What is the Minimum Trade for CFD?

Most brokers will accept a minimum trade size for CFDs of 0.01 (called a micro lot) of 1 standard lot. Since a standard lot is equal to 100,000 units of a given currency, a micro lot (0.01) is 1000 units.

While the lot size will impact how big your trade is, there are other minimums you will need to meet to start trading CFDs. These include a minimum deposit to open an account and margin requirements to make a trade.

On this page, we will dive into what Lot sizes are and how they will affect your trading and also cover minimum deposits and margin requirements.

What Are Lot Sizes And How Do They Affect My Trades?

Lot size is a unit of measure that allows trades in securities or assets to be standardised and makes trading CFDs practical. Trading a single unit is often too small to be practical to trade with. In Forex, for example, changes in one currency relative to the other currency in the pair are measured in pips which goes to the 4th decimal making a single trade so small it will be less than a cent. To solve this, trades are done in large batches or units called lots.

“The aim of a lot size is to determine the minimum quantity of a product of asset that can be traded in a single transaction”

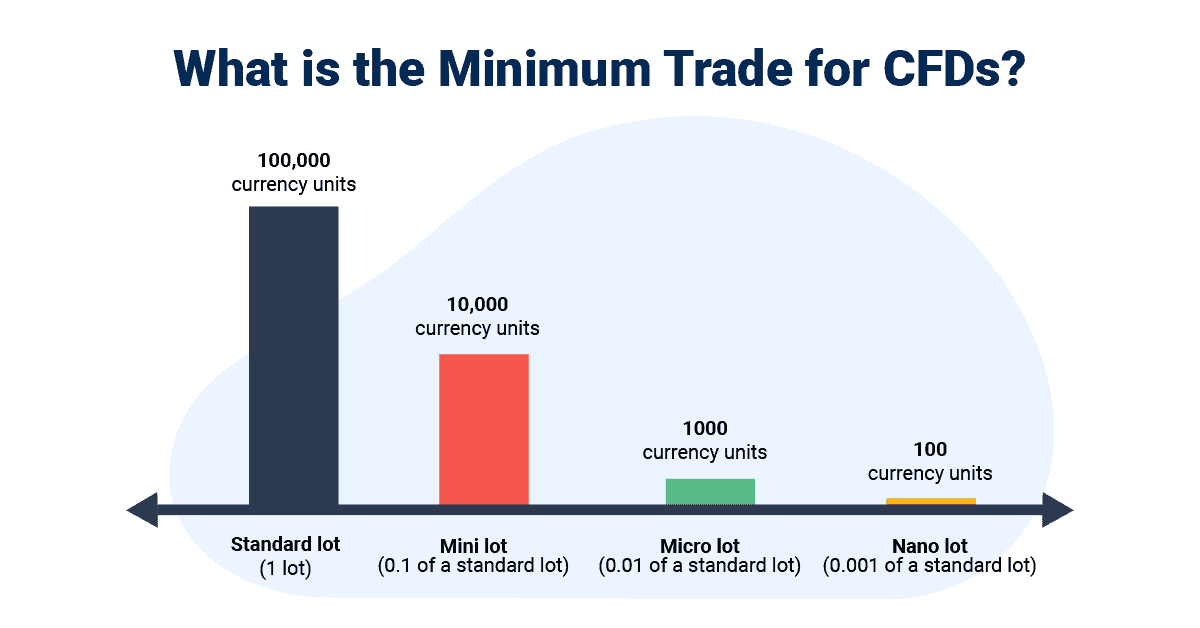

In Forex, there are four types of lots commonly recognised:

- Standard lots (100,000 currency units)

- Mini lots (10,000 currency units or 0.1 of a standard lot)

- Micro lots (1,000 currency units or 0.01 of a standard lot)

- Nano lots (1 currency unit or 0.001 of a standard lot)

While a nano lot is smaller than a micro lot, very few brokers will accept lower than a micro lot. For this reason, for practical purposes, the smallest lot size is a micro lot. The exception to this is with OANDA Trade and when using the TradingView platform (assuming the broker allows it), which permits nano lot trading.

1. Do All CFDs Use Lots Sizing?

Trading sizes can also vary depending if you want to trade share CFDs, commodity CFDs, forex CFDs, index CFDs, bond CFDs, or other products. Options generally have 100 as a standard, while bonds have 1000 lots as a standard. Not all products, however, use lots.

Here are examples of sizes for a few of the most popular CFD products:

| CFD Product | Standard Lot | Mini Lot | Micro Lot |

| Forex Pairs | 100,000 units | 10,000 units | 1,000 units |

| Gold/Silver | 100 ounces | 10 ounces | 1 ounce |

| S&P 500 Indices CFD | $50 per point | $10 per point | $1 per point |

| FTSE 100 CFD | £10 per point | £2 per point | £0,2 per point |

| Crude Oil | 1,000 barrels | 100 barrels | 10 barrels |

| Stocks | 100 shares | 10 shares | 1 share |

Note: measures may vary for each specific product; for example, Copper, unlike gold, is measured in cents per pound, not ounces.

2. What is the value of each Lot?

While the value of lots varies per currency pair and by the brokers, the EUR/USD pair will usually be the following for each one pip movement:

- Standard Lot: $10/pip

- Mini Lot: $1/pip

- Micro Lot: $0.1/pip

- Nano Lot: $0.0001/pip

For example, if you trade one standard Lot of the EURUSD with your CFD broker, you will take on a EURUSD position worth €100,000.

3. An Example of Trading With Lots

When trading a mini lot of a EUR/USD CFD, you deal with 10,000 units of the base currency (EUR). If you enter a position when the EUR/USD is at 1.1000 and it moves to 1.1010, this is a 10-pip movement in your favour. With a mini lot, each pip is worth $1. So, for a 10-pip increase, your profit would be $10 ($1 per pip x 10 pips). Conversely, if the EUR/USD moves against you to 1.0990, a 10-pip decrease means you would lose $10 ($1 per pip x 10 pips).

Shares Examples

Now, imagine you’re trading a standard lot of the S&P500 stock index CFD, which represents $50 per point the index moves. If the index moves 20 points in your direction, you will earn $1000 ($50 per point x 20 points). If the index moves against you by 10 points, you’ll lose $500 ($50 per point x 10 points).

Choosing different lot sizes allows you to determine how much you want to risk and the potential profit on each CFD trade.

Minimum Deposit Of Your Broker

To open an account, some brokers require you to have a minimum amount of funding in your trading account; this is called the initial deposit or minimum deposit. Many brokers require this minimum deposit as they want to ensure clients are serious traders since there is an operational cost of setting up an account for their clients.

FxPro, FP Markets, eToro and City Index have minimum deposit requirements between £50 and £200, while some brokers even have minimum deposit requirements of £1000+. These accounts with minimum deposit requirements tend to be targeted at professional traders and may come with extras such as reduced commission or a personal account manager.

While many brokers do have minimum deposit requirements, not all do. Pepperstone, Axi, IG, Saxo, Interactive Brokers, and CMC Markets allow you to sign up for an account with $0. Obviously, you will still need funding in your account to trade (called minimum margin) but it does allow you to look around their website and use their education tools at no cost.

Minimum Margin Requirements For CFDs

To open a trading position, you must have enough funds in your trading account to meet margin requirements. Margin is the collateral required to open and maintain a leveraged position with your broker and acts as assurance or collateral for the broker that you can hold the trade until it is closed.

The initial margin requirements will vary depending on the CFD you trade and how much leverage you use. For example, if you’re focused on forex trading, and you trade one Standard Lot of the GBPUSD currency pair (worth £100,000), and your broker offers 50x leverage, your position will have a required margin of £2,000 (50 times £2,000 is £100,000). If you’re trading share CFDs a standard lot size is 100 shares.

Major currency pairs such as EUR/USD or GBP/USD have fewer margin requirements since you trade these with higher leverage. Most brokers and regulators will limit the leverage you can use with minor and exotic Forex pairs since they are more volatile and have less liquidity. Understanding a broker’s margin requirements helps us assess how much capital we need to maintain our positions and manage our risk exposure effectively.

Factors Influencing Minimum Trade Requirements

In CFD trading, minimum trade sizes are shaped by various factors, each crucial for traders to understand as it will affect the size of your profits and losses and greatly affect your risk management plan. Here are some of the factors related to minimum trade sizes:

1. Broker Policies

Different brokers have varying minimum trade requirements, influenced by their target clientele and competitive strategies. Choices range widely, catering to beginners with lower minimums and professionals with higher thresholds, emphasising the importance of selecting a CFD provider that aligns with your individual CFD trading goals.

2. Market Volatility

Market volatility can prompt brokers to adjust minimum trade sizes to mitigate risk during turbulent periods. Most brokers don’t want their clients to get blown out in a volatile market, depleting their capital, or even ending up with a debt with the broker.

3. Account Type

Most brokers accept micro lots and above with their trading account, but some are designed for micro lot trading. These accounts are usually called cent accounts and may or may not have slightly increased spreads to account for the small trading sizes.

4. Regulatory Requirements

Regulations across jurisdictions impact minimum trade sizes by dictating leverage and margin requirements. The minimum size for one regulator (such as financial conduct authority)may differ for another.

Together, these factors—broker policies, market volatility, account types, and regulatory requirements determine the landscape of minimum trade size requirements in CFD trading.

How to Find a Broker’s Minimum Trade Size

Identifying a broker’s minimum trade size is an important step when you’re ready to start trading. Here are a few steps to help you find out your broker’s trade size:

- Check the Website: Start by exploring the broker’s official website. Look for sections like “Account Types,” “FAQ,” or “Trading Conditions,” where minimum trade sizes are often listed.

- Read the Fine Print: Dive into the terms and conditions, user agreements, or product disclosure statement. This section contains vital details about trading policies, including minimum trade sizes, which are often overlooked.

- Contact Customer Support: If the information isn’t clear or you need further clarification, don’t hesitate to contact the broker’s customer support. They can answer your queries about minimum trade sizes and other trading conditions directly.

The Importance of Minimum Trade Size for Traders

Understanding the minimum trade size is crucial if you have a small amount of trading capital or if you’re looking to start trading with small amounts. Here are some of the reasons we have that view:

- Managing Risk: Smaller minimum trade sizes allow for finer control over the amount of capital at risk in a single trade. This can be important for traders who like to pyramid into or out of position, adding or removing a fraction of their trading position at any one time.

- Trading Strategy: The minimum trade size can influence the overall trading strategy. Smaller minimums enable more transactions with a lower capital requirement for traders focusing on high-frequency, low-margin trades. Conversely, traders with more considerable capital might prefer brokers with larger minimum trade sizes but potentially lower transaction costs relative to the trade size.

- Costs and Fees: Minimum trade sizes also affect the costs and fees associated with trading. Smaller trade sizes might incur higher relative fees, affecting profitability. For us, this is one of our biggest concerns with trading smaller sizes.

In essence, the minimum trade size is a critical factor in the trading equation, affecting risk management, trading strategies, and the cost-efficiency of trading activities. You have to carefully consider these elements when selecting a broker.

Minimum Trade Size Conclusion

Choosing a broker with the appropriate minimum trade size is more than just a numerical decision; it’s about aligning with your financial goals, trading style, and risk tolerance.

In the vast ocean of trading, understanding and leveraging minimum trade sizes when selecting your broker can help to optimise your trading journey. The above information should be enough to get you started but feel free to look around our website for more information to help you with choosing the best broker for you.

Understanding CFD Trading

CFDs, or Contracts for Difference, are a popular form of derivative trading product that allows you to speculate on the rising or falling prices of fast-moving global financial markets (similar to share trading). This includes stocks, indices, Forex, commodities, and currencies.

The appeal of CFD trading lies in its accessibility, providing leverage to magnify your returns and the ability to go long (buy) if you think prices will rise, or go short (sell) if you expect them to fall. However, it’s not without risks; the leverage that can amplify your gains can also increase your losses.

CFD trading does not involve the actual buying or selling of the underlying asset. Instead, you enter into a contract with a broker to exchange the difference in price from when the position is opened to when it is closed. This approach offers you the flexibility to profit from price movements without ever owning the assets, providing exposure to markets that might be otherwise inaccessible to you.