Best Forex Brokers for fast VPS

The CompareForexBrokers team tested 15 brokers using MetaTrader 4 with Virtual Private Servers (VPS) to find which forex brokers have the fastest execution speeds. Read on to find the best brokers for trading with VPS.

Written by Ross Collins

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Finalists for Best VPS Setups

Based on our 2025 testing, we concluded that the following brokers are the best for trading with VPS, you can read full reviews below:

The brokers we chose

- Have “RAW/ECN” accounts (i.e. commission-based accounts). For VPS testing, it makes sense to use RAW/ECN accounts, as they are generally cheaper than Standard accounts.

- are frequently reviewed on CompareForexBrokers

- are split between No-dealing Desk (NDD) brokers and market makers

- support MT4 (so we can use ready-made and freely available indicators and scripts when testing)

Fastest Execution Speeds using VPS

This table summarises the results of our test using Virtual Private Servers (VPS) for 15 brokers.. We tested execution speeds for both limit orders and market orders and then ranked from fastest to slowest based on the speeds measured in milliseconds.

Our test had a number of ties (e.g. Axi ranked second fastest for Limit Orders and fourth fastest for market orders, while City Index ranked third fastest for both) when this happened we listed the brokers with the same ranking.

These tests follow our testing to find the brokers with the tightest Raw Account Spreads.

| Broker | Overall Ranking | Limit Order Speed | Market Order Speed |

|---|---|---|---|

| Blueberry | 1 | 82 | 90 |

| Axi | 2 | 107 | 154 |

| City Index | 2 | 117 | 144 |

| Fusion Markets | 4 | 169 | 125 |

| EightCap | 4 | 149 | 160 |

| Pepperstone | 6 | 158 | 168 |

| Blackbull Markets | 6 | 139 | 219 |

| FP Markets | 8 | 149 | 344 |

| IG | 8 | 209 | 182 |

| Admiral Markets | 8 | 172 | 270 |

| IC Markets | 8 | 233 | 168 |

| Go Markets | 12 | 175 | 290 |

| TMGM | 13 | 219 | 262 |

| Tickmill | 14 | 186 | 397 |

| CMC Markets | 15 | 235 | 296 |

Why does Execution Speed matter?

Order execution speed is the time between sending an order to your broker and the order being filled. Results for NDD (No Dealing Desk) brokers with STP (Straight Through Processing) will be influenced by their pool of liquidity providers while brokers acting as a market maker will be impacted by the efficiency of their own dealing desk. Other factors include the quality of the infrastructure the broker is using and the volume of orders at one time.

Execution speeds are sub-second, so why does it matter? Forex markets are so volatile that the price you see on your trading screen can vary significantly from the price at which a trade is executed. This variance is known as slippage.

The longer a broker takes to fill your order, the more likely that slippage will occur. If your trading strategy relies on profits of just a few pips (e.g., scalping) or automated trading, fast execution speed to reduce the likelihood of slippage can be critical to your success.

If you don’t use a VPS, the execution speed you experience can be anything up to twice as slow as the speeds shown in the table above. So, instead of having your trade executed in 80 to 400 milliseconds using VPS, you might see execution speeds of up to 800 milliseconds, which can result in slippage that can harm your trading strategy.

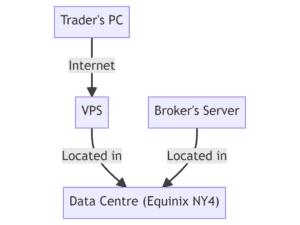

How does VPS work?

A Virtual Private Server (VPS) is provisioned for you to run your trading terminal(s) on. Most mainstream trading platforms such as MT4, MT5, cTrader and TradingView can be supported a VPS. This VPS is situated in the data centre of your broker’s server which allows the latency between your trading terminal and your broker’s server to be minimised.

Virtual Private Servers are:

Virtual

The term virtual refers to the the fact a VPS is not a physical server. Rather a VPS uses partitions or slices of a physical server.

Using partitions means your trading terminal will share the processing and storage capacity of the physical server with other users. Depending on the configuration, up to 8 users can be running simultaneously on the server.

Having your own partition allocated to you within a shared server is fine for regular trading, but high-frequency trading or backtesting is best with dedicated servers. Using a dedicated server means the load of the server (and therefore processing speed) is not compromised by the demand placed on the server from other users.

Private

Data and control are not shared among the users running on the server meaning they are private. This is a fundamental capability as other users should not be able to see or control your actions.

Advantages of VPS

VPS setups have the following advantages over running your trading terminal(s) on your device:

- Location independence – no matter where you are, your VPS will keep trading

- Time zone independence – your VPS will keep trading, even while you’re asleep

- Reduced slippage – VPS is the best way to reduce execution speeds and slippage

- Solution scalability – your VPS can scale up as you do, from 1 terminal to dozens or more

- System availability – your VPS will be available 99% of the time or more

- Uninterruptible Power Supply – VPS providers have redundant power setups

- Advanced security – VPS providers offer high-grade security

- Managed VPS options – your VPS provider may offer managed options, giving you automated backups, automated operating system upgrades, enhanced security through automated SSL certificates and 24 x 7 access to technical support

VPS Plans

Most brokers offer a “sponsored” VPS, meaning they use a third-party provider to set up and manage your VPS. Typically this is provided for free, although the broker may require you to maintain a minimum balance and/or transact a minimum volume to qualify for the service.

Should you not meet the minimum requirements or your broker does not offer a “sponsored” VPS, you can get one directly from one of the third-party providers. To do this, you must ensure the VPS is in the same data centre as the broker’s servers. Fortunately most brokers will list the location of their servers on their website (or you can do a google search).

VPS providers will offer you a choice of location when you set up their service, so you can easily co-locate your VPS trader terminal with the broker’s servers. The most popular location is the Equinix NY4 data centre in New York. Assuming you set up the VPS in the right data centre , you should see pings (latency) of less than five milliseconds, meaning the latency between your trading terminal and the broker’s server is almost negligible.

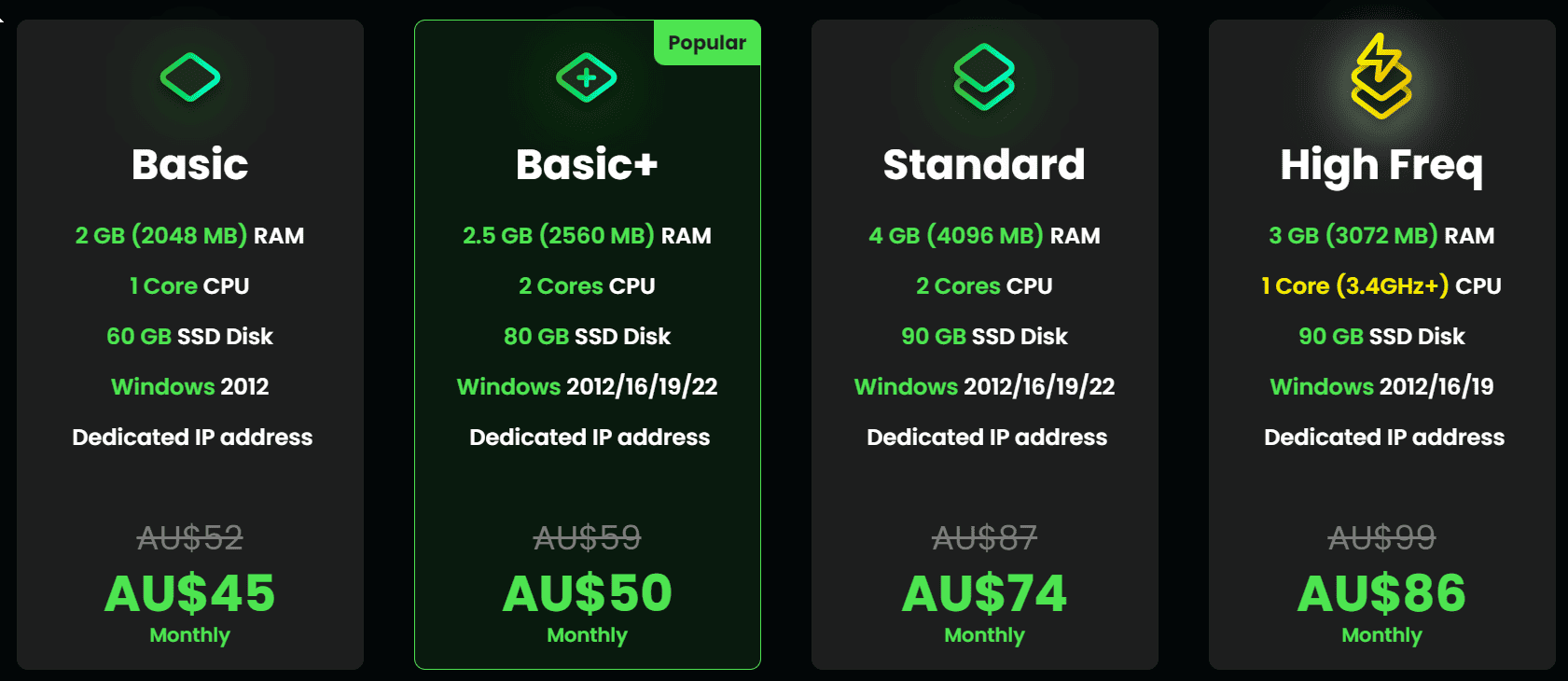

You will then need to decide on a payment plan. VPS providers typically offer tiered VPS plans tailored to different kinds of traders. For example, ForexVPS.net provides four tiers of VPS plans, as well as dedicated servers. The Basic plan should be acceptable if you only run 1 or 2 trading terminals. You can upgrade to the other plans as you need more trading terminals to run more robots.

Dedicated Servers

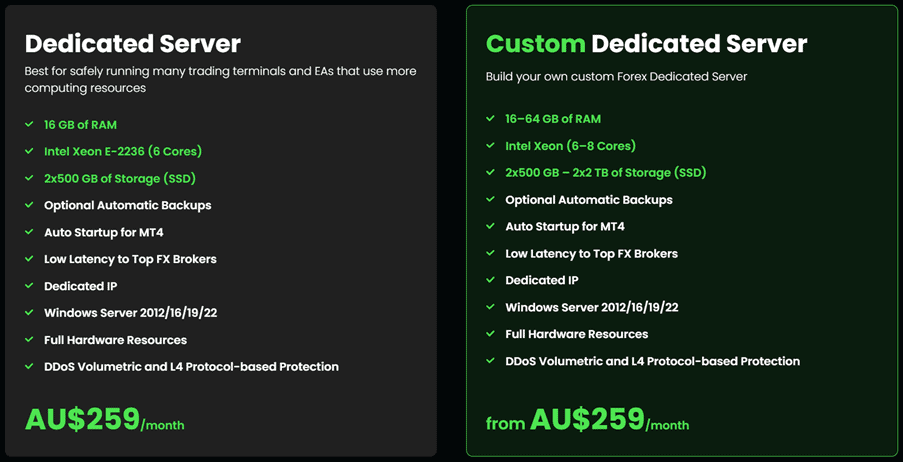

Dedicated servers are for traders requiring servers that do not share their computing resources with other users. This includes traders who run many robots and trade at very high frequencies. Dedicated servers are also required for backtesting, as the performance of a VPS is insufficient to cope with the computing workloads that backtesting produces.

VPS providers usually have a standard dedicated server package and some also allow you to build a customised server (albeit for a higher fee).

Below is an example of dedicated and customer dedicated servers available with ForexVPS.net.

Sponsored VPS

Many best brokers sponsor a free VPS service with a third-party provider. This means you can get a VPS for free or at least at a discount through the broker.

To take advantage of this offer, most brokers typically require you to trade a minimum number of lots per month. Some brokers may also require you to maintain a minimum balance in your account. You can still get a VPS even if you don’t meet the minimum requirements for a sponsored or discounted VPS.

All the brokers we tested use one or more of Beeksfx, NewYorkCityServers, LiquidityConnect or ForexVPS to host their VPS. Servers are typically located in New York, London or Tokyo and (in our experience) cost $20 to $50 per month for a minimum configuration (1 vCPU, 1.5 to 2.5 GB RAM and 30 to 80 GB SSD).

The following table lists the 15 brokers, again from fastest to slowest overall and shows whether these brokers have sponsored (or discounted) VPS and the minimum balance and lots per month required.

| Broker | Sponsored | Min Balance | Lots/Month |

| Blueberry | No | N/A | N/A |

| Axi | Yes | $ - | 20 |

| City Index | No | N/A | N/A |

| Fusion Markets | Yes | $ - | 20 |

| EightCap | Yes | $ 1,000 | 5 |

| Pepperstone | Discounted | N/A | N/A |

| Blackbull Markets | Yes | $ 2,000 | 20 |

| FP Markets | Yes | $ 1,000 | 20 |

| IG | No | $ 5,000 | N/A |

| Admiral Markets | Yes | € 5,000 | N/A |

| IC Markets | Yes | $ - | 15 |

| Go Markets | Yes | $ - | 10 |

| TMGM | No | N/A | N/A |

| Tickmill | Discounted | N/A | N/A |

| CMC Markets | Yes | $ - | 15 |

How We Tested

To compare the Execution Speeds of Forex Brokers, we opened RAW/ECN accounts across 15 top brokers and ran tests for both Limit Orders and Markets Orders.

For Limit Orders, we used the MT4 EA known as ExTest_ForExpat. This EA places several limit orders (buy and sell) and calculates the time between sending orders to brokers and receiving an answer or executing the orders. Minimum, maximum, and average response times are recorded.

For Market Orders, we used the MT4 EA, known as Broker Latency Tester. This EA sends a market order and calculates the time between sending the order and receiving the confirmation. After confirmation, the position is closed. The average response time is calculated across 20 trades at a lot size of MODE_MINLOT (the minimum amount the broker allows).

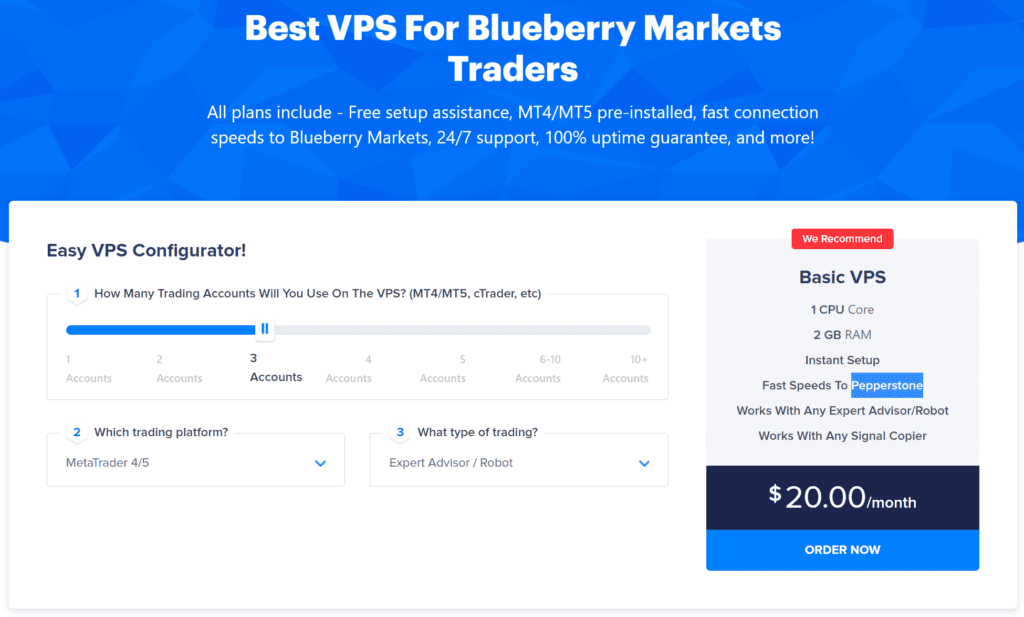

VPS at Blueberry Markets

Blueberry, the fastest broker in our tests, does not have sponsored VPS. However, you can get one for $20/month from Beeksfx.

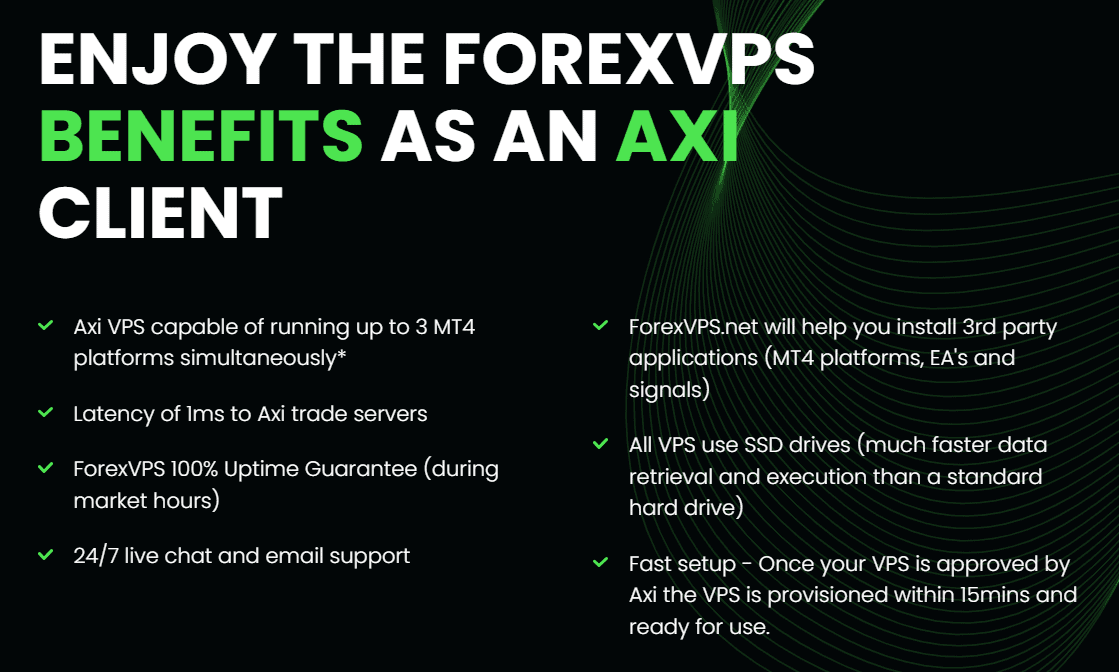

VPS at Axi

Axi, the equal second fastest broker in our tests, has a sponsored VPS but requires traders to trade 20 lots per month. We found their claim of 1 millisecond latency to their trade servers a little overstated. Our tests showed a ping of 1.94 milliseconds. But we’re not going to argue over 0.94 of a millisecond.

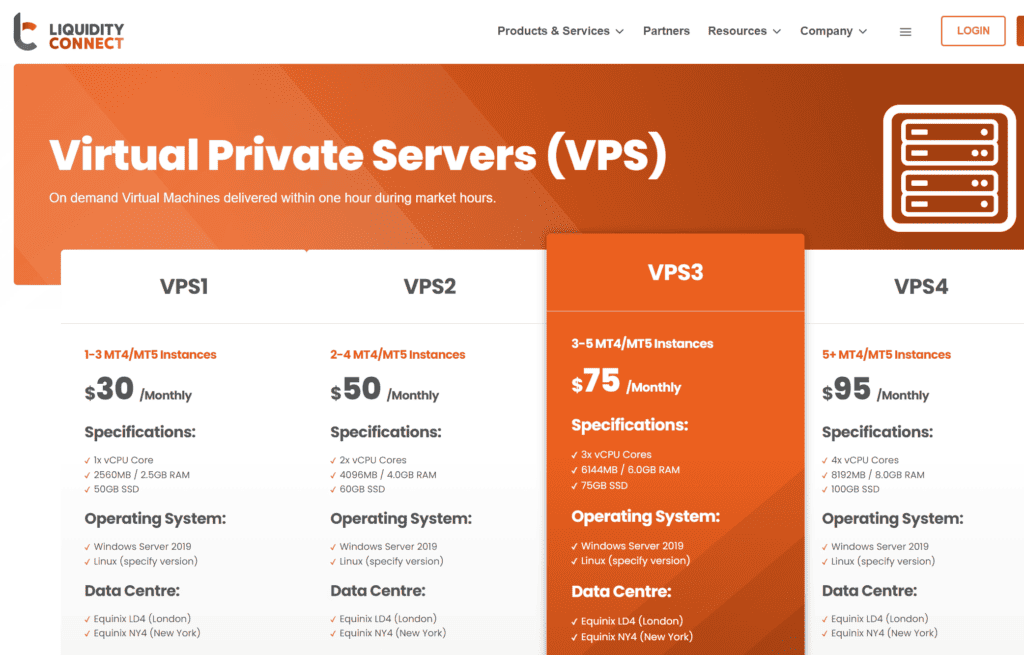

VPS at City Index

City Index, the equal second fastest broker in our tests, does not have sponsored VPS. To get one, you must email their support team. They will set you up with a server from LiquidityConnect in London or New York and charge you at least $30 monthly.

In our tests, the latency to their trade servers was over 15 milliseconds, which was slower than all the other brokers we tested. It’s a testament to their execution speed, then, that they came in third fastest overall.

VPS at Fusion Markets

Fusion Markets, the equal fourth fastest broker in our tests, has a sponsored VPS but requires traders to trade 20 lots monthly. As their website says, there’s no “messy sign-up process” – it’s all very straightforward.

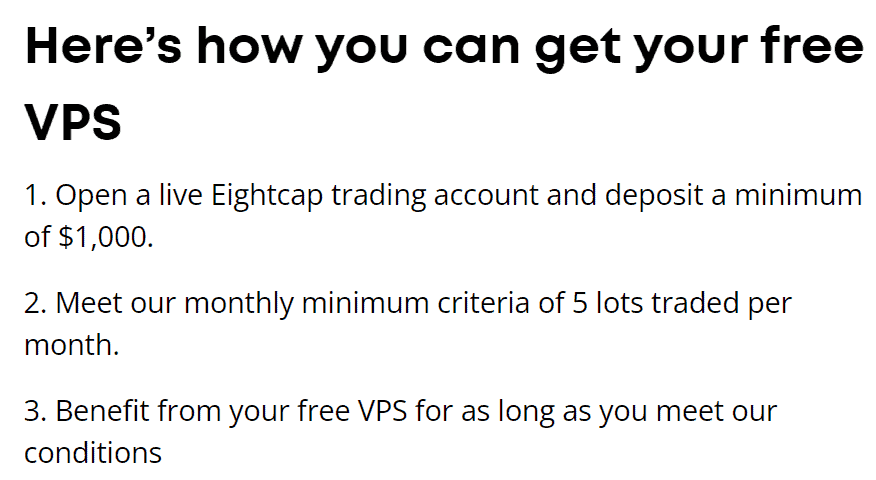

VPS at Eightcap

Eightcap, the equal fourth fastest broker in our tests, has a sponsored VPS but requires traders to trade five lots per month and a deposit of $1,000.

Key Takeaways

- Fast execution speeds minimise slippage and help ensure your trades execute at your desired prices.

- Virtual Private Servers are the best way to minimise latency between your trading terminal and your broker’s servers, ensuring you get the fastest execution speeds possible.

- Dedicated Servers are available for very high-frequency traders requiring even more processing power.

- Blueberry Markets, Axi, City Index and Fusion Markets were the fastest brokers in our VPS Testing.

- Of these, Axi and Fusion Markets both have sponsored VPS, but require 20 lots per month to be traded.

- Blueberry Markets VPS will cost $20 per month, and City Index VPS will cost $30 per month.

Related Articles

Ross Collins

As Chief Technology Researcher at CompareForexBrokers, Ross is in charge of driving technical innovation for the website. Ross uses his deep knowledge of Forex and Information Technology to capture and deliver real-world Forex insights that can help you make better trading decisions. Prior to joining CompareForexBroker, Ross developed trading systems for forex, bonds and options trading.