Best MT4 Forex Brokers In 2025

To help choose an MT4 forex broker, a list of the best MetaTrader 4 brokers was created based on spreads, execution speed and forex trading platform features. Only the best MT4 forex brokers that were ASIC-regulated or FMA regulated were considered for this comparison.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

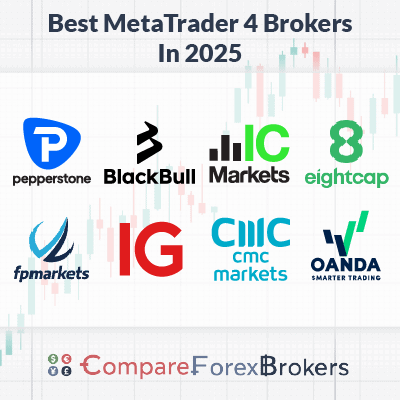

Based primarily on spreads, our 2025 MT4 broker shortlist is.

- Pepperstone - Best MT4 Forex Broker

- BlackBull Markets - Highest Leverage MT4 Broker

- IC Markets - Lowest Standard Account MT4 Account

- Eightcap - Best MT4 Crypto Broker

- FP Markets - Best MT4 Demo Account

- IG Group - Biggest MT4 Instrument Range

- CMC Markets - Most Currency Pairs Available

- OANDA - Best MT4 Broker For Beginners

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

Who Are The Best MetaTrader 4 Brokers?

Most MT4 traders focus primarily on forex markets so we compared the spread of the most commonly traded currency pairs to determine the best MT4 brokers. Other key considerations were regulation, features and customer service levels.

1. Pepperstone - Best MT4 Forex Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.6

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked Pepperstone a fair bit, mainly its lightning-quick execution speeds on MetaTrader 4. This is a massive advantage if you’re a trader who values split-second decisions. It’s not just the speed that sets them apart; their spreads and product range are also top-notch.

Pros & Cons

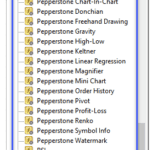

- Extensive range of trading tools for MT4

- Low spreads

- Fast execution speed on MT4

- Does not accept U.S. clients

- Limited product range on MT4

- Lacks guaranteed stop loss orders

Broker Details

Pepperstone Is Our Recommended Broker For MT4

Based on our testing of the best brokers Execution Speeds, Pepperstone is our overall best MT4 broker. Pepperstone achieved the fastest limit order speeds using the MetaTrader 4 platform compared to other top brokers we reviewed and tested. Overall, we gave Pepperstone a total score of 98/100, with the broker scoring highly across all eight categories we tested against. In summary, Pepperstone has many highlights, including:

- Low average spreads

- Fast execution speeds

- Great range of MT4 tools and features

- 5 diverse trading platforms

Pepperstone Has The Fastest Limit Orders

Speed tests that we conducted in 2025 found that Pepperstone had the fastest limit orders during testing. These tests were completed by Ross Collins, chief of technology research at Compareforexbrokers, who compared more than 30 MT4 brokers using limit and market orders. He found that Pepperstone had an average limit order speed of 77ms, faster than its nearest competitors.

Easiest Account Opening Experience

We also like Pepperstone for its easy account opening process. In fact, Pepperstone scored a perfect 15/15 when looking at all factors, from the ease of signing up to account opening time. It was the only forex broker we gave a perfect score. We particularly liked the account manager Pepperstone provided, who was very helpful throughout the whole process.

Competitive Spreads Offered

As one of the best forex brokers in Australia, Pepperstone has competitive spreads on all major currency pairs compared to its major competitors. Don’t just take our word for it, though; you can play around with our spread calculator below. The calculator combines the spreads and commissions of top brokers such as IG and Axi.

The reason for these low spreads is twofold. Firstly, Pepperstone has no dealing desk execution and no markup on spreads, meaning you are not going through a third party to execute a trade. Secondly, the broker provides top liquidity because its servers are located in the NY Equinix data centre, near the top-tier institutions where Pepperstone sources its liquidity. Having fast execution speeds ensures you can lock in these low spreads with less chance of slippage.

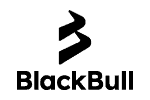

Pepperstone’s Accounts + Product Range

When opening an account, you can choose from Pepperstone’s Standard Account (no commissions) or Razor Account (low spread).

The table below summarises all the features of both accounts. Some key points we’d like to point out:

- cTrader and TradingView platforms only available with the Razor account

- Standard account suited for beginners due to having no commissions

- Razor account is commission-based, which varies based on the trading platform

- Razor account recommended for experienced traders with more cost variables

- Islamic (swap-free) accounts are only available in Islamic-majority countries

Pepperstone offers a wide range of trading instruments, particularly its 62 forex pairs and over 1000 stocks. One unique aspect of Pepperstone is the 3 currency indices and 3 crypto baskets you can trade that not all brokers offer (from our experience).

Great Range of Trading Platforms

In addition to MetaTrader 4, Pepperstone offers a great range of diverse trading platforms, as highlighted below.

- MetaTrader 4 (best forex trading platform)

- MetaTrader 5 (good for share CFDs)

- cTrader (great depth of market features)

- TradingView (top charting platform)

- Myfxbook (MT4 algorithmic trading tool)

- Duplitrade (top social trading platform)

We particularly like Pepperstone’s excellent suite of MT4 platform enhancements, including Trading Signals and a range of EAs (expert advisors), which you can use instead of manual trading. You can also integrate platforms with MT4, such as Capitalise.ai, Myfxbook, and Duplitrade.

Our Final Verdict On Pepperstone For MT4

We selected Pepperstone as the best MT4 forex broker primarily because of its fast execution speeds, but the broker has many other highlights. Time and time again, we’ve selected Pepperstone as the Best Forex Brokers In Australia and with easy account opening, low spreads and top trading platforms, it’s not hard to see why.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.6% of retail CFD accounts lose money’

2. BlackBull Markets - Highest Leverage MT4 Forex Brokers

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend Blackbull Markets

BlackBull Markets offers unparalleled leverage options, up to 1:500. But what really clinches it for us is their market execution rates, which are consistently among the fastest we’ve seen.

Pros & Cons

- Offers high leverage

- Good choice of CFD products

- Excellent execution speeds

- Charges to withdraw

- Limited free market analysis

- $2,000 minimum deposit for ECN Prime account

Broker Details

MT4 With BlackBull Markets Means Fast Execution And High Leverage

Based in New Zealand, BlackBull Markets can offer the highest leverage of 1:500 of any broker on our list. This is because of the difference in NZ regulations by the Financial Markets Authority (FMA) compared to Australian regulations by ASIC. High leverage gives you more purchasing power and risk should you be unsuccessful, so we advise you to tread carefully when trading with leverage.

We’ve listed BlackBull Markets’ key strengths below:

- High forex leverage of 1:500

- Fastest overall execution speeds

- Good range of trading platforms

- Competitive spreads

Fastest MT4 Broker In the Market

Our 2025 execution speed testing[1]Overall rank conducted by Compareforexbroker’s Ross Collins found that BlackBull Markets was the fastest MT4 broker overall. Testing using limit and market orders, Ross’ results show BlackBull Markets had a speed of 72 ms for limit orders and 90 ms for market orders, putting the broker at number 1 overall.

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

| Trading.com | 13 | 14 | 98 | 15 | 138 |

| FBS | 14 | 17 | 135 | 12 | 118 |

| Axi | 15 | 8 | 90 | 25 | 164 |

| Eightcap | 16 | 19 | 143 | 17 | 139 |

| IC Markets | 17 | 16 | 134 | 22 | 153 |

| FxPro | 18 | 23 | 151 | 16 | 138 |

| Go Markets | 19 | 20 | 144 | 20 | 145 |

| Markets.com | 20 | 22 | 150 | 18 | 141 |

| EasyMarkets | 21 | 24 | 155 | 24 | 155 |

| Admirals | 22 | 15 | 132 | 28 | 182 |

| IG | 23 | 26 | 174 | 19 | 141 |

| CMC Markets | 24 | 18 | 138 | 26 | 180 |

| FP Markets | 25 | 32 | 225 | 8 | 96 |

| VantageFX | 26 | 27 | 175 | 23 | 154 |

| XM | 27 | 21 | 148 | 29 | 184 |

| FXCM | 28 | 28 | 108 | 30 | 189 |

| Avatrade | 29 | 33 | 235 | 21 | 145 |

| ThinkMarkets | 30 | 25 | 161 | 36 | 248 |

| Tradersway | 31 | 29 | 198 | 33 | 214 |

| Swissquote | 32 | 37 | 258 | 31 | 198 |

| FXTM | 33 | 36 | 248 | 32 | 210 |

| Libertex | 34 | 31 | 215 | 35 | 244 |

| ATC Brokers | 35 | 34 | 238 | 34 | 241 |

| HYCM | 36 | 35 | 241 | 37 | 268 |

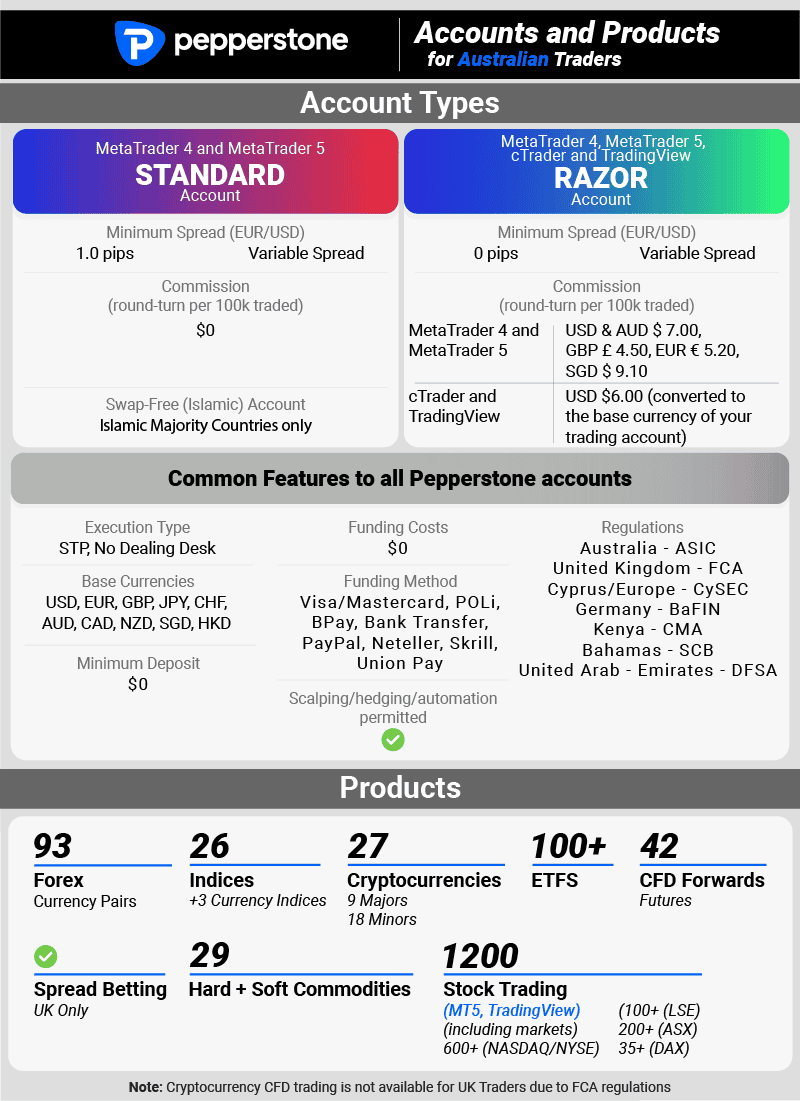

You can open 3 types of accounts with BlackBull Markets, as highlighted below.

We recommend the ECN Standard Account for beginners and the ECN Prime Account for intermediate to experienced traders. It also has the ECN Institutional Account only for the most advanced traders with a lot of capital under their belt. BlackBull Markets uses a mix of Electronic Communication Network (ECN) and Straight-through Processing (STP), which is why these Best ECN Forex Brokers include ECN as part of the account names.

BlackBull Markets has a good range of CFD products, including 64 forex pairs, although Australian traders don’t get access to the broker’s full range of 23,000 shares (as physical assets, not CFDs). However, you can trade currency pairs with 1:500 leverage, which is something only BlackBull Markets can offer from our list of MT4 brokers.

BlackBull Market’s Trading Platforms

BlackBull Markets offers a decent range of trading platforms while not setting the world on fire with an extensive range. You can access the full MetaTrader suite (MT4/MT5), as well as TradingView for charting and ZuluTrade for social trading. In terms of MT4 integration tools, BlackBull Markets gives you access to Myfxbook, but that’s about it.

While BlackBull also has its own share trading app, we use it as the broker doesn’t offer it to Australian clients, which is a shame, given BlackBull Markets’ extensive 23,000 share trading range.

Our Final Verdict of BlackBull Markets

Overall, New Zealand Forex broker BlackBull Markets stands out with high leverage (up to 1:500 leverage) and the fastest execution speeds on the market, according to our testing. Please be mindful of the high risks of trading with leverage, especially if you are not experienced or don’t have a lot of capital to your name.

3. IC Markets - Top RAW Spreads With MT4

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We liked IC Markets, particularly its low non-commission spreads on MetaTrader 4. In our 2025 testing, this broker consistently offered the tightest standard spreads among its competitors. IC Markets also brings a broad range of markets and affordable trading fees.

Pros & Cons

- The lowest standard account spreads

- Social trading tools for MT4

- No fees for depositing or withdrawing

- Lacks educational resources for beginners

- Requires a minimum deposit

- Limited market analysis content

Broker Details

According to our 2025 testing, IC Markets has the lowest standard spreads of any broker we reviewed. IC Markets also has competitive trading fees and a wide range of markets, scoring 83/100 overall. We summarised IC Markets’ key features below:

- Lowest no-commission spreads

- MT4, MT5, cTrader, TradingView platforms

- Competitive trading fees

- 61 Forex pairs to trade

IC Markets Has the Lowest Standard Account Spreads Based On Our Testing

When we tested standard account spreads[2]Published And Tested Data from a list of 15 major forex brokers in 2025, IC Markets came out on top. Our chief of technology researcher, Ross Collins, tested only accounts with no commissions using the MT4 platform, comparing no dealing desk and market maker brokers. Ross found that IC Markets had an average spread of 1.03 pips, at an average spread cost of USD $9.63, which put it at number 1, pipping CMC Markets and Fusion Markets.

| Broker | Average Spread | Average Spread Cost (USD) |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| Fusion Markets | 1.19 | $11.07 |

| TMGM | 1.21 | $11.18 |

| Admiral Markets | 1.31 | $11.96 |

| FXCM | 1.47 | $13.49 |

| Pepperstone | 1.46 | $13.52 |

| FP Markets | 1.47 | $13.60 |

| Go Markets | 1.49 | $13.87 |

| EightCap | 1.51 | $13.97 |

| OANDA | 1.54 | $14.23 |

| Axi | 1.71 | $15.99 |

| City Index | 1.79 | $16.52 |

| Blackbull Markets | 1.82 | $16.95 |

| FXPro | 2.22 | $20.83 |

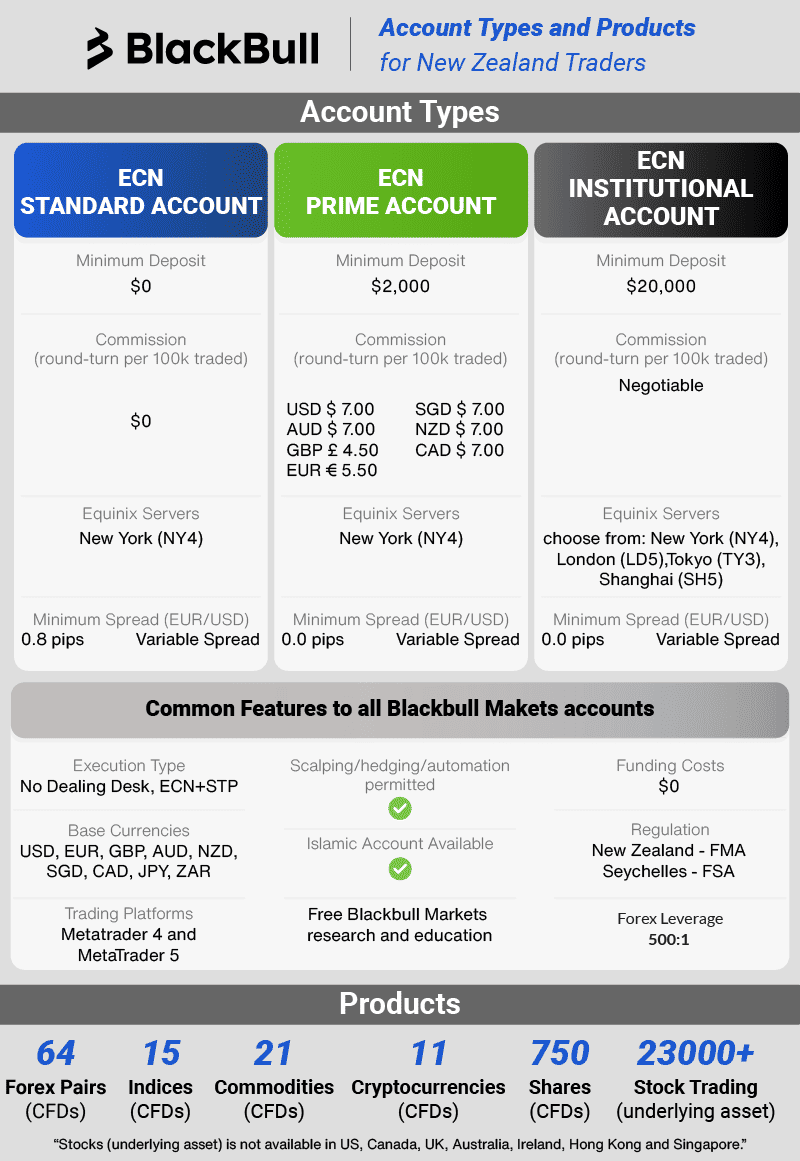

When signing up with IC Markets, you can choose from IC Markets Raw Spread Vs Standard Accounts . With the lowest spreads and no commissions, IC Markets’ Standard Account is our recommended platform, especially for beginner forex traders. With the Raw Spread Forex Account, you can choose either the MetaTrader platforms (MT4/MT5), cTrader or tradingView. It’s important to note the main difference is in commission costs, as cTrader only offers commissions in USD (at $6 round-turn per trade).

IC Markets has a great range of products, particularly its 61 forex pairs and over 1600 stocks. We also like IC Markets’ 4 futures markets as an alternative to trading CFDs.

IC Markets Trading Platforms

IC Markets’ full platform range is listed below:

- MT4

- MT5

- cTrader

- TradingView

- Myfxbook

- ZuluTrade

This platform range is modest to our eyes, with the standard ‘out of the box’ MetaTrader experience featuring the same trading tools you get with most brokers. These MT4 plugins include Myfxbook, AutoChartist, and MetaTrader Signals for algorithmic trading and charting technical analysis.

Having the cTrader trading platform does give IC Markets more platform diversity, which stands out with superior depth of market features and automated trading using cAlgo.

Lastly, copy trading is available using ZuluTrade, one of the most popular social trading platforms on the market.

Our Final Verdict on IC Markets

From our testing, IC Markets is a good choice for beginners, with the lowest no-commission spreads on the market. You can also access an ECN account (RAW account), which features spreads as low as 0 pips. Having decent MT4 trading tools such as Myfxbook, Autochartist, and ZuluTrade adds to your overall trading experience with algorithmic and social trading.

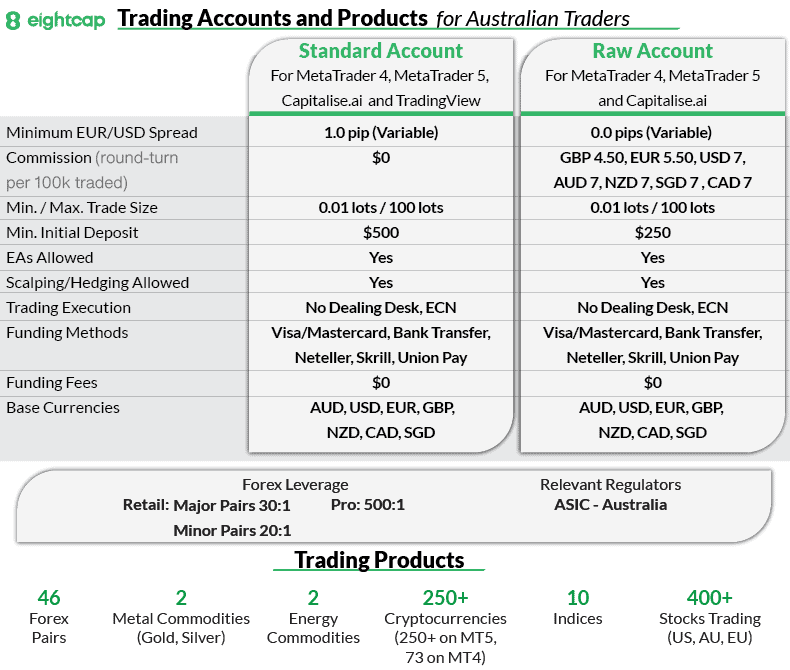

4. Eightcap - Best MT4 Crypto Broker

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.0

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We named Eightcap the bestMT4 Crypto Broker primarily because they offer trading on the widest range of cryptocurrency products using MetaTrader 4. The broker also has some of the lowest RAW spreads and excellent market analysis tools of any broker across the crypto range, cementing them as the top broker in this niche.

Pros & Cons

- Low spreads

- Excellent automation tools

- Offers a variety of market analysis research

- Limited range of CFDs

- Lacks 24/7 customer support

- Minimum deposit required

Broker Details

Offering 79 cryptocurrency pairs to choose from using MT4, Eightcap offers one of the best ranges of cryptos I’ve come across for an MT4 broker. Enhancing its crypto appeal, you can automate your crypto trading code-free with Capitalise.ai, which you can integrate with Eightcap’s MT4 account. Other benefits that added to the broker’s appeal include low RAW spreads, top charting with TradingView and Eightcap Labs, for market analysis.

Top MT4 Crypto Trading

It’s not simply the number of cryptocurrencies on offer that makes Eightcap stand out for me, it’s the additional features that added to my crypto trading experience. As well as having access to the most popular pairs like Bitcoin, Bitcoin Cash and Ethereum, you can also trade rarer alt-coins like Dogecoin, Shiba Inu and NEO.

Eightcap also has one of the largest selections of cryptocurrencies I’ve seen, with most brokers offering between 20 and 30 cryptocurrency products. Only eToro (102) and Capital.com (111) offer more crypto products without the same low RAW spreads or platform diversity as Eightcap.

Should you choose to trade with MT5 or TradingView, you’ll have the added benefit of trading Eightcap’s full range of 95 cryptocurrencies compared to 79 available on MT4.

Competitive RAW Spreads

Like FP Markets and IC Markets, Eightcap is an ECN, no-dealing desk broker, offering a Standard Account (commission-free) and a Raw Account (commission-based). When testing the two accounts, I found the broker’s Raw account offered the most competitive spreads.

From my published spreads analysis of 40 top brokers, Eightcap offers very competitive spreads on its Raw account, averaging 0.06 pips on the EUR/USD. Even when I tested its spreads, Eightcap averaged 0.20 pips for EUR/USD, which was lower than the 0.26 tested average. This might not seem like a big difference, but the 0.06 pips you save per trade will add up in the long run, from my experience.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Good Range of Trading Platforms

In my eyes, few brokers offer as unique a range of specialty third-party platforms as Eightcap does, which can all be used for crypto trading.

As far as main trading platforms go, Eightcap offers both MetaTrader platforms (MT4 and MT5), the excellent Capitalise.ai is considered a top Automated Crypto Trading Platform for code-free trading (integrated directly with MT4) and TradingView, which is a powerful charting platform. Given Capitalise.ai is a ‘code-free’ platform, you don’t have to have any coding knowledge to create a trading bot for automated trading of crypto products.

To enhance its already diverse trading platform experience, Eightcap even offers its own market analysis platform called Eightcap Labs. Here, I found I could enhance my crypto trading with useful articles, e-books and guides on fundamental analysis, trading strategies and platforms and tools, curated from a range of expert investors.

Our Final Verdict on Eightcap

All in all, Eightcap stands out with its top range of 79 crypto products on MT4, low RAW spreads and market analysis tools through Eightcap Labs. I also enjoyed the broker’s diversity of trading platforms and code-free automation through Capitalise.ai, adding to a pleasurable trading experience overall.

Broker Screenshots

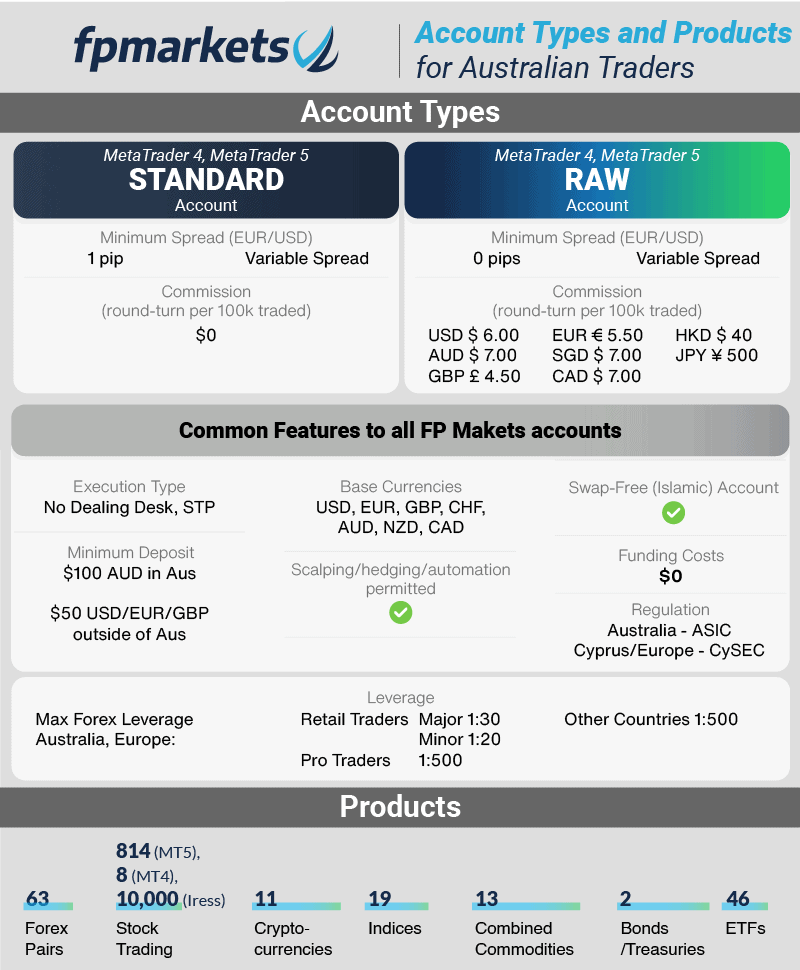

5. FP Markets - Top Demo Account And Scalping

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We recommend FP Markets for their Demo Account and ability to scalp since the platform has some of the industry’s fastest market order execution speeds. The broker also offers competitive spreads and is beginner-friendly.

Pros & Cons

- Unlimited demo account access

- Extensive educational video course

- Tight spreads

- Basic mobile trading app

- Limited selection of forex pairs

- MT4 doesn’t have access to all assets

Broker Details

FP Markets Has Good Educational Tools For Beginner Traders

We recommend FP Markets for beginners based on its excellent education suite, with a great range of webinars, podcasts, eBooks, tutorials and glossaries. In particular, we like FP Markets’ online course, FP Academy, which offers three levels of trading education: Beginner, Intermediate or Advanced. FP Markets has the following key features:

- Great educational resources

- Fast market order execution speeds

- Low MT4 Spreads and Commissions

- Trading Toolbox for MT4/MT5

FP Markets’ Fast Market Order Execution Speeds

When we measured MT4 execution speeds earlier in 2025, FP Markets came in as the 4th fastest broker for market orders. FP Markets had an average market order speed of 96ms, only beaten by Fusion Markets, BlackBull Markets and Hugo’s Way (the latter of which is an unregulated broker). FP Markets even beat out Pepperstone, which was 5th for market order speeds.

Having fast execution minimises slippage on forex trading as well as FP Markets’ other instruments, allowing MT4 users to trade in an ECN-type environment. The high-quality execution is supplemented with competitive institutional-grade pricing facilitated by FP Markets’ top-tier liquidity providers, including financial and private corporations.

FP Markets offers a Standard (no commissions) or Raw (commission-based) account when opening an account. We found spreads are about average for the broker’s Standard account (at 1.47 pips based on our MT4 testing). However, FP Markets’ Raw account has relatively competitive spreads. FP Markets’ Raw account also has cheaper commissions when funding in USD (at $6 round-turn per trade), given most ECN brokers charge USD $7 that we’ve reviewed.

FP Markets has a good selection of trading products across a wide range of asset classes, including forex, stocks, cryptos, indices, commodities, bonds, and ETFs. FP Markets stands out in its IRESS offering of over 10,000 stocks. You’ll only be able to use the IRESS platform at an extra cost. We’d also like to point out that to trade the full range of FP Markets CFD products, you’ll need to use MT5.

FP Markets Trading Platforms

FP Markets offers a useful range of trading platforms and tools, each listed below.

- MT4 (great for forex)

- MT5 (suited for CFDs)

- IRESS (DMA share trading platform)

- FP Markets mobile app

- FP Markets Copy Trading

- Autochartist (MT4 plugin)

- Myfxbook Autotrade (MT4 plugin)

- Trading Central

What we like about the FP Markets MetaTrader suite is Traders Toolbox, a suite of 12 online tools to enhance popular trading platforms. These include such unique tools as market manager and stealth orders, which let you hide orders from the market. You’ll also have access to MT4 plugins Autochartist and Myfxbook Autotrade as handy algorithmic trading tools.

In addition, FP Markets offers the unique IRESS platform, which gives you Direct Market Access (DMA) to order books on major stock exchanges, allowing you to trade over 10,000 stocks.

Lastly, FP Markets has its own mobile app and copy trading platform as an alternative to the broker’s third-party platform range.

Final Verdict on FP Markets

Overall, we picked FP Markets as an MT4 broker for its excellent educational resources, fast market order speeds, and competitive trading fees. FP Markets also offers the IRESS platform, where you can access an unprecedented 10,000 stocks to trade. As a beginner trader, we think FP Markets is a great place to start.

Broker Screenshots

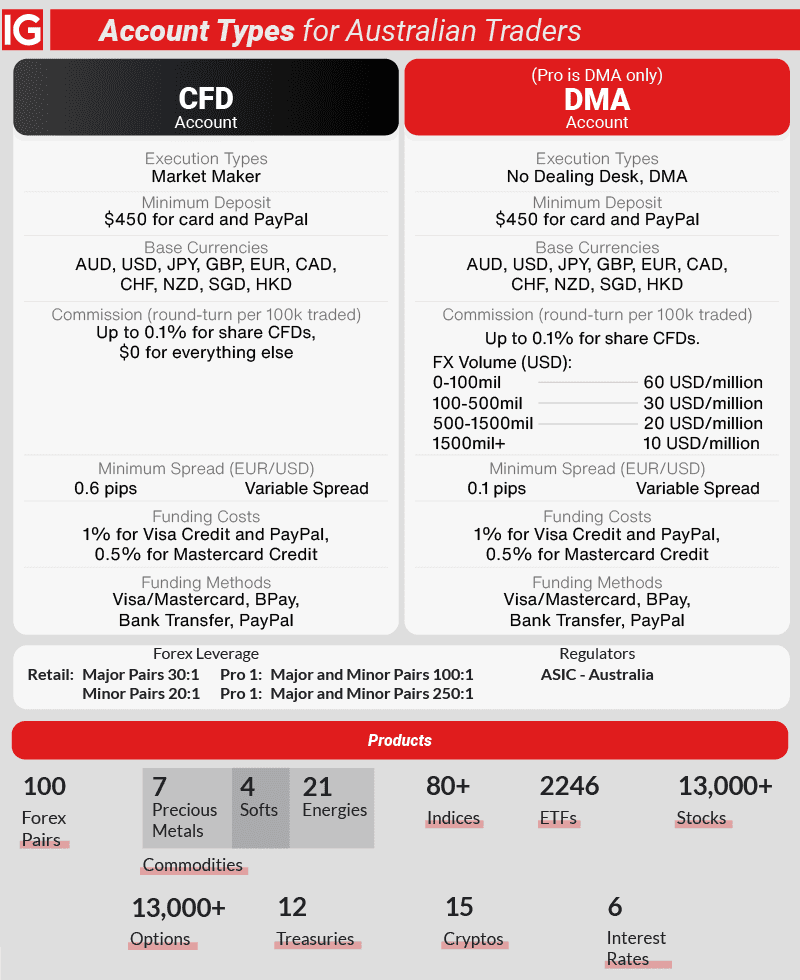

6. IG Group - Biggest Range of MT4 Products

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We liked IG Group mainly for its extensive offering of CFDs on the MetaTrader 4 platform. With over 17,000 markets and 45 years in the game, this broker’s experience and scope are unmatched.

Pros & Cons

- Extensive selection of trading products

- Free online trading courses

- Offers direct MT4 AutoChartist integration

- High minimum deposit

- MT4 has limited access to some of IG’s products

- Limited customer service over the weekend

Broker Details

IG Group Offers An Impressive Array Of Trading Products Via MT4

IG Group is the world’s biggest forex and CFD provider, with over 17,000 markets, 45 years of dedicated service, 178,000 clients from over 16 countries, and global offices. Trustworthy and reliable, IG offers the following highlights:

- Product offering – over 17,000 financial markets

- Free online trading courses

- Top proprietary trading platforms

- Risk management tools

IG’s Superior Product Range and High-Volume Discounts

IG’s superior product range speaks for itself, with over 17,000 financial markets to trade, the most we’ve seen from any of the Best CFD Brokers. These are spread across various asset classes, from forex to stocks to ETFs to cryptocurrencies. You can even trade options with IG for a more complex derivative to diversify your portfolio.

To trade this huge range of markets, IG offers a CFD Account and a DMA account, which are similar to a Standard account and a Raw account. Spreads are competitive for both accounts, while high-volume forex discounts are also offered for the DMA account.

IG Trading Platforms

IG has a unique set of platforms, as highlighted below:

- MT4

- IG Trading Platforms

- ProRealTime (proprietary platform)

- L2 Dealer (proprietary platform)

While IG offers a good MT4 experience, it is the broker’s proprietary platform we highly recommend. ProRealTime and L2 Dealer are highly customisable platforms with advanced charting features and algorithmic trading tools. We particularly like the 100+ charting indicators you can access, which is more than what MT4 (or MT5) currently offers.

Our Final Verdict on IG

IG’s reputation and global standing speak for themselves, but we chose the broker for the substantial product range and niche proprietary software on offer.

Broker Screenshots

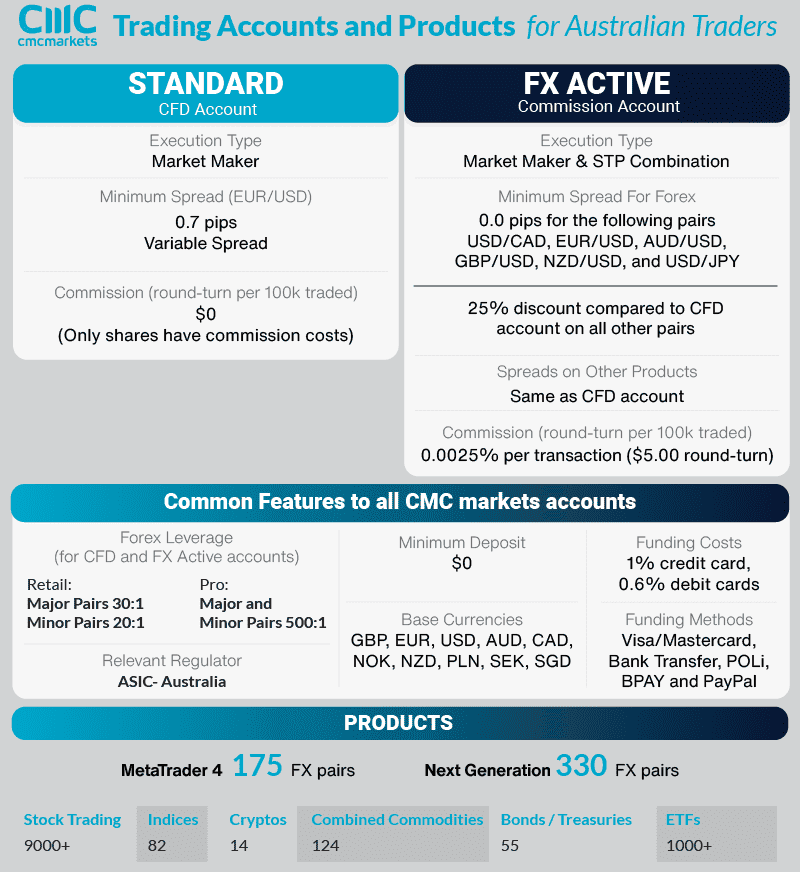

7. CMC Markets - Largest Range Of Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We recommend CMC Markets as they offer the largest range of currency pairs out of all the forex brokers that we reviewed. The broker also stood out with its low spreads and high trust score.

Pros & Cons

- Offers 338 currency pairs

- Low standard account spreads

- High trust score (9.1/10)

- Limited range of trading platforms

- Customer support is only 24/5

- Below average spreads on raw account

Broker Details

Broker Screenshots

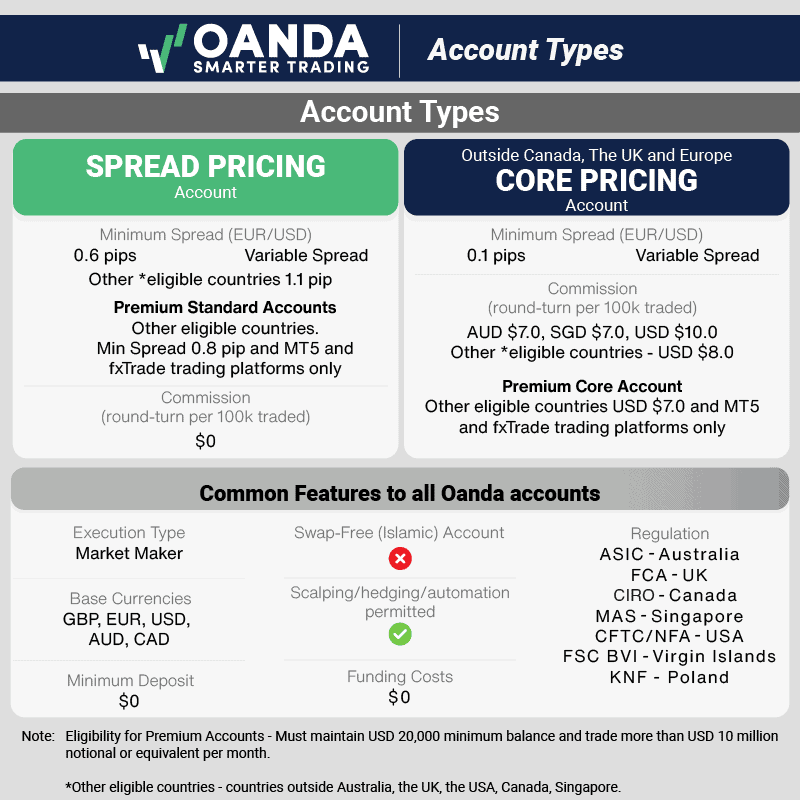

8. OANDA - Top MT4 Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We liked OANDA as being the best MT4 broker for beginners as they offer a plentiful of educational materials and an easy-to-use platform. Apart from that, the broker offers a wide range of currency pairs and competitive spreads.

Pros & Cons

- Offers 65+ currency pairs

- Beginner-friendly UI

- STP-style trading with Elite Trader Account

- Only offers forex and crypto

- No negative balance protection

- No guaranteed stop-loss order

Broker Details

Broker Screenshots

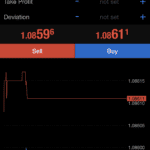

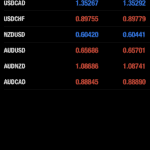

iPhone

iPhone

To activate a tick chart in the MT4 trading platform, you need to:

To activate a tick chart in the MT4 trading platform, you need to: The Candle Clock indicator helps identify the time before the last candle is closed. As the timeframe gets closer to closing, the indicator acts like a countdown clock. As an example, when trading from a one-minute chart, the indicator shows the seconds and minutes left.

The Candle Clock indicator helps identify the time before the last candle is closed. As the timeframe gets closer to closing, the indicator acts like a countdown clock. As an example, when trading from a one-minute chart, the indicator shows the seconds and minutes left.

Ask an Expert

Is MetaTrader 4 better than MetaTrader 5?

Depends, MetaTrader 4 (MT4) is considered by many to be the gold standard trading platform for forex trading. MetaTrader 4 has all the features you need for the successful trading of forex. However, MetaTrader 5 (MT5) is an upgrade on MT4. It allows you to trade more CFD instruments, has more technical analysis tools and has more memory and runs faster making it a better option for backtesting. However there are still good reasons to choose MT4 over MT5, reasons include:

1. MT4 was designed specifically for forex trading. Best for trading instruments that are decentralised (i.e. don’t have a central exchange)

2. More brokers offer MT4, so more choice of fore brokers and easier to change to new forex brokers that also offer MT4

3. MT4 is 32 bit, MT5 is 64 bit meaning MT4 uses less computing resources if you don’t have the most powerful computer

4. MT4 has Financial Information eXchange (FIX) API integration for real-time information related to financial instruments

5. While MT4 has fewer technical analysis tools than MT5, this can make it preferable to new traders who may get overwhelmed with too much information

6. MT4 is easier to install and set up than MT5. This means you can get started trading faster

7. MT4 has a larger marketplace to source extra tools such as expert advisors

8. MT4 has a larger trading community meaning more resources are available when extra information is needed

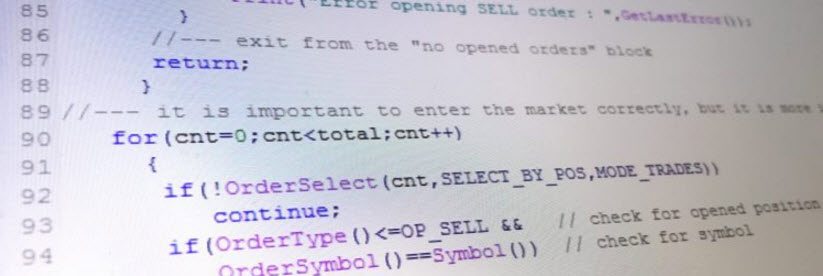

Why do traders prefer MT4?

There are multiple reasons – More brokers offer it (and with no) than any other platform as result it is more accessible to retail traders which created more awareness of the platform. It has all the essential features one needs to trade and is also very flexible. For example you can customise the interface or create your own indicators. Lastly, there is very little it can’t do – you can automate your trading with Expert Advisors or copy trade using Signals. It main weaknesses are that its not built for exchange traded instruments like Shares and does not have a Depth of Market indicator.

Why do people still use MetaTrader4?

MetaTrader 4 maintains it popularity as it is a simpler trading platform to use, many new traders it easier to navigate than MT5. MT4 is also more familiar, that is more traders already use it and don’t wish to learn a new trading platform and there is more general awareness of the trading platform. Other reasons MT4 is more popular than MT5 is more brokers offer it, there is a larger trading community and traders don’t need the extra features MT5 can offer.

How much does it cost to get MT4 license?

Metatrader 4 (MT4) is free for use with brokers that offer this trading platform. There is no need to pay for an MT4 licence.

What is the most useful indicator in MT4?

These indicators have been integrated there for a reason. But trend-following indicators such as the MACD (Moving Average Convergence Divergence) are often favored as they are used to identify potential buy or sell signals.