Best TradingView Brokers

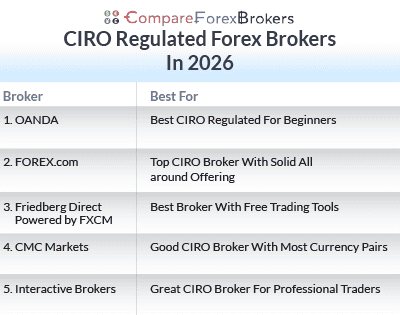

The Canadian financial body is the CIRO (formerly IIROC) which regulates forex brokers across Canada. We reviewed the best CIRO-regulated forex brokers in 2026 based on features such as trading platforms and costs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

The Canadian Investment Regulatory Organization (CIRO) regulates trading activity in Canada and was originally called the IIROC. On their corporate website, they state that dealer members are required to be a member of the Canadian Investors Protection Fund (CIPF) established in 1969.

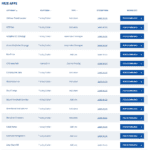

Our list of the top forex trading platforms is:

- OANDA - Best CIRO Regulated For Beginners

- FOREX.com - Top CIRO Broker With Solid All around Offering

- Friedberg Direct Powered by FXCM - Best Broker With Free Trading Tools

- CMC Markets - Good CIRO Broker With Most Currency Pairs

- Interactive Brokers - Great CIRO Broker For Professional Traders

Which broker offers the best tradingview integration for Canadian traders?

Pepperstone delivers superior TradingView integration for Canadian traders with seamless platform connectivity, competitive pricing, and full charting functionality across multiple asset classes. We assessed CIRO-regulated brokers on TradingView platform integration quality, execution speed through TradingView interface, account compatibility with CAD funding, and advanced charting tool availability to identify which broker maximizes the TradingView trading experience for the Canadian market.

1. OANDA -

Forex Panel Score

Average Spread

EUR/USD = 0.94 GBP/USD = 1.68 AUD/USD = 1.48

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

With a top score of 100/100 in our Trust category, OANDA’s long-standing reputation since 1996 and strict CIRO and FCA regulations ensure your trading is safe. We liked its OANDA Trade platform, which is remarkably user-friendly.

With OANDA Trade, you can start trading with small lot sizes, even less than a micro lot, as low as one currency unit. This flexibility offers a low-risk transition from demo to live trading, perfect for easing into risking your own funds.

Pros & Cons

- Highest trust score broker

- Requires no minimum deposit

- Trade lower lot sizes than micro-lots

- 24/7 customer support is not available

- Does not offer share CFDs

- No RAW Spread accounts

Broker Details

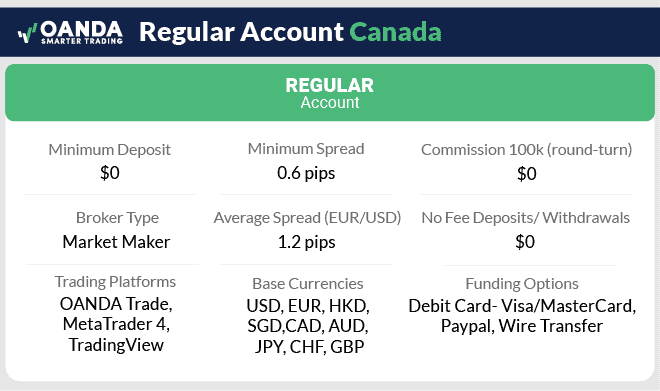

Based on our testing, we think OANDA is the best CIRO-regulated broker if you are a beginner, thanks to its OANDA Trade platform and low trading fees.

Specifically, when it comes to a trading platform, we like that OANDA Trade provides a solid overall experience thanks to its integration with TradingView’s charts. This allows you to use over 80+ indicators and drawing tools to perform technical analysis.

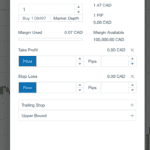

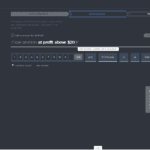

To help you transition from demo to live trading, we found that with OANDA Trade, you can select lower trade sizes than the default micro-lot sizes available with other brokers. This feature allows you to test your trading in a live environment without risking too much to begin with, helping you grow your confidence by risking your funds. As you can see in the image below, we have an order to open a EUR/USD position with one unit, requiring only a 0.07 CAD margin.

Another helpful feature is that the broker offers Autochartist, a third-party technical analysis service that generates potential trading ideas based on price action and chart patterns. We like how the tool is built into the OANDA Trade platform, giving you quick access to potential trading opportunities.

Even though OANDA Trade blends the charts from TradingView with the broker’s simplified platform, OANDA does offer other platforms. If you have experience with MetaTrader 4 or TradingView, we like that you can choose these platforms with OANDA – especially considering MetaTrader 4 allows you to automate your trades.

OANDA also impressed with its low trading costs, offering an average of 1.20 pips on EUR/USD, which is in line with the industry average for CIRO-regulated brokers.

2. FOREX.com - Top CIRO Broker With Solid All-around Offering

Forex Panel Score

Average Spread

EUR/USD = 0.13 GBP/USD = 0.23 AUD/USD = 0.26

Trading Platforms

MT4, MT5, TradingView, FOREX.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend FOREX.com as a top CIRO broker for its solid all-around offering. In our tests, it scored 60/100, showing strength in key areas like trading platforms and markets available.

You’ll benefit from low spreads, averaging one pip on EUR/USD, which means more of your money goes towards your trades, not fees.

Pros & Cons

- Great selection of FX pairs

- Provides decent market analysis for free

- Low average spreads

- Requires a minimum deposit

- No weekend customer support

- Lacks MetaTrader 4 platform

Broker Details

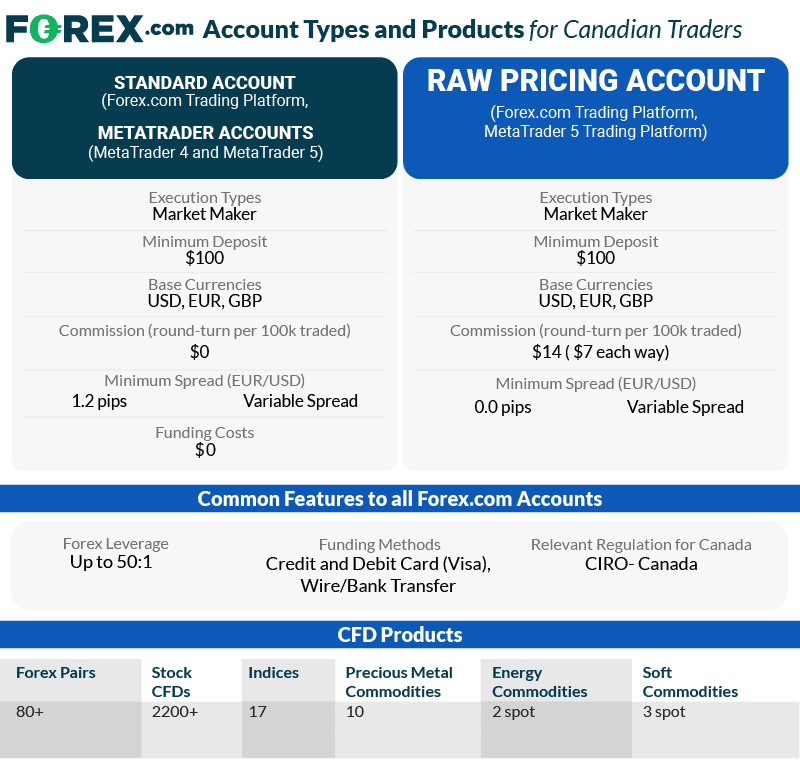

From our testing, we think FOREX.com offers a nice balance of services, a decent choice of markets and platforms, and low trading costs.

The broker is one of a handful that offers commission-based trading accounts in Canada through its Raw trading account, giving you much tighter spreads compared to the Standard account. We like it when brokers give you a choice of trading accounts, giving you more control over your trading conditions based on your trading style and experience.

With the standard account, you are much more exposed to expensive trading during volatile trading periods, while with a Raw account, your trading costs average out thanks to the fixed commissions, allowing you to trade without worrying about spreads widening too much.

We tested standard and Raw accounts spreads and found them decent. The standard account (variable spreads with no commissions) averaged 1.20 pips on EUR/USD, which is as competitive as OANDA.

FOREX.com’s Raw account, on the other hand, had tighter spreads from 0.0 pips on EUR/USD, but you had to pay $7.00 per lot traded, which is the norm for CIRO-regulated brokers.

If you trade high volumes, we found that you can lower the Raw account’s costs through FOREX.com’s ActiveTrader programme via rebates, saving up to 15% on your commissions.

*Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

3. Friedberg Direct Powered by FXCM - Best Broker With Free Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

FXCM is a well-established forex broker, but what stands out for us is that FXCM offers over 50+ trading tools that can make your trading smoother. Among these tools, eFXPlus stands out, providing valuable FX picks and trade ideas from top major banks’ research desks.

With eFXPlus, you get access to insights from experts, helping you trade the forex market more confidently. You’re essentially getting access to investment bank-level research, and it’s all available to you for free.

Pros & Cons

- Small trade sizes available

- Wide choice of trading tools

- NDD execution

- Large minimum deposit

- Limited customer support hours

- No TradingView

Broker Details

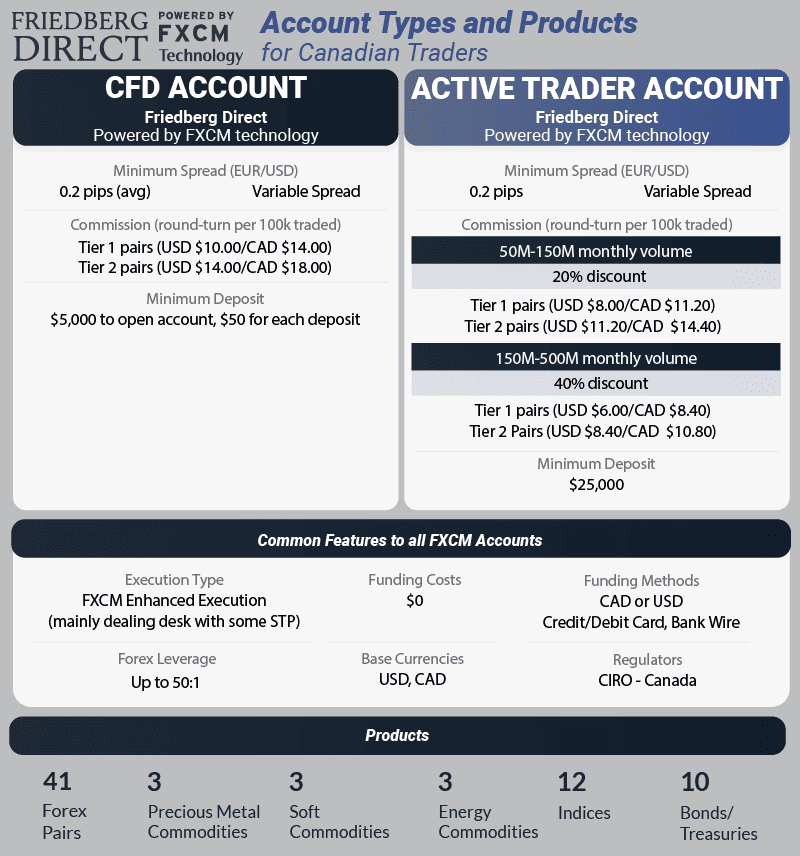

While reviewing CIRO-regulated brokers, FXCM stood out for us with its selection of free trading tools with the live trading account we opened. You can download 30+ trading apps that can be used on Trading Station to enhance the platform with more features.

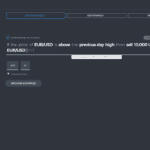

For example, we downloaded and installed the Daily Extremes indicator to test, which was easy to install and set up. This indicator allows us to see the previous days’ highs and lows through a dynamic support and resistance level, which is helpful for day trading as these are considered major levels.

The Trading Station platform is FXCM’s proprietary platform. It blends the features of MetaTrader 4 and TradingView and offers advanced charting tools, including 61 indicators and automated trading.

If you want to automate your trades, you can do so without coding knowledge through FXCM’s partnership with Capitalise.ai, which is a big plus in our books.

We like that you can use Capitalise.ai to test and automate your strategies by simply writing the rules for your strategy. The AI will develop the automation, which can be used for free on the MetaTrader 4 and Trading Station platforms.

While testing Capitalise.ai, we found setting up our first automated strategy easy after following its interactive tutorials. After specifying our rules and saving the strategy, we could backtest it to see how it performed over the past 90 days, which helps validate and optimise your strategy. In the image below, you can see our backtesting of the strategy we developed.

With FXCM offering excellent services for automating your trades, we decided to see how fast the broker’s execution speeds are and compared them to other CIRO-regulated brokers. In our testing, FXCM recorded competitive speeds with 108 ms for limit order execution (how fast your pending/stop-loss/take profit orders are executed) and 123 ms for market orders.

| Broker | Limit Order Speed | Market Order Speed |

|---|---|---|

| FXCM | 108 | 123 |

| OANDA | 86 | 84 |

| FOREX.com | 98 | 88 |

| Admiral Markets | 132 | 182 |

| CMC Markets | 138 | 180 |

| AvaTrade | 235 | 145 |

4. CMC Markets - Good CIRO Broker With Most Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

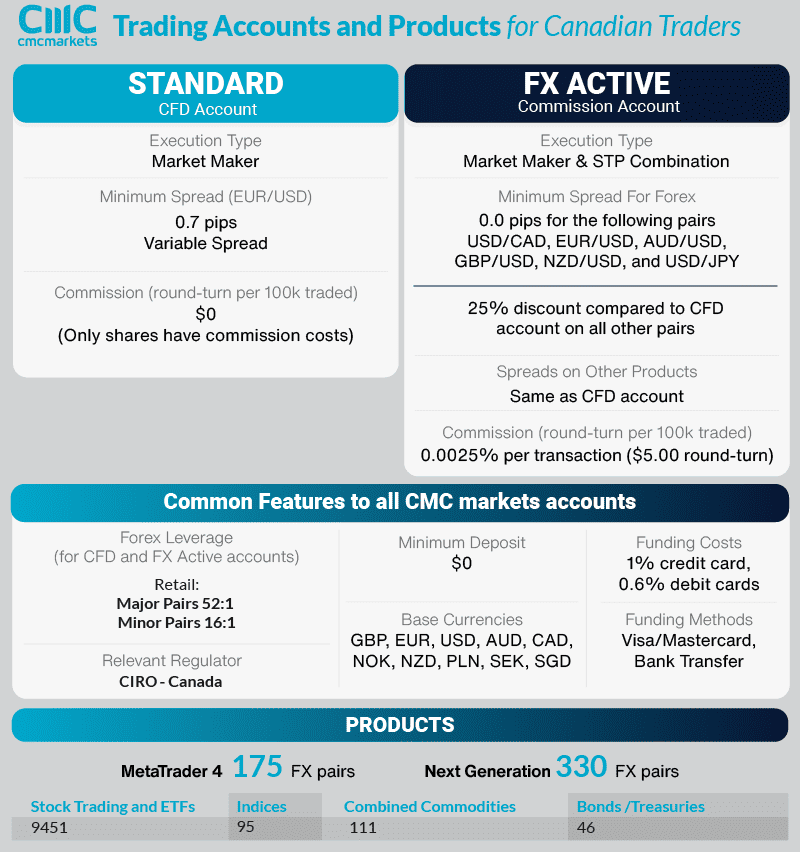

CMC Markets is a top CIRO broker with many decent benefits, but what sticks out for us is it has the most currency pairs available, over 330+ in total.

CMC Markets has an impressive NGEN platform, the broker’s own user-friendly trading platform and comes equipped with advanced charts and tools that challenge TradingView’s charts. We like the market scanners, which help discover new trade ideas, making the trading process more efficient.

Pros & Cons

- The NGEN platform is excellent

- Most currency pairs

- Has low average spreads

- No social trading tools

- Support is limited over the weekend

- Can only automate trades with the MT4 platform

Broker Details

CMC Markets has one of Canada’s largest choices of markets, with over 13,000 CFD products to trade, covering every market from forex to fixed income. What stood out for us was the broker’s 330+ currency pairs, which are the most available for any CIRO-regulated broker. You can trade the majors, minors, and exotics, including taking advantage of inverse currency pairs if you are looking for more market volatility.

Another benefit we found with CMC Markets was its NGEN platform, a web platform that can be used across multiple devices.

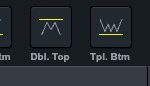

For a proprietary platform, it comes with many features you’d expect from dedicated platforms like TradingView and MetaTrader 4, although it does lack automated trading capabilities. These features include 80+ technical indicators and pattern recognition tools that use chart patterns like channels and wedges to find potential breakout opportunities.

While testing the chart patterns on the NGEN platform, we were impressed that the indicator showed potential take profit levels based on the pattern after applying the indicator. We think this is a decent tool for beginners, giving you a clear idea of when to exit the breakout trade from the current pattern.

The image below shows how the triangle pattern suggests the take profit levels after hovering over the pattern.

Our findings also showed that CMC Market’s Standard account spreads were competitive. Our analyst, Ross Collins, found the broker’s EUR/USD spreads averaging 0.80 pips, one of the lowest among the CIRO-regulated brokers tested.

In fact, the CMC Market had the overall lowest spreads on the major pairs, averaging 1.11 pips, making it the cheapest standard account based on the results.

| Tested Standard Spreads | |

|---|---|

| Broker | Combined for major pairs AUDUSD, EUR/USD, GBPUSD, USD/CAD, USDCHF) |

| CMC Markets | 1.11 |

| Admirals | 1.31 |

| FXCM | 1.47 |

| OANDA | 1.54 |

5. Interactive Brokers - Great CIRO Broker For Professional Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Our top choice for professional traders is Interactive Brokers due to its advanced trading tools and platforms. While it may be complex for beginners, if you’re an experienced trader, you’ll appreciate the capabilities that can significantly enhance your analysis and trading speed.

Interactive Brokers’ access to various markets and exchanges is invaluable. It allows you to explore diverse markets and capitalize on volatility, potentially increasing risk and reward.

Pros & Cons

- Excellent trading tools and platforms for professionals

- It doesn’t require a minimum deposit

- Commissions are low if you trade 1-lot and above

- $2.00 minimum cost per trade (expensive for small trades)

- No third-party platforms like MT4 or TradingView

- IBKR has a steep learning curve

Broker Details

Out of all our tests, Interactive Brokers had the most advanced tools, pricing, and markets, making it a compelling choice for professional traders in Canada. This is especially true if you want to trade more complex markets like futures and options in addition to traditional CFD trading.

The flagship platform, IBKR Trader Workstation, offers a range of advanced tools, including market scanners and Level II pricing, which gives you access to liquidity providers’ order books.

Access to the liquidity provider’s price streams lets you see where other traders place their open orders and how much in lots is placed, giving you the best insights into where other traders think the price will move.

During our testing of the IBKR Trader Workstation, we found the platform had over 100+ indicators built in, but the charting felt basic with limited chart types, especially compared to TradingView.

For the professional tools, we found you could access Level II pricing through the BookTrader module, where you can also place your orders directly with the liquidity providers.

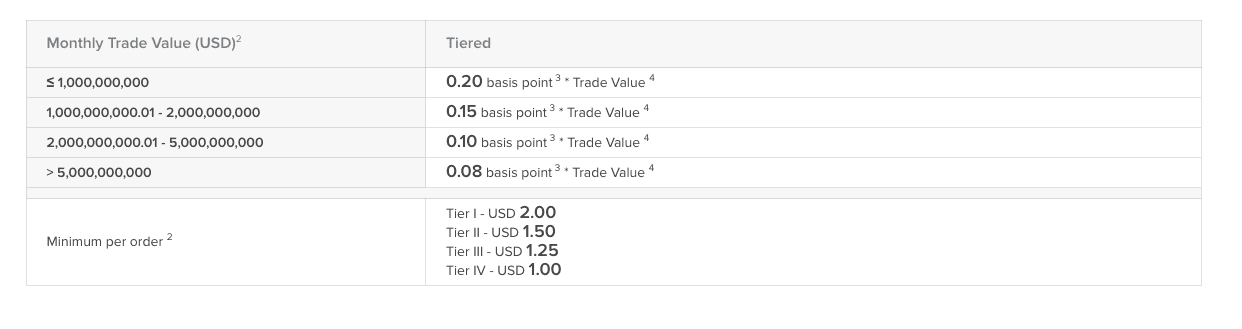

Our testing showed that interactive brokers offer low trading costs that improve with higher trading volumes, making it an ideal set-up for professionals. The broker only offers a commission with a tight spread account, and the highest commission rate is $2.00 per lot traded, which is the lowest out of the CIRO-regulated brokers.

This commission can be reduced if you meet the broker’s requirements for monthly trading volumes, reducing it to as low as $1.00 per lot traded.