Best CFD Brokers in Malaysia

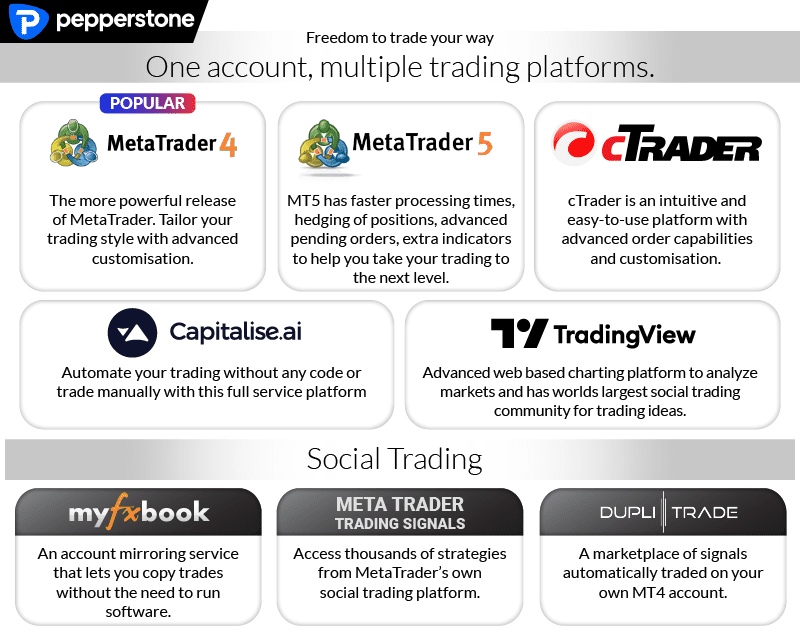

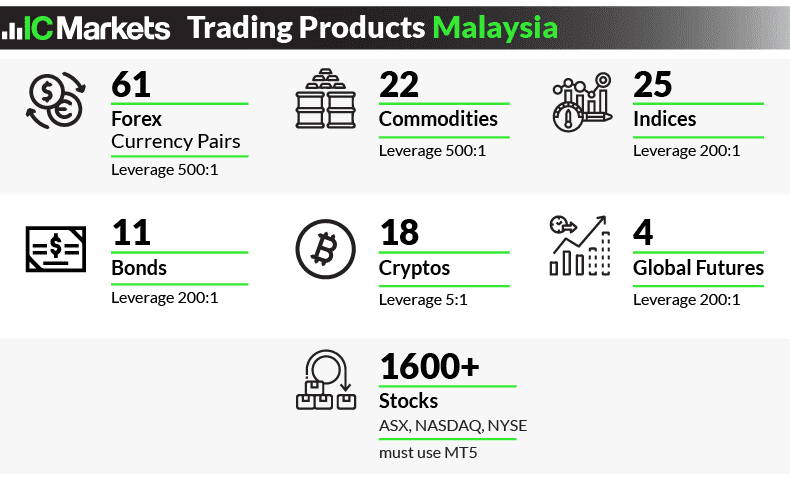

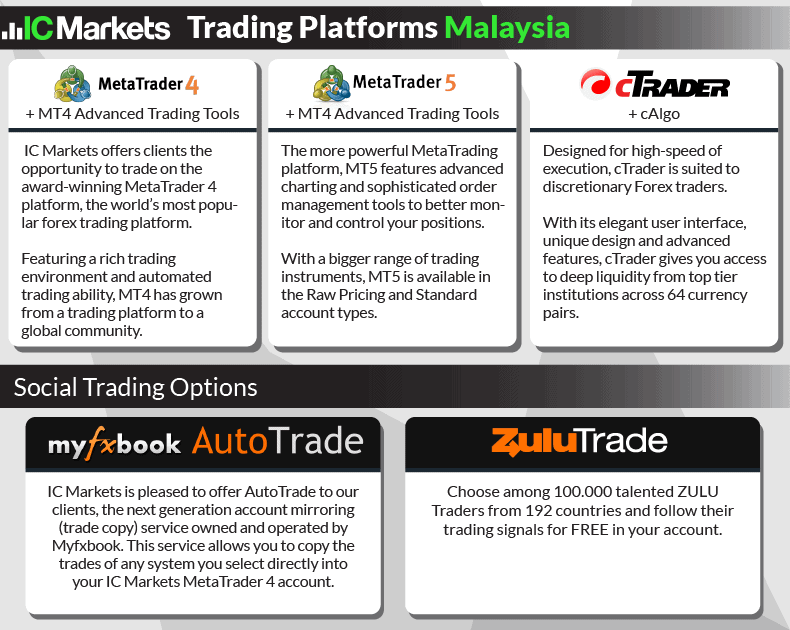

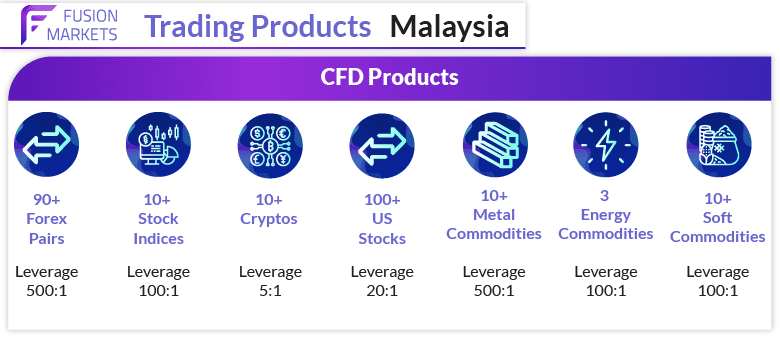

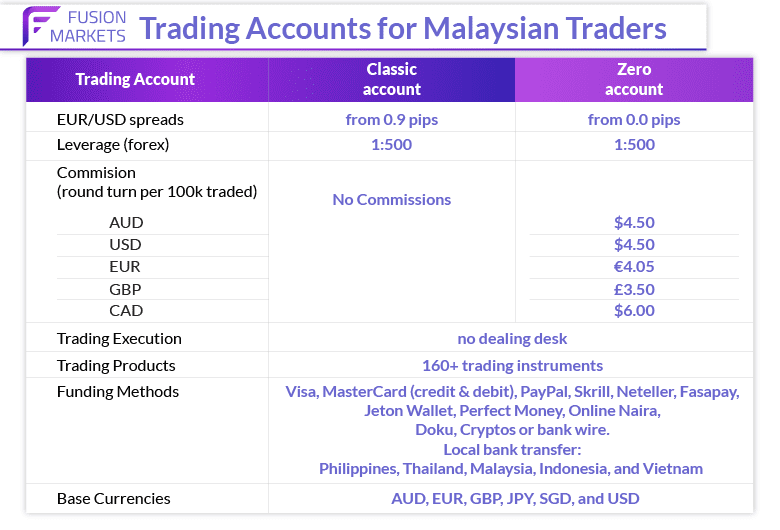

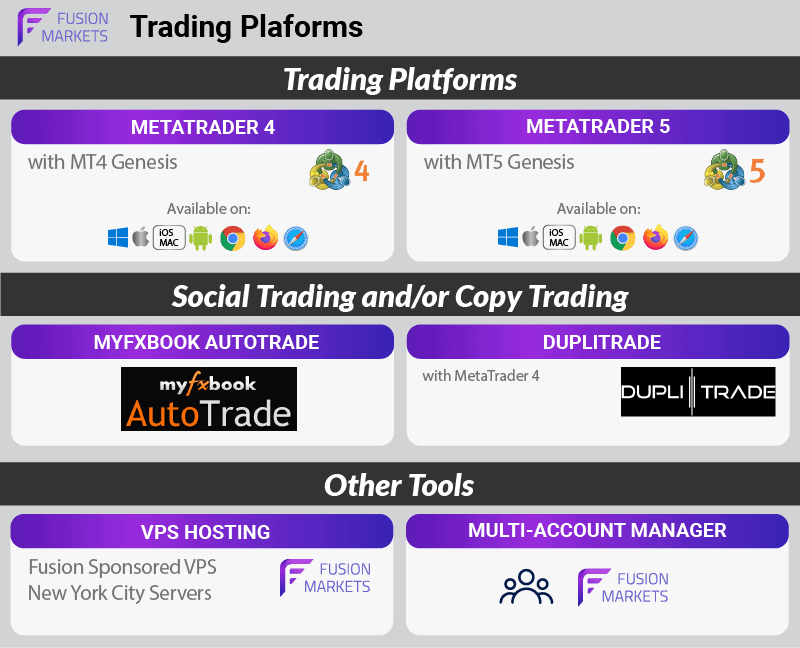

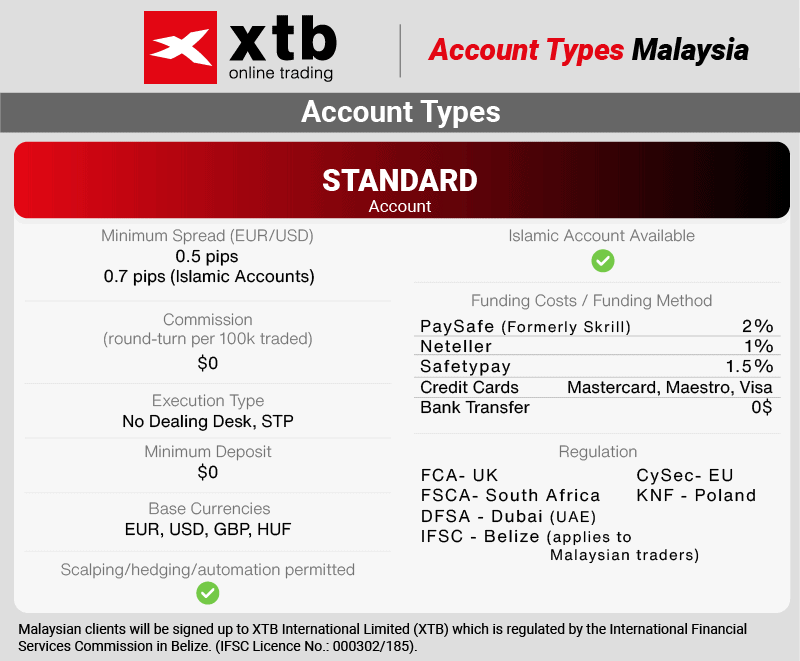

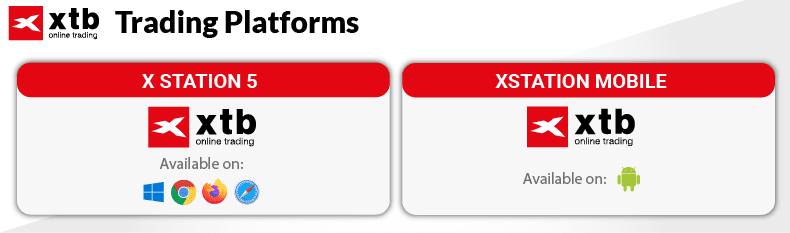

The best CFD Brokers in Malaysia offer a wide range of markets such as forex and crypto, and have good CFD trading platforms. We look at the 6 brokers for CFD trading along with their spreads and costs.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert