Swissquote UK Review: Fees, Safety, Platforms

The FCA regulates Swissquote Ltd, which offers the CFDs trading platforms; Advanced Trader, MetaTrader 4 & MT5. Swissquote offers three forex trading accounts with their PRIME non-commission forex account EUR/USD spreads from 1.0 pips.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Swissquote Summary

| 🗺️ Regulation Country | Hong Kong, Singapore, UK, Europe |

| 📊 Trading Platforms | Advanced Trader, MT4, MT5 Trading Platform |

| 💰 Trading Fees | Low Spread Commission-Free Trading |

| 💰 Minimum Deposit | $1000 |

| 💰 Withdrawal Fees | Free |

| 🛍️ Instruments Offered | Forex, CFD, Commodities, Indices, Metals |

| 💳 Credit Card Deposit | Yes |

Why Choose Swissquote

We consider the broker suitable for experienced traders seeking a reliable and well-established broker with a wide range of trading options. It should be noted that the brokerage lacks advanced risk management tools necessary for some traders.

Founded in 1990 by Marc Bürki and Paolo Buzzi, Marvel Communications SA was established with a specific focus on developing financial software and web-based applications that were designed to help businesses manage their finances more effectively. This business preceded Swissquote, the first financial platform launched in 1996. Swissquote offered free access to prices for all securities traded on the Swiss stock exchange. To this day, Swissquote.ch remains Switzerland’s largest financial portal, attracting over two million visitors every month.

Swissquote was shortlisted as one of the Best Forex Brokers In UK.

Swissquote Pros and Cons

- Choice of trading platforms

- Commission free trading

- Good customer support

- High minimum deposits

- Lack risk management tools

- Spreads can be high

Open Demo AccountVisit Swissquote

*Your capital is at risk ‘82.48% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Fees

Swissquote offers three types of accounts with spreads ranging from 0.0 to 1.3 pips.

Standard Account Spreads

|

No Commission Spreads: Standard Accounts

|

|||||

|---|---|---|---|---|---|

|

1.70 | 1.60 | 1.70 | 2.50 | 2.70 |

|

0.82 | 0.83 | 1.27 | 1.30 | 1.05 |

|

0.83 | 1.12 | 1.29 | 1.65 | 1.31 |

|

1.00 | 1.20 | 1.00 | 1.20 | 1.00 |

|

0.80 | 1.20 | 1.20 | 1.50 | 1.20 |

|

1.00 | 1.00 | 1.20 | N/A | 1.10 |

|

0.80 | 1.00 | 1.00 | 1.50 | 1.60 |

|

0.90 | 1.70 | 1.60 | 2.10 | 1.70 |

|

1.20 | 1.50 | 1.60 | 2.10 | 1.60 |

|

1.00 | 1.11 | N/A | 1.30 | 1.28 |

|

0.84 | 0.83 | 1.79 | 2.32 | 1.92 |

|

1.10 | 1.10 | 1.10 | 1.20 | 1.20 |

|

1.20 | 1.30 | 1.20 | 1.50 | 1.30 |

|

1.20 | 1.30 | 1.20 | 1.20 | 4.00 |

|

1.20 | 1.40 | 1.40 | 1.90 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

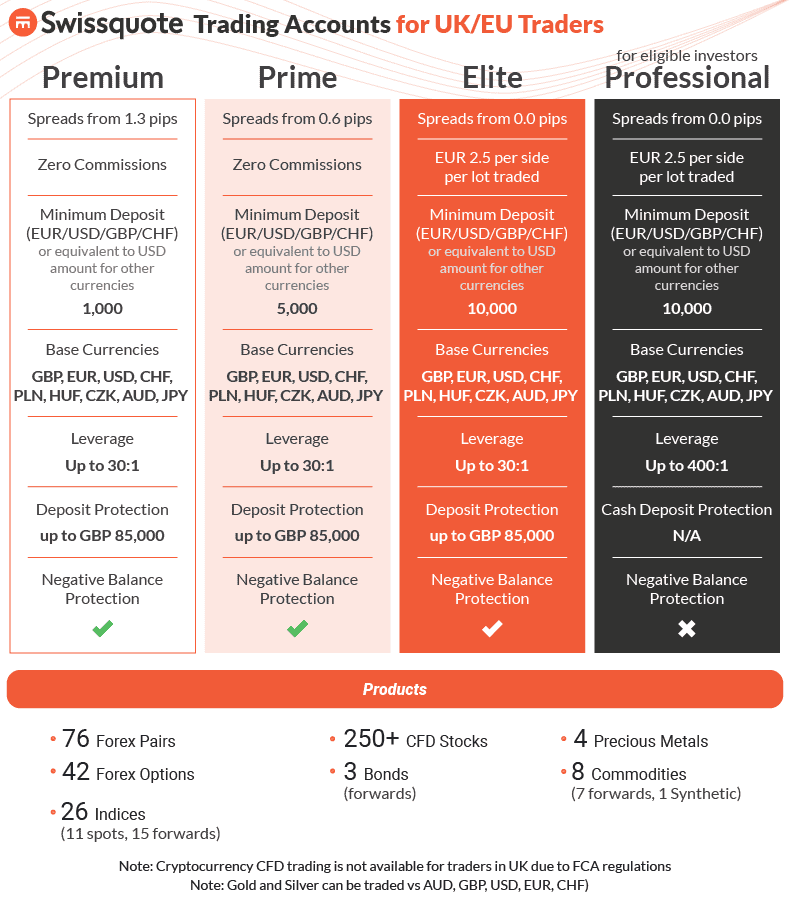

Depending on the goals you have set for yourself and your budget, you can choose between the following:

- Premium account – required minimum deposit of $1,000; the EUR/USD spreads start from 1.3 pips

- Prime account – required minimum deposit of $5,000; the EUR/USD spreads start from 1.0 pips

- Elite account – required minimum deposit of $10,000; the EUR/USD spreads start from 0.0 pips + commission of $5.6 round-turn

There is also a professional account that offers the lowest spreads and higher leverage of up to 400:1. This professional account has qualification requirements, and it’s recommended to get in touch with the forex broker to learn more about the bespoke trading conditions.

Below is a comparison of Swissquote Prime to the standard average spreads. These are the minimum spreads the forex brokers offer, which may increase based on market conditions. It is evident that Swissquote’s spreads are higher.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Swissquote Average Spread | 1.7 | 1.6 | 2 | 1.6 | 2.7 | 1.7 | 2.5 | 2,5 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

Use the calculator below to compare Swissquote’s trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Swap-Free Account Fees

Swissquote provides an account that follows Islamic principles for traders who practice the Muslim faith, which includes a swap-free option. The forex trading environment for Islamic traders is ideal, as it follows strict Sharia law and charges a fixed fee instead of a swap.

Other Fees

There are no extra charges when it comes to deposits, withdrawals, and account inactivity.

Verdict on Fees

Swissquote, being a high-end broker, is capable of offering competitive, tight spreads.

Open Demo AccountVisit Swissquote

*Your capital is at risk ‘82.48% of retail CFD accounts lose money’

Is Swissquote Safe?

Yes, Swissquote is a safe broker with a high trust score of 89/100.

Regulation

Swissquote is regulated by three ‘tier 1’ financial authorities, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Monetary Authority of Singapore (MAS).

| Swissquote Safety | Regulator |

|---|---|

| Tier-1 | FCA CySEC MAS |

| Tier-2 | DFSA MFSA SFC CSSF FINMA |

| Tier-3 | X |

Reputation

Swissquote was established in Gland, Switzerland, in 2000, therefore showcasing over 20 years of experience in the trading industry.

They get over 135,000 hits on Google searches monthly, making them a popular broker among traders.

Reviews

Swissquote has a fair TrustPilot score of 3.4 out of 5 from 1,392 reviews.

Verdict on Swissquote’s Trustworthiness

Swissquote proves to be a highly reliable and trustworthy broker with an overall trust score of 89 and regulation from top tier authorities.

Range of Offerings

Swissquote offers trading on over 3 million products across 50+ global markets with their eTrading account. They offer over 130 Currency Pairs, Metals, CFDs on Indices, Commodities, and bonds with all-in spreads and no commissions.

Traders who want to trade forex and CFDs, forwards, and options have to use Swissquote’s eForex account. This account offers 472 tradeable symbols.

Forex

- Trade over 80 currency pairs, including major, minor, and emerging currencies

- Pricing is transparent with competitive spreads, low margin rates, and no hidden fees

- Flexible transaction sizes, including micro, mini, and standard lots

Stocks

- Begin your trades with just CHF 5.-

- Access to over 60 markets across the globe

- Trading fees are capped for large volumes

ETFs

- Select from a range of over 9,000 ETFs and ETNs

- Trade with Switzerland’s top-ranked bank for ETFs

Funds

- Extensive range of over 20,000 funds to choose from

- Professional portfolio management

Options & Futures

- Direct access to almost one million derivatives

- Engage in trading at any hour, five days a week

Verdict on Swissquote Trading Products

Swissquote offers a vast range of financial product and their eTrading account is designed to provide an organised experience by separating their nearly 500 CFDs from the rest.

What Trading Platforms Does Swissquote Offer?

| Trading Platform | Available With Swissquote |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

Swissquote allows access to the Forex market through 3 award-winning trading platforms: Advanced Trader, MetaTrader 4, and MetaTrader 5.

1) Advanced Trader

1) Advanced Trader

- Advance Trader is a proprietary online trading platform developed by Swissquote LTD

- The customisable interface allows traders to arrange the platform interface to fit their own needs

- Powerful built-in tools and order management tools

- Exclusive access to news from Bloomberg and Swissquote.eu

- Full mobility to switch between the Desktop, Web or Mobile trading versions

2) MetaTrader 4 Platform

2) MetaTrader 4 Platform

- MetaTrader 4 is the most popular Forex trading platform

- Built exclusively for retail traders, it comes with a user-friendly interface

- No tolerance levels applied as MT5 and AT, and it comes with a user-friendly interface

- Deep liquidity and fast trade execution

- Capability to develop automated trading strategies through Expert Advisors (EA)

- Real-time charts, fast live quotes and Android/iPhone apps

3) MetaTrader 5 Platform

3) MetaTrader 5 Platform

- MT5 is the latest generation of MetaTrader software

- It has all the features of the MT4 with additional options and a different codebase. MetaTrader Master Edition is available as well.

- Netting mode available and advanced charting across Android and iPhone devices

- Offers one-click forex trading service with real-time price quotes

- Extensive back-testing facilities and copy trading

Summary Of Online Trading Platforms

| Platform | Accessibility | Adjustable Session Times | Depth Of Market Functionality | Historical Data Access | Algorithmic Trading | Detachable Charts |

|---|---|---|---|---|---|---|

| MetaTrader 4 | Windows MAC Linux | No | No | Yes | Yes | Yes |

| MetaTrader 5 | Windows MAC Linux | No | Yes | Yes | Yes | Yes |

| cTrader | Windows MAC Linux | Yes | Yes | Yes | Yes | Yes |

Advanced traders can use Swissquote’s FIX API to access the interbank market directly from their custom interface and execute orders through Swissquote servers.

MT4 and MT5 platforms offer many features like the Master Edition add-on correlation matrix, conditioned orders, mini terminal, and more. Autochartist and Trading Central are technical tools for Swissquote clients. To test all features, open a Swissquote demo account.

Advanced Trader has pattern recognition, customisable time frames, and no Sunday candle. The app is user-friendly, and flexible, and includes video tips.

Swissquote Trading Tools

Swissquote offers a wide range of analysis and data tools that allow its customers to trade under the best conditions. The technical analysis tools will help you research only the instruments that align with your trading specifications.

1) Automatic Pattern Detection (Advanced Trader only)

Swissquote’s chart pattern recognition leading-edge software allows traders to save time by analysing the most popular chart patterns. Swissquote software can recognise and outline up to 17 of the most commonly used chart patterns.

The automatic pattern detection tool will also indicate the pattern’s strength when your favourite chart pattern is detected. Newbie traders may find this an ideal learning tool for chart pattern trading.

2) Complex Order Types (Advanced Trader only)

Trading with Swissquote.com comes with a high degree of flexibility and complex order management tools. Conditional orders offered by Swissquote can help limit risk and reduce the speed of execution. Additionally, some trading orders are designed to minimize market impact and possibly provide price improvement.

Trading with Swissquote.com comes with a high degree of flexibility and complex order management tools. Conditional orders offered by Swissquote can help limit risk and reduce the speed of execution. Additionally, some trading orders are designed to minimize market impact and possibly provide price improvement.

The forex trading platform allows the trader to engage the market with the following extra order types:

- Order Cancels Other (OCO) – Uses a combination of a stop order and a limit order. When one order is triggered, the other is automatically cancelled.

- If done – Uses a two-legged order in which the second order is triggered only after the conditions of the first order have been satisfied.

- If done / OCO – A variation of the IF DONE order whereby an OCO is placed after the order in the IF section has been executed.

One advantage of using these order types is that the contingent order enables you to implement more sophisticated trading strategies.

Verdict on Swissquote Trading Platforms

Swissquote offers a proprietary trading platform, the Advanced Trader platform, which caters to experienced professional traders. For novice traders, MetaTrader4 and MetaTrader5 are just as good at fulfilling all your trading needs. However, we recommend you compare forex brokers before choosing Swissquote, as they are relatively weak in their MetaTrader offering.

Open Demo AccountVisit Swissquote

*Your capital is at risk ‘82.48% of retail CFD accounts lose money’

How Popular Is Swissquote?

Swissquote shows strong visibility in the online trading space. With approximately 135,000 monthly Google searches, it ranks as the 19th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it somewhat lower, with Similarweb reporting 531,000 global visits in February 2024, placing Swissquote as the 28th most visited broker.

As Switzerland’s leading online broker, Swissquote is publicly listed on the Swiss stock exchange with a market capitalization of approximately CHF 2.2 billion as of 2024. The company reported serving over 561,000 client accounts as of Q1 2024, holding CHF 60.6 billion in assets under custody. Swissquote processed CHF 31.5 billion in trading volume in Q1 2024 alone, underscoring its substantial operational scale. The broker’s strong financial position is reflected in its 2023 pre-tax profit of CHF 255.3 million on net revenues of CHF 525.4 million.

| Country | 2024 Monthly Searches |

|---|---|

| France | 8,100 |

| Germany | 5,400 |

| United Kingdom | 2,400 |

| Spain | 1,900 |

| Italy | 1,900 |

| United Arab Emirates | 1,900 |

| Turkey | 1,300 |

| United States | 1,000 |

| South Africa | 1,000 |

| Thailand | 880 |

| Netherlands | 720 |

| Austria | 720 |

| India | 720 |

| Brazil | 720 |

| Saudi Arabia | 720 |

| Portugal | 590 |

| Poland | 590 |

| Greece | 590 |

| Cyprus | 480 |

| Hong Kong | 480 |

| Singapore | 480 |

| Mexico | 390 |

| Australia | 320 |

| Canada | 320 |

| Colombia | 320 |

| Argentina | 320 |

| Ireland | 260 |

| Sweden | 260 |

| Japan | 260 |

| Egypt | 260 |

| Malaysia | 210 |

| Taiwan | 210 |

| Indonesia | 170 |

| Morocco | 170 |

| Chile | 170 |

| Costa Rica | 170 |

| Panama | 170 |

| Philippines | 140 |

| Nigeria | 140 |

| Peru | 140 |

| Mauritius | 140 |

| Vietnam | 110 |

| Ecuador | 110 |

| Algeria | 90 |

| Uzbekistan | 90 |

| Pakistan | 70 |

| Jordan | 70 |

| Venezuela | 70 |

| Dominican Republic | 70 |

| New Zealand | 50 |

| Kenya | 50 |

| Cambodia | 50 |

| Bolivia | 40 |

| Switzerland | 30 |

| Ghana | 30 |

| Bangladesh | 30 |

| Tanzania | 20 |

| Sri Lanka | 20 |

| Uganda | 10 |

| Ethiopia | 10 |

| Botswana | 10 |

| Mongolia | 10 |

2024 Average Monthly Branded Searches By Country

France

France

|

8,100

1st

|

Germany

Germany

|

5,400

2nd

|

United Kingdom

United Kingdom

|

2,400

3rd

|

Spain

Spain

|

1,900

4th

|

Italy

Italy

|

1,900

5th

|

United Arab Emirates

United Arab Emirates

|

1,900

6th

|

Turkey

Turkey

|

1,300

7th

|

United States

United States

|

1,000

8th

|

South Africa

South Africa

|

1,000

9th

|

Thailand

Thailand

|

880

10th

|

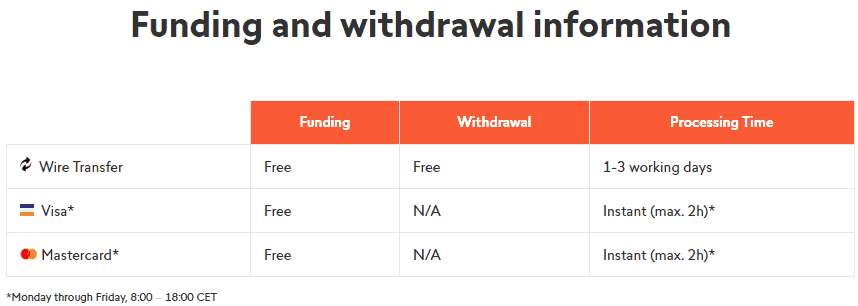

Funding And Withdrawals

Swissquote offers its clients three funding options: credit cards, bank transfers, and Skrill wallet.

This should satisfy most traders, but if you have specific funding requirements (e.g. PayPal), you may need to review our FCA Regulated Brokers.

What is the minimum deposit at Swissquote?

The minimum deposit at Swissquote ranges from $1,000 to $10,000.

Compared to other forex brokers, Swissquote has a high minimum deposit. This is a safety measure to ensure retail traders are well-capitalised to engage in high-risk leveraged products such as forex currencies and CFDs.

The Swissquote Forex accounts come with different minimum deposit requirements:

- Premium account – required minimum deposit of $1,000; the EUR/USD spreads start from 1.3 pips

- Prime account – required minimum deposit of $5,000; the EUR/USD spreads start from 1.0 pips

- Elite account – required minimum deposit of $10,000; the EUR/USD spreads start from 0.0 pips + commission of $5.6 round-turn

Base Currencies Offered

Swissquote Ltd offers an impressive array of 9 different currencies. These include USD, EUR, GBP, CHF, JPY, AUD, PLN, HUF, and CZK.

Deposit Methods And Fees

Swissquote doesn’t apply any fees to deposits and withdrawals. There’s no amount or frequency limit to withdrawals. You can only make a Swissquote deposit from a credit card, bank account, or Skrill wallet in the name of the trading account holder, whether it is a company or an individual.

Withdrawal Methods And Fees

Withdrawals are available via bank transfer only; they can be requested via the client ePortal. The ePortal service allows each client to manage the account, submit the sub-account request, and update personal data.

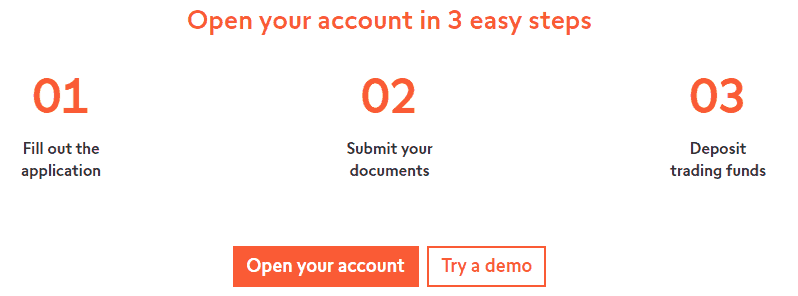

Account Opening

Before you can deposit funds in your account, you need to open an account with Swissquote. The process of opening a Swissquote forex account follows 3 easy steps:

- Apply for a real trading account in just a few clicks, remember to put your tax code/TIN where requested

- Provide two documents to prove your identity and your address

- Fund your account with a credit card (free), bank transfer, or Skrill wallet

The Swissquote account opening procedure is quick and easy, and it comes with an effective digital account opening experience.

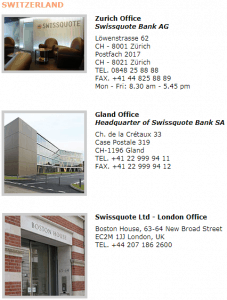

Customer Service

Swissquote enjoys an excellent reputation as a Switzerland brand specialising in online trading. Swissquote Ltd is a branch of Swissquote Group Holding Ltd with headquarters in Gland, Switzerland. But Swissquote has a global presence with secondary offices in:

- Bern

- Dubai

- Zurich

- Malta

- Hong Kong

- Singapore

- Luxemburg

With over 23 years of experience in forex solutions, Swissquote has placed a high standard on customer satisfaction. Clients are pleased with Swissquote for its award-winning and multilingual 24/5 customer service support. Swissquote is a leading global forex broker that serves clients from over 150 countries, including all 28 EU nations and non-European countries like Australia, New Zealand, Hong Kong, and many others.

Due to some jurisdictions’ strict regulatory environment and laws, Swissquote can’t serve clients from the USA, Canada, Japan, or blocked countries.

Customer service is available in multiple languages: Arabic, Czech, Polish, English, Italian, Spanish, and more. Swissquote experts can assist you in more than 10 languages.

To reach Swissquote customer service, you have several channels available at your disposal:

- Phone support

- Live chat with fast response time

Swissquote customer support representatives answer emails within the same business day. Clients can reach Swissquote representatives using their different office locations and speak in their native language.

Verdict on Swissquote Customer Support

Our Swissquote UK review discovered their customer support service excelling in 3 main areas:

- Several channels for support, including live chat

- High level of trustworthiness among Swissquote clients

- Multilingual 24/5 customer service support

They ranked mid-tier in our best forex brokers in UK review with some marks lost based on the difficulty in opening an account and making initial trades.

Research and Education

You can learn the ins and outs of forex trading with the Swissquote learning centre, which consists of a wealth of educational tools:

- Professional educational videos

- Live seminars

- Online webinars

- Forex eBooks and User Guides

The online forex courses will equip the trader with the right knowledge to tackle the forex exchange market and will help you step up your learning curve. The online trading courses are rich in educational videos including introductory tutorials, how-to-trade tutorials, and more advanced video tutorials on risk management.

The Swissquote research team will supply you with tailored products and content like:

- Live Analysis Reports

- All Morning News

- Daily Market Brief

- Daily Technical Report Filter

- Daily Technical Report

Final Verdict on Swissquote

What makes Swissquote a reliable and versatile forex trading broker is a combination of multiple factors:

- A wide range of available instruments for trading, including over 130 Forex currency pairs and CFDs

- Multiple award-winning trading platforms

- Enhanced trading tools

- A reliable Swissquote support team

- A well-regulated Forex broker satisfying all the Financial Conduct Authority (UK) financial market standards.

We believe there is some value in first trying the Swissquote demo account so you can validate by yourself the outstanding trading services provided by one of the best forex brokers. Additionally, Swissquote requires a minimum deposit of USD 1,000 to begin trading, which may place the broker out of reach for some traders.

Open Demo AccountVisit Swissquote

*Your capital is at risk ‘82.48% of retail CFD accounts lose money’

Pros and Cons

- Choice of trading platforms

- Commission free trading

- Good customer support

- High minimum deposits

- Lack risk management tools

- Spreads can be high

FAQs

What is the minimum deposit at Swissquote?

Traders must deposit at least $1,000 when opening a Premium account with Swissquote. For Prime accounts, the minimum is $5,000, while for the Elite account, it’s $10,000.

What Demo Account Does Swissquote Offer?

Get a virtual credit of at least CHF 50’000 by opening a demo account to test the Robo-Advisor in real market conditions.

Is Swissquote Safe?

Yes, Swissquote is a safe broker with a high trust score and is regulated by three tier-1 financial authorities. It a TrustPilot score of 3.4 out of 5 from 1,392 reviews.

What Leverage Does Swissquote Offer?

Swissquote provides various flexible leverage options to its customers. It limits leverage to a maximum of 1:100, which is different from many other brokers. If you’re new to trading, we recommend using lower leverage until you gain confidence in your trading strategy.

What countries are restricted by Swissquote?

Swissquote lacks authorisation from regulatory bodies in multiple countries, including the USA, Canada, UK, Germany, Italy, and France.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You can learn more about how brokers make money like Swissquote and the best spread betting platforms within UK. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Compare Swissquote Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Ask an Expert

Can I transfer crypto from Swissquote?

Crypto payments and transfers using 3rd party wallets directly from your Swissquote account is not permitted.