Using forex trading robots to automate your trades can be a game-changer. Robots can increase your efficiency when trading, remove emotions when making decisions, and help you find trading opportunities. Trading robots can scan a wider range of markets such as Crypto (cryptocurrencies), forex (foreign exchange), CFD (Contract for Difference) faster than is humanly possible but for longer, 24/7 even.

By the end of my essential guide, you will learn:

- How to automate your Forex trades

- How to implement a Forex robot

- The basics of Forex trading automation

What is automated forex trading?

Automated forex trading refers to the use of trading software and algorithms to analyse financial market data and execute trades based on predefined criteria. Moreover, it can respond instantly to market conditions, which is crucial in the fast-moving Forex market.

These auto trading systems are effective ‘trading robots’ that can analyse the market, generate signals, and monitor multiple currency pairs across various timeframes.

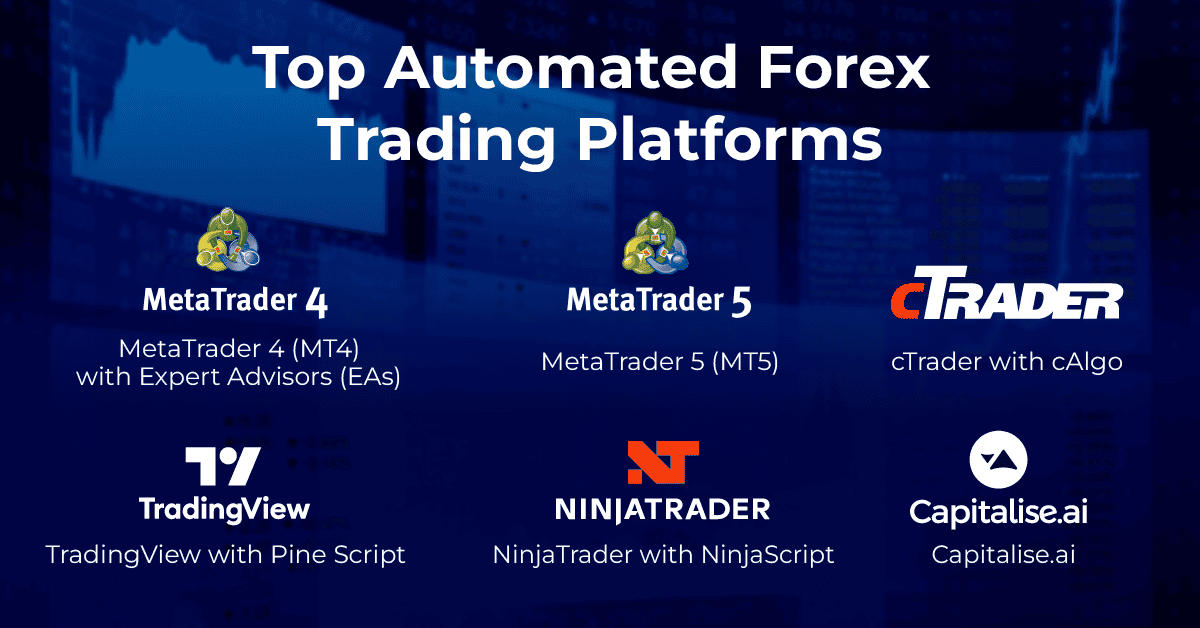

Popular automated trading platforms include MetaTrader 4 (MT4) with Expert Advisors (EAs), MetaTrader 5 (MT5), cTrader with cAlgo, TradingView with Pine Script, NinjaTrader with NinjaScript, and Capitalise.ai.

Why do you need an automated trading strategy?

Automated strategies can improve your trading results. Advanced trading platforms provide greater benefits than ever for all retail traders, even experienced traders.

From my perspective, they allow you to develop and manage trading programs that were once exclusive to large financial institutions. Here are some key advantages of implementing an automated strategy:

- Trade 24/5: Trading bots work non-stop, catching all market moves.

- Remove emotions: No fear or greed in trading decisions.

- Stick to plans exactly. They don’t get distracted, confused, or hesitate like humans can.

Key Components of Automated Forex Trading

Effective automated trading systems rely on several critical components:

1. Trading Platform

-

- Examples: MetaTrader 4 (MT4), MetaTrader 5 (MT5)

- Key feature: Must support automation

2. Expert Advisors (EAs) or Trading Robots

-

- Purpose: Execute your automated trading strategy

3. Trading Algorithm

-

- Function: Core of automated trading

- Basis: Can use technical indicators, price action, or machine learning models

4. Risk Management Strategy

-

- Importance: Protects capital and manages exposure

- Tools: Trailing stops, take-profit levels, position sizing

5. Backtesting Software

-

- Purpose: Test algorithms on historical data

6. VPS (Virtual Private Server)

-

- Benefit: Ensures 24/7 operation without interruptions

Why Use Algorithmic Trading Strategies

From my viewpoint, algorithmic trading strategies play a crucial role in automated forex trading, forming the backbone of an intelligent and efficient automated forex trading system.

Algorithmic trading, or “algo trading,” refers to using automated computer programs for trade execution based on predefined rules or algorithms.

Algo trading tools are ideal for executing a high volume of trades and capitalising on short-term market opportunities. While it requires technical skills and significant computing power, it offers precision and speed that many forex traders find advantageous.

Things to Consider When Starting Algo Strategies

Any Forex trading strategy needs to consider the following six elements:

- Risk

- Leverage

- Time Frame And Market Conditions

- Trading Platform

- Goals

- Personal Time Available

Risk

Risk is the amount of money you put at risk in a trade compared to your total capital. You might profit or lose the amount of money that you are risking in a trade.

For example, If I put up $100 of my $1,000 trading account into a trade, I’m risking 10% of my total capital. Managing this risk is key to a successful trading strategy, helping protect your capital and avoid large losses.

Leverage

Leverage allows you to control multiples of your money for trade. Leverage uses the concept of borrowed funds, it increases both potential gains and losses. In some cases, you could owe more than your initial investment.

For example, A leverage of 1:100 on a trade of $1,000 means you have the control of $100,000 of buying power.

Time Frame And Market Conditions

Using charts and time frames helps identify market trends and uncover trading opportunities.

However, focusing too much on short-term charts can make you lose sight of broader market trends and key opportunities.

Effective trading requires analysing multiple time frames, like using daily charts for trends and 30-minute charts for momentum. Balancing different time frames helps you spot both short-term changes and the overall market trend when making trades.

Trading Platform

Not all trading platforms support algorithmic trading, so ensure both your broker and platform are compatible.

MetaTrader 4 (MT4) is widely used and supports automation with Expert Advisors (EAs). It connects to servers in major data centres like Sydney, London, and New York. Other platforms include MetaTrader 5, cTrader and Capitalise.ai which has machine learning or AI capability.

Goals

Knowing what your goals are when trading can help determine what your trading strategy will be. You should define your goals with specific targets and deadlines, like making $500 by May or completing 30 trades this month.

When you have clearly defined your goals, you can build and adjust your trading algorithms to help you achieve these goals.

Personal Time Available

Lastly, it’s important to consider the amount of time you can dedicate to the project. If you work a full-time job, trying to manage a day trading system can be difficult if not impossible.

You also need to consider the amount of time and effort it takes to program and evaluate your algorithm. If you’re not proficient in the programming languages necessary to run your system, you’ll need to engage an outside programmer.

Five Types Of Trading Algorithms

To get you started on your journey, here are five common strategies used to create Forex algorithms.

| Strategy Type | Description | Key Points |

|---|---|---|

| News-Based | Trades based on news and economic events. | Short trades; watch for slippage. |

| Trend-Based | Follows market trends using tools like moving averages. | Good for trends; be aware of reversals. |

| Mean Reversion | Buys low and sells high, expecting prices to return to average levels. | Risk of prices staying extreme; manage risk. |

| High-Frequency Trading | Makes many quick trades to profit from small price changes. | Requires significant capital; mainly for big firms. |

| Arbitrage | Exploits price differences between markets for profit. | Hard to find opportunities; not common for retail traders. |

Getting Started with Automated Forex Trading: Key Questions

Automated Forex trading is gaining popularity due to its numerous benefits. It uses bots to execute trades without human intervention. However, getting started requires careful planning.

- Which Forex pairs are best suited for automation?

- How much capital should you allocate to your automated system?

- Which Forex brokers offer reliable API access for automated trading?

- What time frames work best for your automated strategy?

- How will you manage risk in a 24-hour market?

Automated Forex Trading Software Purchase Checklist

If you lack knowledge in programming languages, you might want to consider purchasing a ready-made trading robot to automate trading for you. When buying automated forex trading software, keep these key points in mind:

- Currency Pairs: Ensure the software handles major currency pairs with high volumes and liquidity, such as USD/EUR, USD/CHF, USD/GBP, and USD/JPY.

- Trading strategies: Look for software that allows you to choose between different trading strategies, from scalping small gains to making larger trades.

- Customer Reviews: Read online reviews to get insights into the software’s performance and reliability.

- Pricing: Compare prices but focus on quality over cost.

- Support: Opt for software with strong technical and customer support.

Getting Started with DIY Automated Forex Trading

The process of automating Forex trading involves several steps:

Choose a Trading Platform

- Select a user-friendly platform that supports automated trading (e.g., MT4, MT5, cTrader).

- Ensure that your forex broker provides API access and supports automated trading on your chosen platform.

Develop Trading Rules and Code Your Strategy

- Create your strategy based on technical indicators and consider various timeframes and currency pairs, including major pairs like EUR/USD.

Backtest the Strategy

- This involves running the algorithm on historical data to evaluate its performance under different market conditions like win rate, profit factor, and maximum drawdown

Open a Demo Account and Implement Risk Management

- Practice with virtual money to ensure your automated trading strategy works as intended.

- Monitor performance, set appropriate stop-loss levels to limit potential losses, and make necessary adjustments before moving to a live account.

Deploy on a VPS and Monitor

- Set up a Virtual Private Server to ensure 24/7 operation and reduce latency.

- Continuous monitoring is essential to ensure the system operates as intended and to adapt to changing market conditions.

Best Practices for Automated Forex Trading

- Start Small: Begin with a small trading account size until you’re confident in your system.

- Diversify: Don’t rely on a single strategy or currency pair.

- Regular Monitoring: Even automated systems need human oversight to adapt to changing market conditions.

- Stay Informed: Keep up with market news and fundamental analysis that might affect your strategies.

- Continuous Learning: Stay updated on new trading technologies, algorithms, and automated forex trading software.

Avoiding Scams and Choosing Reputable Providers

Be cautious when purchasing automated trading systems or Expert Advisors:

- Research providers thoroughly

- Be wary of unrealistic promises or guaranteed returns

- Check for regulatory compliance and user reviews

- Test any purchased system on a demo account before live trading

Interesting scam case in automated trading tools

The iMarketsLive (IML) scandal in 2019 exposed a major automated Forex trading scam. IML promised unrealistic returns through expert algorithms but operated as an illegal pyramid scheme.

This case highlighted common red flags: guaranteed profits, lack of verifiable results, and misleading marketing tactics. It emphasised the crucial need for due diligence when choosing automated trading systems.

Advantages and Disadvantages of Trading Automation

Automated forex trading lets traders use algorithms to make trades based on set rules, taking emotions out of the equation. While it has many benefits, it also comes with some challenges. Knowing the pros and cons is key to making smart choices.

Advantages:

- 24/5 Trading: Can operate even when you’re not actively monitoring the market.

- Emotion-Free Trading: Automated trading helps remove emotional biases, as trades are executed based on pre-set rules.

- Backtesting Capability: Allows you to test strategies on historical data before live trading.

- Diversification: Can run multiple strategies across multiple currency pairs on a forex trading platform.

- Speed and Efficiency: Respond to market changes faster than manual trading, this real-time feature can lead to more opportunities and improved profit potential.

Disadvantages:

- Over-Optimization: Risk of creating strategies that perform well in backtests but fail in live markets.

- Technical Issues: Dependent on internet connection and VPS uptime.

- Potential for Losses: If not properly configured, can lead to significant losses quickly.

My Thoughts on Automate Trading

Now that you know the basics, automated forex trading can be a powerful tool to help traders remove emotions and execute strategies consistently. However, success requires a strong grasp of both trading fundamentals and technical analysis.

While automation can improve your trading, it’s not a shortcut to guaranteed profits. Key factors like proper risk management, ongoing learning, and regular system updates are essential to ensuring your strategy remains effective in the long run.

Ask an Expert

What is a good broker to use for algo trading?

We recommend any broker that offers STP or ECN trading execution. These brokers generally don’t place restrictions on your trading conditions allow you to make full use of automation tools and because they are using ECN or STP, spreads are likely to be low. If the broker has an account with commissions chances are it is an STP or ECN broker. We suggest not using a market maker broker as many don’t allow automation. Brokers to consider are Pepperstone, IC Markets, FP Markets, Eightcap, TMGM.