Best Future Trading Platforms

Choosing the right futures trading platform requires balancing costs, platform features, and market access. I tested futures brokers available to US traders and ranked them based on commission structures, platform usability, futures product coverage, and educational resources to help you find the best fit for your trading style.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

The Best US Platform for Trading Futures

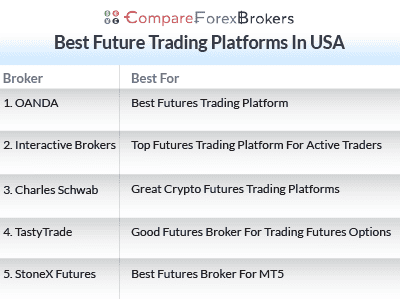

- Plus500 - Best Futures Trading Platform

- Interactive Brokers - Top Futures Trading Platform For Active Traders

- Charles Schwab - Great Crypto Futures Trading Platforms

- TastyTrade - Good Futures Broker For Trading Futures Options

- StoneX Futures - Best Futures Broker For MT5

What are the best platforms for trading futures?

Plus500 is the best platform for trading futures because it offers low, transparent commissions with no platform or market data fees, combined with an easy-to-use futures platform. The $100 minimum deposit, strong risk controls, and broad futures coverage make it a practical choice for most retail futures traders.

1. Plus500 - Best Futures Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.6

AUD/USD = 1

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

Plus500 earns my top spot for futures trading because it combines low, predictable costs with a very easy-to-use platform. There are no fees for the platform, market data, deposits, withdrawals, or inactivity. You only pay a very small commission for each side when you trade.

Standard and E-mini futures cost $0.89 per side, while Micro contracts cost $0.49, making Plus500 one of the more affordable options for active futures traders. I found it incredibly easy to open an account, and their $100 minimum deposit makes it very affordable to test the waters. Plus, customer service is available 24/7 which is always a handy feature for when things inevitably go wrong.

Pros & Cons

- Low fees

- Great educational materials

- Easy to open an account

- Only futures trading

- Only one base currency

Broker Details

Plus500 is low-cost

Plus500 keeps pricing simple. There are no fees for the platform, market data, deposits, withdrawals, or inactivity. Standard and E-mini futures contracts cost $0.89 USD per side and micro contracts cost $0.49 USD per side. The only additional charge is a $10 liquidation fee per contract if positions are forcibly closed.

Plus500 has wide futures market coverage

The Plus500 futures account allows you to trade 70+ products, including equity markets, energy, commodities, FX, agriculture, and crypto.

Equity index futures include E-mini and Micro E-mini contracts on the S&P 500, Nasdaq-100, Dow, and Russell.

Energy traders can access WTI, Brent, and Natural Gas, including micro and E-mini versions.

Metals include gold, silver, and copper with micro contracts available.

FX futures cover major currencies like the euro, yen, and pound.

Agriculture includes corn, wheat, soy, and livestock.

Crypto futures include Micro Bitcoin, Micro Ether, Micro Solana, and Micro XRP.

| Products | No. Contracts Available | Intraday Range |

|---|---|---|

| Equity Index | 5 e-mini 4 micro e-mini 1 micro 1 standard | Micro E-mini $50 - $100 E-mini $500 - $1,000 Standard $1,500 |

| Crypto | 4 micro | Micro $20 - $215 |

| Energies | 2 e-mini 2 micro 6 standard | Micro E-mini $80 - $100 E-mini $250 -$400 Standard $800 - $1,500 |

| Metals | 1 e-mini 3 micro 5 standard | Micro $80 - 200 E-mini $400 Standard $600 - $1000 1 Ounce Gold $25 |

| Forex | 1 e-mini 4 micro 10 standard | Micro $40 - $50 E-mini $150 - $250 Standard $150 - $385 |

| Agricultural | 5 micro 9 standard | Micro $45 - $50 Standard $250 - $500 |

| Interest Rates | 1 micro 2 micro ultra 2 ultra 3 standard | Micro Ultra $120 Micro Yield $45 Micro Note $100 Ultra T-Bond $200 Ultra T-Note $300 - 500 |

Exchanges to trade on include

- CBOE – CFE

- CME Group – CME, CBOT, NYMEX and COMEX

- EUREX

- Intercontinental Exchange – ICE Futures Europe, U.S. (NYBOT) and Canada (WCE)

- NYSE Euronext – NYSE Liffe London and Paris and NYSE Liffe U.S.

If you are wondering what E-minis are, these are one-fifths the value of a standard future so good for smaller investors.

Plus500 has a great platform and educational resources

Plus500 offers its own proprietary Plus500 Futures Platform (also called T4) on web and mobile (Android and iOS), but also allows you to connect your account to TradingView if you prefer the more advanced charting features that TradingView offers.

The Plus500 mobile version (sometimes called TradeSniper) will give access to

- 12 chart types

- 11 time frames (ranging from 1 Minute through to 1 Week)

- 119 indicators (which is superior to MetaTrader’s App offering)

- 21 drawing tools

In my opinion, these app tools not only give you a great range of tools to trade with but make the app superior to other trading apps like MetaTrader 4.

Other features you will appreciate with the app include 2 factor identification for security and the easy ability to switch between demo and live accounts.

I also enjoyed the content in their ‘Futures Trading Academy’ as part of their ‘Learn’ suite. Here you find articles and videos covering topics like contract sizing, margin, and risk control in futures. Overall, I thought their Learn suite was suitable for both beginner and advanced traders.

2. Interactive Brokers - Top Futures Trading Platform For Active Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers (IBKR) is a great choice for futures trading because of its ultra-competitive pricing and institutional-grade platforms. If you’re a high-volume trader, their tiered commission structure is fantastically cost-efficient. Spot-quoted and e-micro futures start at just $0.25 per contract, with commissions dropping as low as $0.10 per contract if you trade over 20,000 contracts per month.

I consider IBKR to be one of the top trading platforms in the USA because of their advanced trading tools. You can use more than 100 order types, including bracket orders, scale orders, time-weighted and volume-weighted execution, futures spreads, and multi-leg combination strategies.

You can trade on a wide range of futures products, including commodities, indices, interest rates, currencies, and crypto covering 30+ global exchanges. Their product access was one of the widest I’ve seen in my comparison.

Pros & Cons

- Great for active traders

- Advanced order types

- Wide product access

- Learning curve on platform

- Not great for beginners

Broker Details

Interactive Brokers offers competitive pricing

Interactive Brokers is hard to beat on pricing, especially for active and high-volume traders. They offer both a fixed and tiered commission model.

| Monthly Volume (Contracts) | Tiered | Fixed |

| <1000 | USD 0.85/contract | USD 0.85/contract |

| 1,001 - 10,000 | USD 0.65/contract | |

| 10,001 - 20,000 | USD 0.45/contract | |

| > 20,000 | USD 0.25/contract | |

| Monthly Volume (Contracts) | Tiered | Fixed |

| <1000 | USD 0.25/contract | USD 0.25/contract |

| 1,001 - 10,000 | USD 0.20/contract | |

| 10,001 - 20,000 | USD 0.15/contract | |

| > 20,000 | USD 0.10/contract | |

| Monthly Volume (Contracts) | Tiered | Fixed |

| <1000 | USD 5.00/contract | USD 5.00/contract |

| 1,001 - 10,000 | USD 4.20/contract | |

| 10,001 - 20,000 | USD 3.40/contract | |

| > 20,000 | USD 2.60/contract | |

Interactive Brokers offers professional platforms and execution

Interactive Brokers provides one of the widest platform lineups I’ve seen in futures trading.

Trader Workstation (TWS) is the main desktop platform and is designed for experienced and active traders managing multiple products. You also get IBKR Desktop, IBKR Mobile, and the Client Portal for browser-based trading. You can also build your own trading platforms using IBKR’s API with Python, Java, C++, or REST. This feature goes a bit over my head but I’m sure it is a great option for super advanced traders.

Trading tools include more than 100 order types and algorithms, ComboTrader for multi-leg strategies, SpreadTrader for futures spreads, and the Index Arbitrage Meter for evaluating futures-versus-spot pricing

Interactive Brokers offers great education

IBKRCampus is one of the most robust education hubs I’ve seen. They offer beginner, intermediate, and advanced trading courses and also give you access to the latest market and financial news. There’s podcasts, webinars, and really just resources to help anyone trade better.

3. Charles Schwab - Great Crypto Futures Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

thinkorswim desktop, thinkorswim web, thinkorswim mobile, Schwab.com, Schwab Mobile

Minimum Deposit

$0

Why We Recommend Charles Schwab

I picked Charles Schwab as the best broker for trading crypto futures because it offers one of the widest product lineups I’ve seen in my comparison. I counted over 120 futures products overall, including a strong selection of crypto futures such as Bitcoin, Micro Bitcoin, Ether, Solana, and Ripple.

Futures pricing is fixed at $2.25 per contract, which is higher than some competitors, but I like that the rate is the same whether you trade online or place orders by phone. Add in paper trading, $0 minimum deposit, and no maintenance fees, and Schwab becomes a solid choice if you want to explore crypto futures with flexibility and great support.

Pros & Cons

- Wide crypto futures range

- Paper trading

- No extra cost phone-trading

- Higher commissions

- Lacking automation tools

- Not ideal for active traders

Broker Details

Charles Schwab offers a fixed pricing structure

Charles Schwab uses a simple fixed commission model. Futures trades cost $2.25 USD per contract, regardless of whether you place the trade online or by calling a broker. This makes Schwab appealing if you prefer to trade over the phone without paying higher commissions. There is no minimum deposit and no account maintenance fee. The only notable extra cost is for outgoing wire transfers, which cost $25 by phone or $15 when requested online.

Charles Schwab offers great futures market coverage

During my review, I found more than 120 futures contracts available to trade. This includes traditional index products like the Micro E-mini S&P 500, along with commodities and interest rate futures.

Where Schwab really stands out is their crypto futures. The platform offers Bitcoin, Micro Bitcoin, Ether, Micro Ether Solana, Micro Solana, Ripple, and Micro Ripple futures, which is one of the broader crypto futures selections I’ve seen from a traditional brokerage.

Charles Schwab has a simple-to-use platform

Schwab’s ThinkOrSwim futures platform is efficient and easy to use. You can enter trades fast with one-click order entry, and have access to a solid range of advanced order types for managing entries and exits precisely.

I also like that Schwab offers paper trading, which let me test the platform without risking any capital. It’s a great way to practice your futures trading and decide whether crypto futures fit your strategy before committing real money.

4. TastyTrade - Good Futures Broker For Trading Futures Options

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend TastyTrade

TastyTrade is a great pick if your focus is on trading options on futures, as this is where the platform clearly stands out. Pricing is straightforward on TastyTrade, with futures trades at $1 per side, micro futures at $0.75, and options on futures at $1.25 per side or $0.75 on micro’s.

I was also a big fan of TastyTrade’s built-in risk analysis tools, especially the SPAN scenarios and portfolio-level exposure tracking. Being able to see delta, buying power impact, and visualized P&L before placing a trade is genuinely useful. Add in one-click execution and the 65+ futures products I counted in my review, and TastyTrade is a great fit if you’re an active trader who prefers to structure your trades around defined risk.

Pros & Cons

- Cost-effective

- Strong risk tools

- No minimum deposit

- Not ideal for passive traders

- Limited platform customization

- $45 international wire fees

5. StoneX Futures - Best Futures Broker For MT5

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

StoneX Futures Platform TradingView MT5

Minimum Deposit

$0

Why We Recommend StoneX Futures

I recommend StoneX Futures for traders who want professional futures access with MetaTrader 5, something almost no other futures brokers offer. StoneX is owned by StoneX Group, the same parent company as Forex.com, which gives it institutional backing and reliable execution.

Pricing varies depending on the product you’re trading. On the StoneX Standard account, standard futures trade at $1.29 per side, micro futures at $0.50, and nano contracts at $0.25 per side. MT5 trades add just $0.15 per side, which is reasonable given how rare the platform is for futures trading. You can also trade through TradingView for $10/m.

I also like the flexibility between their Standard account (for experienced traders who want to do it themselves) and their Premium account (which gives you access to a broker who can help you trade). With no minimum deposit and a 28-day demo, StoneX is a strong fit if you want to trade on MT5 and like having hands-on support.

Pros & Cons

- MT5 support (rare)

- No minimum deposit

- Phone orders incur extra fees

- $50 liquidation fee

- TradingView is $10/m