Trading Platforms

The top trading software in Malaysia can use robot, algo and copy or social trading. Find the best platforms in 2025 to automate your trading and free up your time to do other things.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the trading platforms:

- Trading View - Best Trading Platform for Chart Trading and Overall

- MetaTrader 4 - Top Trading Platform for Customisations

- MetaTrader 5 - Great Platform for Range of Markets

- cTrader - Offers Depth of Market (DoM) And Level II Pricing

- eToro - Top Social and Copy Trading Software

- Capitalise.ai - Great Software for Automation with No Code

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

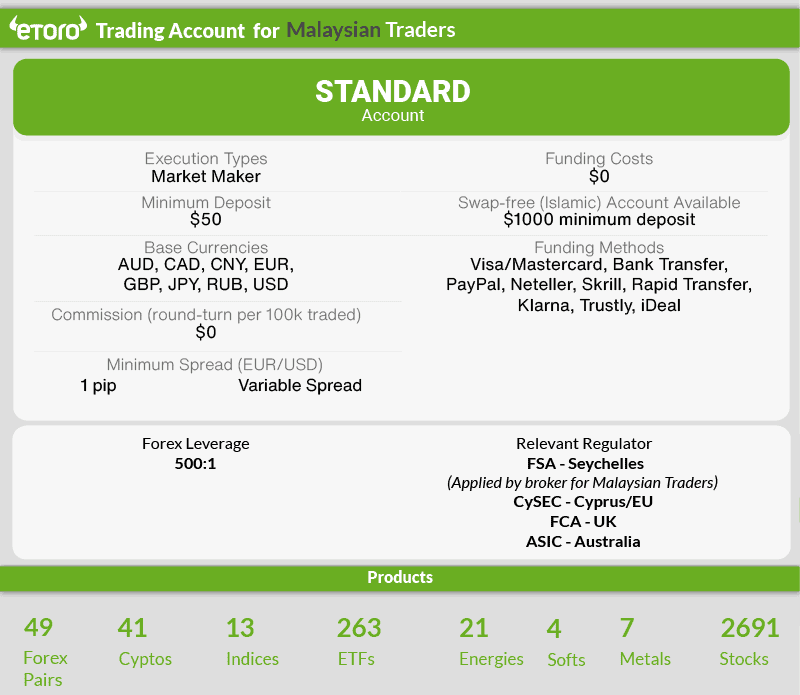

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

62 |

ASIC, FCA, CySEC FSCA, FSC BVI |

0.60 | 0.60 | 1.80 | - | 1.30 | 1.50 | 1.00 |

|

|

|

150ms | $100 | 28 | 24 | 30:1 | 300:1 |

|

What Are The Best Automated Trading Platforms in Malaysia?

The trading platform is your gateway to the forex markets. Nowadays, you have a choice of trading platforms that can make your trading processes easier for you. However, choosing which one is best can be confusing. This is why we have tested and ranked the best trading platforms in Malaysia and recommended a broker to use the platform with.

1. Trading View - BEST TRADING PLATFORM FOR CHART TRADING

Forex Panel Score

Average Spread

N/A

Trading Platforms

TradingView (with BlackBull Markets)

Minimum Deposit

$0 (with BlackBull Markets)

Why We Recommend Trading View

We recommend TradingView for its powerful advanced charting capabilities, which include more than 20 timeframes, 90 drawing tools and 100 pre-built indicators.

Pros & Cons

- Highly customisable trading charts to suit any trader

- Has among the most advanced charting tools on the market

- Has a wealth of pre-built and community-developed fundamental and technical indicators

- Useful trading tools included for free such as the Asset Screener

- User-friendly interface makes it good for beginners

- A community of 50 million traders who actively chat and share trade ideas

- TradingView is cloud-based – no need to back up templates

- Social networking features allow you to collaborate with other traders

- A large number of features are available with the free plan

- Available via web and mobile

- Unable to auto-trade your trading strategies

- Limited customer service available on the platform

- Very few brokers offer TradingView (but growing)

- Some brokers include TradingView charts in their proprietary platform (might be a better option)

- TrardingView basic plan is free but features are restricted. Access to all features needs a more advanced plan

- Lacks follow/signals capability for copy trading

- Customer support could be better

- Not available for download on desktop

Platform Details

TradingView has over 100 trading indicators

TradingView is the perfect trading platform if you demand powerful trading indicators and tools to help improve your trading. With over 100+ trading indicators and unique features like the asset screener, we recommend TradingView for the more experienced traders who wish for deeper analysis tools.

Key TradingView Highlights

- A web-based platform that works across all devices

- Syncs your charts across all devices

- Advanced charting package that is fully customisable

- Custom strategy and indicator development through Pine Script coding

- Over 100+ (and growing) technical indicators are available for free

- Free asset screener to find potential trading opportunities on demand

- Free Paper Trading and backtesting tools

Key Features Of TradingView

If you are a day trader or swing trader, charting will be important.

-

- 14 Chart types

- 20+ Timeframes

- 90+ Drawing tools

- 100+ Pre-built indicators

- 100,000+ Community-built indicators

- 3 indicators per chart

- Multi-timeframe analysis

TradingView, in our opinion, is the best technical analysis charting software in the market.

We think you will find the Asset Screener tool useful. This tool helps you sort through thousands of assets based on the criteria you define in the filters. Filters can be data-based or use technical indicators like candlesticks and chart patterns.

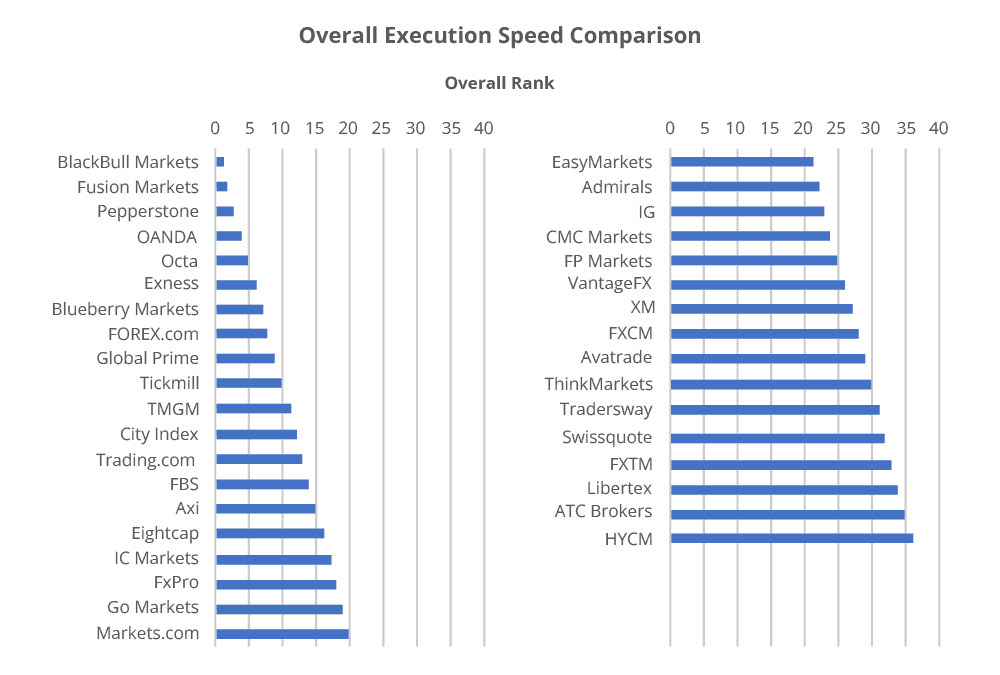

BlackBull Markets has Fast Execution and High Leverage

When trading using third-party platforms, the time it takes to send the order from the platform to the broker is essential.

BlackBull Markets offers the fastest Execution Speeds available, according to the test done by our colleague Ross Collins. The broker finished top in our tests for limit orders with 72 ms and second for market order speeds with 90 ms.

What this means for you as a trader is that you can be confident that you are getting the best execution for your orders without the uncertainty of a missed fill or slippage.

The Highest Leverage with BlackBull Markets

The FMA (New Zealand Financial Markets Authority) regulates BlackBull Markets. The FMA is more relaxed with leverage than its counterparts, such as the ASIC and FCA, where leverage is limited to 1:30.

BlackBull Markets offer up to 1:500 leverage when trading forex. While leverage is beneficial when used right, it can lead to outsized losses if movements are unfavourable. With this in mind, we think it is good that BlackBull Markets has such fast execution speed as this reduces the chances of negative slippage.

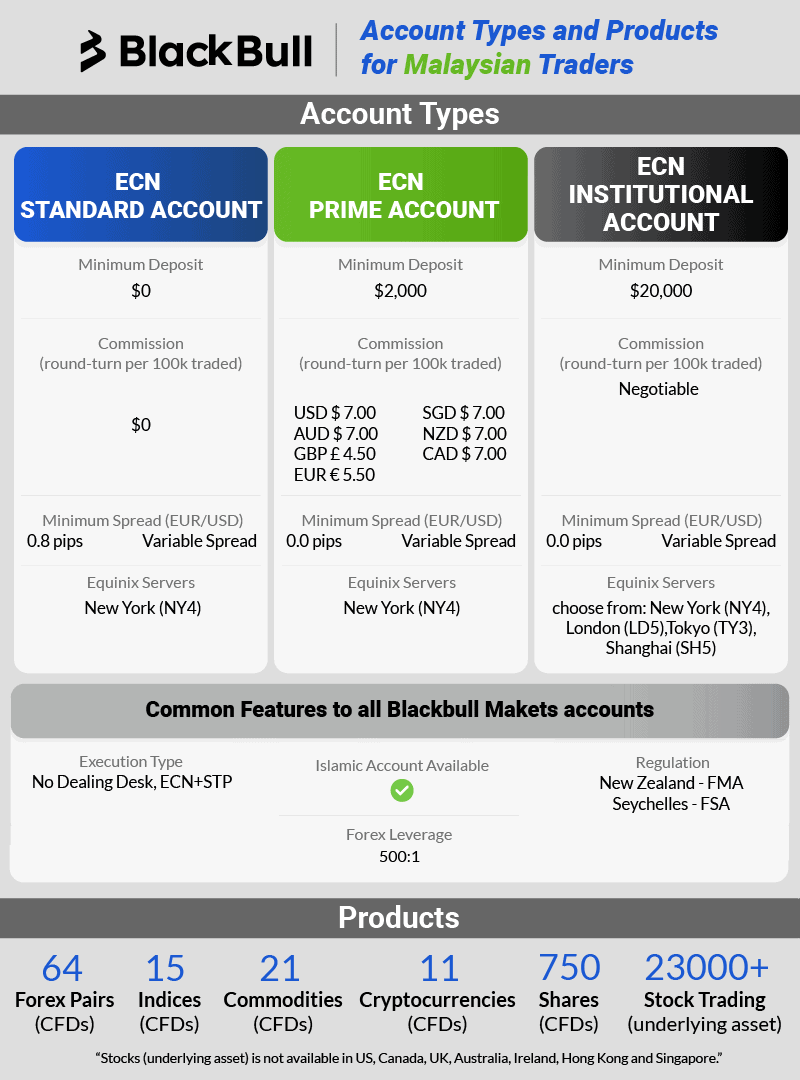

BlackBull Markets Trading Accounts

BlackBull Markets offers three trading accounts with exceptional execution speeds and tight spreads.

Most traders will use the Standard or Prime account due to the deposit requirements.

CompareForexBroker’s Verdict on BlackBull Markets for TradingView:

We recommend BlackBull Markets for its exceptional execution speeds and high-leverage options. You can take advantage of the fast market executions to ensure their trades are filled and reduce the chances of slippage (which can be costly).

They also give you enough leverage to take control of larger positions with lower deposits, which more risk-taking traders want. The features and TradingView make BlackBull Markets a strong choice for a more experienced trader.

2. MetaTrader 4 - THE BEST TRADING PLATFORM OVERALL

Forex Panel Score

Average Spread

N/A

Trading Platforms

MetaTrader 4 (with Pepperstone)

Minimum Deposit

$0

Why We Recommend MetaTrader 4

We recommend MetaTrader 4 for its ease of use, flexibility and cost efficiency. The world’s most popular platform has trading tools to accommodate almost any strategy or style and a devoted community of users.

Pros & Cons

- Most (if not all) brokers offer this free

- World’s most popular trading platform (has the largest community)

- 32-bit processing – won’t overload low-spec computers

- User-friendly design – popular with beginners

- Available with Windows, Linux, Mac, iOS and Android

- Has a wealth of 3rd party software tools that can integrate with it (i.e. for social trading)

- Large marketplace with ready-made for expert advisors

- Easy to find developers to create custom expert advisors

- No share dealing (or centralised trading)

- Back-testing tools and historical data could be better

- No guaranteed stop-loss order option

- 32-bit processing limits its processing power and speed

- lacks Depth of Market (DoM)

- Does not come with an economic calendar

- Charting tools while more than adequate, may lack compared to the competition

- WebTrader platform lacks automation

- Metaquotes have stopped further development and support for MT4

- Webtrader not built to HTML5

Platform Details

MetaTrader 4 is our preferred trading platform

We rate The MetaTrader 4 platform as the best in the market for its versatility and reliability. MT4 is an all-in-one solution – it has a solid range of customisable charts for technical analysis, automation capability through bots known as Expert Advisors and copy trading by signing up to MQL4 Signals. Other features include creating our own indicators and algo scripts and integrating with a wealth of 3rd party apps.

Key MT4 Highlights

- Customisable chart layouts to create a trading environment that is personalised for you

- Automated trading with Expert Advisors (EA)

- 50+ trading indicators pre-installed

- MQL programming to develop your own unique indicators

- One-click trading, which is excellent for scalpers

- Access an online library for MT4 indicators and EAs that you can download

- Recommended broker for MT4 is Pepperstone

Released in 2005, MetaTrader 4 was one of the first trading platforms retail traders can download and use to trade from home.

Why we like MetaTrader 4

According to MetaQuotes (the parent company to MetaTrader 4), in 2021, MT4 generated 74.9% of the forex trading volume. This shows that traders worldwide prefer to trade using the MT4 platform to access these features. [1]https://www.financemagnates.com/forex/metatrader-4-or-5-which-one-is-the-king-of-forex-trading/

With such a large trading community, we knew we would get one of the most reliable trading platforms

We recommend the MetaTrader 4 for its customisation tools and the simplified interface that works with any trader. You can customise every aspect of the MT4 charts and UI, from the 9 timeframes, 23 graphical objects and 30+ indicators to colours and number of charts showing. These features ensure you can set up your page how you like to take advantage of all the technical analysis tools MT4 provides to make trading decisions.

Another reason we like MT4 is for its Expert Advisors (EAs). These are bots or scripts you can buy, build yourself or have someone create for you (from the large MT4 trading community) to automate your trading or create custom indicators. EAs use algorithms to help monitor financial markets and open or close trading positions based on your filters.

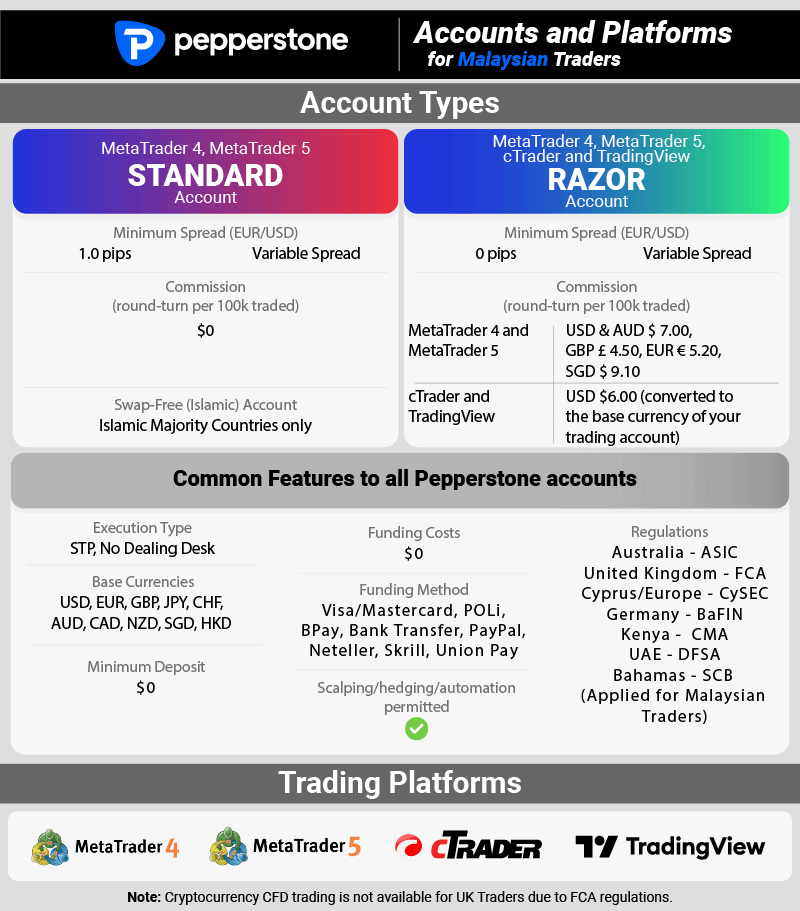

Pepperstone Is Our Pick For MetaTrader

In our Best Forex Broker ratings, Pepperstone scored 91/100. With tight spreads, 4 trading platforms to choose from, 3 social trading apps and 1200+ trading instruments, Pepperstone provides solutions for all traders.

Pepperstone Has The Best Execution Speed For Limit Orders

When it comes to limit order Execution Speeds, Pepperstone averaged 77 ms, which placed them 2nd in our speed testing. Limit orders include the following types: buy limit, sell limit, buy stop and sell stop. Pepperstone also finished in the top 5 for market execution speed, averaging 100 ms.

As a trader, getting your trade at a more favourable level than the market price will better help you achieve your profit goals and a fast limit order speed will help you achieve this.

Pepperstone has Excellent Tools to use with MT4

One of the appealing aspects of MT4 is that it allows you to integrate the platform with extra plugging and 3rd party apps.

Pepperstone Smart Trader Tools

MetaTrader 4 is feature-packed in its own right, but Pepperstone provides you with a suite of MT4 plugins known as Smart Trader Tools. These plugins give you even more functionality with MT4.

Smart Trader Tools features include:

- A Trading simulator that helps test out trading strategies

- Automatic Pivot Point tool to identify market levels based on the previous trading day

- A correlation matrix that helps identify trading bias or any potential arbitrage opportunities

- Plus, 23 additional indicators and tools that can aid your trading

We think this additional MT4 plugin improves the MT4 platform for all traders because there are features that can benefit each trading style.

Finance Magnates: MT4 vs MT5 guide [1]https://www.financemagnates.com/forex/metatrader-4-or-5-which-one-is-the-king-of-forex-trading/

Other tools with MT4

Capitalise.ai is a worthy alternative to EAs should you wish to automate your trading, and the software integrates with MT4. The advantage of Capitalise.ai is that you can create your own algos and backtest using everyday English rather than code.

For social trading, Myfxbook can integrate with MT4. Myfxbook helps you find the most successful traders (vetted and verified) in its 90,000-strong community to copy automatically.

DupliTrade is similar to Myfxbook but focuses on copy trading rather than social trading. This software uses filters to help you find traders to copy based on your trading style or preferences.

Best at opening your account

Getting started with a broker should be as frictionless as possible. If you want to open an account with a broker, chances are you would like to get funded and trade on the same day.

We tested 20 brokers by opening an account with them to determine how long this Account Opening process would take. In this test, we had 15 checks to be met to be considered a fast account opening process. Pepperstone scored 15/15 and was one of the only brokers that allowed us to open an account and get it funded on the same day.

Pepperstone Accounts Types

Pepperstone has two account types: a commission-based trading account (Razor Account) and a spread-only trading account (Standard Account).

If you are new to trading, the Standard Account is ideal as the trading costs are easy to account for. Since there are no commissions, you will only need to pay the spread, allowing you to see your true PnL more easily. Spreads with this account start from 1.0 pips.

With a Razer account, you pay your commission and a small spread (as low as 0.0 pips). The commission is $7 per lot round trade. Pepperstone achieves these low spreads because they are an STP (straight-through processing) broker.

The Razor account is suitable for scalpers because of how they trade, and they need to have fast execution and the tightest spreads possible.

CompareForexBroker’s Verdict on Pepperstone for MetaTrader 4:

Pepperstone is a top choice for all traders. We recommend Pepperstone for the MetaTrader 4 platform specifically because they have tight spreads, fast execution times, are easy to use and provide helpful tools that can improve your trading.

3. MetaTrader 5 - BEST PLATFORMS FOR A LARGE RANGE OF CFD PRODUCTS

Forex Panel Score

Average Spread

N/A

Trading Platforms

MetaTrader 5 (with IC Markets)

Minimum Deposit

$0 (with IC Markets)

Why We Recommend MetaTrader 5

We recommend MetaTrader 5 for anyone interested in experimenting with trading on central exchanges. The platform inherited many of the best features of MetaTrader 4, along with some important improvements like depth of market access and more powerful processing.

Pros & Cons

- Allows trading with stocks and centralised markets on the platform (unlike MT4)

- Advanced trading indicators

- Improved depth of markets gives real-time trading volume

- 64-bit processing improves power for backtesting

- Has a greater range of charts, indicators, timeframe and order types compared to MT4

- Comes with Depth of Market (DoM) and economic calendar

- Robust security with top encryption, authentication and authorization protocols

- Development and improvement are still being made by MetaQuotes

- MT4 custom indicators & EAs do not work with MT5

- Software is more resource-dependent compared to MT4. Therefore, traders on slower computers may not be able to use it.

- MQL4 (MT4) coders must re-learn how to code with MQL5

- Lacks a guaranteed stop-loss order

- Hedging is turned off by default (needs to be activated by broker)

- Fewer 3rd party tools (compared to MT4)

- Smaller expert advisors market-place

- Not built for Mac computers

- Webtrader is not built to HTML5

Platform Details

MT5 allows trading with all CFD Financial products

The MT5 platform is our recommended choice if you want a true multi-asset experience without sacrificing the familiarity of the MetaTrader 4 platform.

Being a newer and more powerful version of the MetaTrader 4 platform, MT5 can offer more technical indicators and processing capabilities. Plus, the ability to trade shares and certain cryptos, which MT5 cannot.

Key MT5 Highlights

- Depth of market – access to real volume data

- Built-in economic calendar

- Built-in strategy tester

- Centralised trading (i.e. shares trading)

- 6 Pending order types (vs 4 with MT4

- Improved charts and time frames (23 MT5 v 9 MT4)

- 21 timeframes (21 MT5 vs 9 MT4)

MetaTrader 5 Is An Upgrade On MetaTrader 4

MT5 adopts many features from the MT4 platform and improves on them. These features include depth of market (DoM) data, an upgraded programming MQL5 language for better EA development, and 64-bit processing for more powerful backtesting, and these are only some notable changes.

Unlike MT4, MT5 is built for trading products like shares and certain cryptocurrencies, which require a central exchange and decentralised products like Forex. For this reason, we think you will appreciate powerful analysis tools like 38 technical indicators, 44 analytical objects, 21 timeframes, 1 minute history and unlimited charts. Along with 6 pending order types, these changes represent a big increase in MT4 and, thus, better opportunities to identify trading opportunities.

MetaTrader 5 Pros and Cons

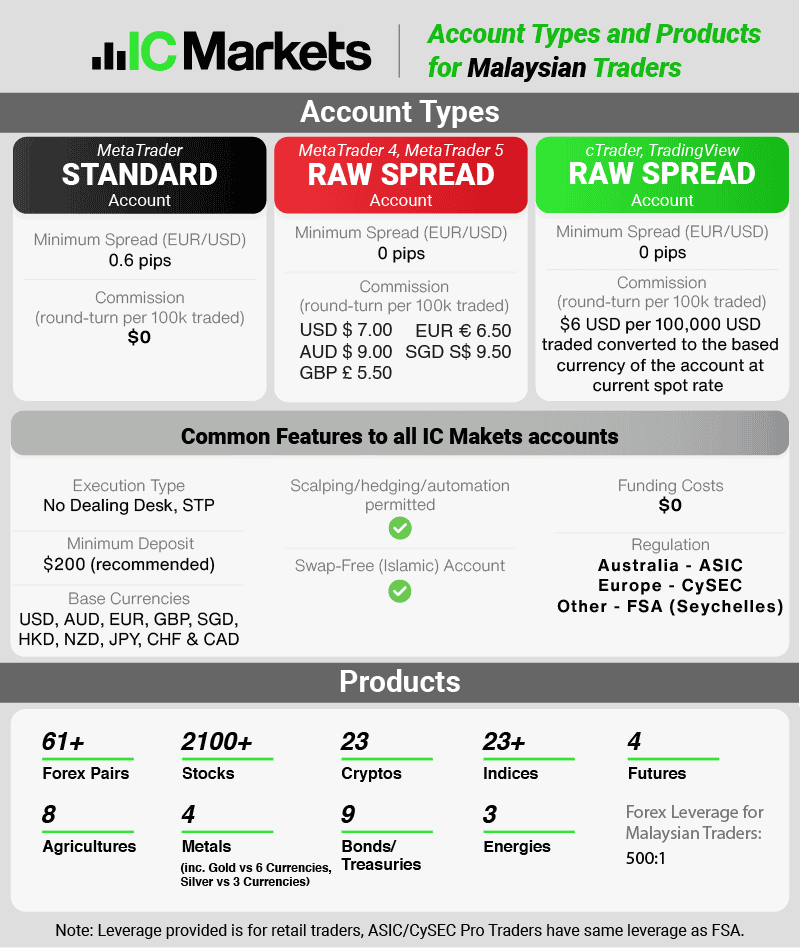

IC Markets has the Lowest MetaTrader 5 Spreads

Lowering your spreads is one way of increasing your profit margins. In our test to find the lowest spread brokers, our Chief Technology Researcher, Ross Collins, ranked IC Markets 1st place for the lowest Standard Account Spreads and Raw spreads.

Ross found that IC Markets had an average spread of 1.03 pips when we combined the average spread for the 6 currency pairs we tested (AUD/USD, EUR/USD, GBP/USD, USD/CAD, USD/CHF and USDJPY). All this equates to an average spread cost of $9.63 per lot, far outperforming its competitors. IC Market finished in the top 2 for each tested pair. For the most popular pair – the EUR/USD, the broker averaged 0.73 pips (1st overall).

| Broker | Average Spread | EURUSD | AUDUSD | USDCAD | USDJPY | GBPUSD | USDCHF |

|---|---|---|---|---|---|---|---|

| IC Markets | 1.03 | 0.73 | 0.82 | 1 | 1.09 | 1.15 | 1.4 |

| CMC Markets | 1.11 | 0.8 | 0.77 | 1.5 | 1.17 | 1.08 | 1.31 |

| Fusion Markets | 1.19 | 1.01 | 1.02 | 1.17 | 1.27 | 1.23 | 1.44 |

| TMGM | 1.21 | 1 | 1.03 | 1.31 | 1.26 | 1.21 | 1.43 |

| Admiral Markets | 1.31 | 0.74 | 1.1 | 1.83 | 1.32 | 1.11 | 1.75 |

| FXCM | 1.47 | 0.93 | 1.31 | 1.96 | 1.38 | 1.39 | 1.84 |

| Pepperstone | 1.46 | 1.21 | 1.24 | 1.6 | 1.55 | 1.5 | 1.67 |

IC Markets also finished top for best spreads for RAW commission based accounts in our Raw Account Spreads tests. The broker averages 0.32 pips for the same currency pairs and a tight 0.19 pips for EUR/USD.

| Broker | Average Spread | EURUSD | AUDUSD | USDCAD | USDJPY | GBPUSD | USDCHF |

|---|---|---|---|---|---|---|---|

| IC Markets | 0.32 | 0.19 | 0.23 | 0.45 | 0.24 | 0.27 | 0.57 |

| Pepperstone | 0.36 | 0.19 | 0.19 | 0.61 | 0.36 | 0.41 | 0.39 |

| FP Markets | 0.41 | 0.20 | 0.31 | 0.51 | 0.39 | 0.31 | 0.71 |

| EightCap | 0.50 | 0.20 | 0.48 | 0.64 | 0.47 | 0.44 | 0.76 |

| CMC Markets | 0.73 | 0.44 | 0.68 | 0.75 | 0.64 | 0.90 | 0.94 |

| Admiral Markets | 0.79 | 0.21 | 0.70 | 1.46 | 0.58 | 0.73 | 1.08 |

| BlackBull Markets | 0.94 | 0.46 | 0.85 | 1.01 | 0.43 | 0.96 | 1.31 |

IC Markets Trading Accounts

IC markets provide two accounts that can be used with the MetaTrader 5 platform. These are the Standard Account and the RAW Spread Account.

Like with Pepperstone, the Standard account is suitable for beginner traders since it has no commission. Spreads start from 0.6 pips.

The RAW spread account spreads start from 0.0 pips for major pairs, with the commission being USD $6.00 per lot. Our advanced traders preferred this account.

CompareForexBroker’s Verdict on IC Markets for MetaTrader 5:

IC Markets is our recommended broker for MetaTrader 5 because of its wide range of trading products, backed with tight spreads.

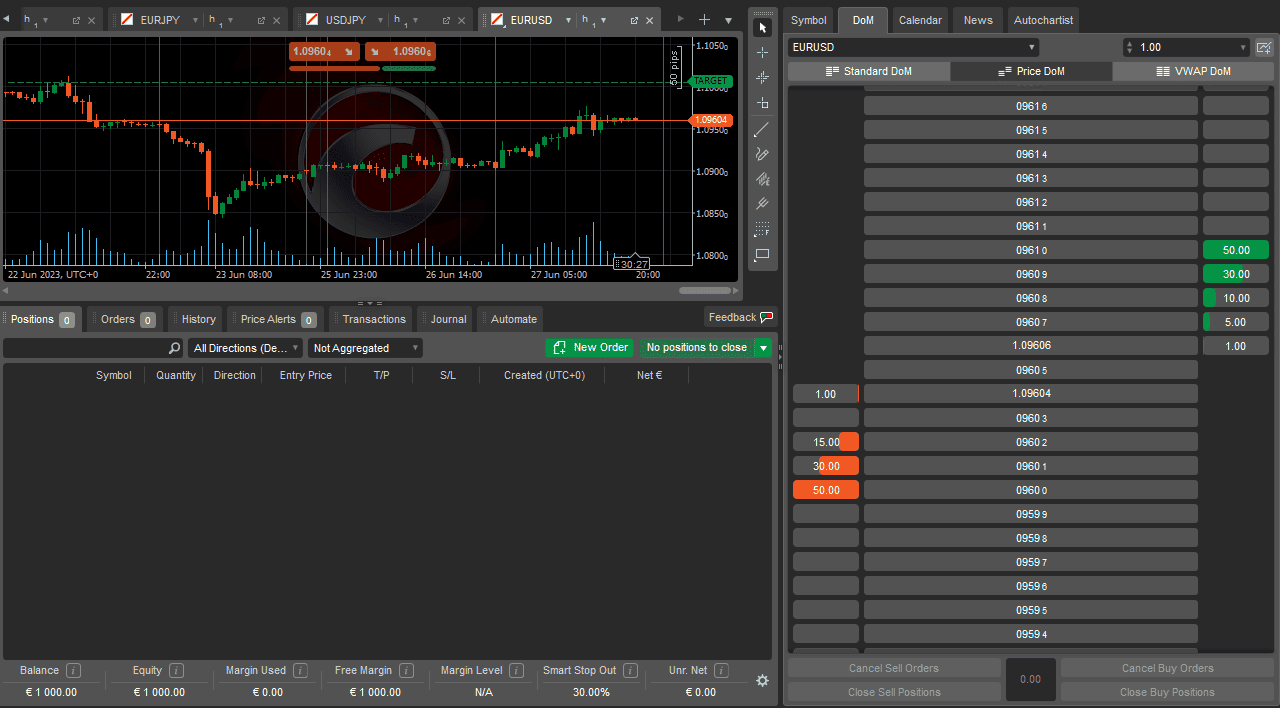

4. cTrader - CTRADER OFFERS DEPTH OF MARKET (DOM)

Forex Panel Score

Average Spread

N/A

Trading Platforms

cTrader (with FP Markets)

Minimum Deposit

$50

Why We Recommend cTrader

We recommend cTrader for its winning combination of depth of market access and a friendly, easy-to-navigate design that makes strategy development and deployment straightforward.

Pros & Cons

- Excellent depth of market pricing (DoM) and level II pricing

- Excellent charting capabilities including detachable charts

- Over 70 pre-installed technical indicators

- Automated trading (cAlgo) and copy trading (cCopy)

- Notably fast entry and execution of trades (popular with scalpers)

- Cloud-based service – sync your account across all devices

- Mobile trading with iOS and Android

- You need to know how to program with c# to create cBots (for algo trading)

- It can only run with ECN/STP execution, so not available to all brokers (i.e. market makers)

- A smaller community of traders and brokers compared with MT4 and TradingView

- No Mac version for desktops

- Lack of guaranteed stop-loss orders

- Not all brokers include cCopy for copy trading

- Some niche financial products are not available for trading with cTrader

Platform Details

cTrader is our choice for Scalpers or traders who analyse order blocks through the Depth of Market tool. The platform provides an easy-to-access tool showing the depth of markets and a built-in ladder, ready for you to submit your orders at the price levels you want.

Key Highlights

- Intuitive and user-friendly interface

- Fast execution speeds through the platform

- Advanced Depth of Market tools

- Automated trading with cBots (cTrader’s version of EAs)

- Copy trading features

- Cloud-based account so it can sync your platform settings across every device

cTrader is a multi-asset trading platform that works with ECN/STP brokers to maximise execution speeds. Its integration with ECN brokers allows it to connect to multiple liquidity providers and display the depth of markets directly in cTrader.

In many respects, cTrader is a polished version of the MetaTrader platforms with its ability to:

- Process automated trading;

- Customised charts;

- Simplified interface, and

- The ability to copy trade.

We think the depth of the market tool is a useful feature as it means you know what the true market price should be.

In particular, the price ladder is much more intuitive than what the MetaTrader 5 platform offers. We like that the price ladder gives the last four pips as digits instead of displaying the total price. Because, as a scalper, these are the figures you care about, and you can tell that cTrader understood this when designing the platform.

As you can see in the image above, you can see the markets’ prices with current orders. This information can be invaluable for trading, depending on your trading strategies. You will benefit from the depth of market access if you are the following:

- Swing traders;

- Scalpers,

- Stock traders.

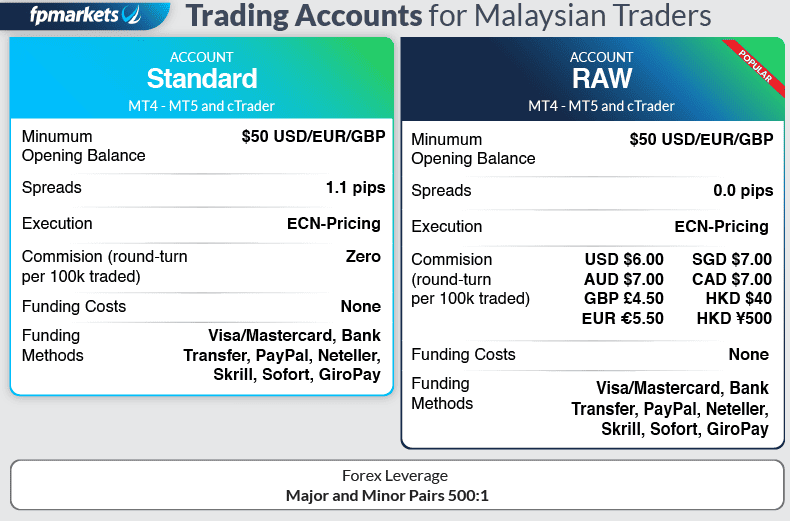

FP Markets Just Started Offering cTrader

To take advantage of what cTrader offers, we recommend FP Markets, which provides the following:

- Tight spreads from 0.0 pips;

- Trade a wide range of products from forex to stock CFDs;

- Fast execution speeds for the cTrader platform; and

- AutoChartist feature that enhances the cTrader experience

- Automation with cTrader Automate

- Copy Trading with cTrader Copy

Interestingly, FP Markets allows you to choose between a standard and RAW account with cTrader. Many brokers only have a commission-based account with cTrader. Commissions are USD $6.00 per lot with the RAW account.

CompareForexBroker’s Verdict on FP Markets for cTrader:

We recommend FP Markets because you can use both Standard and RAW accounts with cTrader. You can also get free tools like AutoChartist, which provides trading ideas within cTrader.

5. eToro - TOP SOCIAL AND COPY TRADING PLATFORM

Forex Panel Score

Average Spread

N/A

Trading Platforms

eToro

Minimum Deposit

$50 (eToro)

Why We Recommend eToro

We recommend eToro for its unique collection of social and copy trading tools that you won’t find anywhere else. Don’t let the friendly, ‘gamified’ approach to trading, eToro’s Copy Portfolios and CopyTrade tool have a lot going on under the hood.

Pros & Cons

- The platform is designed for social and copy-trading from the ground up

- Social trading tools (like portfolio baskets) that no other broker offers

- Good for beginners as copy trading and market portfolios remove the need for technical analysis

- Large selection of trading markets (especially crypto)

- Has a community of 20+ million users to share ideas with

- Sharia-compliant swap-free account

- The interface is easy to use

- eToro comes with a learning centre

- The standard account is the only account type on offer

- eToro trading platform is the only available platform

- Can get exposed by copying the wrong trader

- Small withdrawal fee from the broker

- The minimum deposit is high for swap free account

- Currency conversion fees may apply

- Trading fees (spreads) may be high compared to other brokers

Platform Details

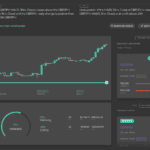

eToro Allows Collaboration with Expert Traders

Our top platform for social and copy traders is eToro. While most brokers allow integration with 3rd party software for social trading, eToro is one of the few platforms with traditional and social trading. Social trading is useful if you are new to trading since you can leverage the expertise of other traders while learning how to trade.

Key Highlights

- CopyTrade to find and copy other verified traders in the eToro community

- Investments Portfolios – trading baskets of the most successful traders or trading themes

- No commission trading;

- Suitable for beginners.

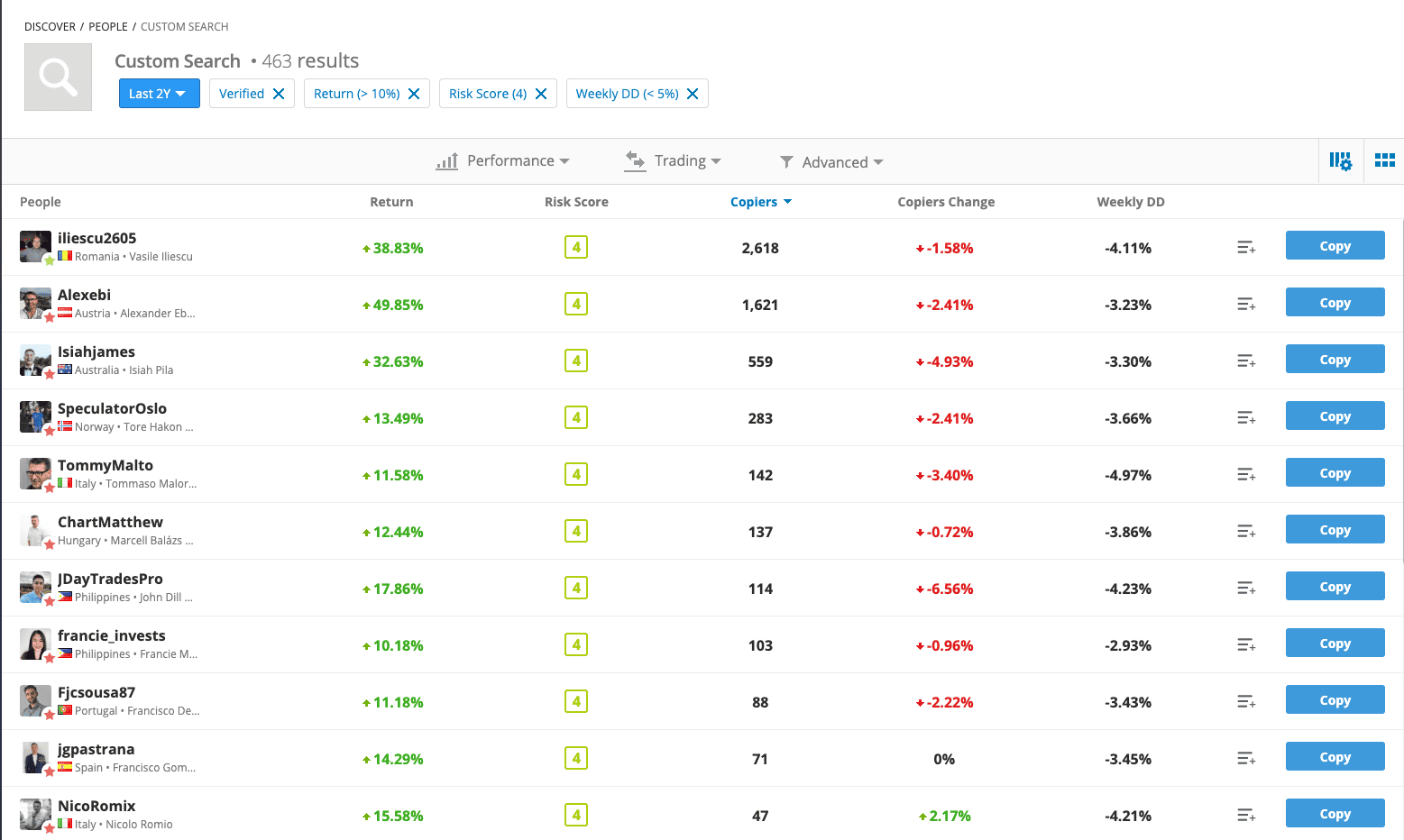

While eToro has a host unique features that make them stand out, we liked the CopyTrader feature of eToro (after all, that is what they are best known for). eToro has made the entire trader database searchable through filters.

So you can find traders that meet your criteria. E.g.:

- Traders with a risk score of 4;

- With a profit of 10% in the last 12 months;

- Verified, and

- A weekly Draw Down of a maximum of 5%

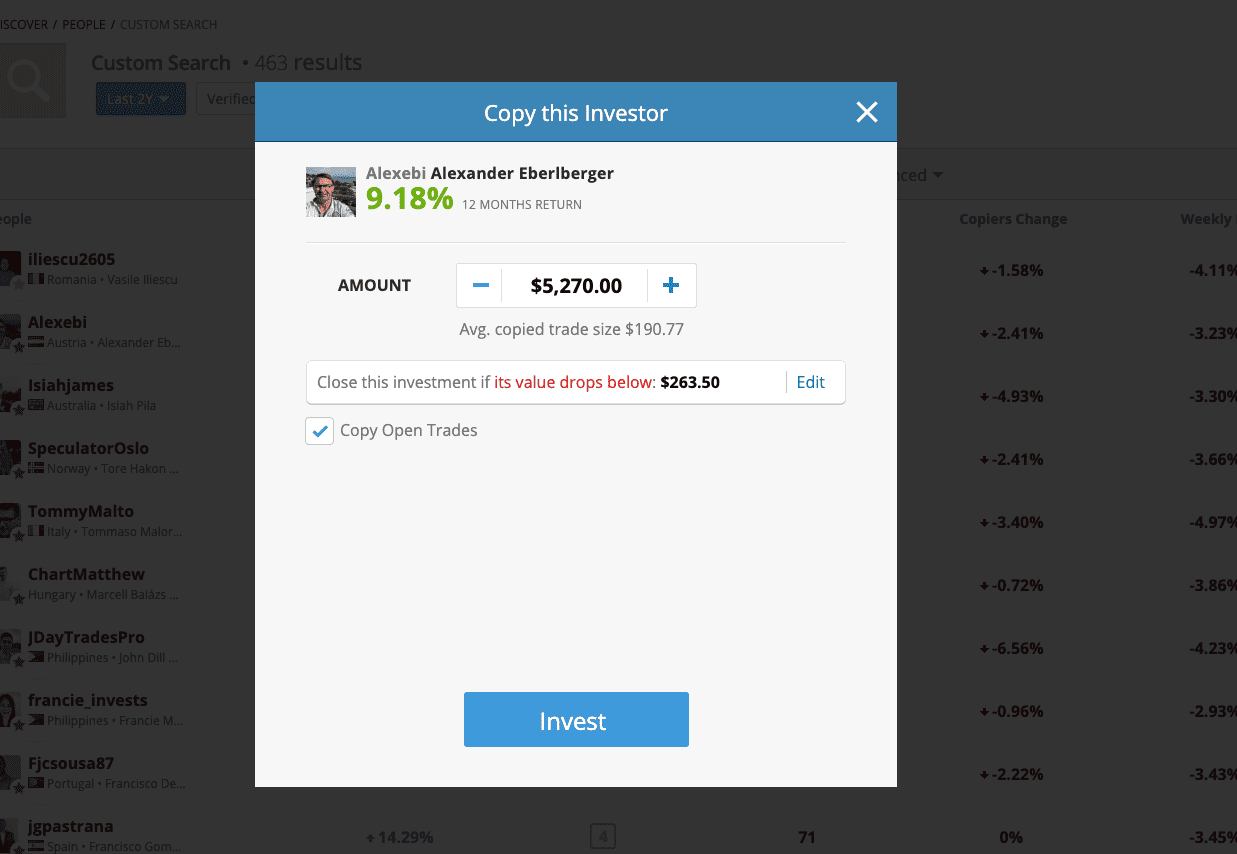

As you can see, based on these criteria, it narrowed 145,900 traders down to 463. Now, all we had to do was click Copy to Invest and then follow our selected trader’s trades automatically.

Not only could we search for a trader we wanted to copy with a click of a button, but it also told us in plain English how much we were investing and how much our investment value had to drop before it closed.

eToro Account Type

Unlike other brokers, eToro is both the platform and broker. They offer an extensive range of assets and attract traders who want to use the CopyTrade features.

eToro only has one Standard Account, which is spread-based fees only and grants access to all its features.

There is no commission even when trading stocks, which is a bonus. The spreads start from 1 pip but are not the lowest compared to the other brokers on this list.

CompareForexBroker’s Verdict on eToro:

eToro is ideal if you prefer to leverage expert traders’ experience. You can access and review the performance of a wide range of experts on the platform, providing transparency to choose the right traders to follow.

6. Capitalise.ai - GREAT SOFTWARE FOR AUTOMATION

Forex Panel Score

Average Spread

N/A

Trading Platforms

Capitalise.ai (with Eightcap)

Minimum Deposit

$100 (with Eightcap)

Why We Recommend Capitalise-ai

We recommend Capitalise-ai for its accessible approach to automated trading that allows anyone to build a custom bot. This no-code solution democratises algorithmic trading and provides a host of educational materials.

Pros & Cons

- Clean and simple user interface

- Allows you to create algorithms to automate your trading without knowing any code

- Helps you analyse markets with backtesting and simulated trading strategies

- Smart notifications provide real-time notifications 24/7

- Step-by-step instructions on how to create a strategy

- Integrates directly with MT4 to trade from your strategy

- With MT4 to trade from your strategy automatically

- Limited indicators on the platform

- Basic exit strategies, no trailing stops

- Backtesting can be misleading because it doesn’t include trading costs such as spreads or commissions

- Some brokers only offer Capitalise.ai with an MT4 account

- Only a few brokers offer this platform

- Better platforms for manual trading

Platform Details

Capitalise.ai helps you create algos with no code

Automating your trading has several advantages but can be intimidating as many tools require some knowledge of coding. Capitalise.ai solves this by allowing you to create algo even if you don’t have computer programming skills.

Key Features

- User-friendly platform

- Can use templates to inspire trading strategies

- Easy-to-follow tutorials to create strategies

- Automate strategies through technical indicators, time of day, or macro news flow

- Capitalise.ai can automate TradingView strategies through its software.

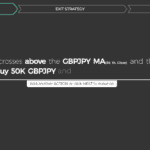

Capitalise.ai allowed us to create automation instructions using plain English. We think this tool is fascinating because programming tools on MT4 and TradingView using MQ4 and Pine scripts can take a while to learn.

With Capitalise.ai, we simply typed our idea into the chat box, and it worked with us step by step to output a trading strategy. Then, we can backtest it to see how it performs.

We set up an account to test Capitalise.ai using Eightcap’s trading account. You simply enter your Eightcap MT4 details, and you get instant access.

When we tested the program, we were impressed by how simple it was to create a strategy. All we needed to do was tell the AI what we wanted it to do, and we had our script up and running in less than 10 minutes.

Then, testing the new strategy was just as easy. You can also test the strategy using past data before making it live.

We liked the concept of Capatilise.ai, and it’s an excellent platform for novice traders who want to automate their strategy but do not know how to code.

Eightcap has a Huge Range of Cryptos for Trading

We recommend Eightcap as the best broker for Capitalise.ai, thanks to its extensive range of cryptocurrencies and Forex pairs. Just know that you will need an MT4 account to use Capitalise.ai.

Eightcap Trading Account Types

You can choose from two account types on Eightcap. These are a Standard Account and a RAW account.

CompareForexBroker’s Verdict on EightCap for Capitalise.ai:

Eightcap is a low-spread broker that offers an extensive range of trading products with the broadest range of tradeable crypto assets and Forex pairs available. Through Capitalise.ai, they simplify strategy generation and testing, allowing anyone to create an automated trading strategy.

Ask an Expert

I want to open an account with you to trade with your automated trading facility.

We don’t personally offer an automated trading facility, however, feel free to sign up with any of the recommended brokers on this page. A new broker to consider is eightcap. They have Capitalise.ai which is a very good platform to automate your trading.

Sorry, we don’t have an automated trading facility. We compare forex brokers, we do not provide trading services ourselves.