Best Forex Demo Account

This page looks at the best Forex brokers with demo accounts for traders in Malaysia. When choosing a broker, you need to consider features such as trading accounts, spreads, trading platforms, and products. See our forex broker comparison for Malaysia.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The accounts to trade with virtual currency in Malaysia are the following:

- Eightcap - Best Forex Demo Account Overall

- Pepperstone - Best No Commission Demo Trading

- IC Markets - Best Forex Broker MT4 Demo Account

- FP Markets - Low Spread Demo Trading Broker

- AvaTrade - Great Fixed Spread Demo Trading Account

- eToro - Best Social Demo Trading Platform

- IG Group - Most Popular Forex Demo Broker

- FOREX.com - Best Demo Educational Resources

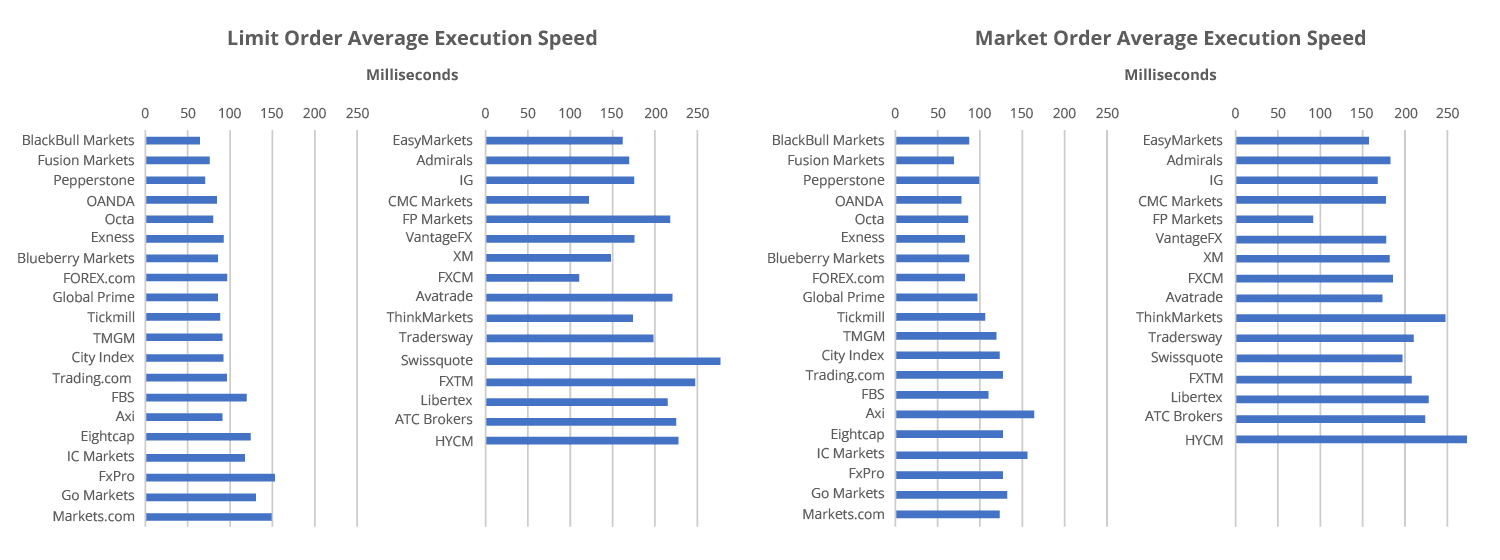

- FXCM - Top Demo Trading Execution Speed

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

84 |

FCA, CIRO, NFA/CFTC CySEC, JFSA, CIMA |

0.17 | 0.29 | 0.3 | $6.00 | 1.5 | 1.8 | 1.5 |

|

|

|

30 ms (May 2023) | $100 | 91 | 8 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

77 |

ASIC, FCA, CySEC CIRO, BaFin, FSCA |

0.30 | 0.90 | 0.40 | $4.00 | 1.3 | 1.8 | 0.7 |

|

|

|

150ms | $50 | 42 | 7 | 30:1 | 500:1 |

|

What are the Best Forex Demo Accounts for Traders in Malaysia?

We created the Best Forex Brokers In Malaysia review based on live accounts but understand that demo accounts can be different. We refined this list based on accounts that offered a free environment to find the best forex trading platform in this category.

1. Eightcap - Best Forex Demo Account Overall

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.0

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We liked Eightcap’s extensive variety of trading products and their tight spreads. Their range of financing options, from bank transfers to e-payment solutions, is noteworthy. If trading cryptocurrency is your game, then Eightcap is right up your alley. Their 24/5 multilingual customer support makes the trading experience all the more seamless for traders in Malaysia.

Pros & Cons

- Spreads as low as 0 pips

- Great range of funding methods

- Offers both MetaTrader platforms

- Limited commodities and indices

- Real stocks not available

- Research tools limited

Broker Details

Eightcap has a range of features that make it our best broker overall

We’ve found that Eightcap offers diverse trading products, boasting tight spreads and a comprehensive range of funding methods – from bank transfers to various e-payment options. Furthermore, their higher leverage of up to 500:1 presented many trading advantages. Those of us passionate about trading cryptocurrencies genuinely considered Eightcap the top choice.

These trading advantages are further enhanced by the excellent trading tools they provide for the MT4 and MT5 trading platforms, which we’ll explain below.

In terms of customer service, we appreciated Eightcap’s approach. They offer multilingual customer support and are available 24/5 to assist.

Trading Accounts

There are two account types, Standard and Raw. We observed tighter spreads with the Raw Account due to the $7 commission (round turn). On the other hand, while the Standard account charges no commission, it has slightly wider spreads on average.

The initial deposit requirement sits at $100 in your base currency. We commend that flexibility and the various deposit and withdrawal methods, including e-payment.

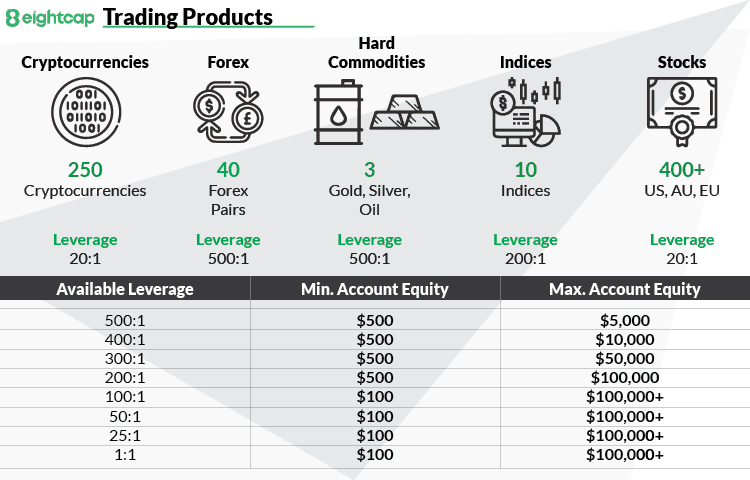

Trading Products

Though Eightcap offers slightly fewer Forex pairs (40 in total) compared to some other brokers we’ve tried, they impressively provide a more extensive range of cryptocurrencies (250) and stocks (over 400). Additionally, Eightcap offers higher leverage for Forex and hard commodities markets at 500:1.

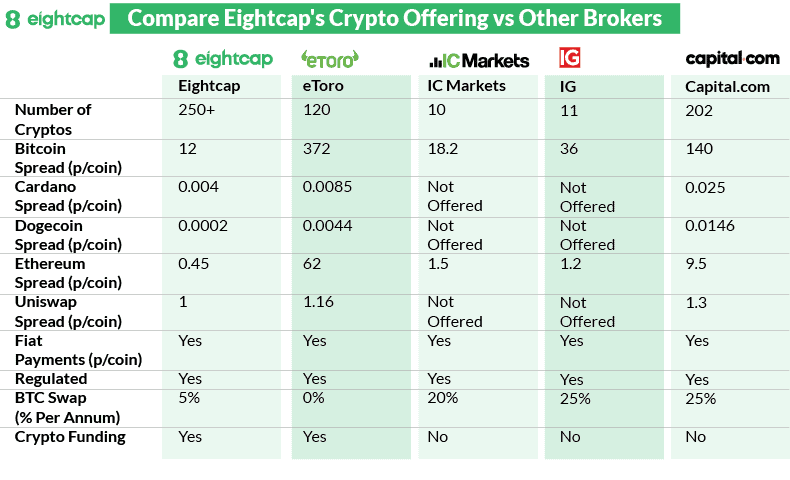

Cryptocurrencies are where Eightcap truly stands out for us. They have over 250 derivatives, including popular options like Bitcoin, Ethereum, and Dogecoin CFDs. Notably, they provide more than 120 cryptos matched to the USD, and there’s also the option to trade 20 cryptos against other fiat currencies such as AUD, EUR, GBP, CAD, and even MXN (Mexican Peso) and BTC.

Given this extensive range, we believe Eightcap presents the most comprehensive range amongst CFD brokers in the market. And it’s not just about the quantity; they also compare favourably against other CFD brokers in terms of spread costs.

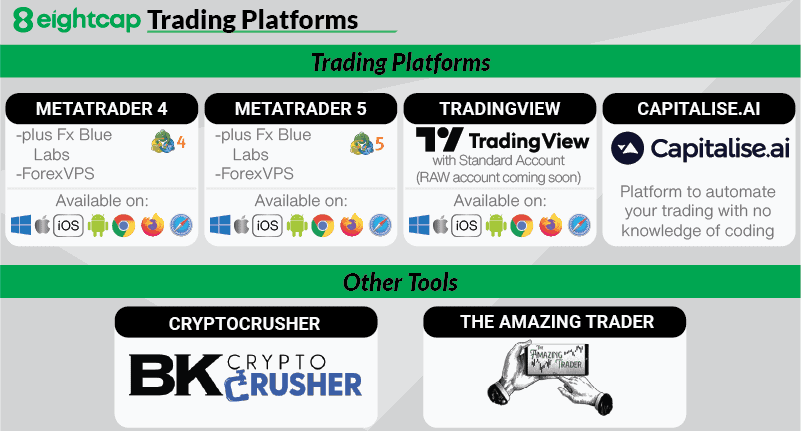

Trading Platforms

Both MT4 and MT5 are accessible on desktop and mobile, though only with MT5 were we able to use WebTrader via Eightcap. While MT4 is undoubtedly a solid platform, for those of us seeking a richer toolkit for fundamental and technical analysis, plus keen on trading shares and cryptocurrencies, we’d recommend using MT5.

Through our experience, this platform grants access to a more comprehensive range of crypto products in contrast to MT4, which, while still impressive, isn’t as complete.

A distinct feature we explored with Eightcap is Capitalise.ai, enabling us to automate our trading without requiring any programming know-how. However, it’s worth noting that this tool requires MT4.

Verdict On Eightcap’s Demo Platform

From our experience, we truly appreciated the diverse range of trading platforms, the simplicity of account set-up, and the competitive spreads offered by Eightcap, so we named it the best in the category.

2. Pepperstone - Best No Commission Demo Trading

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked that Pepperstone provides a choice of trading platforms catering to traders across the board. While MetaTrader 4 is a favourite for many, MetaTrader 5 offers greater flexibility for those with more trading experience. On the other hand, for traders seeking a distinct edge, there’s cTrader. This platform is especially ideal for forex trading, offering depth of market (DoM) and enhanced charting features, making it a top pick for traders in Malaysia looking for a no-commission demo account.

Pros & Cons

- Has low spreads with no commissions

- Fast execution speeds

- Solid range of trading platforms

- Lacks guaranteed stop-loss orders

- Limited demo account access

- DMA access is limited to cTrader and MT5

Broker Details

Pepperstone Offers No Commission Accounts With The Best Spreads

While many Market Maker brokers often boast the best spreads for no commission accounts, Pepperstone, which isn’t a market maker, has dropped their spread for standard accounts. Notably, with a minimum spread of 1.0 pips for EUR/USD, we found their spreads to either match or even outperform those of market makers.

Pepperstone combines multiple factors well, ranging from competitive spreads, strong trading tools, and around-the-clock customer support (including weekends).

With the option to trade into 92 foreign exchange markets, our trading experience with Pepperstone was amplified by some of the tightest spreads across currency pairs. It can be attributed to their strategy of sourcing pricing from multiple Tier 1 banks. Engaging with Tier 1 banks ensures superior liquidity and negates the need for a dealing desk. Furthermore, by strategically placing their servers in the same data centres as these liquidity providers, Pepperstone achieves impressive speeds, often less than 30ms, minimising our chances of slippage.

To optimise your strategy once you start trading, Pepperstone offers a rich set of trading tools, particularly Smart Trader, which has 28 trading apps with a range of expert advisers and indicators.

For Malaysian investors, Pepperstone is licenced and regulated by the Securities Commission of the Bahamas (SCB). Having an offshore regulator means the ability to trade with higher leverage (up to 500:1 for professionals and 200:1 for retail investors).

As well as 24-hour customer support on weekdays, Pepperstone is unique in offering 18-hour support on weekends.

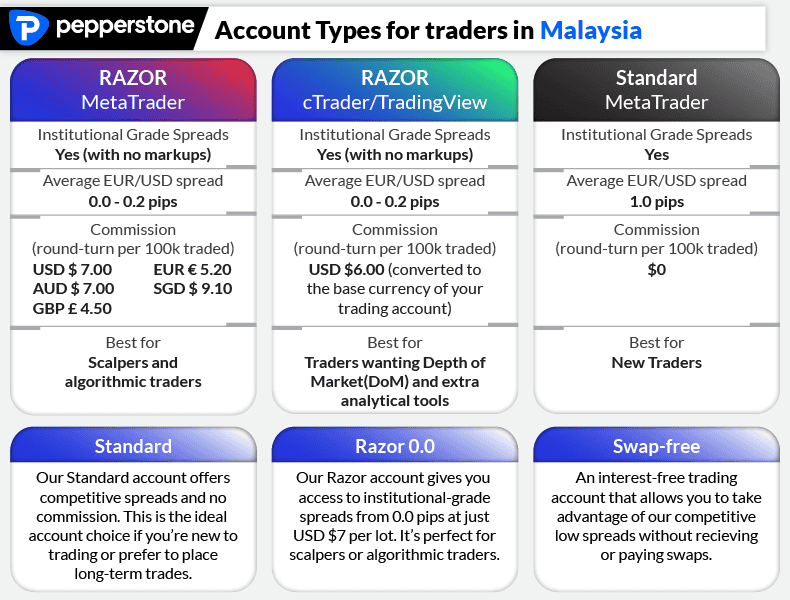

Trading Accounts

Much like our experience with Eightcap, with Pepperstone, we encountered two primary account options: Standard and Razor. The Standard account is tailored for novices, while the Razor is designed for those with more advanced traders. We observed slightly wider spreads with the Standard, averaging around 0.6 pips, but there’s no commission. On the other hand, the Razor account is optimised to offer the lowest possible costs, making it a solid fit for seasoned traders, including scalpers and those who prefer algorithmic trading.

There is no minimum deposit to open an account. However, 200 USD is suggested (or roughly 600 Malaysian Ringgit). You also have the option of a free demo account. And for Malaysian traders, given the Islamic nature of the country, there’s the advantageous inclusion of a swap-free account. It’s interest-free, though bear in mind there are administration fees if a trade lingers beyond ten days.

Standard Account Spreads

When comparing with other brokers, we distinguished that Pepperstone’s spreads for Standard accounts are amongst the most competitive in the Forex landscape. The following segment provides the average spreads brokers regularly update on their platforms monthly.

What stood out to us was that the no-commission account spreads from Pepperstone either mirror or, in several instances, surpass their counterparts across all currency pairs.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

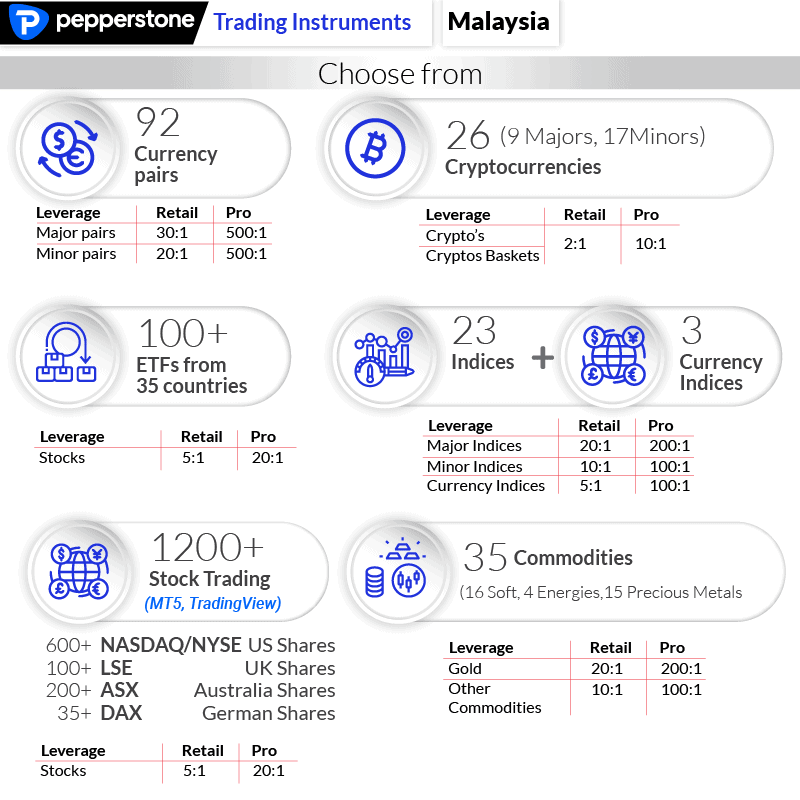

Trading Products

In our journey with Pepperstone, we noted it as a committed CFD broker, extending trading CFDs across a diverse range of indices, commodities, ETFs, individual shares, and the cryptocurrency markets.

For those of us who place a premium on maintaining a varied portfolio, Pepperstone unfurls many options, allowing us to distribute our risks across multiple financial instruments.

Trading Platforms

Pepperstone offers three trading platforms for all levels of traders.

MetaTrader 4 is the most popular trading platform, while MetaTrader 5 is for more experienced traders, with advanced and flexible customising options.

Venturing beyond the MetaTrader universe, Pepperstone introduces cTrader to the mix. If forex trading is your forte and you are inclined toward depth of market (DoM) and enriched charting capabilities, cTrader emerges as a compelling choice. Its speedier interface makes it especially appealing for many of us in the trading community.

Further enriching the trading experience, Pepperstone equips your MT4 platform with handy social trading tools such as MetaTrader Signals, Myfxbook, and DupliTrade. These tools grant us insights into trading signals and strategies wielded by fellow traders.

3. IC Markets - Best Forex Broker MT4 Demo Account

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We liked IC Markets as they provide advanced trading tools specifically designed for MT4 and an additional 20 exclusive tools to elevate the trading journey. The integration of ZuluTrade and Myfxbook Autotrade offers traders the added advantage of social and copy trading seamlessly within the MT4 environment. This combination ensures that traders get an enhanced and comprehensive MT4 trading experience.

Pros & Cons

- Low trading spreads

- Offers a range of copy trading tools

- No fees on deposits or withdrawals

- High minimum deposit required

- Limited range of trading instruments

- Market analysis resources are limited

Broker Details

IC Markets’ MT4 Comes With Advanced Tools To Enhance Trading

IC Markets has the distinction of being the largest Forex broker in trading volume, which simply means it is a trusted broker globally. One aspect where we felt IC Markets truly shone was its vast array of trading products, boasting 64 currency pairs, 22 commodities, 11 bonds, 18 cryptos, 4 global futures, and over 1600 stocks to choose from.

A standout feature we noticed was their unique Raw Spread account. Drawing from top-tier liquidity providers, this account promises optimal trading conditions, including low latency, thanks partly to its NY server location.

We chose IC Markets as the best MT4 broker since it comes with advanced MT4 trading tools available, which consist of 20 extra exclusive trading tools to supercharge your trading experience. Plus, integrations with ZuluTrade and Myfxbook Autotrade are seamlessly incorporated with MT4 for those intrigued by social trading and copy trading.

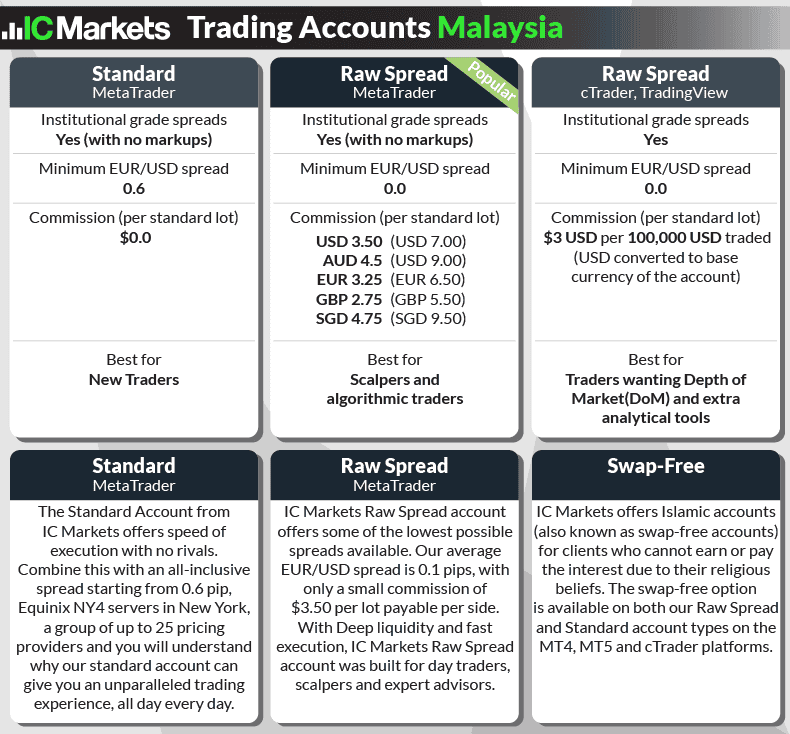

Trading Accounts

Upon our review, we identified two primary account options: Standard and Raw. The former is tailored for discretionary traders, while the latter caters to day traders and scalpers. IC Markets advises an initial deposit of $200 to start, although one can kick off with a smaller amount. However, meeting the margin prerequisites before opening a position is essential. The 50% stop-out level is a beneficial feature that safeguards against potential losses.

In terms of commission, it’s attractively priced ($0 for Standard and $7 round turn for Raw).

Trading Products

As we’ve mentioned, IC Markets has one of the more diverse ranges of trading products compared to other brokers. This includes higher leverage on average for commodities (500:1), bonds (200:1), and indices (200:1), meaning more buying power in the market.

One important point to highlight: you can only use the MT5 trading platform for ASX, NASDAQ, and NYSE stocks.

Trading Platforms

The four main options are MetaTrader 4, 5, cTrader and TradingView. All trading accounts are safe choices, but MetaTrader 4 and 5 are among the most popular platforms. Having access to advanced MT4 trading tools gives IC Markets a competitive advantage. These tools include economic calendars, alert managers, sentiment tools, and custom trading terminals to further enhance your trading experience.

Those looking for account mirroring (the ability to copy trades) can use MyFxBook AutoTrade, and ZuluTrader is available for social trading.

4. FP Markets - Low Spread Demo Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We were impressed with FP Markets for its top-tier liquidity providers, ensuring consistently tight spreads in forex, starting at a remarkable 0 pip. Furthermore, their demo account is enriched with educational materials covering Forex market essentials like charting tools and volatility for those keen on honing their strategies before diving into live trading. It’s a solid choice for traders in Malaysia seeking a low-spread demo trading broker.

Pros & Cons

- Tight spreads

- ECN-style broker

- Excellent trading platforms available

- Limited selection of forex pairs

- Not all shares available on MT5

- Time-limited demo accounts

Broker Details

FP Markets Offers Tight Forex Spreads And Low Minimum Deposit

In our experience with FP Markets, three standout attributes captured our attention: consistently low spreads, comprehensive risk management tools, and commendable customer support. We found that the broker consistently offers tight spreads in Forex, starting from as low as 0 pips, backed by impressive liquidity sourced from top-tier providers. For those of us who prefer honing our strategies before taking the plunge into live trading, FP Markets extends a demo account enriched with educational resources, shedding light on the intricacies of the Forex market, spanning charting tools to volatility nuances.

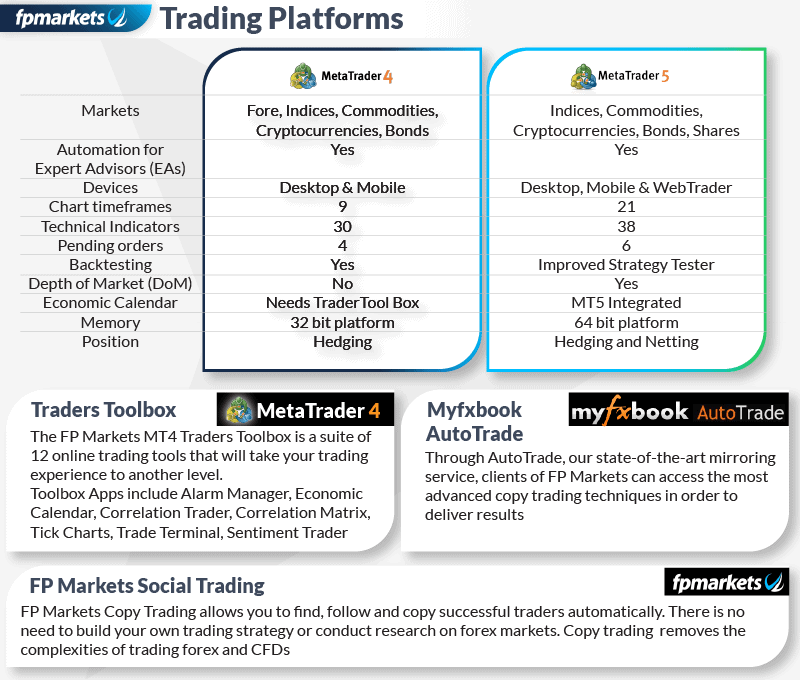

One tool we especially appreciated was their Traders Toolbox, which is compatible with both MT4, MT5, cTrader and TradingView platforms. This is a godsend for day traders, packing 12 online trading tools, all complemented by real-time market analyses. With multilingual customer support, FP Markets caters to Malay speakers if English is your second language.

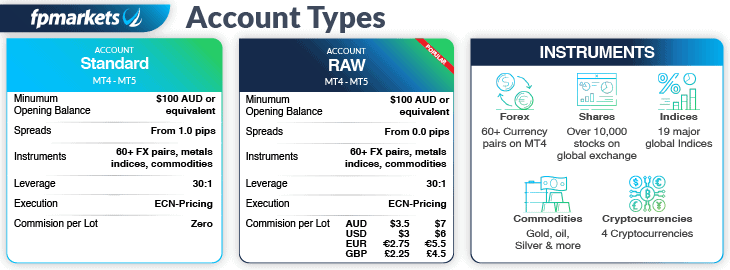

Trading Accounts

Similar to IC Markets, FP Markets offers Standard and Raw trading account options with only a $100 AUD minimum deposit required to open. Being ECN-style accounts, there is no dealing desk, and the spreads are comparable to the prices institutions get themselves.

‘ECN’ Like Spreads With FP Markets

When compared to other ECN-style accounts, FP’s spreads stack up well, as highlighted by the broker comparison below. These spreads are the average spreads brokers publish on their websites.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

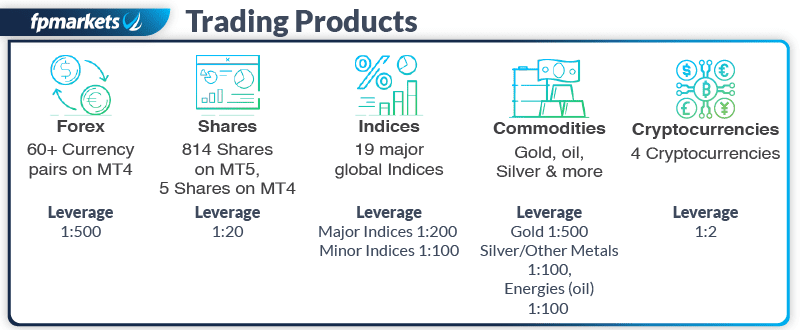

Trading Products

For Forex, FP Markets offers over 60 currency pairs, the same as IC and Pepperstone. The indices, commodities, shares, and crypto markets are available but light. One downside of FP Markets is the limited variety of cryptocurrency products compared to other brokers.

For those wishing to trade share CFDs, however, FP Markets gives access to over 10,000 markets. This is due to having DMA (direct market access) pricing using the powerful Iress trading platform.

Trading Platforms

FP Markets only offers the MetaTrader trading platforms MT4, MT5, cTrader and TradingView. However, it includes Traders Toolbox, which is 12 extra trading tools like newsfeeds with trader toolbox connect, correlation trader to find correlations between trading symbols, and an alarm manager ensuring you’re promptly notified of trading updates.

If you want advanced charting, AutoChartist is available with MT4 and Myfxbook auto-trade, as well as some of the best social trading platforms.

5. AvaTrade - Great Fixed Spread Demo Trading Account

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We liked AvaTrade’s fixed spreads and strong reputation, evident with numerous 5-star Trust Pilot reviews vouching for their exceptional customer service. AvaTrade offers their own mobile trading software with the latest market news and trends. Furthermore, their unique risk management tool provides protection against losses on individual trades up to $1 million for a hedging cost.

Pros & Cons

- Top broker for fixed spreads

- Provides free analysis research tools

- Offers social trading tools

- No RAW spread pricing options

- High inactivity fees

- Spreads are slightly higher than average

Broker Details

AvaTrade Was Awarded 2024’s Best Fixed Spread Broker

AvaTrade is an award-winning fixed spread broker specialist, winning both the best fixed and lowest spread broker for 2024. Several 5-star Trust Pilot ratings suggest that AvaTrade has a good reputation for customer support.

AvaTrade also offers an in-house mobile trading app called AVATradeGo which gives access to up-to-date market news and movements. For a hedging cost fee, AvaProtect is a risk management tool designed to protect you from losses from a specific trade of up to a million dollars.

Trading Accounts

Given AvaTrade’s dedication to being a fixed spread broker, the account options understandably lean towards the concise side. Retail investors can easily open a retail account, while professional trading accounts are also on the table. However, these come with stringent criteria, such as boasting a portfolio north of 500,000 Euros. Mirroring our experience with FP Markets, the entry barrier is set low, with a mere $100 required as a minimum deposit across all currencies for both account categories.

You can also open an Islamic account, as AvaTrade is Sharia-compliant according to Muslim religious guidelines. AvaTrade is also notable for its range of E-Payment deposit options, including Neteller and Skrill.

AvaTrade Spreads

Stacking AvaTrade against its contemporaries, we couldn’t help but be impressed. Their fixed spreads are arguably the market’s best, often outperforming some standard account spreads, a view echoed in our Pepperstone section.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

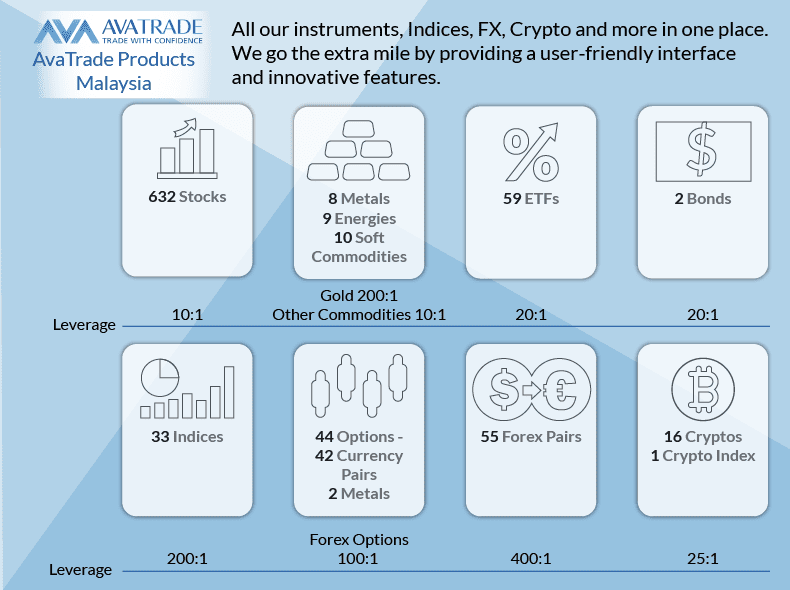

Trading Products

AvaTrade has a good range of trading products that cover all bases. What genuinely caught our eye was the opportunity to trade across 59 ETFs (exchange-traded funds).

While competitive across Forex currency pairs, it’s important to note that even though AvaTrade have fixed spreads, they can vary depending on market conditions.

Accessing these trading instruments is a breeze across all AvaTrade platforms.

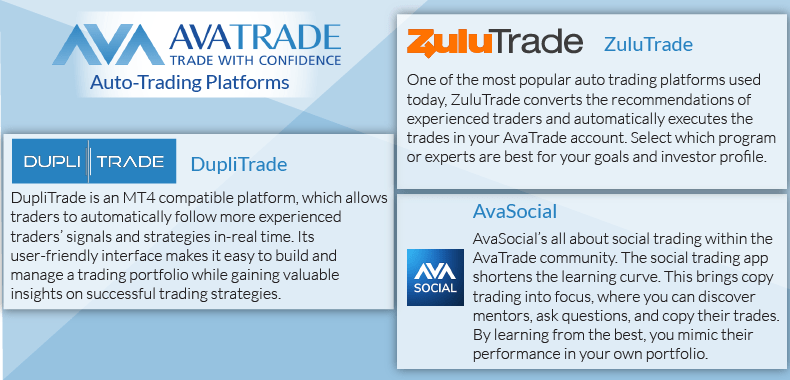

Trading Platforms

What sets AvaTrade apart is the number of trading platforms to suit your trading personality and skill set.

As well as offering the standard MT4 and MT5 trading platforms, AvaTrade has a WebTrading option that requires no download and is quick to set up. Their AVATradeGo app is intuitive, ensuring a personalised trading journey with advanced features.

Lastly, AvaTrade has automation covered, with three auto-trading platforms to choose from, including its own social trading platform, AvaSocial.

Overall, the fixed spread option, risk management features, and trading platform make AvaTrade the most suited to either beginner or risk-averse traders looking for advanced features.

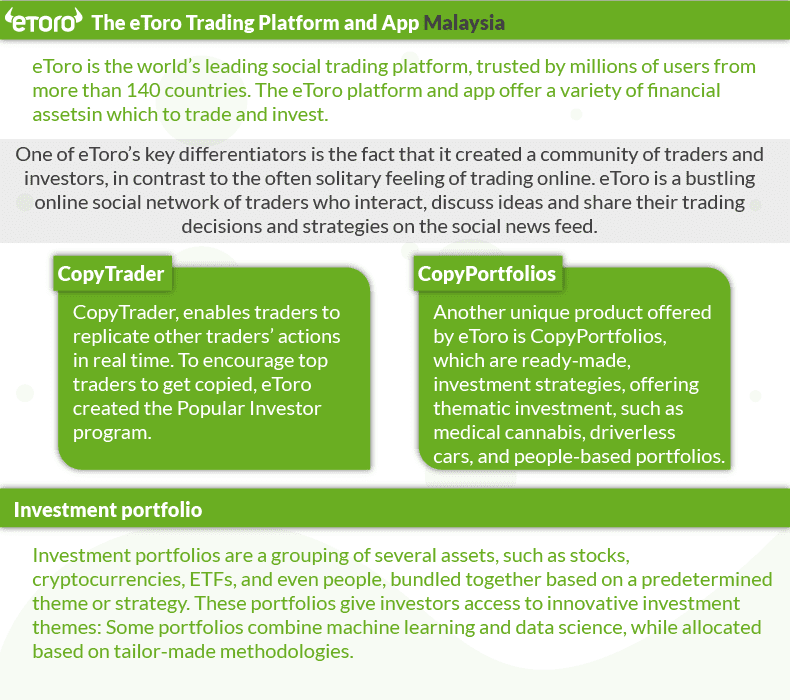

6. eToro - Best Social Demo Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

We liked eToro as their platform allows you to mirror top traders with the CopyTrader feature and encourages connecting with fellow traders. With 2631 stocks on offer, all at 0% commission, it’s evident that stocks are their primary highlight. Another commendable feature is eToro’s Negative Balance Protection; should your equity dip into the negative, eToro steps in to cover the loss.

Pros & Cons

- Free demo account to try Copy Trading

- Proprietary platform is user-friendly

- No commissions on trading

- Doesn’t support third-party platforms

- Is not an ECN/STP broker

- Has withdrawal fees

Broker Details

eToro Has The Best Social Network for Mirror Trading

In pursuing the most dynamic social trading broker, eToro emerged as the front-runner. Through its CopyTrader feature, we found the platform adeptly mirrors the moves of top traders, all while encouraging an engaging environment to connect with fellow traders, enhancing the social trading experience.

There is a clear focus on stocks with 2631 available to trade, all with 0% commission. A standout advantage we enjoyed with eToro, setting it apart from other brokers, is the Negative Balance Protection. This means eToro will absorb your loss should your equity go negative.

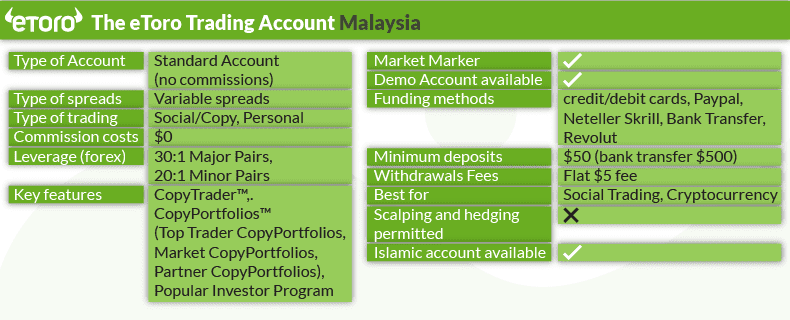

Trading Accounts

Like AvaTrade, eToro separates its accounts by Retail and Professional clients. The main difference between accounts is in leverage and ESMA protections. Professional clients receive higher leverage but aren’t protected by the Investor Compensation Fund like a Retail client is.

A characteristic that genuinely sets an eToro account apart is the option to seamlessly emulate another trader, whether on an individual trade or a more expansive portfolio scale, courtesy of the CopyTrader and/or CopyPortfolios features. To open an account, a minimum deposit of $50 is required unless through bank transfer, which is $500. A slight drawback is the flat $5 fee for any withdrawal.

Trading Products

With slightly fewer Forex currency pairs (49) than other brokers, eToro still has a healthy range of trading products.

eToro really stands out in stocks (2631) and ETFs (263), the latter of which is the most offered by any Malaysian broker.

Trading Platforms

eToro only offers one trading platform for a one-size-fits-all approach. The benefit here is everything you need is in one place, including multiple asset classes, trading tools, and social trading options.

For the trading novices, eToro offers a gentle nudge into the trading world. Upon account initiation, a virtual portfolio flush with $100,000 is at your disposal, allowing you to dip your toes into real-time trading without any financial strings attached.

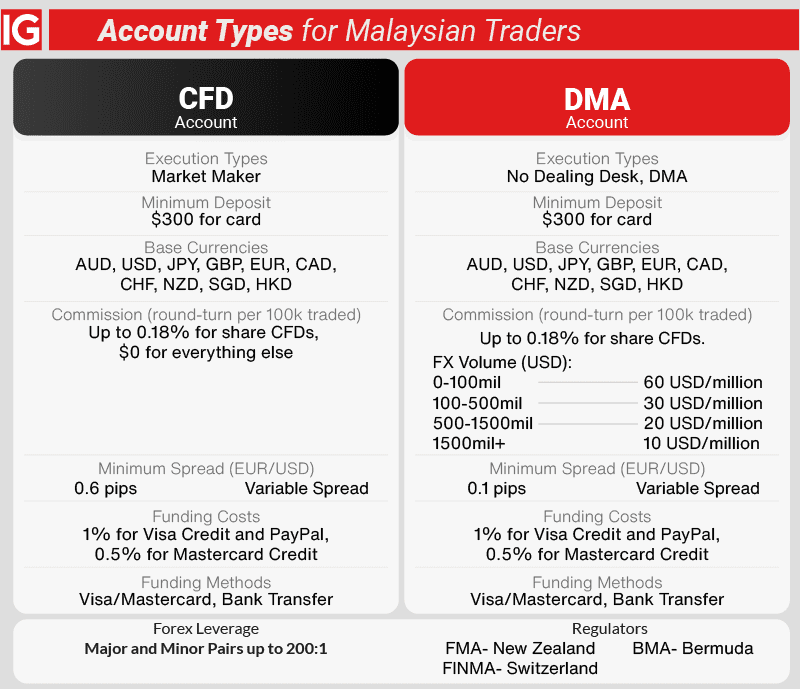

7. IG Goup - Most Popular Forex Demo Broker

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We liked IG for its unmatched volume and diversity in trading products. With access to over 17,000 financial markets, including a leading 100 Forex currency pairs, they stand a cut above the rest. They enhance the trader experience with 24-hour customer support and an Online Community for peer assistance. The IG Academy’s complimentary trading courses and webinars are a boon for budding and seasoned traders.

Pros & Cons

- A wide range of trading products is available

- IG platform is beginner-friendly

- Offers DMA access

- High minimum deposit required

- Lacks social trading tools

- MT4 has a limited range of products available

Broker Details

IG Has An Impressive Array Of Trading Products And User-Friendly Platform

In our search for trading platforms, IG unmistakably carved a niche for itself, especially when assessing the volume and the breadth of trading products. With a staggering 17,000 financial markets on offer, including 100 Forex currency pairs – the highest we’ve encountered among brokers – IG leaves a lasting impression. It’s no surprise that they bagged the ADVFN accolade for the best finance app in 2020. Their platform proved swift, intuitive, and remarkably versatile in our trials.

IG also has 24-hour customer support in addition to IG’s own Online Community for peer support from fellow traders and IG Academy for free trading courses and webinars.

Trading Accounts

The options are simple, either a live or a demo trading account. The live trading account requires no minimum deposit unless you’re paying by credit card or PayPal. A live account is the only one compatible with MetaTrader 4, as well as a variety of other trading platforms.

Trading Products

With 17,000 markets between 9 different instruments, IG has the top range of trading products compared with the other brokers. Overall the spreads are very competitive, but Forex spreads rank among the top-performing brokers. IG also offers 100 currency pairs, the most of any broker.

Trading Platforms

IG has two types of trading platforms based on the type of device used (web, tablet, and mobile trading) and specialist trading platforms. For newcomers, the device-based platforms are a godsend, being notably user-centric. A feature we particularly appreciated was the guaranteed stop-loss, ensuring you’re insulated from losses exceeding your set threshold.

The specialist platforms are designed for more experienced traders: shares specialists (L2 Trader), technical chart users (ProRealTime), and Forex traders (MetaTrader 4). However, a minor hiccup we encountered was the absence of MetaTrader 5 compatibility, which might be disappointing for some.

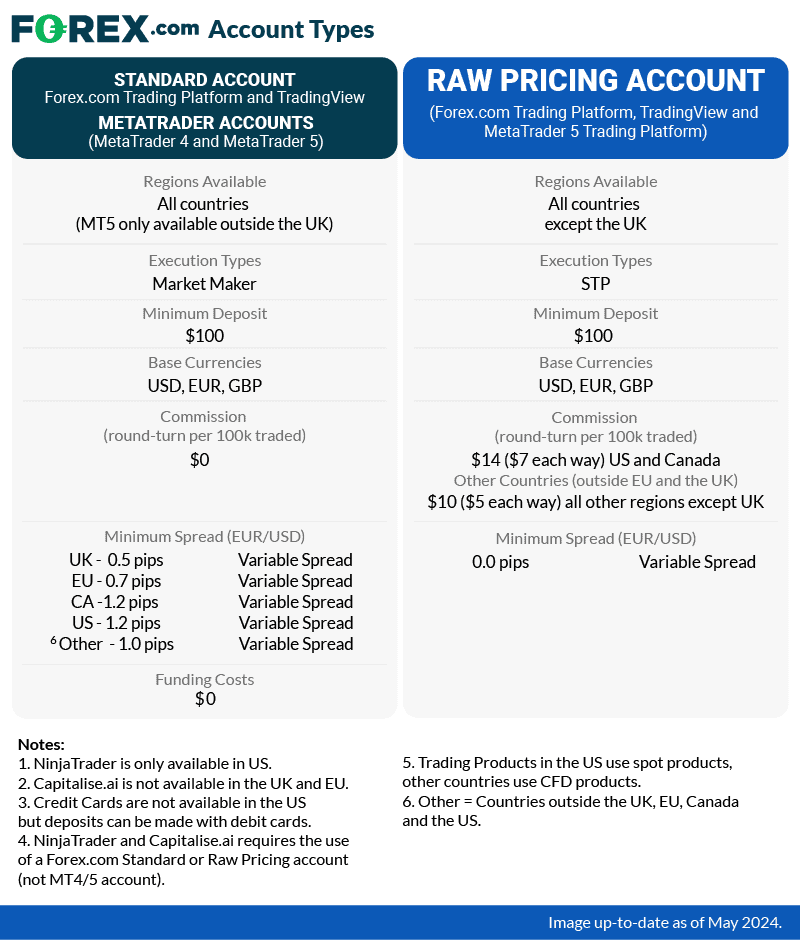

8. FOREX.com - Best Demo Educational Resources

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.6

AUD/USD = 1.4

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We liked FOREX.com for its top-tier educational resources, which stand out due to enhanced charting, expert analysis, and comprehensive video tutorials. They provide access to over 80 Forex currency pairings and more than 500 marketplaces, all available through the modernised MetaTrader 5 platform. With spreads kicking off at a competitive 0.8 pips, they cater to a broad spectrum of trading needs. Moreover, for those keen on maximising their trading benefits, the Active Trader program offers attractive rebates and tailored expert support, making it a prime choice for Malaysian traders seeking the best demo educational resources.

Pros & Cons

- Competitive trading fees

- Access to a large range of forex pairs

- Excellent educational resources

- The product range is limited on MT4

- Inactivity fees charged

- Withdrawal fee on wire transfers

Broker Details

FOREX.com’s Trading Education Resources Build Confidence in Forex Trading

As we explored FOREX.com, we noticed their comprehensive trading education resources. They surpass other brokers in this area with advanced charting, in-depth analysis, and intuitive video guides. The platform caught our eye with its solid market offering of over 80 Forex currency pairs. The MetaTrader 5 allows users to navigate over 500 markets, an impressive feature.

Spreads start from 0.8 pips but can vary depending on the market. For those who prefer MT5, FOREX.com has gone out on a limb to upgrade the platform and offer a competitive advantage. There is also the Active Trader program in which you can earn good rebates and one-on-one professional support.

Trading Accounts

The three options you have are a Standard, MetaTrader Account, and RAW Pricing account.

The Standard account and MetaTrader Accounts are commission-free and have spreads from 1 pip. The difference between the accounts being the trading platforms you can choose from.

The RAW Pricing Account has spreads from 0.0 pips and and commission of USD5 for each 100k lot.

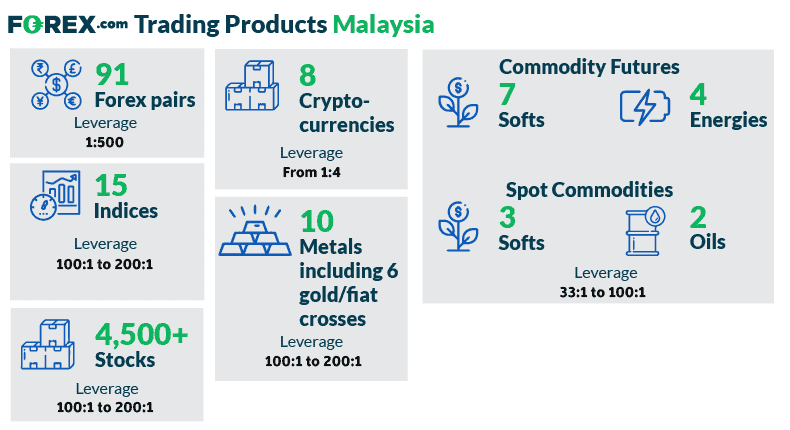

Trading Products

There are over 4500 markets available to trade, the bulk of which are stocks, but there are also Forex, indices, commodities, and cryptocurrency options.

For Forex, you can trade 91 currency pairs with competitive spreads starting at 0.8 pips.

Trading Platforms

You can choose between Forex.com Trading Platform, TradingView, MetaTrader 5 and MetaTrader 4 trading platforms. MetaTrader 4 is not available via Web Browser (Web Trader), while choosing the Forex.com Trading Platform includes a guaranteed stop loss.

Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

9. FXCM - Top Demo Trading Execution Speed

Forex Panel Score

Average Spread

EUR/USD = 1.3

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

We were impressed by FXCM’s Trading Station platform, which offers top-tier analytical tools, charting capabilities, and unmatched trading execution speed. FXCM has been recognised for its foreign exchange expertise, winning accolades for best zero commission and best FX broker in 2021. The MT4 platform’s seamless integration with forex trading highlights its effectiveness. Plus, with a modest initial deposit requirement of just $50, it’s easy for traders to get started, making FXCM a leading choice for Malaysian traders prioritising execution speed in demo accounts.

Pros & Cons

- Solid choice of trading platforms

- Wide variety of extra trading tools

- Good educational material

- Product choice is limited

- Bank transfer withdrawal fees

- Customer support is limited to 24/5

Broker Details

FXCM Provides Access to Superior Trading Platform For Speed Of Execution

FXCM emerged as our top pick when searching for the broker with the best trading execution speed. Its stellar trading platforms, especially the Trading Station, are a significant drawcard for this choice. This platform opens the doors to potent analytical tools and charting capabilities. The broker is also a Forex specialist, winning awards for best zero commission and best FX broker in 2021. One of the reasons for this is that the MT4 platform integrates seamlessly with Forex trading. And it’s only a $50 minimum deposit to open an account with FXCM.

Trading Account

True to its reputation as a client-centric entity, FXCM crafts your account, taking cues from your geographic location. Once you sail through the application approval process, setting up your CFD Trading account is a breeze, priming you for immediate trading.

The minimum deposit varies between regions. For a Malaysian trader, it is $50. FXCM also works with some of the biggest liquidity providers globally, including UBS, Citi, and Barclays.

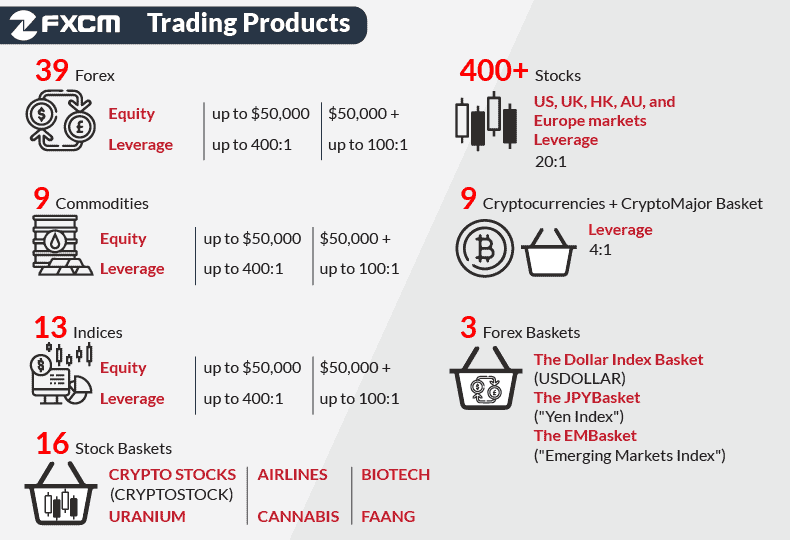

Trading Products

FFXCM has a decent range of 1000 Forex, indices, commodities, shares, and cryptos markets. It also allows you to trade baskets in FX and stocks. This makes it possible for you to speculate on a certain sector and not open yourself up to unnecessary exposure to any one instrument.

With an improved execution system and no restrictions on stop and limit orders, you can also trade with full control of your risk portfolio.

Trading Platforms

FXCM has the benefit of a proprietary FX and CFD platform, Trading Station, which allows you to trade using multiple trading platforms. Specific trading platforms include MetaTrader 4, NinjaTrader (for more advanced analytics and charting) and the social platform ZuluTrade.

Ask an Expert