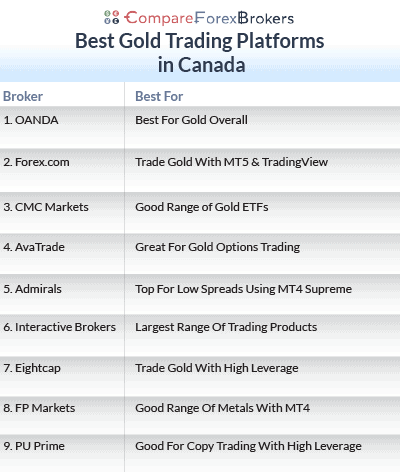

Best Gold Trading Platforms in Canada

We compared 17 gold trading accounts to find the best gold brokers for Canadian traders. I opened accounts, tested execution speeds during volatile sessions, and analyzed spreads on XAU/USD to produce this ranking.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Best Gold Trading Platforms in Canada

- OANDA - Best For Gold Overall

- Forex.com - Trade Gold With MT5 & TradingView

- CMC Markets - Good Range of Gold ETFs

- AvaTrade - Great For Gold Options Trading

- Admirals - Top For Low Spreads Using MT4 Supreme

- Interactive Brokers - Largest Range Of Trading Products

- Eightcap - Trade Precious Metals With High Leverage

- FP Markets - Good Range Of Metals With MT4

- PU Prime - Good For Copy Trading With High Leverage

Which broker offers the best gold trading platforms for Canadian traders?

FOREX.com leads in gold trading platforms for Canadian traders through tight precious metals spreads, multiple platform options including MT4 and proprietary solutions, and comprehensive commodity market access. We compared regulated brokers on XAU/USD pricing transparency, platform features for commodity trading, and Canadian dollar account support to determine the optimal gold trading solution for the Canadian market.

1. OANDA - Best For Gold Overall

Forex Panel Score

Average Spread

EUR/USD = 0.94 GBP/USD = 1.68 AUD/USD = 1.48

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA offers something unique in the Canadian gold trading space by allowing you to trade gold against 11 different currencies beyond the standard USD that most brokers do. XAU/JPY, XAU/CHF, XAU/GBP, XAU/CAD, and seven other pairings open up trading opportunities most competitors just don’t offer.

I like the XAU/CAD pair because it gives you direct exposure to gold against the Canadian dollar without managing cross-currency pairs. This matters if you’re earning in CAD and want to trade gold movements without extra conversion risk.

OANDA gives you 68 forex pairs, 21 bullion products including silver, platinum and palladium, and over 100 CFD instruments covering commodities, indices and bonds. You get four trading platforms: OANDA Trade, MT4, MT5, and TradingView. The broker is CIRO-regulated with CIPF protection. Zero minimum deposit requirement makes it accessible.

Pros & Cons

- Gold vs 11 currencies

- CIRO-regulated with CIPF protection

- Fractional unit gold trading

- Zero minimum deposit

- Four trading platforms

- Wider gold spreads (0.41 pips)

- Basic gold education

- No raw spread account

- Higher overall trading costs

Broker Details

Trade gold against 11 different currencies

OANDA lets you trade gold against JPY, CHF, EUR, GBP, AUD, CAD, NZD, SGD, and HKD plus USD. The XAU/CAD pair gives you direct exposure to gold against the Canadian dollar, useful if you’re earning in CAD and want to trade gold movements without cross-currency risk.

The XAU/JPY pair moves differently than XAU/USD because the yen strengthens during risk-off periods when gold rallies. You get different trading dynamics compared to just trading XAU/USD all the time. Most Canadian brokers don’t offer these alternative gold pairs at all.

Fractional units for exact sizing

OANDA uses a fractional system instead of standard lots for gold trading. As long as you are using OANDA trade (OANDA fx) you can trade positions as small as 1 unit which equals one unit of the base currency. This precision helps when you want exact position sizing without being forced into 0.01 or 0.1 lot increments.

I found this useful because you’re not locked into predetermined lot sizes on gold. You can scale your position to match exactly what your risk tolerance allows. On MT4 the minimum is 0.01 lots which equals 1,000 units on OANDA Trade.

This flexibility suits will suit you if you wish to trade small amounts to test new gold strategies without overcommitting capital. As far as I know, OANDA is the only broker offering this level of precision.

Complete trading offering

OANDA gives you 68 forex currency pairs to trade alongside gold. The broker offers 21 bullion products total, which includes silver, platinum, and palladium against multiple currencies. You also get access to commodities like Brent crude, WTI crude oil, natural gas, plus both hard and soft agricultural products.

Indices and bonds are available as well. This range suits traders who want to diversify beyond precious metals without opening multiple accounts. All instruments run through the same platforms with consistent execution quality.

Four trading platforms including TradingView

You get four platform choices with OANDA including their proprietary OANDA Trade, MT4, MT5, and TradingView. The broker impressed me because MT5 offers 21 timeframes compared to MT4’s nine timeframes, plus depth of market features for seeing gold order flow.

TradingView integration lets you trade gold directly from charts with their advanced technical tools. I prefer TradingView for analyzing gold price action because the charting capabilities beat most other platforms.

All four platforms connect to the same account so you can switch between them without opening multiple accounts for gold trading. OANDA Trade works on web, mobile, and tablets which gives you flexibility.

2. Forex.com - Trade Gold With MT5 & TradingView

Forex Panel Score

Average Spread

EUR/USD = 0.13 GBP/USD = 0.23 AUD/USD = 0.26

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

I recommend FOREX.com because they give you MT4, MT5, and TradingView with CIRO regulation and CIPF coverage up to $1 million. Their Raw Pricing account offers tighter gold spreads combined with transparent commissions that work well for active traders. The standard account has gold spreads from 1.0 pips with zero commissions, which suits traders holding positions longer.

FOREX.com gives you 4,500+ CFDs covering forex pairs, indices, commodities and bonds. The broker has been operating since 2001, showing a long track record in the industry.

Pros & Cons

- Three platforms for gold

- CIRO-regulated with CIPF coverage

- Raw pricing account option

- 4,500+ CFDs available

- Long operating history

- Commissions on Raw account

- Only XAU/USD available

- Demo expires after 30 days

- Spreads widen during volatility

Broker Details

Four professional platforms for gold trading

FOREX.com gives you FOREX.com trading platform, MT4, MT5, and TradingView from one account. You can use all three platforms without restrictions, switching between them based on what you need.

MT4 remains popular for automated gold trading strategies through expert advisors. MT5 offers more timeframes and better backtesting tools if you’re developing gold trading systems. TradingView integration gives you superior charting with the ability to execute trades directly from charts.

I like that you can use different platforms for different tasks, for example, TradingView for analysis and MT4 for running automated gold strategies with all connected to the same account balance. Just note that while your funds are shared across platforms, open trades aren’t synced, so you can’t open a gold CFD on MT4 and close it on TradingView.

Raw pricing account offers tighter gold spreads

Standard accounts offer gold spreads from 1.0 pips with zero commissions. Raw accounts have spreads from 0.4 pips plus commission per lot traded. Calculate your total cost per gold trade based on your trading frequency to determine which account works better for you.

A Raw Pricing account is also available but this is for Forex trading, if you use this account for Gold trading, you will only pay the spread and rollovers. Should you trade Gold, commission will be $7.00 each way or $14 in total. Spreads with this account start from 0.10 for EUR/USD and there are 84 Forex pairs to choose from.

In addition to low spreads, you can also get cash rebates. Provided you trade at least 4 million in metals, you can get a rebate. The more you trade, the more your rebate will be.

| Level | Volume | Rebate | Earn up to |

|---|---|---|---|

| 1 | $4m -$16m | $4 | $68 |

| 2 | $17m - $39m | $7 | $280 |

| 3 | $40m - $99m | $11 | $1100 |

| 4 | $100m - $199m | $16 | $3200 |

| 5 | $200m - $399m | $21 | $8380 |

| 6 | $400m+ | $27 | $10.8K+ |

4,500+ CFDs across multiple markets

Forex.com gives you 4,500+ CFDs covering different asset classes. You can trade forex pairs, major indices like the S&P 500 and NASDAQ, other commodities such as oil and natural gas, plus bonds. This range lets you diversify across different markets without opening multiple accounts.

CIPF coverage extends up to $1 million if the broker faces insolvency which matters for traders with larger account balances. You also get segregated client funds and negative balance protection, which means you can’t lose more than your account balance even during extreme gold volatility events.

| Forex | Indices | Shares | Soft Commodities | Energies | Metals | ETFS |

|---|---|---|---|---|---|---|

| 84 | 17 | 2500+ | 3 | 2 | 5 | 200 |

3. CMC Markets - Good Range of Gold ETFs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets are a solid broker choice as they offer over 1,000 ETFs including multiple gold-focused funds that give you different ways to gain gold exposure.You can trade gold mining ETFs, physical gold ETFs, and leveraged gold products from one account.

You can trade gold mining ETFs, physical gold ETFs, and leveraged gold products from one account. Other than gold, you get access to 330 forex pairs, over 9,000 shares, and more than 11,000 CFDs.

Their Next Generation platform comes with over 70 technical indicators built in for gold analysis. Gold spreads can go as low as 0.2 pips on XAU/USD during good market conditions, and there’s zero minimum deposit requirement to get started which is great for new traders.

Pros & Cons

- 1,000+ ETFs including gold

- CIRO-regulated in Canada

- 330 forex pairs available

- Zero minimum deposit

- 70+ technical indicators

- Commission account gets expensive

- No live chat support

- Platform learning curve

- MT4 version is basic

4. AvaTrade - Great For Gold Options Trading

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade operates in Canada through Friedberg Direct. The broker impressed me because they offer AvaOptions platform with vanilla options on gold featuring 260 different expiry dates. Gold options let you take defined-risk positions where your maximum loss is limited to the premium paid upfront. This becomes valuable when you expect significant gold moves but want to control downside risk.

The broker offers fixed spreads on gold meaning costs stay consistent even during volatile sessions when other brokers’ spreads widen. AvaTrade gives you 170+ instruments total including 40+ currency pairs for options, commodities, indices, stocks, and bonds/treasuries. You also get access to MT4, MT5, AvaOptions and WebTrader platforms. Minimum deposit is $250 USD.

Pros & Cons

- Gold options (260 expiries)

- CIRO-regulated through Friedberg Direct

- Fixed gold spreads

- 170+ instruments available

- Defined-risk options trading

- Higher fixed gold spreads

- Lower leverage vs offshore

- Inactivity fees apply

- No cTrader platform

5. Admirals - Top For Low Spreads Using MT4 Supreme

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.5 AUD/USD = 0.4

Trading Platforms

MT4, MT5, Admirals Platform

Minimum Deposit

$100

Why We Recommend Admirals

I recommend Admirals because they offer a Zero account with 0.0 pips spreads on gold combined with a $3 per lot commission. The broker provides MT4 Supreme Edition which is an enhanced version of MT4 with additional trading tools along with MT5. Spread only gold trading is also available with a Trade.MT4 or Trade.MT5 account.

Admirals gives you 82 forex pairs, 4,500+ stocks, and 300+ ETFs to trade. The broker offers 16 spot commodities plus 11 commodity futures including silver, platinum, oil, gas and agriculture. You also get 43 indices and bonds.

Their commission structure stays competitive for active gold traders, and the broker offers gold education through Admirals Academy which includes webinars and tutorials focused on precious metals trading.

Pros & Cons

- Zero gold spreads (0.0 pips)

- CIRO-regulated in Canada

- MT4 Supreme Edition

- 4,500+ stocks available

- 300+ ETFs to trade

- Commissions add up quickly

- Fewer gold pairs available

- No TradingView integration

- Inactivity fee after 24 months

6. Interactive Brokers - Largest Range Of Trading Products

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers offers gold futures, gold options, gold CFDs, and gold ETFs all from one account. This range beats most competitors because you get multiple ways to access gold markets depending on your trading style. The broker provides direct market access to COMEX gold futures which gives you deep institutional liquidity.

You get access to over 160 markets in 36 countries through Interactive Brokers. Their Trader Workstation platform offers advanced tools including Level II pricing for gold. The broker also provides Bitcoin ETPs and ETFs which are CIRO-compliant for Canadian clients, plus crypto futures like Micro Bitcoin and Micro Ether. You can trade stocks, options, futures, bonds and ETFs alongside gold.

The broker is CIRO-regulated with CIPF coverage. TradingView integration is available but note there’s no MetaTrader support.

No minimum deposit but inactivity fees apply if you don’t maintain minimum activity levels. The platform complexity suits experienced traders more than beginners.

Pros & Cons

- Gold futures, options, CFDs, ETFs

- Bitcoin ETPs/ETFs available

- TWS and TradingView platforms

- Direct COMEX gold access

- 160+ markets in 36 countries

- Complex platform for beginners

- Higher inactivity fees

- Steep learning curve

- No MetaTrader support

7. Eightcap - Trade Gold With High Leverage

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

I like Eightcap because they offer gold spreads from 0.12 pips on XAU/USD with their Raw account which ranks among the tightest available. The broker gives you access to 95 cryptocurrency CFDs covering Bitcoin, Ethereum and many altcoins that CIRO brokers in Canada don’t offer. This makes Eightcap a strong choice if you want both tight gold pricing and crypto exposure from one account.

Eightcap gives you 56 forex pairs, 600 stock CFDs available on MT5 and TradingView, plus 16 commodities including gold, silver and oil. You also get 17 indices to trade. The broker offers leverage up to 1:500 for gold and forex under their SCB Bahamas license, which exceeds what Canadian regulated brokers can provide.

You get MT4, MT5, and TradingView platforms for your trading. I like their Insights section which includes Trade Zone for live market analysis and Labs for trading ideas. The AI-powered economic calendar is useful because it alerts you before major releases.

FlashTrader is their execution tool for scalping with low latency, which matters if you’re trading volatile gold moves.

Pros & Cons

- Tight gold spreads (0.12 pips)

- 95 cryptocurrency CFDs

- High gold leverage (1:500)

- Three trading platforms

- Low $100 minimum deposit

- No Canadian investor protection

- Demo limited to 30 days

- Inactivity fees after 3 months

- Limited educational resources for metals

8. FP Markets - Good Range Of Metals With MT4

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets offers gold, silver, platinum, and palladium trading which gives you diversification across precious metals. You get access to over 10,000 instruments 70 forex pairs, 12 crypto CFDs covering Bitcoin, Ethereum, Litecoin, Ripple and more, plus hundreds of stocks available via their platforms.

Other products include commodities like silver, platinum, oil, gas, corn and sugar alongside gold. Indices, ETFs and bonds round out the offering. Forex and gold pairs can be traded with leverage of 1:500.

Their Raw account provides gold spreads from 0.12 pips plus $3 commission per lot. You get MT4, MT5, cTrader and TradingView for trading. The broker also provides copy trading features through Signal Start developed by Myfxbook along with their own copy trading app should you want to follow experienced gold traders automatically.

Pros & Cons

- Multiple precious metals available

- 10,000+ instruments total

- Five trading platforms

- Copy trading features

- No Canadian investor protection

- $100 minimum deposit

- Limited gold education

9. PU Prime - Good For Copy Trading With High Leverage

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4, MT5, PUPrime Webtrader

Minimum Deposit

$50

Why We Recommend PU Prime

I’d recommend PU Prime to traders interested in copy trading. The broker lets you automatically follow experienced traders, which works well if you want to learn from others or don’t have time to watch the markets constantly.

You get leverage up to 1:1000 which gives you more position control, plus access to cryptocurrency CFDs that CIRO-regulated brokers in Canada cannot provide.

The broker gives you more than 1,400 instruments including forex, crypto CFDs, indices, stocks, commodities, ETFs and bonds. PU Prime isn’t CIRO-regulated, which allows Canadian traders to access the higher leverage and crypto markets.

You get three platforms including MT4, MT5, and their proprietary WebTrader. I like that they offer ECN accounts with spreads from 0.0 pips which keeps costs down for active traders. The $50 minimum deposit makes it accessible if you’re starting small.

Should you wish to copy trade, PU Prime has PU Copy trading and PU Social.

Pros & Cons

- Copy trading features

- Leverage up to 1:1000

- Cryptocurrency CFDs available

- Low $50 minimum deposit

- ECN spreads from 0.0 pips

- Not CIRO-regulated

- No Canadian investor protection

- Limited educational resources

- Spreads vary by account type