Best MetaTrader 4 Brokers

MetaTrader 4 remains the most popular platform for forex trading. To find the best forex broker we compared each MT4 trading account based on spreads, trading experience and customer service levels.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The Singaporean MT4 best forex brokers in April 2025 are:

- Pepperstone - Best MT4 Forex Brokers For Singapore

- IC Markets - Lowest Spreads On Standard Account

- BlackBull Markets - Good For Fast Execution Speed

- FP Markets - Best Broker For Scalping

- ThinkMarkets - Top Broker for CFD Market and Shares

- AvaTrade - Good Option For Day Trading

- Eightcap - Best Crypto Broker

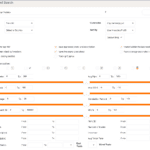

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

What Are The Best MetaTrader 4 Brokers For Singaporean Traders?

Traders in Singapore should only trade with a broker with Tier 1 regulation. This can either be locally through MAS (Monetary Authority of Singapore) or with a ‘tier 1’ regulator such as ASIC, FCA or CySEC. Then elements such as trading fees, MT4 features and customer service should be considered. We matched the different trading needs in Singapore to the brokers that best cater for those individuals below.

1. Pepperstone - Best MT4 Brokers For Singapore

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.4 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone tops our pick for the best MT4 broker because of its incredibly tight RAW spread of 0.1 pip for the EUR/USD currency pair. According to our calculation, Pepperstone shows excellent zero spread testing with 100% time at minimum spread (outside rollover), zero minimum deposit, and zero cost VPS service on the MT4 trading platform. These are advantageous if you are considering low-cost trading on the MT4 platform.

We also like the integrations with 3rd party tools like Myfxbook, DupliTrade and Capitalise.

Pros & Cons

- Zero spread available

- No minimum deposit

- Offers VPS service

- Fast execution speed

- No proprietary platform

- Standard spreads are among the highest

Broker Details

Even though MT4 is available with most brokers, we felt Pepperstone works best. It’s our highest-scoring broker (98/100) thanks to its low trading costs and fast execution speeds. As a bonus, the broker offers an improved MetaTrader 4 experience through its Smart Trader Tools, making Pepperstone an easy pick for the best MT4 forex broker.

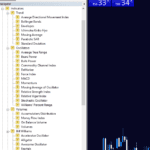

The Smart Trader Tools provides 28 new indicators and expert advisors you can download and install after opening a trading account. These add improved trade management features and more advanced indicators to the 30+ technical indicators with MT4 by default.

The Smart Trader Tools provides 28 new indicators and expert advisors you can download and install after opening a trading account. These add improved trade management features and more advanced indicators to the 30+ technical indicators with MT4 by default.

In particular, we liked the Mini Terminal EA as it improved the default one-click trading feature. It allows you to pre-set your stop loss and take profit levels, ensuring your risk management is always applied when you place a market order. The Smart Tools also add new indicators, including the High-Low and Pivot indicators, which are useful if you trade breakouts.

Pepperstone scored highly overall in our tests, including the trading costs category, which is important for all traders. From our testing, we found the broker’s Standard account spreads averaging 1.12 pips on EUR/USD, lower than the industry average of 1.24 pips – making it a low-spread broker.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.62 |

| Eightcap | 1 |

| ThinkMarkets | 1.1 |

| FP Markets | 1.1 |

| Pepperstone | 1.12 |

| Blackbull Markets | 1.2 |

| Industry Average | 1.24 |

The Razor account also recorded impressively low trading costs after our analyst, Ross Collins, discovered the broker offered 0.0 pip spreads on its major pairs 100% of the time. In this case, you’ll only pay the $3.50 per lot traded commission, even in volatile markets, giving you a fixed cost when trading major pairs.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

With this in mind, we think the Razor account would suit algo traders looking for stable, low costs during any market condition.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.6% of retail CFD accounts lose money’

2. IC Markets - Lowest Spreads On Standard Account

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

Our indicators point to IC Markets as great MT4 brokers because of its average of 0.62 pips for the Standard account and 0.02 pip on the Razor account for EUR/USD.

These are very low spreads by all standards if we look at what other brokers offer on their MT5 trading platforms. IC Markets offers zero minimum deposits on all trading accounts for low-cost trading. Like all MetaTrader brokers, scalping and EAs are permitted allowing you to take advantage of all trading conditions.

Pros & Cons

- Tight spread

- Zero minimum deposit

- Offers VPS

- Lacks proprietary platform

- Basic educational resources

Broker Details

To get the most value out of MetaTrader 4, you will need low spreads to benefit from the one-click trading and automated trading tools available. With IC Markets, you can use their Standard account, which is spread-only with no commissions, or a Raw account with tight spreads and low commissions.

In our tests, we used IC Market’s Standard account to find how low its spreads are compared to the rest of the industry in Singapore. To do this, we asked our analyst Ross Collins to get the average EUR/USD spread for each broker using MetaTrader 4 as the testing platform.

Ross found that IC Markets had the lowest standard spreads, averaging just 0.73 pips on EUR/USD, almost 50% lower than the industry average of 1.11 pips. The broker outperformed its peers on AUD/USD and USD/JPY, making IC Markets our lowest-spread broker on standard accounts.

| AUDUSD | SPREAD | EURUSD | SPREAD | USDJPY | SPREAD |

|---|---|---|---|---|---|

| CMC Markets | 0.77 | IC Markets | 0.73 | IC Markets | 1.09 |

| IC Markets | 0.82 | Admiral Markets | 0.74 | CMC Markets | 1.17 |

| OANDA | 1 | CMC Markets | 0.8 | TMGM | 1.26 |

| FusionMarkets | 1.02 | FXCM | 0.93 | FusionMarkets | 1.27 |

| TMGM | 1.03 | TMGM | 1 | Admiral Markets | 1.32 |

| City Index | 1.07 | FusionMarkets | 1.01 | FXCM | 1.38 |

| Admiral Markets | 1.1 | OandA | 1.06 | FP Markets | 1.51 |

| Pepperstone | 1.24 | City Index | 1.16 | Go Markets | 1.52 |

| FP Markets | 1.28 | EightCap | 1.16 | EightCap | 1.55 |

| FXCM | 1.31 | FP Markets | 1.19 | OANDA | 1.55 |

| EightCap | 1.34 | Pepperstone | 1.21 | Pepperstone | 1.55 |

| Go Markets | 1.38 | Blackbull Markets | 1.34 | Axi | 1.62 |

| Axi | 1.59 | Go Markets | 1.34 | City Index | 1.74 |

| Blackbull Markets | 1.69 | Axi | 1.45 | FXPro | 1.87 |

| FXPro | 2.49 | FXPro | 1.59 | Blackbull Markets | 2 |

| Tested Industry Average | 1.28 | 1.11 | 1.49 |

Low spreads on the MetaTrader 4 platform will reduce trading costs and boost profit margins.

What stood out was that IC Markets offers specialist MT4 copy trading services like MyFXBook AutoTrade and ZuluTrade, allowing you to mirror more experienced trades while leveraging IC Market’s low trading costs.

While testing these services, we found them simple to set up. Both require contacting IC Markets to request access, and the broker does the rest. Once set up with ZuluTrade, we could use the advanced search tool to find potential traders who match our criteria. This tool covers 25+ different settings, giving you in-depth customisation to find the right traders.

The results found of the traders allowed us to dive deeper into their trading histories and performance to verify that the traders matched our criteria manually. We could also view important risk metrics to ensure we weren’t following traders above our risk tolerance.

After we chose to copy a trader and placed our funds, the system automatically proceeded with the trades and used the MetaTrader 4 platform to mirror the trader’s orders.

With low trading costs and easy-to-access copy trading features, we think IC Markets is a good option for investors looking to gain market exposure to leveraged products through market-proven traders.

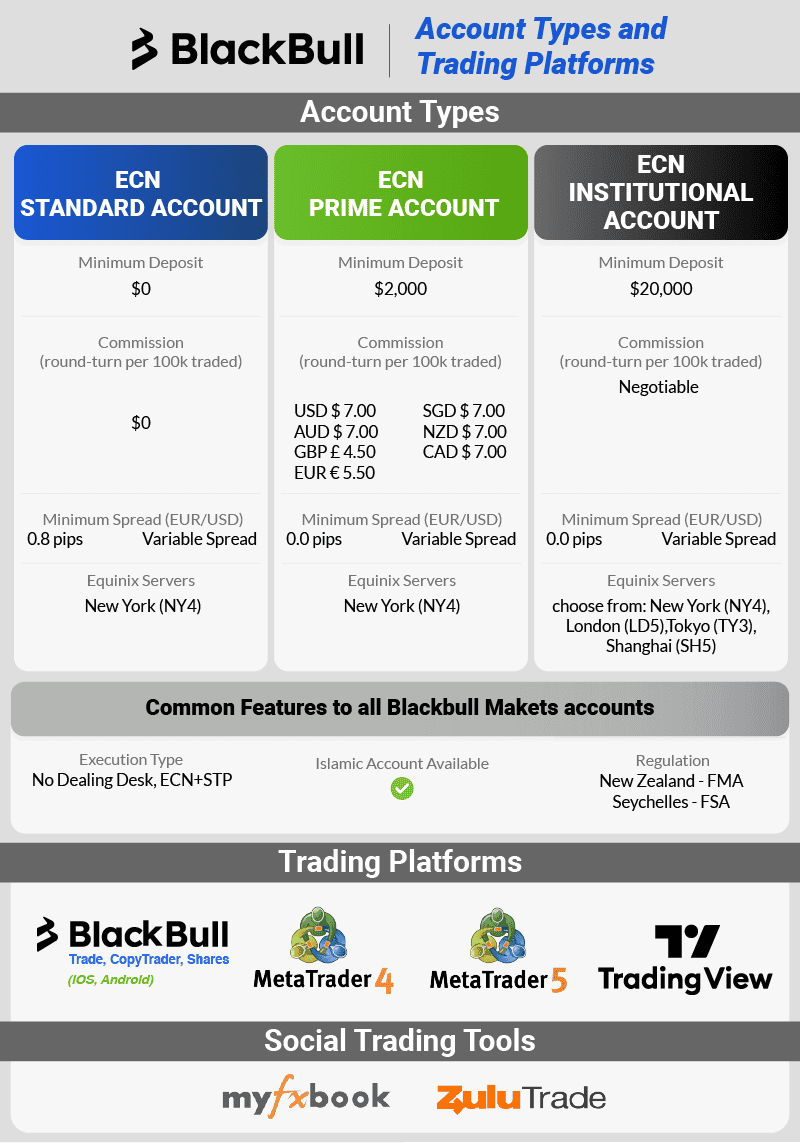

3. BlackBull Markets - Good For Fast Execution Speed

Forex Panel Score

Average Spread

EUR/USD = 0.23 GBP/USD = 0.72 AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlakcBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Markets ranks highest in our execution speed testing with a limit order speed of 77 milliseconds for limit order execution speed and 90 milliseconds for market order execution speed. This allows high-volume traders to capitalise on fleeting market opportunities and reduce slippage. BlackBull Markets is not about speed;

The broker’s RAW spread is among the most decent in class, averaging 0.23 pips for the EUR/USD currency pairs and zero deposit and inactivity fees.

Pros & Cons

- Fastest execution speed

- No inactivity fee

- Great Platform Range

- Has a withdrawal fee

- High minimum deposit

- No Share Trading in Singapore

Broker Details

Our analyst, Ross Collins, tested the execution speed of 20 brokers to find who had the fastest limit order and market order speeds on MetaTrader 4. Ross found that BlackBull Markets led the pack for limit order speed, averaging 72ms, giving you faster pending orders, stop loss, and take profit execution speeds.

In the same tests, BlackBull Markets came second for market order speed of 90ms, behind Fusion Markets, which achieved 77ms. This speed is important for scalping; anything sub 100ms is extremely fast. In fact, in the tests, only 4/20 achieved speeds below 100ms. Overall, Ross ranked BlackBull Markets in first place for execution speed.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| HugosWay | 4 | 104 | 7 | 94 | 3 |

| TMGM | 5 | 94 | 5 | 129 | 7 |

| FXCM | 6 | 108 | 8 | 123 | 6 |

| City Index | 6 | 95 | 6 | 131 | 8 |

| Axi | 8 | 90 | 4 | 164 | 16 |

| Eightcap | 9 | 143 | 12 | 139 | 10 |

| FP Markets | 10 | 225 | 20 | 96 | 4 |

BlackBull Markets offers MetaTrader 4, allowing you to take advantage of the platform’s key features, such as one-click trading that benefits from the fast execution speed. The broker also offers a suite of other platforms, such as TradingView (one of our favourite platforms thanks to its advanced charting tools) and cTrader, combining the best of TradingView and MetaTrader 4.

As an ECN-style broker, BlackBull Markets offers a Raw spread account with tighter spreads and low commissions of $3.00 per lot traded, below the industry average of $3.48.

Something to note is that BlackBull markets also offer high leverage up to 1:500, which is higher than that of other MAS-regulated brokers, which the regulator restricts to 1:20. This leverage makes BlackBull Markets a solid choice for those with lower funds who wish to take on more risk.

4. FP Markets - Best Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We recommend FP Markets for scalping based on its zero-spread offering that allows scalp traders to enter and exit positions based on short market movement. FP Markets offers an average 0.1 pips RAW spread on the EUR/USD currency pair.

Another feature we like is FP Market’s free VPS service allows traders to conduct faster and more secure trading on the MT4, MT5, cTrader and TradingView trading platforms.

Pros & Cons

- Zero spread broker

- Offers VPS service

- Has minimum deposit

Broker Details

FP Markets excelled in many of our tests designed for execution speed and low trading costs. While testing the broker, we found its Raw account spreads to average 0.10 pips, below the industry average of 0.22 pips. Tight spreads improve the profit margin, especially for scalpers who look to exit positions quickly.

| Broker | EURUSD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| Pepperstone | 0.1 |

| BlackBull Markets | 0.23 |

| Industry Average | 0.22 |

In our execution speed tests, the broker achieved a market order speed of 96ms, which placed it in second place out of the MAS-regulated brokers. Fast market order speed is vital for scalpers as it allows you to capture market movements with minimal slippage, making it easier and more reliable for scalping.

| Broker | Market Order Rank | Market Order Speed |

|---|---|---|

| Fusion Markets | 1 | 77 |

| BlackBull Markets | 2 | 90 |

| HugosWay | 3 | 94 |

| FP Markets | 4 | 96 |

| Pepperstone | 5 | 100 |

| FXCM | 6 | 123 |

| TMGM | 7 | 129 |

| City Index | 8 | 131 |

| FxPro | 9 | 138 |

| Eightcap | 10 | 139 |

Although the broker isn’t as fast as BlackBull Markets, we gave FP Markets the advantage thanks to its low trading costs, which are lower than BlackBull Markets, giving you a better overall scalping experience.

When you combine low trading costs with fast market execution speed, you can take advantage of MetaTrader 4’s one-click trading feature. We regularly use this feature to place a trade instantly without filling in an order ticket, which can be time-consuming.

FP Markets offers a suite of additional trading tools in addition to the one-click trading tool. The one that stands out is the Tick Chart, which allows us to follow the price to understand the market’s velocity and better time our trades compared with standard time-based timeframes.

As for the range of markets, the broker offers 63 forex pairs covering everything from major to minors, 19 indices, 13 commodities and 10,000 stocks, giving you plenty of markets to scalp.

5. ThinkMarkets - Top Broker for CFD market and Shares

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets offers an unprecedented range of tradeable CFD products and shares translated to its impressive showing on the range of market categories on our score. Its 0.1 pips RAW spread average on the EUR/USD currency pair plus the choice of MT4 and MT5 trading platforms, and wide range of products help make ThinkMarkets one of our top choices.

Pros & Cons

- Wide range of tradable products

- Tight RAW spread

- Multiple top-tier regulations

- High minimum deposit

- Average customer support

- Poor trade execution speed

Broker Details

From our testing, we found ThinkMarkets to have a solid selection of CFD markets covering 46 forex, 26 indices, 15 commodities, and 400 share CFDs. This solid selection of financial instruments allows you to trade multiple markets freely with a single account.

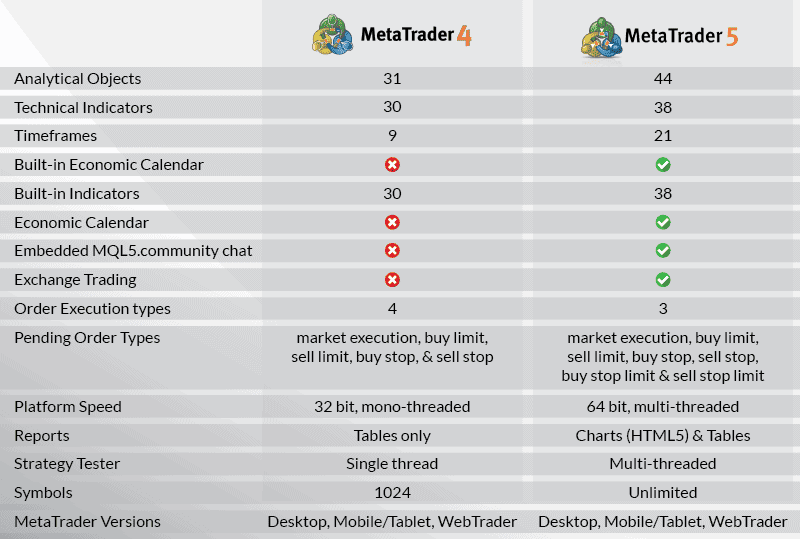

Although the broker offers MetaTrader 4, this platform doesn’t support share CFD trading. Hence, we recommend MetaTrader 5, which has all the same features as MT4 but improved performance, 38+ indicators and advanced drawing tools, plus more advanced tools such as a native economic calendar and depth of markets.

ThinkMarkets has two trading account options, giving you a choice of how you wish to pay for the broker’s services. You can choose a Standard account with spread-only pricing (commission-free), offering a simplified pricing structure ideal for beginners. Our tests found that the standard account spreads averaged 1.10 pips on EUR/USD, placing ThinkMarkets lower than the industry average of 1.24 pips.

Or you can choose the ThinkZero account, which has much tighter spreads starting from 0.0 pips. However, you’ll have to pay a small commission of $3.50 per lot traded. Although the spreads are 0.0 pips, we found in our testing that the broker kept them at zero pips on the majors 94.93% of the time (which is still impressive).

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| ThinkMarkets | 95.65% | 100% | 91.30% | 91.30% | 91.30% | 100% | 94.93% |

In particular, EUR/USD and USD/JPY stayed at 0.0 pips throughout our testing, offering you even better trading costs if you trade these pairs.

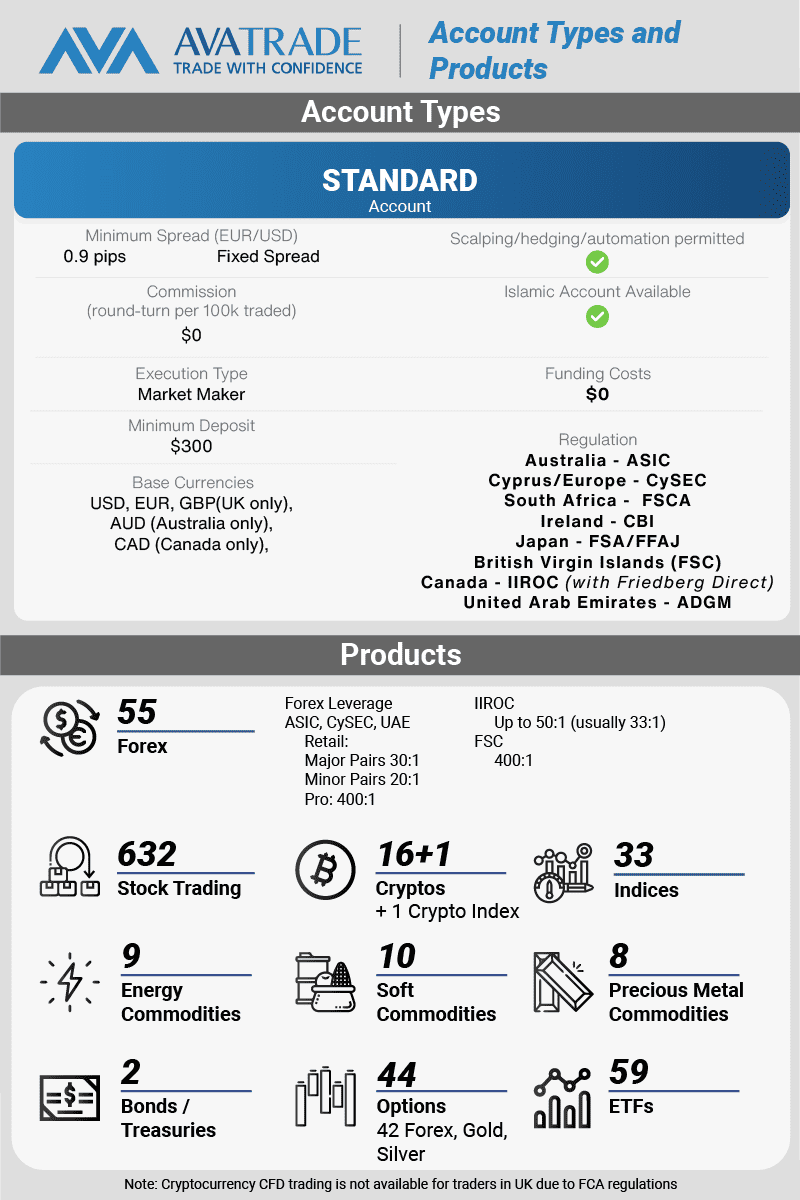

6. AvaTrade - Good Option For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.5 AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is our top recommendation for day trading because of its tighter fixed spread, averaging 0.9 pips on the EUR/USD currency pair. In contrast, other brokers have a cumulative average spread of 1.8 pips for the same currency pair. AvaTrade MT4 and MT5 trading platforms run with a free VPS service to provide a faster and more reliable order execution for day traders who need to capitalise on fleeting market opportunities.

Pros & Cons

- Tight fixed spread

- Free VPS

- Offers proprietary platform

- Lacks ECN Account

- No TradingView

- Limited Education

Broker Details

Out of all the MAS-regulated brokers we’ve tested, AvaTrade is the only one that offers fixed spreads in its markets. Using a fixed-spreads broker can be beneficial if you day trade, as the cost of trading will average out if you trade during volatile times.

You will never unknowingly enter a trade with expensive spreads, which can happen with variable spread brokers when markets move too fast.

In the past, fixed-spread brokers were expensive compared to variable-spread brokers such as Pepperstone and IC Markets. However, our testing found AvaTrade competitive with 0.9 pips fixed spreads on EUR/USD.

This is below the variable spread industry average of 1.24 pips, lower than other brokers like ThinkMarkets and BlackBull Markets. Making AvaTrade a real contender for low trading costs, especially considering they are fixed.

| Broker | Avg. Spread EUR/USD | Variable/Fixed |

|---|---|---|

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| Eightcap | 1.00 | Variable |

| Pepperstone | 1.12 | Variable |

| FP Markets | 1.10 | Variable |

| ThinkMarkets | 1.10 | Variable |

| BlackBull Markets | 1.20 | Variable |

The broker offers fixed spreads across its full range of markets, including 55 forex pairs, 33 indices, 17 crypto, 27 commoditise, and 630+ stock CFDs. However, we found that stock CFDs had fixed percentage-based spreads so that the cost would scale based on your trading value.

AvaTrade offers multiple platforms, including popular platforms like MetaTrader 4 and MetaTrader 5, which allow you to trade with fixed spreads. The AvaTradeGO platform offers unique risk management tools like the AvaProtect feature, allowing you to exit a trade without taking a loss by paying a small premium.

This is a great feature for beginners as it allows you to confidently enter trades, knowing you can exit a losing trade at any time for a small fee.

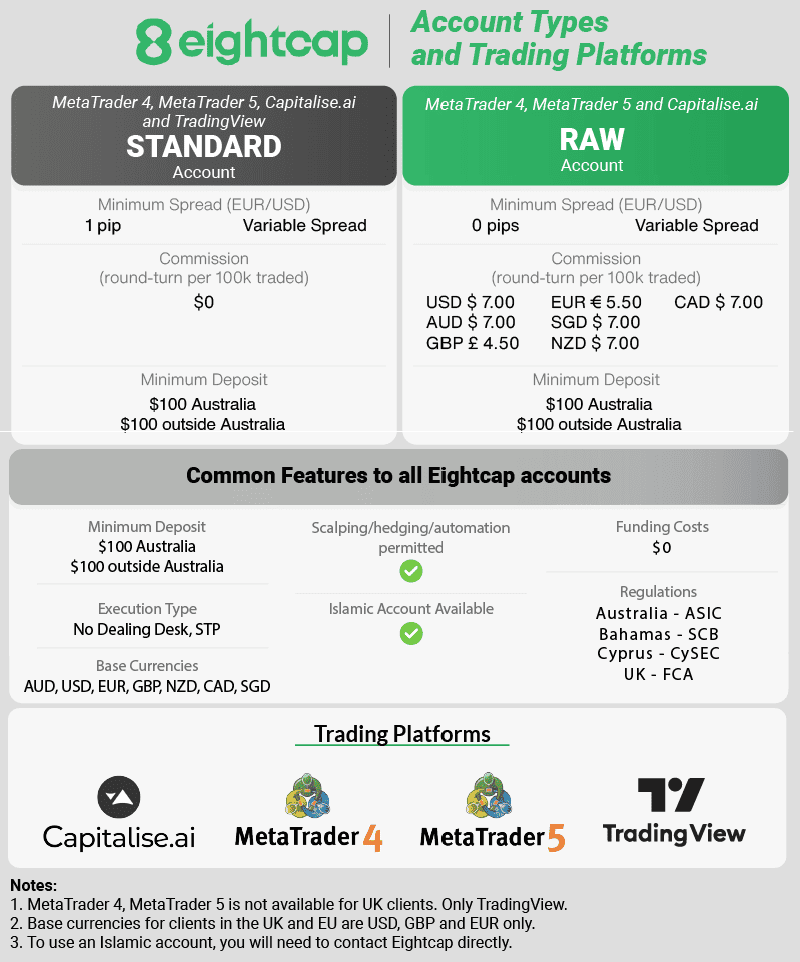

7. Eightcap - Best Crypto Broker

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.73 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Eightcap is our top crypto broker as it offers a wide variety of established and emerging crypto derivatives with robust regulatory compliance. With an extensive range of 95 tradeable crypto derivatives, Eightcap allows you to diversify your portfolio.

You can trade with low spreads, particularly using Eightcap’s RAW account with average EUR/USD spreads of 0.06 pips. We also scored Eightcap highly in trading platforms (8/10), with an excellent and diverse platform range, and customer service (9/10).

As a highly trusted broker with a diverse platform and crypto product range, we recommend Eightcap for beginners and experienced traders.

Pros & Cons

- Wide range of tradeable crypto offerings

- Has mobile trading app

- Free demo account

- No proprietary trading platform

- Educational content lacks depths

- Average execution speeds

Broker Details

We found Eightcap to offer the largest range of 95 crypto markets, including major cryptocurrencies like Bitcoin, Litecoin, Ethereum, and DOGE. Compared to all the brokers we’ve tested, Eightcap had almost five times the amount ThinkMarkets offers, making the broker a top choice for crypto trading.

| Broker | No. of Crypto Markets |

|---|---|

| Eightcap | 95 |

| ThinkMarkets | 21 |

| Pepperstone | 19 |

| IC Markets | 18 |

| AvaTrade | 17 |

| FP Markets | 11 |

| BlackBull Markets | 11 |

Even though the broker offers a variety of crypto markets, we found the selection of 800 traditional markets to focus only on the most liquid and popular assets. While this isn’t an issue for most traders focusing on major currency pairs and blue-chip indices like US500, traders seeking more volatile markets may be put off.

To trade the markets on Eightcap, you can use TradingView, which is good for technical analysis, or MetaTrader 4 (or 5), which offers excellent trading tools for scalping and automating trades.

One highlight of Eightcap is that they integrate Capitalise.AI into the MetaTrader 4 platform, allowing you to develop automated strategies without coding an Expert Advisor. If you have a consistently profitable trading strategy that you want to automate, Capitalise.AI opens up new possibilities.

We tried Capitalise.AI to see how fast we could design and launch a crypto trading strategy. Thanks to the interactive tutorials, this process was rather easy. You type in your entry and exit conditions of the strategy using simple phrases like “if BTC/USD falls 1% in one hour, buy USD 10,000 worth.” Impressively, Capitalise.AI generated our strategy instantly, and we could backtest it to see how it would perform over the last 90 days.

Along with excellent trading platforms and crypto markets, Eightcap had low trading costs based on our tests. The standard account averaged 1.0 pips on EUR/USD, which placed it as one of the lowest standard account brokers on our list.

Ask an Expert

Can I withdraw money from MT4 without broker?

No, you need a broker to use MT4.

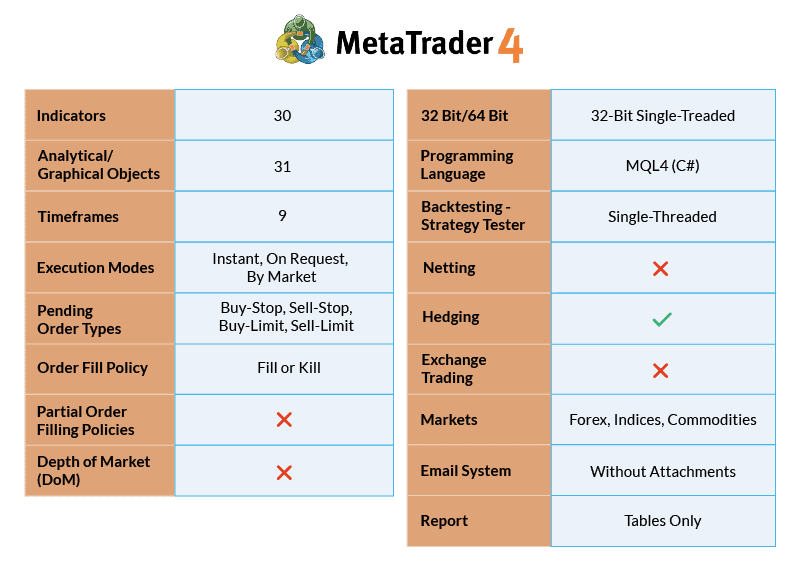

What broker should I use as a beginner in forex trading and which platform is best, MT4 or MT5?

MT4 would be a better choice, while MT5 is an upgrade on MT4 and most has the same features and much much more, these extra features can overwhelm new traders. So while MT4 might not be as fancy as MT5, its greater simplicity will appear to new traders. Another point to mention is that more traders use MT4, so you are more likely to find helpful resources with MT4 compared to MT5.

Can you close multiple trades on MT4?

Yes, MT4 allows you to close multiple positions simultaneously. TO close all positions at once you can use the close-by feature.