IC Markets vs Swissquote 2025

As you take a deep dive into this comprehensive review of IC Markets and Swissquote, you’ll uncover their impressive range of competitive features and platforms. However, by the end, you’ll discover a significant distinction between the two, leading to one clear winner emerging from this analysis. Keep reading to find out who triumphs!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most crucial trading factors to help you make an informed choice between IC Markets and Swissquote. Here are the top five differences:

- IC Markets offers tighter spreads than Swissquote, making it more cost-effective for traders.

- IC Markets has a more diverse range of CFD instruments.

- IC Markets is significantly more popular, receiving far more website visits.

- Swissquote requires higher minimum deposits for its accounts.

- Swissquote is regulated by four top-tier authorities, offering a higher level of trustworthiness.

1. Lowest Spreads And Fees – IC Markets

Keeping forex trading costs low is crucial, especially for active traders. Low spreads and competitive fees enhance profitability and market activity. This review compares IC Markets and Swissquote to determine which broker offers better value. Understanding each platform’s cost structure will aid in selecting the right broker for your trading style.

IC Markets and Swissquote stand out as two leading brokers in the forex trading sector, each presenting distinctive features and services. Established in 2007, IC Markets is celebrated for its competitive spreads and sophisticated trading platforms. In contrast, Swissquote, founded in 1996, is a Swiss-based broker recognized for its extensive banking services and strong regulatory framework. This review will explore their offerings, highlighting spreads, commission structures, standard account fees, and will culminate in a conclusion informed by the latest trends and developments in forex trading as of 2025.

Spreads

IC Markets stands out for its remarkably competitive spreads, offering a EUR/USD spread of just 0.82, significantly better than Swissquote’s 1.7 and the industry average of 1.2. For AUD/USD, IC Markets features a spread of 0.83, compared to Swissquote’s 1.6, while the industry average sits at 1.5. When looking at the overall average spread, IC Markets holds an impressive 1.09, far lower than Swissquote’s 2.04 and the industry average of 1.6. These advantageous spreads position IC Markets as a highly cost-effective choice for traders.

| Standard Account | IC Markets Spreads | Swissquote Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.09 | 2.04 | 1.6 |

| EUR/USD | 0.82 | 1.7 | 1.2 |

| USD/JPY | 0.94 | 1.6 | 1.4 |

| GBP/USD | 1.03 | 2 | 1.6 |

| AUD/USD | 0.83 | 1.6 | 1.5 |

| USD/CAD | 1.05 | 2.7 | 1.8 |

| EUR/GBP | 1.27 | 1.7 | 1.5 |

| EUR/JPY | 1.3 | 2.5 | 1.9 |

| AUD/JPY | 1.5 | 2.5 | 2.1 |

Commission Levels

IC Markets imposes a commission fee of $3.50 per lot, compared to Swissquote’s more competitive rate of $2. However, Swissquote requires a minimum deposit of $1,000, without setting a recommended deposit amount. In contrast, IC Markets has both a minimum and recommended deposit of just $200. Both brokers waive funding fees and offer SWAP-free accounts. While IC Markets’ commission may be higher, its significantly lower deposit requirement enhances accessibility for retail traders.

Standard Account Fees

IC Markets provides a competitive edge in standard account trading with spreads of just 0.62 for EUR/USD and 0.77 for AUD/USD. In comparison, Swissquote’s spreads are significantly higher, at 1.70 for EUR/USD and 1.60 for AUD/USD. This disparity underscores the cost-effectiveness of IC Markets, especially for traders concentrating on these specific currency pairs.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

|

1.70 | 1.60 | 1.70 | 2.00 | 1.60 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

|

1.46 | 2.06 | 1.52 | 1.76 | 1.59 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

IC Markets distinguishes itself through its lower spreads and minimal deposit requirements, making it an excellent choice for budget-minded traders. Conversely, Swissquote, while providing strong regulatory oversight and extensive banking services, tends to have higher spreads and deposit minimums. As forex trading in 2025 increasingly prioritizes cost efficiency and accessibility, IC Markets emerges as the more appealing option for traders focused on EUR, USD, and AUD currencies.

Our Lowest Spreads and Fees Verdict

Without a doubt, IC Markets rides high in this category owing it to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

The right forex trading platform significantly impacts success, providing advanced charting, real-time data, and fast execution. A good platform is user-friendly, customizable, and secure, suitable for automated or social trading. This review compares IC Markets and Swissquote to determine which offers the superior trading experience.

IC Markets and Swissquote are prominent players in the forex trading arena, each providing a diverse range of platforms and tools tailored to various trading requirements. IC Markets, founded in 2007, is celebrated for its exceptionally low spreads and sophisticated trading platforms. On the other hand, Swissquote, established in 1996, is a reputable Swiss broker recognized for its extensive banking services and strong regulatory oversight. This review will delve into their offerings, focusing on MetaTrader, advanced trading platforms, and copy trading, while also drawing conclusions based on the latest trends and developments in forex trading for 2025.

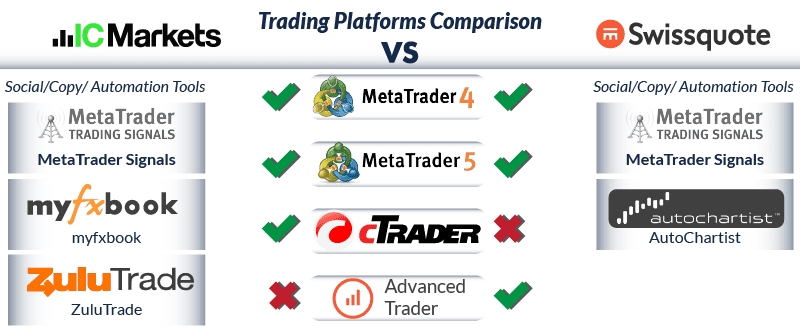

| Trading Platform | IC Markets | Swissquote |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader

IC Markets offers an impressive selection of trading platforms, including the widely favored MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as cTrader. MT4 and MT5 have maintained their popularity for over fifteen years, thanks in large part to their user-friendly interfaces and the capability to utilize Expert Advisors (EAs) for automated trading, making them among the top choices for CFD and forex trading globally. Additionally, Swissquote provides both MT4 and MT5, complemented by their proprietary platform, Advanced Trader.

Advanced Platforms

IC Markets’ cTrader stands out as a sophisticated platform, equipped with specialized features like depth of market and unique order types. Meanwhile, Swissquote’s Advanced Trader platform presents a versatile array of chart and order options, boasting extensive customization capabilities. This allows traders to develop personalized tools to enhance their analysis, empowering them to become ‘Advanced Traders’. Both brokers deliver robust platforms designed to meet the needs of traders at all levels, from novice to expert.

Trader’.

Copy Trading

IC Markets and Swissquote both offer robust copy trading options that empower traders to mirror the strategies of seasoned professionals. IC Markets connects seamlessly with well-known copy trading platforms such as MyFxBook and MetaTrader Signals, enhancing the trading experience. Meanwhile, Swissquote presents an array of social trading tools, including ZuluTrade and HokoCloud. These offerings enable traders to leverage the expertise of others, allowing for enhanced strategy diversification and improved trading outcomes.

Both IC Markets and Swissquote provide an array of platforms and tools to meet diverse trading needs. IC Markets excels with its low spreads and sophisticated trading platforms, making it an attractive option for budget-minded traders. On the other hand, Swissquote distinguishes itself through its strong regulatory framework and extensive banking services, ensuring a secure trading environment. As forex trading trends in 2025 highlight the growing integration of AI and machine learning, both brokers are strategically positioned to equip traders with the necessary tools and platforms for success in the dynamic market landscape.

Our Better Trading Platform Verdict

Undeniably, IC Markets steals the show in this category on the account of having better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

A well-designed trading account enhances a trader’s experience. IC Markets and Swissquote offer customized options for various trading styles, featuring competitive spreads, low commissions, and advanced tools. They provide demo accounts, swap-free options for Islamic trading, and a wide range of instruments, including forex and commodities. With automated trading, quality analysis, and strong support, these brokers aim to create an efficient trading environment. This review compares their accounts and features to identify the standout broker.

IC Markets and Swissquote stand out as reputable brokers in the forex trading landscape, each providing unique account types and features tailored to diverse trading preferences. Established in 2007, IC Markets is celebrated for its competitive spreads and cutting-edge trading platforms. Meanwhile, Swissquote, founded in 1996, is a Swiss-based broker acclaimed for its extensive banking services and strong regulatory framework. This review will delve into a comparison of their account offerings while also spotlighting the latest trends and news in forex trading for 2025.

Accounts and Features

When it comes to accounts and features, both brokers have their merits, but one stands out more than the other. IC Markets offers three main types of accounts:

– **Standard**: Commission-free with spreads starting at 1.0 pips.

– **Raw Spread**: Spreads from 0.0 pips with a $3.50 commission per lot.

– **cTrader Raw**: Spreads from 0.0 pips with a $3.00 commission per lot.

Swissquote, on the other hand, provides a more simplified approach with just two account types:

– **Standard**: Spreads from 1.7 pips with no commissions.

– **Premium**: Spreads from 1.4 pips with no commissions.

Here’s a quick table to break it down:

| IC Markets | Swissquote | |

|---|---|---|

| Standard Account | Yes | - |

| Raw Account | Yes | - |

| Swap Free Account | Yes | - |

| Active Traders | Yes | - |

| Spread Betting (UK) | Yes | - |

IC Markets stands out with its diverse array of account types, effectively meeting the needs of both novice and experienced traders through competitive spreads and low commission fees. Meanwhile, Swissquote, despite having a more limited selection, delivers a simple and user-friendly experience complemented by zero commission fees. As forex trading trends shift in 2025 towards cost efficiency and sophisticated trading tools, IC Markets emerges as the more appealing choice for traders looking for flexibility and reduced trading expenses.

Our Superior Accounts and Features Verdict

We can easily surmise that IC Markets brings home the gold in this field thanks to their superior account and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

A top trading experience relies on advanced technology, quick execution, and tight spreads, vital for forex profits. IC Markets and Swissquote offer robust platforms for all traders, ensuring smooth execution and market insights. With user-friendly interfaces, advanced charts, and quality education, both brokers aim for an efficient trading journey. This review will assess their strengths and weaknesses to identify the best broker.

When evaluating trading platforms, IC Markets and Swissquote both present compelling options tailored to various trading preferences. IC Markets stands out by providing access to the popular MetaTrader 4 and 5 platforms, renowned for their user-friendly interfaces and advanced functionalities, including one-click trading and detailed charting tools. This makes it particularly attractive for traders looking for efficient execution and a smooth trading experience. Meanwhile, Swissquote features its proprietary Advanced Trader platform, which offers extensive customization and a variety of chart types and order options, catering to traders who prefer a more personalized trading environment.

In terms of spreads and commissions, IC Markets boasts competitive pricing structures. Their Standard Account eliminates commission fees, with spreads beginning at just 0.6 pips—making it an excellent choice for beginners. For seasoned traders, the Raw Account offers spreads starting from 0.0 pips, accompanied by a commission fee of $7 USD per standard lot round-turn. Swissquote, in contrast, provides commission-free trading with floating spreads beginning at 1.4 pips in its Standard account, though it imposes a relatively high minimum deposit requirement of $1,000.

Recent market trends show the EUR/USD pair in a bearish phase, with the euro losing ground against the US dollar. This decline is driven by the Federal Reserve’s unwavering commitment to a restrictive monetary policy. Conversely, the AUD/USD pair displays resilience, trading within an ascending channel after breaching the January high of 0.6331 earlier this month. These trends highlight the forex market’s dynamic nature and emphasize the necessity of staying updated on economic indicators and central bank policies.

IC Markets and Swissquote both offer robust platforms and competitive trading conditions. IC Markets excels with its low spreads and versatile account options, while Swissquote impresses with its customizable platform and diverse financial instruments. Traders should assess their individual needs and remain informed about market trends when making a decision between these two brokers.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| Swissquote | 258ms | 36/36 | 198ms | 30/36 |

Our Best Trading Experience and Ease Verdict

IC Markets, definitely, takes home the cake in this field due to their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IC Markets

Robust regulation is essential in forex trading for security and transparency. Brokers like IC Markets and Swissquote, regulated by reputable authorities, adhere to strict standards that protect traders from fraud. This oversight builds trader confidence and promotes market participation. Trustworthy brokers enhance their reputation and attract more clients, solidifying their competitive position.

IC Markets Trust Score

Swissquote Trust Score

It is evident that Swissquotes has a superior trust score compared to IC Markets. However, let’s delve deeper to evaluate the reliability of their additional features and platforms.

In the highly competitive and dynamic world of forex trading, the importance of trust and regulatory oversight cannot be overstated. IC Markets operates under the regulation of the Seychelles Financial Services Authority (FSA), which ensures that they comply with international financial standards, providing a layer of security for traders. Conversely, Swissquote, regulated by the Swiss Financial Market Supervisory Authority (FINMA) and listed as a publicly traded company, demonstrates a strong commitment to transparency and robust governance practices. These regulatory frameworks not only serve to protect traders from the risks of potential fraud but also foster an environment of confidence, ultimately encouraging greater active participation and engagement in the forex market.

Here’s a table for a quick comparison:

| IC Markets | Swissquote | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | FCA (UK) CYSEC (Cyprus) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) MFSA (Europe) SFC CSSF FINMA (Switzerland) |

|

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

Our Stronger Trust and Regulation Verdict

Without a doubt, IC Markets is riding high in this niche by the reason of their stronger trust and regulation.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than Swissquote. On average, IC Markets sees around 246,000 branded searches each month, while Swissquote gets about 135,000 — that’s 45% fewer.

| Country | IC Markets | Swissquote |

|---|---|---|

| United Kingdom | 33,100 | 2,400 |

| South Africa | 9,900 | 1,000 |

| India | 8,100 | 720 |

| Thailand | 8,100 | 880 |

| Vietnam | 8,100 | 110 |

| Australia | 6,600 | 320 |

| United States | 6,600 | 1,000 |

| Spain | 6,600 | 1,900 |

| Germany | 5,400 | 5,400 |

| Pakistan | 5,400 | 70 |

| France | 4,400 | 8,100 |

| United Arab Emirates | 4,400 | 1,900 |

| Brazil | 4,400 | 720 |

| Morocco | 4,400 | 170 |

| Singapore | 3,600 | 480 |

| Italy | 3,600 | 1,900 |

| Nigeria | 3,600 | 140 |

| Malaysia | 3,600 | 210 |

| Indonesia | 3,600 | 170 |

| Colombia | 3,600 | 320 |

| Poland | 2,900 | 590 |

| Sri Lanka | 2,900 | 20 |

| Canada | 2,400 | 320 |

| Hong Kong | 2,400 | 480 |

| Netherlands | 2,400 | 720 |

| Philippines | 2,400 | 140 |

| Kenya | 2,400 | 50 |

| Mexico | 2,400 | 390 |

| Algeria | 2,400 | 90 |

| Bangladesh | 1,900 | 30 |

| Saudi Arabia | 1,900 | 720 |

| Switzerland | 1,600 | 30 |

| Egypt | 1,600 | 260 |

| Peru | 1,600 | 140 |

| Sweden | 1,300 | 260 |

| Turkey | 1,300 | 1,300 |

| Japan | 1,300 | 260 |

| Argentina | 1,300 | 320 |

| Portugal | 1,000 | 590 |

| Taiwan | 1,000 | 210 |

| Uzbekistan | 1,000 | 90 |

| Ecuador | 1,000 | 110 |

| Dominican Republic | 1,000 | 70 |

| Ireland | 880 | 260 |

| Cyprus | 880 | 480 |

| Ghana | 880 | 30 |

| Austria | 720 | 720 |

| Greece | 720 | 590 |

| Uganda | 720 | 10 |

| Ethiopia | 720 | 10 |

| Chile | 720 | 170 |

| Venezuela | 720 | 70 |

| Mongolia | 720 | 10 |

| Jordan | 590 | 70 |

| Mauritius | 480 | 140 |

| Costa Rica | 390 | 170 |

| Tanzania | 320 | 20 |

| Panama | 260 | 170 |

| Botswana | 260 | 10 |

| Bolivia | 260 | 40 |

| New Zealand | 210 | 50 |

| Cambodia | 170 | 50 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

Swissquote - UK

Swissquote - UK

|

2,400

2nd

|

IC Markets - ZA

IC Markets - ZA

|

9,900

3rd

|

Swissquote - ZA

Swissquote - ZA

|

1,000

4th

|

IC Markets - Australia

IC Markets - Australia

|

6,600

5th

|

Swissquote - Australia

Swissquote - Australia

|

320

6th

|

IC Markets - US

IC Markets - US

|

6,600

7th

|

Swissquote - US

Swissquote - US

|

1,000

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 531,000 for Swissquote.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: IC Markets

A diverse product lineup and comprehensive CFD markets are crucial for an enriching trading experience. Both IC Markets and Swissquote offer an impressive array of financial instruments, empowering traders to diversify their portfolios and effectively respond to fluctuating market conditions.

IC Markets grants access to more than 60 forex pairs along with an extensive selection of commodities, indices, bonds, cryptocurrencies, and futures, making it an ideal platform for active traders. In contrast, Swissquote goes beyond forex and CFDs by providing stocks, ETFs, and structured products, which appeal to traders seeking long-term investment opportunities alongside active trading strategies. This broad market coverage allows traders to seamlessly adapt to evolving trends.

| CFDs | IC Markets | Swissquote |

|---|---|---|

| Forex Pairs | 61 | 80 |

| Indices | 25 | 10 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 10 |

| Cryptocurrencies | 23 | 0 |

| Share CFDs | 2100+ | 15 |

| ETFs | No | 0 |

| Bonds | 9 | 5 |

| Futures | Yes | 5 |

| Treasuries | 9 | 5 |

| Investments | Yes | 5 |

Our Top Product Range and CFD Markets Verdict

Our dedicated team of experts can surmise that IC Markets steals the show in this stage due to their top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources: IC Markets

A diverse product offering and access to extensive CFD markets are essential for traders aiming to diversify their portfolios and take advantage of market fluctuations. Both IC Markets and Swissquote provide an impressive array of assets, including forex pairs, commodities, indices, and cryptocurrencies, ensuring that traders have ample opportunities to adapt their strategies according to market dynamics.

Moreover, education is vital for achieving long-term success in trading. IC Markets offers webinars, comprehensive articles, and trading guides tailored to both novice and seasoned traders. Meanwhile, Swissquote is renowned for its institutional-grade insights, providing robust market research, trading courses, and expert analysis that empower traders to make well-informed decisions. By merging a wide range of assets with high-quality educational resources, both brokers enable traders to refine their skills and confidently navigate the ever-evolving forex landscape.

IC Markets offers a robust set of educational resources that include webinars, tutorials, and even a demo account for hands-on practice. These resources are designed to cater to traders of all levels, from novices to experts.

IC Markets focuses on webinars and tutorials, which are excellent for beginners looking to get their feet wet.

Swissquote offers in-depth research reports, catering more to advanced traders who require deep market insights.

Both brokers provide market analysis, an essential tool for traders aiming to make informed decisions.

IC Markets offers a demo account, a fantastic learning tool that allows traders to practice without risking real money.

Swissquote offers trading courses, beneficial for traders aiming to upskill.

Both brokers have FAQs and glossaries, great for quick reference and to clear any trading-related doubts.

Our Superior Educational Resources Verdict

Evidently, IC Markets takes the spotlight in this category on the account of their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

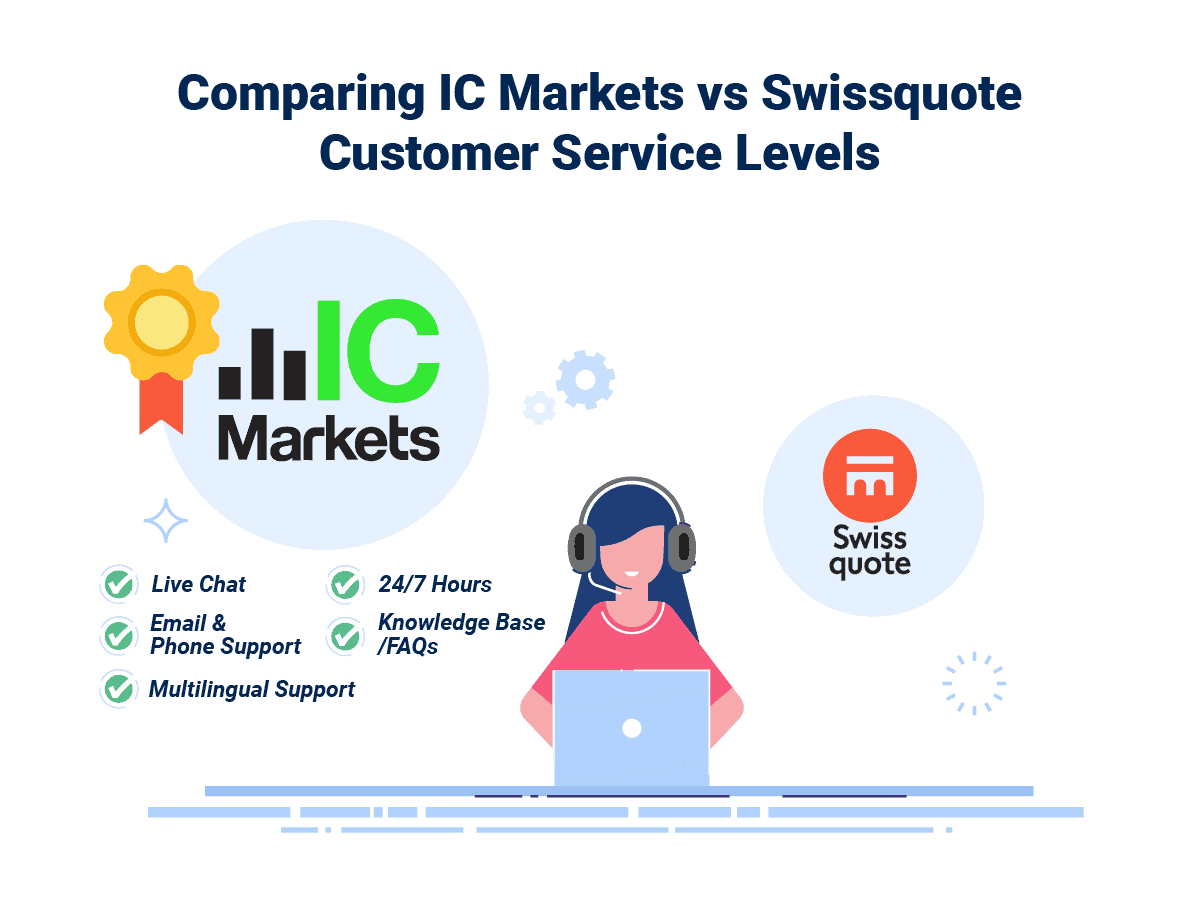

9. Superior Customer Service: IC Markets

Exceptional customer support is a pivotal factor in forex trading, delivering traders timely assistance and expert guidance for a seamless trading experience. Both IC Markets and Swissquote recognize the importance of client support, offering live chat, phone, and email options to assist traders with technical issues, account management, and market inquiries.

IC Markets stands out with its 24/7 multilingual support, catering to traders around the globe with quick response times and knowledgeable staff. Meanwhile, Swissquote, as a FINMA-regulated bank, guarantees top-tier customer service, providing dedicated account managers for premium clients—thereby fostering trust and reliability. Robust support significantly boosts trader confidence, enabling them to concentrate on executing profitable trades.

In forex trading, swift and dependable customer support is crucial, especially when dealing with major currencies like EUR, USD, and AUD, where market fluctuations can be rapid and unpredictable.

IC Markets excels with its 24/7 customer support, guaranteeing that traders in various time zones have access to assistance whenever they need it. Whether faced with technical difficulties, account inquiries, or market-related questions, traders can obtain immediate help through live chat, phone, or email.

Conversely, Swissquote offers high-quality support, though it is restricted to business hours. While their dedicated account managers provide a personal touch, traders in urgent need of assistance outside these times may encounter delays.

For those who require continuous market access, IC Markets clearly surpasses in both availability and responsiveness, whereas Swissquote focuses on delivering a more personalized, albeit scheduled, support experience.

| Feature | IC Markets | Swissquote |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Apparently, IC Markets come up trumps in this portion in light of their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options: IC Markets

For forex traders, particularly those engaged in EUR, USD, and AUD transactions, having diverse deposit and withdrawal options is essential. An efficient funding process guarantees quick access to capital and ensures smooth trading execution.

IC Markets stands out with its extensive array of funding methods, which includes bank transfers, credit and debit cards, e-wallets such as PayPal, Skrill, and Neteller, as well as cryptocurrencies. This broker is celebrated for its zero deposit fees and rapid processing times, making it an ideal choice for traders seeking cost-effective transactions.

On the other hand, Swissquote, as a Swiss-regulated bank, offers secure and dependable funding options that include bank transfers and credit/debit cards. However, its selection of e-wallets is limited, and transaction fees are generally higher. While the robust banking infrastructure offers an added layer of security, traders may face longer processing times compared to those experienced with IC Markets.

In terms of speed and affordability, IC Markets clearly has the upper hand. Conversely, for those who prioritize regulatory protection and security, Swissquote’s bank-level safeguards may be more appealing despite the potential delays in transaction speed.

Both brokers offer a variety of funding options, but IC Markets has a slight edge due to its more flexible methods. From traditional bank transfers to modern eWallets, IC Markets offers a plethora of options to suit every trader’s needs.

| Funding Option | IC Markets | Swissquote |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | No |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

IC Markets, clearly, come out on top due to their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit: IC Markets

For forex traders focusing on EUR, USD, and AUD, the minimum deposit requirement can significantly influence their choice of broker. Lower deposit thresholds facilitate entry for novice traders, allowing them to engage in the market with minimal risk, while seasoned traders can explore a platform before investing more substantial capital.

IC Markets stands out with a minimum deposit of just $200 (or its equivalent in EUR/AUD), making it an attractive option for traders of all experience levels. This broker provides both beginners and professionals with tight spreads and rapid execution speeds, all without demanding a significant initial investment.

In contrast, Swissquote, a bank-backed broker, imposes a higher entry requirement with minimum deposits beginning at $1,000 (or equivalent in EUR/AUD). While this might discourage novice traders, it tends to appeal to institutional clients and high-net-worth individuals who appreciate Swissquote’s reputable regulatory standing and top-tier services.

For traders seeking a cost-effective start in forex trading, IC Markets presents a more manageable entry point, whereas Swissquote caters to those who prioritize the security of bank-level backing and sophisticated financial services over lower costs.

IC Markets is incredibly accessible with no minimum deposit requirement, making it an excellent choice for traders who are just starting out or those who prefer to trade with smaller amounts. Swissquote, on the other hand, requires a minimum deposit of $1,000, which could be a barrier for some traders.

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| Swissquote | $1,000 | $0 |

Our Lower Minimum Deposit Verdict

IC Markets, obviously, is victorious in this category due to their lower minimum deposit.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Swissquote Or IC Markets?

IC Markets is on top of the world at this moment because it offers lower spreads, a robust trading platform, and a more comprehensive range of trading instruments. The table below summarises the key factors that led us to this conclusion.

| Categories | IC Markets | Swissquote |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Best For Beginner Traders

For beginners, IC Markets is the better choice due to its user-friendly platform and educational resources.

Best For Experienced Traders

For the pros, IC Markets takes the cake with its advanced trading features and lower spreads.

FAQs Comparing IC Markets vs Swissquote

Does Swissquote or IC Markets Have Lower Costs?

IC Markets has lower costs. They offer spreads starting from 0.0 pips on major currency pairs, while Swissquote’s spreads start at 1.3 pips. For more on low-cost brokers, visit our Lowest Spread Forex Brokers page.

Which Broker Is Better For MetaTrader 4?

IC Markets is your go-to for MetaTrader 4. They offer a seamless MT4 experience with a range of customisable features. Check out our best MT4 brokers for more details.

Which Broker Offers Social Trading?

Neither IC Markets nor Swissquote offer social trading. If social trading is your thing, you might want to look elsewhere. Here’s our guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither IC Markets nor Swissquote offer spread betting. For those interested, here’s our list of best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is superior for Australian traders. They are ASIC-regulated and offer a comprehensive trading experience. For more, visit our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For UK traders, I’d recommend IC Markets. They are FCA-regulated and offer a robust trading platform. For more, check out our best UK Forex brokers page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert