While CFDs generally don’t expire, that doesn’t necessarily mean you should hold a CFD position indefinitely. How long you can hold a CFD position comes down to your personal preference and trading style.

While most CFD traders prefer a short-term strategy, you may wonder if this financial instrument works for swing trading. Below, we explain the pros and cons of a long-term CFD position.

Key Takeaways

- CFDs do not expire. You can hold a position indefinitely.

- Your CFD provider’s financing charges may make long-term CFD trading expensive.

- Using leverage for long-term CFD trading can impact your free margin available for other positions.

- Trading CFDs with a regulated UK broker licensed by the Financial Conduct Authority is an important form of risk management.

Do CFDs Have Expiry Dates?

No, CFDs don’t expire. As long as you maintain the required margin, you can hold your CFD position open for as long as you want.

Do CFDs Expire Every Quarter?

In general, no. As long as you have the margin required by your CFD broker in your trading account, you can hold a CFD position open indefinitely.

The belief that a CFD position expires at the end of the quarter likely stems from some CFD broker policies. Many leading brokers, including CMC Markets and IG Markets, set expiration dates for CFDs where the underlying asset is an energy commodity or a metal commodity.

Why Do Some CFDs Expire Every Quarter?

In order to provide a standardised framework for traders and retail investors, some CFD brokers set expiration dates for CFDs linked to commodities and indices. These expiration dates typically align with financial reporting periods or established market cycles.

How Long Should You Hold a CFD Position?

The answer to this question depends on your trading strategy, trading goals and risk tolerance.

If you’re a day trader who aims to profit off small market movements, you likely won’t hold a CFD position for more than 24 hours. If, on the other hand, you’re a swing trader, you may find yourself holding a CFD position for a few days or weeks as you monitor market movements.

Likewise, if you’ve decided to pursue CFD trading to pick up short-term profits, you’ll need to open and close your positions quickly to generate profits. If you’re trading CFDs with a more medium or long-term view, you can probably afford to hold your CFD position until market conditions align with your needs.

If you’re an experienced trader accustomed to market volatility with a well-funded trading account and diverse portfolio, you likely have a risk management strategy in place to control any losses associated with your CFD position. New to CFD trading and still learning the ropes? You may be better off devising a simple, short-term trading strategy such as:

- Pick one CFD market to go long (or buy)

- Decide on a price above the market where you want to make a profit (I.E. Take Profit order)

- Choose a level below the market at a price you can afford to lose money (I.E. A Stop Loss order)

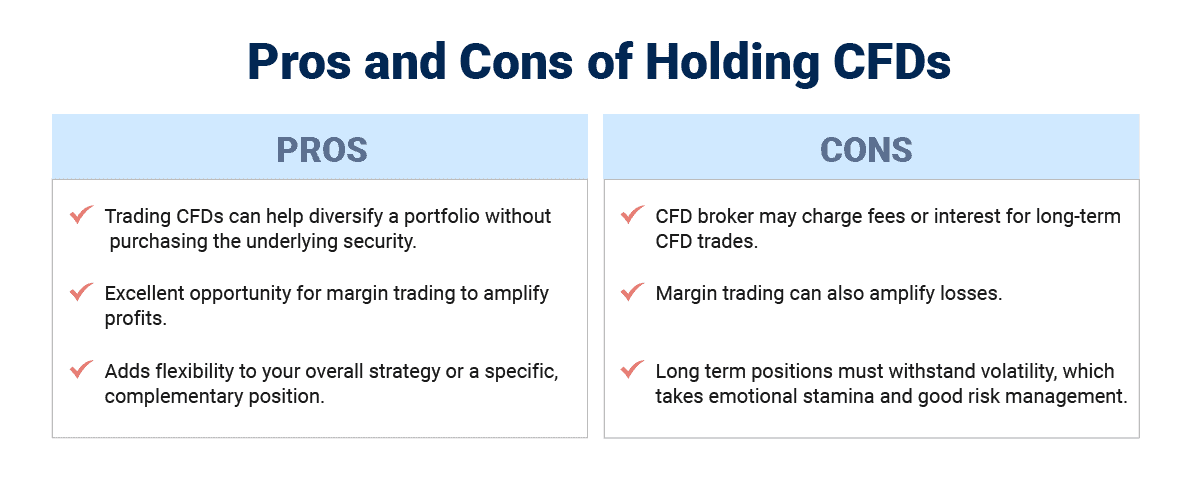

What Are the Pros and Cons of Holding CFDs?

On the positive side, holding a CFD trade open long-term can help you diversify your portfolio and inject some flexibility into your overall strategy when riding out volatile market conditions.

On the negative, holding a CFD trade open for a long period may come with additional costs in the form of fees and interest from your CFD provider. The same market volatility that amplifies gains, particularly when combined with leverage, can also lead to substantial losses.

Long-Term vs. Short-Term CFD Trading

Before diving into the benefits and drawbacks of trading CFDs on a short-term or long-term basis, let’s define what we mean by those terms.

Aimed at capitalising on short-term price fluctuations, short-term CFD trading usually involves holding a CFD position intraday or for only a few days. If you aim to trade CFDs short-term, you’ll likely rely heavily on technical indicators, charts and economic news or data announcements to shape your strategy.

Trading CFDs long-term involves holding a position for an extended period ranging from weeks to months. This type of CFD trade hopes to capture broader market trends and allows for appreciation over time. If this sounds like you, you’ll probably use fundamental analysis and base your decisions on macroeconomic factors.

Be aware that long-term and short-term trading aren’t the same as going long or short, which we’ll discuss below.

Can CFDs be used for long-term investments?

While CFDs are often associated with short-term trading, as we’ve mentioned, they also have potential for long-term strategies. This shift requires a different mindset and approach. Let’s take a look at some advantages and potential risks of using CFDs for long-term investments.

Advantages:

- Diversification Opportunities

CFDs offer a diverse range of assets for long-term investment, allowing you to create a well-rounded and diversified portfolio. This can mitigate risks associated with a single asset class.

- Leverage and Its Role

Leverage, a key feature of CFDs, can be advantageous for long-term traders. It allows you to control a larger position size with a relatively small capital investment.

- Tax Implications

Understanding the tax implications of CFD trading is essential for long-term traders. Tax regulations vary by jurisdiction, and as a UK trader, you should consider how CFD profits are taxed by the Financial Conduct Authority. In the UK, CFDs are free from stamp duty, but you may pay capital gains on your profits.

Risks:

- Market Volatility

One of the primary challenges of using CFDs for long-term investments is the inherent market volatility. Prices can experience significant fluctuations, impacting the value of your investment.

- Margin Calls

As a long-term CFD trader, it’s important to be mindful of margin calls, as the extended duration of the investment may expose you to increased margin requirements. A Margin call is a demand by a broker to deposit further cash or securities to cover possible losses. A Margin requirement is the amount of money you must put up as collateral to open a CFD position.

- Regulatory Considerations

The regulatory landscape for CFDs varies globally. As a UK trader, you must be aware of and comply with the regulations in your jurisdiction (I.E. the FCA) to ensure a secure trading environment for long-term CFD trading.

Strategies for Long-Term CFD Investments

Once you understand the advantages and potential risks of long-term CFD investments, it’s important to learn trading strategies to guide you on your CFD trading journey. We have listed a few key considerations for long term CFD investing below:

Research and Analysis

Thorough research and analysis are paramount for successful long-term CFD investments. It’s important to stay informed about market trends, economic indicators, and the financial health of the assets in your portfolio.

Risk Management

Implementing effective risk management strategies is crucial for mitigating potential losses. Setting stop-loss orders and diversifying your portfolio can help safeguard against adverse market movements.

Monitoring and Adjustments

As a long-term CFD trader, you should regularly monitor your investments and be prepared to make adjustments based on changing market conditions. This proactive approach enhances your potential for sustained success.

How Much does CFD Trading Cost?

Generally speaking, the costs of trading CFDs fall into two categories: financing charges and trading fees.

A financing charge refers to the cost associated with holding a leveraged position open overnight. These are sometimes called ‘swaps’ or ‘overnight fees’. If you live in a Muslim-majority country, you might want to check if your CFD broker offers a ‘swap-free’ account to avoid conflict with Sharia law regarding swap or rollover interest on overnight positions.

Trading fees, sometimes called direct trading costs, refer to the broker’s fees to execute your CFD trade. Depending on your account type, the broker will either price its fee into the minimum spread or charge a commission for every round-turn trade.

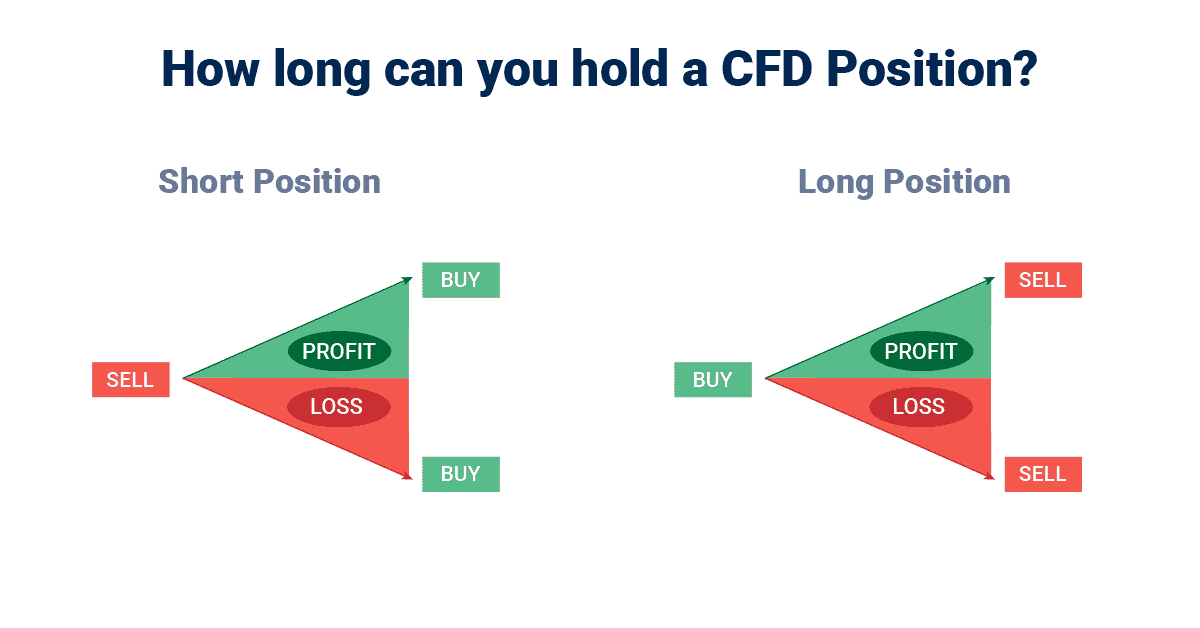

Long vs. Short Trading

In CFD trading, you can either ‘go long’ or ‘go short’. Simply put, going long means you are buying and going short means you are selling. The profit or loss is the difference between your entry and exit points. It’s important to note that you can earn a profit (or loss) from both buying or short-selling a CFD market. We explain the distinctions between both long and short trading below.

What happens if you take a long CFD position?

‘Going long’ on a CFD means that you’re buying or, in other words, betting the price of the underlying asset or underlying security will rise. When ‘going long’, a CFD trader wants to buy low and sell high, profiting from the price increase. When buying a CFD, you you will buy at the bid price of the bid-ask spread when entering the market. The ask is the price you will sell at when closing the long CFD position.

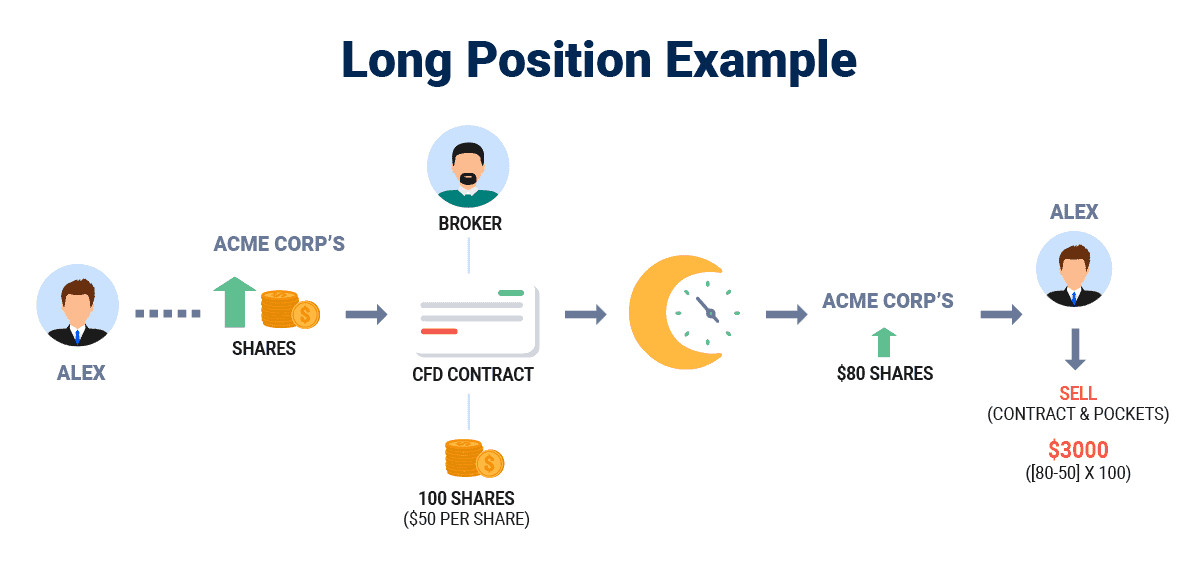

Long Position Example

Here’s an example of how a long CFD position might work for a successful trader:

Alex believes that the price of Acme Corp’s share will increase. He signs a CFD contract with his broker for 100 shares at the current price of US $50 per share. Overnight, Acme Corp shares increase to US $80. Alex sells his contract and pockets US $3,000 ([80-50] x 100).

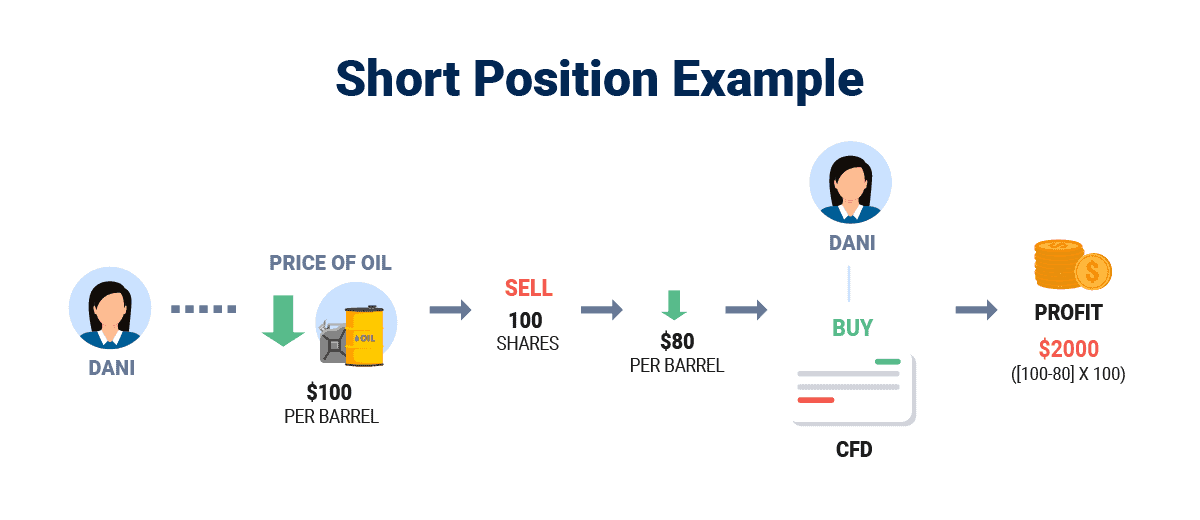

What happens if you take a short CFD position?

As you might expect, ‘shorting’ or ‘going short’ on a CFD means that you’re selling or betting that the price of the underlying asset or underlying security will fall. When ‘going short’, the CFD trader wants to sell high and buy low, profiting from the price decrease. When shorting a CFD (sometimes referred to as short-selling), you will sell at the bid price of the bid-ask spread when entering the market. The ask is the price you will buy at when closing the short CFD position. As you will notice, the bid-ask price is the same for short-selling as it is for going long. You are always entering a position at the bid price and always exiting a position at the ask price.

Short Position Example

Now, let’s look at how a winning short CFD position might turn out:

Dani believes that the price of oil will drop from its current level of US $100 per barrel and decides to sell 100 shares on this basis. when the price does, indeed, fall to US $80 per barrel, Dani buys back the CFD and makes a profit of US $2,000 from the difference ([100-80] x 100).

The Bid-Ask Spread: How Does It Work in CFD Trading?

If you’re currently forex trading, you’ve already heard of the bid-ask spread. For those of you new to day trading, here’s a quick refresher.

The bid refers to the buying price of a CFD’s underlying asset. It’s the price at which a CFD trader enters a position if you are going long, or exits a position if you are going short. In our example featuring Alex, above, the bid price for his initial transaction is US $50 per share.

The ask price, as you’ve probably guessed, refers to the selling price for the underlying asset. Opposite to the above, it’s the price at which a CFD trader exits a position if you are going long or enters a position if you are going short. Going back to Alex, the ask price when the CFD broker buys back the contract is US $80 per share.

The distance between a CFD’s bid and ask price is known as the ‘spread’. Because the CFD trader incurs the cost of the spread when opening a position, tighter spreads mean better profits.

If the bid price for a CFD is US $50, and the ask price is US $55, the spread is US $5. If you enter a long position, you would buy at US $55 and, if you immediately sold, receive $50. That means a US $5 loss due to the spread.

Free Margin and Its Role in CFD Trading

Your ‘freemargin’ in CFD trading refers to the funds you have available to open a new position or absorb your losses. Essentially, it represents the surplus funds you have for additional trades.

For most traders, it’s a fancy way of saying ‘trading account balance’. If you’re using leverage, however, you’ll calculate your trading account balance by subtracting the funds in your account from the margin you’ve used in any open positions.

If you’ve got US $10,000 in your trading account and open a CFD trade with a required margin of US $2,000, then you have US $8,000 in free margin left.

Key Learnings

- CFDs have no expiry date and can be held indefinitely.

- Long-term CFD trading might become costly due to financing charges from your CFD provider.

- Utilizing leverage for extended CFD trading can affect your available free margin for other positions.

- Opting for a regulated UK broker licensed by the Financial Conduct Authority is a crucial risk management step in CFD trading.

FAQs

If you’re just beginning to trade CFDs after trading forex or another financial instrument, you may have questions about how they differ from currency pairs or other trading products.

1. What is a CFD?

Contracts for difference (CFDs) allow you to speculate on price movements in financial markets without purchasing an underlying asset. In share trading, for example, you purchase the actual shares. Likewise, when you trade forex, you buy small quantities of the underlying currency. In the case of a CFD, however, you don’t own anything. Instead, you sign an agreement with your CFD provider committing to pay (or be paid) when the price of your preferred asset reaches a certain level.

Example: Bob believes the price of gold will increase from US $1,800 an ounce to US $1,850 an ounce. Rather than buy gold, however, he signs a CFD with his broker. If the price does, indeed, rise to at least US $1,850, the broker will pay Bob the difference of US $50. If, on the other hand, the price falls to US $1,700, Bob will pay the broker the US $100 difference.

2. How are CFDs different from futures contracts?

Because both CFDs and futures contracts are financial derivatives, it’s easy to confuse these two trading products.

Futures contracts usually imply an obligation to buy or sell the underlying asset and have a fixed expiry date. CFDs do not involve purchasing the underlying asset and do not expire.

3. Is trading CFDs legal in the UK?

Yes, UK residents can safely and legally trade CFDs. To benefit from the strongest regulatory protections, we recommend trading with a CFD broker licensed and regulated by the Financial Conduct Authority (FCA).

4. What is the Financial Conduct Authority?

The FCA (Financial Conduct Authority) is a regulatory body in the United Kingdom that oversees and regulates financial firms to ensure the integrity, stability, and fairness of the financial markets. It operates independently of the UK government and is accountable to the Treasury.