With over $7.5 trillion traded daily, the foreign exchange market (forex) is the largest and most liquid financial market in the world. In comparison, this is ten times more than US equity markets that deal with over $600 billion per day.

Due to its high liquidity, forex pairs pricing tends to fluctuate throughout the day, making it a decent asset for day trading. Additionally, forex markets are 24/5, allowing US traders to trade London, Tokyo, and New York trading sessions to capture more opportunities.

To trade forex online, you need a US forex broker that provides live price feeds and executes your trades. Brokers will also provide trading platforms, such as TradingView and MT4, that let you analyze the FX markets.

How Forex Trading Works

Trading currency is different from shares. When you trade a currency you need to sell one currency in order to buy another. This is quoted in pairs (know as a forex pair). These currency pairs are standardized and grouped into major, minor and exotic forex pairs. For example, two of the most traded pairs EUR/USD and USD/JPY are major forex pairs that are the standard for the industry.

To make a profit a trader needs to speculate on the future movement of a currency pair. For example, you could speculate that that the US Dollar would strengthen against the Japanese Yen which would require you ‘buy’ the USD/JPY currency pair. If the price increases, you will make a profit. If it falls, you will make a loss.

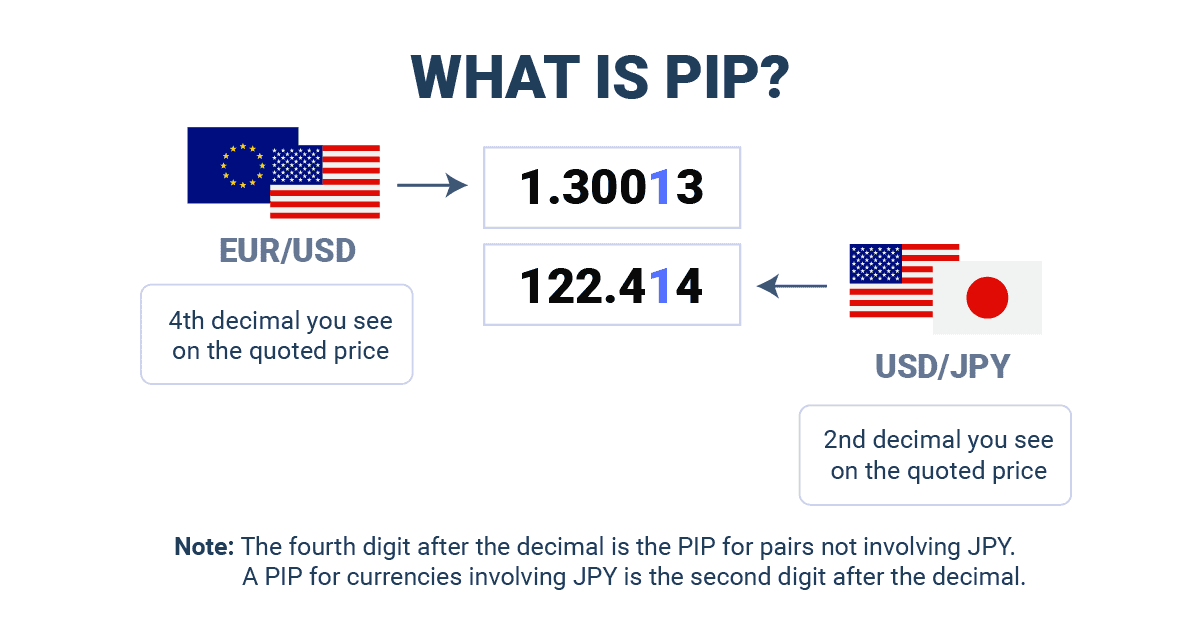

The way movements are measured is called pips (percentage in points). This price movement as shown below is the fourth decimal of each currencies price. Broker fees are also measured in pips which are discussed later.

Currencies can fluctuate for many factors and it’s important to remember that forex markets are global. Factor that can lead to sharp movements include economic data releases (eg an unemployment report), central bank policies (eg interest rate decisions) and general market sentiment. As prices can change quickly after the release of new data it’s important USA forex traders have a calendar and pay attention to these upcoming events.

We developed a profit calculator tool to help determine what profit or loss a trade can make. Just put in the currency pair you would trade, trade size and the opening/closing price.

Your Profit

Profit in pips:

Profit in Pips Calculation

= ( Close Price - Open Price ) / 0.0001 x Trade size

= ( - ) / 0.0001 x Profit in Pips Calculation

= ( Open Price - Close Price ) / 0.0001 x Trade size in lot

= ( - ) / 0.0001 x

Profit/Loss Calculation:

Profit/Loss in Calculation

= Profit in Pips x Pip value

=

What Hours Can You Forex Trade?

Forex trading occurs 24 hours a day every business day. Each week, the market opens at 5:00 p.m. ET (Eastern Time) on Sunday evening when the Sydney session begins. It then closes on Friday at 5:00 p.m. ET. There are periods when there is more liquidity then others, primarily when both the London and New York markets are open as explained on our forex market hours page. The time zone forex converter below shows which market sessions occur over the week.

Forex Market Time Zone Converter

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

Sydney

(UTC +10)

Tokyo

(UTC +9)

London

(UTC +1)

New York

(UTC -4)

Trading Volume is usually

at this time of day.

Choosing a Broker

One of the most important decisions a USA forex trader will make is what broker they select. As the intermediary between the trader and forex markets, the broker determines the price feeds you receive, the software you use and the execution speeds of the trades made. All US brokers have no upfront charges to open an account with the minimum deposit from $0 to $500. This means there are low barriers to trading and a demo account is offered by most brokers at no extra charge.

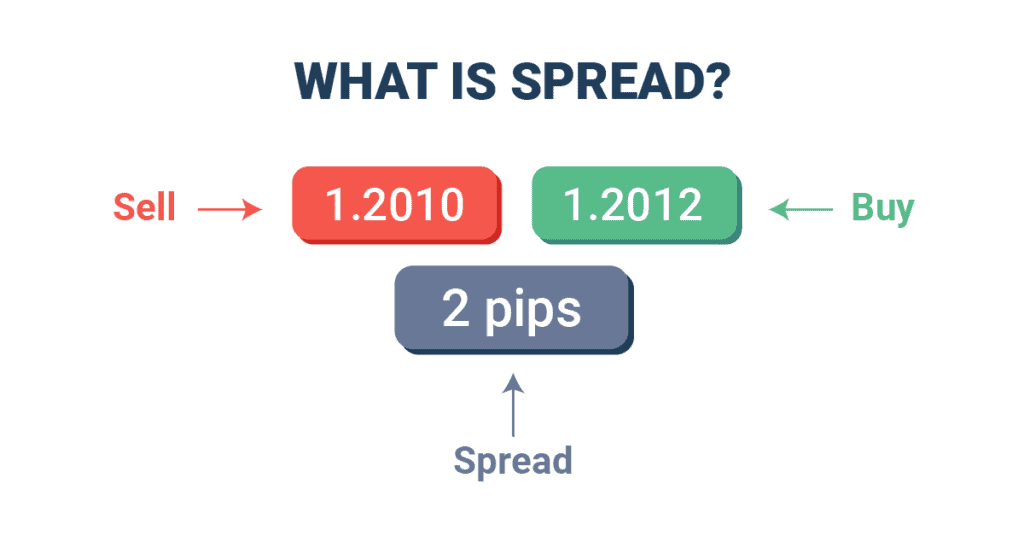

The way forex brokers make money is though a spread. This is the price difference between the buy and sell price (quoted in pips explained earlier). Spread vary by the mark-up a broker puts on trading, market based spreads of each forex pair and the liquidity of the market at the time of the trade.

An example of a spread is shown below with the buy price 1.2010 and the sell price being 1.2012. The difference (spread) is 0.0002 which is also known as 2 pips (2 pip spreads).

Choosing A Forex Broker

The top US brokers have excellent trading conditions, low spreads and a good range of markets to trade in. Our quick list to consider when selecting a broker includes:

- Ensuring the broker is US regulated – When you hear about forex scams they are always from offshore brokers with little to no regulation. Stick to a regulated broker in the USA explained further below.

- Low trading fees – Check the spreads on the currency pairs you plan to trade by broker and the commission rates if the broker offers a RAW account.

- Fast execution speed – Brokers vary in the speed which they can execute a trade. This means that the price quotes is likely to be processed avoiding slippage which is a major complaint by traders.

- Trading platform availability – Brokers vary on the software they offer when trading which needs to match either what your familiar with or your trading needs.

- Customer support – Ensuring the customer service levels are suited to your trading knowledge level and that response rates are good should be a key factor in your consideration criteria.

Our team analysed all top forex brokers in USA to determine what provider is best suited to each type of US trader.

Regulation

The USA has two main regulators. The first is the Commodity Futures Trading Commission (CFTC) which overseas forex market regulation. The second is the National Futures Association (NFA) that directly manages each broker’s licensing. To offer retail trading on currency markets a broker needs to regulated by both the CFTC and NFA.

By choosing a regulated US broker the main benefits a trader receives is:

- Negative balance protection ensuring you don’t lose more than your deposit (balance).

- Security as the broker must hold a minimum capital level of US $20 million.

- Knowledge their funds are segregated from the forex broker’s operational account

Each provider also must complete periodic financial reporting ensuring it meets legal obligations set. Leverage is also set a maximum of 50:1 for major forex pairs and 20:1 for more exotic currencies. These leverage restrictions are to avoid retail traders from being over-exposed to currency market fluctuations which can be highly volatile at times.

Trading Platforms

US brokers offer between 1 to 5 forex platforms which impacts your interface, charting to trading features. While some brokers like Interactive Brokers and eToro only offer their own proprietary platform, most brokers offer at least one of the four third-party software options below. These are listed from the most to lead popular globally.

1. MetaTrader 4 (MT4)

MT4 was one of the first trading platforms that offered retail forex trading. This is one of the main reasons that it remains the most popular in the world. The platform is well know for it’s automated trading facility (EAs) with new programs easily created or purchased on the marketplace. There are also custom indicators and charting to assist trading decisions.

While the interface looks as old as the software, it does have the charting, watchlist and market news functionality needed to trade. We listed the best MT4 forex brokers that onboard US traders and names the best provider.

2. MetaTrader 5 (MT5)

As the successor to MT4, MT5 focused more on CFD trading (eg Shares) in addition to currency trading. It has some nice improvements such as inbuilt Depth of Market (Dom) and economic calendar features. This is why this software has been popular with day traders with more insight into market liquidity including hidden support / resistance levels.

Generally, MT5 is rarely offered in the US as CFD trading is banned meaning the advanced day trading functionality has limited uses.

3. TradingView

TradingView is the newest and fastest growing trading platform. After using all the software packages available, I find TradingView to have the best interface, most advanced charting tools and easiest order execution process. ‘Market scanners’ are offered within the platform that help individuals find trades and similar to eToro there is a social trading section with 50+ million traders.

TradingView also has AI trading platforms capabilities that include AI technical analysis and can predicts target prices based on momentum and volatility.

4. cTrader

This platform is more niche based although it does allow manual trading, automation and copy trading. I consider the software’s ‘sweet spot’ to be for scalpers thanks to its Depth of Markets tool and one-click trading feature. Automation is available though cBots which can automatously find and then execute trades in the right conditions.

Platform Comparison

| Feature | MetaTrader 4 | MetaTrader 5 | TradingView | cTrader |

|---|---|---|---|---|

| Markets Supported | Forex, Indices, Commodities, Crypto | Forex, Indices, Commodities, Crypto, Stocks, Futures | Forex, Indices, Commodities, Crypto, Stocks, Futures | Forex, Indices, Commodities, Crypto, Stocks, Futures |

| Execution Model | Market, Instant, Request | Market, Instant, Request | Market and Instant | ECN/STP |

| Charting Tools | Basic | Improved over MT4 | Advanced with social/community tools | Advanced, professional-grade |

| Timeframes | 9 | 21 | Unlimited custom + standard | 26 |

| Indicators | ~30 built-in, custom MQL4 | ~38 built-in, custom MQL5 | 100+ built-in + custom (Pine Script) | ~70 built-in, custom (C#) |

| Automated Trading | Yes (Expert Advisors – MQL4) | Yes (Expert Advisors – MQL5) | Limited (via alerts or webhook) | Yes (cAlgo – C#) |

| Programming Language | MQL4 | MQL5 | Pine Script | C# (via cAlgo) |

| Web/Browser Version | Limited | Limited | Fully featured | Yes |

| Mobile App | Yes (No Expert Advisors or Custom Indicators) | Yes (No Expert Advisors or Custom Indicators) | Yes | Yes |

| Broker Integration | Widely supported | Growing support | Some proprietary platforms and select brokers | Supported by select brokers |

| Pricing | Free via brokers | Free via brokers | Freemium (Pro plans available) | Free via brokers |

There are three main ways you can trade:

- Desktop Platforms: This is the most advanced way to trade and requires software installation on your laptop or desktop computer. I favour trading on my desktop when using automation as this requires processing speed and may require coding.

- Web Platforms: Unlike above, a web platform requires no downloads. It just works on the browser which means less functionality but is suitable for most forms of manual trading. TradingView is an excellent example of a solid web-based platform with most charting and functionality available.

- Mobile Trading App Platforms: Mobile trading apps are designed for either Android or iOS devices for trading on the go. They require downloading and setting up but then make it simple to view a watchlist or make a trade in a few seconds. Ideal for those on-the-go with no access to a computer.

We created the CompareForexBrokers Trading Platform selector. Just answer five questions and we will determine which software matches your trading needs.

Market Access

US forex brokers offer a range of markets but they do have limitations due to regulatory requirements. If you require additional markets you may want to consider the best forex brokers that accepts US clients.

Forex

All forex brokers offer currency trading. The question is how many major, minor and exotic forex pairs they offer.

All that should matter to an individual trader is knowing what currency pairs they may trade and making sure the broker offers that. The average spreads for each of these pair should then be considered when comparing brokers.

Commodities

Trading popular commodity markets such as silver, oil or wheat in a leveraged environment is a great way to speculate on short term movements. US traders can use future contracts and day trade based on the price changes without owning the commodity itself. Over the past two years gold has being the most popular commodity to trade with a large choice of best gold trading platforms available for US traders.

Indices

Index trading is another popular way to get exposure to market movements. These indices are set by country and then by market impacted by individual company or general sector information and results.

Cryptocurrencies

Crypto CFDs are banned in the US by the regulators. A new development though is that brokers like OANDA are offering spot cryptocurrency trading on coins such as Bitcoin and Ethereum. This allows you to trade 24/7 but without leverage limiting exposure to price fluctuations.

Shares

Like crypto, share CFDs are not available for US traders. That said, brokers like Interactive Brokers do offer traditional share trading (stockbroking services) where you can profit from rising share prices and/or dividends.

Trading Account Types

There are four main types of accounts forex brokers offer. Some may offer several types while other providers specialise in just one.

1. Standard Account

In the US the standard account is the most popular in terms of trader preference and the number of brokers offering the account type. The broker marks-up each forex pair spread making it the primary trading fee.

I recommend beginner forex traders choose the standard account as the pricing is straightforward. It’s also easy to calculate your profit or loss for a trade as there are no additional commission fees charged later. Below shows example average spreads of standard accounts:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

2. Raw Accounts

A raw account is a combination of the spread and a commission based on trading volume. Trading volume is measured in lots (100,000 units traded) and can range from $3 to $7 per lot. The spreads on the other hand are a lot tighter than a standard account but still exist due to market conditions.

I generally recommend the RAW account as it leads to the lowest brokerage and either leads to a No Dealing Desk (NDD), best ECN brokers, or Straight Through Processing (STP) execution model. This can have an added benefit of faster execution speeds. The key issue is very few brokers in the US offer this model type as indicated on our lowest spread forex broker page.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

3. Swap-Free Accounts

This account type is rarely selected by US traders as it’s designed to solely to comply with Sharia law. This means it’s more designed form the middle easy where swap-free account moves interest charges from holding positions overnight. In our evaluation these accounts generally have premium trading costs so we don’t advise choosing it unless you are required by your faith.

4. Other Account Types

Professional Accounts

Pro accounts are reserved for experienced or institutional forex brokers who are recognized by the NFA/CFTC as a professional trader. To qualify as a professional trader you need to prove your trading experience, financial ability and that you are in-fact a professional. The benefits of this account type can be lower trading fees, higher leverage while protections such as negative balance protection are removed.

Fixed-spread Account

This is the rarest account type where the spreads are fixed for each currency pair. While this gives certainty to the trader in regards to trading fees it’s charged by the broker at a premium. Generally only risk adverse US traders would consider this account type which may also include other risk management tools such as guaranteed stop loss orders.

Demo Accounts

Most US brokers offer a free demo account. Traders can simulate making live trades while some packages include back testing facilities to see how automated programs would of performed in past market conditions. It’s a great way for a beginner to test if forex trading is right for them.

Understanding Leverage & Margin

What is Leverage?

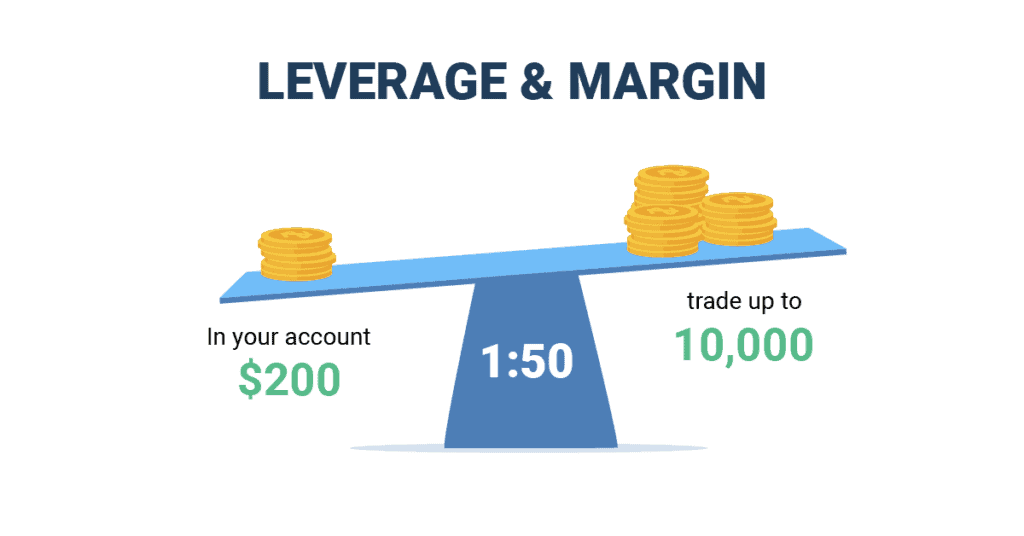

Leverage increases your exposure to the markets amplifying small market movements. So for example, the maximum 50:1 leverage in the US means that a $100 deposit can lead to $5,000 being traded on markets. In this scenario, just a 1% change in a forex pair could lead to 50% profit or loss on a trade.

Just remember, leverage amplifies the exposure and the risk. This is why the CFTC and NFA limit leverage to 50:1 on forex majors. Just keep in mind that all regulated brokers offer negative balance protection so you can’t lose more than your deposit.

What is Margin?

Margin is the deposit a forex broker requires to trade a leveraged position. This means it’s acting as collateral as leverage is effectively borrowed money from the broker. In an example $100,000 trade of EUR/USD with a 50:1 leverage you would need $2,000 in margin.

Risk Management

Understanding and managing risk is a fundamental area of understand when it comes to forex trading. There are in-built elements all brokers are required by the regulator to offer while some are more broker or platform specific. I recommend that you use a demo account and test these features before trading with real money.

Stop Loss Orders

This is the most popular risk management tool all forex platforms offer. Trader’s can determine the maximum amount they are willing to lose on a trade leading the position being closed automatically. This can be set at a specific price or loss level if that is easier to calculator. It’s just worth nothing that this loss level is not guaranteed and in extreme market conditions slippage may lead to additional losses.

Take Profit Orders

Similar to a stop loss order, a take profit order automatically closes a position once a pre-determined price is met. In this case, the trader determines the profit level that should trigger the selling of their position.

Negative Balance Protection

As discussed earlier, all CFTC/NFA regulated brokers offer negative balance protection. This means you can’t lose more than your funds in the account. In the past, extreme volatility have led many brokers to go into negative balance and unregulated brokers have demanded payment by the trader.

Forex Trading Strategy Selection

There is no ‘right’ or wrong’ strategy but it’s important the tactics are in-line with your risk appetite and trading philosophy.

The top 5 trading strategies include:

- Breakout trading – This technique focuses on making a profit from momentum. Once a market breaks a support or resistance level is normally when a trade is active. Intraday traders often use breakout trading tactics but overnight positions have been held in the past.

- Scalping strategies – In recent years this has gained the most popularity as small price movements can lead to quick profits or losses. It’s a combination or breakout trading discussed below and the use of technical indicators and often incorporate the use of AI tools or automation.

- Price action strategies – Traders often focus on chart patterns or candlestick charts to monitor market signals. They are looking for a price continuation or reversal pending to enter a trade. Examples of price actions include engulfing candlestick patterns and head and shoulder patterns.

- Swing trading strategies – This strategy can be considered the most risky as traders try to enter at a high or low position. They are looking for reversal positions or focusing on trends before they form. It can involve a high risk but high return scenario.

- Trend trading strategies – This final strategy waits for a consistent trend and then trades in the same direction. The aim is to jump onto the trend and exit before it reverses when it may be more appealing to a swing trader.

Copy and Social Trading

Many traders don’t want to learn how to trade but want exposure to market movements. This is when social and copy trading becomes a viable option.

Copy trading focuses on mirroring the trades of an experienced trader. Platforms help individuals view a list of traders and details on their past trading behaviour including what they trade, the risk profile involved and past returns. Of course, past performance is not an indication of future performance so traders should be wary of this type of trading. We have listed the best copy trading platforms that are regulated in the US.

Social trading allows traders to interact with an online community to share trades and concepts. Traders in the community can review ideas and information and then consider if that trade is valid. View the best copy trading platforms for US traders.

Automated Trading Strategies

This is the fast growing way that forex trades are getting made as it allows trading to be executed 24 hours a day. It also allows simulations trades to be made on multiple markets.

To implement automated trading tactics, you need to know how to code based on the platforms code base. For example, cTrader has cBOT and MetaTrader has Expert Advisors (EAs). You will need to code a market-proven strategy that is back-tested to ensure the strategy performs as expects and has clear entry and exit rules.

For those that can’t code they can still be involved in automated trading by buying a program from a marketplace. All major platforms offer these environments to purchase bot programs which you can view on our automated forex trading platforms page.

FAQs

Is forex trading legal in the USA?

Yes, the CFTC and NFA overseas currency trading making it legal with a registered broker for retail traders. Avoid overseas forex brokers that don’t offer the protections of a US broker.

Can US traders open accounts with offshore brokers?

US traders can open accounts with offshore brokers but we don’t recommend it due to the loss of regulator oversight and risk management controls.

Is Forex Trading Profitable

Trading can be profitable due to leverage which amplifies the relatively small movements that occur on currency markets. Increase leverage means increased exposure so understand the risks whenever trading a leverage instrument.

How Do You Trade Forex

Retail traders can speculate on currency movements through a forex broker. This is the intermediatory between the trader and the market and also offers leverage to increase exposure.

Do forex traders pay tax?

Yes, in the USA traders pay taxes on profits generated through forex trading. Traders can get their account history by the broker to work out any profits made over the financial year to work out taxable income.

Ask an Expert