OANDA Review

OANDA offers 68 spot forex pairs with no commission, along with rebates with their Elite account. In addition to competitive spread,s you can choose from top platforms like OANDA Trade, MT4, and TradingView.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

OANDA Corporation 2026

US-based FX broker OANDA has been around since 1996, making it one of the more established online brokerages we cover. With more than 65 currency pairs, three trading platforms and, most importantly, they are registered with the Commodities Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA), OANDA makes a great starting point for Americans ready to explore online forex trading.

- Over 65 currency pairs, including majors and minors

- Choice of three trading platforms, including MetaTrader 4

- STP-style trading with the Elite Trader Account

- Limited product offering: only forex and crypto*

- No negative balance protection

- No guaranteed stop-loss order

*Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA.

Our analysis takes into account the key features of any regulated forex broker, as well as unique tools and resources that may make a particular brokerage stand out. You can read more about our methodology here. We also conduct our own testing to verify individual broker claims. Ross Collins, our Chief Technology Researcher, draws on over three decades of experience in information technology and trading to design our independent assessments.

OANDA Corporation Key Features Snapshot

| 🗺️ Country Regulation | US, UK, Australia, Singapore, Canada, Malta, Japan, British Virgin Islands |

| 💰 Trading Fees | Low Spreads for the Standard Account and Elite Trader Account |

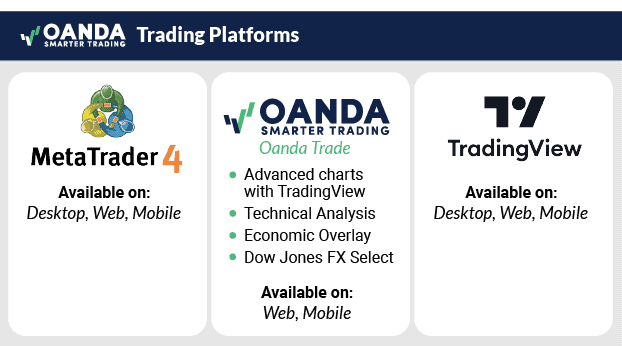

| 📊 Trading Platforms | OANDA Trade; MetaTrader 4; TradingView |

| 💰 Minimum Deposit | $0 |

| 💰 Funding Fee | $0 |

| 🛍️ Trading Products Offered for Americans | Forex and cryptocurrencies* |

*Note | Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA. |

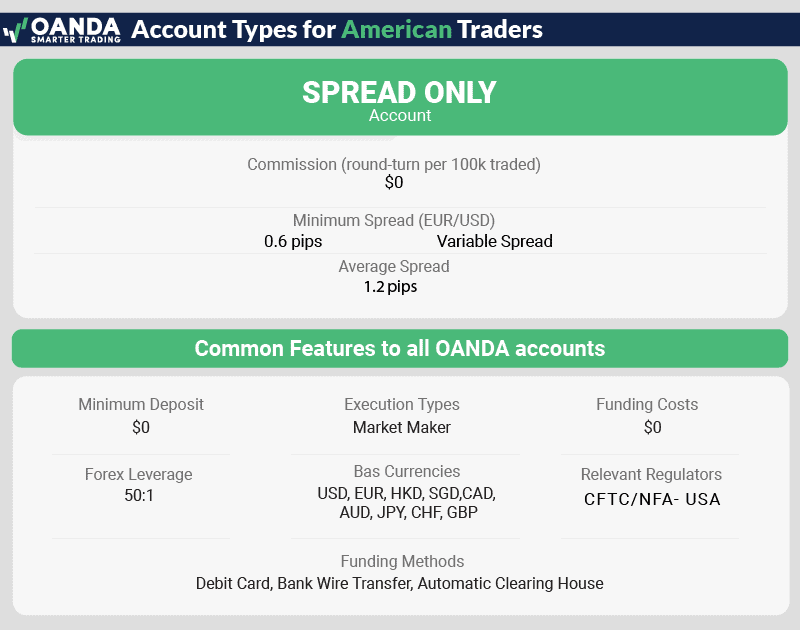

OANDA Corporation Account Types

OANDA offers a single account type for American traders: a Spread Only account. With variable spreads starting at 0.6 pips and an included commission, this account makes calculating your trading costs straightforward and predictable.

Based on our analysis, OANDA Corporation remains largely consistent with its publicly posted historical Standard Account Spreads. Our testing shows that the Spread Only account averages 1.54 pips, which works out to USD 14.36 per trade. That means you only need the market to rise (or fall) by USD 14.36 before you begin generating a profit.

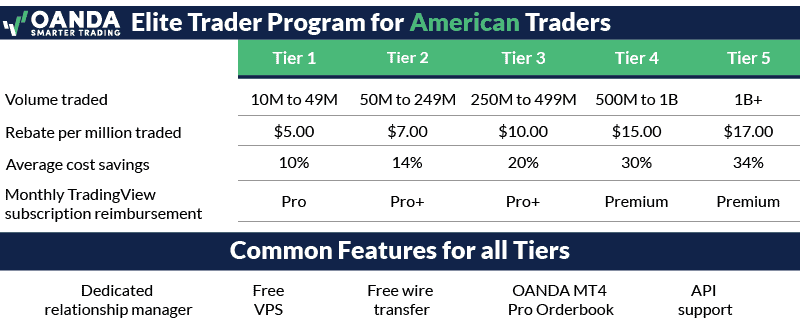

Elite Trader Program

OANDA Corporation also offers an advanced account for experienced traders: the Elite Trader account. To maintain an Elite Trader account, you’ll need to show proof of monthly trading volume in excess of USD 10 million, so it’s not for beginners. If you’ve already got significant trading experience under your belt, however, the rebate program might make you look twice.

In all cases, OANDA Corporation acts as a market maker, which means the broker may sit on the opposite side of some trades. While this does guarantee that your order will fill, it can also lead to slightly wider spreads than with brokers offering STP or ECN-style execution.

You can also try out a demo account for free if you’re not ready to commit. A demo account affords access to all of OANDA’s main trading platforms, which you can try out using USD 100 thousand in virtual currency.

OANDA Corporation was among the first brokers to use fractional pips when quoting spreads. Also known as pipettes, fractional pips are 1/10 of a pip which means more precise and tighter spreads as there is less rounding. Pipettes allow you to compare pairs out to five decimal places (with the exception of JPY, which can be viewed to three decimal places). Fractional pips make for more precise market analyses and more opportunities for profit – something we like very much in a broker focused so tightly on forex.

We also appreciate that OANDA allows you to input exact orders for some platforms (vs ordering by lots). A lot is considered 100,000 units, so with OANDA Trade, you enter your trade size in units, the minimum of which is 1 unit, equivalent to 1 EUR/USD. With MT4, the minimum trade size is 0.01 lots (equal to 1000 units on OANDATrade), and it increases from there.

Open A Demo AccountVisit OANDA

Affiliate receives a commission for accounts opened through the link on this page

The overall rating is based on review by our experts

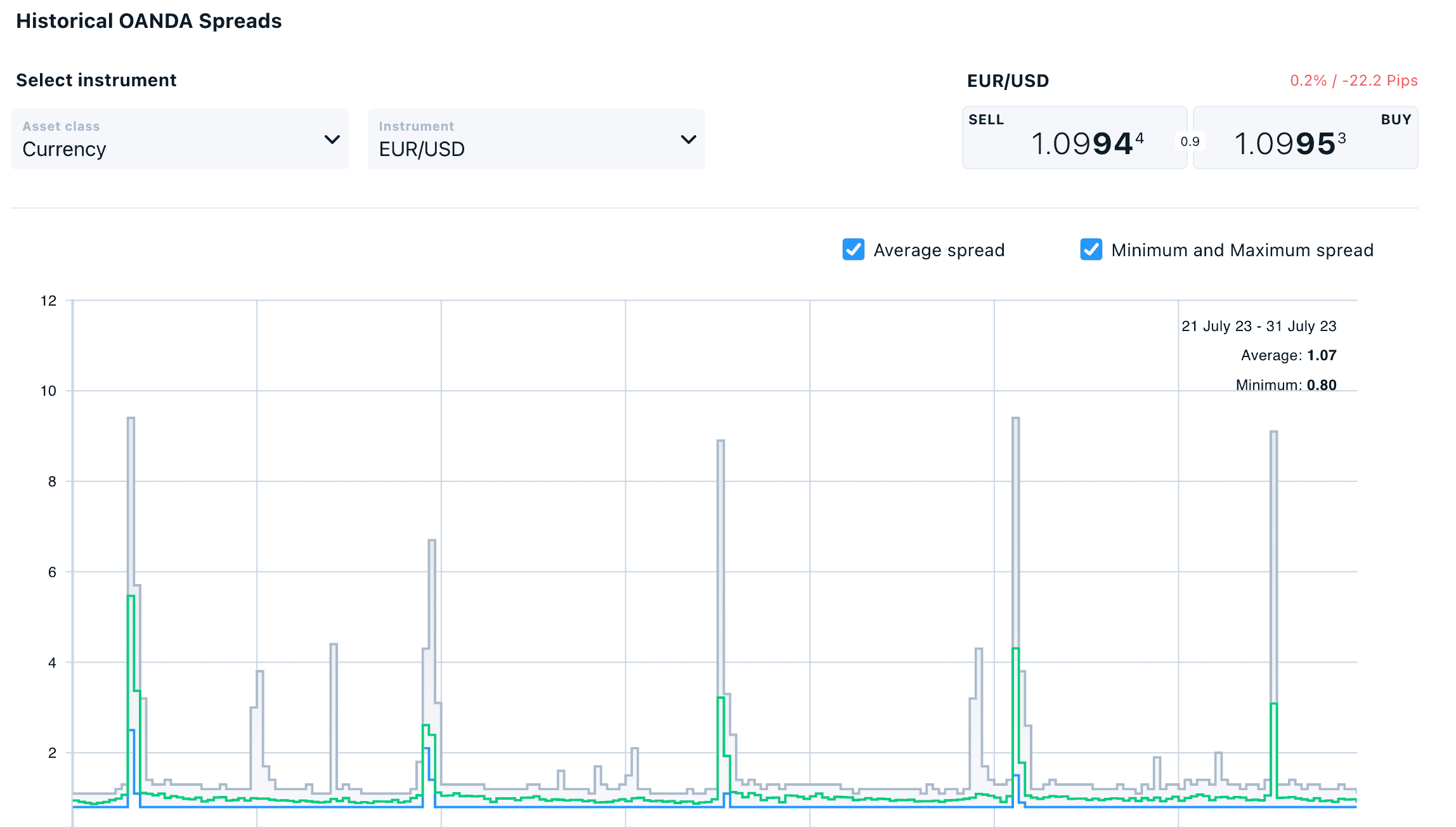

OANDA Corporation Spreads

When it comes to integrity, we have a lot of respect for OANDA. The typical spreads published on the website – that’s typical, not minimum – track with the results we obtained in our independent testing.

| Standard Account Spreads | OANDA Spread | Industry Average Spread |

|---|---|---|

| Overall Average | 2.02 | 1.7 |

| EUR/USD | 0.9 | 1.2 |

| USD/JPY | 1.9 | 1.4 |

| GBP/USD | 1.78 | 1.6 |

| AUD/USD | 1.54 | 1.6 |

| USD/CAD | 2.1 | 1.8 |

| EUR/GBP | 1.52 | 1.5 |

| EUR/JPY | 3.41 | 2.0 |

| AUD/JPY | 2.99 | 2.2 |

For example, our tests found that OANDA Corporation offers an average spread of 1.06 pips for the EUR/USD currency pair – lower than the officially published spread. Likewise, the GBP/USD spread of 2.0 pips only slightly exceeds the result of our tests – 1.86 pips.

OANDA Corporation also stands out from other brokers for its transparency around historical spreads. If you’re curious – or slightly obsessive – you can review spread data and calculate the hypothetical cost of a trade.

OANDA Corporation Trading Account Fees

OANDA Corporation also earned high marks from us for controlling indirect trading costs – fees a broker charges for administering your account or performing certain services. OANDA Corporation doesn’t require a minimum deposit but does charge an inactivity fee of USD 10 per month if your account lies dormant for more than one year.

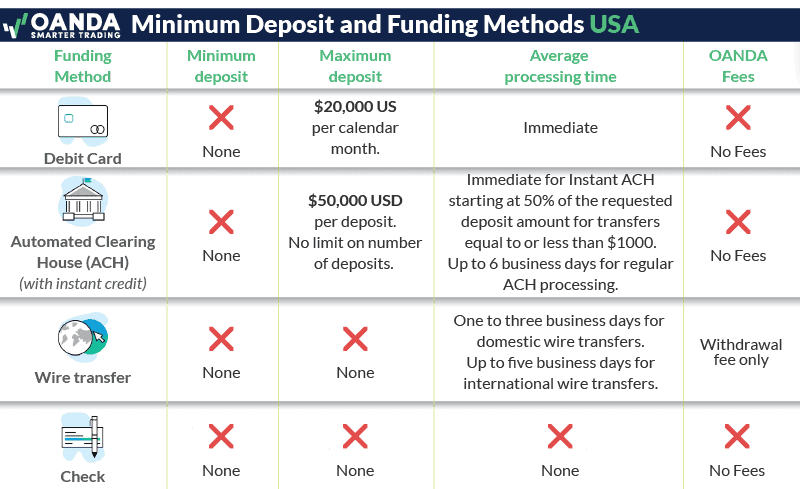

OANDA Corporation Funding Methods

There are no minimum deposit requirements to open an OANDA account, along with no funding fees (except for bank wire withdrawal), a major benefit of the US broker.

For high-volume or active traders, however, there may be a maximum deposit, depending on your funding method.

Funding methods allowed by OANDA Corporation include bank transfer/bank wire (with no funding limits), ACH (automated clearing house) and debit card (which is backed by Mastercard and Visa). Credit cards and PayPal are not available with OANDA Corporation.

Open A Demo AccountVisit OANDA

Affiliate receives a commission for accounts opened through the link on this page

OANDA Corporation Order Execution Types and Liquidity Providers

As noted, OANDA Corporation acts as a market maker, meaning the broker provides clients with immediate liquidity and then hedges its overall exposure via liquidity providers. While this might seem to create a conflict of interest, the no-dealing desk (NDD) execution model ensures that the broker can’t intervene in trade execution and that all clients using the same pricing model receive identical quotes from liquidity providers.

We appreciate OANDA Corporation’s commitment to transparency around its trade execution technology. When we requested a trade execution report, we received a comprehensive file showing the aggregate pricing for all similar client trades executed during our specified time period in record time.

We were also able to access live information on OANDA Corporation’s spreads easily, which made testing much more straightforward! The broker streams its floating spreads directly from its liquidity providers, which meant we had real-time information on which to base our testing and analysis.

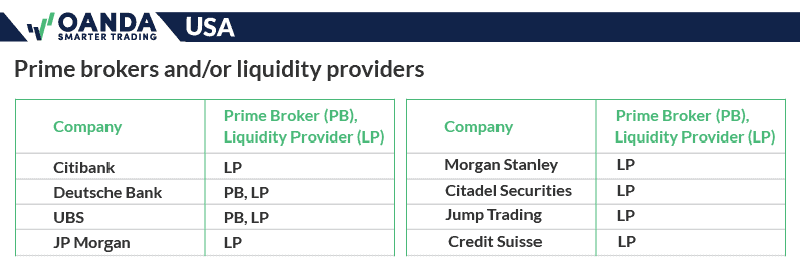

We compiled a list of OANDA’s Liquidity Providers, which include some of the biggest banks in the world.

Open A Demo AccountVisit OANDA

Affiliate receives a commission for accounts opened through the link on this page

OANDA Corporation Trading Platforms

| Trading Plaform | Available With OANDA |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

OANDA Corporation, like most online brokerages, offers you a choice of trading platforms: OANDA Trade, the broker’s own in-house technology, or MetaTrader 4. Both platforms have integration TradingView which is means you get a wealth of charts and indicators to help with your trading analysis.

OANDA Trade

For a start, OANDA Trade competes with the top proprietary platforms in the market with a user-friendly interface, quality market research and excellent charting features for advanced technical analysis.

In terms of advanced charting features, OANDATrade has 80 technical tools, including 32 overlay indicators and 50 drawing tools. Add TradingView to the mix, and you’ve got 65 extra charts.

We like that OANDA Trade manages to find a balance between ‘accessible’ and ‘custom’. New traders won’t struggle to perform basic tasks, while more experienced traders will enjoy creating a custom interface. When I poked around inside a demo account, I found I could tweak just about any aspect of the OANDA Trade interface to match my preferences. Charts, order sizes, notifications, price alerts? All open for me to adjust as I saw fit.

Even more than custom interfaces, we really, really like OANDA Trade’s risk management tools. Most online brokers don’t offer a guaranteed stop-loss order, but OANDA Corporation does. (If you’re wondering how a stop-loss order works, you probably need to have one at your disposal.) You also have access to detailed performance analytics for use in analysing the success of your strategy, as well as comprehensive market research tools.

OANDA Trade is available as a WebTrader, mobile trading app (iOS or Android devices) or as a desktop platform, making it versatile based on whether you trade at home or on the go.

To get even more features with OANDA Trade, you have the option to integrate with TradingView, which we cover below.

MetaTrader 4

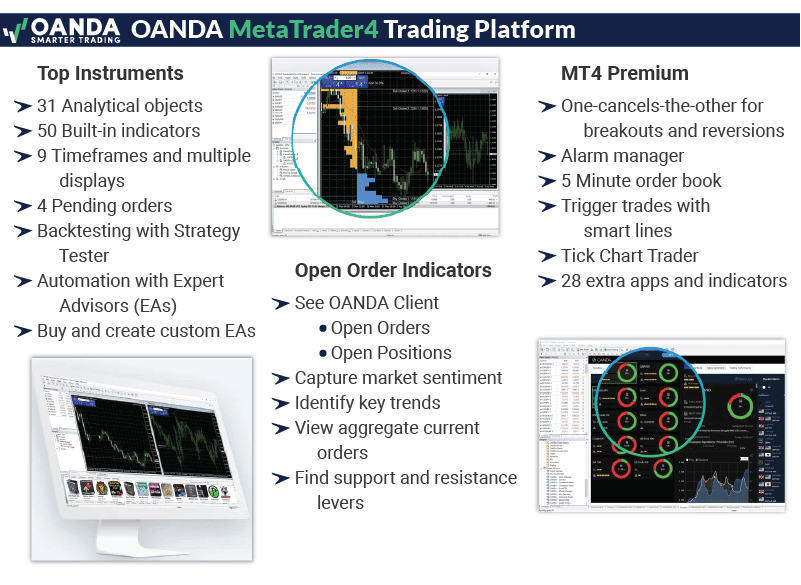

Globally popular for forex trading, the platform boasts an intuitive interface, excellent charting features, a customisable order book and an overall user-friendly trading experience.

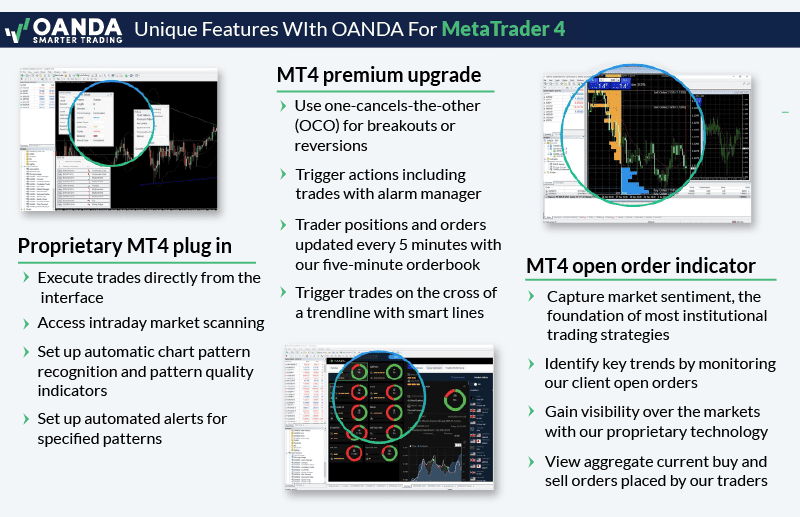

We’re no strangers to MT4 at Compare Forex Brokers – it’s the leading forex trading software on the planet. The platform’s charting highlights include 31 analytical objects, 50 built-in indicators and nine timeframes to improve your trading strategy. You also have the ability to automate your trading with Expert Advisors (EAs), trading robots that perform market transactions automatically. There are hundreds of downloadable EAs available on the platform.

OANDA Corporation’s version of MT4 also includes some unique features that we enjoyed testing. Even the standard ‘vanilla’ version of the platform offers an enhanced trading experience via OANDA Corporation’s proprietary plugin. We used this to set up automatic price alerts that fed into our automated trading, as well as an automatic chart pattern recognition indicator tailored to our test strategy. In both cases, we spotted opportunities we would’ve otherwise missed using MT4 alone.

If you’re committed to MT4 and have room in your trading budget, you can upgrade to MT4 Premium, which gives you access to more advanced tools such as one-cancels-the-other order types, an alarm manager and the ability to trigger trades with smart lines, not to mention the 28 extra apps and indicators at your disposal.

Like OANDA Trade, MT4 is available via mobile, desktop or as a Web Trader.

Other Trading Platforms

In addition to OANDA Trade and MT4, OANDA offers a number of third-party platforms like TradingView. We don’t necessarily consider these stand-alone platforms. Still, the option to connect them to your OANDA Trade or MetaTrader 4 platform can make a big difference, especially if you rely on technical analysis and advanced charting more than automation in your trading.

One of the major benefits of TradingView is its worldwide community of over 30 million traders – including Justin. He describes it as having the Best Copy Trading Platforms resource and has benefitted from exchanging ideas with experienced forex traders with a similar approach to the fx markets.

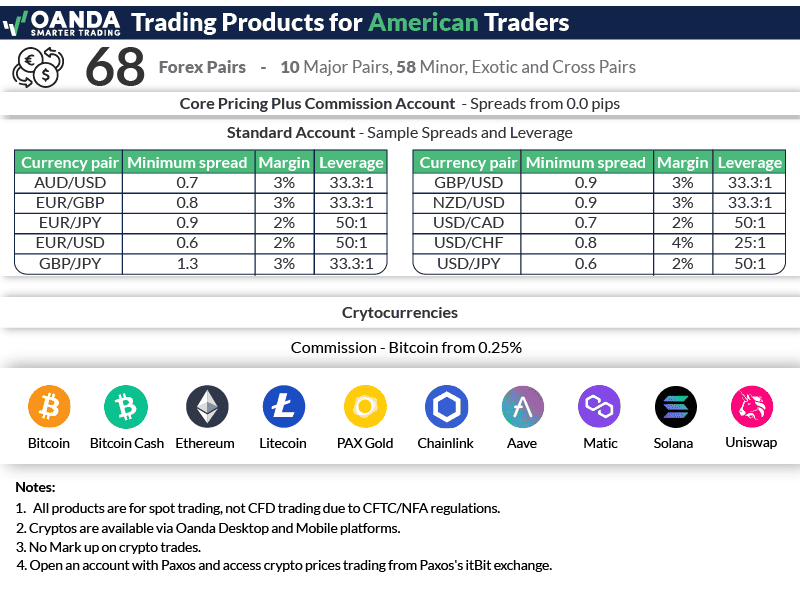

OANDA Corporation Range of Markets

OANDA Corporation caters to American traders, which means no CFDs. As an FX-only broker, OANDA Corporation has a respectable offering, but not quite as impressive as some of the competition. 68 currency pairs – 10 majors and 58 minors – is nothing to sniff at, but it’s not as comprehensive as some other forex-heavy brokerages.

Within these Forex pairs, OANDA offers nine account currencies: USD, CAD, EUR, JPY, CHF, GBP, SGD, AUD, and HKD. You can easily create a new sub-account in any one of these currencies at any time. (We pushed it to the limit and ended up with 19 different sub-accounts.)

OANDA Corporation, interestingly enough, also allows you to trade in cryptocurrencies with paxos*. In addition to Bitcoin and Ethereum, you can trade in eight other established tokens. Here’s hoping the broker continues this expansion, despite American regulators seeming pretty hostile to crypto. Recall that OANDA Corporation’s range of markets is only available for spot trading (not CFDs) in the U.S. due to CFTC/NFA regulations.

Leverage also varies depending on what currency pair you’re trading. Maximum leverage is as high as 50:1 for EUR/USD, USD/JPY, USD/CAD and EUR/JPY, and as low as 25:1 for USD/CHF. A disclaimer on leverage: trading forex using the maximum leverage available comes at high risk: the more leverage you deploy, the more you stand to lose if the market moves against you.

*Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA.

OANDA Corporation Regulation

1. Regulation

Simply put, trading forex always entails a high degree of risk. The same market volatility that leads to big wins can also produce significant losses. We award high trust scores to brokers that empower account holders to make the best financial decisions possible and that demonstrate a commitment to protecting client money by implementing operational controls.

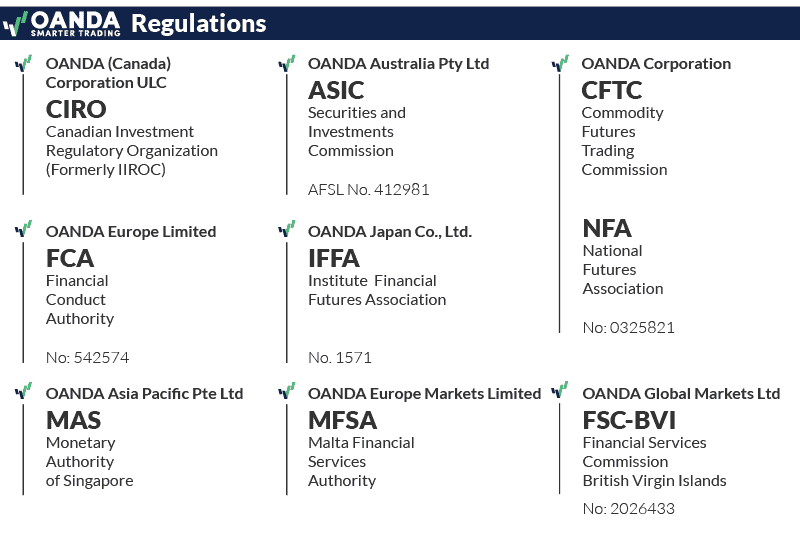

Trusted and respected around the world, OANDA registered from over nine regulatory agencies – including the Australian Securities and Investment Commission (ASIC), the UK’s Financial Conduct Authority (FCA) and the American Commodities Futures Trading Commission (CFTC) – making it a popular choice for forex traders located in tightly-regulated jurisdictions like the United States. No surprise, OANDA scored 83/100 for ‘Trust’ based on our in-house testing.

In addition to six Tier-1 licenses, OANDA holds licenses from three regulators, the Canadian Investment Regulatory Organization (CIRO) in Canada and the Malta Financial Services Authority (MFSA) in Europe. The quantity of licenses alone places OANDA and its subsidiaries in a special class, but we awarded extra points for transparency and risk management tools described above.

Note that the OANDA Group has multiple subsidiaries that are each licensed to offer products to clients around the globe. This means that depending on your country of residence, you will be contracted to that country’s OANDA subsidiary as a client, further cementing OANDA’s global presence. As an American trader, however, you will be signing with OANDA Corporation, which is regulated by CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association).

OANDA’s regulatory track record makes it not only a trusted broker but accessible to traders from all over the world.

| OANDA US Safety | Regulator |

|---|---|

| Tier-1 | NFA/CFTC MAS CIRO FCA ASIC |

| Tier-2 | JFSA KNF MFSA |

| Tier-3 | FSC-BVI |

2. Reputation

OANDA demonstrates strong visibility in the online trading landscape. With approximately 550,000 monthly Google searches, it ranks as the 7th most popular forex broker among the 65 brokers analyzed. Web traffic data positions it somewhat lower but still strong, with Similarweb reporting 7,047,000 global visits in August 2025, placing OANDA as the 8th most visited broker.

Founded in 1996, OANDA is one of the forex industry’s pioneering online brokers. While the company doesn’t publicly disclose its exact client numbers, industry estimates suggest it serves hundreds of thousands of traders globally, with particularly strong penetration in North America, Europe, and developed Asia-Pacific markets. OANDA’s trading volumes reportedly reach several billion dollars daily, reflecting its established position as one of the industry’s institutional-grade retail forex brokers. The company’s acquisition by CVC Capital Partners in 2018 positioned it for further expansion beyond its traditional markets.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 49,500 |

| Germany | 40,500 |

| India | 33,100 |

| United Kingdom | 27,100 |

| Spain | 22,200 |

| France | 22,200 |

| Switzerland | 22,200 |

| Italy | 18,100 |

| Japan | 14,800 |

| Canada | 12,100 |

| Philippines | 9,900 |

| South Africa | 9,900 |

| Colombia | 9,900 |

| Singapore | 9,900 |

| Portugal | 8,100 |

| United Arab Emirates | 6,600 |

| Brazil | 6,600 |

| Australia | 6,600 |

| Mexico | 6,600 |

| Malaysia | 6,600 |

| Netherlands | 6,600 |

| Nigeria | 5,400 |

| Thailand | 5,400 |

| Austria | 5,400 |

| Poland | 4,400 |

| Cyprus | 4,400 |

| Turkey | 4,400 |

| Kenya | 4,400 |

| Hong Kong | 4,400 |

| Argentina | 4,400 |

| Sweden | 4,400 |

| Indonesia | 3,600 |

| Pakistan | 2,900 |

| Greece | 2,900 |

| Ghana | 2,900 |

| Taiwan | 2,900 |

| Mauritius | 2,900 |

| Ireland | 2,900 |

| Saudi Arabia | 2,400 |

| Bangladesh | 2,400 |

| Peru | 2,400 |

| Vietnam | 2,400 |

| Egypt | 2,400 |

| Morocco | 1,900 |

| New Zealand | 1,600 |

| Jordan | 1,600 |

| Tanzania | 1,600 |

| Sri Lanka | 1,300 |

| Chile | 1,300 |

| Algeria | 1,300 |

| Dominican Republic | 1,300 |

| Uganda | 1,300 |

| Ecuador | 1,000 |

| Panama | 1,000 |

| Venezuela | 880 |

| Costa Rica | 880 |

| Ethiopia | 720 |

| Uruguay | 720 |

| Cambodia | 590 |

| Bolivia | 590 |

| Uzbekistan | 480 |

| Botswana | 390 |

| Mongolia | 70 |

49,500 1st | |

40,500 2nd | |

33,100 3rd | |

27,100 4th | |

22,200 5th | |

22,200 6th | |

22,200 7th | |

18,100 8th | |

14,800 9th | |

12,100 10th |

3. Reviews

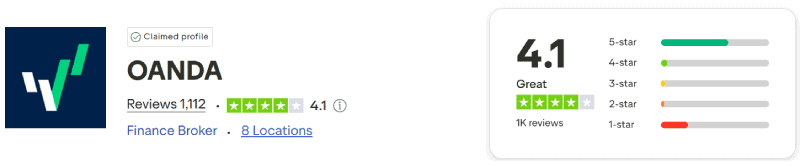

OANDA has a high TrustPilot score of 4.1/5 from 1,112 reviews.

Open A Demo AccountVisit OANDA

Affiliate receives a commission for accounts opened through the link on this page

OANDA Corporation Customer Service

We found OANDA’s customer service exemplary, with multiple layers of support available at any time, anywhere in the world. We tasked a team member with resolving three ‘issues’ with an OANDA Corporation account and were impressed with the speed with which she came back to us with solutions.

In the first instance, our tester found the answer to her question in the broker’s online FAQ resources, which connected her to an online chatbot. Granted, this was an easy question about how to withdraw funds from the account, but she reported minimal wait for a response and a comprehensive, step-by-step instructions on how to move forward.

For her second and third questions, which concerned MetaTrader 4 and OANDA Corporation’s liquidity providers, our tester turned to email and phone support. An American located in Europe, she found customer service admirably responsive. The broker claims to provide round-the-clock support every day of the week except Saturday and Sunday. An email sent Thursday evening EST had a response by the close of business on Friday.

OANDA Corporation Educational Tools

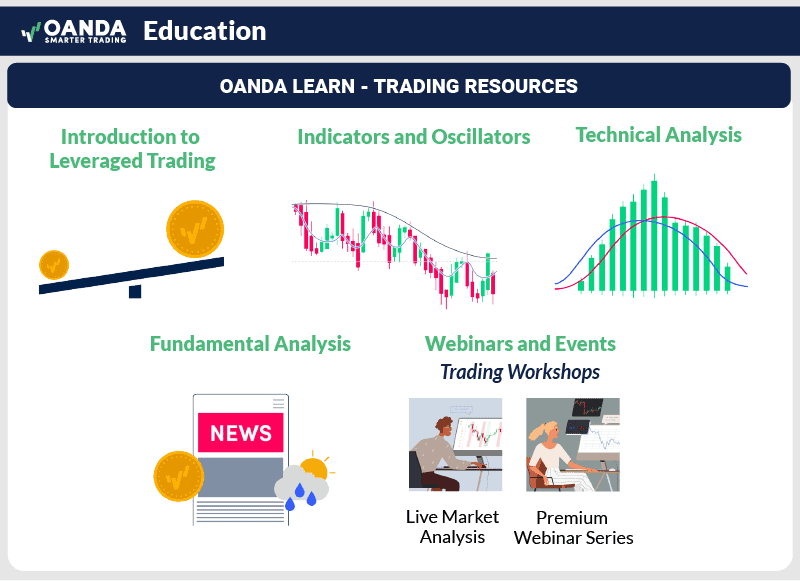

All the indicators and drawing tools in the world won’t help your trading strategy if you’re not sure how they work. While most online brokerages offer some form of educational support, we like to dig deeper. Good educational resources show commitment to account holder success.

Great Market Research

OANDA offers a broad range of research for forex traders. To start with, the broker’s MarketPulse site has an excellent selection of articles organized by category, with multiple updates published each day, including news headlines on both MT4 and the OANDA Trade platform.

Open a Demo AccountVisit OANDA

Affiliate receives a commission for accounts opened through the link on this page

Educational Resources

There is also a decent range of written educational materials and webinars, including an online course that teaches the basics of fundamental and technical analysis.

Topics covered include getting starts, fundamental analysis, technical analysis and capital management.

OANDA Corporation Account Opening Process

As part of our testing, we opened over 20 accounts with top online forex brokers to assess the overall process. Our logic: a broker with a slow, complex or difficult-to-understand account opening process probably won’t win any prizes for customer service, client resources or overall accessibility.

Unsurprisingly, given its track record for excellent customer service, OANDA ranked within the top three, with an overall score of 12/15.

While OANDA doesn’t offer the most straightforward Account Opening process, most difficulties were smoothed over by the dedicated account manager. Some brokers reserve account management assistance for high-value or professional trader accounts, but OANDA assigns one to each and every new client.

Error messages we received were resolved quickly, but it bothered us that we couldn’t pinpoint the cause. We also wondered how we would’ve proceeded had we not had the assistance of a dedicated account manager. Fortunately, we did, so the entire process took less than 24 hours.

We’ve outlined the process below with screenshots from Justin’s account-opening process.

Step 1.

Navigate to the OANDA homepage and click any of the ‘Open an Account’ buttons you’ll find on the screen.This will take you to page one of the application. Enter a username and password – preferably something you’ll remember.

Step 2.

Once you set your username and password, you’ll need to enter some information about yourself. In addition to your name and birthdate, you’ll need to provide a copy of a valid ID or input the number and expiration date.

With apologies to privacy buffs, you can’t skip this step. Brokers like OANDA are subject to Know Your Customer laws designed to protect against fraud and are required to verify that you are who you claim to be.

Step 3.

If the idea of sharing a copy of your photo ID feels a bit out there, then brace yourself. Like other licensed brokers, OANDA expects you to share some information about your personal finances.

It may feel invasive, but brokers assume a certain level of risk with each client. This goes double for brokerages that allow you to trade on margin. They want at least some assurance that you can cover your bets.

Step 4.

After submitting your financial details, you’ll need to answer some questions about your trading experience. Be honest – and aware – that OANDA takes these seriously.

Assuming all goes well, you’ll receive an email inviting you to verify your identity. Once you’ve done so, the account should go live within 24 hours. If not, you’ll end up with an email like this one, inviting you to open a demo account and try again later.

Remember that error we mentioned above? We were referring to this email. Somehow, we thought it odd that a trader with over ten years of experience wouldn’t qualify for an account. Thankfully, a quick email to customer service resolved the problem within 24 hours

OANDA Broker Verdict

Americans interested in trading forex aren’t exactly spoiled for choice, given the restrictions on CFDs and other trading products enacted by US regulators. Based on our test of numerous factors, your trading experience, trading costs and regulatory protections, we found OANDA Corporation to be the best option for US citizens.

Obviously, OANDA Corporation’s extensive licensing and regulatory compliance contributed to the high score. Still, we were equally impressed by the competitive trading costs, risk management tools, educational resources and accessible customer service.

While some brokers might boast tighter spreads, we’re genuinely curious how they would stack up against OANDA Corporation after implementing the same transparency measures. Live streams of floating spreads, publicly available historical spread data and responsive account managers give us confidence that OANDA shares accurate information that we can trust.

Open A Demo AccountVisit OANDA

Affiliate receives a commission for accounts opened through the link on this page

Disclaimers:

OANDA Corporation is regulated by the CFTC/NFA. OANDA is a member Firm of the NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA’s regulatory oversight and examinations.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

Affiliate receives a commission for accounts opened through the link on this page.

FAQs

Does OANDA Offer Prop Trading?

Yes, OANDA launched their prop firm in 2024. You can read a full review of their offering on our sister prop website which has a full OANDA Prop Trader review.

About Compare Forex Brokers

The forex trading comparison on compare forex brokers was made by experienced individuals who have worked with financial services companies. They understand how hard it is to compare forex brokers and have developed criteria from spreads to leverage traders to find the best forex broker for them.

If you see any issues with any of our forex broker comparison tables or this OANDA review, please contact the owners using the contact form and changes will be made promptly to ensure all forex trading elements are correct.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to OANDA Website

Visit

Ask an Expert

CAN ONE TRADE XAUUSD WITH OANDA IN THE USA AND WILL OANDA ACCEPT FULL 24/7 ROBOT TRADING IN MT4 WITH A PURCHASED EA AND TRAILING STOPS

This is a question to ask OANDA. You can try their live chat

How long does it take to be approved by OANDA?

Once you have provided all the needed information for your application with OANDA and it is correct, you will receive an email from OANDA approving you application in 1-2 working days.

Is OANDA good for scalping?

OANDA allows scalping and does have some advantages such as a good record for instant fills and low slippage however scalpers tend to prefer ECN or RAW style accounts as they are cheaper. While OANDA does have RAW spread accounts in Australia, Singapore and in emerging markets, only a standard account is available in Canada, US and Europe, still good for scalp trading but there may be better options.

What is the margin requirement for OANDA?

This will depend on the region you are in but for Australia, Europe and the UK- the margin requirements for Major forex pairs starts from 3.33%.