Best Forex Trading Apps In Malaysia

To help compare forex trading platform providers, the top brokers and the software they utilise were reviewed based on spreads, execution speeds and trading features. View the full 2025 comparison and top forex broker list below.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The top apps in 2025 for trading forex and CFDs are:

- Pepperstone - Best Forex Trading App In Malaysia Overall

- Eightcap - Top Forex Platform Provider For Cryptocurrency

- AvaTrade - Best Provider For Fixed Spread Forex Trading

- IC Markets - Great Forex Platform For Intermediate CFD Traders

- FP Markets - Good ECN Style Low Brokerage Forex Platform

- IG - Top Good Forex Provider For Beginner Forex Traders

- eToro - Best Forex Platform Provider For Copy Trading

- ThinkMarkets - Good MetaTrader 4 Forex Platform Provider

- markets.com - Best Broker With The Best Tools

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

What Are The Best Malaysian Forex Trading Apps?

To determine the best trading apps for CFD traders in Malaysia we looked at elements from features, and simplicity to the fees the provider charges. Below we aligned different traders’ needs to the app that best suits them.

1. Pepperstone - Best Forex Trading App In Malaysia Overall

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Ultra-fast execution speeds and competitive trading costs combine with excellent customer service and top-tier regulation to make Pepperstone a highly recommended broker.

Pros & Cons

- The tightest spreads for a Standard Account, per our tests

- Fast execution speeds

- Four trading platforms from which to choose

- Excellent customer service

- Additional administration charge for swap-free account

- Limited range of payment options

- Educational tools somewhat limited

Broker Details

The broker offers a range of trading platforms, which allows you to choose the app that best suits your trading style. These apps include:

- MetaTrader 4 (MT4) offers an easy-to-use interface, a large user community, and plenty of automatic trading options (known as Expert Advisors or EAs), making it excellent for automating your trading strategies.

- MetaTrader 5 builds on MT4’s legacy, adding access to more markets and improved features such as Direct Market Access.

- cTrader stands out with its social trading features, allowing users to mimic the trades of others.

- TradingView is an app that’s the go-to choice if you are a technical analyst and want extensive charting options.

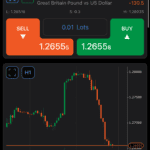

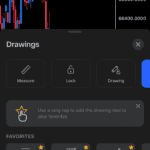

We tried the cTrader mobile app, and compared to the other apps, cTrader packs the most on a mobile device. The app has 30+ indicators, three chart types, and nine timeframes, plus most of the features from its desktop app, such as Depth of Markets and One-click trading.

We like that cTrader’s market overview covers everything on one screen, including execution, market sentiment, and depth of markets, and it even includes Autochartist technical analysis.

In our live tests, we found the Standard account’s spreads low, averaging 1.12 pips on EUR/USD, below the industry average of 1.24 pips. However, when we tested the RAW account, our analyst Ross Collins found Pepperstone offered zero-pip spreads on the major pairs 100% of the time, which can help lower trading costs.

| Broker | Time At Minimum Spread |

|---|---|

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

| Axi | 82.61% |

| CMC Markets | 81.88% |

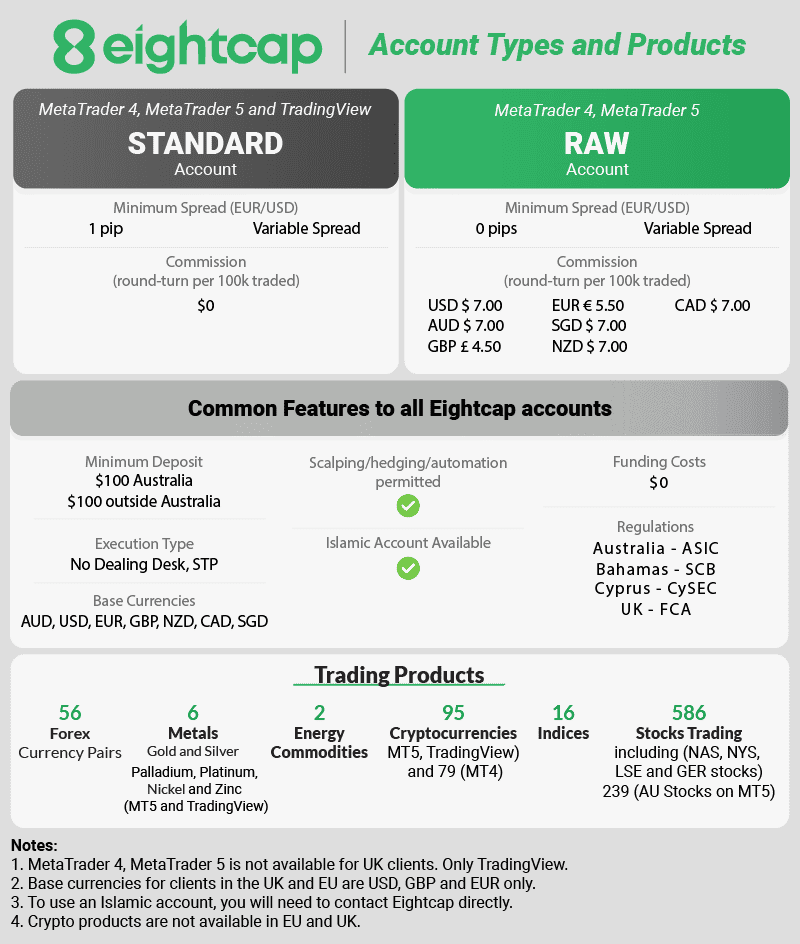

2. EightCap - Top Forex Platform Provider For Cryptocurrency

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend EightCap

We recommend EightCap for its comprehensive selection of cryptocurrency products to trade and flexible account funding options. We also like its support for automated trading and the broker’s wide selection of trading platforms.

Pros & Cons

- Wide range of trading products, including cryptos

- Great third-party trading tools

- Solid choice of trading platforms

- Limited educational resources

- No weekend customer service support

- Limited social and copy trading tools

Broker Details

While testing Eightcap, we found they had the largest range of crypto markets, offering 95 cryptocurrencies, from Bitcoin to Ripple. This allows you to follow and trade the crypto markets while still having access to traditional assets. In addition to crypto markets, Eightcap offers 56 currency pairs, 586 shares, 16 indices, and eight commodities, making you a solid choice, especially if you like to trade multiple markets.

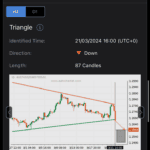

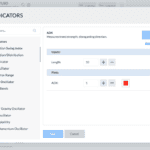

Our experience with the Eightcap RAW account introduced us to various platforms, including MetaTrader 4, MT5, and TradingView. We tried the TradingView app and found it to have most of the features you’d expect from the desktop version, except it was missing the market scanner tool.

The charting available on TradingView is one of the core reasons traders use the app; it offers 110+ technical indicators, 50+ drawing tools, and the fact that the charts sync between devices. This lets you always have the same analysis regardless of your device. Plus, we like that the app is constantly updated with new features (for free), and they are always adding and updating their indicators, growing the list based on demand – something MetaTrader 4 doesn’t offer.

Our analyst Ross Collins tested Eightcap’s RAW account spreads and found they averaged 0.20 pips on EUR/USD, one of the lowest we’ve tested. Tight spreads are important as they can help reduce your overall trading costs, especially if you are an active trader.

| GBP/USD | Average Spread |

|---|---|

| City Index | 0.17 |

| Fusion Markets | 0.21 |

| IC Markets | 0.27 |

| FP Markets | 0.31 |

| TMGM | 0.35 |

| Pepperstone | 0.41 |

| EightCap | 0.44 |

| Blueberry Markets | 0.44 |

| Go Markets | 0.59 |

| Tickmill | 0.59 |

| ThinkMarkets | 0.62 |

| Admiral Markets | 0.73 |

| CMC Markets | 0.9 |

| Axi | 0.95 |

| Blackbull Markets | 0.96 |

3. AvaTrade - Best Provider For Fixed Spread Forex Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade for its excellent risk management tools, particularly for new traders. We also like the broker’s easy-to-calculate trading costs and straightforward account structure.

Pros & Cons

- Excellent risk management tools

- Good trading platform for beginners

- Straightforward pricing structure

- High inactivity fees

- Wider spreads than other top-tier brokers

- Limited selection of trading products

Broker Details

If you day trade or specialise in trading volatile markets, we think AvaTrade is a top choice thanks to its fixed spreads with no commission. Using AvaTrade’s Standard account, we tested their spreads and found they offered 0.9 pips on EUR/USD.

While this may appear more expensive compared to others, we think the lack of commission makes it a competitive option, especially for active traders who can save on costs during volatile periods when variable spreads tend to widen significantly.

| Broker | Avg. Spread EUR/USD (Standard Account) | Fixed/Variable |

|---|---|---|

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| FP Markets | 1.10 | Variable |

| ThinkMarkets | 1.10 | Variable |

| Pepperstone | 1.12 | Variable |

| IG Group | 1.13 | Variable |

| markets.com | 1.60 | Variable |

With the AvaTrade Standard account, you can access multiple platforms, including MT4, MT5, Web Trader, AvaTradeGO, and AvaTrade Options. Of all the platforms available, the AvaTradeGO mobile app stands out with its market sentiment tool, which is built into the platform and can be easily viewed while scanning the markets.

This tool collects all of AvaTrade’s client open and pending positions and determines the percentage of traders that are long or short the market. Using something like this can help gauge where AvaTrade’s clients think the market will go, which we think can be a helpful indicator by validating trends and market direction.

For example, if over 46% of traders believe the EUR/USD will fall, as shown in the image, it provides a quick snapshot of other market participants’ sentiment.

4. IC Markets - Great Forex Platform For Intermediate CFD Traders

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We recommend IC Markets for its ultra-tight spreads – the lowest we tested – and high leverage – an excellent combination for advanced traders. Traders of all skill levels will appreciate the extensive range of markets and instruments to trade and solid platform selection.

Pros & Cons

- Winner for lowest spreads with Standard and Raw accounts

- Leverage of 1000:1 with negative balance protection

- 24/7 customer support

- Swap-free account has administration change in place of swaps

- Slow responsiveness on live chat

- No crypto funding methods

Broker Details

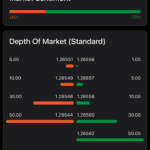

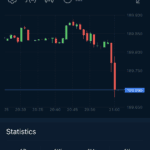

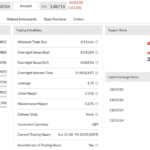

The MetaTrader 5 mobile trading app offers a user-friendly interface and a comprehensive set of features similar to the desktop version, including the Depth of Markets Tool. The iOS version of the app we tested had 38 indicators and 20 drawing tools, which cover the basics for analysing the markets on the go.

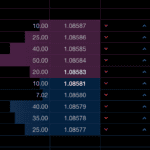

The depth of market tool visually represents the order book, displaying the available buy and sell orders at different price levels. This was easy to set up; you can tap on the market you wish to trade, and the Depth of Market (DOM) option is available.

However, we found it takes up a full screen, so you cannot monitor the market and read the DOM tool simultaneously. We believe this feature is useful for scalpers and day traders, as it helps find market sentiment and identifies potential support and resistance levels.

The account we used to test the broker was IC Market’s RAW account, a commission-based account with tighter spreads. We found these spreads to average 0.02 pips on EUR/USD, the lowest spreads we tested. We think these tight spreads are excellent as they reduce trading costs, potentially improving your profit margins.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| Pepperstone | 0.1 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| IG | 0.16 |

| FXCM | 0.3 |

| Industry Average | 0.22 |

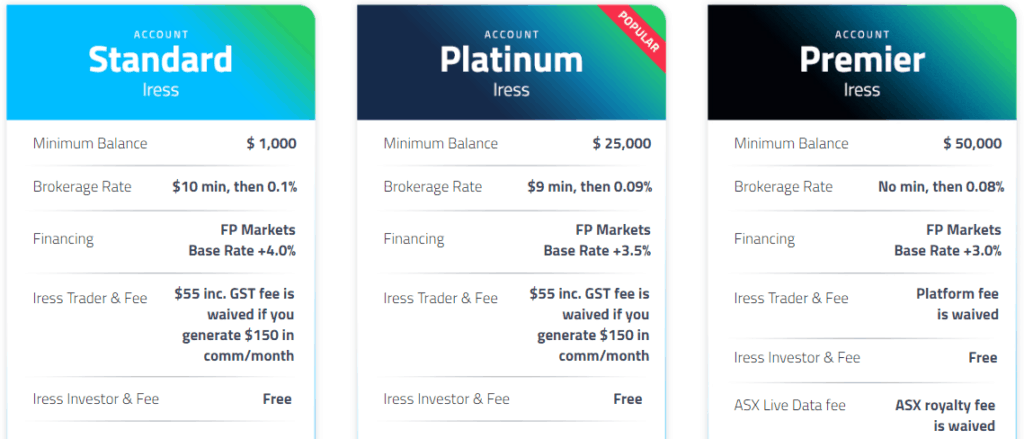

5. FP Markets - Good ECN Style Low Brokerage Forex Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$50

Why We Recommend FP Markets

We recommend FP Markets for its commitment to the fundamentals: low-latency execution, deep liquidity and true ECN pricing. We also appreciate its excellent research tools, structured according to trading skill level.

Pros & Cons

- 500:1 leverage with negative balance protection

- 33 funding methods, including crypto

- 10 base currency options

- Limited range of third-party social tools

- Mobile app lacks important features

- Educational content could be more in-depth

Broker Details

As an ECN broker, FP Markets provides direct access to multiple liquidity providers, allowing you to trade at competitive prices without hidden markups. We like the transparency and cost-efficiency this model offers, as the broker only charges the commission. This means you always get the best pricing, and the execution speed from ECNs is typically fast.

Our analyst, Ross Collins, tested FP Markets’ execution speed and compared it to 14 other ECN brokers. His findings demonstrated excellent order execution speed, averaging 96ms for market orders. We think this rapid execution capability is crucial for scalpers, ensuring your trades are filled instantly, especially when market conditions demand split-second timing.

| Broker | Market Order Rank | Market Order Speed |

|---|---|---|

| FP Markets | 8 | 96 |

| Blackbull Markets | 5 | 90 |

| Fusion Markets | 1 | 77 |

| Pepperstone | 10 | 100 |

| Octa | 6 | 91 |

| OANDA | 2 | 84 |

| Exness | 3 | 88 |

| TMGM | 13 | 129 |

| City Index | 14 | 131 |

| FBS | 12 | 118 |

| Eightcap | 17 | 139 |

| FxPro | 16 | 138 |

On the RAW account we used, the spreads on EUR/USD averaged a tight 0.1 pips – one of the lowest in our testing. We feel these spreads, combined with the ECN model’s direct access to liquidity providers, ensure we receive the most favourable pricing without any markup, allowing you to get near-zero spreads.

The FP Markets Trading app offers a wide range of tradable instruments, including 63 forex pairs, 10,000+ CFDs on shares, 19 indices, 13 commodities, and 11 cryptocurrencies.

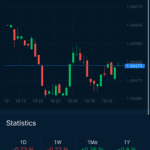

While using the FP Mobile Trading app, we found the tool’s features to be basic at best, which is fine if you use the app to execute trades remotely. Although we found the charts similar to TradingView’s, they lacked all of the indicators and drawing tools you’d expect to find.

6. IG Group - Top Good Forex Provider For Beginner Forex Traders

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We recommend IG for its size, global reputation and top-of-the-line trading environment with trading platforms and tools to suit any style or strategy. Access to over 17,000 financial markets also doesn’t hurt.

Pros & Cons

- Excellent educational tools

- Best-in-class web trader app

- No withdrawal or deposit fees

- The number of tradable products could be larger

- Higher trading costs than comparable brokers

- Slow customer support response time

Broker Details

As far as brokers go, IG Group offers one of the most extensive trading education services through its IG Academy. It offers 18 online trading courses and weekly live sessions where you can learn directly from its experts.

We like that you can participate in them live, where you can interact and ask questions – or you can watch the webinar later as they upload them to their library, which is free to watch. We think this is a great way for beginners to speed up their learning process and gain valuable insights from professionals without paying for costly courses or seminars.

While exploring IG Group, we found that they offered several trading platforms, including MetaTrader 4, IG Group Trading Platform, L2 Dealer, and ProRealTime. We think the IG Trading App is the top choice for beginners because of its user-friendly interface and comprehensive set of tools. It offers over 40 built-in indicators, covering popular indicators like moving averages, relative strength index, and Bolling Bands.

We tested the Standard account to see how low IG Group’s spreads were across the forex markets and found that they were low compared to the industry average. The broker averaged 1.13 pips on EUR/USD, in line with other low-spread brokers like Pepperstone.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.62 |

| Eightcap | 1 |

| eToro | 1 |

| ThinkMarkets | 1.1 |

| FP Markets | 1.1 |

| IG | 1.13 |

| Pepperstone | 1.12 |

| HF Markets | 1.2 |

| Markets.com | 1.6 |

| Industry Average | 1.24 |

7. eToro - Best Forex Platform Provider For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro for casual traders and anyone interested in seriously exploring social or copy trading. This broker makes up for limited account types and platform options with some of the best custom-designed tools for social and copy traders.

Pros & Cons

- Large selection of trading markets, especially crypto

- Best social and copy trading tools of any platform

- Sharia-compliant swap-free account

- High minimum deposit

- Single account type

- Only one trading platform

Broker Details

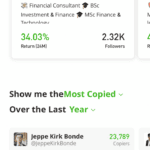

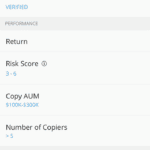

eToro’s CopyTrader feature allows you to mirror the trades of experienced traders automatically. We think this is incredibly useful for those new to forex trading or anyone looking to learn from successful traders. By copying the strategies of top-performing traders, you can gain valuable insights and potentially replicate their profits without extensive experience or analysis.

In our tests, eToro’s CopyTrader platform stood out for its ease of use and powerful filtering tools. With over 30,000,000 traders, we could fine-tune the criteria to find traders aligned with our risk tolerance and trading goals. This is particularly beneficial for beginners who may feel overwhelmed by the many options.

One feature we liked was the advanced “filter” tool. We were presented with top traders who matched our essential preferences by selecting specific criteria like markets and risk levels. This is a valuable tool if you’re unsure about specific performance metrics but know your general trading requirements. We used the market filter to narrow our choices to traders who specialise in a specific asset, allowing us to be more targeted in our copy trading strategy.

This means you can choose the best copy traders that match your filter across multiple markets, benefiting from eToros’ range of markets, including 49 currency pairs and even 51 crypto markets. Essentially, you are diversifying your risk across multiple markets through multiple traders.

8. ThinkMarkets - Good MetaTrader 4 Forex Platform Provider

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

Dedicated spread betting educational tools, Tier-1 regulation and tight spreads make ThinkMarkets our recommended broker for traders interested in this form of day trading.

Pros & Cons

- No minimum deposit

- Extensive regulation

- Tight spreads

- Not widely known

- Limited range of trading products

- Only three trading platforms available

Broker Details

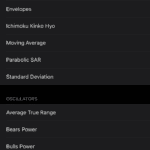

In our tests, we found the MetaTrader 4 app to be an excellent choice for day traders, scalpers, and beginners. Its simplistic interface keeps your focus solely on the charts and watchlists, preventing distractions from the news or social media feeds that some other platforms include. We think this streamlined approach is excellent for price action traders who don’t want to be distracted from fundamental news.

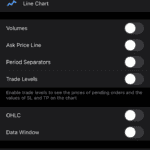

The platform comes packed with features offering over 30 built-in indicators, including popular ones like Ichimoku Kiko hyo, MACD, and Bollinger Bands, which are available for free. We tested the various chart types (3 options), timeframes (9 choices), and customisable indicators and found them robust and user-friendly.

Regarding spreads, we found ThinkMarkets to be competitive. Their standard account offers spreads of 1.1 pips on EUR/USD with no commission, which is reasonable for most traders.

However, for those seeking even tighter spreads, the ThinkZero account provides average spreads from 0.1 pips on EUR/USD, though it charges a commission of $3.50 per lot traded. We feel this commission rate is in line with industry standards and could be a worthwhile trade-off for active traders looking to minimise their trading costs.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| Pepperstone | 0.1 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| IG | 0.16 |

| FXCM | 0.3 |

| Industry Average | 0.22 |

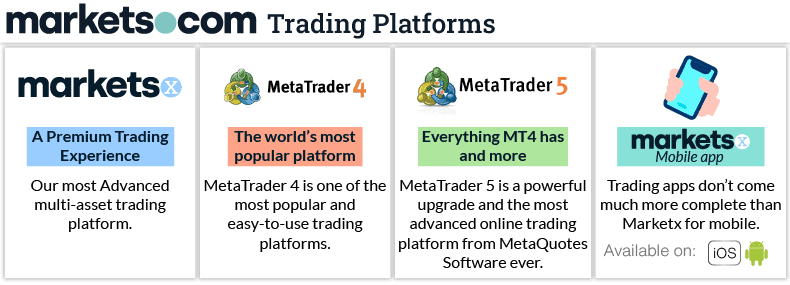

9. markets.com - Best Broker With The Best Tools

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.6

AUD/USD = 1.8

Trading Platforms

MT4, MT5, TradingView, Markets.com Trading App

Minimum Deposit

$10

Why We Recommend markets.com

We recommend markets.com for its comprehensive package of advanced charting and trading tools and excellent selection of markets to trade. Access market insights from over 50,000 sources and apply your knowledge with premium fundamental, technical and sentiment tools.

Pros & Cons

- Excellent trading tools and charting

- Great educational tools

- Easy account opening process

- High trading costs

- Platforms lack some common features

- Range of trading products could be larger

Broker Details

With our Markets.com Standard account, we could choose from trading platforms like MetaTrader 4 and MetaTrader 5 and their in-house web platform. During our testing, we found that the Markets.com web platform offered some handy tools, like market sentiment indicators, which can be beneficial for gauging overall market sentiment and adjusting trading strategies accordingly.

We think the Related Instruments tool is particularly useful, showing the current markets correlated with your chosen asset and helping you identify potential diversification opportunities or hedging strategies.

While the web platform seemed rather basic compared to more advanced offerings like IG’s Trading Platform, we valued that the TradingView charting integration provided access to 89 indicators, seven drawing tools, and six chart types.

However, we felt that Markets.com simplified the charts excessively, which could deter more experienced traders from seeking advanced charting capabilities. We believe opting for MetaTrader 4 or MetaTrader 5 would be a better choice for those seeking more robust charting and analysis tools.

As we explored the platform, we noticed a decent range of tradable markets, including 67 forex pairs, 995 shares, 16 indices, ten commodities, 38 ETFs, and 13 crypto markets.

While this range is relatively comprehensive, it may not be as extensive as some of the larger brokers in Malaysia, which could be a consideration for traders seeking access to a broader array of markets and instruments.

Ask an Expert

Do traders in Malaysia trade forex more with international brokers of local ones?

IF we are talking about CFDs, then traders based in Malaysia are more likely to use international brokers for Forex trading. This is because there are more of them and they are easily accessible online.