Best CFD Trading Platforms

Good trading platforms should make it easy to trade Contract for Differences (CFDs). Types of CFDs include indices, forex, metals, and cryptocurrencies. I compared the best CFD trading platforms from MAS regulated forex brokers for Singapore traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

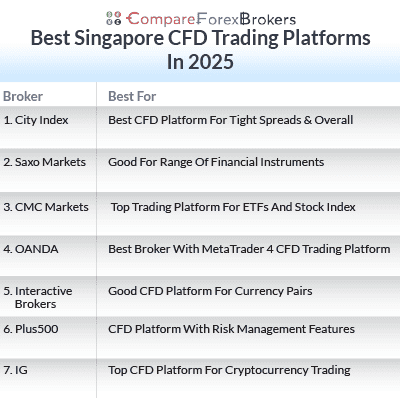

Below contains the list of my best trading platforms for trading CFDs from MAS regulated brokers:

- City Index - Best CFD Platform For Tight Spreads & Overall

- Saxo Markets - Good For Range Of Financial Instruments

- CMC Markets - Top Trading Platform For ETFs And Stock Index

- OANDA - Best Broker With MetaTrader 4 CFD Trading Platform

- Interactive Brokers - Good CFD Platform For Currency Pairs

- Plus500 - CFD Platform With Risk Management Features

- IG Group - Top CFD Platform For Cryptocurrency Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Who Are The Best CFD Brokers For Singaporean Traders?

Traders in Singapore should only choose a broker regulated by MAS or a ‘tier 1’ regulator such as ASIC, FCA or the FMA. We shortlisted brokers based on this requirement and then matched the best broker for each trading style.

1. City Index - Best CFD Platform For Tight Spreads & Overall

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView,

City Index WebTrader

Minimum Deposit

$0

Why I Recommend City Index

I liked City Index for having narrow spreads and low trading costs. This can make a difference to your profit margins more than you could imagine.

With over 35 years of expertise and a clientele of over 150,000 retail traders worldwide, this broker has earned their reputation as one of the most trusted providers in the forex space. This isn’t a newcomer trying to make a name; City Index already has an established platform that knows the ropes and delivers consistently.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Extensive choice of CFD products

- Limited range of products on MT4

- Lacks MetaTrader 5

- WebTrader platform has a learning curve

Broker Details

With over 35 years of experience serving +150,000 retail traders from across the world, I selected City Index as the best CFD platform for tight spreads and low trading fees. Here are the three main reasons why I hand-picked them:

- +4,500 financial markets with TIGHT SPREADS (based on my testing)

- BEST CFD TRADING PLATFORMS (Web Trader platform, MetaTrader 4 and TradingView)

- ADVANCED TRADING TOOLS (Performance Analytics, Smart Signals and Advanced Charting)

Tight RAW Spreads Based on Testing

City Index offers the lowest RAW spreads among the CFD brokers I reviewed in Singapore. Based on my testing of RAW/ECN accounts, the broker achieved spreads of 0.25 pips for the 6 major currency pairs. Surprisingly, these turned out to be the lowest spreads in Singapore and number 2 on my list overall, just behind Fusion Markets at 0.22 pips.

These were the lowest spreads in Singapore and number 2 on our list overall, just behind Fusion Markets at 0.22 pips.

Having tight RAW spreads added to my low-cost experience trading the broker’s over 4500 CFD markets, including 84 forex pairs, one of the biggest product ranges I’ve seen in Singapore.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Best Trading Platform Experience

City Index is also my top pick for the best CFD brokers with powerful trading platforms. When I reviewed CFD brokers in Singapore for their trading platform features, City Index scored the most points due to its proprietary web trader platform.

While this broker also offers MT4 and TradingView as platform options, their web trader platform is a standout, combining a simple and intuitive interface with advanced trading tools.

Through the web trader, I had been given access to 90 technical indicators via the platform integration with TradingView, as well as the ability to execute complex order types like OCO (one-cancels-the-other) orders.

Perhaps my favourite feature is the ability to drag stop-loss or limit orders to a new price level, saving me time when day-trading or scalping where speed is vital.

While I found it rather complicated to manually arrange widgets when setting up a new workspace, the web trader did come with a wide variety of predefined screeners and layouts.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

2. Saxo Markets - Good For Range Of Financial Instruments

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 0.9

Trading Platforms

MT4, TradingView,

SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$10,000

Why I Recommend Saxo Markets

I liked Saxo Markets because no other platform came close to offering me access to 9,000+ global CFD markets, spanning equities, currencies, indices, and beyond.

What’s more, I observed that this broker isn’t just a wide-reaching platform but also a trustworthy one. They adhere to rigorous regulatory standards in 15 countries. Hence, if you’re a Singaporean trader looking to diversify your CFD portfolio, Saxo Markets should be a top contender on your list.

Pros & Cons

- Comprehensive choice financial markets

- Well regulated

- Excellent trading tools on SaxoTraderGo

- Highest minimum deposit

- SaxoTraderGo has a learning curve

- Lacks live chat and 24/7 customer support

Broker Details

Saxo Markets offers the most CFD markets that I’ve encountered, providing a gateway to over 9,000 CFD global markets, including stocks, foreign exchange currencies, indices, and other underlying assets.

In addition, I gave Saxo Markets high marks for its long-standing reputation and trust, being regulated in 4 tier-1 jurisdictions. To top it all up, the broker has excellent trading platforms and advanced trading tools which can make your trading experience versatile.

Huge Range of Financial Instruments

Among the top regulated brokerages servicing Singaporean clients I reviewed, Saxo offers the most extensive range of financial instruments. The broker offers nearly 9000 share CFDs, 675 ETFs, and 29 indices. While you can trade over 185 spot forex pairs, I found that the broker only offered CFDs on 7 forex pairs.

In terms of CFDs, we found the broker offered nearly 9000 share CFDs, 675 ETFs and 29 indices. While you can trade over 185 spot forex pairs, we found the broker only offered CFDs on 7 forex pairs.

However, if you’re interested in trading more than CFDs, Saxo Markets provides access to over 70,000 tradable instruments grouped in several diverse asset classes including spot products, FX options, and ETFs.

Low Fees for Active Traders

While Saxo Markets’ three account types require significant minimum deposits as you move up, high-volume traders will benefit with zero commissions and progressively lower spreads the more that you trade.

As such, having a tiered account structure will appeal the most to you if you’re an experienced trader with high monthly trading volumes and a significant capital to back you up.

Disclaimer: I only managed to test the Classic account due to the steep $200,000 and $1 million minimum deposits for the Premium and VIP accounts. Still, I found that you can obtain competitive spreads on all account types, particularly 1.1 pips for Classic, 1 pip for Platinum, and 0.9 pips for VIP on the EUR/USD pair.

Excellent Proprietary Trading Platforms

Saxo offers three award-winning trading platforms – SaxoTraderGO, SaxoInvestor, and SaxoTraderPRO, that will suit CFD traders of all experience levels.

For my recommendation, SaxoTraderGO is the way to go, combining a user-friendly interface with advanced trading tools. One feature I loved is the ability to easily switch between forex CFDs, futures, forwards, or forex options using the trade ticket.

I also appreciated the Quick Trade option which allowed me to set price tolerance for slippage when I needed immediate fills.

Broker Screenshots

3. CMC Markets - Top Trading Platform For ETFs And Stock Index

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why I Recommend CMC Markets

I liked CMC Markets for its Next Generation platform which I find working well if you’re keen on trading ETFs and major stock indices. This platform offers exceptionally competitive spreads for Singaporean traders — starting as low as 0.7 points for FX pairs and 0.3 points for the most traded global stock indices.

Also, it’s not just about great spreads; it’s also about having reliable, cutting-edge trading technology that works well. And if you’re keen to give it a whirl before diving in, I found that they offer a free sample account that you can test.

Pros & Cons

- Superb choice of ETFs and indices

- Excellent NGEN trading platform

- Competitive trading fees

- Limited support with mobile app

- Too many FX pair variations (330+)

- Limited social trading tools

Broker Details

CMC Markets offered the best technological solution when I compared the best CFD platforms for trading indices like the Dow Jones index, S&P 500 index, FTSE 100, China’s SHCOMP, and the Singapore Stock Market index STI.

As such, my review concludes that this broker offers the most extensive list of global Stock Indices and ETFs available to trade as CFDs for Singapore-based clients.

Trade 82 Stock Indices and 1000 ETFs

I’ve explored the brokerage’s offerings and can confirm that you can trade over 82 Stock Index CFDs and 1000 ETFs. Trading these CFD products via MetaTrader 4 platform and the CMC Markets’ award-winning CFD trading app, I was impressed with the platform’s real-time charting capabilities and a suite of over 80 technical indicators and drawing tools.

In addition to stock indices and ETFs, I found that the broker provides access to 338 FX pairs and over 9000 global stocks. From my analysis, no other provider offered such an extensive range of products for Singaporean traders.

I recommend trading these products via the broker’s Next Generation platform, which is easy to use, whilst also featuring advanced charting tools. One feature I particularly liked is the customisability of the platform, with the ability to have floating or fixed windows, in addition to predefined layouts or custom setups.

Competitive Commission-Free Spreads

Of CMC Markets’ two retail investor accounts, I discovered that it is the broker’s CFD account (commission-free) that you’ll obtain the most competitive spreads. The broker averaged spreads of 1.11 pips for the 6 major currency pairs from my testing of Standard (commission-free) accounts, coming 2nd on my list overall.

Only IC Markets could beat those spreads, averaging 1.01 pips for the USD-backed majors.

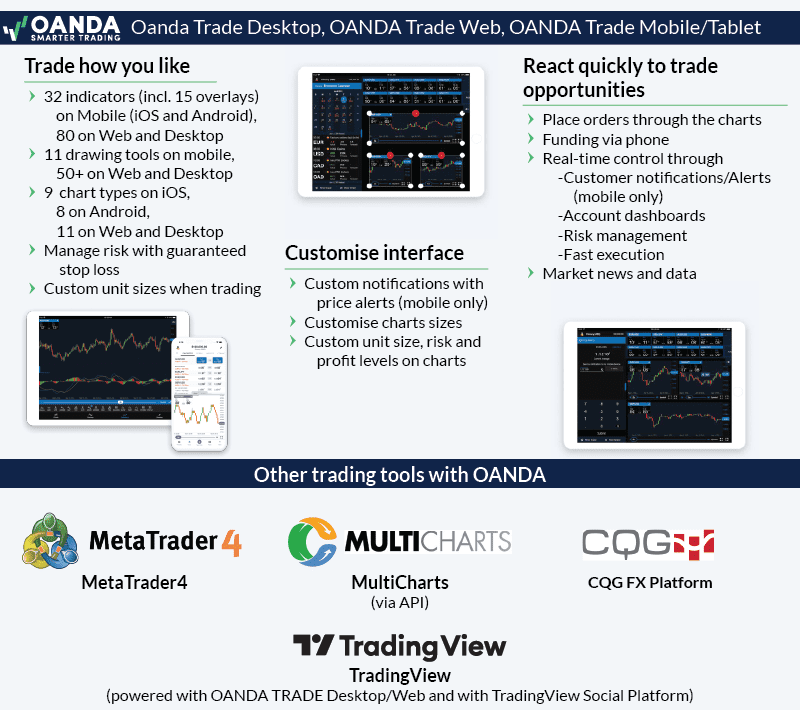

4. OANDA - Best Broker With MetaTrader 4 CFD Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView,

OANDA Web (fxTrade)

Minimum Deposit

$0

Why I Recommend OANDA

I liked OANDA’s strong MetaTrader 4 offering, making them a top choice for Singaporean traders with a preference for this platform.

The broker has designed a unique bridge that connects Singapore traders to MT4, the world’s most popular retail forex trading platform. This feature earned them top marks in my exclusive star ranking system.

Also, if you’re just starting your trading journey, OANDA removes one significant hurdle: no minimum deposit requirements.

Pros & Cons

- No minimum deposit required

- Competitive spreads

- Premium MT4 plugin available

- Market maker broker

- Limited resources for beginners

- Support is not 24/7

Broker Details

Among the top regulated CFD brokers in Singapore I reviewed, OANDA offers the most competitive MetaTrader 4 software solution. The broker’s custom-built bridge combines their pricing and execution with the charting and analytical capabilities of the MetaTrader 4 platform. In addition, I scored them highly for low spreads, trust (10/10), and range of 70 forex pairs.

Full Suite of MT4 Trading Tools

When I tested OANDA’s user-friendly MT4 solution, I was delighted to find that Singapore-based traders can take advantage of an advanced charting package which includes over 50 built-in technical indicators. There are also automated trading tools (EAs) and an Open Order Indicator tool where you can view aggregate open orders and open positions directly on the MT4 charts.

From my testing, I can say that the great benefit of the Open Order Indicator is that you could make decisions based on retail pricing sentiment, from clearly visible levels of support and resistance on the charts.

Lowest Published Commission-Free Spreads

From my extensive spread analysis, I found that OANDA offers the lowest published spreads for a commission-free (Standard) account in the industry. The broker achieved average spreads of 0.70 pips across the 5 most traded currency pairs.

This put them well above the industry average of 1.52 pips, and just in front of IC Markets at 0.76 pips.

5. Interactive Brokers - Good CFD Platform For Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why I Recommend Interactive Brokers

I liked Interactive Brokers’ breadth of forex currency options, specifically for offering 105 currency pairs for trading. This makes them my top choice for Singaporean traders looking to diversify forex portfolio.

Interactive Brokers brings not just variety but also expertise and reliability to the table, with more than 40 years of experience in the industry. They are based in the United States but offers some of the best retail forex investor accounts through their Singapore operations.

Pros & Cons

- Extensive selection of forex pairs

- No minimum deposit required

- Good range of trading tools

- Has a minimum commission of $2 per trade

- IBKR platform has a learning curve

- Lacks choice of third-party trading platforms

Broker Details

Based on CompareForexBrokers’ proprietary star scoring system, Interactive Brokers takes the cake as the leading platform for forex trading in CFD currency trading. As the biggest US-based brokerage trading firm, IB Singapore offers highly sophisticated CFD trading platforms which allows you to trade an extensive range of over 80 currency pairs.

Extensive Range of Currency Pairs

With Interactive Brokers, Singapore-based traders are granted direct market access (DMA) to interbank quotes from 17 of the world’s largest Forex dealing financial institutions. The broker offers a total of +80 major, minor and exotic currency pairs, comprised of 23 trading currencies, which is one of the largest ranges you could encounter in the country.

In addition, you can take advantage of the best bid and ask prices derived directly from several liquidity providers, with spreads being as low as 1/10 pip.

In terms of trading costs, I discovered that the broker charges a small commission of 0.08 to 0.20 basis points depending on trade size, with the minimum commission being $2.00 (or currency equivalent) per trade.

Sophisticated Trading Platforms

Out of all its sophisticated trading platforms, it is the broker’s Trader Workstation (TWS) that stood out to me, specifically FXTrader, which is the main terminal within TWS for trading forex.

This features advanced trading tools designed by the broker and supports more than 20 order types, including trailing stop limits, brackets, one cancels all and limit if touched.

I particularly liked FXTrader’s easily customisable layout, with every currency pair’s “trading cell” showing the position, average cost, and profit and loss data.

6. Plus500 - CFD Platform With Risk Management Features

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why I Recommend Plus500

I liked Plus500 for its comprehensive approach to risk management. As a London Stock Exchange-listed company, the broker operates within stringent regulatory frameworks that prioritise trader safety.

As mentioned, what sets Plus500 apart is its automated risk management features, giving CFD traders in Singapore the tools needed to keep trading risks in check. Hence, if you’re keen on safeguarding your investments while enjoying the dynamics of CFD trading, I highly recommend adding Plus500 on your radar.

Pros & Cons

- Good platform for beginners

- Low spread trading account

- Offers good risk management tools

- No third-party platforms available

- Lacks market research tools

- Inactivity fee

Broker Details

In my experience with London Stock Exchange-listed Plus500, I found the broker offers comprehensive risk management features. Actually, that’s the best I’ve encountered in Singapore.

Risk Management Features

Plus500’s extensive range of risk management features allowed me to reduce my trading costs. It also alerted me on important news events and protected my online trading account from going negative.

I’ve highlighted the 4 key risk management features Plus500 offers:

- GUARANTEED STOP LOSS ORDER (GSLO) – helps minimise CFD losses by eliminating slippage (for a small fee)

- NEGATIVE BALANCE PROTECTION (NBP) – safeguards your deposit funds (you can’t lose more than your account balance)

- ADVANCED ORDER TOOLS – trailing stop loss, stop limit and stop-loss orders (to reduce slippage)

- REAL–TIME ALERTS – for changes in the price of your favourite CFD instruments, percentage changes and market sentiment notifications

Plus500 Bonuses and Trade Rebates

Plus500 stands out as the only MAS-regulated CFD provider offering welcome deposit bonuses. Depending on the size of your initial deposit, you can receive a deposit bonus of up to SGD 13,000, usable as a margin for future trades.

Based on my testing, the one-time CFD bonus can range in size, depending on the initial deposit made. To be eligible to receive the minimum deposit bonus of SGD 80, you need a minimum deposit of SGD 300. You can refer to the table below for a comprehensive list of welcome bonuses.

Additionally, within the first 12 days from your initial deposit, you’re automatically enrolled in Plus500’s Rebates Program. CFD rebates are credited to your account at the end of each week.

7. IG Group - Top CFD Platform For Cryptocurrency Trading

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, IG Trading Platform,

L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why I Recommend IG Group

I named IG Markets as the ultimate platform for cryptocurrency trading, especially if you’re based in Singapore. The broker offers free trades on eight major digital currencies including Bitcoin, Ethereum, and Litecoin.

IG Markets is a part of the established IG Group Holdings Plc, with a trading history dating back to 1974 and operations across 16 countries on five continents. If you’re keen to dive into the crypto world, they provide a good variety of underlying asset and the backing of a time-tested, multi-regulated broker.

Pros & Cons

- Offers a range of popular cryptocurrencies

- Provides good trading tools

- IG trading platform is user-friendly

- High minimum deposit

- No social trading tools

- MT4 has limited access to some trading products

Broker Details

I compared the top CFD platforms that allow trading of cryptocurrencies and found that IG Markets offers best Cryptocurrency CFD offering for traders in Singapore.

Singaporean residents can trade 8 major digital coins (Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Stellar, NEO and EOS) with zero commissions and do electronic wallet.

Top Cryptocurrency Trading

IG Group offers 8 of the most popular digital currencies, which can be traded as CFD contracts on all of its platforms with no commissions charged (traders pay only the spread).

Based on my testing of the broker’s demo account, I found that you can trade Bitcoin with a low minimum spread of 36 points and a minimum margin requirement of 20% using the MT4 platform.

I want to note that larger position sizes will require more margin, as per IG’s tiered margin policy — tiers depend on the number of contracts included in a trader’s position. For example, trading 70 or more CFD contracts in Bitcoin will require a margin of 30%, while 140 or more contracts – a margin of 75%.

Cryptocurrency CFD specifications for all digital coins available on IG Markets’ MT4 trading platform are presented in the following table. It also shows the risk premium the broker will charge if a trader’s Guaranteed Stop Loss order is triggered.

Excellent Trading Platforms

You can trade IG Group’s range of CFD markets via its expansive suite of trading platforms including its own Web-based platform (Webtrader), MT4, L2 Dealer and ProRealTime.

Ask an Expert

How much money do you need to trade CFD?

To make a trade, you need enough capital to cover margin requirements. This margin will vary depending on the trade with, the how much leverage you use and the size of your trade. Some broker may also have a minimum deposit requirement to open an account.