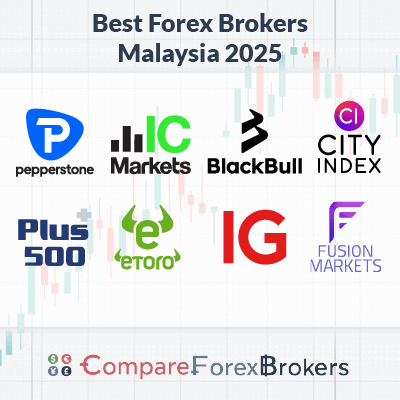

Compare Forex Brokers Malaysia

Broker trust – along with trading costs, forex platforms and products to tradable products – is an important consideration when choosing a forex broker. We list the brokers we consider to be the top choices for Malaysian traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Top Regulated Brokers For Malaysian Traders

- Pepperstone - Best MT4 Forex Broker

- IC Markets - Best Lowest Spread Broker

- BlackBull Markets - Best Broker for High Execution Speeds

- City Index - Broker with the Best Trading Tools

- Plus500 - Best CFD Provider

- eToro - Best Copy Trading Platform

- IG Group - Best Range of Products

- Fusion Markets - Lowest Commission Broker

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

In this article, we recommend the Forex brokers we think offer the top trading services for clients in Malaysia. To select the brokers considered several important factors regulatory compliance, safety measures, trading platforms and tools along with broker reputation.

Read on to see which brokers we rate highly to trade with

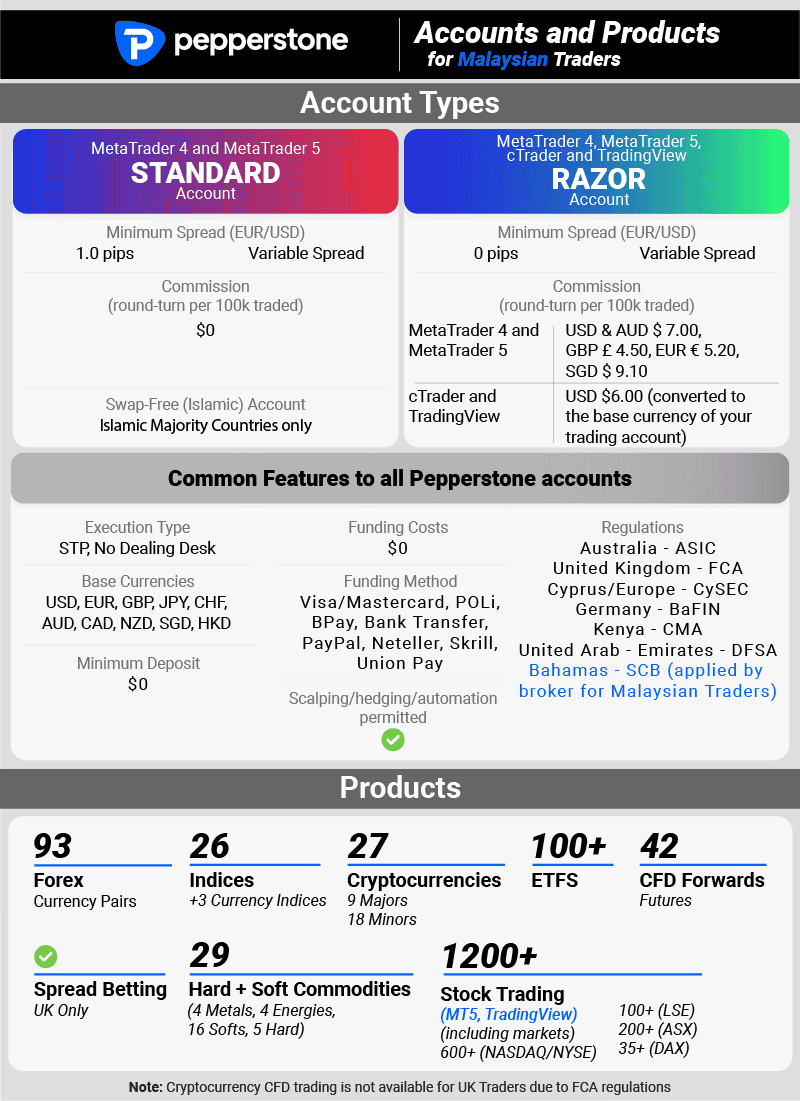

1. Pepperstone - Best MT4 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone earns our recommendation for traders in Malaysia for its swift execution speed, diverse trading platforms, and competitive spreads.

Our tests done by Ross Collins found Pepperstone Razor account RAW spreads average 0.1 pips for EUR/USD and have an execution speed of 77 for limit orders. This combined with a choice of MT4, MT5, cTrader and TradingView platforms and top customer service adds to Pepperstone’s appeal.

We gave Pepperstone an impressive 98 out of 100, solidifying its position as the highest-rated broker in our assessment.

Pros & Cons

- Tight spreads for both standard and raw accounts.

- Excellent resources for automated trading.

- Our winner for fastest execution speeds.

- Fast and easy account opening.

- Swap-free account charges an administration fee.

- Educational materials are less comprehensive than expected.

- 24/5 customer support, rather than 24/7.

Broker Details

Best MT4 Broker

We rated Pepperstone as the best MT4 broker for its fast execution speeds, competitive spreads and overall trading experience on the platform. In fact, we scored Pepperstone 98 out of 100 from our methodology comprising 10 categories, cementing itself as the top scorer of all brokers we assessed for Malaysian traders.

Swift MT4 Execution Speeds

We conducted tests on the execution speed of 36 brokers using MetaTrader 4 to identify which brokers executed our orders fastest.

Our findings revealed that Pepperstone ranked second for limit order speed with an execution time of 77 milliseconds. This means when you use a buy limit, sell limit, buy stop, or sell stop, your chances of getting your desired price are increased.

We also tested market order execution and found Pepperstone averaging 100 milliseconds, placing them 5th overall.

The faster execution speed we obtained reduced the risks associated with negative slippage and gave us more desirable spreads when trading on a demo account.

Smooth MT4 Account Opening

We examined the account opening process of 20 brokers to assess how easy it was to set up.

To us, the Pepperstone account opening process using MT4 was seamless. We particularly liked that there was no requirement to disclose funding details or provide identification when creating a demo account, allowing us to start trading immediately.

While we needed to upload identification documents and answer a Forex questionnaire when setting up a live account, we were able to get through this process quickly, enabling us to start trading within a day.

Another positive aspect we noted was that funding is not mandatory until an actual trade is executed, and Pepperstone provides a dedicated account manager to assist with the process.

Combining the fast execution and effortless account opening process, we scored Pepperstone 15 out of 15 for account opening and 9 out of 10 for the overall trading experience.

Enhanced MT4 Trading: Smart Trader Tools

While Pepperstone offers a solid range of platforms including both MetaTrader platforms, cTrader and TradingView, we found the MT4 platform experience was the highlight.

Alongside the standard features including a user-friendly interface, real-time charts (with 30 technical indicators) and range of EAs (Expert Advisors) for algorithmic trading, Pepperstone offers 28 additional MT4 enhancement tools, called Smart Trader Tools.

Of these 13 Expert Advisors and 15 indicators, we were particularly partial to the Mini Terminal, which allowed us to quickly and precisely enter the market by setting our take profit and stop loss levels alongside our risk parameters.

We could even save this as a template for all future orders, further saving us time and effort in highly volatile market conditions.

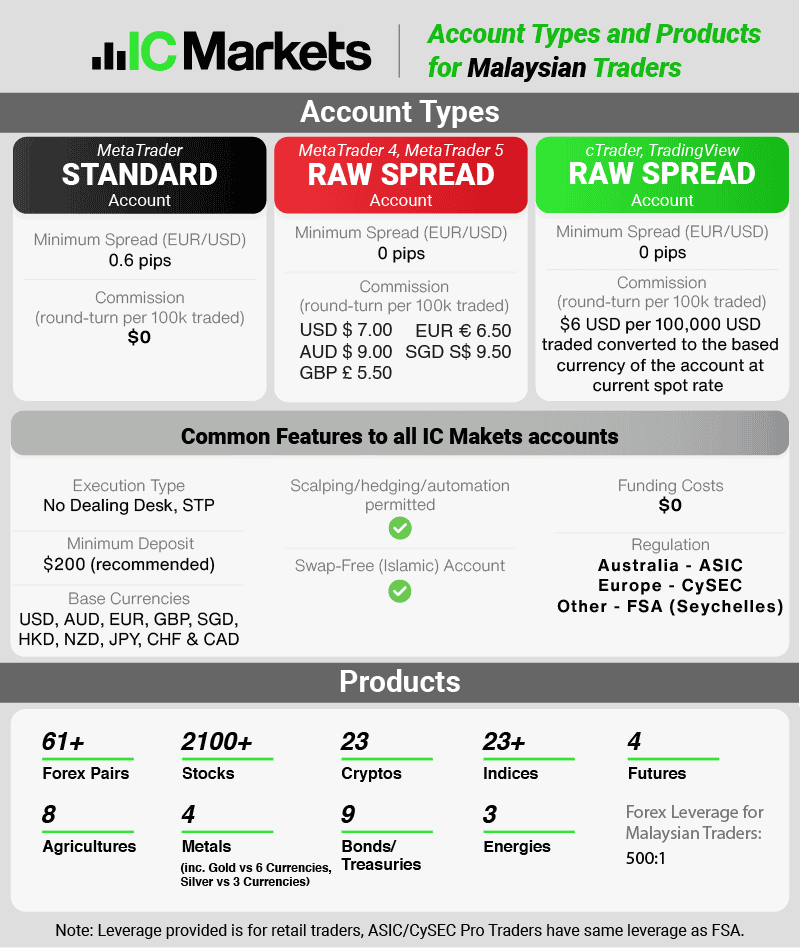

2. IC Markets - Best Lowest Spread Broker

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

Among the 20 brokers we tested, IC Markets stands out as one of the best choices for low spreads in Malaysia.

Whether opting for their standard or RAW spread account, IC Markets consistently offers tight spreads. Our testing done by Ross Collins revealed IC Markets to have the 2nd lowest average standard spread (0.76 pips) and the lowest RAW spread (0.16 pips) overall across 5 major currency pairs. Trading is available with MT4, MT5 and cTrader.

If you are seeking competitive spreads, IC Markets proves to be an excellent option.

Pros & Cons

- Very low trading fees.

- Offers all four popular third-party trading platforms.

- Does not charge any minimum deposit.

- Excellent customer support and knowledge base.

- Slow execution speeds.

- They are licensed by very few regulators.

- Their educational materials are poor.

Broker Details

IC Markets is an Australian-based broker with offices in Cyprus and Seychelles and is one of the largest brokers in the world when it comes to trading volume per day.

We tested the spreads of 20 brokers and found that IC Markets is the best choice to save on trading costs. IC Markets not only has the tightest spreads for Standard accounts but also for its RAW spread account.

Lowest Standard Account Spreads

With commission costs included in the spread minimising your trading cost variables, we recommend the Standard account for any trader.

To test who had the most competitive Standard account spreads, we conducted a thorough analysis of 15 top brokers using six major currency pairs: AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/CHF, and USD/JPY.

Our results highlighted IC Markets as the broker with the lowest average spread of 1.03 pips. This translates to an average trading cost of USD 9.63. IC Markets averages 0.73 pips for the EUR/USD pair (placing them 1st), 0.82 pips for AUD/USD (2nd) and 1.08 pips for GBPUSD (3rd).

The industry average was 1.49 pips, highlighting how competitive IC Markets’ spreads are.

| Broker | Average Spread | Average Spread Cost (USD) |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| FusionMarkets | 1.19 | $11.07 |

| TMGM | 1.21 | $11.18 |

| Admiral Markets | 1.31 | $11.96 |

| FXCM | 1.47 | $13.49 |

| Pepperstone | 1.46 | $13.52 |

| FP Markets | 1.47 | $13.60 |

| Go Markets | 1.49 | $13.87 |

| EightCap | 1.51 | $13.97 |

| OandA | 1.54 | $14.23 |

| Axi | 1.71 | $15.99 |

| City Index | 1.79 | $16.52 |

| Blackbull Markets | 1.82 | $16.95 |

| FXPro | 2.22 | $20.83 |

It’s important to keep in mind that the spread represents the minimum amount that your trade needs to move to realise a profit.

For example, when trading a single lot with IC Markets, the trade will need to gain a value of USD 9.63 for you to achieve a profit. In contrast, our least favourable broker would require the trade to gain a value of USD 20.83.

In terms of individual currency pairs IC Markets averaged the following spreads:

| Broker | Average Spread | EURUSD | AUDUSD | USDCAD | USDJPY | GBPUSD | USDCHF |

|---|---|---|---|---|---|---|---|

| IC Markets | 0.32 | 0.19 | 0.23 | 0.45 | 0.24 | 0.27 | 0.57 |

| Pepperstone | 0.36 | 0.19 | 0.19 | 0.61 | 0.36 | 0.41 | 0.39 |

| FP Markets | 0.41 | 0.20 | 0.31 | 0.51 | 0.39 | 0.31 | 0.71 |

| EightCap | 0.50 | 0.20 | 0.48 | 0.64 | 0.47 | 0.44 | 0.76 |

| CMC Markets | 0.73 | 0.44 | 0.68 | 0.75 | 0.64 | 0.90 | 0.94 |

| Admiral Markets | 0.79 | 0.21 | 0.70 | 1.46 | 0.58 | 0.73 | 1.08 |

| BlackBull Markets | 0.94 | 0.46 | 0.85 | 1.01 | 0.43 | 0.96 | 1.31 |

IC Markets also did very well in our RAW account testing, with the broker finishing second with an average spread across our 6 tested currency pairs with 0.32 pips (second to Fusion Markets).

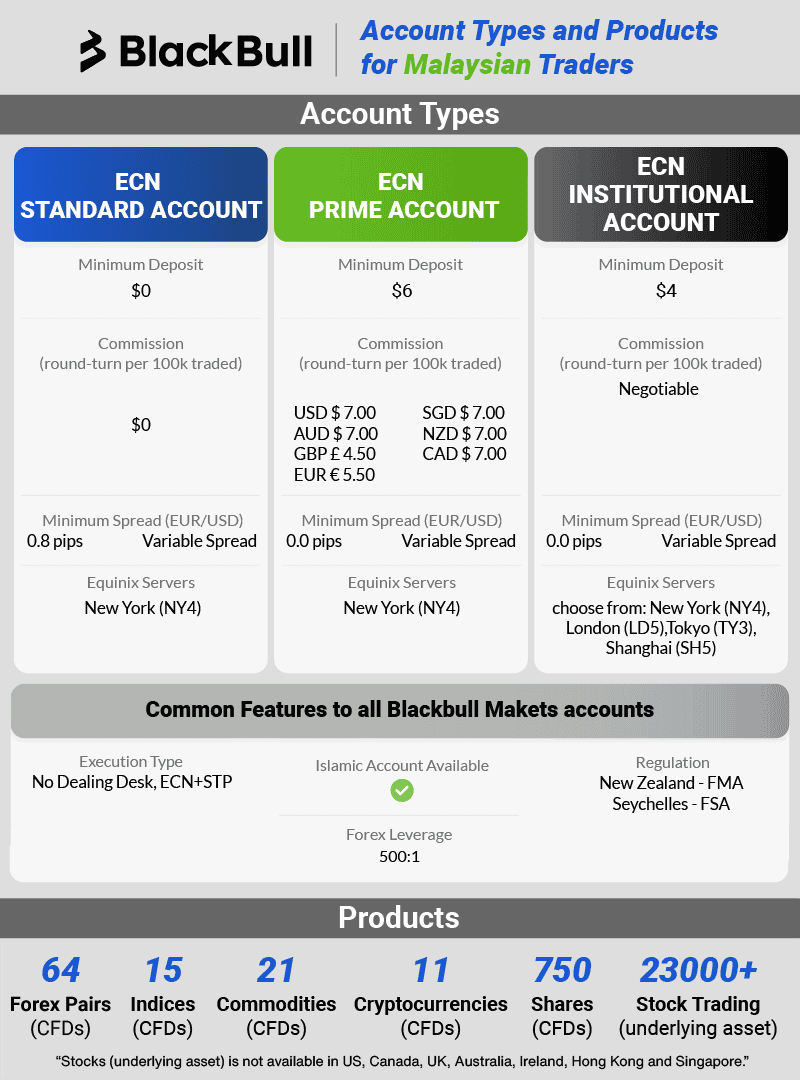

3. BlackBull Markets - Best Broker for High Execution Speeds

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We recommend BlackBull because they use a no-dealing desk model and implement ECN execution, resulting in very fast execution speeds.

We tested the execution speeds for market and limit orders using both a no-dealing desk and market makers style brokers offering the MT4 trading platform, BlackBull Markets emerged as the clear winner, boasting an impressive execution speed of 72 ms for market orders and 90 ms for limit orders. These speeds make BlackBull the best choice for scalp trading.

To trade with BlackBull Markets you can use MT4, MT5, cTrader and TradingView.

Pros & Cons

- Fastest overall execution speed, according to our tests.

- Good range of trading products, including shares.

- Solid Standard spreads.

- Good commission of $3 per side.

- High minimum deposit for Raw account ($2000).

- Less well-known than comparable brokers.

- No cTrader of TradingView.

Broker Details

Headquartered in New Zealand, BlackBull Markets operates under the regulatory oversight of the Financial Markets Authority (FMA). As a Malaysian trader, you’ll be onboarded through the broker’s offshore regulator, the Financial Services Authority in Seychelles (FSA).

From our testing, BlackBull Markets stood out with the fastest execution speeds we’ve seen. We also like BlackBull Markets’ range of platforms which include MT4, MT5, cTrader and TradingView and a solid selection of social trading tools.

Fastest Execution Speeds

If your trading strategy involves capitalising on small market fluctuations, then you must select a broker that has fast order execution and minimal slippage. This ensures your orders fill at or as close to the quoted price as possible.

Using various EAs on the MetaTrader 4 platform, Ross Collins (our chief researcher at CompareForexBrokers) tested the execution speeds for market and limit orders across various forex brokers to identify the top performers.

The tests were run using both market-making and no-dealing desk brokers, with BlackBull Markets emerging as the clear winner, boasting an impressive execution speed of 72 ms for market orders and 90 ms for limit orders.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|---|

| Blackbull Markets | 1 | 72 | 90 |

| Fusion Markets | 2 | 79 | 77 |

| Pepperstone | 3 | 77 | 100 |

| OANDA | 4 | 86 | 84 |

| Octa | 5 | 81 | 91 |

| Exness | 6 | 92 | 88 |

| City Index | 12 | 95 | 131 |

| FBS | 14 | 135 | 118 |

| Eightcap | 16 | 143 | 139 |

| IC Markets | 17 | 134 | 153 |

| FxPro | 18 | 151 | 138 |

| IG | 23 | 174 | 141 |

| CMC Markets | 24 | 138 | 180 |

| FP Markets | 25 | 225 | 96 |

| XM | 27 | 148 | 184 |

| FXCM | 28 | 108 | 189 |

| Avatrade | 29 | 235 | 145 |

Other Benefits of BlackBull Markets

Other notable features we appreciated include the huge leverage of 1:500 on offer, a solid range of trading platforms (MT4, MT5, cTrader and TradingView) and a huge range of over 23,000 physical shares on its own, proprietary share trading platform.

This, combined with the fact that BlackBull offers a suite of social trading tools, including the BlackBull Copy app, Myfxbook, and DupliTrade, positions the broker well as an attractive venue for all sorts of trading styles and strategies.

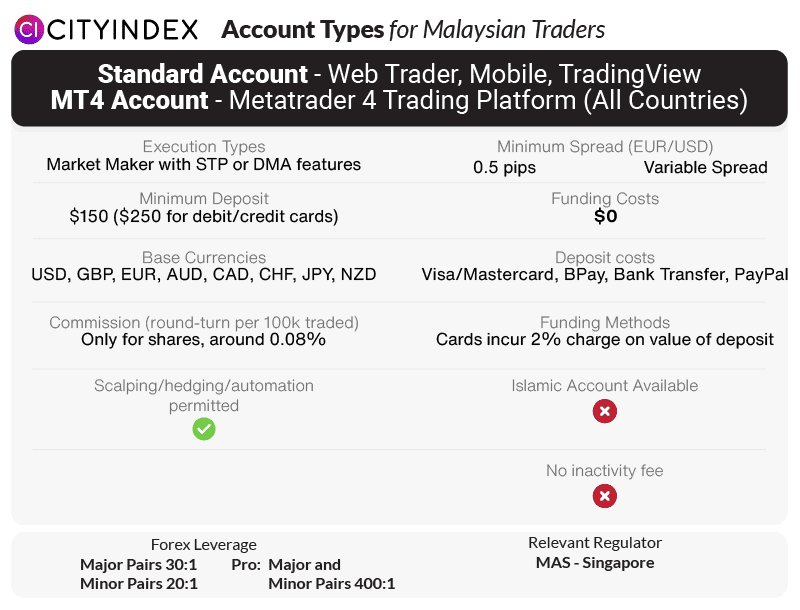

4. City Index - Broker with the Best Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.07

GBP/USD = 0.011

AUD/USD = 0.8

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$0

Why We Recommend City Index

We recommend City Index because the City Index Web Trader platform includes a guaranteed stop-loss order. They also include bonus tools like “Performance Analytics” to provide coaching tips and help you improve and ‘Smart Signals’ to alert you to trading opportunities.

Other important features we like include the broker offering a comprehensive education library and commission-free trading. And the availability of MT4 and TradingView platforms.

Pros & Cons

- Tight spreads and low commission.

- Excellent customer support with a dedicated account manager.

- Good execution speeds.

- Does not offer swap-free accounts.

- Does not accept Paypal or Neteller.

- Only 24/5 customer support.

- Does not offer MT5 or cTrader.

Broker Details

City Index operatives under the trading name StoneX Financial Pte. Ltd. (“SFP”) and is owned by StoneX Group Inc. which is listed on NASDAQ as SNEX. Malaysian traders trade with SFP which is a derivatives trading and clearing member of the Singapore Exchange (“SGX”).

We like City Index because of its wealth of trading tools, which include solid risk management features (including guaranteed stop-loss orders), AI-powered trading signals and quality educational resources.

Wealth of Trading Tools

From our extensive testing, you’ll obtain the most value from City Index’s proprietary platform, particularly its wealth of trading tools.

The four main trading tools the broker offers are Performance Analytics, SMART Signals, Trading Central and Advanced Charts.

To summarise, Performance Analytics helps you understand your trading psychology with personalised performance stats, SMART Signals uses a powerful algorithm to analyse historical global market data, Trading Central gives you real-time trade ideas and Advanced Charting harnesses TradingView’s powerful charting tools.

Solid Risk Management Tools

We also like City Index’s solid range of risk management tools, which includes guaranteed stop loss orders (GSLOs) on its proprietary platform to automatically close your trading position when the market reaches a specified price.

While a small premium is required for this feature, we believe it is a worthwhile investment, to protect your capital while refining your strategies, particularly as a beginner. Unlike regular stop orders, which may suffer from slippage, GSLOs obligates your broker to execute the order precisely at the price you have set.

Additionally, we found the broker’s available webinars and tutorials to be highly informative and easily accessible for traders of all experience levels. As such, their resources received top marks in both the intermediate and beginner categories and we consequently scored them an impressive 25/30.

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

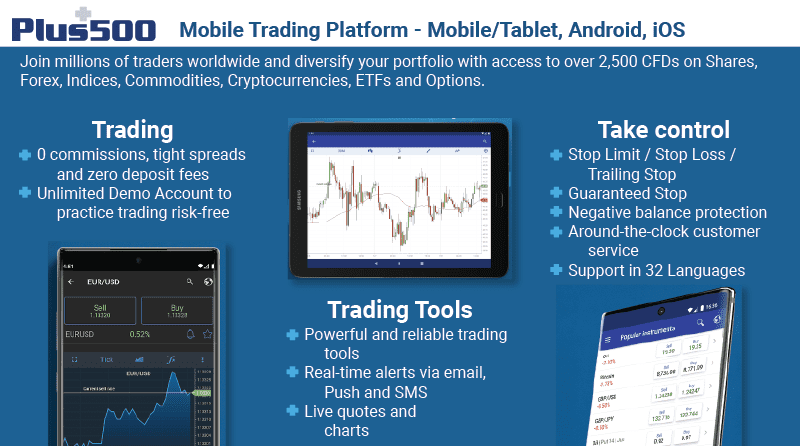

5. Plus500 - Best CFD Provider

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

We recommend Plus500 because it offers a robust and user-friendly app that boasts an impressive range of trading tools and a simplified user interface. We particularly like that the Plus500 mobile app incorporates the same comprehensive charting and analysis tools as its web-based counterpart.

We thoroughly tested the advanced charting and drawing tools and found them to deliver a comprehensive experience for users on the go. We found Plus500 spreads for the EUR/USD pair to average 1.7 pips.

Pros & Cons

- Responsive customer support.

- Easy account opening process.

- Good selection of trading products.

- Highly rated mobile trading app.

- No commission-based account.

- Lack-lustre research tools.

- Minimum deposit required.

Broker Details

Marketing themselves as a CFD provider rather than a Forex broker, Plus500 is the best CFD provider we’ve come across. In addition to a decent range of CFD products (across forex, indices, shares, commodities, cryptos, options and ETFs), we found the broker offers its own, user-friendly trading app (and platform) with commission-free spreads and great risk management features.

User-Friendly CFD Platform

Regardless of whether you predominantly trade from a desktop or use a mobile app while on the move, it’s important to choose a broker that delivers a well-rounded service across multiple platforms and devices.

Fortunately, Plus500 has all the features you should look for in a CFD trading platform.

From our testing, we found the Plus500 platform to have a user-friendly interface, the ability to sort your charts and instruments in an easy-to-navigate manner, customisable charts and the integration of the trading app with web trader. The app also has a guaranteed stop loss, a risk management feature only a few brokers offer.

We particularly like that the Plus500 mobile app incorporates the same comprehensive charting (109 indicators) and analysis tools (20 drawing tools) as its web-based counterpart.

Solid Range of CFD Products

Plus500 offers a large selection of over 2,500 CFDs across a wide range of asset classes from forex (71) and shares (1100) to ETFs (98) and options (8). As a CFD provider, we appreciated Plus500’s diversity in CFD products, allowing us to diversify our own portfolios.

As Plus500 is a market maker, you will trade these CFDs commission-free with spreads from 0.9 pips for EUR/USD.

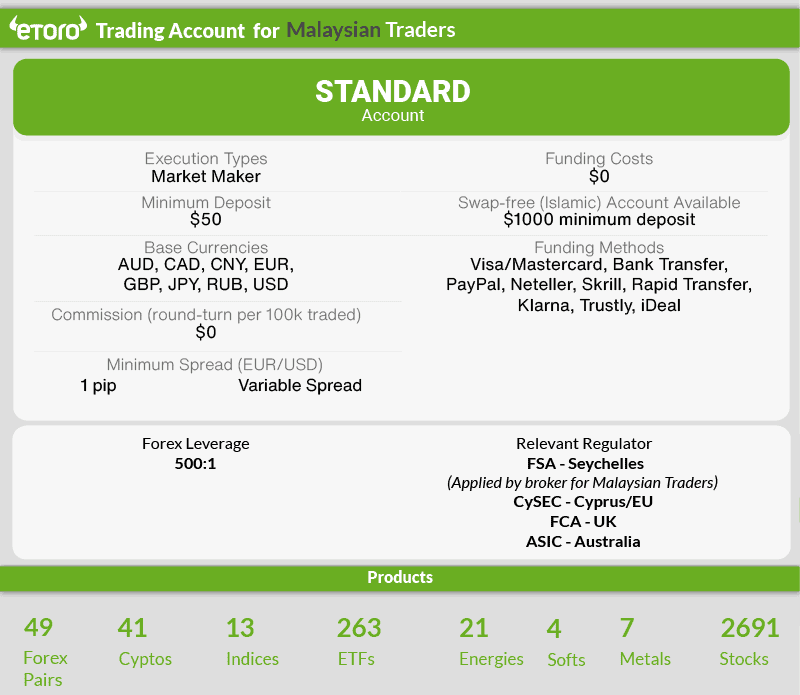

6. eToro - Best Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro because they provide the best copy trading service. eToro’s trading platform is built from scratch with social trading in mind. If you’re new and don’t have the time to learn how to trade, this broker allows you to leverage the knowledge of its huge trading community not just within Malaysia but across the globe for your benefit.

Key features of eToro:

- Large social trading community.

- Indices are created based on the best traders to follow.

- Algorithms that create indices based on the most traded shares.

Pros & Cons

- Wide variety of markets to trade, including crypto.

- Unique social and copy trading tools developed in-house.

- Accessible trading experience suitable for casual traders.

- Only one trading account type.

- Only offers in-house trading platform.

- Emphasis on copy and social trading can limit skill development.

Broker Details

With the largest social trading community globally, the eToro trading platform is built from scratch with social trading in mind. Not only that, eToro’s platform functions as a solid multi-asset platform for normal trading. We enjoyed both aspects of eToro’s offering, but the platform is best suited for copy trading to leverage and profit off the knowledge of its huge trading community.

Top Copy Trading Platform

For individuals who are new to trading, social and copy-trading strategies present a great opportunity to leverage the experience and skills of more experienced traders.

From our testing, eToro’s platform interface resembles a social media wall and provides users with direct access to ideas from popular traders and investors. Additionally, eToro offers a unique feature called ‘thematic investing’ which enables users to invest in Smart Portfolios, focused on specific industries or asset classes.

Where we think eToro stands out, however, is its CopyTrader function, which helps you find the best investors to copy based on three simple filters: return, duration and asset type. We particularly liked how easy it was to select an investor, click copy and choose how much of our funds we wanted to allocate.

7. IG Group - Best Range of Products

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

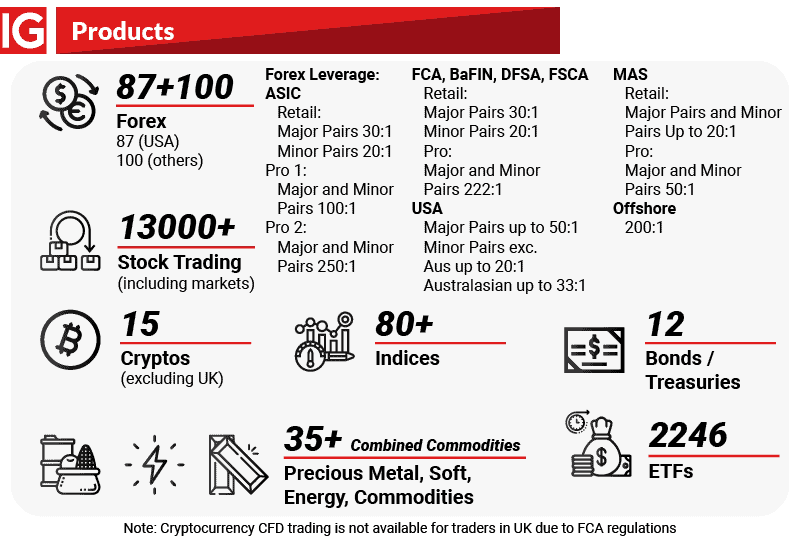

We recommend IG because it boasts over 17,000 markets to trade. Markets include 12,000+ shares 13 cryptos, 80+ Forex pairs and even futures, options, ETFs and sectors.

IG is one of the world’s oldest and largest Forex brokers, and you can trade using IG WebTrader and mobile which includes a guaranteed stop loss, ProRealTime and MT4. Spreads for the EUR/USD average 1/13 pips which we think is competitive.

Pros & Cons

- Safe broker to trade through.

- Very wide range of products.

- No minimum deposit for the Standard account.

- Very high commission of $6 per side.

- Clunky account opening process.

- Few forex pairs on MT4

Broker Details

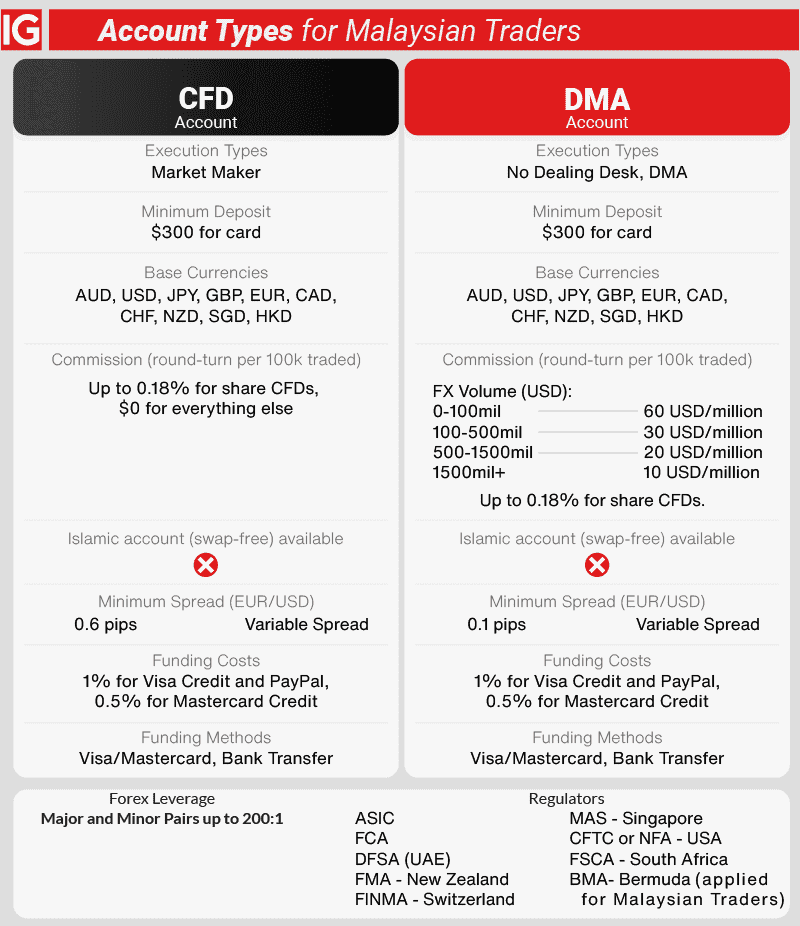

Founded in 1974, IG is one of the world’s oldest and largest forex brokers and is licensed by local financial regulators to operate in more countries than most brokers. From our broker analysis, IG has one of the most extensive collections of CFD trading instruments of any broker along with top-quality CFD trading platforms to choose from.

Largest Range of Products

A well-balanced and diverse portfolio can yield substantial benefits and therefore, it can be beneficial to use a broker with a broad range of markets.

From all the brokers we have reviewed, IG Markets boasts over 13,000 trading products, the largest we’ve seen, making it very attractive for Malaysian traders who want to diversify their portfolios. Not only is the product selection wide, the range of asset classes is diverse, ranging from forex, shares, indices and commodities to complex derivatives such as ETFs and options.

Solid Proprietary Platform Experience

IG Group offers a solid range of platforms, including MT4, ProRealTime, L2 Dealer and its own proprietary platform. L2 Dealer and ProRealTime are more advanced platforms, offering direct market access trading (L2 Dealer) and more sophisticated tools for market analysis (ProRealTime).

We found IG Group stands out, however, with its proprietary platform. When we signed up for a demo account to test the IG trading platform, we found it has 22 timeframes, 20 drawing tools and 5 chart types. With a user base of 300,000 clients, we also found the client sentiment data allowed us to predict trend reversal as it shows the percentage of traders buying and selling currency pairs.

8. Fusion Markets - Lowest Commission Broker

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

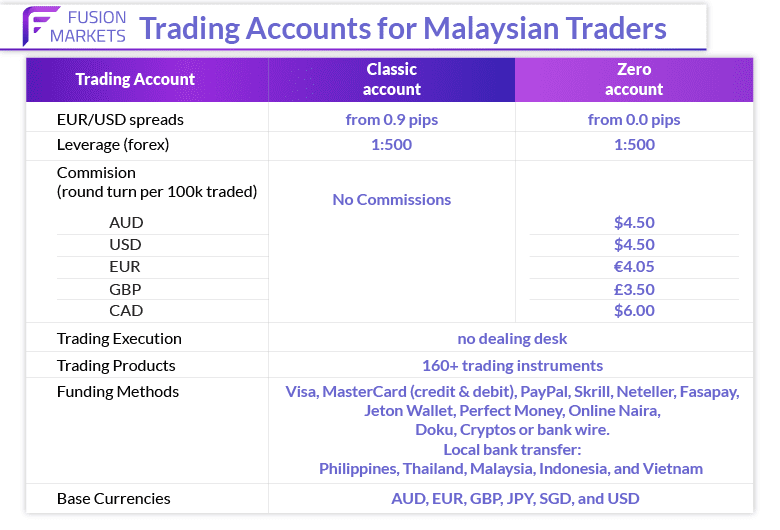

We recommend Fusion Markets as our tests done by Ross Collins proved they have some of the lowest spreads and lowest commission costs with the Zero Account. This allows you to save on trading costs in two different ways.

Our tests found Fusion Markets averages 0.22 pips and has a commission of $2.25. Just as impressive is their average execution speed of 77 for market orders and 79 for limit orders. If you wish to scalp trade and use MT4, MT5 or cTrader, you can’t go past Fusion Markets.

Pros & Cons

- Very low spreads and commission.

- User-friendly mobile app with great design.

- Responsive, knowledgeable customer service.

- Fast, fully digital account opening.

- Desktop app challenging to use.

- Limited selection of educational resources.

- Very few licenses from financial regulators.

Broker Details

Australian-based Fusion Markets have the lowest commission costs we’ve tested. Not only do Fusion Markets have among the lowest commission costs with its Zero account but the broker’s spreads are lower than most, if not all brokers we have reviewed. This allows you to save on trading costs in two different ways.

Lowest Commission Costs

When selecting a RAW account that uses an electronic communication network (ECN) or straight-through-processing (STP) for trade execution, it’s crucial to choose a broker with low commission costs and competitive spreads.

Fortunately, Fusion Markets offers both, from our analysis. We analysed the commission costs of 40 Forex brokers and found that Fusion Markets, with a round-turn commission per lot of USD $4.50, is 45 to 55% lower than the $6.00 or $7.00 commission brokers typically charge.

You can see how low Fusion Markets’ commissions are below, compared to a range of other top brokers.

| Amount (round-Turn) | Broker 1 | Broker 2 | Broker 3 | Broker 4 |

|---|---|---|---|---|

| $4.00 | Tickmill | RoboForex | FXTM | |

| $4.50 | Fusion Markets | London Capital Group | ||

| $5.00 | Fair Markets | Go Markets | BD Swiss | AMarkets |

| $6.00 | VT Markets | FIBO Group | Admiral | BlackBull Markets |

| $6.00 | FP Markets | HF Markets | MultiBank Group | TradersWay |

| $7.00 | XM | Pepperstone | Eightcap | Axi |

| $7.00 | IC Markets | TMGM | FxPro | OctaFx |

| $8.00 | HYCM |

Competitive Spreads

It is not just the saving on commission costs you will get with Fusion Markets but also the lowest spreads.

We tested 20 RAW (or ECN) accounts and found that Fusion came out on top for low spreads. The most popular pair to trade is the EUR/USD, Fusion markets averaged 0.16 pips (placing them 3rd behind TMGM and Tickmill with 0.15 pips). While Fusion Markets might have been pipped for this pair, they were the best choice with 0.09 for AUD/USD with the next best being TMGM with 0.15 pips.

When trading, we don’t usually trade just one currency pair so to provide a better reflection across the board and an element of fairness, we averaged the results of the 6 pairs we tested with – AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF and USDJPY.

In this test, we found that Fusion Markets came out on top with 0.22 pips ahead of City Index (Australia) and IC Markets.

Ask an Expert