Best CFD Brokers in Malaysia

The best CFD Brokers in Malaysia offer a wide range of markets such as forex and crypto, and have good CFD trading platforms. We look at the 6 brokers for CFD trading along with their spreads and costs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

The brokers in Malaysia to trade Contracts For Differences

- Eightcap - Best Forex Broker For CFD Trading Overall

- Pepperstone - Top Forex Broker CFD Trading With MT4

- IC Markets - Lowest Spreads For CFD Trading

- Fusion Markets - Good Forex Broker For Low Trading Commission Costs

- XTB - Top Broker CFD Trading With No Commissions

What is the best CFD trading platform in Malaysia?

Eightcap offers the best CFD platform with 63 forex pairs, 250+ crypto products, RAW account spreads under 1 pip on majors, and access to MT4, MT5, cTrader, and TradingView with Capitalise.ai automation. Malaysian CFD platforms provide multi-asset trading with leverage up to 500:1 on forex. We compared market diversity and platform features across multiple brokers.

1. Eightcap - Best Forex Broker For CFD Trading Overall

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

With 56 Forex pairs, 6 metals, 2 energies, 16 indices and 95 cryptocurrencies, when trading with MT4, MT5 or TradingView, Eigthcap shines for its CFD product offering.

When using the Eightcap RAW account, we found the brokers have average spreads of 0.06 pips for the EUR/USD which we think is impressive. After a deeper analysis, we found that RAW spreads for EUR/USD are kept at 0.0 pips almost 100% of the time, making Eightcap an excellent option if you want to maximise your profit potential.

Pros & Cons

- Algorithmic trading

- 95 Cryptos

- Good range of trading platforms

- Low trading fees

- Tight spreads

- Fast execution speeds

- Education tools could be better

- Needs better research content

- No 3rd party social trading tools

Broker Details

Traders Can Benefit Fully From Eightcap’s Products With The Use of MT5

A MetaTrader specialist, Eightcap is our recommended broker for the MetaTrader 5 (MT5) platform, notably since this platform allows you to take full advantage of all the products this broker offers.

An upgrade of MetaTrader 4 (also made by MetaQuotes), MT5 excels in CFD trading, mainly designed for centralised and decentralised trading (meaning you can trade products that require a central exchange and those that do not).

Trading Products With Eightcap

Eightcap offers a solid range of markets, superior trading conditions, and fast execution speed.

In addition to 63 currency pairs, Eightcap also boasts over 250 cryptocurrency products, and it’s the Best Crypto CFD Brokers. While all products can be traded against USD, 20 of these coins can also be traded against currencies other than USD, including AUD, GBP, EUR, CAN, and MXN. You can even cross-pair these 20 cryptos against Bitcoin.

Leverage for Malaysian traders when trading forex, metals, and energies is up to 500:1; however, leverage balancing applies depending on trade size. This is to protect your account balance, as leverage is a risky instrument and no negative balance protection is provided.

You can trade crypto, stocks, and indices with leverage up to 20:1.

Commissions and Fees

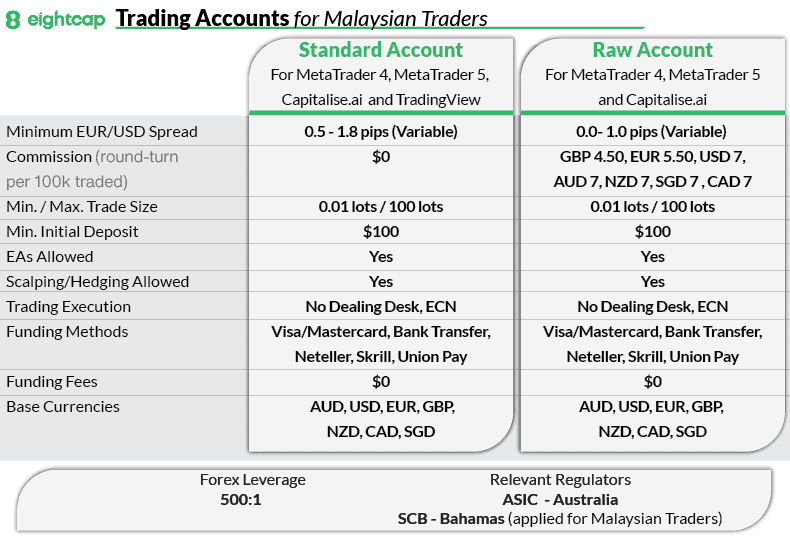

The two trading accounts that Eightcap offers are Standard and Raw.

The commission-based Raw account has the lowest spreads, averaging under 1 pip across all major currency pairs at the $7 round turn industry standard.

The spread-only Standard account, meanwhile, is suited for beginners with no commissions, albeit a wider average spread.

Clients in Malaysia will be registered with Eightcap Global Limited based in the Bahamas. Eightcap Global Limited is regulated by The Securities Commission of The Bahamas (SCB) with licence number SIA-F220.

Fastest Execution Speeds For Malaysian Traders and Tightest Spreads

If you are in Malaysia, it is fascinating that Eightcap places its servers at the Equinix data centre in Tokyo (TY3). Since TY3 is closer to Malaysia than the NY4 Equinix data centre in New York (which nearly all brokers use), you can expect faster speeds with Eightcap than their competitors. A closer data centre means faster execution speed since there is less distance for data to travel.

As a no dealing desk broker (NDD), Eightcap also sources liquidity from multiple tier-1 providers, using ECN-like, STP (straight-through processing) pricing, meaning no price interference.

By utilising the prime model of trade clearing and pricing aggregation, Eightcap can more effectively distribute risk, exposure, and pricing across a broader range of participants in the underlying markets, all while keeping costs to a minimum.

For ECN-type accounts, Eightcap has competitive spreads compared to other brokers, as we highlight below. This module captures the average spreads brokers publish on their website, which they update monthly.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Compare Lowest Spread Forex Brokers

Trading Platforms and Plugins

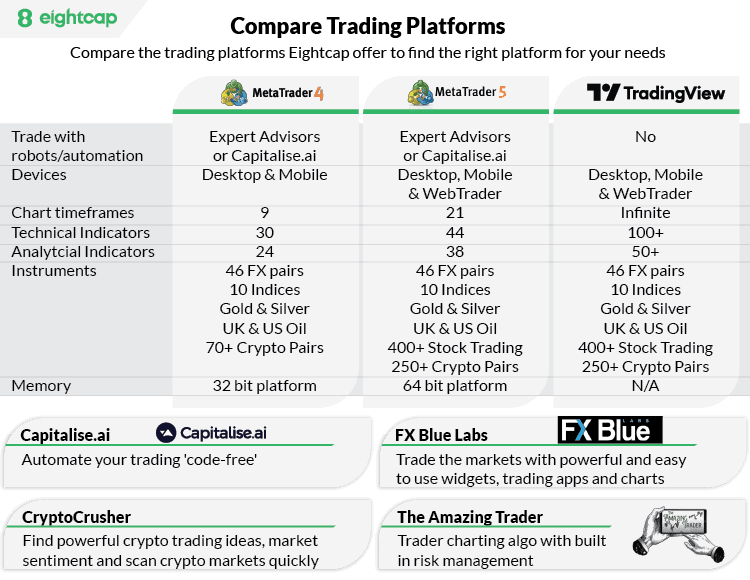

MetaTrader 4 and 5 are the two main trading platforms Eightcap offers. The primary difference is in tradeable markets and device versatility. MT5 offers more markets and is available as WebTrader, while both MT4 and MT5 can be used via desktop or mobile.

As highlighted above, MT5 is particularly suited to CFD trading and a greater range of markets to trade. If you intend to trade cryptos, you are better off choosing MT5. MT4 is still a great option and suited for Forex trading.

Eightcap provides a range of MetaTrader platform plugins from FX Blue Labs, which enhance its standard suite. It also supports integration with Capitalise.ai, a third-party platform allowing algorithmic trading within your MT4/5 account without requiring programming or coding experience.

Ever-growing Range Of New Features: Cryptocrusher and Amazing Trader

Cryptocrusher is a new trading tool designed to enhance your crypto trading experience with precise entry, target and stop levels, market trend analysis, exclusive indicators and a 24-hour chat room to discuss your trades.

Eightcap has partnered with Amazing Trader to offer a new charting algo platform. This platform provides three trading strategies for FX, indices, cryptos, and metals, along with built-in automated risk management. You can test the platform at no cost by participating in their 28-day success program. To use Amazing Trader, your account balance must be at least $500.

2. Pepperstone - Top Forex Broker CFD Trading With MT4

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

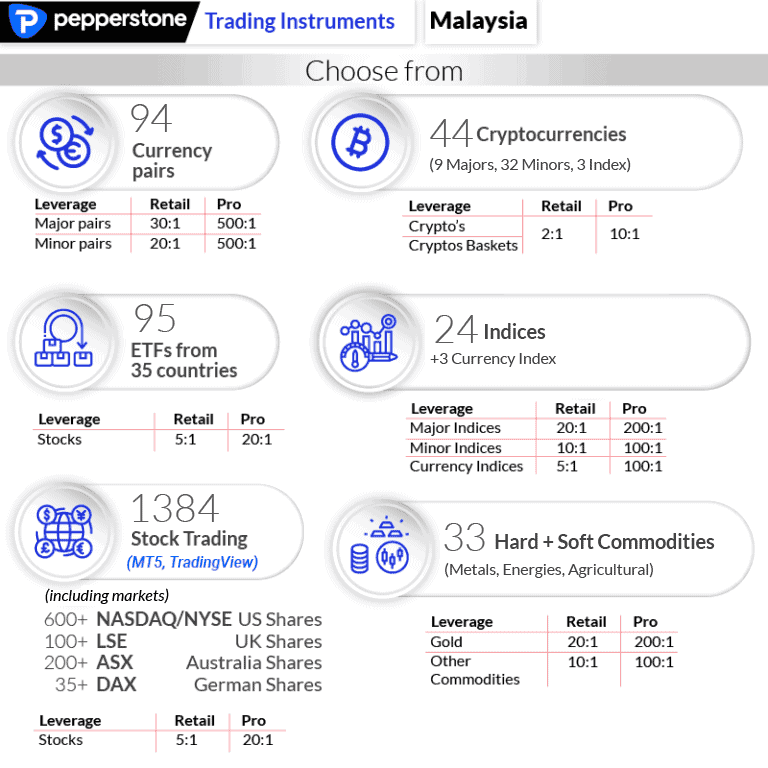

We liked how Pepperstone broadens its horizons by offering a range of CFD platforms. Using MT4, MT5, cTrader or TradingVIew, you can trade 92 Forex pairs, 19 cryptos, 25 indices, plus shares and commodities.

If using MT4, extra 3rd party apps like Capitalise.ai for automation and Myfxbook for copy trading are provided so you can try out many different trading tools and strategies, and capitalise on market opportunities more efficiently.

Pepperstone’s execution speeds and spreads were also impressive, averaging 0.1 pips for the EUR/USD and speeds of 77ms for limit orders.

Pros & Cons

- Low spreads

- Fast STP execution

- A wide range of CFD platforms

- Great CFD product range

- A demo account only lasts 90 days

- Education is good but could be updated

- Live chat is 24/5

Broker Details

Pepperstone Offers a Wide Array Of Choices For CFD Trading

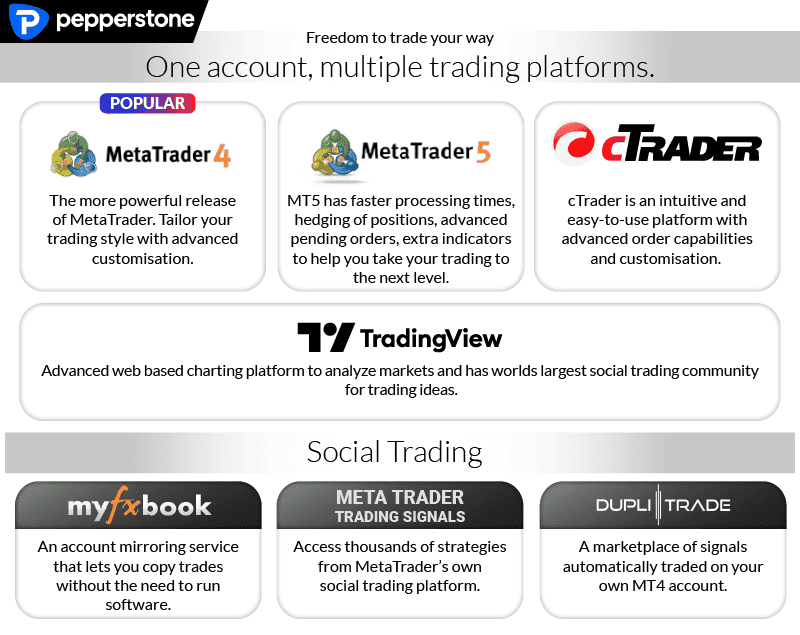

Pepperstone offers a variety of third-party platforms for CFD trading. Pepperstone offers a range of trading platforms, including MetaTrader 4 and 5, cTrader for scalping, and TradingView for chart trading.

They offer excellent customer support with 18-hour coverage on weekends and 24/5 during weekdays.

Clients in Malaysia will be registered with Pepperstone Markets Limited, a subsidiary of the broker located in the Bahamas. This subsidiary is regulated by The Securities Commission of The Bahamas ( SIA-F217).

Low Spreads and Superior Trading Conditions

Like Eightcap, Pepperstone sources pricing from multiple Tier 1 liquidity providers, meaning prices are similar to what the institutions get, which translates to lower spreads across the board.

You can also lock in prices at speeds of under 30ms due to Pepperstone having servers in the NY4 Equinix data centres, which results in less risk of slippage.

Commissions and Fees

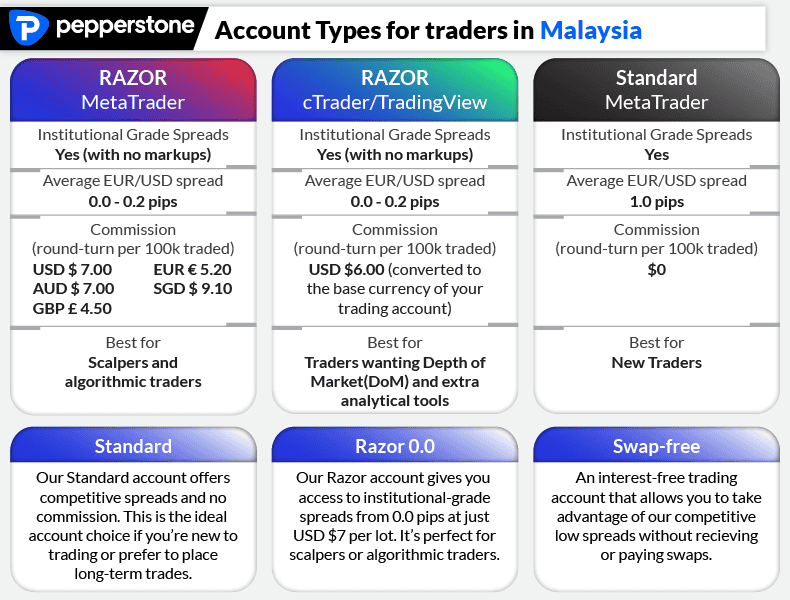

Pepperstone offers two main account types: Standard (no commissions) and Razor (spread-based).

The Razor account, suited to experienced traders, has competitive spreads, averaging at less than 0.5 pips for EUR/USD, with commissions at industry standard rates.

You also have the option of either using the MetaTrader or cTrader platform with Razor. MetaTrader is best for Forex or CFD trading, while cTrader suits algorithmic traders.

Pepperstone offers a commission-free Standard account with average spreads as low as 1.0 pips, making it highly competitive among brokers.

Despite not being a market maker, Pepperstone’s spreads are competitive against market maker brokers such as IG Markets and CMC Markets.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

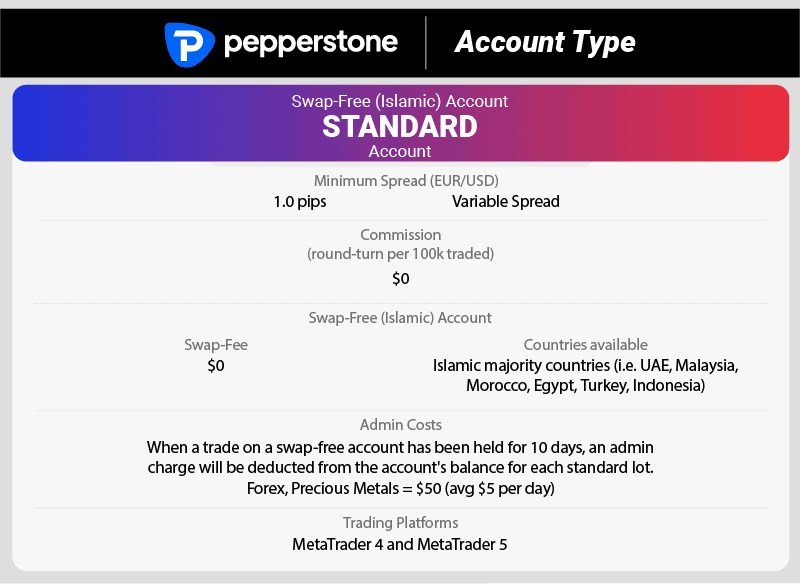

If you are a Muslim trader, you may know that swaps and overnight fees are not Sharia law-compliant since they are considered riba. Pepperstone offers a swap-free account as a solution to this matter. This account is identical to the standard account, except that swaps are replaced with an admin fee.

The admin fee varies depending on the trading instrument and is charged every 11 days for open positions. Most major forex pairs will incur a charge of USD50 for each lot.

Trading Products

Pepperstone offers a diverse selection of tradeable markets. They offer various currency pairs, including major, minor, exotics, and cross-pairs. In total, there are 92 options to choose from. This range means Pepperstone has one of the more comprehensive selections of pairs of any broker. Leverage is up to 500:1.

Trading Platforms and Additional Trading Tools

Pepperstone provides a range of trading platforms, including MT4, MT5, cTrader, and TradingView, equipped with various helpful third-party trading tools and plugins.

Our trading experience using MT4 and MT5 was improved by Smart Trader Tools and Figaro Advanced Tools. These tools allow advanced customisation with Expert Advisors, extra indicators, and add-ons for more in-depth analysis.

Autochartist can be used with MetaTrader and cTrader platforms, and it offers an intuitive charting package to capitalise on high-probability trades.

TradingView is a relatively new introduction to the Pepperstone suite of platforms. This platform allows you to conduct advanced charting to gain deeper insights and analysis. You can even trade directly through the chart. The other notable feature is the ability to share your trades and see what others are trading through the TradingView social network.

Social Trading Platforms

Pepperstone offers three excellent copy and social trading platforms: myFxbook for MetaTrader, DupliTrade for cTrader and MetaTrader, and MetaTrader’s Native Trading Signals platform.

3. IC Markets - Lowest Spreads For CFD Trading

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

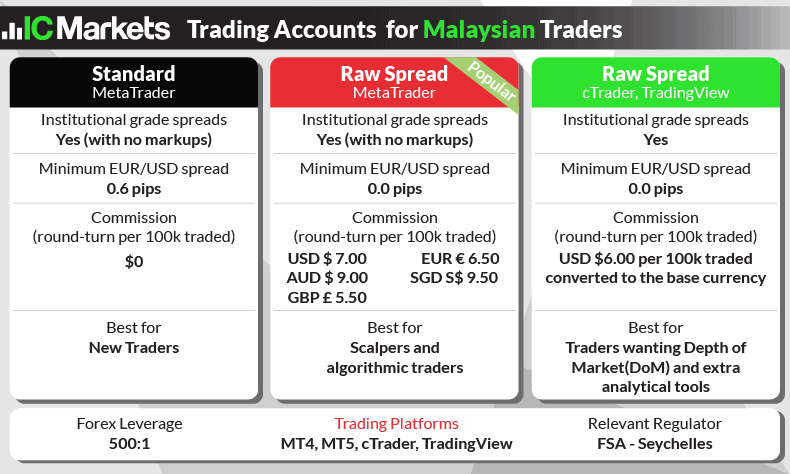

Why We Recommend IC Markets

Our test results done by Ross Collins proved IC Markets have one of the lowest spreads for Forex of any broker. With the RAW spread account, we found IC Markets has an average spread of 0.32 pips and 0.76 for the Standard account. These results place IC Markets in the top 2 of the 20 brokers we tested.

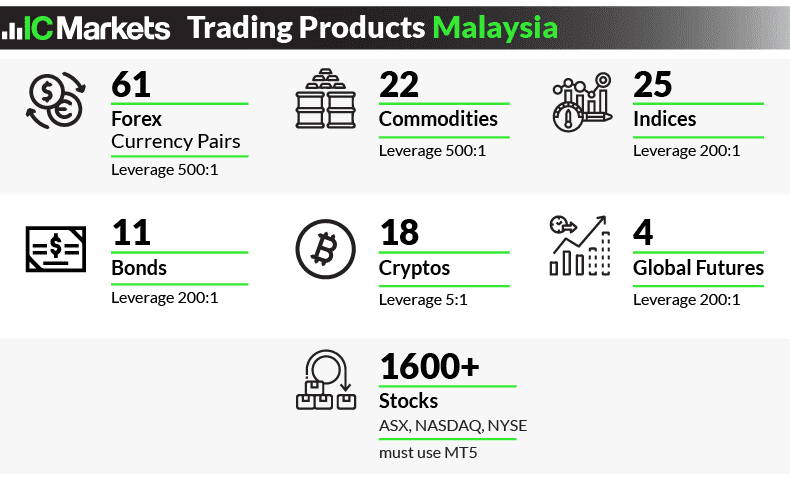

You can trade 61 Forex pairs, 18 Cryptos, 17 commodities, 25 indices plus stocks, bonds and even futures. with MT4, MT5, cTrader and TradingView platforms.

With a low spread, a large range of CFDs and good trading platforms, IC Markets is a top choice.

Pros & Cons

- Low spreads

- MT4, MT5, cTrader

- No withdrawal fees

- No inactivity fees

- Social and algorithmic trading

- Lacks market analysis tools

- Slow live chat support

- Some delays in payments

Broker Details

IC Markets Has The Elements Needed For Automated Trading

Combining low cost, a variety of execution methods, and support for Virtual Private Servers (VPS), IC Markets has all the ingredients for algorithmic trading for CFDs.

The broker offers a desktop version of MetaTrader that supports algorithmic trading, and the cTrader suite includes trading applications such as cAlgo for automated trading and cTrader Copy for social copy trading.

IC Markets is also considered a top MetaTrader broker with competitive spreads, fast execution, and great additional trading tools.

Commissions and Fees

IC Markets offers competitive pricing across all account types with low average spreads.

Like Eightcap and Pepperstone, you can choose between a Standard (no commission) and Raw Spread (spread-based) account. With Raw Spread, IC Markets also gives you the option of either MetaTrader or cTrader platforms.

A swap-free (or Islamic) account option is also available for those unable to earn or pay interest due to their religious beliefs. Unlike Pepperstone, IC Market allows you to use either the Standard or Raw Spread MetaTrader accounts.

Clients with IC Markets will be signed in with its subsidiary based in Seychelles, Raw Trading Ltd. The Financial Services Authority of Seychelles regulates this subsidiary with License number SD018.

Trading Products

With the MT5 trading platform, you can access various trading instruments, including over 1600 Stock CFDs, 61 Forex pairs, and various cryptocurrencies. This allows you to diversify your investment portfolio and take advantage of different market opportunities. Leverage with forex can be up to 500:1.

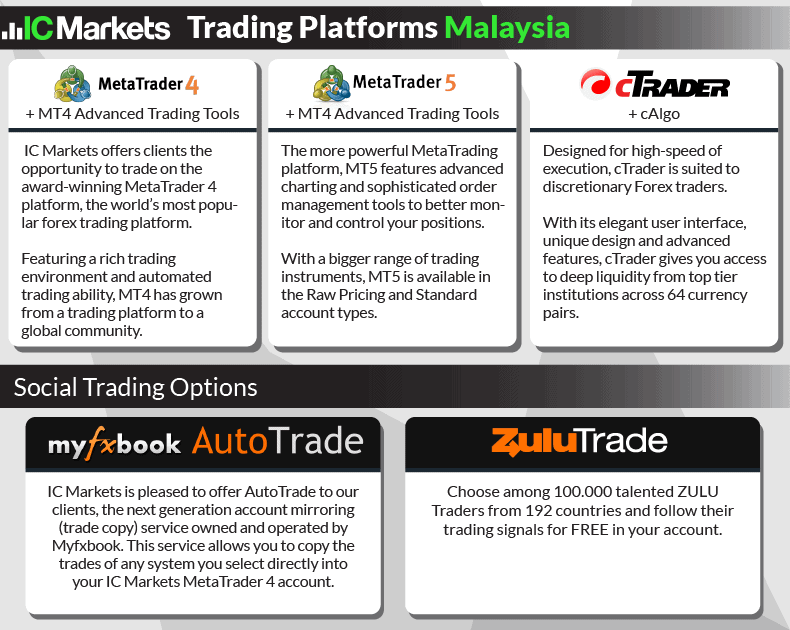

Trading Platforms

IC Markets has a great range of trading platforms overall.

In addition to MT4, MT5, cTrader and TradingView and their plugin enhancements, the broker also offers Myfxbook and ZuluTrade for social and copy trading.

ZuluTrade boasts one of the largest networks of copy traders globally and can also integrate with MT4 or MT5, with over 3,500 trading symbols available and plenty of trading signals to follow.

Myfxbook Autotrade is another social copy option, particularly suited for algorithmic traders.

4. Fusion Markets - Good Forex Broker For Low Trading Commission Costs

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.1 AUD/USD = 0.13

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Our team put Fusion Markets to the test and gave it a high 79/100 for its trading experience.

This score was mainly due to its impressively low commissions which are USD 2.25 per lot, very tight spreads (EUR/USD = 0.93 pips), and fast limit order speeds of 79ms.

Fusion Markets allows you to trade with 80 Forex pairs using MT4 and MT5 platforms. They also support most payment methods and have a minimum deposit of $0 regardless of account.

Pros & Cons

- Fast execution speeds

- Winner for lowest commissions

- Tight spreads

- Good selection of trading tools

- No TradingView

- Inactivity fee

- Currency conversion fee

Broker Details

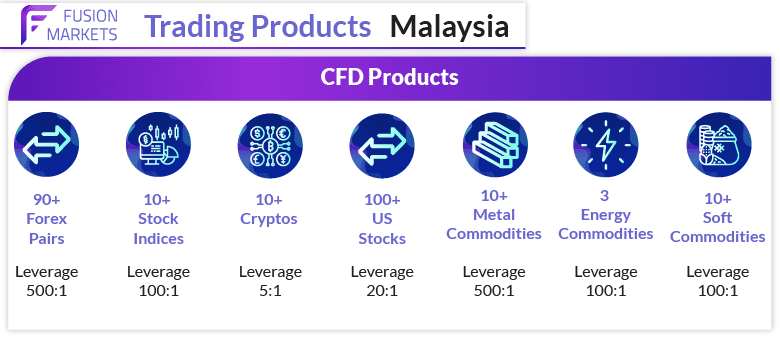

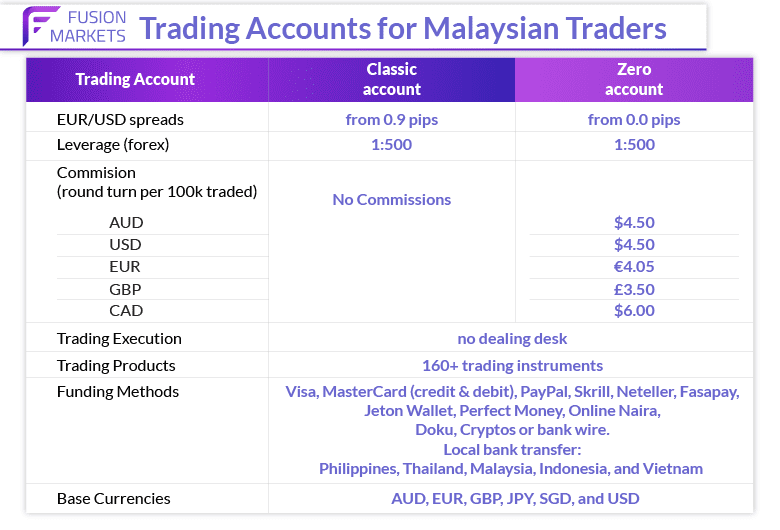

Fusion Markets Features Low Commission Accounts And No Deposits

Fusion Markets offers the lowest commissions of any broker, featuring zero commissions for their Classic account and as low as $4.50 (round turn) for their Zero account.

In addition, you can trade a wide variety of US share CFDs with zero commissions with Fusion, further lowering their trading costs.

The broker also has competitive spreads, a massive range of over 90 Forex currency pairs to trade, the most of any broker on this list, and a high leverage of up to 500:1.

Commissions and Fees

You can choose between Classic (no commissions) or Zero (spread-based) accounts. Zero account offers the lowest commissions among all brokers listed.

Fusion Markets does not charge deposit fees and has no minimum account size, making it easier to start trading.

Multiple e-payment options are available, including local transfers from Malaysian bank accounts.

Fusion Markets International Ltd, regulated by the Financial Services Authority of Seychelles, serves the broker’s clients with license number SD096.

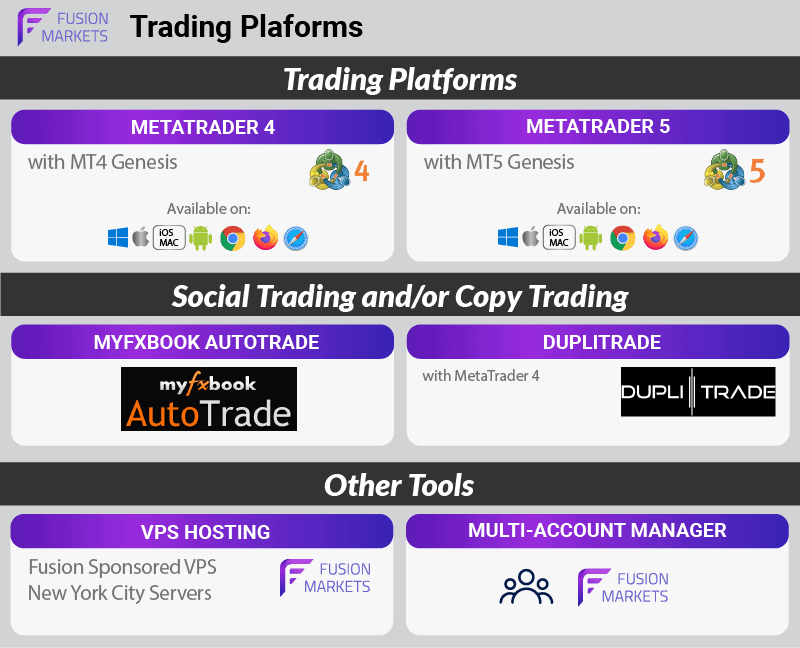

Trading Platforms

Like Eightcap, Fusion Markets is a MetaTrader specialist, offering both MT4 and MT5, which are available on all devices and as a webtrader.

A unique benefit of Fusion Markets is that they provide the MT5 platform powered by MetaQuotes, giving the broker a competitive advantage in multi-asset trading.

The platform offers two social trading options: Myfxbook for algorithmic trading and DupliTrade for MT4 copy trading. Some extra tools are available, such as a Sponsored VPS (Virtual Private Server) for virtual trading. It includes a multi-account manager that is helpful for fund managers who have to handle multiple clients or accounts and portfolios.

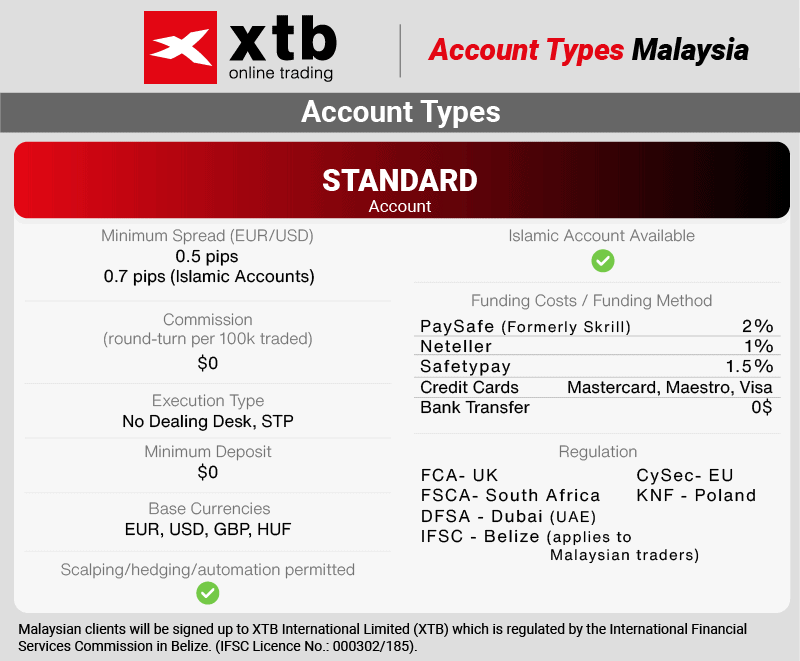

5. XTB - Top Broker CFD Trading With No Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 0.14 AUD/USD = 0.13

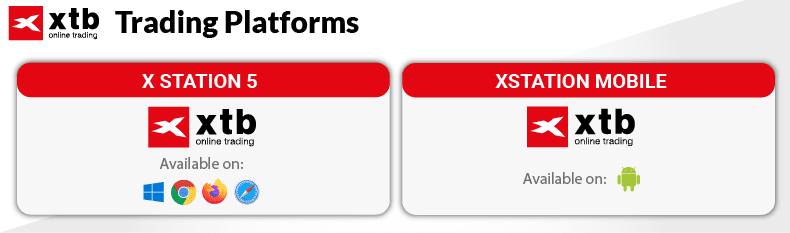

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

We think it’s safe to say XTB is a top-tier broker for CFD product variety, offering almost 2000 CFDs based on:

- Forex

- Indices

- Commodities

- Cryptocurrencies

- Stocks

- ETFs

You can easily navigate these products through XTB’s very user-friendly proprietary platform, xStation 5.

xStation 5 is equipped with tight spreads averaging 1.3 pips for the AUD/USD pair, and handy customisable chart tools.

Pros & Cons

- $0 minimum deposit

- Huge CFD product range

- Tight spreads

- Fast execution speeds

- Very user-friendly

- Inactivity fees

- Withdrawal fees

- Currency conversion fees

- Limited trading platform diversity

Broker Details

XTB Allows Trading With A Vast Selection Of CFD Products

As a trusted multi-asset broker, we have personally utilised XTB and can attest to their diverse range of forex and CFD options available through their exceptional xStation 5 trading platform.

We found XTB’s feature-rich xStation 5 platform user-friendly due to its minimalist design, and it comes packed with a rich selection of powerful trading tools and features.

Lastly, we can vouch for XTB’s exceptional customer service, including their top-tier educational resources that can enhance your trading experience.

Commissions and Fees

We’ve used XTB and found they offer one primary account type, a no-commission Standard account.

From our experience, the average minimum spreads sit at a competitive 0.5 pips. Forex, Indices, Commodity, and Cryptocurrency CFDs attract no commission fees. On the other hand, stock and ETF CFDs also have fairly low commissions, starting from 0.16% round turn.

Malaysian clients will be signed up to XTB International Limited (XTB), which is regulated by the International Financial Services Commission in Belize. (IFSC Licence No.: 000302/185).

Top Proprietary Trading Platform

While we noticed that XTB doesn’t provide MT4, their proprietary xStation 5 platform certainly holds its ground. We accessed XTB Station through various means: as a webtrader, on a tablet, desktop, and even via the mobile app.

The xStation 5 mobile app mirrors its web counterpart and is cleanly designed with features such as streaming news, predefined watchlists, an economic calendar, top movers, and client sentiment data.

When diving into xStation 5, we found 37 technical indicators and 29 drawing tools. Plus, its highly customisable charts let us tweak things to our preference. The platform allows configurations across multiple workstations. We had the flexibility of three order types: Market, Limit, and Stop, making it convenient to set both stop loss and take profit orders.

One standout aspect of xStation 5 was the in-house analytics provided by the XTB analysts. It was also equipped with news updates, economic calendars, and tools to gauge market sentiment.

Though it doesn’t support automation and backtesting, we believe the platform is a solid choice, especially considering XTB’s extensive range of CFD products.

Excellent Educational Resources

XTB offers a comprehensive educational experience with written content, video materials, and archived webinars. These are incorporated throughout its platform suite and website, sorted by topic or experience level.

XTB’s Trading Academy offers 200 lessons, including 10 for forex and CFD education. Each category features quizzes to test your knowledge.

Ask an Expert