Best AI For Forex Trading in the United Kingdom

In my review of the best AI forex trading tools, indicators, and bots for 2026, I will help you find the right AI features to support your trading strategy. On this page, I’ll explain what AI is, how it can enhance your Forex trading, and recommend some of the top tools currently available along with broker that offer is.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Here are our top AI Forex trading brokers in the UK:

- Pepperstone - Best AI Powered Forex Broker in the UK

- Eightcap - Leading UK Broker for TradingView AI Integration

- IG Group - Excellent ProRealTime AI Analytics

- eToro - Top Social and Copy Trading with AI Tools

- AvaTrade - Driven AI Strategies

Which broker offers the best AI tools for UK traders?

IG Group delivers superior AI trading tools for UK traders through ProRealTime’s ProRealTrend feature, which automatically calculates trend lines, support and resistance levels across multiple timeframes. Our comparison examined AI-driven pattern detection, backtesting capabilities on UK market data, GBP pair analysis speed, and sentiment integration from UK news sources to determine which broker provides the most sophisticated AI-assisted trading environment.

1. Pepperstone - The Best AI-Powered Forex Broker in the UK

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

I awarded Pepperstone my highest score (98/100) for its tight spreads with its Razor account. With average spreads of 0.19 pips for EUR/USD currency pairs and execution speeds below 100ms plus 93 currency pairs, the Razor account has some of the best trading conditions available.

Pepperstone has a solid range of AI trading tools including Autochartist for automated AI-powered technical analysis. You can also use Copy trading with Pepperstone, cTrader Copy and Signals if using MetaTrader 4 or 5. You can also use AI to automate your trading with MT4 and MT5 Expert Advisors.

Pros & Cons

- Best-in-class spreads and execution speeds.

- AI tools for both beginners (AutoChartist) and pros (cTrader Automate).

- Free TradingView Premium access.

- No native social trading features

- Limited stock CFDs

Broker Details

Excellent AI Trading Tools

Pepperstone gives you a good choice of trading tools, most of which have useful AI features. Below is a summary of the AI features I found with each platform.

1. MetaTrader 4 And MetaTrader 5

- Expert Advisors for Automation. You can write algorithms to create bots that will search for opportunities and open and/or close trading positions for you.

- MQL5 Signals – Over 3200+ signals are available to copy other traders in real time.

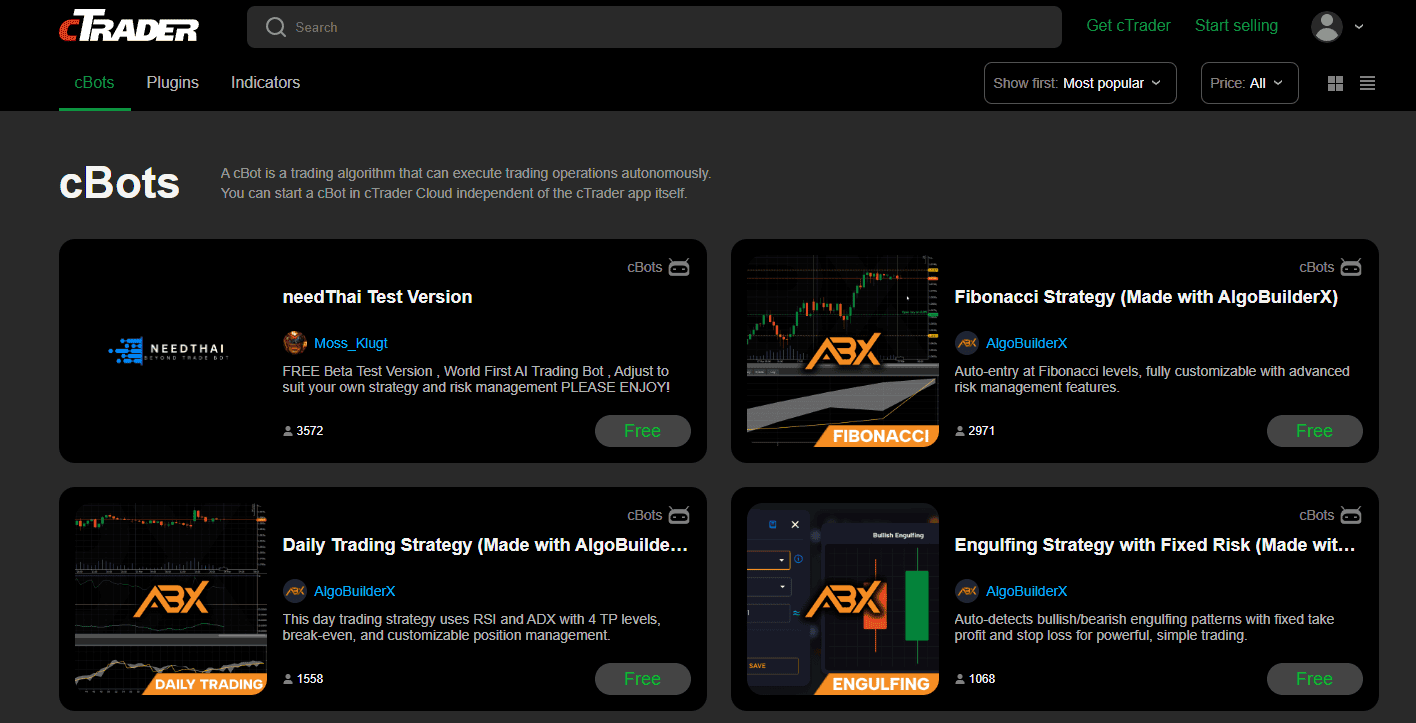

2. cTrader

- cTrader Copy integrates with cTrader platforms so you can copy the trading strategies of other traders in the network.

- CTrader Automate – cBots can be created to automate your trading much like Expert Advisors

3. TradingView – I cover some of these features in the Eightcap section

4. Copy Trading by Pepperstone – this app leverages Pelican Trading INC. extensive network of signal providers to help you find the providers to copy. This app also comes with useful risk management tools.

Another tool that I find helpful and available with all these platforms is Autochartist. This tool scans Pepperstone’s 1200 markets to find trading ideas to help you with trading. Autochartist uses methods like harmonic patterns, support and resistance levels, candlestick patterns, and Fibonacci setups to achieve this.

With over five signals per day along with entry, stop loss, and take profit levels, I find Autochartist makes trading much simpler. This is especially so since Autochartist includes commentary explaining the logic behind the analysis.

Fast Execution Speeds on Multiple Trading Platforms

An important factor for me is how fast a broker’s execution speeds are as they can cost you considerably by suffering from negative slippage.

Fortunately, in my analyst’s tests Pepperstone secured 2nd place out of 36 brokers tested thanks to its 77 ms limit order speeds.

Limit orders impact your pending orders like stop loss and take profits, so having anything sub-100ms is a near instant execution which protects you from slippage.

| Broker | Limit Order Rank | Limit Order Speed (ms) | Broker Type |

|---|---|---|---|

| Blackbull Markets | 1 | 72 | ECN |

| Pepperstone | 2 | 77 | ECN |

| Fusion Markets | 3 | 79 | ECN |

| Octa | 4 | 81 | ECN |

| OANDA | 5 | 86 | Market Maker |

| Blueberry Markets | 6 | 88 | ECN |

| Global Prime | 7 | 88 | ECN |

| Axi | 8 | 90 | ECN |

| Tickmill | 9 | 91 | ECN |

| Exness | 10 | 92 | Market Maker |

Low Spreads On Standard and Raw Account

Pepperstone gives you a choice of Standard or Razor account when it comes to account types. The Standard account is commission-free with spreads from 1 pip on Forex CFDs.

The Razor account has lower spreads from 0 pips while you pay a £2.25/lot. Overall my colleague Ross Collins found Pepperstone spreads to be among the most competitive in the markets with an average spread of 0.19 pips on EUR/USD which is 30% cheaper than the industry average.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

2. Eightcap - Best UK Broker for TradingView AI Integration

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.23 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why I Recommend Eightcap

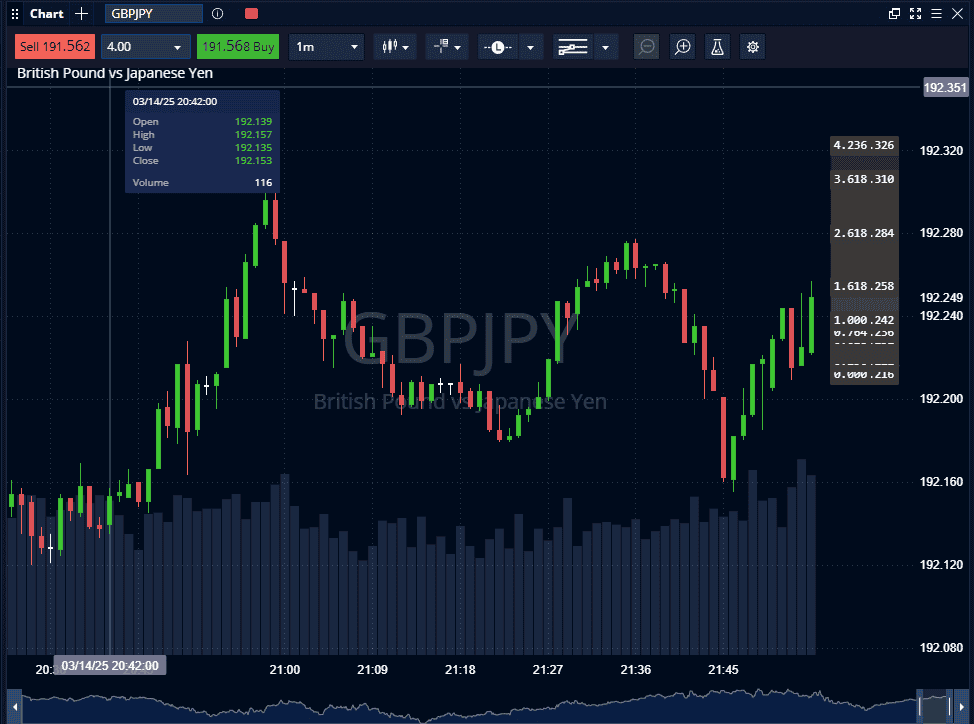

Eightcap is one of my top brokers for TradingView, providing low spreads (from 1 pip) and no commissions on its TradingView account.

The platform’s AI-generated trend lines help find support and resistance levels, making it easier to identify potential breakout trades across the broker’s 300+ CFD markets.

Eightcap scored highly in my tests, achieving 96/100 with top markets for its low trading costs and excellent customer service.

Pros & Cons

- Seamless TradingView AI scripting.

- No-code automation via Capitalise.ai.

- Competitive crypto CFD range.

- No MT4/MT5 for UK clients.

- Limited research tools.

Broker Details

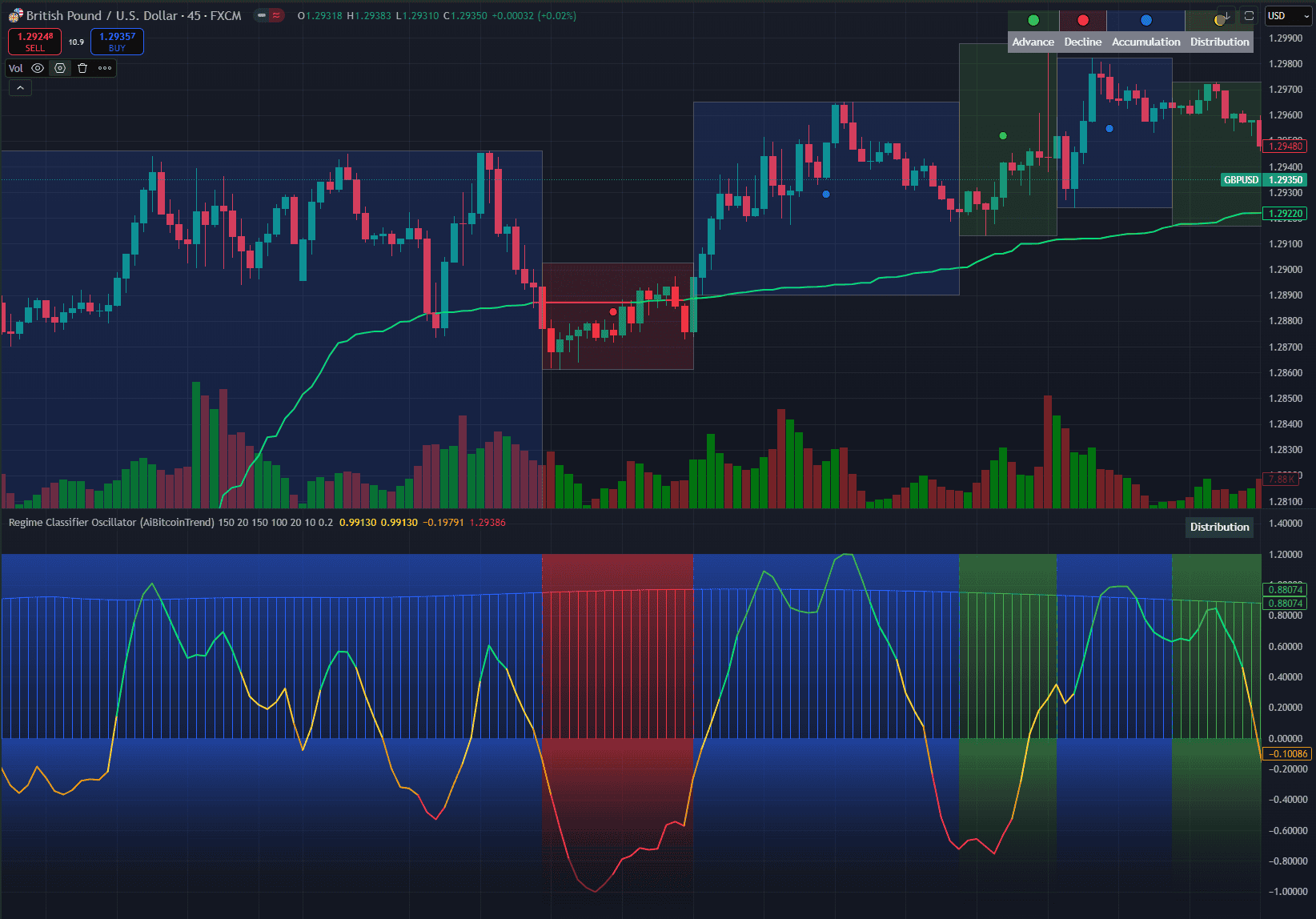

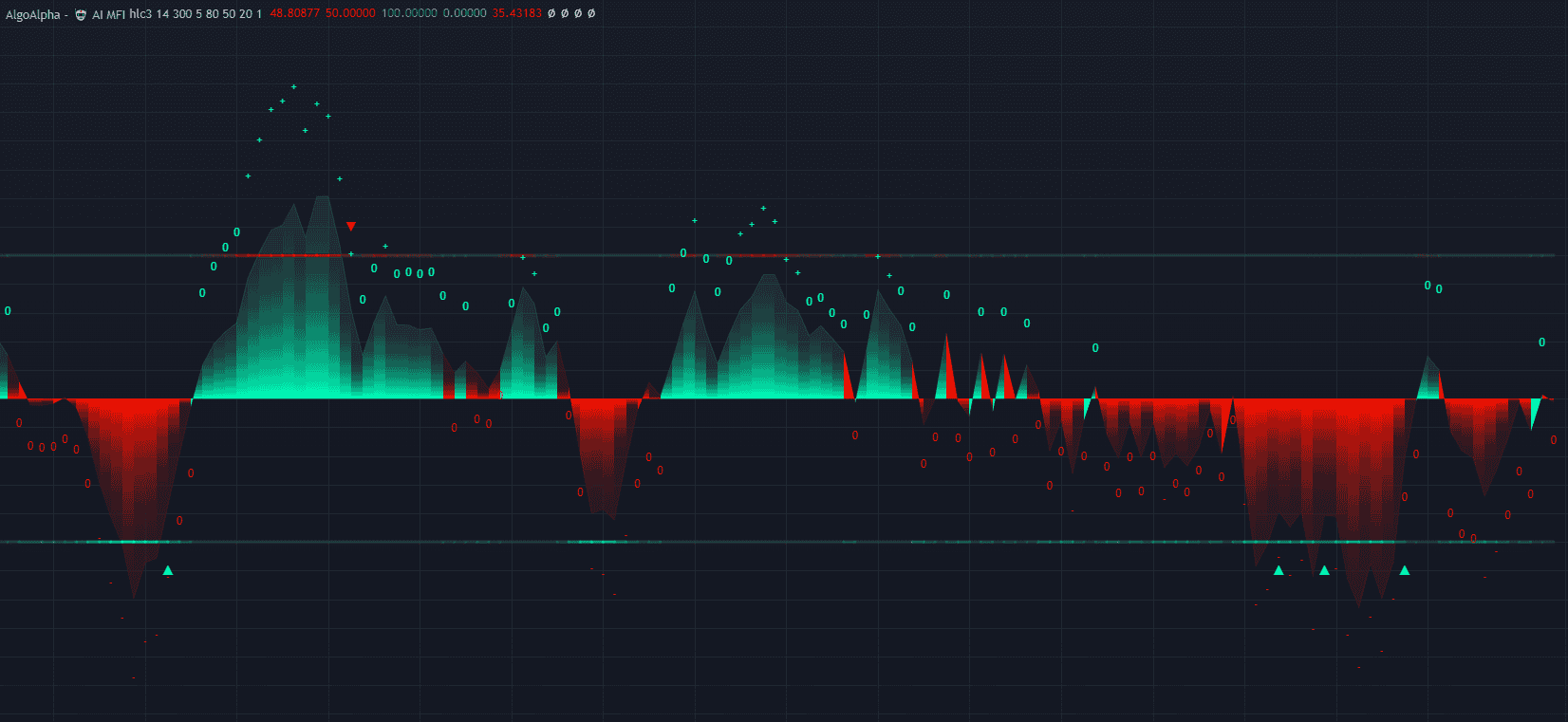

AI Trading Tools With TradingView

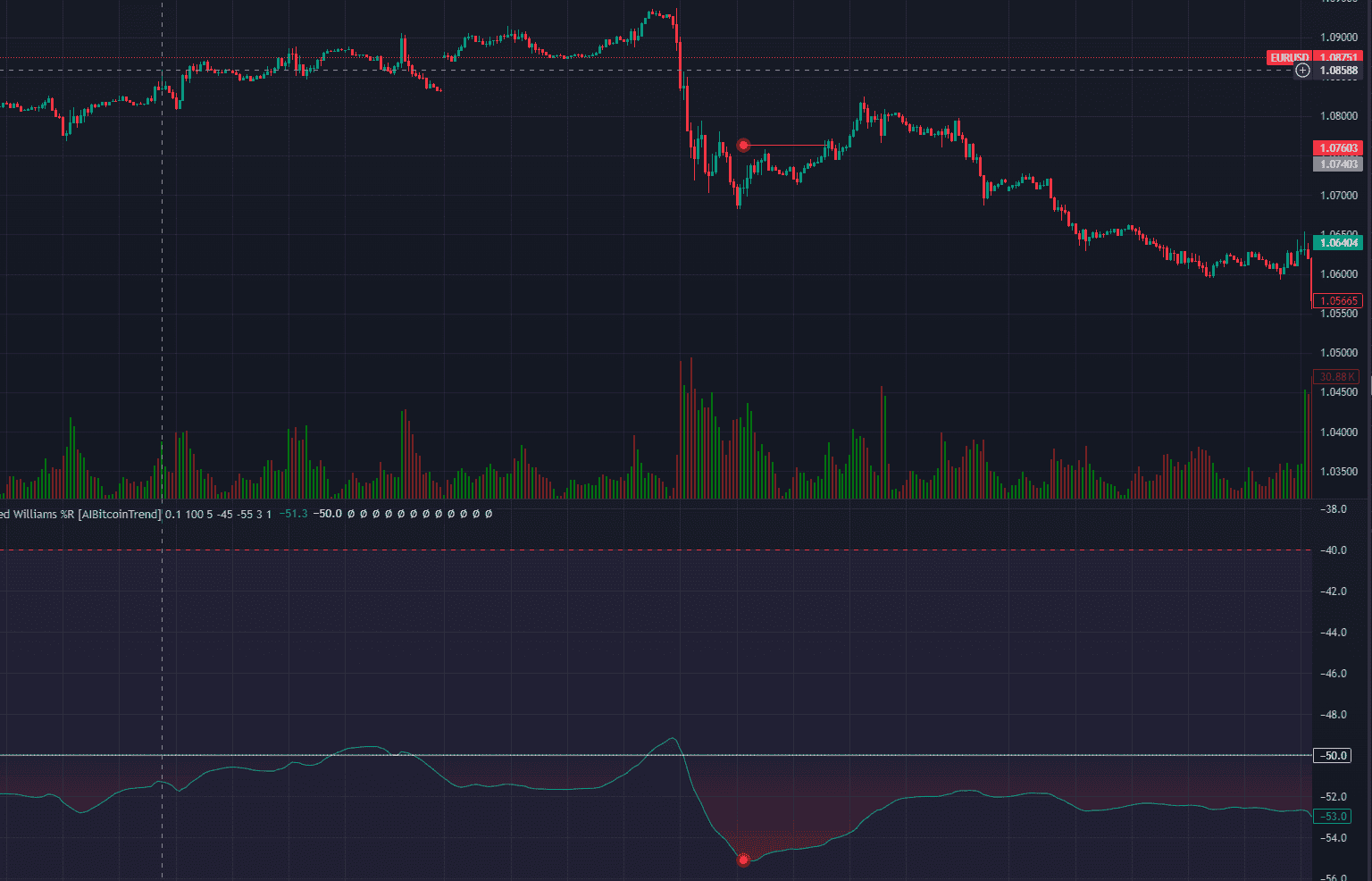

TradingView is my top trading platform choice for technical analysis with its 110+ technical indicators covering everything from MACD to Pivot Points.

You can use custom indicators and scripts from the tens of thousands of developers for free. This gives you more tools to find a trading strategy that suits you. Examples include AI-powered indicators like

- AI Trend Navigator which uses a k-Nearest Neighbours (KNN) classifier to forecast market trades based on price actions

- AI-Powered Breakouts combines breakout detection techniques with adaptive moving averages to find market breakouts.

For me, this makes it easy to analyse multiple markets in seconds. The tool highlights the key levels to watch, even for markets I don’t typically trade.

Other AI tools include:

‘All Chart Pattern’ to automatically help you find technical patterns like tops and bottoms

Trend Analysis to find recurring patterns and predict future market trends using historical and live data

Sentimental analysis to analyse trends in the news and online social media

Low Spreads On The TradingView Account

Eightcap currently provides a Standard account for their TradingView platform with spreads from 1 pip on EUR/USD with zero commissions.

During my time trading with the account, I found the spreads varied between 1 and 1.2 pips for both EUR/USD and GBP/USD. Compared to most brokers I’ve used, I’d consider Eightcap’s spreads to be on the lower end.

As you can see below, here are the spreads on Eightcap compared to the industry average across the major pairs.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall |

|---|---|---|---|---|---|---|---|---|---|

| Eightcap Average Spread | 1 | 1.2 | 1.2 | 1.2 | 1.2 | 1.1 | 1.2 | 1.2 | 1.16 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 | 1.6 |

Great Range of Financial Markets

With Eightcap, you have a decent collection of markets, offering 300+ CFD markets, which include:

- 55 currency pairs (including all major and minors, with some exotic pairs)

- 150 share CFDs covering UK and US markets like Tesco and Tesla

- 10 commodities including natural gas, oil, and metals like gold and silver

- 30 stock indices ranging from the FTSE 100 to the NASDAQ

By using TradingView, you can set up market scanners to find potential trading opportunities. These scanners work based on your trading criteria, like RSI above 80 or moving average crossovers.

I find tools like this make day trading easier. You can set up the scanner and let it find matching assets, allowing you to quickly validate the alert before trading.

Fund an Eightcap account and unlock a TradingView Plus plan worth £33.95 per month

*Your capital is at risk ‘74% of retail CFD accounts lose money’

3. IG Group - Best for ProRealTime’s AI Analytics

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why I Recommend IG Group

I chose IG for its ProRealTime platform that offers ProRealTrend tools to automate channel trading and find key price levels on any timeframe. This tool makes ProRealTime a top choice if you’re a breakout trader as the ProRealTrend speeds up your analysis.

You can benefit from the automated tool while scanning IG Group’s 17,000+ markets, including 110 forex pairs and 130 indices. This is the most extensive collection of UK brokers I tested.

Due to the large range of markets and low trading costs (from 0.6 pips), the broker scored 78/100 from my tests.

Pros & Cons

- Institutional-grade AI backtesting

- 17,000+ markets, including UK shares.

- Reliable FCA regulation.

- High minimum deposit for ProRealTime.

- Wider spreads than Pepperstone/Eightcap.

Broker Details

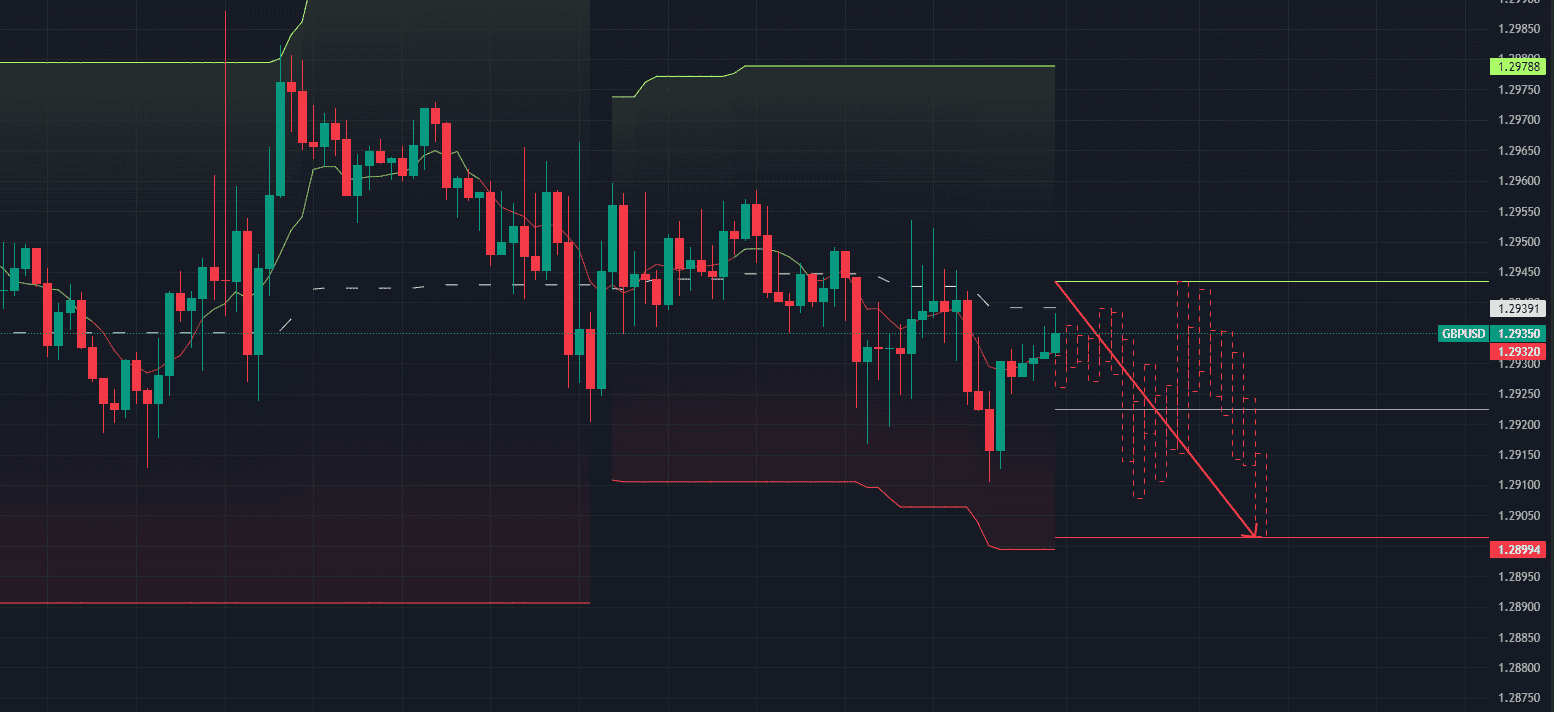

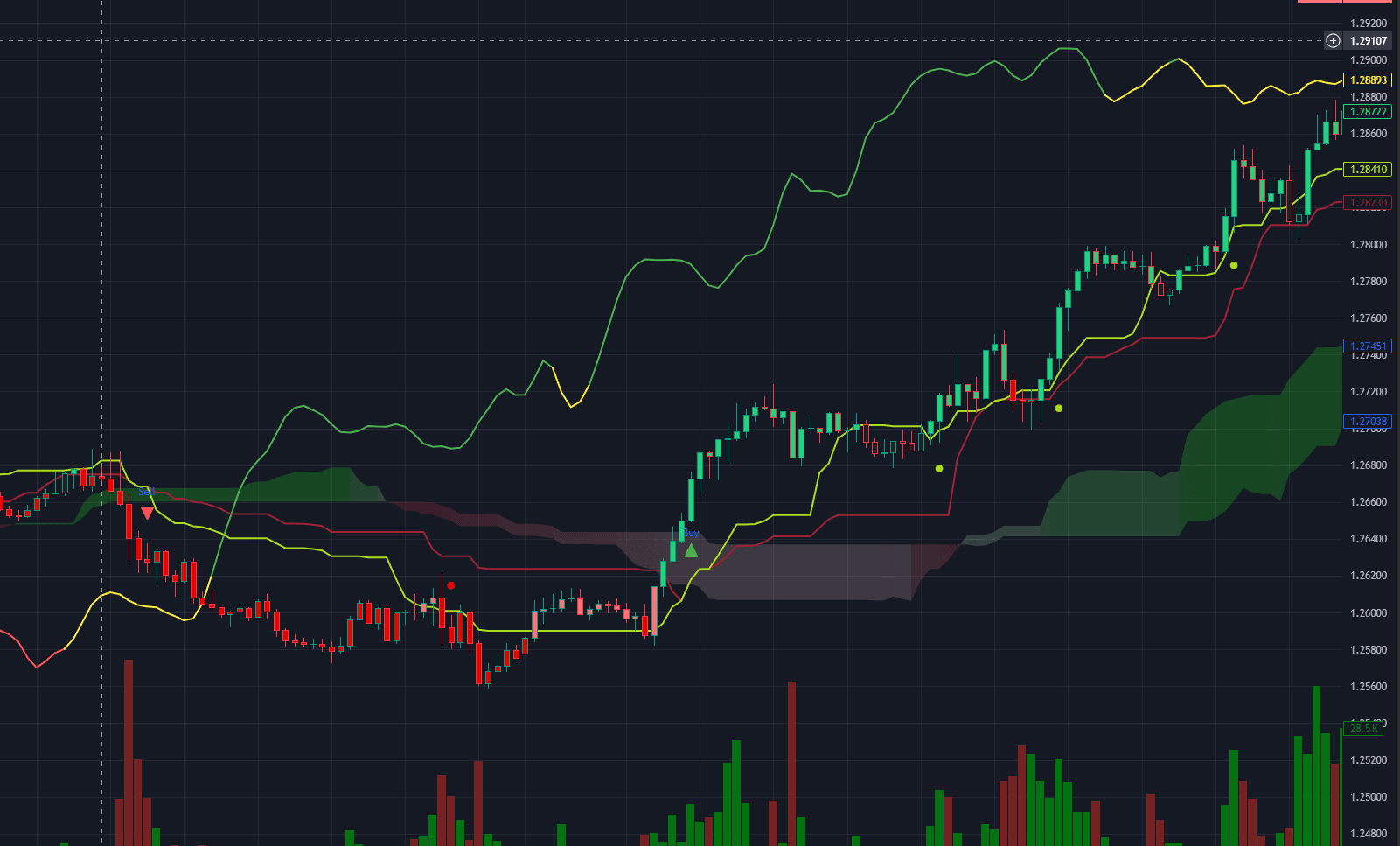

AI-Generated Trend Lines With ProRealTime

ProRealTime is a trading platform combining TradingView’s charting features and MetaTrader 4’s automated trading – making it a solid all-in-one platform.

One of my top features on the platform is the ProRealTrend tool which automates trend lines and support and resistance levels on any chart. The tool does this through its AI, calculating the key levels across multiple timeframes to suggest the strength of each line.

If you trade breakouts, I find ProRealTrend a valuable asset. It helps quickly scan markets near strong key levels to take advantage of, without plotting the analysis manually.

On top of the ProRealTrend tools, you can access 60+ technical indicators and drawing tools, allowing for manual technical analysis.

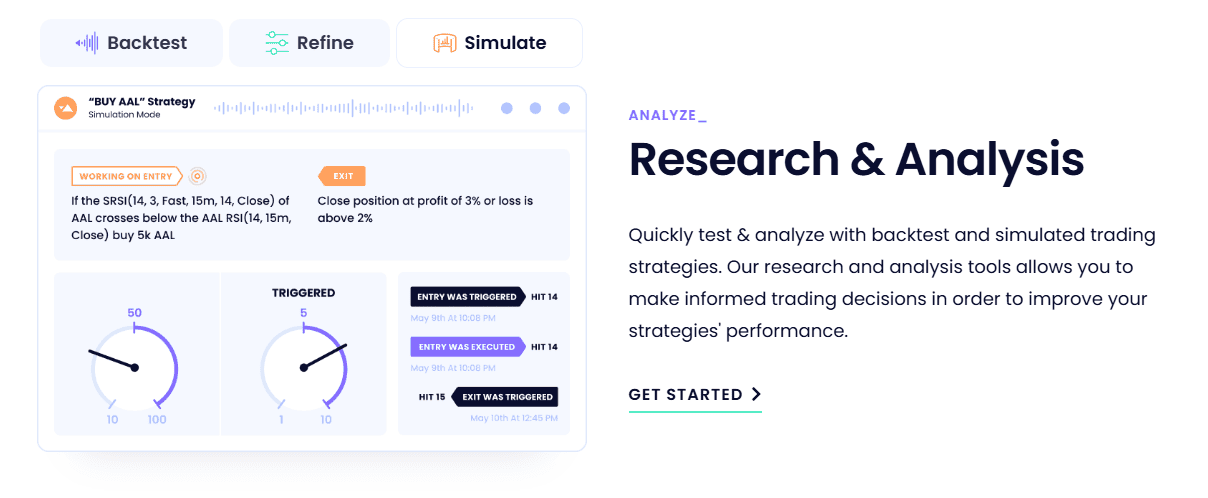

Automate Trading Strategies

IG Group lets you automate your trades through ProRealTime. I find the platform has a user-friendly approach thanks to its ProRealCode Wizard, which generates strategies without writing code.

What stood out when creating my own robot is that you can utilise any trading indicator on ProRealTime – including its ProRealTrend indicator.

This lets you create sophisticated strategies using the AI-generated key levels that can be used as entry or exit signals for the bot.

Wide Range of Financial Instruments

IG Group has 17,000 CFD products, which is the largest choice of the brokers I’ve tested with markets covering:

- 110+ forex pairs

- 13,000 share CFDs

- 130+ indices

- 40 commodities

- Forward contracts

- Options trading

The spreads are rather competitive too with its Standard account charging spreads starting from 0.60 pips on EUR/USD.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

4. eToro - Best for Social Trading AI

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why I Recommend eToro

I picked eToro for its social trading AI that refines your content based on the products you trade. It also recommends traders that discuss the markets you care about, helping you find new traders to follow.

Equally as impressive is the broker’s low spreads from 1 pip and no commissions on any of its products (including shares) are equally impressive, simplifying your trading costs.

eToro has the most user-friendly copy trading platform with CopyTrader. The platform provides a simple interface for finding and investing in copy traders, while also having the largest choice (2 million traders).

The broker also has professional Smart Portfolios with AI-driven rebalancing to optimise your profits while reducing risk.

Pros & Cons

- Zero-commission stock/crypto trading.

- Beginner-friendly AI social tools.

- Passive investing made simple.

- High spreads and withdrawal fees.

- No MT4/MT5 support.

Broker Details

AI Helps Recommend Traders To Follow

eToro’s social trading is one of the best thanks to its AI that starts recommending like-minded traders for you to follow and copy based on your current interactions.

For example, I found myself being shown traders who were focused on GBP/USD and FTSE 100 markets. The AI-generated recommendation means your eToro wall or timeline consists of content and ideas relevant to you, exposing you to new potential trade ideas.

With over 50+ million traders in the eToro network, eToro’s ability to find traders with similar interests helps avoid the noise from other markets and traders in the community.

Largest Range of Copy Traders

With 2,000,000 copy traders, you can use the filter tool on the CopyTrader platform to shorten the list based on your metrics such as:

- Risk Score – eToro’s proprietary metric designated for every copy trader to highlight how risky the copy trader is.

- Markets traded – Narrow your choice to traders that focus on specific markets like shares or forex.

- Trade frequency – Choose traders that trade intraday (active traders) or those who trade 1-3 times per week.

- Plus 11 more filters.

Each copy trader has their own performance profile storing historical trading performances giving you a snapshot of how the trader performs.

Smart Portfolios For Hands-Off Trading

If you want a professional approach to investing, you can invest in eToro’s Smart Portfolios that focus on specific sectors like AI or green energy.

With a Smart portfolio, I find everything is taken care of as eToro’s analysts pick the assets and manage the positions. The AI continually rebalances your portfolio to optimise the risk management and profits generated.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

5. AvaTrade - Best UK Broker for News-Driven AI

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGO

Minimum Deposit

$100

Why I Recommend AvaTrade

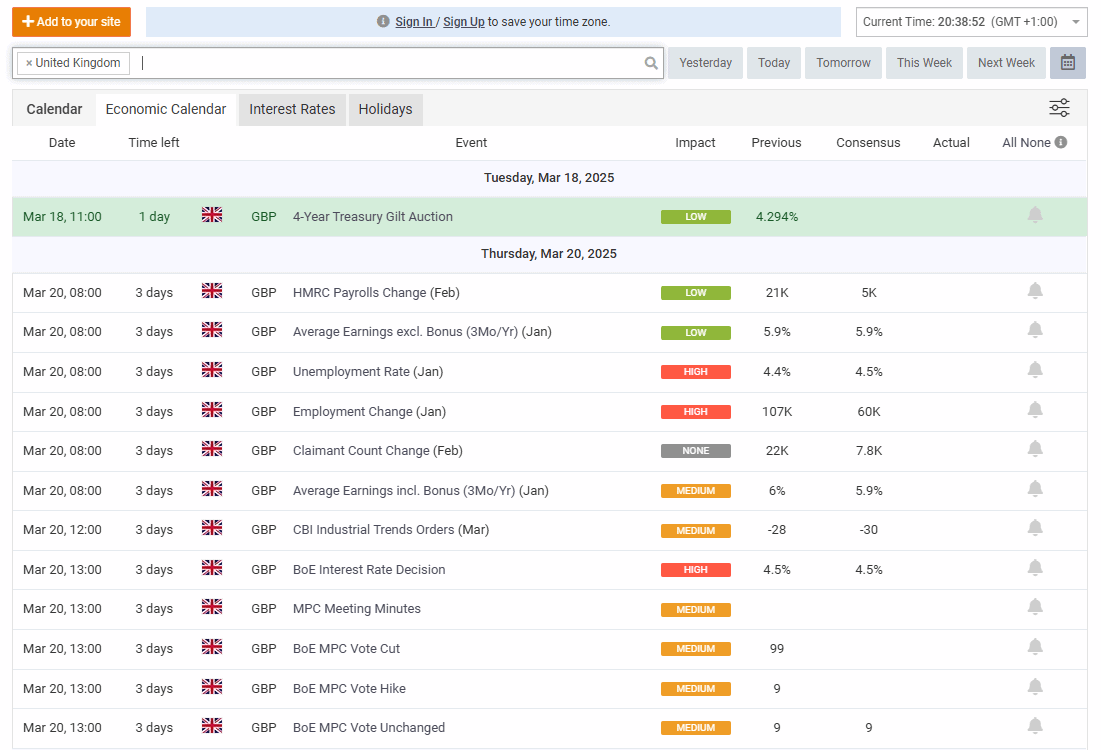

AvaTrade is my top pick for day trading thanks to its fixed spreads from 0.80 pips on EUR/USD. In testing, this spread is cheaper than most UK forex brokers with variable spreads.

With fixed spreads, you can enjoy the same spreads even when market volatility rises around news announcements. This allows you to enter the markets with low spreads to take advantage of the spike.

Trading Central is one of the top AI tools to provide daily trading signals that scan AvaTrade’s 900+ markets for new trading opportunities.

Pros & Cons

- Real-time sentiment analysis.

- Fixed spreads during volatility.

- Strong regulatory oversight.

- Limited forex pairs (under 60).

- No TradingView integration.

Stabilise Trading Costs With Fixed Spreads

AvaTrade offers fixed spreads, which are unique compared to the rest of the industry which offers variable spreads. The key difference is that variable spreads widen (get more expensive) during periods of market volatility, while fixed spreads remain the same.

This is why I think fixed spreads are a solid option if you day trade around news announcements. With fixed spreads you won’t pay a premium to open trades during these times.

While testing AvaTrade, the fixed spreads are low starting from 0.80 pips on EUR/USD. This is cheaper than most variable spread brokers (typically 1 pip).

This means trading around major news announcements like the Institute of Supply Management (ISM) figures, you’ll get 0.80 pips on EUR/USD. With other brokers, their spreads could widen by 50-100%, making it infeasible to open the trade and potentially miss out on a trading opportunity.

| Broker | Advertised EUR/USD Spreads | Fixed or Variable Spreads |

|---|---|---|

| AvaTrade | 0.80 | Fixed |

| Eightcap | 1.00 | Variable |

| Pepperstone | 1.10 | Variable |

| IG Group | 1.13 | Variable |

| Plus500 | 1.20 | Variable |

AI Trading Signals

When you open a live trading account, AvaTrade gives you access to its AI trading signals on the WebTrader platform. Trading Central powers these signals, using different technical analysis techniques such as chart patterns (like triangles) and Fibonacci setups.

I think this is great because the signals are generated by professional analysts who also provide insights behind the trade. This allows you to digest the validity of the signal before entering with professional market commentary.

Trade The News On 900+ Markets

AvaTrade has a solid selection of 900+ markets with fixed trading costs, so your trading fees will be stable even during market volatility. Based on my testing, you can trade the following markets:

- 55 forex pairs covering the major and minor pairs like GBP/USD and USD/JPY

- 750+ share CFDs with UK and US stocks

- 17 commodities, including gold

- 33 indices, including the FTSE 100

*Your capital is at risk ‘66% of retail CFD accounts lose money’

Ask an Expert