TMGM Review (2024)

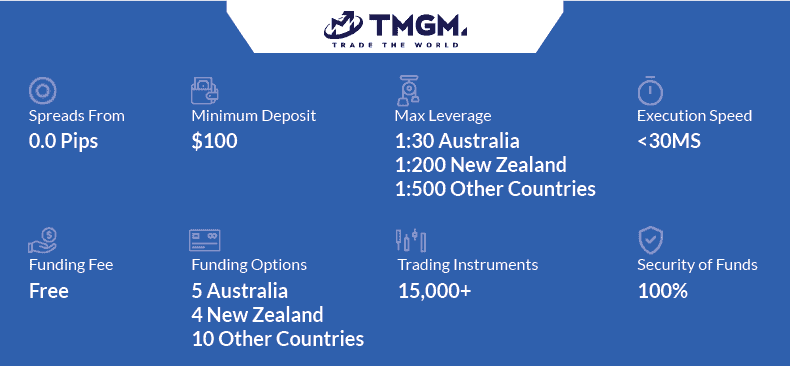

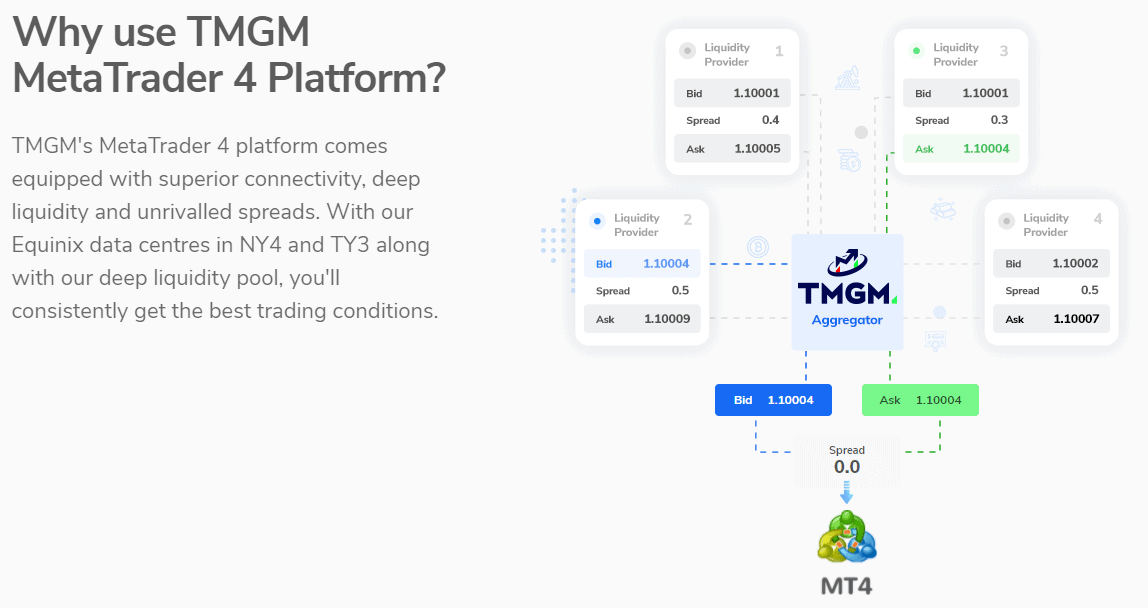

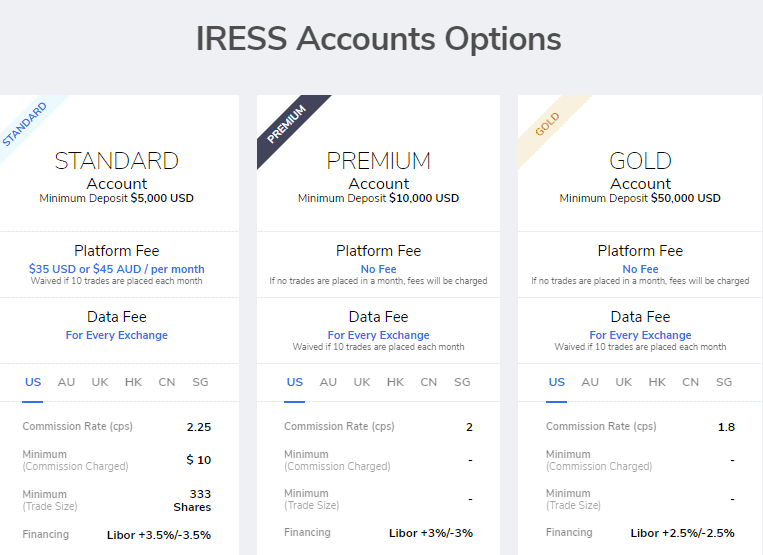

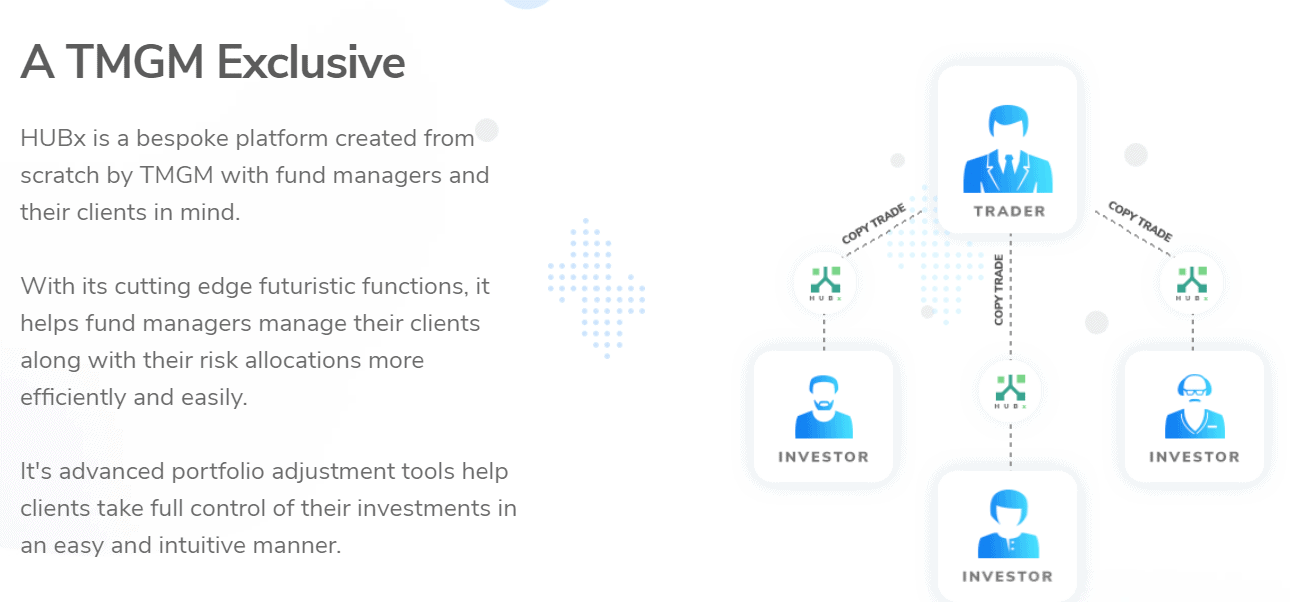

TMGM (formerly known as TradeMax Global Markets) is a multi-regulated forex broker with a powerful presence in Australia and New Zealand. This fx broker has low spreads with ECN pricing, MetaTrader 4 and DMA execution for stocks with IRESS.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

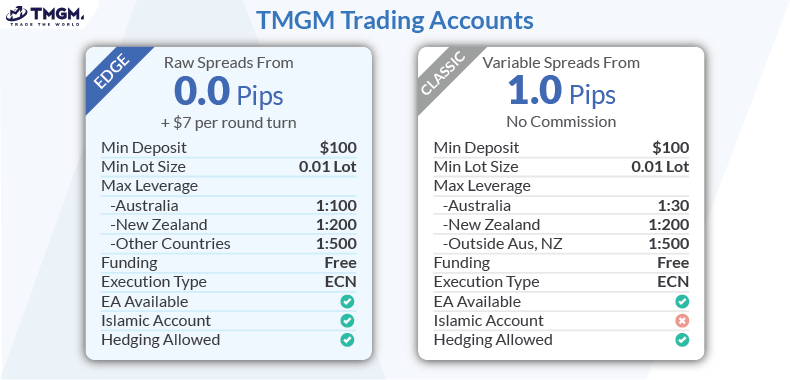

Account Types

Account Types

Spreads

Spreads

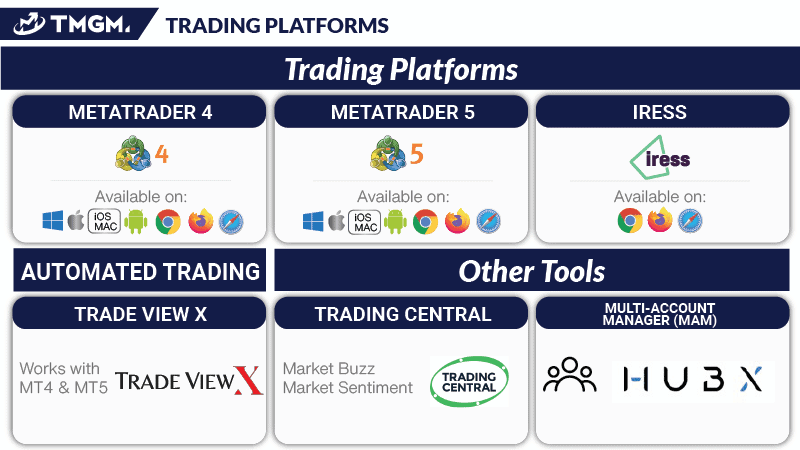

Trading Platforms

Trading Platforms

Forex Pairs + CFDs

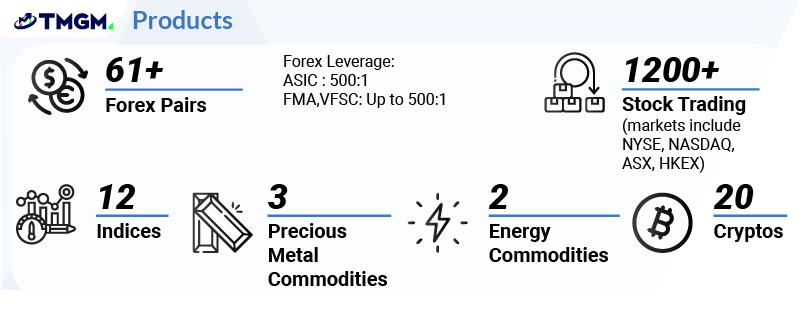

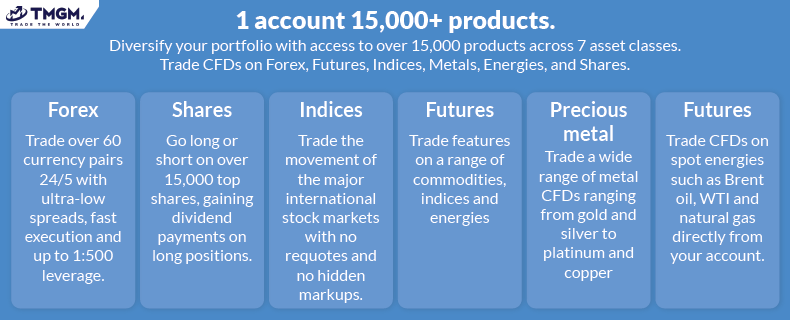

Forex Pairs + CFDs

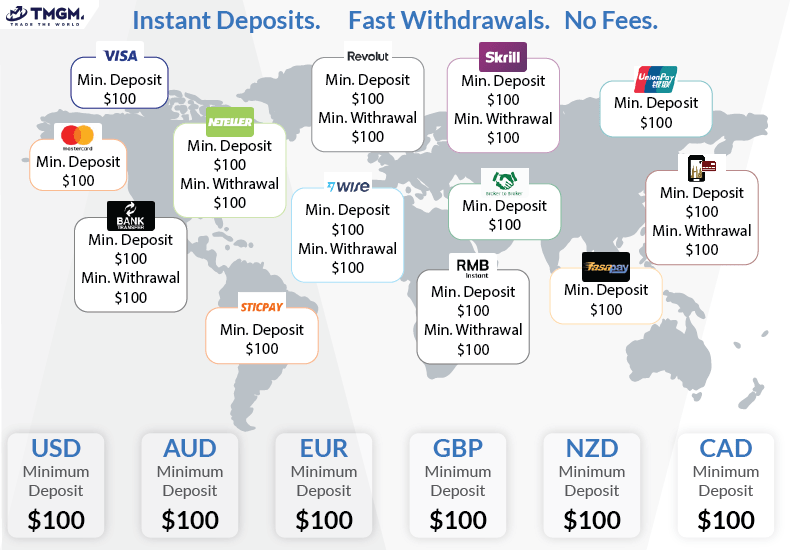

Minimum Deposit

Minimum Deposit

Forex Pairs + CFDs

Forex Pairs + CFDs

Leverage

Leverage

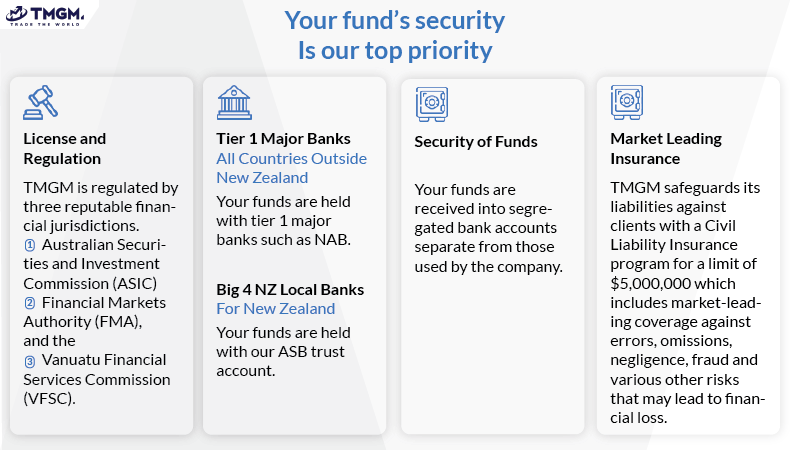

Regulation

Regulation

Ask an Expert

Hi, just wondering if there are any similar brokers that offer IRESS platform outside of Australia? Particularly in Asia countries. Interested in trading ASX CFD stocks with DMA.

As far as we are aware, TMGM is the only broker that offers IRESS for CFD trading outside Australia. Within Australia there is FP Markets