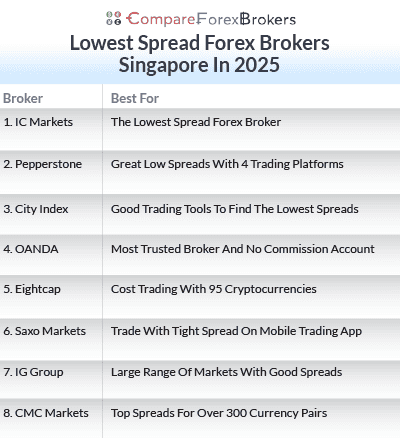

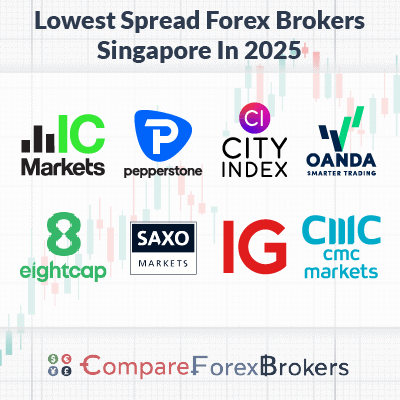

Singapore Lowest Spread Forex Brokers

To help reduce brokerage we compared the best low-spread forex brokers that cater for Singaporean CFD traders factoring in commissions and other fees. Other factors such as the forex platform were also considered to determine the best lowest spread forex broker.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The best low spread forex broker for Singapore traders by category are shown below.

- IC Markets - The Lowest Spread Forex Broker

- Pepperstone - Great Low Spreads With 4 Trading Platforms

- City Index - Good Trading Tools To Find The Lowest Spreads

- OANDA - Most Trusted Broker And No Commission Account

- Eightcap - Cost Trading With 95 Cryptocurrencies

- Saxo Markets - Trade With Tight Spread On Mobile Trading App

- IG Group - Large Range Of Markets With Good Spreads

- CMC Markets - Top Spreads For Over 300 Currency Pairs

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

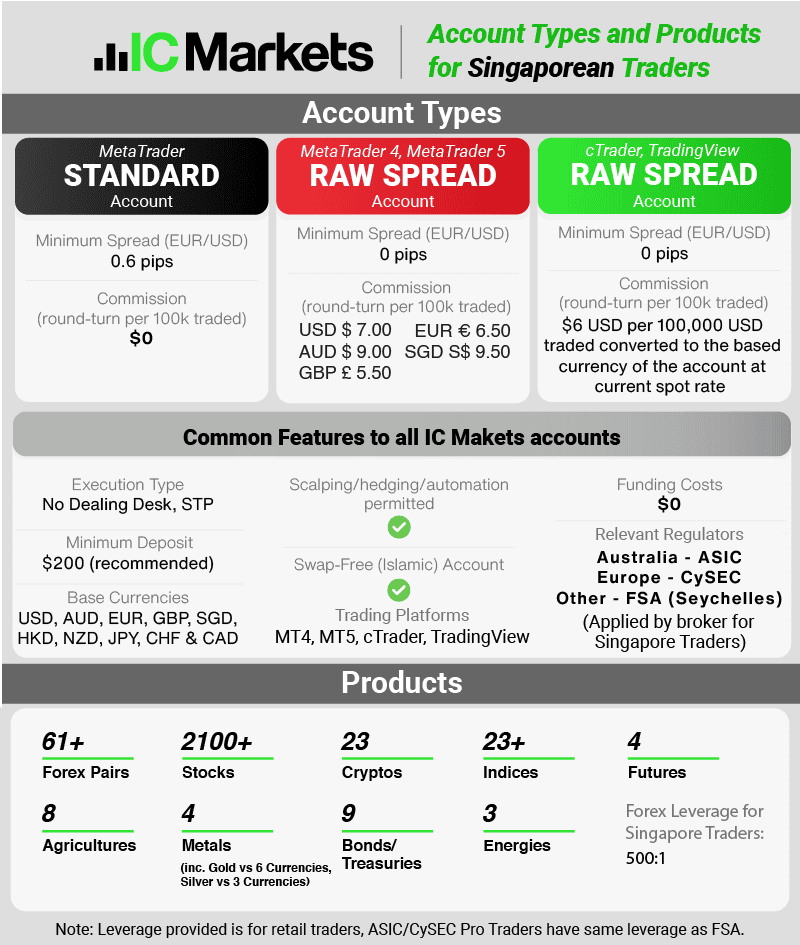

1. IC Markets - The Lowest Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We consider the CFD Broker IC Markets the best because of their extremely tight spreads and low fees. They offer an average spread of 0.76 pips on the top 5 most traded currency pairs for their standard account and 0.16 pips for their Razor or RAW account both well above the industry average of 1.52 pips and 0.44 pips respectively.

When you combine these low spreads with a choice of 3 trading platforms – MetaTrader 4, MetaTrader 5, cTrader and TradingView and 2250+ tradeable instruments we think IC Markets is a worthy winner as the best broker.

Pros & Cons

- Very low-cost broker

- Offers all major third-party trading platforms

- Does not require a minimum deposit

- Excellent 24/7 customer support and FAQs knowledge base

- No deposit and withdrawal fees

- They are not regulated by the MAS

- Execution speeds could be better

- They are licensed by very few regulators

- Their educational materials are not extensive

Broker Details

Spreads With IC Markets

To test spread with IC Markets, we opened a Standard account to test IC Market’s spreads and asked our analyst, Ross Collins, to get the average spreads for the FX majors over a trading day using MT4. The test results were impressive as Ross found that IC Markets had the lowest average spreads on EUR/USD at 0.73 pips, 34% lower than the industry average of 1.11 pips.

We also found that IC Markets had the lowest average spreads for USD/CAD (1.00 pip) and USD/JPY (1.09 pips). When we combined the average of all the combined spreads on the majors we tested, IC Markets averaged 1.03 pips, making them the cheapest for the standard account.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

If you want access to tighter spreads, we found the RAW account provided spreads averaging 0.02 pips, with a commission of $3.50 per lot traded when using their platforms MT4, MT5, cTrader and TradingView.

Copy Trading With IC Markets

During our testing, we found that the broker has a decent range of trading tools like popular copy trading platforms ZuluTrade and MyFXBook, which are helpful if you are new to trading. Plus, we like that they provide Autochartist and Trading Central, as these tools can scan the markets for new trading opportunities that you can plug into your MetaTrader 4 or 5 platform.

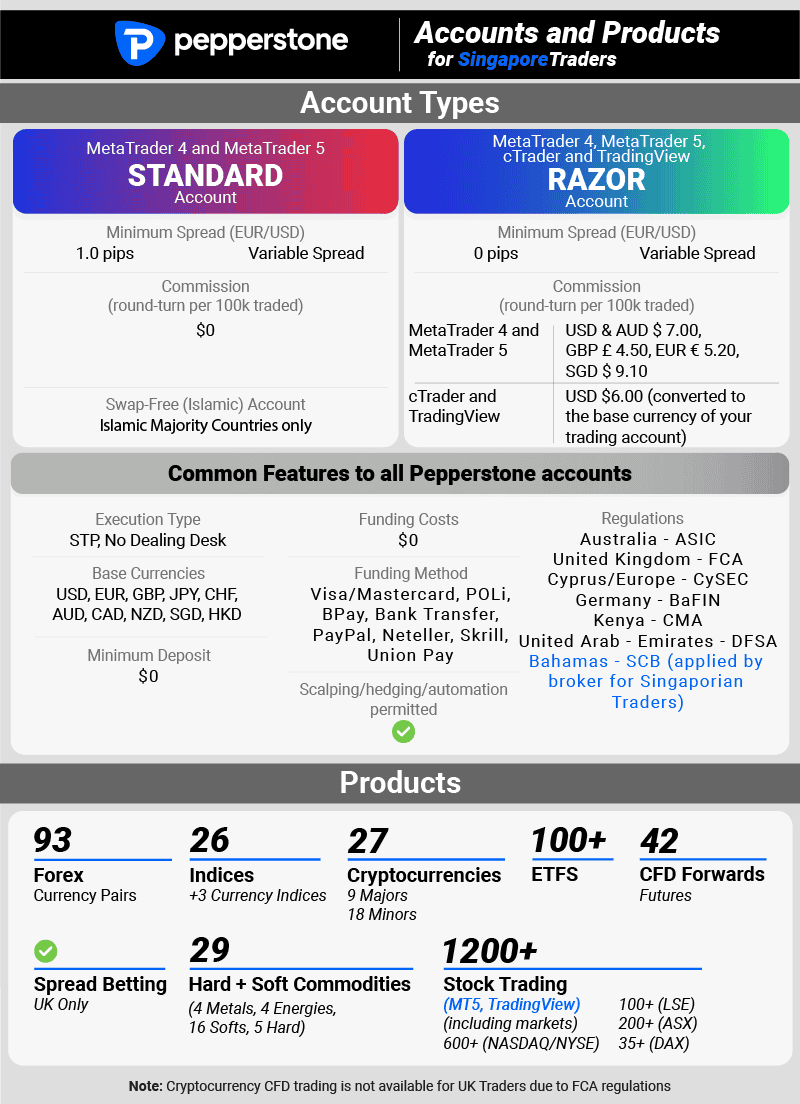

2. Pepperstone - Great Low Spreads With 4 Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

What we like most about Pepperstone is that they offer 4 major trading platforms – MT4, MT5, cTrader, and TradingView. This means you can pick a trading platform that suits your trading style. We like MetaTrader 4 and 5 because they have expert advisors to create automation features and customer indicators along with TradingView for their 15+ charts and 100+ technical indicators.

We recommend Pepperstone because they offer excellent raw spreads with their Razor account. Ross Collins tested the spreads of 20 MT4 brokers and found Pepperstone has an average spread of EUR/USD 0.36 pips for the EUR/USD pair comfortably making them one of the cheaper brokers.

Pros & Cons

- They offer the SGD as a base currency.

- No minimum deposit when opening a Raw account.

- Very fast execution speeds.

- All major third-party trading platforms are available.

- Their educational materials could be better.

- They are not regulated by the MAS.

- They don’t offer a fixed spread account.

Broker Details

Trading Platforms With Pepperstone

We like it when a broker gives you a preference for trading platforms, which is why we highly rate Pepperstone, as they provide MetaTrader 4, MetaTrader 5, cTrader, and TradingView. You can also use Capitalise.ai to automate your trading with MetaTrader 4.

To set up the MetaTrader 4 platform, we used our RAW trading account to execute a few trades and get a feel for the platform. We found that the platform has 23 analytical and 30 tech indicators such as Ichimoku, RSI, and MACD.

If you want more advanced indicators, MT4 allows you to install custom indicators, which you can program with MQL4 or install from the MetaQuotes Marketplace.

What stood out for us was the one-click trading feature you can turn on, and we used this while executing our trades. You can set up your default lot size (ours was 0.10), and when you hit the sell or buy button, it will do a market execution with that lot size.

We think this is useful if you day trade or are a scalper who needs to place trades frequently, as this feature is a lot faster than opening and ordering through the traditional trade ticket route.

Pepperstone Has 0 Pips Spreads

Based on our tests, the spreads on the RAW account are low, averaging 0.19 pips for EUR/USD and 0.36 pips for USD/JPY. Our analyst Ross Collins to test how often Pepperstone offers 0.0 pips and compare it to the rest of the industry.

In our zero-pip test, Ross Collins found that Pepperstone offered its spreads at 0.0 pips on EUR/USD 100% of the time, meaning you only pay commission when you trade. We think this is excellent as it reduces your trading costs and keeps them predictable as the commission doesn’t change.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

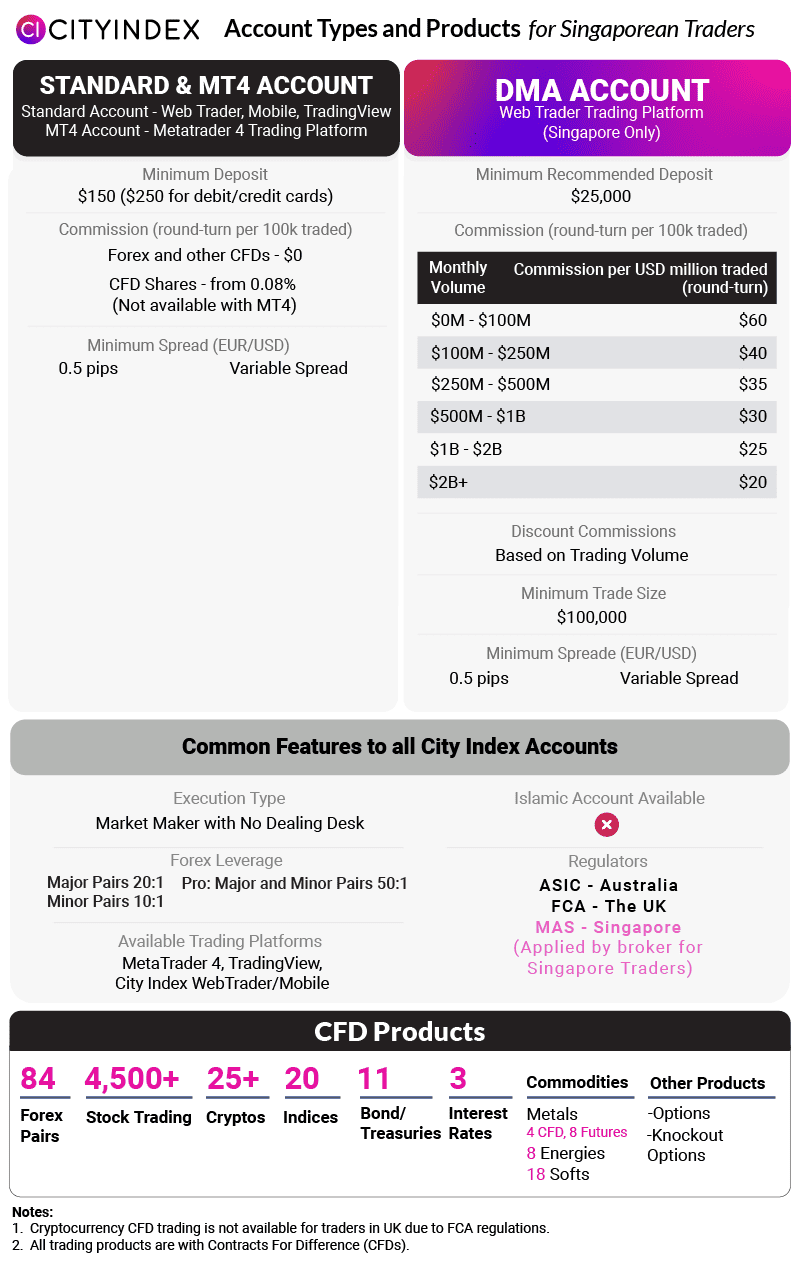

3. City Index - Good Trading Tools To Find The Lowest Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.07

GBP/USD = 0.011

AUD/USD = 0.8

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

City Index combined good trading tools with low spreads as a market maker. Their City Index trading Platform comes with 3rd party tools to help you identify trading opportunities, a trading coach and a guaranteed stop-loss order for risk management. The broker also offers MetaTrader 4 and TradingView platforms.

Most clients with City Index will sign up for their standard account spreads and the spreads are competitive. With an average of 1.24 pip across 5 major pairs (well below the industry average of 1.54 pip) you are getting good value when you trade.

Pros & Cons

- Low-cost forex broker

- Regulated by the MAS of Singapore

- Excellent Customer Support with Dedicated Account Manager

- Good execution speeds

- Does not offer swap-free accounts.

- Accepts very few payment providers such as Paypal or Neteller.

- No customer support on weekends.

- Does not offer MT5 or cTrader

Broker Details

City Index Trading Platforms has Smart Signals

We were impressed with City Index’s range of trading tools that impacted all aspects of your trading. For example, one trading tool offered is SMART Signals, which uses 800+ price action patterns to scan and analyse the markets daily.

We like that it offers a hit rate stat for a quick overview of the SMART signal’s previous success. This can help give you a quick snapshot of the signal and whether it is worth taking.

Another excellent tool we liked was the Performance Analytics tool, which collects the data from your trading and gives you feedback in real-time on your performance and discipline.

What stood out for us is the feature that analyses your trading day. We like that you can click a button, and it takes all of your performance data and outputs a report highlighting details like how many trades hit your take profit. We think this is important information as it can tell you if you are exiting your trades too early and potentially optimise your exit strategy.

Spreads With City Index

We found City Index’s spreads competitive, averaging 0.7 pips with no commission on EUR/USD, which is 44%% lower than the industry average we’ve tested.

| Broker | Avg. Spread EUR/USD |

|---|---|

| OANDA | 0.60 |

| IC Markets | 0.62 |

| City Index | 0.70 |

| Eightcap | 1.00 |

| Pepperstone | 1.12 |

| CMC Markets | 1.12 |

| IG Group | 1.13 |

| Saxo Markets | 1.20 |

During our testing, we found City Index had an impressive selection of markets available, covering 84 currency pairs, 4,500+ stocks, 20 indices, 30 commodities, and 25+ crypto markets.

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

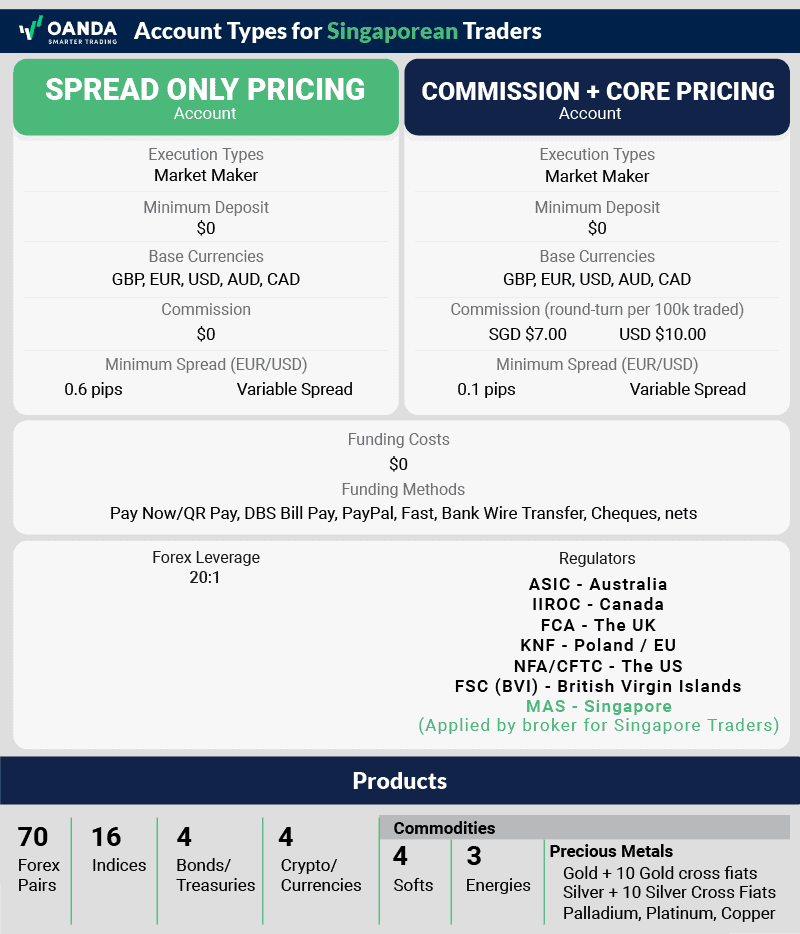

4. OANDA - Most Trusted Broker And No Commission Account

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend Oanda because not only is it regulated by the MAS of Singapore, but it holds several licenses from reputed financial authorities such as the FCA of the UK and the ASIC of Australia.

According to data from their website, the average Standard spread they charge for the top five most traded major currency pairs clocks in at 0.70 pips which is one of the lowest we have ever seen. According to our test, they offered a spread of 1.54 pips for trading the benchmark EUR/USD currency pair.

Pros & Cons

- No minimum deposit.

- MAS-regulated broker.

- Offers a dedicated account manager.

- Licensed by the FCA and ASIC.

- No swap-free account and no fixed spread account.

- They don’t offer the MT5 or the cTrader.

- Do not accept payments through PayPal, Neteller, or Skrill.

- No customer support on weekends

Broker Details

OANDA was established in 1996, making it one of the oldest brokers on our list. Our tests found that the broker is regulated by five tier-1 regulators, who are:

- Monetary Authority of Singapore (MAS)

- Australian Investment and Securities Commission (ASIC)

- Financial Conduct Authority (FCA)

- Canadian Investment Regulatory Organisation (CIRO)

- US regulators NFA/CFTC

Given the broker’s age and high regulation, we think OANDA is a worthy winner for most trusted broker in the industry.

Spreads With OANDA

With almost 30 years of experience in the forex industry and being regulated by multiple authorities in different jurisdictions, these are huge trust signals we look for in a broker. This is why we scored OANDA 100/100 in our Trust category tests, the only broker to achieve this.

To get a picture of OANDA’s standard account spreads, we collected the average spreads across the top five majors and calculated their total average. This resulted in OANDA having an average spread of 0.7 pips across its major pairs, the lowest we’ve tested, beating the industry average by more than 50% at 1.54 pips.

What this means for you is that if you trade all the major currency pairs, then OANDA is the lowest overall.

| Top 5 Most Traded Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| OANDA | 0.70 |

| IC Markets | 0.76 |

| Fusion Markets | 0.99 |

| Admirals | 1.04 |

| Eightcap | 1.06 |

| Go Markets | 1.08 |

| OctaFX | 1.10 |

| TMGM | 1.16 |

| FIBO Group | 1.18 |

| Trading212 | 1.22 |

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| City Index | 1.24 |

| HYCM | 1.24 |

| Industry Average | 1.52 |

OANDA Trading Platforms

OANDA offers a selection of trading platforms, including TradingView, MetaTrader 4, and its proprietary OANDA Trade platform. We liked the OANDA Trade platform as it had a couple of quality-of-life features that are missing with popular platforms like TradingView, such as the default order trade template.

This setting allows you to set your default lot size, fixed stop loss and take profit levels, which is helpful as it can help you prevent mistakes by accidentally adding an extra 0 to your lot stop loss, which could cost you.

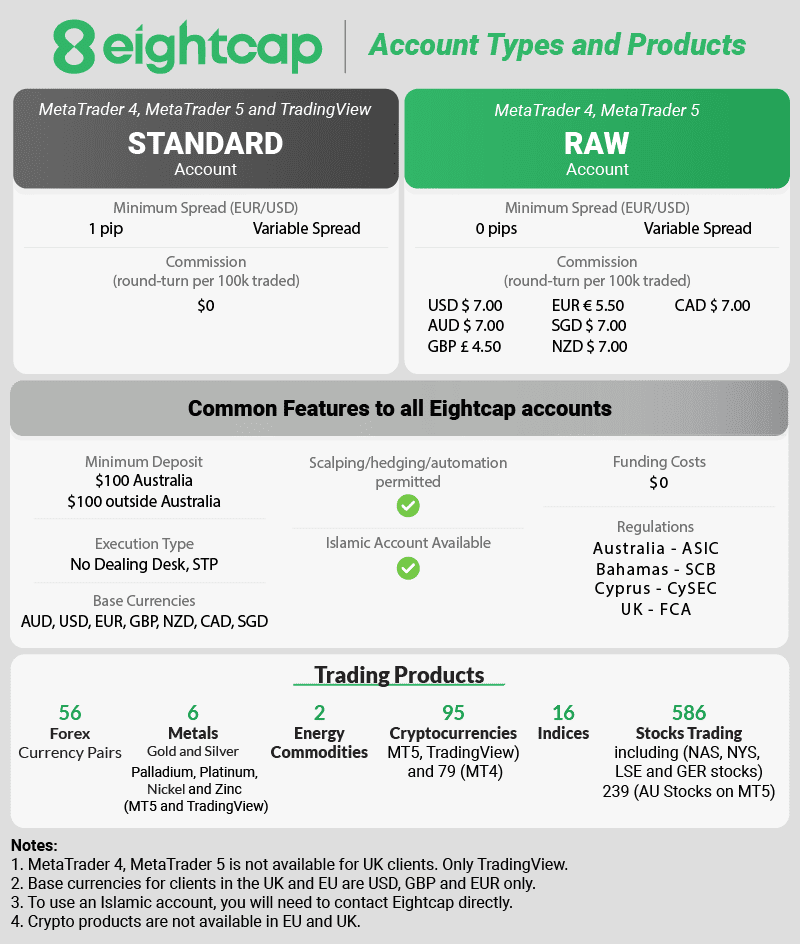

5. Eightcap - Top Low-Cost Trading With 95 Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

With 95 crypto products we recommend Eightcap for crypto trading this is far more than the 10-20 cryptos most other brokers offer. Eightcap also has a large range of other financial instruments including 56 currency pairs and 586 stocks along with a few indices, energy commodities, and metals.

You can trade with MetaTrader 4, MetaTrader 5, TradingView and they even have Captialise.ai for code-free automation.

Pros & Cons

- Tight Raw and Standard spreads.

- A high number of cryptocurrency products.

- Decent commission of $3.5 per side.

- Offers MT4, MT5, and TradingView.

- Not regulated by the MAS.

- Does not have a proprietary trading platform.

- Very high minimum deposit.

- No swap-free accounts or fixed spread accounts

Broker Details

Eigthcap Gives You A Choice Of Platforms For Crypto and Forex Trading

If you want access to crypto markets, then Eightcap is an excellent choice. While exploring the broker’s standard account, we found that they offered 95 crypto markets, including Bitcoin, Ethereum, and Litecoin, offering the most markets out of all the brokers we’ve tested.

We also found that Eightcap gives you a decent choice of trading platforms to access the crypto markets. You can choose from TradingView, MetaTrader 4, MetaTrader 5, and Capitalise.ai platforms.

What stood out for us was that Eightcap offers Capitalise.ai, a tool that lets you automate your trades without knowing any code. We used our Eightcap account to test Capitalise.ai, which allowed us to generate our first strategy in 5 minutes thanks to their interactive step-by-step tutorial.

You can even forward-test the strategy on the live markets to see how it performs in real-time, and Capitalise.ai will report back all the stats. We think this is excellent as you can use the feedback to optimise your strategies without risking your money.

Eightcap Accounts and Spreads

We like that Eightcap gives you a choice for trading accounts by offering a RAW (tight spreads + commission) and a Standard (no-commission) account. We asked our analyst, Ross Collins, to test the average RAW spreads for Eightcap and compare it with the rest of the industry. He found that Eightcap averaged 0.2 pips on EUR/USD, which was only 0.01 pip behind IC Markets in the tests.

| EURUSD | Average Spread |

|---|---|

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| EightCap | 0.2 |

| CityIndex | 0.22 |

| CMC Markets | 0.44 |

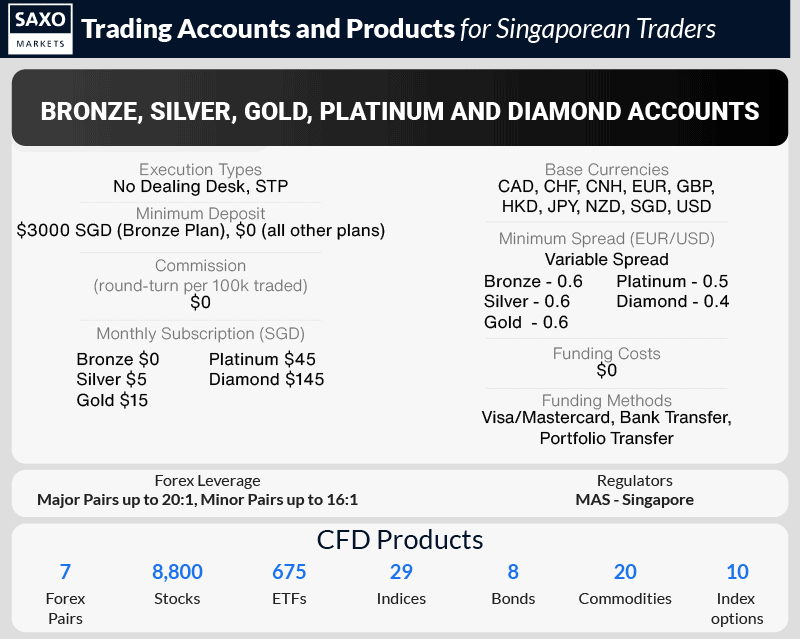

6. Saxo Markets - Trade With Tight Spread On Mobile Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.7

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$0

Why We Recommend Saxo Markets

We recommend Saxo Markets primarily for their mobile trading app SaxoTraderGo which offers a convenient way for traders to access the financial markets while they’re on the move. The app is available on both Android and iOS devices. They offer decent technical analysis tools such as live charts, annotations, and automated Trade Signals. If you want something else, the reliable MT4 and TradingView are also available.

Other good reasons to sign up with Saxo Markets include the fact that they are licensed by the MAS of Singapore so they are safe for traders from Singapore and they offer a great range of stock CFDs with 8,800 options.

Pros & Cons

- A high number of stock trading CFDs.

- Excellent proprietary mobile trading app

- Regulated by the MAS.

- Dedicated account manager

- No zero-spread account for high-volume traders

- No MT5 or cTrader

- Requires a minimum deposit of $100

- Limited alternative payment options

Broker Details

SaxoTradeGo Trading Platform And App

We think Saxo Markets has the best mobile trading app with its SaxoTraderGO platform, which is available on Android and iOS. After downloading the app to our phone and logging into SoxoTraderGO, we found it offered 40+ indicators, five chart types, and 20+ time frames.

Impressively, the mobile app allowed you to view its trading signals from AutoChartist, which is something normally reserved for the web platform. In fact, we noticed that you could use all the same features from the web platform on the mobile app, something we’ve not experienced before from a forex broker.

Spreads With Saxo

While exploring the SaxoTraderGO platform, we found Saxo’s spreads decent, averaging 1.2 pips on EUR/USD, slightly lower than the industry average. However, we were surprised by a large broker like Saxo Markets having wider spreads for USD/JPY and GBP/USD – we had expected them to be lower.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | |

|---|---|---|---|---|---|

| Saxo Markets | 1.2 | 1.8 | 1.8 | 0.9 | 1.7 |

| Industry Average | 1.24 | 1.44 | 1.57 | 1.54 | 1.82 |

Our testing also found that Saxo Markets had a solid choice of financial instruments covering 185 forex pairs, 8,800+ stocks, 29 indices, and 20 commodities. This is an impressive choice as most brokers offer less than 2,000 markets from our testing.

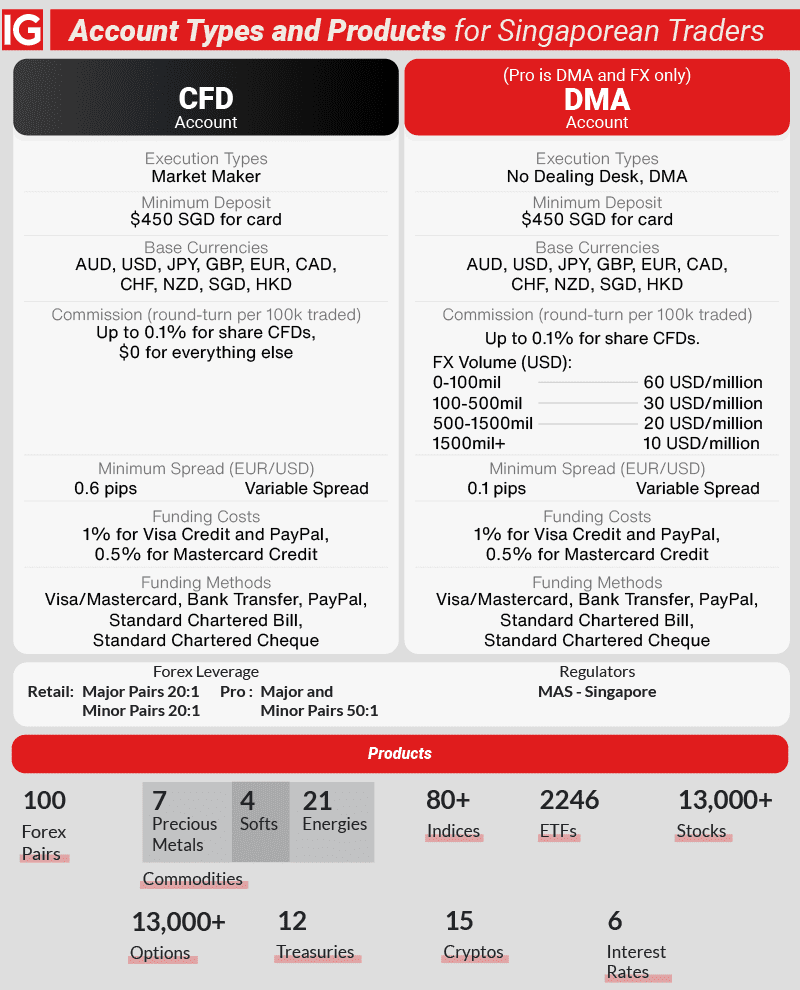

7. IG Group - Large Range Of Markets With Good Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We recommend IG Group primarily because of the wide range of markets that they offer. Most forex traders will like that they offer 100 currency pairs but IG goes beyond that. They offer 13,000+ stocks, 13,000+ options, 2,246 ETFs, 80+ indices, and a lot more including cryptocurrencies.

Most traders will trade using IG Groups’ commission-free standard account and for commission-free trading, IG Group averages 1.13 pips for the EUR/USD pair, 1.01 for AUD/USD and 1.71 for EUR/GBP.

Pros & Cons

- Wide range of trading instruments

- No minimum deposit for the Standard account

- Regulated by the MAS of Singapore

- Very high commission

- No MT5, cTrader, or TradingView

- $450 minimum deposit for Raw account

Broker Details

Trading Markets With IG Group

Of all the brokers we’ve tested, IG Group had the most financial markets, with over 17,000. We found that IG Group offered 100 forex pairs, 12,000+ stocks, 130 indices, 41 commodities, 6,000+ bond markets, and 7,000 options markets. So, if you like to trade multiple markets, we think IG Group will have you covered.

We also found the spreads fairly competitive, averaging 1.13 pips on EUR/USD with no commission. This puts it in line with CMC Market’s standard account spreads of 1.13 pips and below the 1.24 pips industry average.

IG Group’s spreads are fairly competitive, and we found them averaging 1.13 pips on EUR/USD commission-free, better than the industry average of 1.24 pips.

| Broker | Total Range of CFD Markets |

|---|---|

| IG Group | 17,000+ |

| CMC Markets | 13,000+ |

| Saxo Markets | 8,800+ |

| City Index | 4,600+ |

| IC Markets | 1,700+ |

| Pepperstone | 1,200+ |

| Eightcap | 700+ |

| OANDA | 100+ |

IG Group Trading Platform

IG Group gives you access to a variety of platforms, which are IG Trading Platform, ProRealTime, MetaTrader 4, and L2 Dealer. If you want access to IG’s full spectrum of markets, you must choose IG Trading Platform, as the other platforms have limited access.

What stood out for us was the ProRealTime platform, which is similar to MetaTrader 4 in features but isn’t as popular. The platform has 53 indicators, 12 chart types, and a proprietary ProRealTrend tool, generating real-time automated support, resistance levels, and trend lines.

We like the ProRealTrend tool as it saves time finding your levels and automatically considers major price levels from higher timeframes.

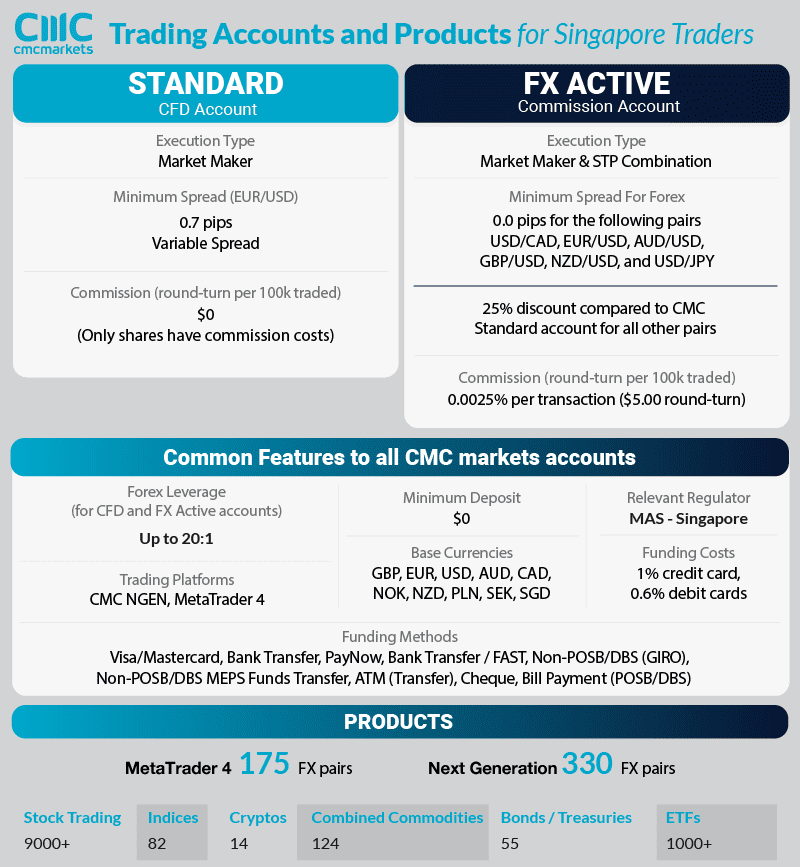

8. CMC Markets - Top Spreads For Over 300 Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We recommend CMC Markets because of the low commission of USD 2.5 that they charge which is better than the average 3.5 USD charged by most other brokers.

Another good reason to trade through CMC Markets is their incredible range of 175 currency pairs available when trading through MetaTrader 4 and 330 currency pairs when trading through the Next Generation trading platform. They also do well in terms of other instruments which include 14 cryptocurrencies.

Pros & Cons

- Wide range of currency pairs

- Regulated by the MAS

- SGD as a base currency

- No minimum deposit

- Charges a deposit fee

- Slow execution speeds

- No MT5, cTrader, or TradingView

- Average customer support

Broker Details

CMC Markets Has A Large Range Of Trading Products With NGEN Platform

Like IG Group, CMC Markets has an impressive trading product catalogue, including 330+ currency pairs, 9,000 stocks, 20 indices, 11 bonds, and 30 commodities. If you want access to the full range of currency markets, you’ll need to use the NGEN platform. This is the default platform for CMC Markets and has 80+ indicators (including technical and price action-based indicators) and 13 chart types.

MetaTrader 4 and TradingView are alternative platforms available, but these do not have all 330+ currency pairs on the market. We found both platforms were limited to around 180+ pairs – which is still a lot.

Testing The FX Active Account With CMC Markets

We decided to open the FX Active account, which offers spreads from 0.0 pips on six pairs of forex with a commission. Our tests found that the average spread on EUR/USD was 0.44 pips, better than their Standard account spreads of 0.8 pips.

The commission for the FX Active is $2.50 per lot traded, which is very competitive compared to the rest of the industry, which averages $3.48 per lot. As you can see in the table below, CMC Markets, with its FX Active account, has the lowest commission costs out of the Singapore brokers we’ve tested.

| Broker | USD |

|---|---|

| CMC Markets | $2.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

We think commission-based accounts are ideal if you scalp or automate your trades, as the commission brings a predictable cost, even during volatile markets, while accessing the tightest spreads.