Best CFD Trading Platforms

CFD trading lets you speculate on price movements across forex, indices, commodities, shares, and cryptocurrencies without owning the underlying assets. We tested CFD brokers available to UAE traders, testing spreads, commissions, platform features, and product ranges to identify which brokers deliver the best conditions.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

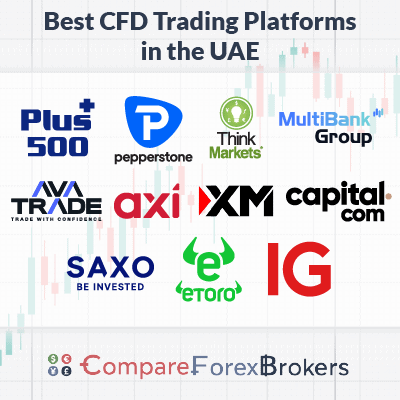

The Top UAE CFD Brokers are:

- Plus500 - Best CFD Trading Platform

- Pepperstone - Best MT4 CFD Broker

- ThinkMarkets - Best CFD Trading App

- Multibank Group - Lowest Spread CFD Broker

- AvaTrade - Best Islamic CFD Broker

- Axi - Best CFD Trading Demo Account

- XM - Best MT5 CFD Broker

- Capital.com - Best Gold CFD Broker

- Saxo Markets - CFD Broker With Automated Trading

- eToro - Good Broker For Copy Trading

- IG Group - Best range of CFD Markets

What is the best CFD broker in the UAE?

Plus500 is the best CFD broker in the UAE with 2,401 instruments including 78 forex pairs, 1,622 shares, and 480 options, offering guaranteed stop-loss orders and spreads from 0.8 pips with zero commissions. Other UAE regulated CFD brokers were shortlisted based on instrument diversity, risk management tools, and pricing transparency across asset classes.

1. Plus500 - Best CFD Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1.0

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

Plus500 gives you 2,401 instruments through their proprietary platform that’s built specifically for CFD trading. You get 78 forex pairs, 1622 shares from global exchanges like NYSE, NASDAQ, and LSE, 43 indices including S&P 500 and FTSE 100, 30 commodities covering gold, crude oil, and agricultural products, plus 23 cryptocurrencies, 480 options, and 125 ETFs.

The platform includes guaranteed stop-loss orders (GSLO) – your position closes at your exact specified price even during flash crashes or extreme gaps when regular stop-losses slip.

You pay zero commission fees with spreads from 0.8 pips on major forex pairs, keeping costs transparent. The $100 minimum deposit gets you started with 24/7 customer service. Plus500 is regulated by both DFSA and SCA, and the proprietary platform works on web, desktop, and mobile.

Pros & Cons

- Massive product range

- Zero commission fees

- Guaranteed stop-loss orders

- 24/7 customer service

- 1622 shares from global exchanges

- Proprietary platform designed for CFDs

- $100 minimum deposit required

- No MT4/MT5 platform support

- Limited crypto selection

- 1:30 retail leverage (lower than SCA brokers)

Broker Details

Guaranteed Stop-Loss Orders (GSLO)

Plus500’s guaranteed stop-loss orders protect you when markets gap violently. During the 2015 Swiss Franc crisis, regular stop-losses slipped hundreds of pips as liquidity vanished – traders woke up to losses far exceeding their planned risk. GSLO guarantees your position closes exactly at your set price regardless of market gaps or volatility spikes.

You enable GSLO when opening positions, setting your maximum acceptable loss with certainty. The feature works across all asset classes (forex, indices, commodities, shares, and crypto CFDs). You pay a small premium for this protection through slightly wider spreads on GSLO-protected trades, but it prevents losses during unexpected events.

This matters particularly for leveraged CFD trading where a 5% overnight gap can wipe out your account if using standard stop-losses. GSLO ensures your risk management actually works when you need it most.

Share and Index CFD Trading

Plus500 offers 1622 share CFDs from NYSE, NASDAQ, London Stock Exchange, Euronext, and other global exchanges. You trade Apple, Tesla, Amazon, Microsoft, and thousands of other companies without owning the actual shares. This lets you short stocks easily when you think prices will fall, something complicated with real share ownership.

The 43 indices cover major global markets – S&P 500, NASDAQ 100, DAX, FTSE 100, Nikkei 225, and regional indices. You capture broader market movements without picking individual stocks, trading index sentiment during earnings seasons or economic announcements.

The 480 options available let you trade options contracts as CFDs, combining options strategies with CFD execution. The 125 ETFs give you exposure to sector-specific baskets like technology ETFs, bond ETFs, or commodity ETFs through CFD trading.

Proprietary Platform and 24/7 Support

The Plus500 platform is built specifically for CFD trading rather than being a forex platform with CFDs tacked on. You see real-time prices, economic calendar integration showing high-impact events, price alerts notifying you when instruments hit your targets, and charting with technical indicators for analysis.

The interface works across web browser (no download needed), Windows and Mac desktop applications, or mobile apps for iOS and Android.

Customer service operates 24/7 via live chat, email, and phone with support in multiple languages including Arabic. You get help outside normal business hours when Asian or US markets trade, not just during European hours. The platform offers negative balance protection preventing you from losing more than your account balance.

2. PEPPERSTONE - Best MT4 CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone delivers ultra-tight spreads from 0.10 pips on EUR/USD with 77ms execution speeds – the fastest we tested among UAE brokers. You get access to 94 currency pairs, 44 crypto CFDs, 23 indices, and 900+ share CFDs from US, UK, European, and Australian exchanges all through MT4, giving you the world’s most popular platform with its massive Expert Advisor library for automation.

The Razor account offers raw ECN-style spreads with $3.50 commission per side, while the Standard account provides spread-only pricing from 1.10 pips with zero commissions.

You can choose between MT4, MT5, cTrader, and TradingView platforms depending on your needs. Pepperstone is DFSA-regulated with $0 minimum deposit, 30:1 retail leverage, and 500:1 for professional traders. The broker enhances MT4 with Smart Trader Tools adding trade management features beyond standard MT4.

Pros & Cons

- Ultra-tight spreads from 0.10 pips

- 77ms execution speeds

- 94 currency pairs, 44 crypto CFDs

- MT4, MT5, cTrader, TradingView support

- 900+ share CFDs available

- $0 minimum deposit

- Smart Trader Tools integration

- Low leverage for share CFDs

- No guaranteed stop-loss orders

- Demo account expires after 90 days

- Live chat available 24/5 only

- Some CFDs not available on MT4

Broker Details

Ultra-Fast Execution and Tight Spreads

Pepperstone’s 77ms average execution speeds mean your orders get filled before other brokers finish processing. This matters when trading volatile sessions like NFP releases or central bank announcements when prices move 50+ pips in seconds. Every millisecond counts when you’re trying to catch breakouts or exit positions during fast markets.

The Razor account delivers spreads as low as 0.10 pips on EUR/USD, 0.20 pips on GBP/USD, and 0.10 pips on AUD/USD with $3.50 commission per side ($7 round-turn). These are ECN-style raw spreads with minimal markup, giving you institutional-grade pricing.

The Standard account offers 1.10 pips on EUR/USD, 1.30 pips on GBP/USD, and 1.10 pips on AUD/USD with zero commissions if you prefer spread-only pricing without calculating commission costs. Both accounts access the same 94 currency pairs covering all majors, minors, and several exotics.

MT4 Platform with Smart Trader Tools

Pepperstone’s MT4 isn’t standard – they integrate Smart Trader Tools adding features beyond vanilla MT4. You get trade management tools like quick-close all trades buttons, mass stop-loss adjusters letting you modify all positions simultaneously, and position sizing calculators. The Trade Terminal add-on shows floating P&L across all positions, margin utilization, and account equity curves updating in real-time.

The platform supports full Expert Advisor functionality for automating forex and CFD trading strategies. You access the MQL4 marketplace with 1,700+ trading robots and 2,100+ custom indicators built over 15+ years by the MT4 community. The Strategy Tester lets you backtest EAs across 10+ years of historical data, optimizing parameters before deploying them live with real money.

VPS hosting runs free when maintaining minimum account balances, keeping your EAs running 24/7 with 99.9% uptime even when your home computer shuts down. The server sits physically close to Pepperstone’s data centers, reducing execution delays that matter for scalping strategies.

Multiple Platform Choices

Beyond MT4, you get MT5 access with 21 timeframes versus MT4’s 9 options, 38 technical indicators versus 30, and multi-threaded backtesting using all your CPU cores simultaneously for faster strategy optimization. MT5 handles stock CFDs more natively with better order types and market depth display.

cTrader provides Level II pricing showing order book depth across multiple price levels, helping you gauge liquidity before entering large positions. The interface is more modern than MT4’s 2005 design, with advanced charting and one-click trading.

TradingView integration gives you access to superior charting with 100+ indicators and social features, executing trades directly from TradingView charts into your Pepperstone account.

You’re not locked into one platform – use MT4 for automated trading with EAs, TradingView for chart analysis, and cTrader for manual execution all from the same account. The Pepperstone mobile app consolidates everything, letting you monitor positions and adjust trades from your phone.

3. ThinkMarkets - Best CFD Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets’ ThinkTrader mobile trading app offers features most mobile platforms lack – multi-screen charts letting you monitor multiple instruments simultaneously, market scanners filtering opportunities across thousands of CFDs, mobile alerts notifying you when conditions trigger, and daily trading signals providing trade ideas.

You get commission-free trading with spreads from 1.10 pips EUR/USD, 1.30 pips GBP/USD, and 1.10 pips AUD/USD across 43 forex pairs, thousands of share CFDs from global exchanges, and 19+ crypto CFDs.

ThinkMarkets is DFSA-regulated with $0 minimum deposit and 161ms execution speeds. The broker offers only one account type, keeping things simple with spread-only pricing. Swap-free Islamic accounts are available for Shariah-compliant trading, and you also get TradingView integration if you prefer technical analysis and chart-based trading over the mobile-focused ThinkTrader app.

Pros & Cons

- Multi-screen charts on mobile

- Market scanners and daily trading signals

- Commission-free trading

- TradingView integration

- $0 minimum deposit

- 30:1 retail, 500:1 professional leverage

- Only one account type available

- Demo account lasts just 14 days

- No MetaTrader platforms in UAE

- Limited crypto CFDs

- 43 forex pairs (smaller selection)

4. Multibank Group - Lowest Spread CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.5

AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why We Recommend Multibank Group

Multibank Group delivers some of the tightest spreads among UAE brokers – raw spreads start from 0.1 pips on EUR/USD, 0.5 pips on GBP/USD, and 0.4 pips on AUD/USD in the ECN account.

While many CFD brokers provide competitive pricing with tight spreads and low commissions, Multibank stands out by charging just $3.00 commission per side versus the industry standard $3.50, saving you $1.00 per round-turn on every trade.

You get 14,000 share CFDs on MT4 – the largest range among UAE brokers – letting you trade Apple, Tesla, Amazon, and thousands of other global stocks. The broker offers 40 forex pairs, 23 indices, 4 precious metals (gold, silver, platinum, palladium), 5 energies including crude oil and natural gas, plus 11 crypto CFDs.

Multibank Group is regulated by the Securities and Commodities Authority in the UAE, offering 20:1 retail leverage and 500:1 for professional traders with a $50 minimum deposit. You can use MT4, MT5, or the MultiBank-Trader 4 mobile app.

Pros & Cons

- Lower $3.00 commission vs $3.50 standard

- 14,000 share CFDs

- Tight spreads from 0.1 pips

- 500:1 professional leverage

- MT4, MT5, mobile app support

- $50 minimum deposit required

- Execution speeds not disclosed

- Inactivity fee charged

- Smaller forex selection (40 pairs)

5. AvaTrade - Best Islamic CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade offers swap-free Islamic accounts letting you hold positions up to 5 days without overnight interest charges that violate Shariah principles. Positions held longer incur fees, so this works for swing trading but not long-term holds.

You trade 53 forex pairs, 36 indices, 19 commodities, 62 ETFs, and 27 crypto CFDs across four platforms (MT4, MT5, AvaTradeGO mobile app, or AvaOptions) for options trading. AvaTrade provides fixed spreads of 0.8 pips EUR/USD, 1.2 pips GBP/USD, 0.9 pips AUD/USD; the spreads stay constant during volatile markets when variable spreads widen.

The broker is ADGM-regulated with a $100 minimum deposit, 160ms execution speeds, 30:1 retail leverage and 400:1 professional. MQL5 Signals integration lets you copy trade directly within MT4/MT5.

Pros & Cons

- Islamic swap-free accounts

- Fixed spreads provide price certainty

- MQL5 Signals copy trading

- Four platforms (MT4, MT5, AvaTradeGO, AvaOptions)

- 62 ETFs available

- ADGM regulation

- $100 minimum deposit

- 160ms execution slower

- Islamic positions limited to 5 days

- Fixed spreads higher than ECN

- AvaProtect not available on MT4

- Inactivity and currency conversion fees

6. Axi - Best CFD Trading Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend AxiTrader

Axi’s demo account mirrors live trading conditions showing the same 0.1 pips EUR/USD, 0.2 pips GBP/USD, 0.2 pips AUD/USD spreads you’ll see in the live Pro account with $3.50 commission.

You’re not getting sanitised demo fills that look perfect then fail when you go live. The 90ms execution speeds work across 72 currency pairs and 37 crypto CFDs, which is faster than most UAE brokers.

The $0 minimum deposit on live accounts means easy transition from demo testing to real trading with 0.01 micro lots. Axi is DFSA-regulated offering 30:1 retail leverage and 400:1 professional. The Standard account gives you spread-only pricing at 0.7 pips EUR/USD, 0.8 pips GBP/USD, 0.7 pips AUD/USD with no commissions.

Pros & Cons

- Realistic demo matching live conditions

- Fast 90ms execution speeds

- 72 currency pairs, 37 crypto CFDs

- $0 minimum deposit

- Tight spreads from 0.1 pips (Pro)

- Standard spreads wider (0.7-0.8 pips)

- Inactivity fee charged

- Limited educational resources

- Smaller broker presence

- Only MT4 platform (no MT5)

7. XM - Best MT5 CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.5

AUD/USD = 0.8

Trading Platforms

MT4, MT5,

XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM provides MT5 with 21 timeframes versus MT4’s 9 options, 38 technical indicators versus 30, and multi-threaded backtesting using all CPU cores simultaneously for faster strategy optimization.

You trade 55 forex pairs with spreads from 0.2 pips EUR/USD, 0.5 pips GBP/USD, 0.8 pips AUD/USD in the XM Zero account with $3.50 commission, or 1.6/1.8/2.3 pips in the Standard account with zero commissions.

The $5 minimum deposit is the lowest among UAE brokers, letting you test strategies with 0.01 micro lots risking minimal capital. XM is DFSA-regulated with 148ms execution speeds, 30:1 retail leverage and 400:1 professional. The broker offers swap-free Islamic accounts without additional fees, and the XM App integrates TradingView charts.

Pros & Cons

- MT5 with 21 timeframes, 38 indicators

- $5 minimum deposit (lowest available)

- Swap-free Islamic accounts

- XM App with TradingView integration

- 24/7 customer service

- DFSA regulated

- 148ms execution slower

- No crypto CFDs available

- Limited forex pairs (55)

- High inactivity fee after 1 year

- Spreads wider than competitors (0.2 pips raw)

8. Capital.com - Best Gold CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

Why We Recommend Capital.com

Capital.com delivers tight spreads ideal for gold CFD trading during Federal Reserve announcements or geopolitical tensions that spike XAU/USD volatility. The Standard account offers 0.60 pips EUR/USD, 1.30 pips GBP/USD, 0.60 pips AUD/USD with zero commissions across 120 forex pairs and 25 crypto CFDs.

You can use MT4, MT5, TradingView, or Capital.com’s AI-powered proprietary platform providing trading insights and pattern recognition. The broker provides 141ms execution speeds with $20 minimum deposit and 300:1 leverage for both retail and professional accounts – significantly higher than DFSA brokers capped at 30:1 retail.

Capital.com is SCA-regulated and known for its AI-driven insights. The platform supports AED as an account currency, eliminating conversion fees for UAE traders.

Pros & Cons

- Excellent for gold CFD trading

- 120 forex pairs available

- 300:1 leverage (retail and professional)

- AI-powered trading insights

- Multiple platforms (MT4, MT5, TradingView)

- Supports AED currency

- Spread-only pricing (no raw accounts)

- 0.60 pips wider than ECN brokers

- SCA regulation

- $20 minimum deposit

- 141ms execution slower than Pepperstone

9. SAXO MARKETS - CFD Broker With Automated Trading

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.8

AUD/USD = 1.1

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$10,000 USD

Why We Recommend Saxo Markets

Saxo Markets provides 327 forex pairs (the widest currency selection among UAE brokers) with institutional-grade automated trading through SaxoTraderGO and SaxoTraderPro platforms.

You also get MT4 and TradingView integration. Spreads start from 0.9 pips raw EUR/USD, 0.7 pips GBP/USD, 0.9 pips AUD/USD or 1.1/1.8/1.1 pips standard pricing. The broker offers 135ms execution speeds and you get 50:1 leverage for both retail and professional accounts.

The $2,000 minimum deposit targets serious traders seeking premium service with dedicated account managers, extensive research tools, and professional-grade platforms.

Pros & Cons

- 327 forex pairs (widest selection)

- Professional platforms (SaxoTraderGO, Pro)

- Premium customer service

- Extensive research and analysis tools

- Multiple regulatory licenses

- Good for professional traders

- High minimum deposit ($2,000+)

- Spreads wider than ECN (0.9-1.1 pips)

- High inactivity fees

- Customer support not 24/7

- 50:1 leverage lower than competitors

10. eToro - Good Broker For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$500

Why We Recommend eToro

eToro is regulated by the ADGM and is a top choice for social and copy trading, allowing you to replicate the trades of experienced investors through automated copy trading. The CopyTrader feature lets you allocate funds to experienced traders and automatically mirror their positions proportionally in your account without manual intervention.

The platform shows verified performance statistics including monthly returns, maximum drawdown, average holding period, and win rates before you commit funds. You trade 68 forex pairs and 200+ crypto CFDs – the largest crypto selection among UAE brokers – with spreads around 1.0 pips EUR/USD, 2.0 pips GBP/USD, 1.0 pips AUD/USD.

eToro is ADGM-regulated with 130ms execution speeds and $100 minimum deposit. The social feeds show what 30 million registered users are buying, selling, and discussing in real-time. CopyPortfolios use AI algorithms to create diversified portfolios automatically.

Pros & Cons

- CopyTrader for automated mirroring

- 200+ crypto CFDs (largest selection)

- 30 million users for selection

- CopyPortfolios with AI diversification

- Social feeds showing real-time activity

- ADGM regulation

- No MT4/MT5 support

- Spreads wider (1.0-2.0 pips)

- Proprietary platform only

- $100 minimum deposit

- Copy trading dependent on trader performance

11. IG GROUP - Best Range of CFD Markets

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

IG is frequently ranked as the best overall broker in the UAE for 2025, offering a massive range of over 19,000 tradable instruments – the most comprehensive available to UAE traders.

You get 97 forex pairs, 30 crypto CFDs, thousands of share CFDs from global exchanges, indices, commodities, bonds, interest rates, and options all from a single account.

The broker is DFSA-regulated with $0 minimum deposit, 174ms execution speeds, and spreads from 0.16 pips EUR/USD, 0.59 pips GBP/USD, 0.29 pips AUD/USD with $6.00 commission per side in the raw spread account. Standard account pricing runs 1.13/1.66/1.01 pips with no commissions.

IG provides MT4, TradingView integration, their proprietary IG Trading Platform, and L2 Dealer for direct market access. The extensive educational resources and 50+ years operating since 1974 make IG suitable for beginners.

Pros & Cons

- 19,000+ instruments

- $0 minimum deposit

- 97 forex pairs, 30 crypto CFDs

- Multiple platforms (MT4, TradingView, proprietary)

- Extensive educational resources

- DFSA regulated, 50+ years history

- 174ms execution slowest tested

- No MT5 platform

- MT4 doesn’t access all products

- Customer service limited weekends

- 30:1/200:1 leverage lower for professionals

Ask an Expert