Lowest Spread Forex Broker Malaysia

Tight spreads are key to reducing costs and increasing profitability. This guide reviews the top Malaysian forex brokers offering competitive spreads and robust platforms. We analysed the published spreads and also tested the live spreads, identifying the best low-spread broker for Malaysian traders in 2025.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

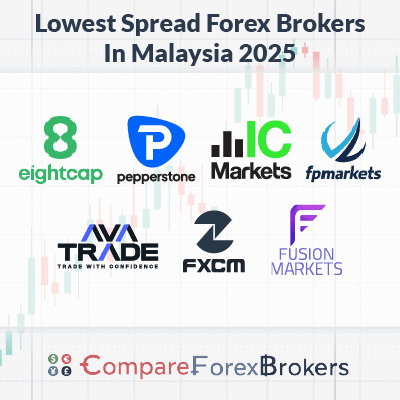

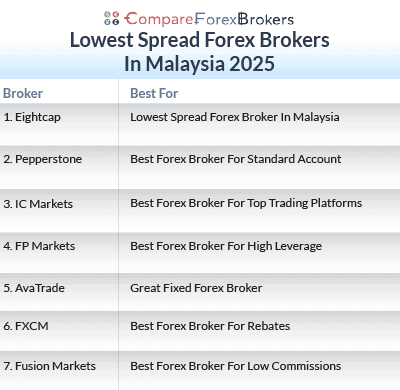

The best forex brokers with the lowest spreads are:

- Eightcap - Best Low Spread Broker Overall

- Pepperstone - Great MT4 Forex Broker

- IC Markets - Lowest Spread Forex Broker In Malaysia

- FP Markets - Good Forex Broker For Scalping

- AvaTrade - Great Forex Broker For Day Trading

- FXCM - Best Forex Broker For Rebates

- Fusion Markets - Best Forex Broker For Low Commissions

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

77 |

ASIC, FCA, CySEC CIRO, BaFin, FSCA |

0.30 | 0.90 | 0.40 | $4.00 | 1.3 | 1.8 | 0.7 |

|

|

|

150ms | $50 | 42 | 7 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

What Are The Lowest Spread Forex Brokers In Malaysia?

Low spread forex brokers offer tight spreads on currency pairs, which translates to lower trading costs and improved profitability potential. After reviewing the top brokers, Eightcap leads our list, followed by Pepperstone and IC Markets.

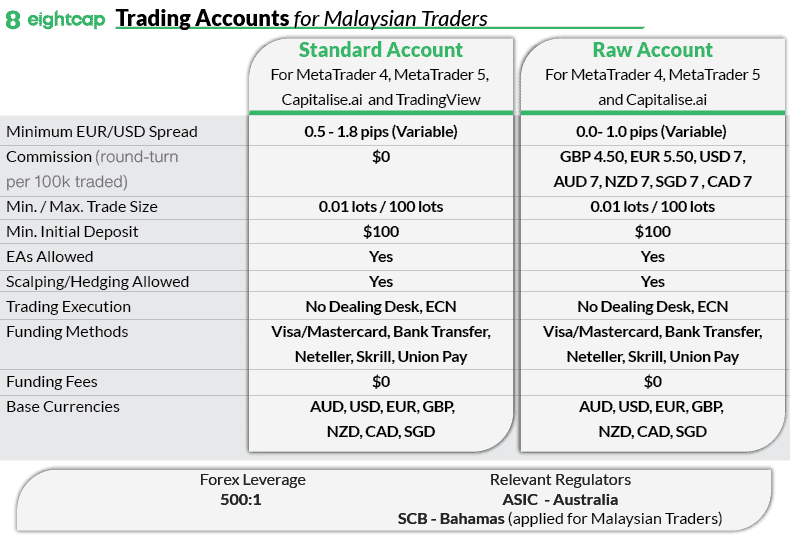

1. Eightcap - Best Low Spread Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

I recommend Eightcap because they offer tight Raw ECN spreads. This lowers trading costs, especially for high-frequency forex traders and scalpers. Combined with excellent charting tools courtesy of TradingView, Eightcap can help you execute your trading strategy with precision.

Additionally, the broker offers a good range of crypto CFDs – great if you’re looking to trade more volatile markets. If you rely on automated strategies, you can take advantage of Capitalise.ai’s full suite of analytics and automated trading tools. This enables you to develop automated trading solutions without any coding experience.

Pros & Cons

- Excellent charting with TradingView

- Advanced Trading Platforms

- Good crypto offering

- Not beginner-friendly

- High $100 minimum deposit Requirement

Broker Details

Eightcap’s Raw ECN (Electronic Communication Network) account provides access to a network of liquidity providers without dealing desk intervention. What I really appreciate about this setup is its transparency and institutional-grade liquidity. I find this results in tight spreads starting as low as 0.0 pips, depending on market conditions.

I found that the Eightcap’s spread for a popular currency pair like EUR/USD is very low, outperforming industry giant Pepperstone. Eightcap averages 0.06 pips for EUR/USD, while Pepperstone averages 0.1 pips for the same pair.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Compared to the industry average of 0.45 pips, their average spread for the top 5 currency pairs is a significantly lower 0.20 pips.

| Forex Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | Overall Average |

|---|---|---|---|---|---|---|

| Average Raw Spreads | 0.06 | 0.23 | 0.23 | 0.27 | 0.2 | 0.20 |

| Industry Average | 0.27 | 0.42 | 0.53 | 0.44 | 0.60 | 0.45 |

Charting With TradingView

Eightcap offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView as platform options. I think TradingView stands out for its advanced charting capabilities, allowing you to perform precise technical analysis.

I counted more than 15 chart types, including Kagi, Renko, and Point & Figure, which let you customise your charting experience to suit your trading style. You can use up to 8 charts per tab, with the option to synchronise symbols and time intervals for seamless analysis. Plus, there are more than 90 smart drawing tools at your disposal, making detailed analysis efficient.

Additionally, you get access to leading technical indicators and over 100,000 community-built indicators. If this isn’t enough, you’ve got the option to create your own with TradingView’s PineScript. You can also set up alerts for price levels and custom conditions to stay informed on forex market movements.

Eightcap Top Crypto Range

Eightcap offers an extensive selection of 95 cryptocurrencies with leverages as high as 1:2. These give you the opportunity to diversify your portfolio across a range of markets to maximise the profit potential. I found trading ADAUSD (Cardano / USD) particularly advantageous because of its tight spread, starting from just 5 pips.

Capitalise.ai

By integrating my Eightcap account with Capitalise.ai, I was able to automate my trading strategies without any prior coding knowledge. I also like that I can backtest my strategies against historical data to evaluate their performance before deploying them in live markets.

Additionally, the platform offers a Smart Notifications feature that fires real-time alerts to your mobile device when specific forex market conditions are met. This ensures you stay updated throughout the day, no matter where you are.

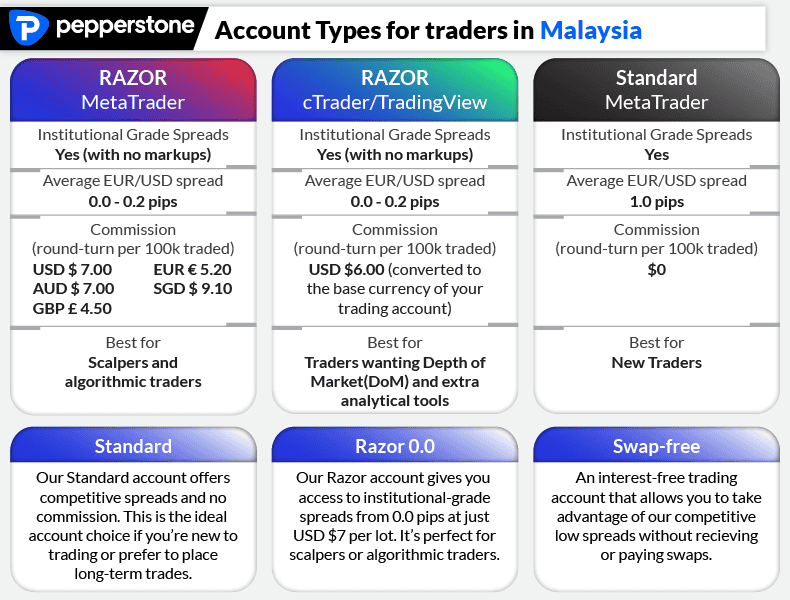

2. Pepperstone - Best MT4 Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone earned an impressive score of 98/100 in my review. This was thanks to their low Standard account spread on the most traded currency pairs. They offer 93 forex pairs, one of the broadest ranges I’ve come across with a broker.

On top of that, Pepperstone is the best MT4 broker. Combining Pepperstone with the popular platform gives you an additional suite of 28 Smart Trader Tools to improve trade execution, risk management, and market analysis.

Pros & Cons

- 93 currency pairs

- Zero-pip spreads on major forex pairs 100% of the time

- Fast execution speeds

- Offers a wide range of trading platforms, but is best with MT4

- Islamic trading account for swap-free trades

- Limited crypto range

- Lacks a guaranteed stop loss order

- Limited market research and educational resources

Broker Details

I noticed that Pepperstone’s Standard account offers highly competitive spreads across all eight major currency pairs I analysed. This makes their Standard account an excellent choice if you want to keep trading costs low while focusing on majors. Their overall average spread of 1.35 pips is notably lower than the industry average of 1.6 pips.

Looking at specific pairs, their EUR/USD spread stands out at just 1.1 pips. Currency pairs involving the Japanese Yen show slightly wider spreads, and the EUR/JPY pair is their widest offering at 1.8 pips. Still, even this higher spread remains below the industry average of 1.9 pips for the same pair.

| Currency Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall |

|---|---|---|---|---|---|---|---|---|---|

| Standard Account Spread | 1.1 | 1.3 | 1.3 | 1.2 | 1.4 | 1.2 | 1.8 | 1.5 | 1.35 |

| Industry average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 | 1.6 |

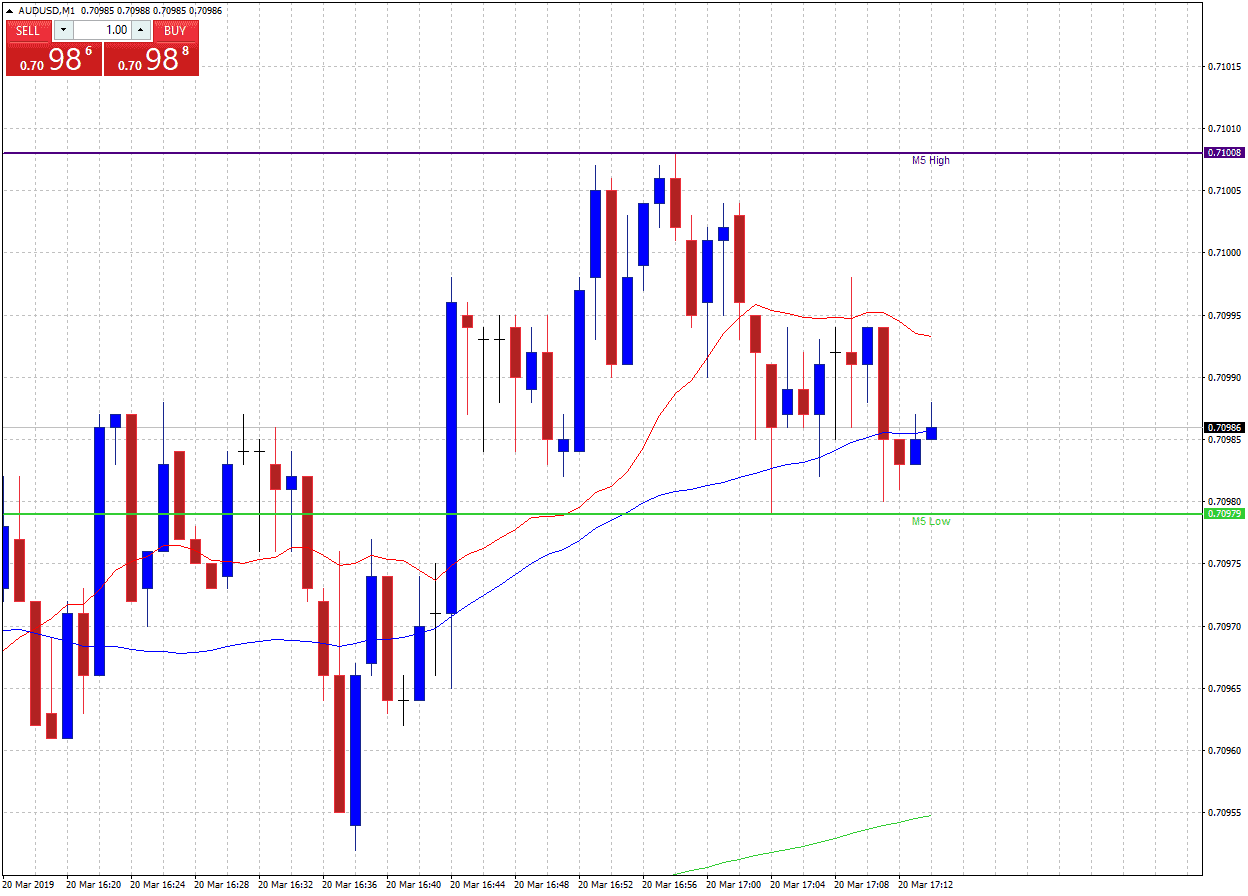

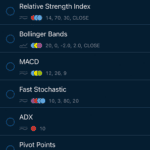

MT4 Trading Experience

Pepperstone offers a suite of trading platform options, including MT4, MT5, cTrader, TradingView, and their proprietary Pepperstone software. In my opinion, MT4 perfectly complements Pepperstone’s competitive trading environment, thanks to its advanced charting tools, customizable indicators, and fast execution.

The forex broker takes the MT4 experience to a whole new level by integrating their exclusive Smart Trader Tools. This is a collection of 28 advanced tools, which includes sophisticated alarms and broadcast facilities. The suite offers up-to-date forex market data and features designed to improve your forex trading experience.

From improved trade management and advanced order types, to sentiment analysis and risk monitoring, these tools provide everything you need to execute your forex trading strategies efficiently.

Among the indicators, the High-Low indicator stuck out for me. It automatically placed the previous day’s high and low on the chart, constantly reminding me of two significant price levels for the day.

Lastly, Pepperstone has impressively fast execution speeds, which reduce slippage. The forex broker averaged 77ms for limit orders and 100ms for market orders, coming in third place just behind BlackBull Markets and Fusion Markets.

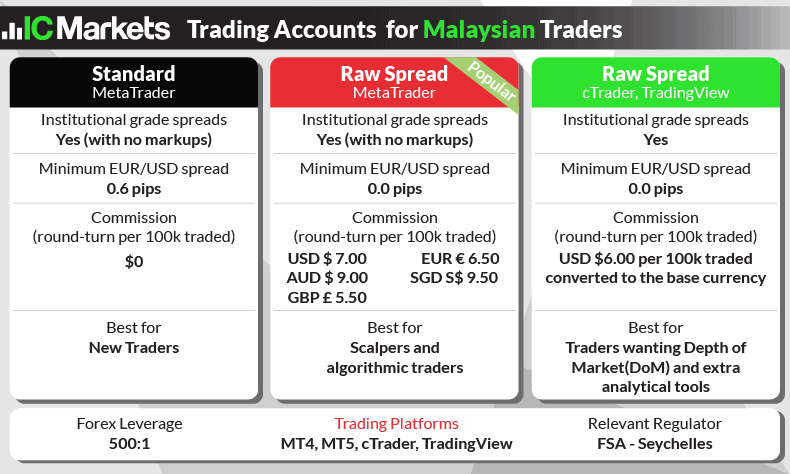

3. IC Markets - Lowest Spread Forex Broker In Malaysia

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets offers some of the lowest standard account spreads on most major currency pairs. For the top 5 pairs – EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD – the IC Markets Standard account averaged a spread of 0.93 pips. This is significantly lower than the tested industry average of 1.51 pips.

Besides low spreads, IC Markets offers a great range of trading platforms, including MT4, MT5, cTrader and TradingView. I also like the forex broker’s generous offering of share CFDs. This presents a lot of opportunities for you as a trader.

Pros & Cons

- Lowest average standard account spreads

- Tight Raw account spreads

- Fast execution speeds are ideal for algorithmic strategies

- Lacks a proprietary forex trading app.

- Low-quality educational materials

- High minimum deposit of $200

Broker Details

Ross Collins, my colleague at CompareForexBrokers, conducted spread tests for over 40 brokers to find out which ones offer the tightest spreads. These tests show that IC Markets offers some of the lowest Standard account spreads in the market.

Spreads for major currency pairs like EUR/USD and GBP/USD are lower than the industry average, as you can see below. With such low spreads, you’ll be paying less to enter and exit trades, potentially increasing your overall profitability.

| Currency Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall |

|---|---|---|---|---|---|---|---|---|---|

| Average Spreads | 0.82 | 0.94 | 1.03 | 0.83 | 1.05 | 1.27 | 1.3 | 1.5 | 1.09 |

| Industry average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 | 1.6 |

Advanced Trading Tools With MT5

In my opinion, MT5 stands out as the superior trading platform offering the most advanced trading tools. You have access to 38+ indicators, such as moving averages, MACD, RSI, and Bollinger Bands. There are also more than 20 drawing tools and 21 timeframes.

I also appreciate the availability of multiple order types, one-click trading and support for algorithmic trading with Expert Advisors (EAs).

One feature I find incredibly useful on the trading platform is the Depth of Market (DoM) tool. It provides detailed insights into market liquidity and order flow for specific trading instruments, highlighting areas of high or low liquidity. I use it to identify potential support and resistance levels and plan entry or exit points effectively.

Good Number of Stock CFDs

IC Markets offers 2,100+ large-cap stock CFDs from major exchanges like the ASX, NYSE, and NASDAQ. This selection includes popular companies such as Nvidia, Apple, Meta, Microsoft, and BHP Billiton, providing diverse trading opportunities.

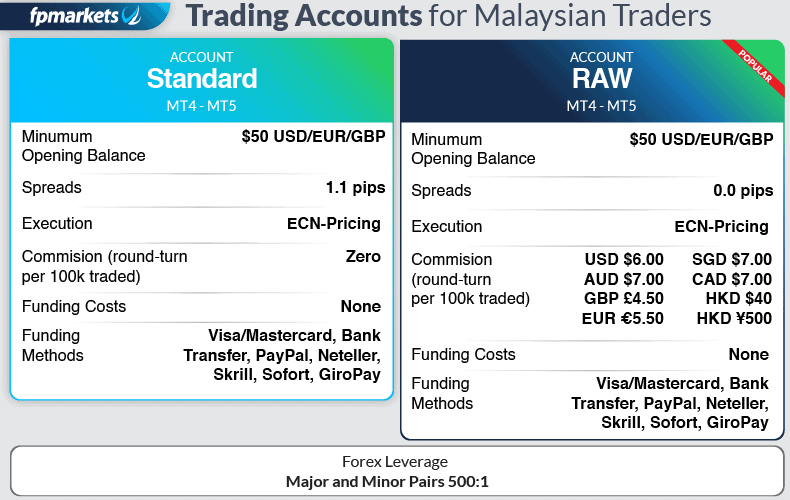

4. FP Markets - Best Forex Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

I recommend FP Markets for their exceptionally low ECN spreads, which are highly advantageous for scalping. With a major pair average spread of 0.35 pips on their Raw account and competitive commission rates, FP Markets provides the cost efficiency scalpers need for high-frequency trading.

Pros & Cons

- Tight Raw spreads

- Fast execution speeds

- Excellent trading platforms

- Wide range of CFDs

- Poor social trading features

- No proprietary trading platform

Broker Details

FP Markets utilises a No Dealing Desk (NDD) model and works with various liquidity providers to offer competitive prices and deep liquidity across many instruments. This approach, combined with direct market access pricing, ensures tight spreads and ultra-fast executions ideal for scalping.

The Raw account offers tight spreads for most major currency pairs, which can help minimise forex trading costs and allow scalpers to retain more of their profits.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

The spread for EUR/USD is 0.2 pips, notably lower than the industry average of 0.27 pips, reflecting excellent cost efficiency for this major pair. Overall, most pairs in the list have spreads significantly below industry averages.

The USD/JPY pair was the only outlier from those we tested, but pricing is very competitive in general.

| Currency Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Average Raw | 0.2 | 0.56 | 0.29 | 0.21 | 0.5 | 0.43 | 0.3 | 0.5 |

| Industry average | 0.27 | 0.42 | 0.53 | 0.44 | 0.60 | 0.55 | 0.72 | 0.92 |

Great Trading Tools & Platforms For Scalping

FP Markets provides an excellent range of trading platforms to suit different trading styles. You have access to MT4, MT5, cTrader and TradingView.

I highly recommend MT5 for scalping, due to its advanced features that help you capitalise on small price movements within short time frames. One of the standout features is one-click trading, which lets you execute trades swiftly with a single click.

The Depth of Market (DOM) tool is very welcome as well. It provides real-time information on market liquidity and pricing, enabling informed decision-making during high-frequency forex trading sessions.

And I also need to point out the platform’s advanced charting tools and a wide array of technical indicators, such as moving averages and Bollinger Bands. They assist in accurately identifying potential entry and exit points, which are essential for effective scalping strategies.

You can also take advantage of MT5’s Strategy Tester, which provides reliable backtesting functionality. This allows you to analyse past trades and identify potential improvements to your strategy.

As well as this, the Australia-based forex broker provides VPS (Virtual Private Server) services, designed to minimise latency and maintain 24/7 connectivity. This is particularly beneficial for scalpers who depend on ultra-fast execution and uninterrupted trading performance.

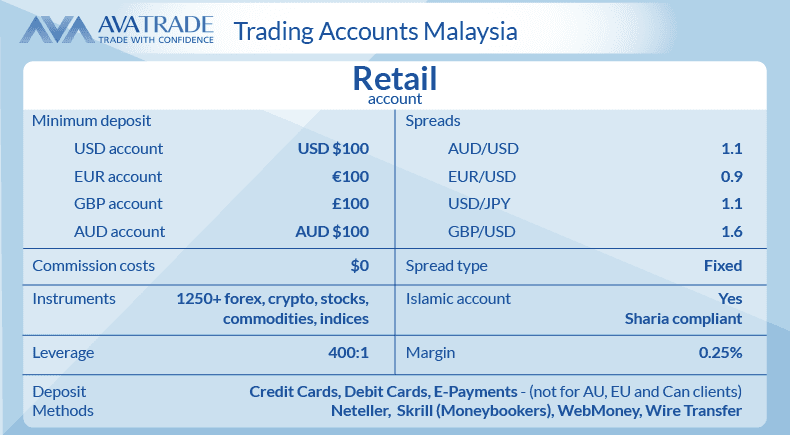

5. AvaTrade - Great Forex Broker For Day-Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is an excellent choice for day traders due to their tight fixed spreads, which provide cost predictability even in volatile markets. Apart from that, AvaTrade offer a great range of trading platforms including a specialised one for options trading.

Pros & Cons

- Tight fixed spreads

- Good range of trading platforms, including a proprietary app

- The AvaOptions desktop platform is slow to load and outdated

Broker Details

AvaTrade stand out by offering tight fixed spreads across a wide range of CFDs, including an impressive selection of 55 forex pairs. This consistency in pricing has earned the forex broker the top spot as my preferred broker for fixed spread trading.

Fixed spreads are particularly advantageous for day traders as they provide cost predictability. This can help in effectively managing trading costs.

| Currency Pair | EUR/USD | AUD/USD | EUR/GBP | EUR/JPY | GBP/USD | USD/JPY | USD/CAD |

|---|---|---|---|---|---|---|---|

| AvaTrade Fixed Spreads | 0.9 | 1.1 | 1.5 | 1.8 | 1.5 | 1 | 2 |

| Industry average | 1.8 | 2.2 | 2 | 2.2 | 2.14 | 1.8 | 2.3 |

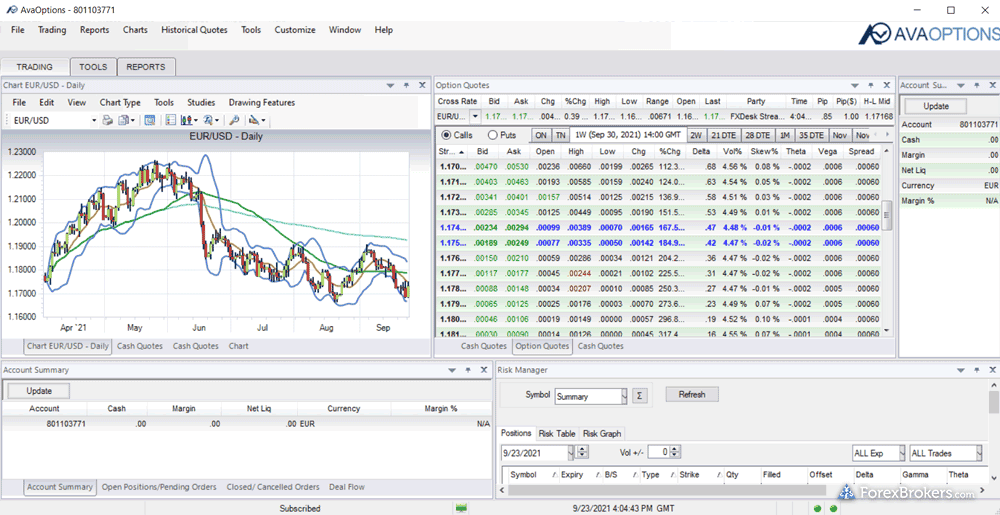

Options Trading With AvaOptions

I like AvaTrade’s proprietary AvaOptions platform for trading forex and commodities options. Built on the MetaTrader 4 foundation, it’s available on both desktop and mobile, and offers a comprehensive suite of sophisticated features.

These include advanced risk management tools like stop-loss and limit orders, as well as 13 top option strategies, including Spot, Calls, and Puts. There are also combination strategies available, such as Straddle and Strangle.

You can apply these strategies to a wide range of financial instruments, all within a single account. Among the tradable instruments are over 40 currency pairs, and commodities like gold and silver, as well as indices.

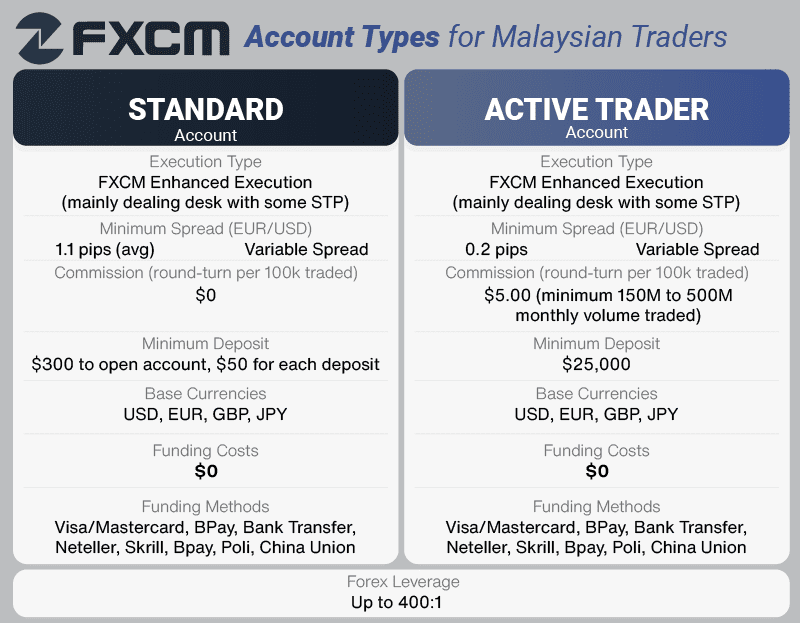

6. FXCM - Best Forex Broker For Rebates

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

FXCM provides a highly competitive average overall spread of 1.48 pips on Standard accounts for major currency pairs, which is slightly lower than the industry average of 1.6 pips.

In addition to their attractive pricing, FXCM’s rebate program rewards active traders with cash rebates based on their monthly trading volume. The more you trade, the higher the rebate per million dollars traded, providing a tangible incentive for high-volume traders.

Pros & Cons

- Generous rebate program for active traders

- Good algorithmic trading and copy trading features

- Wide Raw spreads

- No cTrader

Broker Details

I noticed that FXCM shows particular strength in certain pairs. AUD/USD, for example, comes in at an impressively low 0.7 pips, significantly below the industry average of 1.5 pips.

The widely traded EUR/USD pair is priced at 1.3 pips, while most other major pairs maintain spreads around or below industry standards. The exception is AUD/JPY, which shows a wider spread of 2.6 pips. This is broader than the industry average of 2.1 pips.

| Currency Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall |

|---|---|---|---|---|---|---|---|---|---|

| Average Spreads | 1.3 | 1.1 | 1.8 | 0.7 | 1.3 | 1.1 | 1.9 | 2.6 | 1.48 |

| Industry average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 | 1.6 |

FXCM Rebate Program

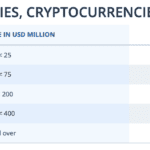

FXCM’s Active Trader program will be very attractive for high-frequency traders or those who trade large positions, thanks to its rebate system. The Rebate Program rewards active traders based on their monthly trading volume. To be eligible, you must maintain a combined notional volume of at least USD 10 million per month.

The rebate structure is divided into five tiers. The highest, Tier 5, requires a notional trading volume above USD 400 million, and gives a rebate of $25 per million. So for example, if you achieve this notional volume, your $25 is multiplied by 400 – giving you a total rebate of $10,000.

Below are the cash back rates for Forex, Shares, Commodities, Cryptocurrencies, and Baskets:

| Tier | Notional Volume In USD Million | Rebate per Million USD Traded |

|---|---|---|

| 1 | 10-25 | 5 |

| 2 | 25-75 | 10 |

| 3 | 75-200 | 15 |

| 4 | 200-400 | 20 |

| 5 | Above 400 | 25 |

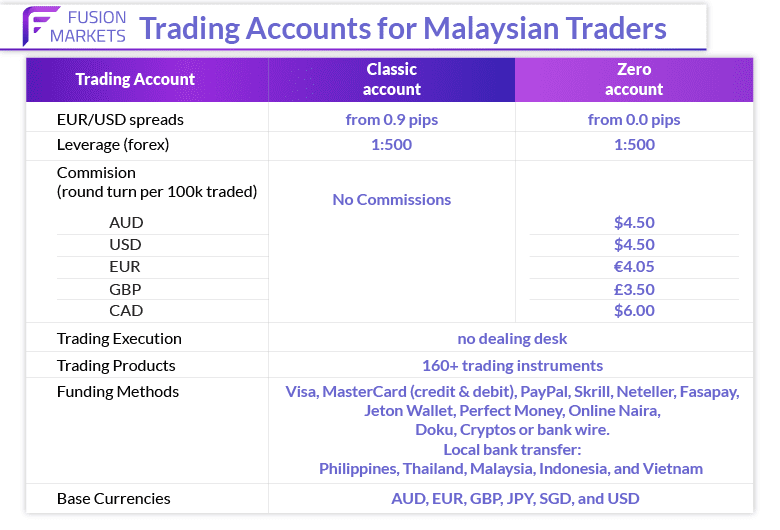

7. Fusion Markets - Best Forex Broker For Low Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

I recommend Fusion Markets because they offer tight Raw account spreads as well as the lowest commission rates on the most popular base currencies – USD, EUR, GBP, AUD. On top of this, they offer lightning-fast execution speeds, which can help reduce slippage.

Pros & Cons

- Low commissions

- Ultra-fast execution speeds

- Low trading fees, including highly competitive swap rates

- Quality trading tools and VPS hosting

- No minimum deposit requirement

- Lacks advanced educational tools

- Limited product selection

Broker Details

Fusion Markets’ Raw account demonstrates exceptionally competitive spreads across all major currency pairs, consistently outperforming industry averages. Their EUR/USD spread of 0.09 pips is notably lower than the industry average of 0.27 pips.

Even on pairs that typically have wider spreads, Fusion Markets manages to keep things low. For example, AUD/JPY averages 0.67 pips, versus the industry average of 0.92 pips.

| Currency Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Average Raw | 0.09 | 0.41 | 0.28 | 0.14 | 0.23 | 0.25 | 0.63 | 0.67 |

| Industry average | 0.27 | 0.42 | 0.53 | 0.44 | 0.60 | 0.55 | 0.72 | 0.92 |

I observed that Fusion Markets’ Raw account offers zero-pip spreads approximately 98.55% of the time for major currency pairs I tested. These include AUD/USD, EUR/USD, GBP/USD, USD/CAD, and USD/JPY.

This places them just behind Pepperstone and City Index, which maintain zero-pip spreads 100% of the time.

Lowest Commission Rates

Fusion Markets also offers the lowest commission rates on popular base currencies with a fee of $2.25 per lot for USD and AUD pairs, $1.78 per lot for GBP, and $2.03 per lot for EUR. These rates are lower than many competitors like Pepperstone and IC Markets.

In my experience, low commissions can help reduce trading costs and increase profit potential.

| Broker | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Fusion Markets | $2.25 | $2.25 | £1.78 | €2.03 |

| CMC Markets | $2.50 | $2.50 | £2.50 | €2.50 |

| Fair Markets | $2.50 | $2.50 | N/A | N/A |

| Go Markets | $2.50 | $3.00 | £2.00 | €2.00 |

| VT Markets | $3.00 | $3.00 | £2.00 | €2.50 |

| FIBO Group | $3.00 | $3.00 | £3.00 | €3.00 |

| FlowBank | $3.25 | $3.25 | £2.50 | €2.50 |

| City Index | $2.50 | $3.00 | N/A | N/A |

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| EightCap | $3.50 | $3.50 | £2.25 | €2.75 |

| IC Markets | $3.50 | $3.50 | £2.50 | €2.75 |

Ultra-Fast Execution Speeds

Fusion Markets came in second place in my execution speeds, behind only BlackBull Markets. They have an impressive limit order speed of 79 milliseconds and market order speed of 77 milliseconds.

| Broker | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|

| BlackBull Markets | 72 | 90 |

| Fusion Markets | 79 | 77 |

| Pepperstone | 77 | 100 |

| IC Markets | 134 | 153 |

| OANDA | 86 | 84 |

| CMC Markets | 138 | 180 |

| IG | 174 | 141 |

| City Index | 95 | 131 |

| FP Markets | 225 | 96 |

| Axi | 90 | 164 |

| Eightcap | 143 | 139 |

Ask an Expert