What Are The Forex Brokers That Accept Canadian Clients?

Canadian clients can choose a broker with CIRO regulation or consider a handful of replicable offshore forex brokers. We have compared both types of brokers and made 2025 recommendations based on different trader needs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

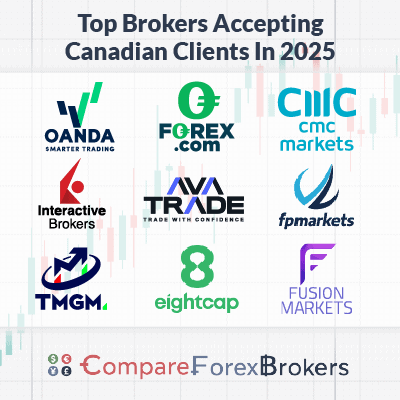

Our 2025 list of forex brokers that accept canadian clients is:

- OANDA - Most Trusted Forex Broker Accepting Canadian Clients

- FOREX.com - Top CIRO Broker With Solid All around Offering

- CMC Markets - Great CIRO Broker With Most Currency Pairs

- Interactive Brokers - Best Broker For Professional Traders

- AvaTrade - Good Fixed Spread Broker For Day Trading

- FP Markets - Top Broker For Scalping

- TMGM - Best Broker For Range Of Markets

- Eightcap - Great Forex Broker for Cryptocurrency

- Fusion Markets - Cheapest Broker with Lowest Commission

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

FCA, CIRO, ASIC FSC-BVI, NFA, CFTC MAS, JFSA, KNF |

- | - | - | - | 1.4 | 2 | 1.4 |

|

|

|

120ms | $0 | 69+ | - | 50:1 | - |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

69 |

ASIC, FCA MAS, CIRO |

0.5 | 0.9 | 0.6 | $2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 339+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

52 |

CIRO NFA/CFTC,ASIC,FCA,MAS |

- | - | - | 0.08%-0.2% | - |

|

|

|

120ms | $0 | 100+ | - | 30:1 |

|

|||

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

1. OANDA - Most Trusted Forex Broker Accepting Canadian Clients

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA, excelling with a perfect 100/100 in our Trust category, is our preferred choice for Canadian traders. Established in 1996 and regulated under CIRO, it assures reliability and a long-standing reputation of over 20+ years of operating in forex trading.

The broker offers competitive spreads of two pips on EUR/USD with no commission, which is low compared to its peers. This combination of trust and transparent pricing makes OANDA a solid choice, especially if you value a straightforward, dependable trading partner without hidden costs.

Pros & Cons

- Well regulated broker

- No minimum deposit

- Trade partial lots with OANDA Trade

- Client support is not 24/7

- Lacks stock CFDs

- It does not offer RAW spreads

Broker Details

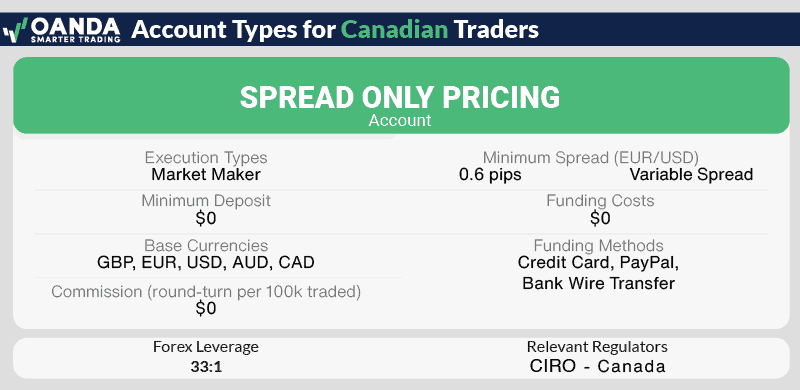

OANDA is our top CIRO-regulated forex broker for Canadians for several reasons including low trading fees, excellent trading tools with low trading fees and a wide range of forex pairs to trade.

Following our comprehensive methodology, comprising over 80 thorough checks, we scored OANDA a solid 71/100. The scoring criteria is demanding, so its score has put OANDA in the top spot for Canadian Forex Brokers and the top ten of all brokers we’ve reviewed.

Lowest No-Commission Spreads

As a market maker, OANDA simplifies the pricing model by offering only one trading account type for retail traders, a Spread-Only account.

From our extensive published spreads analysis, OANDA offers the most competitive spreads for a commission-free account at 0.70 pips for the 5 most traded currency pairs.

This not only tops our list of 40 brokers, the next best being IC Markets averaging 0.76 pips, but it smashes the industry average of 1.52 pips for the 5 most traded pairs.

You can take advantage of OANDA’s low forex spreads on its 69 currency pair offering. What we particularly like is the ability to trade gold and silver with different currencies (up to 10 combinations for each), allowing you to trade metals that could capture more volatility in the market. We haven’t seen many brokers that offer this.

Excellent Choice of Trading Platforms

OANDA offers three main trading platforms: MT4, TradingView and its own excellent OANDA Trade platform.

If we had to pick, we highly recommend the OANDA Trade platform as it is a simplistic forex trading platform and comes with some advanced tools that cannot be found on other platforms. For a start, OANDA Trade allows you to trade directly from the charts and has direct access to the broker’s premium trading tools, such as AutoChartist.

For example, you can control your trading size all the way down to a single unit (0.00001 unit). This feature is excellent for beginners because you can start trading in a real environment with your own money for around CAD 1.50 whilst you are learning.

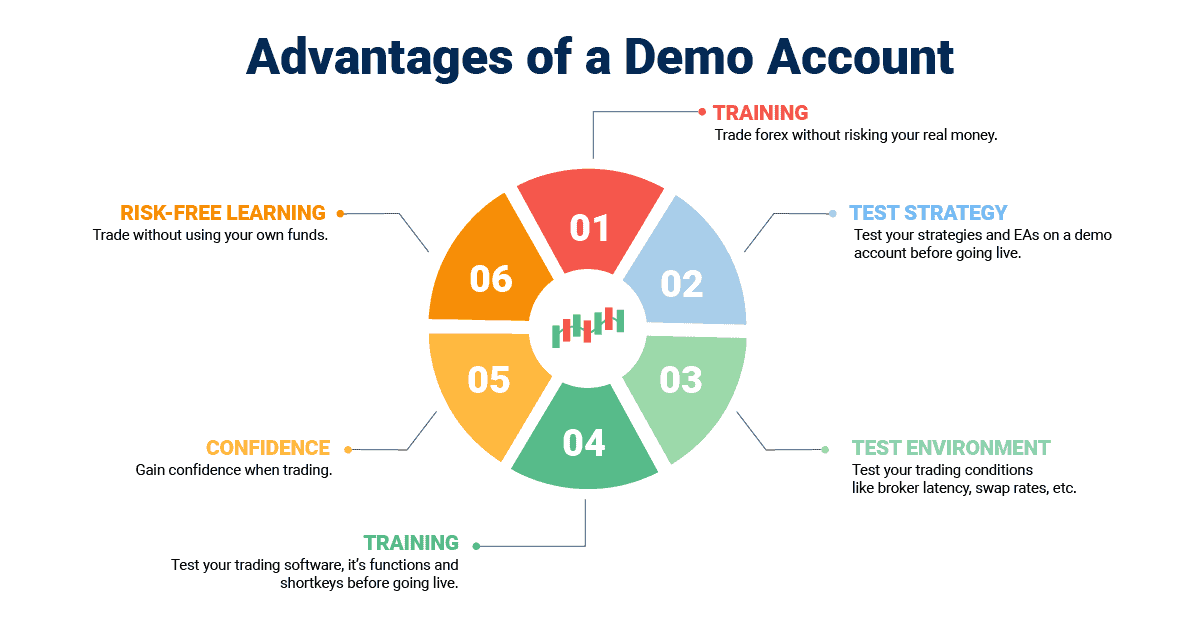

We like this because it’s a soft “next step” that beginners can go through to get live trading experience and trade with their own money. By trading real money, you will gain a better experience of what it is like to have skin in the game compared with a demo account, where you can just ignore the losses as there is no risk involved.

2. FOREX.com - Top CIRO Broker With Solid All-around Offering

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

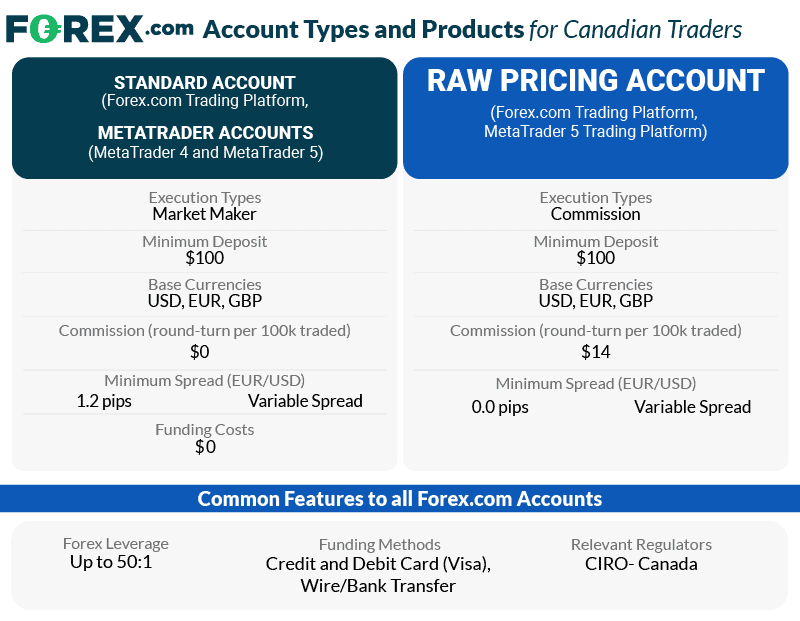

FOREX.com is our top choice for MT4 users under CIRO regulation, offering low average spreads from just one pip on EUR/USD on the Standard account. If you want tighter spreads but don’t mind commissions, the RAW account with a $7 per lot commission offers average spreads from 0.5 pips.

Additionally, the broker provides the MT5 platform, which enhances your trading experience with faster execution and a broader range of tools, including more indicators.

Pros & Cons

- A variety of trading platforms are available

- Offers a unique choice of gold and silver exotic pairs

- Has low average spreads

- It needs a minimum deposit

- Customer support is only available during the week

- Lacks MetaTrader 4

Broker Details

As one of the longest-serving brokers that the CIRO directly regulates, FOREX.com has our favourite all-around offering which includes competitive RAW spreads, volume-based rebates, an excellent proprietary platform and over 80 forex pairs to trade.

Competitive RAW Spreads With Volume-Based Rebates

While FOREX.com offers two account types, it is the broker’s RAW Pricing account that stands out to us with its tight spreads and volume-based rebates.

With its RAW Pricing account, you can obtain spreads from 0.0 pips on EUR/USD. However, this account charges a commission of CAD$14 per lot round turn, which is double the industry standard for a RAW account.

Where you’ll obtain the most benefit, however, is as an active trader with volume-based rebates. By trading a minimum volume of $50M per month (or opening an account with a $10,000 initial deposit), you can receive cash rebates that reduce costs by up to 15%.

Enhanced MetaTrader 4 Tools

FOREX.com offers a solid variety of trading platforms, including MetaTrader 4, MetaTrader 5, and its own proprietary platform. We recommend the broker’s Advanced Trading platform (Desktop) for experienced traders, as it offers advanced order types and deep platform customization.

Casual traders may prefer the web trader, which features great charting capabilities (including 100 indicators) via TradingView while the mobile app offers a fluid user interface and minimalist design.

A notable feature we discovered is the ability to set price tolerance from within the trade ticket using the desktop platform, which helped us manage our portfolio according to our risk profiles.

80 Forex Pairs to Trade

One of the main reasons FOREX.com stands out, in our opinion, is that it provides a wide range of 80 currency pairs, which is appealing if you are a trader who seeks higher volatility opportunities.

You can trade many of exotic pairs such as the TRY, CNH, ZAR, THB and MXN. Having access to exotic pairs like the TRY crosses provides unique trading opportunities compared to majors.

While the higher volatility can open up more opportunities, we must emphasise risk management vital.

3. CMC Markets - Great CIRO Broker With Most Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We recommend CMC Markets for its impressive range of 330+ currency pairs, giving you a better range of volatile pairs to trade that most brokers don’t offer. This lets you find more opportunities to find trades that suit your strategy, especially if you day trade.

The NGEN platform is a solid trading platform that is very user-friendly and lets you take advantage of CMC’s lowest spreads and fastest execution times.

Pros & Cons

- Excellent trading platform

- The most comprehensive range of fx pairs

- Tight spreads with FX Active account

- Lacks social trading tools

- Limited support over the weekend

- No automated trading on NGE

Broker Details

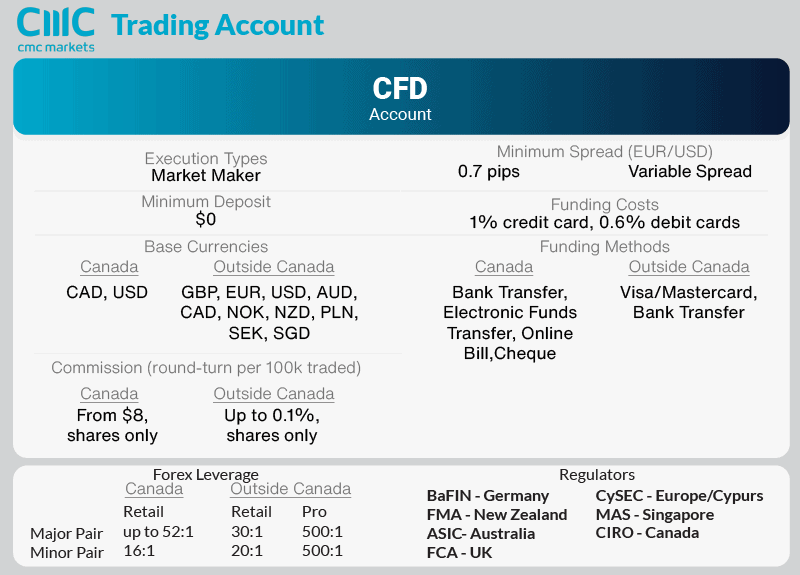

From our analysis, CMC Markets offers the largest range of currency pairs we’ve seen of any Canadian broker. We also recommend CMC Markets for its low commission-free spreads, high-quality risk management tools and intuitive trading platform.

Largest Range of Forex Pairs

Make no mistake, CMC Markets offers the largest range of forex pairs we’ve seen, at 331. You can also trade over 9,500 CFDs, making it one of the most diverse offerings by a Canadian forex broker.

When digging a little further, we found CMC Markets can offer such a huge range of forex pairs given the broker quotes its 158 currency pairs both ways (E.G. you can trade both EUR/USD and its inverse, USD/EUR).

Competitive Commission-Free Spreads

CMC Markets offers some of the most competitive Standard account spreads we’ve seen, with average spreads of 1.11 pips across the 6 major USD-backed currency pairs (including EUR/USD and GBP/USD). Only IC Markets, with average spreads of 1.01 pips, had tighter spreads in our tests.

As a Canadian trader, you can also open an FX Active account, which is commission-based. From our analysis, the USD $5 commissions per round turn the broker charges are highly competitive compared to the industry average of US $7 round-turn.

Solid Proprietary Platform Experience

CMC Markets provides access to the popular MetaTrader 4 trading platform and its own Next Generation platform. The Next Generation platform is fast, reliable across all devices and feature-rich, offering advanced charting with up to 80 technical indicators.

As well as full access to CMC Markets’ range of over 10,000 products, we particularly like Next Generation’s risk management features, including offering guaranteed stop-loss orders (GSLOs), that not many CIRO-regulated brokers offer. GSLOs offer the reassurance of exiting the markets without you losing more than you intend to.

Surprisingly, CMC only offers the GLSO only on the Next Generation platform, which means it is not available on their MT4 or TradingView platforms.

4. Interactive Brokers - Best Broker For Professional Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Our top pick for professional traders is Interactive Brokers, thanks to its extensive trading tools and low-cost volume trading fees. What impressed us is the broker offers in-depth fundamental analysis available alongside chart views, helping you research your trades thoroughly.

The broker has low RAW average spreads of 0.1 pips on EUR/USD and a $2.00 per lot commission. Although this is the minimum charge, which means anything smaller than one lot still charges $2.00 per trade, smaller lot sizes are more expensive than their peers.

Pros & Cons

- Advanced trading platform for professionals

- No minimum deposit

- Low commissions for high-volume traders

- High commissions for mini and micro-lot traders

- Lacks TradingView and MetaTrader platforms

- IBKR takes time to learn

Broker Details

We like Interactive Brokers for several reasons. Firstly it is one of the largest brokers in the world, regulated by every Tier 1 jurisdiction, including CIRO. Secondly, the broker has advanced trading platforms through its proprietary platforms that allow trading on a diverse range of complex products. As such, because the broker offers an institutional-grade trading platform with many features, it’s not beginner-friendly, so we recommend IB for professional traders.

ECN-Style Execution for Lower Costs

The execution of each trade is managed by Interactive Brokers’ IBKR BestX, which uses advanced technology to route your trades to one or more liquidity providers. This ensures that you get the best execution and pricing while using the IBKR platform.

IB sources pricing directly from 17 major banks. This gives you low-cost forex spreads as low as 0.1 pips on EUR/USD and 0.5 pips on USD/CAD. You have to pay a commission with the spread, which ranges from 0.08 to 0.20 basis points based on your trading volume. There are four tiers, so increased trading activity leads to better commissions per trade.

Because IB prices their commissions differently, we opened a demo account to clarify how much a one-lot round trade would cost you.

As you can see, a one-lot trade charges a $2.25 commission to enter the markets and the same to exit, giving it a total of $4.50 per lot round trade, which makes it one of the lowest commission brokers available in Canada.

5. AvaTrade - Good Fixed Spread Broker For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is one of a few brokers to provide fixed spreads that keep your trading costs the same, even during volatile market movements. The fixed spreads start from 0.6 pips on EUR/USD with no commission fees, making them a very competitive broker with spreads like these.

Pros & Cons

- Tight fixed spreads

- Decent choice of markets

- Offers options trading with AvaOptions

- Requires a minimum deposit

- No RAW-based pricing

- Limited market research tools

Broker Details

If you are looking for a CIRO-regulated forex broker that offers fixed spreads, then Friedberg Direct (powered by AvaTrade) is our top choice. Based in Toronto, Ontario, Friedberg Direct is directly regulated by the CIRO but uses AvaTrade’s trading technology to offer Canadian traders leveraged trading products. You can trade with low fixed spreads from 0.6 pips on the EURUSD, which is very competitive compared with the variable spreads of other brokers.

Stable Trading Account With Fixed Spreads

When you open a trading account with Friedberg Direct, you only have the option to use a Standard account. This account offers fixed spreads from 0.6 pips on the EURUSD, which is surprisingly low compared to the industry average of 1 pip for an account of its type.

One of the key reasons we recommend fixed spreads is that they do not widen during volatile trading times, (E.G. high-impact economic news). This is great if you are a purely technical analysis-based forex trader and don’t want to suffer from spread variation during turbulent times.

This is also why we recommend Friedberg Direct (powered by AvaTrade) for day trading, as your spreads will remain stable and competitive, which is vital for traders looking to profit from short-term price movements.

What’s more, AvaTrade compares highly favourably against other fixed spread brokers we’ve analysed. For a selection of major and minor currency pairs that we traded, AvaTrade has the following fixed spreads:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

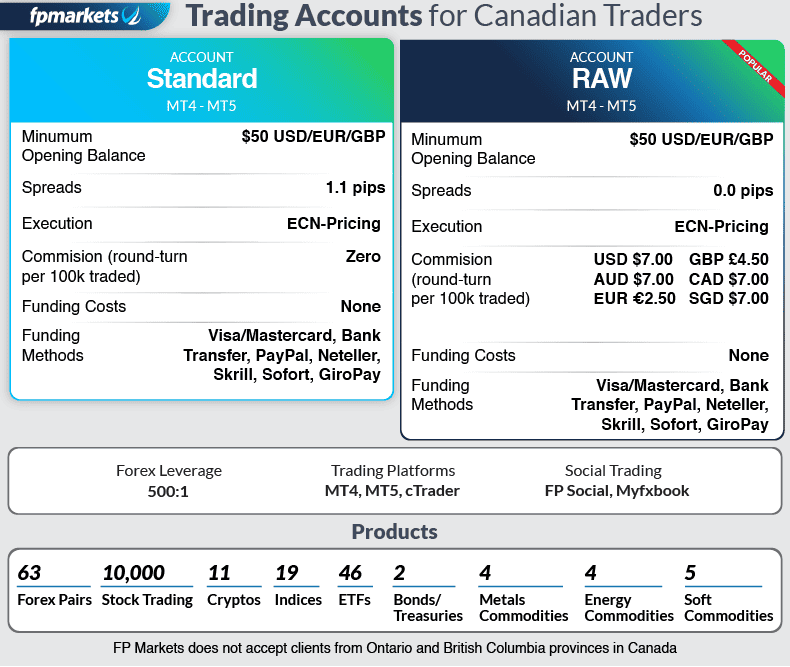

6. FP Markets - Top Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets excels as a top scalping broker, offering incredibly tight RAW spreads, averaging just 0.1 pips on EUR/USD. Interestingly, in our testing, the broker achieved zero-pip spreads 97.83% of the time, meaning you’ll only pay the commission to trade.

The use of the MT4 platform, with its one-click trading feature, makes executing trades fast so you can scalp the markets and improve your profit margins with tight spreads.

Pros & Cons

- Solid range of trading products

- Low average RAW spreads

- Offers a choice of trading platforms

- IRESS platform is only available in Australia

- Requires minimum deposit on Standard account

- Not all shares are available on the MT5 platform

Broker Details

Australian broker FP Markets will appeal to scalpers with its deep liquidity, ECN-like trading environment and ultra-tight spreads. While it is not Canadian-regulated, you’ll be onboarded through its offshore regulator, CySEC in Cyprus. This means you’ll have access to leverage that extends to 500:1 meaning ample opportunities to amplify your profits if you have the nerves and the know-how.

Low RAW Spreads + High Leverage

When we put top forex brokers’ RAW spread accounts to the test, FP Markets emerged as a clear winner. FP Markets’ averaged 0.22 pips for the top 5 most traded currency pairs, such as EUR/USD, beating the industry average of 0.45 pips for the RAW/ECN accounts we tested by some margin.

As the most traded, these pairs are the most liquid thus meaning there is more trading volume in a typical trading session to take advantage of small price movements, particularly as a scalper.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Tight spreads impress on their own, but when you couple them with leverage, the profit potential increases dramatically (along with the risk of loss, of course.) FP Markets stands out for combining consistently tight spreads with the maximum allowable leverage of 1:500.

Fast Market Execution Speeds

Along with tight RAW spreads and high leverage, FP Markets offers execution speeds for market orders, which are immediately entered at the best market price.

When we tested 20 brokers to determine which had the fastest execution speeds, FP Markets scored an average market order speed of 96ms, which was only one of 4 brokers that had speeds under 100ms (which is very fast).

These fast speeds add to FP Markets’ scalping appeal, to reduce latency in trading execution, resulting in less slippage and more efficient profit-making opportunities while trading.

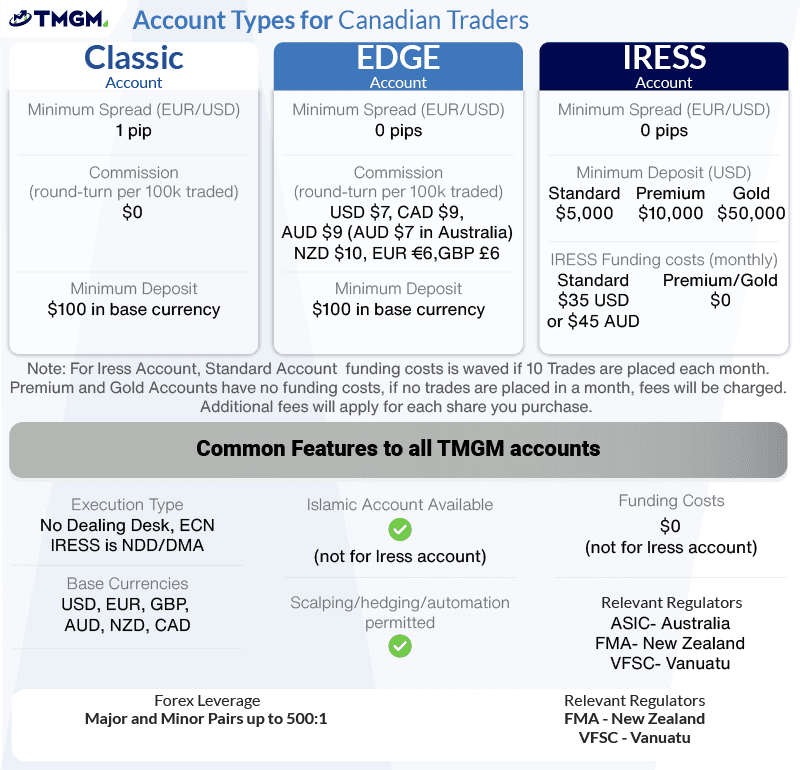

7. TMGM - Best Broker For Range Of Markets

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.42

AUD/USD = 0.21

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

We like TMGM as it offers one of the broadest market choices with over 12,000 trading products, including forex, indices, commodities, and shares. This variety is ideal if you trade multiple markets, allowing you to trade from one account.

The spreads are decent too; TMGM ranked joint-third in our tests with an average RAW spread of 0.32 pips.

Pros & Cons

- Solid selection of markets

- Trading fees are low

- Decent execution speeds

- Educational tools aren’t great

- A minimum deposit is needed

- The range of forex pairs is limited to majors and minors

Broker Details

Alongside a huge range of 12,000 markets to trade via the IRESS platform, TMGM’s ECN model provides lightning-fast order execution, reducing costly slippages so you can fill your orders at the desired price. Ideal if you are a breakout trader who sets order limits to execute a trade on its earliest confirmation.

12,000 Shares Via IRESS Platform

TMGM provides three trading accounts that connect you to the foreign exchange markets with low fees.

While both the Classic and Edge accounts are both good options, we recommend the broker’s IRESS account which is primarily optimized for trading on the stock market, giving you access to a huge range of 12,000 shares.

If you can get past the $5,000 minimum deposit requirement, this is an appealing option for the sheer range of markets. The other benefit of using the IRESS platform is having access to TMGM’s full range of 1300 CFD products, which MT4 doesn’t cover.

Fast Execution Speeds

Every millisecond counts in forex. So, our team tested over 20 brokers to find the fastest execution brokers, and TMGM recorded an average execution speed of 94ms for limit orders. This put it in the top five brokers worldwide based on our tests.

Anything under 100ms is fast, and having fast execution speeds will reduce your latency while trading thus lower your slippage and overall trading costs.

Top MetaTrader 4 Broker

Both the Classic and EDGE trading accounts give you access to the MetaTrader 4 platform, which we think is one of the best platforms and is especially beneficial if you are a scalper. TMGM’s ECN execution model delivers fast execution speeds on MT4, which allows you to enter and exit your trades faster while reducing slippage.

Meanwhile, one of the features we like is the one-click feature, which allows you to trade the markets without filling in an order ticket. This is helpful so you can instantly execute the trades you need instead of wasting time filling in a new order ticket.

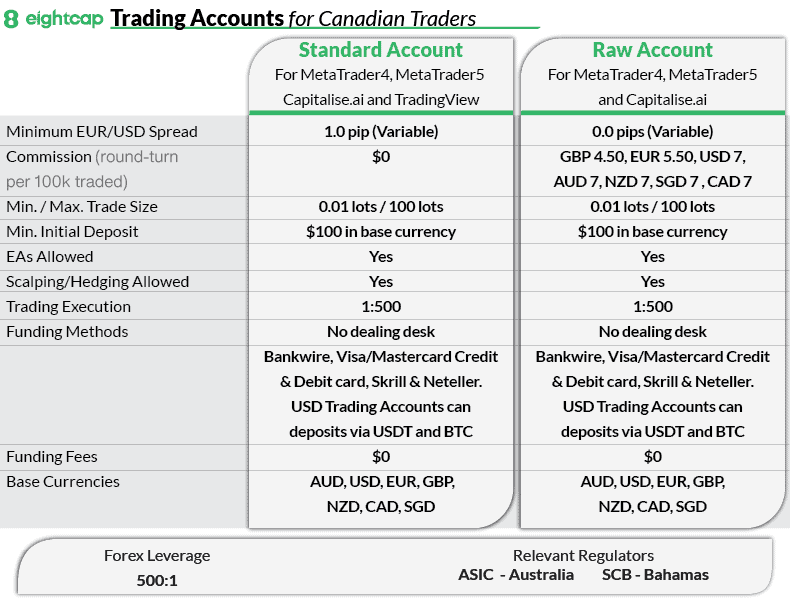

8. Eightcap - Great Forex Broker for Cryptocurrency

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

For trading the cryptocurrency markets, Eightcap is a solid choice offering a range of 95+ crypto markets – ideal if you want to take on more risk through non-traditional currencies.

Eightcap’s spreads are tight too, averaging 0.06 pips on EUR/USD with its RAW account and one pip average spread on the Standard account. This combination of crypto trading and low spreads opens an affordable route to trade the crypto markets as a Canadian trader.

Pros & Cons

- Offers a solid choice of trading platforms

- Provides a wide range of cryptocurrencies

- Low average RAW spreads

- Not the largest range of markets

- Lacks weekend client support

- Has a minimum deposit

Broker Details

Eightcap is another broker that you will be onboard through CySEC in Cyprus as a Canadian client. Given this, the broker operates outside CIRO’s jurisdiction, so you can access 95 cryptocurrency markets unavailable through CIRO-regulated forex brokers. This is our recommended broker if you want exposure to the crypto markets.

Impressive Range of Crypto Products

In terms of cryptocurrency products, Eightcap stands out with over 95 cryptocurrencies available for trading, including 20 cross-currency products against USD, AUD, CAD, EUR, GBP, and MXN.

This extensive range of cross-pairing options against Bitcoin provides Canadian traders with the largest crypto offering that we’ve seen.

What’s more, we think Eightcap sets itself apart as a top crypto broker by offering funding options in Tether (USDT) or Bitcoin (BTC).

We must mention, however, that you must use MetaTrader 5 to trade Eightcap’s full range of crypto products.

Unique Platform Features

In addition to the MT4, MT5, TradingView and Capitalise.ai (for code-free automated trading) platform offerings, Eightcap stood out to us for its unique platform features.

These include an AI-powered economic calendar, weekly trade ideas through Trade Zone and our pick of the bunch, FlashTrader.

FlashTrader allows you to target multiple profits, calculate position size, and place stops and limits in one click, using your trade ticket.

What we particularly found useful was the ability to take profit on half of our position, then quickly move the stop order to break-even and target a potentially much larger second profit level. Having adjustable profit targets helped us react dynamically to market movements.

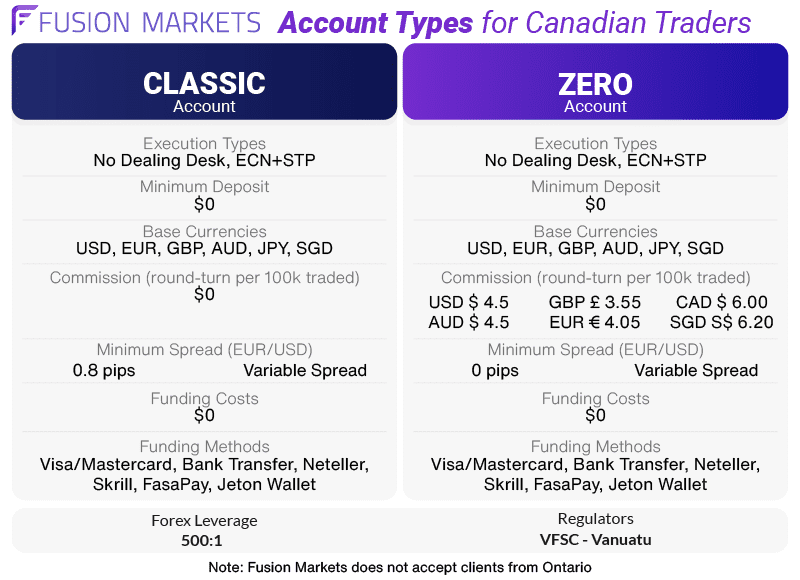

9. Fusion Markets - Cheapest Broker with Lowest Commission

Forex Panel Score

Average Spread

https://www.compareforexbrokers.com/landing-redirect/?pid=fusion-markets Why We Recommend Fusion Markets

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Fusion Markets is the best forex broker for lower commissions, charging only $2.25 per lot, the lowest we’ve encountered (the average is $3.48 in our tests). This makes it an excellent choice for traders looking to minimize trading costs.

The broker’s average RAW spreads are impressive, at just 0.22 pips on EUR/USD, significantly lower than the industry average of 0.49 pips. Fusion Markets doesn’t have its own platform, but the broker has MetaTrader 4 and 5, two top platforms to take advantage of these low spreads.

Pros & Cons

- Have the lowest commissions tested

- Fast execution speeds

- Offers a top selection of trading tools

- No TradingView available

- The overall market range is low

- Charges inactivity fees

Broker Details

Fusion Markets is another broker not directly regulated by CIRO/IIROC but accepts Canadian clients. As a Canadian trader, you’ll be onboarded through offshore regulator VFSC in Vanuatu. From our testing, Fusion Markets offers the lowest commissions we’ve seen. In addition, we found Fusion Markets has the tightest RAW account spreads we’ve tested.

Low Trading Costs with Zero Account

Our team tested 15 brokers that offer commission-based trading accounts to find which broker had the lowest commissions. In our tests, Fusion Markets placed second place overall, but in Canada, it is the broker with the lowest commissions.

With the broker’s Zero account, you will be charged CAD $6 per lot, round-turn. Should you choose to fund your account in USD, however, you’ll obtain even cheaper commissions of USD$4.50, per round-turn lot traded. By comparison, that’s $2.50 cheaper than the industry average of $7.

We also tested brokers to see how often they keep their spreads at 0.0 pips and found that Fusion Markets kept their spreads at the minimum offered for 98.55% of the time.

Not only do you get the most cost-effective trading environment, but because Fusion Markets are not regulated directly by CIRO, you can get access to 1:500 leverage too through VFSC regulations.

Ask an Expert

If I live in Canada but am not a Canadian citizen, should I still use these brokers or should I use US-based brokers?

There is no reason to use a US-based broker, you should use a Canadian regulated broker.