Have you seen TV shows like Billions and movies like Wolf of Wall Street, Margin Call, and The Big Short with images of successful and wealthy traders in swank business suits and driving flashy cars and thought, “yeh! I could do that”? While you can certainly make money by trading different CFDs like forex, stocks, cryptocurrencies, and indices, the reality is about 70% of retail traders lose money.

In this article, we look at how much a forex trader really earns. As part of the guide, we will cover the following topics:

- Types of Forex traders

- Employed Forex trader salaries

- Independent Forex trader salaries

- Average Forex trader salaries by location

- Forex trader hours and workload

- Employed traders vs independent traders

Types Of Forex Traders

Three key forex trading roles cover different aspects of online trading. Whether a hedge fund or investment bank is hiring you, your years of experience trading and understanding of forex markets will determine your suitability for the position and your annual salary.

1. Forex Analysts

A forex analyst’s role is to research foreign exchange markets. This includes any political and economic event that may affect global markets. Forex Analysts then report their findings and investment recommendations to senior traders and clients.

Forex Analysts’ job titles may also be described as currency/forex researchers or currency strategists. It is one of the more entry-level positions for forex traders.

2. Forex Account Manager/Trader

Forex traders and account managers trade on behalf of one or more clients. Account managers tend to be experienced traders as they manage large amounts of funds for their clients.

The role often requires years of experience trading forex and CFDs, as clients expect traders to reach profit targets.

3. Forex Exchange Operations Assistant/Associate

The customer service-based role supports foreign exchange traders with administrative duties. The role often involves processing withdrawals and deposits or verifying clients’ IDs.

To become a forex trader, there are two ways to enter the industry:

- Employed traders: Often employed by trading firms, hedge funds, or investment banks

- Independent traders: Work from home independently

Below we discuss the different salaries and benefits offered to both employed and independent traders.

Employed Forex Trading Salaries

The average salary of an employed forex trader depends on various factors. Although each trading firm structures salaries differently, forex traders may be paid:

- A base salary that forex traders receive regardless of trading performance.

- Commission and bonuses that are derived from your performance.

- Employee benefits, such as profit-sharing schemes, health insurance, pension plans, and holiday pay, may also be offered.

Your overall salary as a forex trader depends on the following key elements:

- Your trading experience. While junior traders may be required to pay their dues initially, senior traders can expect generous salaries.

- Your education. Your academic background and whether you’ve studied finance and foreign exchange markets.

- The trading firm. Large hedge funds and investment banks like Morgan Stanley may offer higher average salaries than small trading firms just starting.

- The location. Major financial hubs such as London, New York, and Singapore may offer higher average salaries.

- Trading performance. The performance of the trading firm, your team, and yourself may affect bonuses and commissions.

- Economic and political factors. For instance, a global pandemic or recession may affect the demand for forex traders and, therefore, average salaries.

Average Salary For Employed Forex Traders

Due to the large variance in base salaries, commissions, and bonuses, it can be challenging to determine a forex trader’s average salary. Additionally, there needs to be more accurate information regarding forex traders employed by private hedge funds.

If based in a financial hub in the United Kingdom, PayScale suggests an average salary of £53,500 per year for a full-time fx trader. Yet, for the reasons mentioned above, there is a significant difference between what junior traders and experienced traders should expect:

- Base salary – can range from £30k to £130k

- Bonuses – from £4k to £103k

- Profit sharing – between £3k and £10k

- Total fx trader salary – £25k to £162k

There is also a large variance in forex trader salaries depending on your years of experience. Entry-level employees can expect 29% less than the average salary, while experienced traders receive 70% more.

Reported average salaries also differ between websites. Glassdoor suggests an average of £63,065 per year, while Indeed states an average of £36,100.

Independent Forex Trading Salaries

Independent forex traders are not employed by a trading firm and use their own funds to trade currency pairs.

Choosing to work as an independent trader for some is a lifestyle choice. Only a small amount of capital is needed to get started. There is no reporting to a senior, meaning you are accountable only to yourself. Plus, you only need a laptop or PC (or mobile) and an internet connection.

As derivatives are complex instruments, you are taking on significant risks when trading with your own money. The high risk is amplified even further if you place trades with high leverage.

Your salary will depend on factors such as whether you are trading part or full-time, the income tax you are paying, and the costs involved.

The amount of profit you make, referred to as your return on investment (ROI), will be affected by how long you plan to trade forex, your initial deposit, and your ability to develop successful trading strategies.

Forex Trading Costs

There are certain costs involved when operating as an independent forex trader. As you are self-employed, you’ll be required to source your own equipment, internet connection, insurance, and accountancy services.

Depending on the broker and trading software used to access forex markets, different fees and costs will be involved. For example:

- Spreads are considered a cost. Brokers often offer either commission or non-commission forex spreads.

- Overnight financing fees, aka swap rates, are incurred when forex positions are held open overnight.

- Mainstream or proprietary trading software (i.e. for automation or technical analysis) may involve fees.

- Account management fees. For example, deposits and withdrawals or inactivity fees.

As fees vary by broker, we always recommend you compare forex brokers thoroughly and periodically. The same applies when choosing among the top UK spread betting brokers.

Average Salary For Independent Traders

As each independent forex trader’s circumstances and dealing are completely individual, it’s not possible to determine an accurate average salary. The average profit you make from trading forex depends on the fees you are paying, the amount of time you can dedicate, and the efficiency of your trading strategies.

To illustrate the importance of an investment term and initial deposit, assume a forex trader earns the same ROI of 5% every month.

- If you invest $500 for a year and make a monthly ROI of 5%, and each monthly gain is re-invested, your total profit for the year will equal:

- $897.92 – $500 = $397.92 profit

- If you invested a larger sum, say $10,000, you would make a profit of:

- $17,958.56 – $10,000 = $7,958.56 profit

- If you continued investing for another two years and were making the same monthly ROI, your profit would be:

- If you invested $500 initially = $2,895.90 – $500 = $2,395.90 at the end of three years.

- If you invested $10k initially = $58,918.16 – $10,000 = $47,918.16 three years later.

Employed Traders vs Independent Traders

There are pros and cons to being an independent versus employed trader. You are offered much flexibility as an independent trader, while employed traders must reach their employer’s targets while working long hours. However, employed traders receive employee benefits and can drastically increase their income by earning bonuses and commissions on top of their base salary.

Independent traders receive no such employee benefits and are not provided with any security in terms of income and stability. Additionally, as an independent trader, you carry all the risk and are solely responsible for any costs involved.

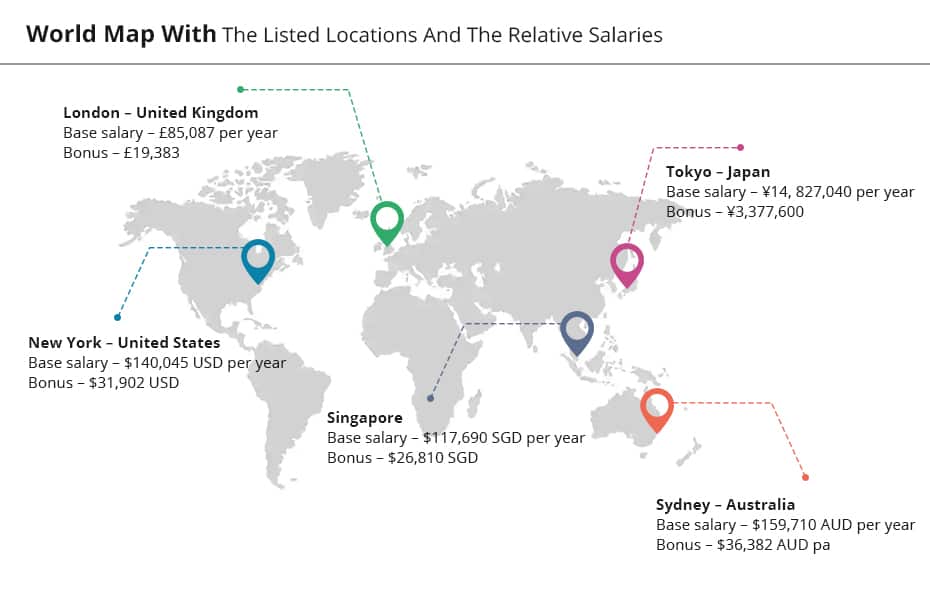

Average Salary By Location

According to Salary Expert, traders earn differing average base salaries depending on where they are based.

London – United Kingdom

- Base salary – £85,087 per year

- Bonus – £19,383

New York – United States

- Base salary – $140,045 USD per year

- Bonus – $31,902 USD

Sydney – Australia

- Base salary – $159,710 AUD per year

- Bonus – $36,382 AUD pa

Tokyo – Japan

- Base salary – ¥14, 827,040 per year

- Bonus – ¥3,377,600

Singapore

- Base salary – $117,690 SGD per year

- Bonus – $26,810 SGD

Fx Traders Hours And Workload

Forex markets operate 24 hours a day from Monday to Friday due to the overlap in different forex centres’ time zones. For instance, forex markets in Sydney and Tokyo can be open when London and New York are closed.

If you are a forex trader employed by a trading firm, you may be expected to work 12-hour days or weekends due to the different international time zones. If you are an independent forex trader or trade part for an extra source of income, you can be flexible and trade the forex markets’ time zones that suit you.

What Is The Foreign Exchange (Forex) Market?

Forex markets are decentralised global markets where traders can buy and sell different currencies. Foreign exchange is the largest financial market in terms of both liquidity and trading volume, with a daily turnover of $6.6 trillion dollars and a total value of $2.409 quadrillion (see our Forex Trading Statistics).

Market participants include individuals, firms, organisations, and governments that trade forex to conduct international business as well as profit from exchange rate fluctuations.

When forex trading, you are speculating on whether a currency’s value will increase or decrease relative to another currency. Many factors affect foreign exchange markets, including political, economic, and social events. Forex traders analyse these markets and events. They then develop trading strategies with the goal of profiting from these market movements. The final element requires is a liquidity provider with traders recommended to view our best forex broker UK list which factors in regulation, fees and software.

FAQS

Can you get rich trading forex in the UK?

With leverage, forex traders can make significant profits when buying and selling currencies. But all forex traders should beware of the high risk of losing money when trading. To learn more about the risks involved in forex trading, along with tools available to reduce the high risk, read our UK Forex Trading Guide here.

How much do forex traders earn UK?

According to PayScale, the average base salary for a forex trader in the UK is £53,500. Yet, there are many factors, such as experience and location, that may increase or decrease a trader’s salary.

What do forex trader jobs involve?

Forex traders are buying and selling a currency with the intention of profiting from price movements. As an employed forex trader, a hedge fund or investment bank may hire you to conduct analysis and trades on behalf of clients, while independent traders work from home investing their own funds.

If you are an independent forex trader looking for a broker, you can find a list of the FCA Regulated Brokers.

Ask an Expert