Best MT4 Brokers In UAE

The MT4 or MetaTrader 4 trading platform is one of the most widely used platforms globally, offering advanced charting tools, automated trading through Expert Advisors, and extensive customisation options. We tested MT4 brokers available to UAE traders, focusing on spreads, execution speeds, and platform features to identify the best options.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

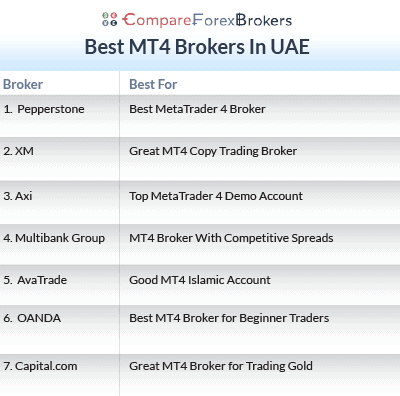

Best MT4 Brokers In UAE

- Pepperstone - Best MetaTrader 4 Broker In UAE

- XM - Great MT4 Copy Trading Broker

- Axi - Top MetaTrader 4 Demo Account

- Multibank Group - MT4 broker With Competitive Spreads

- AvaTrade - Good MT4 Islamic Account

- OANDA - Best MT4 Broker for Beginner Traders

- Capital.com - Great MT4 Broker for Trading Gold

What is the best forex broker with MT4?

Pepperstone takes the top spot as the best MT4 broker in the UAE. This is because they offer spreads from 0.1 pips on EUR/USD with $3.50 commissions and 77ms execution speeds under DFSA regulation. XM comes second with MQL5 Signals integration for copy trading and a low $5 minimum deposit.

I also shortlisted six other brokers for you to consider. For each broker I highlight their strengths, such as them having tight spreads, Smart Trader Tools integration, or Expert Advisor compatibility.

1. PEPPERSTONE - Best MetaTrader 4 Broker In UAE

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone impressed me with its Razor account offering spreads as low as 0.10 pips on EUR/USD, which is among the tightest you’ll find from a DFSA-regulated broker. The execution speeds average just 77ms, meaning your MT4 orders get filled quickly without frustrating delays during volatile market sessions.

What sets Pepperstone apart on MT4 is the platform enhancements. You get access to Smart Trader Tools and Figaro by FX Blue, which add suites of Expert Advisors and custom indicators beyond the standard MT4 offering.

If you want automated trading without coding skills, Capitalise provides a user-friendly solution that connects directly to your Pepperstone MT4 account. You can trade 94 currency pairs and 44 crypto CFDs on MT4, giving you broad market access. The broker offers 30:1 leverage for retail accounts and up to 500:1 for professional traders, with no minimum deposit requirement.

Pros & Cons

- Tight spreads from 0.10 pips

- Fast execution speeds

- Good CFD product range

- No additional fees

- Additional tools (Smart Trader Tools, Figaro, Capitalise)

- No minimum deposit

- Lacks guaranteed stop-loss orders

- Some CFDs not available on MT4

- Demo account only lasts 90 days

- Live chat is only 24/5

Broker Details

MT4 Platform Enhancements and Expert Advisors

Pepperstone doesn’t just give you basic MT4 – they’ve integrated third-party tools that enhance your trading experience. Smart Trader Tools provides you with additional Expert Advisors covering everything from trade management to advanced indicators. Figaro by FX Blue adds professional-grade analytics and automated trading capabilities that aren’t available in standard MT4.

You get access to the full MT4 Expert Advisor marketplace with over 1,700 trading robots and 2,100+ technical indicators. The marketplace hosts free EAs for testing automation without spending anything, plus premium robots typically priced $30-$500 with performance stats and user ratings visible before purchase.

You can filter by strategy type – scalping systems executing 50+ trades daily, trend followers holding positions for weeks, or grid traders opening multiple levels.

If you’re not comfortable coding your own Expert Advisors in MQL4, Capitalise lets you build automated strategies using a visual interface. You simply connect it to your Pepperstone MT4 account and create trading rules without writing a single line of code.

Strategy Tester and Backtesting

MT4’s Strategy Tester at Pepperstone runs your EA across historical data from 2005 onward, showing every trade it would’ve taken with exact entry prices, exit prices, profits, and losses. Visual mode plays your EA trading at 32x speed, letting you watch how it handles sideways chop versus strong trends instead of just staring at final profit numbers.

You can test how your Expert Advisor would’ve performed during the 2015 Swiss Franc crisis or 2020 COVID crash using 10+ years of tick-by-tick historical data. This helps you identify whether your strategy survives extreme market conditions before risking real capital.

Optimisation tests thousands of parameter combinations automatically, running your moving average crossover system with MA periods from 10 to 200 in 10-period increments. Results rank by profit factor, maximum drawdown, or total profit, showing which settings performed best historically.

Account Options and VPS Hosting

You have two main account types on MT4 with Pepperstone. The Razor account gives you ECN-style raw spreads starting from 0.10 pips on major pairs like EUR/USD, with a $3.50 commission per side. This works well if you’re trading frequently and want the tightest possible spreads.

Pepperstone also offers free VPS hosting when you maintain minimum account balances, typically around $1,000-$5,000. The VPS runs your Expert Advisors 24/7 with 99.9% uptime and dedicated connections to broker servers, eliminating the latency from your home internet.

You can access your VPS from any device anywhere, checking EA performance from your phone while traveling without needing your home computer powered on.

2. XM - Great MT4 Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM stands out for MT4 copy trading, offering you MQL5 Signals directly integrated into the platform. You get access to thousands of signal providers with verified trading histories, letting you automatically copy their trades into your account. The execution speeds average 148ms, which is reasonable for a DFSA-regulated broker, and you can start with just a $5 minimum deposit.

What I like about XM is the flexibility, meaning you can trade 55 currency pairs on MT4 with spreads from 0.2 pips on EUR/USD in the XM Zero account (with $3.50 commission), or use the Standard account with 1.6 pip spreads and no commissions. The low entry barrier means you can test their MT4 copy trading features without committing significant capital upfront.

XM offers 30:1 leverage for retail accounts and 400:1 for professional traders under DFSA regulation.

Pros & Cons

- MQL5 Signals integration for copy trading

- Low $5 minimum deposit

- 148ms execution speeds

- 55 currency pairs available

- DFSA regulated

- Free VPS available

- 30:1 leverage limit for retail

- No crypto CFDs available

- Smaller EA marketplace than global MT4

- Spreads wider than ECN brokers

Broker Details

MQL5 Signals and Copy Trading

XM gives you direct access to the MQL5 Signals marketplace from within your MT4 platform. You can browse thousands of signal providers, see their complete trading history including win rates, drawdowns, and monthly returns, then subscribe with a few clicks.

The signals automatically execute in your account proportionally – if the signal provider buys 1 lot of EUR/USD and you’ve allocated 10% of their capital, you’ll buy 0.1 lots. You maintain full control and can stop copying anytime or adjust your risk settings.

What’s useful is the detailed statistics on each signal provider. You see exactly how they’ve performed over months or years, their maximum drawdown percentages, average holding periods, and profit factors before you commit funds. The performance data is verified by MetaQuotes, so you’re not relying on unverified marketing claims from signal sellers.

Each signal shows real trading results with verified account statements, so you’re not buying blind based on marketing promises that never materialise. You can filter by strategy type, risk level, and monthly returns to find providers matching your risk tolerance.

Expert Advisors and Automation

Beyond copy trading, XM’s MT4 supports the full Expert Advisor marketplace with thousands of pre-built robots ready to download. The MQL4 programming language works like C, making it accessible if you’ve done any coding before, though you don’t need to code at all since the marketplace has free and paid EAs available.

The Strategy Tester lets you backtest Expert Advisors across historical data from 2005 onward, showing exactly how your EA would’ve performed during the 2015 Swiss Franc crisis or 2020 COVID crash using 10+ years of tick-by-tick data. You can test across any timeframe (1-minute scalping systems, 4-hour swing trades, or daily trend following).

MT4’s code editor includes autocomplete suggestions, syntax highlighting, and built-in debugging tools showing which line caused errors when your EA crashes. Community forums have millions of posts solving common coding problems, so when you get stuck implementing a trailing stop, you’ll find working code examples within minutes.

VPS Hosting and Mobile Trading

XM offers free VPS hosting when you maintain minimum account balances. The VPS runs your Expert Advisors and copy trading signals 24/7 with 99.9% uptime, eliminating issues when your home internet drops or Windows updates restart your computer at 3am.

Setting up VPS takes about 10 minutes, you connect via Remote Desktop, install MT4, drag your EA onto charts, and it runs continuously even when your local computer shuts down. The server sits physically close to XM’s data centers, reducing execution delays which matters when running scalping strategies.

XM’s MT4 mobile app lets you monitor your copy trading strategies and Expert Advisors on the go. You get push notifications when your copied trades or automated strategies open or close positions, keeping you informed without constantly checking screens.

The XM App also integrates TradingView charts, giving you access to more advanced charting capabilities while still executing trades through your MT4 account.

3. Axi - Top MetaTrader 4 Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

Axi’s MT4 demo account lets you practice strategies and test Expert Advisors in a risk-free environment before committing real capital. The demo mirrors live conditions with the same spreads you’ll see in live accounts, 0.1 pips on EUR/USD, 0.2 pips on GBP/USD and AUD/USD in the Pro account with $3.50 commission per side.

You get 90ms execution speeds across 72 currency pairs and 37 crypto CFDs – that’s faster than XM’s 148ms. The $0 minimum deposit on live accounts means you can transition from demo testing to live trading with micro lots without needing thousands upfront.

Pros & Cons

- Realistic demo account mirroring live conditions

- Fast 90ms execution speeds

- Tight spreads from 0.1 pips (Pro account)

- 72 currency pairs, 37 crypto CFDs

- $0 minimum deposit

- DFSA regulated

- Standard account spreads wider (0.7-0.8 pips)

- Demo limitations vs live experience

- Smaller broker than competitors

- Educational resources limited

4. Multibank Group - MT4 broker With Competitive Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.5 AUD/USD = 0.4

Trading Platforms

MT4, MT5, WebTrader

Minimum Deposit

$50

Why We Recommend Multibank Group

Multibank Group gives you access to 14,000 shares on MT4 – you can automate trading strategies across Apple, Tesla, Amazon, Microsoft and thousands of other global stocks from the same platform running your forex Expert Advisors. This lets you build diversified automated portfolios trading US tech stocks during New York hours while your forex EAs capture London session volatility.

The ECN account delivers lowest spreads from 0.1 pips on EUR/USD with $3.00 commission per side. You get 40 forex pairs, 23 indices, 4 precious metals (gold, silver, platinum, palladium), 5 energy products including crude oil and natural gas, plus 11 crypto CFDs.

The broker is SCA-regulated offering 20:1 retail leverage and up to 500:1 for professional traders. The $50 minimum deposit gets you started, and you can choose between MT4, MT5, or the MultiBank-Trader 4 mobile app. They also offer a 20% deposit bonus up to $40,000 and provide in-depth educational courses covering 15 topics with 9 downloadable ebooks.

Pros & Cons

- 14,000 shares accessible on MT4

- $3.00 commission structure

- Tight spreads from 0.1 pips

- MT4, MT5, and mobile app support

- 20% deposit bonus up to $40,000

- 15 in-depth courses with 9 ebooks

- SCA regulation (not DFSA)

- 20:1 retail leverage lower than DFSA brokers

- $50 minimum deposit required

- Execution speeds not disclosed

- No Islamic account option

5. AVATRADE - Good MT4 Islamic Account

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade offers swap-free Islamic accounts on MT4 that comply with Shariah principles, letting you hold positions up to 5 days without overnight interest charges. Positions held longer than 5 days incur fees, so this works for swing trading strategies but not long-term holds. All MT4 features remain available including Expert Advisors and automated trading.

You get 53 forex pairs, 36 indices, 19 commodities, 62 ETFs, and 27 crypto CFDs. The broker is ADGM-regulated offering 30:1 retail leverage and 400:1 for professional traders.

Standard account spreads are 0.8 pips EUR/USD, 1.2 pips GBP/USD, and 0.9 pips AUD/USD with no commissions. The $100 minimum deposit is higher than some competitors, and execution speeds average 160ms (slower than Pepperstone or Axi but acceptable for most strategies).

Pros & Cons

- Islamic swap-free accounts available

- MQL5 Signals integration for copy trading

- Good product selection

- MT4 and MT5 support

- Four platform choices (MT4, MT5, AvaTradeGO, AvaOptions)

- $100 minimum deposit required

- Islamic positions limited to 5 days

- Spreads higher than ECN brokers

- AvaProtect and AvaOptions not available on MT4

- Inactivity and currency conversion fees

6. OANDA - Best MT4 Broker for Beginner Traders

Forex Panel Score

Average Spread

EUR/USD = 0.89

GBP/USD = 1.54

AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA makes MT4 accessible for beginners with extensive educational resources and a user-friendly approach to forex trading. You get access to comprehensive learning materials covering trading fundamentals, technical analysis, and risk management. This is crucial when you’re starting out and learning how MT4’s Expert Advisors and automated trading work.

The broker offers Standard account spreads of 0.89 pips on EUR/USD, 1.54 pips on GBP/USD, and 1.37 pips on AUD/USD with no commissions, keeping costs simple without calculating round-turn commission fees.

You can trade 68 currency pairs with $0 minimum deposit, letting you start with whatever capital you’re comfortable risking. The platform supports MT4, TradingView integration, and OANDA’s proprietary FxTrade platform, giving you flexibility as you develop your trading skills.

Pros & Cons

- Extensive educational resources for beginners

- $0 minimum deposit requirement

- 68 currency pairs available

- MT4, TradingView, and FxTrade platforms

- No commission fees (spread-only pricing)

- Spreads wider than ECN brokers

- Limited crypto CFDs

- Raw spread accounts not offered

- Execution speeds not disclosed

7. Capital.com - Great MT4 Broker for Trading Gold

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView, Capital.com Web Platform and CFD Trading App

Minimum Deposit

$20

Why We Recommend Capital.com

Capital.com delivers tight spreads for gold trading on MT4, making it ideal if you’re running Expert Advisors targeting XAU/USD volatility during Federal Reserve announcements or geopolitical events that spike gold prices. The Standard account offers 0.60 pips on EUR/USD, 1.30 pips on GBP/USD, with no commission fees (spread-only pricing keeps costs transparent).

You get access to 120 forex pairs and 25 crypto CFDs across MT4, MT5, TradingView, and Capital.com’s proprietary web platform and mobile app. The broker offers 141ms execution speeds with a $20 minimum deposit, and provides 300:1 leverage for both retail and professional accounts (higher than most UAE brokers capped at 30:1 retail).

The broker is SCA-regulated and integrates AI-powered trading insights through their platform, helping you identify potential opportunities. The educational resources include trading essentials, risk management courses, market guides, and demo trading for practice.

Pros & Cons

- Excellent for gold trading on MT4

- 120 forex pairs, 25 crypto CFDs available

- 300:1 leverage (retail and professional)

- 141ms execution speeds

- $20 minimum deposit

- Multiple platforms (MT4, MT5, TradingView, proprietary)

- AI-powered trading insights

- Spread-only pricing

- 0.60 pips EUR/USD higher than ECN brokers

- Limited precious metals beyond gold

- No VPS hosting mentioned

Ask an Expert

What is the cheapest broker to copy-trade with on MT4?

Our top recommendation for copy trading on MT4 is Pepperstone. You will get great trading conditions and very low brokerage fees for both their standard and commission-based (razor) account types. Tools available for copy trading include MetaTrader Signals, Myfxbook, DupliTrade and Pelican (the UK only)

does copy trading cost any money?

Copy-trading means that you ‘copy’ all the trades of a professional or highly successful trader that you follow. It generally does not cost money to follow these traders. However, you will still have to pay all brokerage fees when trades are executed, and this can either come in the form of the spread cost or commission fees.