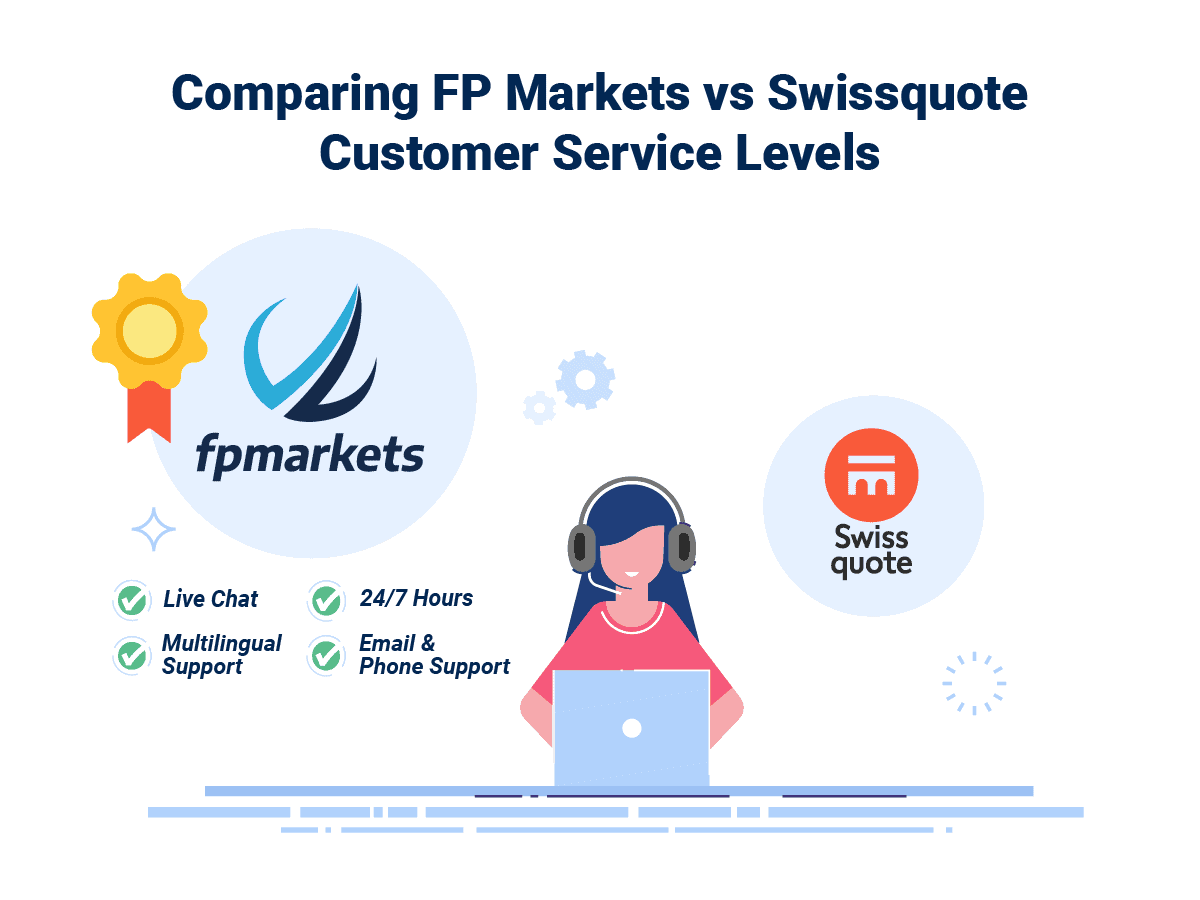

FP Markets vs Swissquote 2024

This FP markets vs Swissquote forex broker review found spreads with FP markets are lower starting from 0 pips and US 6.00 commission with their RAW Account which is superior to 1.1 pips and no commission with Swissquote.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert