remember Alex, our lucky CFD trader? Let’s keep following him for a few more imaginary trades to understand how winning and losing trades work when buying or selling.

CFD Trading Example 1: Buying

In these examples, we’ll look at what happens when Alex bets that the asset price of Apple will rise and buys CFDs, taking on a long position.

Winning CFD Trade

For an example of a winning long trade, take a look at the example above. Alex bet that Apple, Inc. would increase in price, and so purchased 1,000 CFDs at a buy price of £150. He read the market correctly and, when the value increased to £180, he sold them at a profit.

Even better, because Alex had access to leverage, he was able to purchase more CFDs than he would have if limited to his trading account balance. As a consequence, he also enjoyed larger profits.

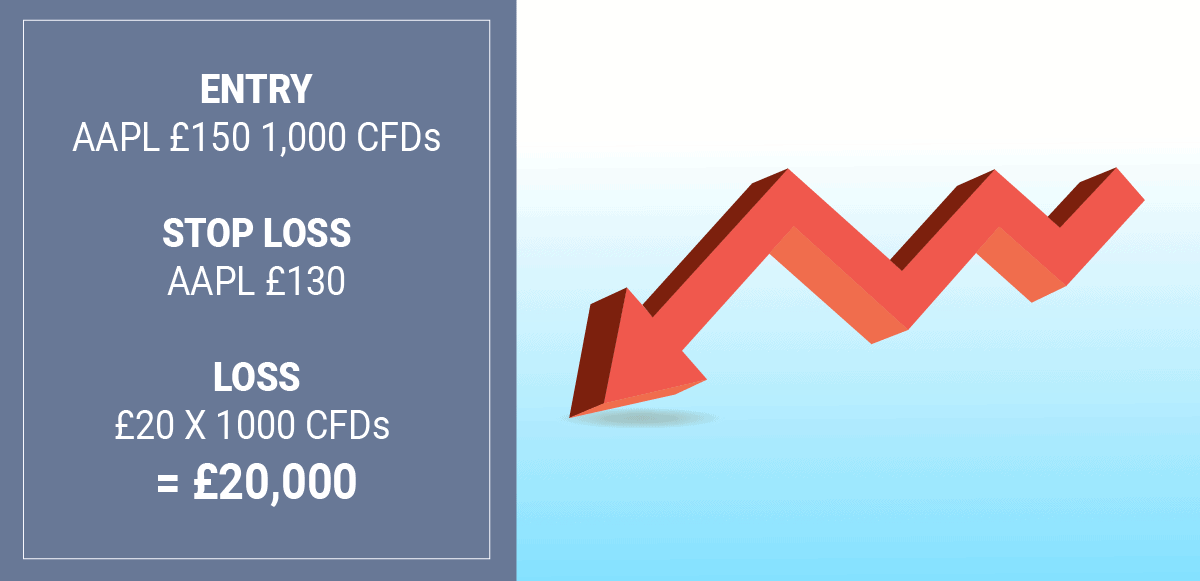

Losing CFD Trade

Let’s say that, instead of a favourable market report, Apple, Inc. discloses significant internal cutbacks and budgetary constraints. Far from rising, the price of its shares begins to drop.

Alex sets a stop loss at £130 per share and waits for a day or two in hopes of a rally. The next day, Alex sees that his stop loss has been hit. Alex incurs a loss of £20,000, which the broker deducts from his trading account.

Fortunately, Alex has the funds to cover his loss. Had he not, his broker might have issued a ‘margin call’ as his losses approached the value of his account balance and forcibly closed his position. When you trade with margin, you borrow money from your broker, and it reserves the right to protect itself.

CFD Trading Example 2: Selling

Now, let’s turn the tables to consider how CFD trading works when you decide to ‘go short’ (take on a short position) on an asset and bet that the price will fall.

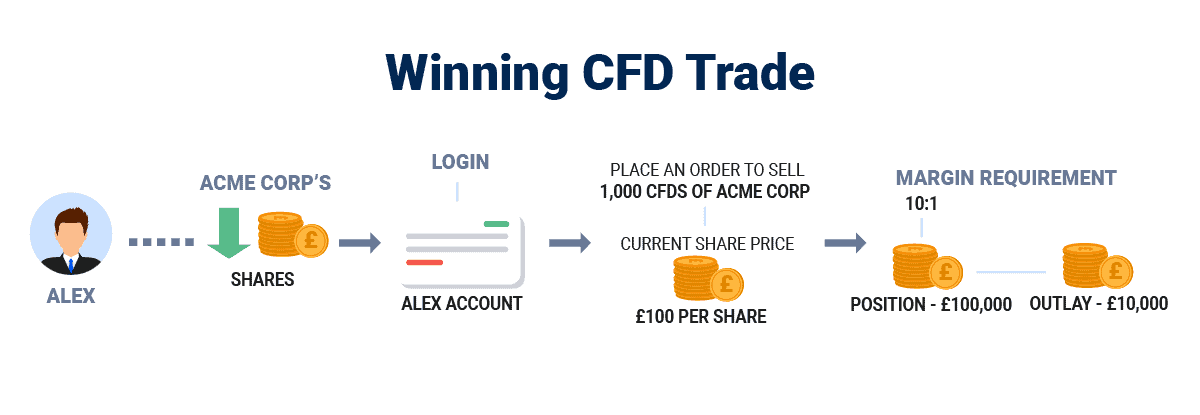

Winning CFD Trade

Alex has been following the news and has good reason to believe that the price of tech stocks will soon decline. In particular, he thinks that the price of Acme Corp’s shares will fall dramatically based on sluggish sales during the most recent quarter.

On the basis of this analysis, he logs into his account and places an order to sell 1,000 CFDs of Acme Corp at the current share price of £100 per share. In fact, he’s so confident in his analysis that he takes a position with a margin requirement of 10:1 to enlarge his position to £100,000 with an outlay of just £10,000 of his own capital.

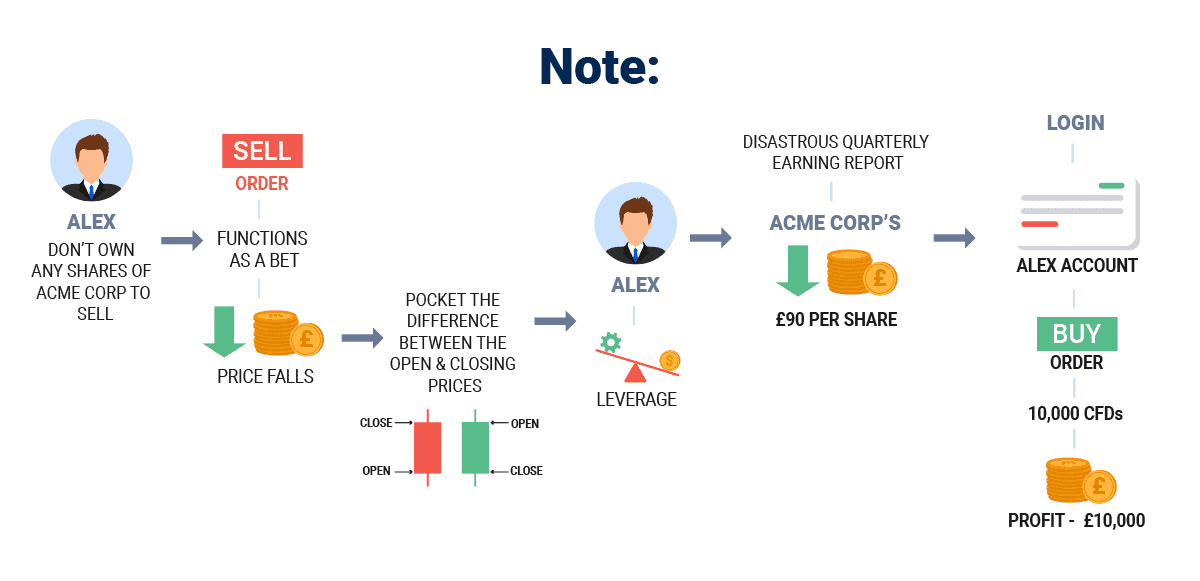

Note that Alex doesn’t actually own any shares of Acme Corp to sell. His ‘sell’ order here functions as a bet that the price will fall, at which point he’ll pocket the difference between the open and closing prices. Alex is also using leverage and doesn’t have to have the entire value of the trade in his account before opening the position.

Following a disastrous quarterly earning report, the price of Acme Corp’s shares drops to £90 per share. Alex logs into his trading account and places a ‘buy’ order for 1,000 CFDs. The buy order serves to close his short-sell position, at which point he profits to the tune of £10,000.

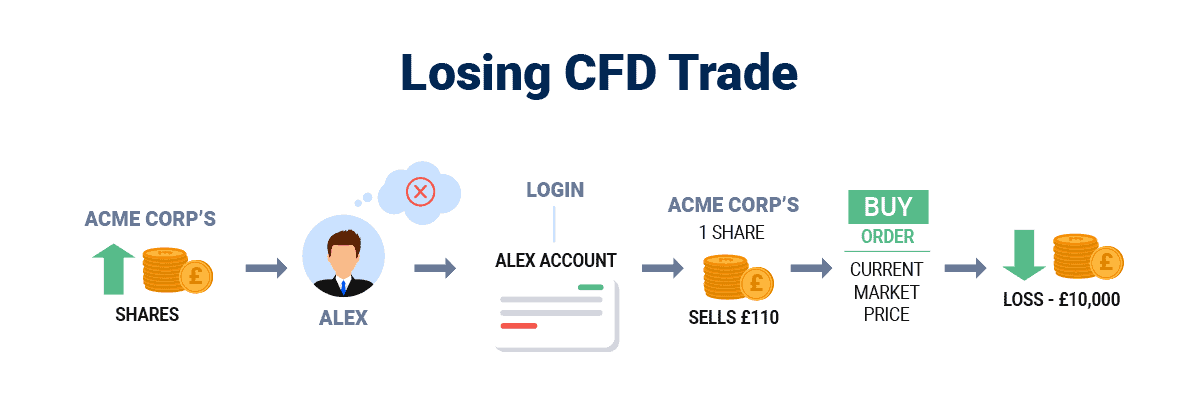

Losing CFD Trade

Now imagine that, instead of falling, the price of Acme Corp shares rallies unexpectedly on the back of a surprisingly optimistic earning report and a new product launch. When Alex realises that the market has moved against him, he rushes to close out his position.

Upon logging into his account, he sees that one share of Acme Corp now sells for £110. He places a ‘buy’ order for the current market price and absorbs his loss of £10,000.

Key Takeaways

Trading CFDs offers an appealing alternative to traditional day trading, as it doesn’t require the purchase of assets.

- CFDs enable you to profit in markets where price rises (by being long) or price falls (by short selling).

- The use of leverage in CFD trading allows for large gains (and losses) with short-term market volatility.

- CFDs are available for a diverse array of global markets such as forex pairs, indices and shares.

- CFDs are also useful for risk management and hedging price moves.

Frequently Asked Questions

Can you make money trading CFDs?

Yes. Many CFD traders enjoy financial gains from their trading. That said, don’t put money in the markets that you can’t afford to lose, especially when you start trading.

Be aware, too, that you will pay taxes on your CFD trading profits. Unlike spread betting, which HMRC considers gambling, your CFD trade winnings are subject to stamp tax and capital gains tax.

You can read more about the pros and cons of CFDs here.

How to choose a CFD trading platform?

With so many reputable brokers, selecting from among the best CFD trading platforms to suit your trading strategy can feel overwhelming.

When in doubt, consider your overall trading objectives and your preferred style. For example, if you’re also interested in forex trading, MetaTrader 4 is the logical choice. On the other hand, if you dabble in traditional share trading on a centralised exchange, you’ll want access to MetaTrader 5. Traders who rely extensively on advanced charting might be interested in TradingView.

What is the best CFD broker?

Similar to CFD trading platforms, the best CFD broker for you will depend on a number of factors, including your budget, trading strategy, leverage needs, access to demo accounts, beginner friendliness and desired trading platform.

Regardless of your other trading needs, we always recommend trading with a regulated broker licensed in your jurisdiction and preferably trying the broker out with a free demo account before depositing funds. As a UK resident, look for evidence that the Financial Conduct Authority (FCA) oversees your CFD provider.

Trading CFDs vs Spread Betting?

While both CFD trading and spread betting allow you to speculate on price movement without purchasing a financial asset, they differ in several key respects.

The two most significant: tax treatment and trading costs. As mentioned above, HMRC treats spread betting profits as gambling winnings in the United Kingdom, which means you won’t pay tax. CFD trading profits, on the other hand, are subject to capital gains and stamp tax.

When spread betting, you pay on the spread when executing your trade. (Remember, the spread is the difference between the ask price and the sell price for a given asset and can vary significantly.) With CFD trading, you may have the option of a spread-only pricing model, but many traders prefer to pay commissions to their brokers in exchange for tight minimum spreads.

CFD Trading vs Share Trading?

CFD trading and share trading have similarities but are fundamentally different creatures. In share trading, forex trading and other forms of retail investing, you purchase the underlying asset. CFD trading, by contrast, involves only speculating on price movements in financial markets. CFD contracts are traded over-the-counter (OTC) and are created by an issuer (often times that’s your CFD broker).

Don’t be fooled by lookalike account structures, trading platforms and pricing models. Trading shares and trading CFDs require different skill sets and strategies for success.

CFDs are among the most versatile derivatives to trade. The above examples demonstrate how you can use this unique product to profit in rising and falling markets.