Best Forex Brokers In UAE

Our team created a list of forex brokers regulated in the region by the DFSA, ADGM, or SCA. To then determine the best UAE forex broker we focused on the June 2025 spreads followed by trading platforms available, range of markets and customer service levels.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The Best DFSA Regulated Forex Brokers For Dubai And UAE Traders:

- Pepperstone - Best Forex Broker in UAE

- IG Group - Most Trusted Brokers In UAE

- eToro - Great For Social Trading

- AvaTrade - Top Broker For Day Traders

- XM - Top Swap Free Islamic Account

- FXTM - Great Micro Account

- HYCM - Good For Fixed Spreads

- Saxo Markets - Great For Professional Traders

- TickMill - Top Broker With Lowest Commission

- Axi - Great MetaTrader 4 Forex Broker

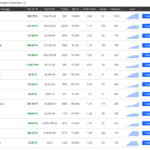

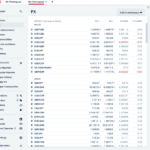

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

DFSA FCA, ASIC |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

57 |

ASIC, FCA CYSEC, DFSA, IFSC |

0.02 | 0.24 | 0.25 | $3.50 | 1.6 | 1.8 | 2.3 |

|

|

|

148ms | $5-$100 | 55 | - | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

61 |

DFSA, FCA CySEC, CIMA |

0.1 | 0.4 | 0.3 | $4.00 | 1.0 | 0.4 | 1.3 |

|

|

|

170ms | $100 | 69+ | 14+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

77 | FCA, CYSEC, DFSA, FSA-S, Labuan FSA | 0.1 | 0.3 | 0.1 | $3.00 | 1.6 | 1.6 | 1.6 |

|

|

|

125ms | $100 | 62 | 9 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

68 |

ASIC,FCA ,DFSA,FMA |

0.2 | 0.5 | 0.5 | $3.50 | 1.2 | 1.3 | 1.3 |

|

|

|

90ms | $0 | 72 | 37 | 30:1 | 400:1 |

|

Who Are The Best UAE Forex Brokers?

We compared the best brokers with DFSA regulations based in Dubai. Featured compared ranged from spreads, trading platforms to broker features. The list below aims to match different trading needs and styles to the most suitable regulated broker.

1. Pepperstone - The Best Forex Broker In UAE

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

From our analysis of various forex brokers, Pepperstone is undeniably one of the best forex brokers in the UAE.

From ultra-low spreads to fast execution speeds and robust tier-1 regulation, Pepperstone has many attractive features that make it a competitive option for traders of all experience levels.

The broker offers a wide range of financial instruments and CFDs, particularly in equities, and boasts a range of platforms including MetaTrader 4, MetaTrader 5, cTrader and TradingView.

These platforms are enhanced with advanced tools which are ideal for forex traders looking to undertake comprehensive technical analysis.

Pros & Cons

- MT4, MT5, cTrader and TradingView

- Top customer service

- Fast order execution

- No deposit fees

- Limited e-wallet deposit options

- No credit card option for retail traders

- No spot shares (CFD only)

- No proprietary platform

Broker Details

Competitive Spreads

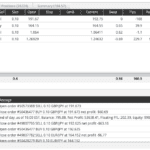

Once a month we capture the average spreads from brokers and we found that with an average spread of 0.1 pips for the EUR/USD pair, Pepperstone has some of the the lowest no-commission spreads of any broker we’ve reviewed.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

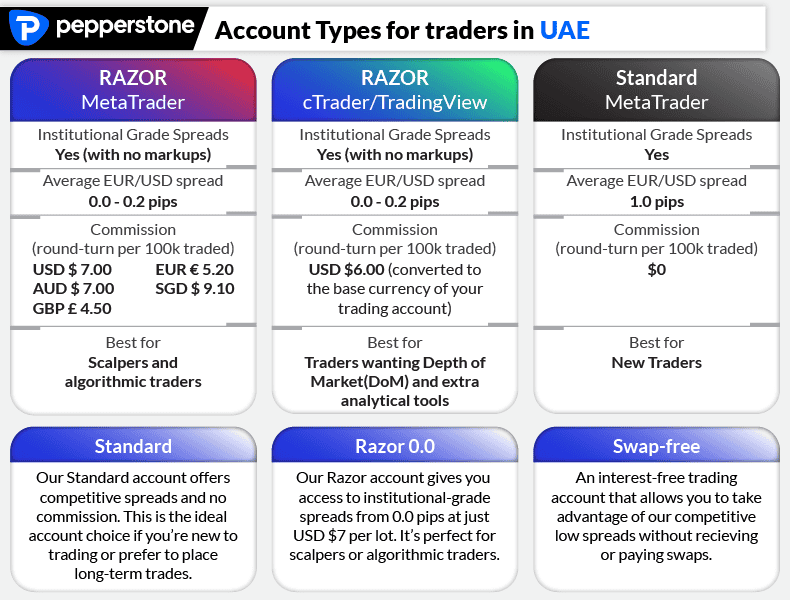

Out of Pepperstone’s two accounts, we think the Standard (commission-free) account is suited for beginners and the Razor Account (commission-based) will be more suitable for you as an experienced trader, especially those trading with larger volumes to keep your trading costs down.

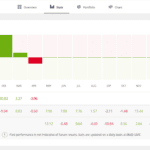

Execution Speed

To get a better feel of Pepperstone’s ECN order execution speed, we used a MetaTrader 4 script to verify the quality of trade execution. We found Pepperstone recorded an impressive execution speed of 77 milliseconds for limit orders and 100 milliseconds for market orders.

Below you can view a full trade execution speed comparison among Dubai forex brokers using limit orders.

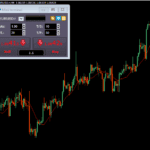

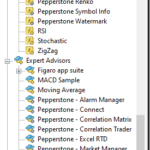

DIVERSE RANGE OF PLATFORMS

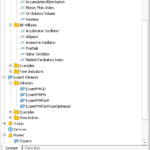

Pepperstone has a diverse range of platforms that includes MetaTrader 4, MetaTrader 5, cTrader and TradingView.

From our testing, we particularly like Pepperstone’s offering of Smart Trader Tools for MT4 and MT5 which are a collection of expert advisors and indicators to help with your trading. Our favourite tool was the mini terminal, which allowed us to save an order template with stop loss, take profit and trailing stop levels to streamline our future trades.

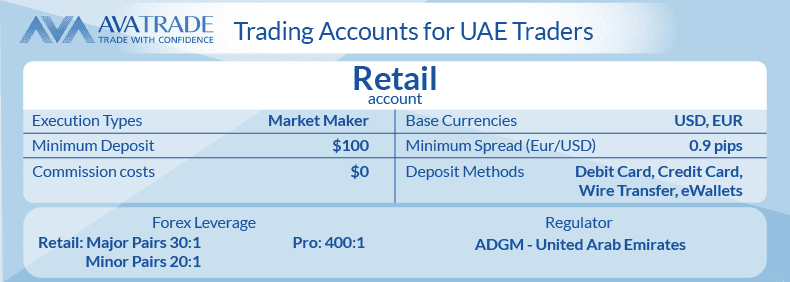

2. AvaTrade - Top Broker For Day Traders

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

In our view, AvaTrade is one of the most reputable and beginner-friendly online brokers available in the UAE. Not only are they regulated by multiple tier-1 regulators across 6 different countries, but they also have a large product offering.

Ross Collins from the CompareForexBrokers team analysed how many markets each broker had available and found that AvaTrade has one of the most on offer with over 50 forex pairs, shares, indices, and a large collection of cryptocurrencies.

They have Islamic accounts available for Muslim traders, demo accounts and interesting social and copy trading features that provide you with access to DupliTrade (with MT4) and ZuluTrade.

Pros & Cons

- Overseen by multiple tier-1 regulators

- A large range of financial markets

- Islamic accounts available

- Social and copy trading functionality

- Limited account types

- Spreads aren’t overly attractive

- No integration with TradingView

Broker Details

STABLE SPREADS FOR DAY TRADING

The consistency of AvaTrade’s spreads was a real highlight for us. Based on our testing, AvaTrade averaged consistently low spreads of 0.9 pips for EUR/USD which will suit day trading and scalping strategies. While wider than typical standard accounts, they are more stable and fixed at different part of the day.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

EXCELLENT PROPRIETARY PLATFORMS

We constantly check which platforms brokers are integrated with and AvaTrade performs well in this regard, scoring 8/10 in this category. In addition to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), AvaTrade offers its own proprietary AvaTradeGO platform, and specialty AvaOptions platform.

While we enjoyed the simplicity of AvaTrade’s mobile apps, what stood out from our testing of the platforms was the broker’s extensive range of copy trading platforms, from popular third-party platforms, ZuluTrade, Duplitrade and MetaTrader’s Signals, to its own, AvaSocial platform.

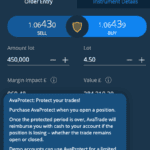

AVAPROTECT

AvaProtect is a unique feature that stands out to us and is worthy of mention. For a small fee, it provides you with the opportunity to protect your trades from losses for a specified period. Just make sure you are using AvaTradeGo or AvaOptions.

3. IG Group - Most Trusted Brokers In UAE

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG

IG is one of the world’s largest DFSA-regulated forex brokers and ranks as the best forex broker for safety and security. This is important given there are numerous scams in the industry.

We conduct extensive research into each broker, including reading disclaimers, to determine which regulators they are regulated by. We can confirm that IG is regulated by several tier-one regulatory bodies and has been around for over 45 years with a global presence across 16 offices.

In this time, IG Group has managed to establish itself as a reputable and leading name within the industry. From our assessment, their proprietary trading platform is world-class and they boast one of the largest ranges of markets in the industry.

For this reason, we gave IG Group a score of 71/100.

Pros & Cons

- Extensive range of markets

- Regulated by numerous tier-1 regulators

- 4 Trading Platforms

- IG Platform has guaranteed stop-loss orders

- Customer service isn’t top-notch

- Inactivity fees are charged

- No TradingView

- No MetaTrader 5

- No RAW spread account for retail traders

Broker Details

HUGE RANGE OF MARKETS

IG Group offers over 10,000 markets to trade in the UAE, the largest we’ve seen, spanning forex, crypto, shares, and options which places the broker among the top-tier. We like that they have products not usually found with other major CFD brokers such as options, futures and interest rates.

| Products | Volume |

|---|---|

| Forex Pairs | 80+ |

| CFD Shares | 12,000+ |

| Indices | 130 |

| Energies | 7 |

| Metals | 11 |

| Soft Commodities | 23 |

| Bonds | 14 |

| ETFs | 6000+ |

| Cryptocurrencies | 15 |

| Options | 7000+ |

| Futures | Yes |

| Interest Rates | Yes |

| Spot Trading | Yes |

| Sectors | Yes |

ACCOUNTS, SPREADS AND RISK MANAGEMENT

Of IG’s retail investor accounts, its CFD account has reasonably competitive spreads from our testing of UAE-regulated brokers. Spreads are 1.13 pips for EUR/USD, 1.01 for AUD/USD and 1.12 for USD/JPY however we thought 1.66 pips for GBP/USD and 1.98 pips for USD/CAD was a bit high.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Additionally, we like that IG offers negative balance protection on standard IG trading accounts while you get guaranteed stop-loss orders on the limited-risk account.

GREAT PLATFORM EXPERIENCE

IG offers a diverse range of proprietary trading platforms (IG Trading Platform, L2 Dealer, ProRealTime) which are all robust and highly suitable for experienced traders. You can also use MetaTrader 4 if you’re more accustomed to this platform.

If you have the patience, we recommend you try IG’s Web-based platform. We particularly loved that you can save a custom layout where you can display everything from live market prices to news headlines to indicator alerts, in an uncluttered way.

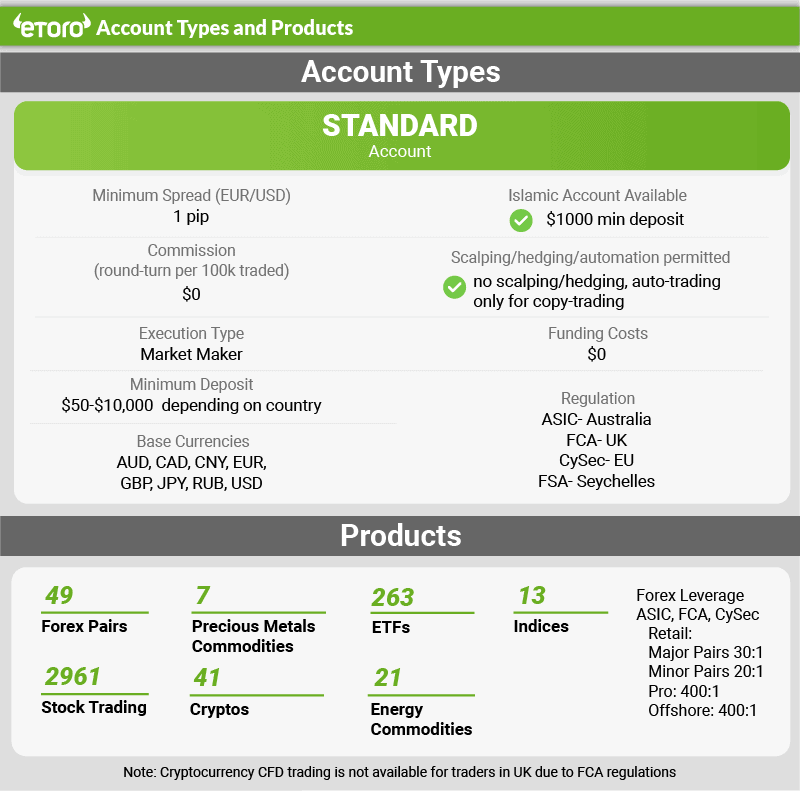

4. eToro - Great For Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

eToro is undeniably unique because of its social trading and copy trading functionality which allows you to browse traders and automatically copy their trading strategies.

You can use various filters to find the trading style you want to copy including by location, risk score, and strategy type.

Another unique aspect is eToro’s social trading feeds which create the ability for traders to interact with other traders.

Pros & Cons

- Unique social and copy-trading

- Intuitive and streamlined user interface

- Negative balance protection

- Regulated by numerous tier-one regulators

- Beginner friendly

- No MetaTrader 4 and 5

- No TradingView

- No stockbroking services

- No guaranteed stop-loss order

- Relatively high spreads and fees

Broker Details

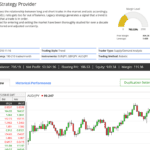

SOCIAL TRADING PLATFORM

eToro offers one of the most simple and easy trading platforms we’ve tested, which is uniquely designed for copy trading. However, there is no integration with MetaTrader which might be an issue for those accustomed to the popular third-party platform.

While there is a lack of functionality and features such as guaranteed stops and customisable charting, we did enjoy the ability to search for the most copied traders (along with their performance stats) with a simple filter toggle at the top of the window.

COMMISSION-FREE SPREADS

From our testing, eToro had the lowest Standard-account spreads in the UAE for EUR/USD, averaging 1 pip spreads.

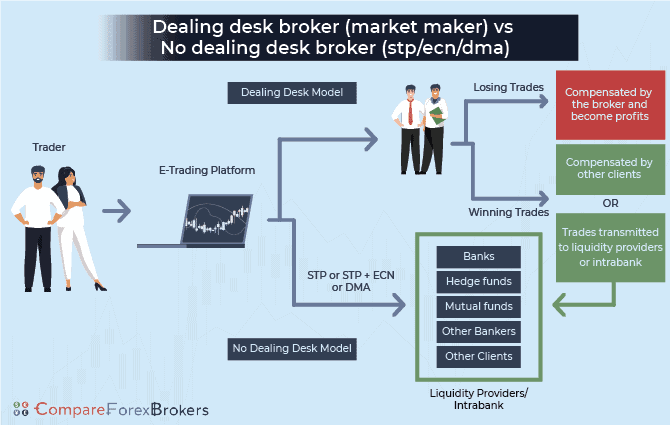

As a market maker, eToro also doesn’t charge commission fees, keeping your trading costs low. Additionally, there is no management fee when you copy other traders, which we particularly liked.

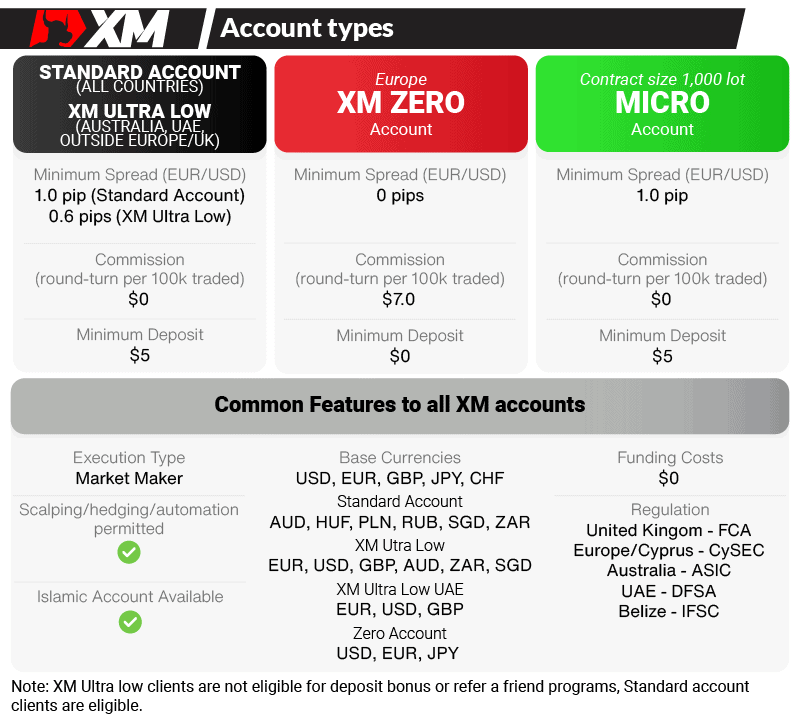

5. XM - Top Swap Free Islamic Account

Forex Panel Score

Average Spread

EUR/USD = 1.6

GBP/USD = 1.9

AUD/USD = 1.6

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM offers various account structures including the best swap-free Islamic account we’ve seen in the market.

If you’re a trader of the Muslim faith, the account provides you with access to the markets with no interest charges on positions held open for longer than a day.

Additionally, XM doesn’t widen the spreads offered to Islamic account holders, and no commissions are charged.

Pros & Cons

- Regulated by numerous tier-1 regulators

- Offer exclusive technical indicators

- $5 minimum initial deposit

- Micro Accounts available for beginners

- Negative balance protection

- Inactivity fees charged after 90 days

- Withdrawal fees on amounts less than 200

- Expensive spread pricing

Broker Details

GOOD RANGE OF ACCOUNTS

In addition to the swap-free Islamic account, XM has 2 types of commission-free accounts for UAE traders: the Micro and Standard accounts.

From our analysis, the spreads on both the Micro and Standard Accounts are fairly expensive, starting from an average of 1.72 pips on major pairs, offsetting some (if not all) of the benefit from having no commissions.

DIVERSE MARKETS

We like that XM offers a diverse range of markets that are accessible for all investor accounts with over 1,250 CFD trading products.

Whether you want to focus on the most commonly traded currency pair (EUR/USD) or develop strategies using minor and exotic FX pairs, the XM group offers great access to forex markets with no commission fees and low spreads.

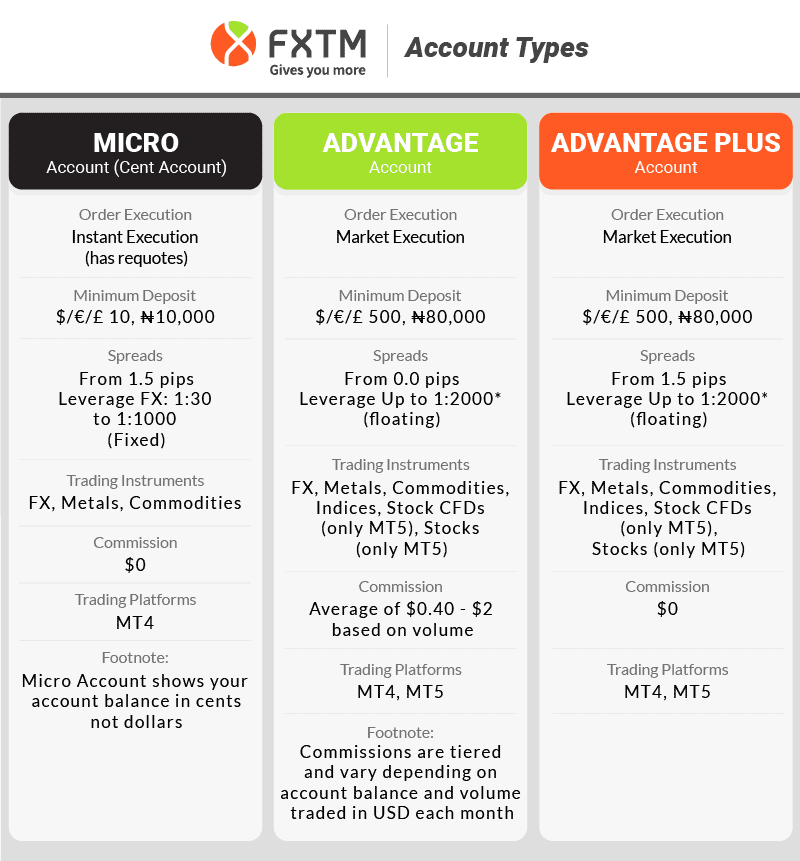

6. FXTM - Great Micro Account

Forex Panel Score

Average Spread

EUR/USD = 1.9

GBP/USD = 2

AUD/USD = 2

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

FXTM is a global broker that is regulated by tier-1 financial authorities, including the UK’s FCA.

Unlike many other top brokers, FXTM offers a Micro Account, specifically designed for micro trading on MetaTrader 4.

Pros & Cons

- Good range of account options

- Great educational resources

- Copy trading available

- No funding fees

- No integration with cTrader

- Not regulated by DFSA

- Inactivity fees charge

- No guaranteed stop-loss option

Broker Details

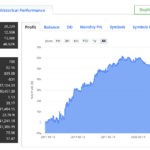

From our testing, a standout feature of FXTM is its impressive account offering. There are three account types to choose from (Micro, Advantage and Advantage Plus), each providing access to different asset classes, pricing models, and commissions, giving you a diversity of options.

PLATFORMS

Focusing exclusively on the MT4 and MT5 platforms, FXTM offers a solid (if not ground-breaking) trading experience with all the standard trading tools we’ve come to expect from MetaTrader.

EXCELLENT COPY TRADING

Platform-wise, where FXTM stands out, however, is FXTM Invest, which is a copy trading service similar to the setup at eToro. You follow the FXTM traders, known as strategy managers in this case, with the risk management principles and system that align with your expectations.

If you’re a risk-tolerant trader, then choose a high-risk system. If you want short-term results, then choose a scalping system. The choice is entirely up to you.

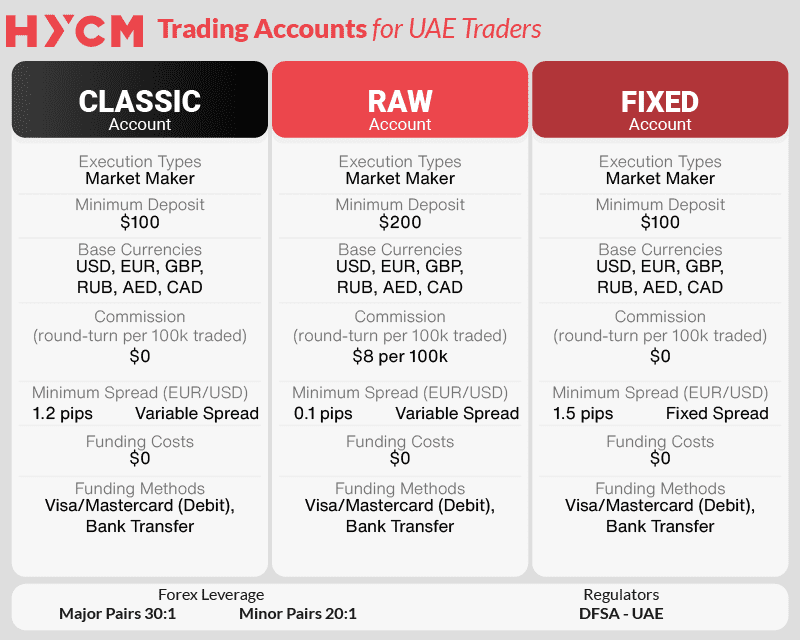

7. HYCM - Good For Fixed Spreads

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5

Minimum Deposit

$100

Why We Recommend HYCM

HYCM is one of the oldest forex brokers in the industry and offers some of the best-fixed spreads available, starting from 1.2 pips on EUR/USD.

They have a worldwide presence and are regulated by numerous tier-1 regulators including the FCA, CYSEC, and DFCA in Dubai.

Pros & Cons

- Attractive fixed spreads

- Integrated with MetaTrader

- Social and copy trading tools available

- Automated trading allowed

- No deposit integration with Paypal

- Inactivity fees are charged

- No integration with cTrader

- No guaranteed stop-loss

Broker Details

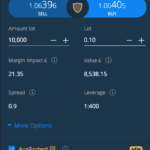

TIGHT SPREADS

From our testing, HYCM offers tight spreads of 1.24 pips for its Classic (commission-free) account and 0.26 pips for its RAW account across the 5 major USD-backed forex pairs.

Similar to classic accounts, on a RAW account, you can trade with the use of Expert Advisors and can set this account to run either on MetaTrader 4 or MetaTrader 5.

PROPRIETARY MOBILE APP

In addition to integration with both MetaTrader platforms, HYCM offers a proprietary mobile app, HYCM Trader, which we like for its simple design and integration with market news and analysis.

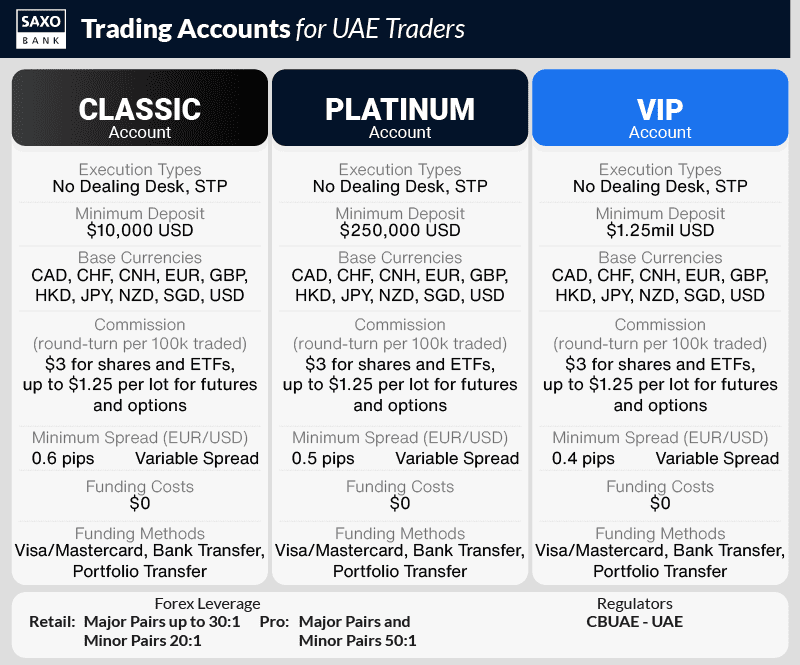

8. SAXO MARKETS - Great For Professional Traders

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTrader Pro

Minimum Deposit

$0

Why We Recommend Saxo Markets

Saxo is an advanced broker that we think is better suited for professional traders. It provides you with an extensive range of markets to trade on its proprietary trading platform which has social and copy trading features available.

Pros & Cons

- No inactivity fees

- No funding fees

- Proprietary trading platform

- Social and copy-trading

- No swap-free account

- No integration with MetaTrader

- No guaranteed stop-loss

Broker Details

ACCOUNTS + PERKS FOR PROFESSIONALS

While Saxo Bank offers multiple accounts, its main retail investor account is the commission-free Classic account with average spreads of 1.2 pips for EUR/USD from our testing.

If you’re a professional trader seeking extra perks, Saxo Bank’s VIP trading account offers discounted pricing and exclusive benefits (for the princely sum of 3.5 million dirham).

LARGE RANGE OF MARKETS

Saxo Capital Markets offers a large range of more than 9,000 CFD instruments including stocks, ETFs, crypto, commodities, and more. You can trade these markets on Saxo Bank’s highly sophisticated proprietary platforms (SaxoTraderGO and SaxoTraderPRO).

TRUSTED BROKER

Saxo Bank is a multi-regulated broker that operates in the UAE under DFSA oversight. It is also regulated by ASIC in Australia, the FCA in the UK, and many other tier-1 regulators. As such, we scored Saxo Bank a high 86/100 for trust.

9. TICKMILL - Top Broker With Lowest Commission

Forex Panel Score

Average Spread

EUR/USD = 1.6

GBP/USD = 1.6

AUD/USD = 1.6

Trading Platforms

MT4, MT5, Tickmill Mobile App CQG Agena Trader

Minimum Deposit

$100

Why We Recommend Tickmill

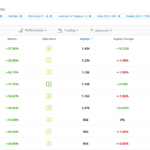

We like Tickmill for various reasons including the fact that they have the lowest commissions that we have seen for the UAE.

From our analysis, the average commission rate per side for each broker is $3.48, but TickMill comes in substantially lower at $2 for USD pairs, £2 for GBP pairs and €2 for euro pairs. This positions them very favourably as far as commissions go.

It’s important to note however that their markets outside of forex are somewhat limited, with only 2 metals, 4 bonds, and no crypto or shares.

Pros & Cons

- Low commissions

- Swap-free Islamic account available

- Social and copy-trading

- No funding fees

- Charge inactivity fees

- No integration with MetaTrader 5

- No integration with TradingView

- No automated trading

Broker Details

COMPETITIVE RAW SPREADS

From our testing, Tickmill offers the most competitive spreads for its Pro (commission-based) account with 0.16 pips across the 5 major currency pairs.

When you combine the commissions of USD 4 per round-turn trade and low average spreads of 0.16 pips, this keeps your trading costs even lower.

The Classic Account, however, offers significantly higher average spreads which is why we recommend the Pro account for the lowest trading costs.

METATRADER SPECIALIST

Tickmill is a MetaTrader specialist, offering both MT4 and MT5 as well as a Tickmill app for account management only.

From our testing, Tickmill offers a standard MT4/MT5 platform experience (reliable but not spectacular), which will suit most traders.

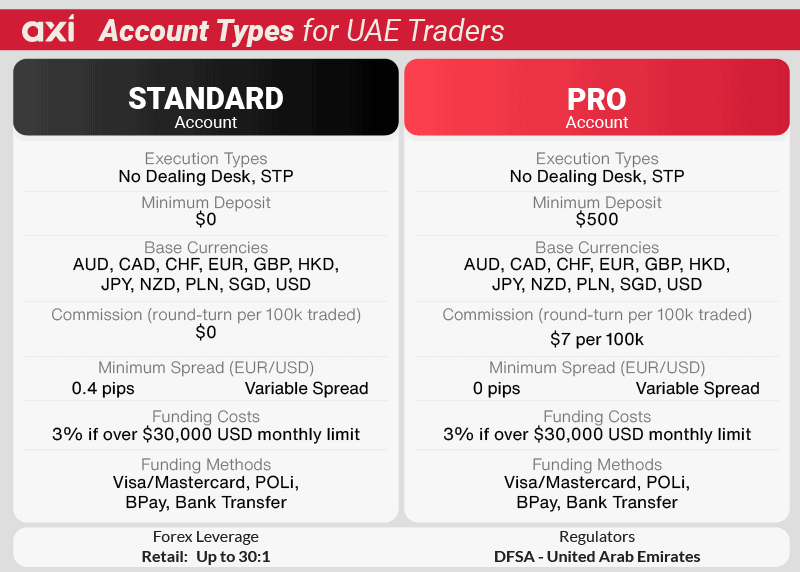

10. AXI - Great MetaTrader 4 Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

We like Axi because they offer ECN-style tight spreads for a range of markets, making them a great MetaTrader 4 forex broker.

Via this platform, you can access 140+ currency pairs for forex trading, a $0 minimum deposit, fast execution, award-winning customer support and other CFD products including cryptocurrencies like Bitcoin.

Pros & Cons

- Low spreads

- Integration with MetaTrader 4

- Extensive range of forex markets

- No inactivity fees

- No integration with MetaTrader 5

- No guaranteed stop loss available

- No proprietary platform

Broker Details

ENHANCED MT4 FEATURES

From our testing, Axi has the MT4 enhancement tool which gave us several benefits including an Alarm Manager which alerted us when a trigger was reached, an economic calendar with RSS news, and market correlation tools.

ADVANCED TECHNOLOGY FOR FASTER EXECUTION

Axi’s MT4 offering is based on superior network technology, which allows for considerable latency reduction. This means slippage is reduced significantly, lowering your trading costs compared to a standard connection.

Our testing backed this up, as Axi boasted a 90-millisecond execution speed for limit orders, putting it as the 4th quickest on our list.

Note: The below testings were conducted using a third-party MetaTrader 4 script on a demo account using market orders.

FAST VPS SPEEDS

When we tested Virtual Private Servers (VPS) speeds, Axi was the second fastest broker overall, achieving speeds of 107 ms for limit orders.

Ask an Expert

Is the DFSA the only regulator in the UAE?

The UAE has a number of regulators – the DFSA is the regulator of the Dubai free trade zone, in much the same way the ADGM is the regulator of the Abu Dhabi free trade zone. Regulators on the mainland (outside the free trade zone) include the Central Bank of UAE and SCA (Securities and Commodities Authority)

Can i use DFSA regulated broker if i am in Abu Dhabi?

Yes, being in the UAE you can use a DFSA regulated broker throughout the region

I heard the DFSA are making changed later this year. Will this impact my trading conditions?

That is correct, On the 4th of December 2021, the DFSA tightened leverage conditions when trading. While retail traders could previously trade major forex pairs, gold and major indices at 50:1, it is not restricted to 20:1. Minor forex pairs and minor indices are now 10:1 after previously being 20:1. Other leverage changes include oil, now 20:1 (previously 50:1), commodities (excluding gold and oil) 10:1 (previously 20:1), shares 5:1 (previously 10:1), cryptocurrencies 2:1 (was 5:1). Bonds remain 20:1 and all other markets are now to 5:1.

All retail traders will also receive negative balance protection meaning you cannot lose more than your deposit. A margin close out will occur when the equity in your trading account drops below 50% which means traders using a guaranteed stop loss should check how margin close out rules will affect them with their broker.

I there any objection from the uae bank…for withdrawing and depositing money to forex broker ..or before starting a forex trading in UAE we have to get permission from Bank?

Hi Jamsheer, you will need to contact your local bank but technically you are not trading your money to the forex broker. If you are using a UAE regulated broker then the broker must have a segregated account in your name and this is where your money will be transferred to. This segregated account will most likely be with a UAE authorised bank. Since the account is segregated, the forex broker cannot touch the funding. Just make sure you are using a UAE regulated broker (i.e. DFSA, ADGM or CBUAE regulated).