Pepperstone vs OANDA: Which One Is Best?

This comprehensive review will compare Pepperstone and OANDA, focusing on their features, platforms, and spreads/fees. Your trading success depends on choosing the right broker. We’ll present the details for your decision. So read on further, and enjoy the ride.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

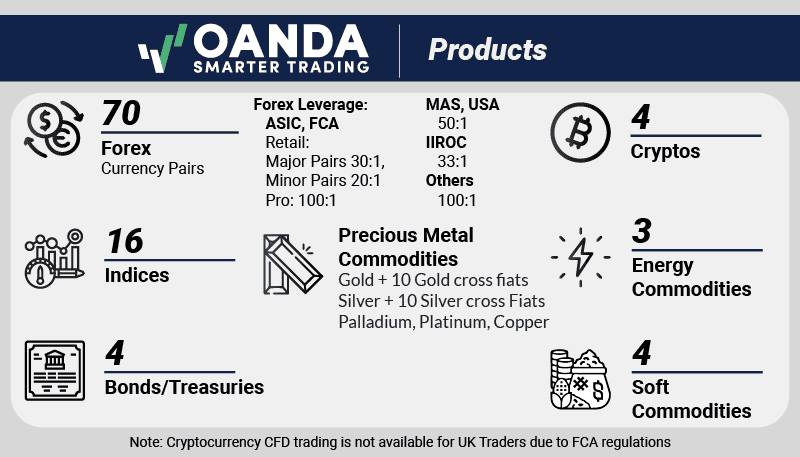

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 33:1

Minor Pairs 33:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and OANDA:

- Pepperstone offers lower EUR/USD from 0.0 pips, while OANDA’s spreads can be higher.

- Pepperstone provides more CFDs, including a broader range of cryptocurrencies.

- Pepperstone offers a wider variety of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, whereas

- OANDA primarily offers MT4 and its proprietary fxTrade platform.

- OANDA offers a minimum deposit of $0 and a recommended deposit of $25.

- OANDA offers low spread of EUR/USD 0.92

1. Lowest Spreads And Fees – Pepperstone

In this section, we will talk about how brokers with low spreads and fees attract more traders. With this feature traders will increase their volumes and revenue. Competitive pricing enhances their reputation, making them ideal for cost-conscious traders. It’s beneficial for both brokers and traders.

Spreads

Based on the data we’ve analysed, Pepperstone offers a spread of 1.1 for EUR/USD, compared to OANDA’s 0.92 for the same currency pair. For AUD/USD, Pepperstone provides a spread of 1.2, while OANDA has a slightly lower rate of 1.1. Despite these higher individual rates, both brokers remain competitive, as the overall industry average spread stands at 1.6.

| Standard Account | Pepperstone Spreads | OANDA Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.35 | 1.2 | 1.6 |

| EUR/USD | 1.1 | 0.92 | 1.2 |

| USD/JPY | 1.3 | 1.2 | 1.4 |

| GBP/USD | 1.3 | 0.9 | 1.6 |

| AUD/USD | 1.2 | 1.1 | 1.5 |

| USD/CAD | 1.4 | 1.5 | 1.8 |

| EUR/GBP | 1.2 | 1.16 | 1.5 |

| EUR/JPY | 1.8 | 1.5 | 1.9 |

| AUD/JPY | 1.5 | 1.3 | 2.1 |

Commission Levels

Although we lack specific data on OANDA’s commission rate, it’s noteworthy that Pepperstone charges a commission fee of $3.50. Both brokers provide a $0 deposit requirement for trading. When it comes to the AUD/USD currency pair, OANDA offers a spread of 0.2, while Pepperstone offers 0.20. Neither broker imposes funding fees; however, it’s important to mention that Pepperstone exclusively offers swap-free accounts, unlike OANDA.

This fee calculator we have created just for you will show how reduced spreads affect trading. Choose your base currency, trade amount, and pair to view the cost.

Standard Account Fees

Both brokers, in addition to RAW accounts, provide standard accounts with wider spreads, which represent their primary revenue stream. To illustrate the cost differences, we compared the average spreads for standard accounts between the two brokers and other well-known providers. Pepperstone offers a EUR/USD spread of 1.10, while OANDA boasts a more competitive 0.60. For the AUD/USD pair, Pepperstone’s spread is 1.20 compared to OANDA’s lower 0.70.

|

Standard Account Spreads

|

|||||

|---|---|---|---|---|---|

|

1.10 | 1.10 | 1.20 | 1.20 | 1.20 |

|

0.90 | 1.54 | 1.52 | 1.78 | 1.90 |

|

1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

|

1.20 | 0.90 | 1.50 | 1.80 | 1.80 |

|

1.50 | 1.50 | 1.60 | 1.80 | 1.80 |

|

1.20 | 1.40 | 1.40 | 1.50 | 1.40 |

|

1.20 | 1.80 | 1.90 | 1.90 | 1.60 |

|

1.32 | 1.95 | 1.37 | 1.70 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

It is safe to assume that when selecting a forex broker, the primary factor you should consider is transaction costs. In this section, we’ll explore which broker—Pepperstone or OANDA—can better assist you in minimizing your expenses in the forex exchange market.

Our Lowest Spreads and Fees Verdict

Overall, Pepperstone comes ahead of OANDA with its low transaction costs. Clients with Pepperstone can benefit from lower trading costs, which is great for scalping. Pepperstone offers competitive average spreads and commissions with its transparent pricing model. If you want to take advantage of the ultra-tight spreads, make sure you open a Pepperstone demo account first to test it with your own hands. To learn more about Pepperstone charges, view the full Pepperstone Fees analysis.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

A top-tier trading platform is a game-changer in the fast paced industry of forex trading. Imagine having advanced charting tools, real-time market data, and lightning-fast execution speeds at your fingertips. A user-friendly interface with customizable features and robust security measures ensures a seamless trading experience. Plus, with support for automated trading, social trading, and access to a diverse range of financial instruments, traders are empowered to make informed decisions and execute trades with precision. This combination of features truly elevates the trading experience to new heights.

| Trading Platform | Pepperstone | OANDA |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Our team created the exclusive fee calculator below which in most scenarios shows which broker has the lower fee RAW account type.

Metatrader

This section touches base into what the trading world is known for: The MetaTrader platforms, widely regarded as the benchmark in trading. MetaTrader 4 (MT4) is favored for its security, bolstered by a large user base and extensive compatibility with brokers. On the other hand, MetaTrader 5 (MT5) boasts advanced features and a wider array of Contracts for Difference (CFDs), positioning it as the future preference as MT4 gradually loses prominence. Both Pepperstone and OANDA provide the MT4 platform, while only Pepperstone offers MT5, distinguishing itself with innovative trading tools such as advanced charting capabilities and order signals. Thus, whether you choose MT4 or MT5, Pepperstone reinforces its reputation as the premier option with its outstanding offerings.

Advanced Platforms

cTrader is a highly esteemed trading platform that provides direct access to interbank market depth, making it ideal for algorithmic forex trading. It features a customizable interface with detachable charts, robust back-testing capabilities, and sophisticated order modification and placement options across iOS, Android, WebTrader, and desktop for both PC and Mac. In contrast, TradingView is an indispensable tool for forex traders, offering advanced charting, real-time data, and a supportive community. This platform enables traders to fine-tune strategies, identify trends, and make informed decisions, greatly enriching the trading experience for all skill levels. Retail investors will discover an array of valuable trading tools from both Pepperstone and OANDA. While Pepperstone provides both cTrader and TradingView, OANDA solely offers cTrader. cTrader stands out as the most advanced automation software available, a distinctive advantage of Pepperstone. Furthermore, Pepperstone adds value by providing access to TradingView, a increasingly popular platform celebrated for its exceptional charting capabilities and mobile-first design.

Copy Trading

Pepperstone excels in social and copy trading features, partnering with third-party providers like MyFxBook’s AutoTrade, MetaTrader signals, DupliTrade, Mirror Trader, and RoboX. OANDA lacks features related to social and copy trading, making it less suitable for beginner traders. Pepperstone combines social trading with risk management tools for a complete solution in volatile markets. However, neither broker offers the copy trading platform Zulutrade.

Our Trading Platform Verdict

Our review process discovered that the Pepperstone range of trading platforms is superior to OANDA’s technological solution. Overall, after evaluating Pepperstone vs OANDA trading platforms, including the available technical tools, the quality of order executions, security and functionality, our team of industry experts awarded Pepperstone with the big prize.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

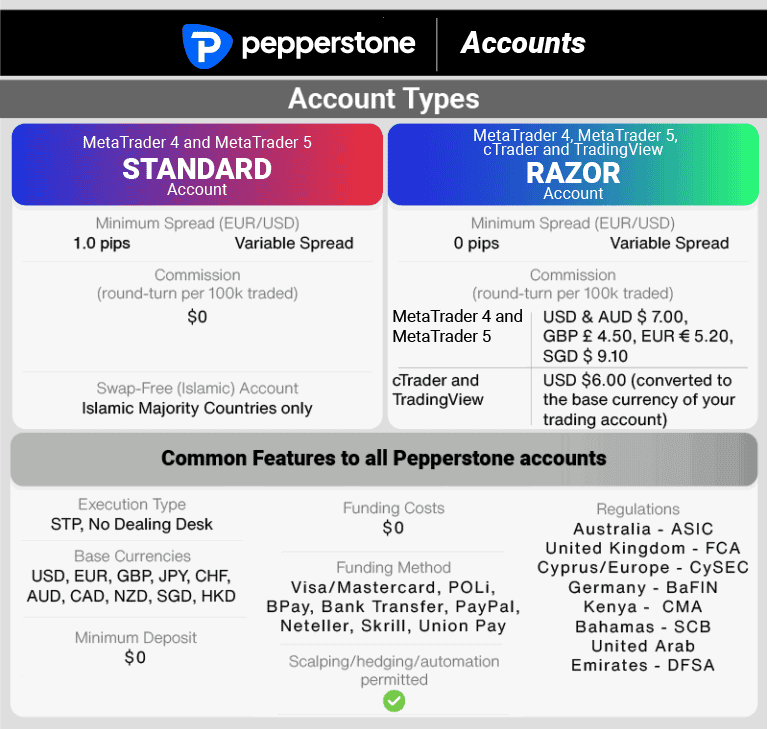

3. Superior Accounts And Features – Pepperstone

In this section of our review, we will explore exceptional accounts and features designed to meet the diverse needs of traders. These accounts typically offer competitive spreads, low commissions, and sophisticated trading tools. We can confidently confirm that they often include demo accounts for practice, swap-free options, and access to an extensive array of financial instruments. Additionally, enhanced features such as social trading, automated trading, and outstanding customer support create a seamless and efficient trading experience, ultimately promoting client satisfaction and fostering loyalty.

In our review, we considered the different types of trading accounts offered by forex brokers Pepperstone and OANDA. Both brokers provide two main types of trading accounts. The best account for you depends on factors like:

– Capital size (minimum balance)

– Risk tolerance

– Maximum leverage

– Position size limits

– Base currencies

– Market range

– Trading fees

Here’s a brief overview of the options available:

Pepperstone:

– Razor Account (for scalpers and algorithmic traders)

– Standard Account (for beginner traders)

OANDA:

– Standard Account

– Premium Account

These accounts cater to various trading needs and preferences.

Pepperstone removed its $200 minimum deposit but still requires a deposit for margin needs. OANDA clients typically use the ‘Spread Only Pricing’ account, akin to Pepperstone’s standard account, while its ‘Core Pricing’ account, similar to Pepperstone’s Razor Account, is for clients in Australia, Singapore, and the USA, with round-trip commissions of AUD 7.00, SGD 7.00, and USD 10.00, respectively.

Our Pepperstone review found that the Australian forex broker offers PAMM and MAM solutions for professional managers, unlike OANDA, which lacks managed accounts. Pepperstone excels by providing account packages for fund managers.

NOTE: Only Pepperstone offers tailored services for Muslim traders through an Islamic trading account, available by default in specific regions.

| Pepperstone | OANDA | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

We can see here that both brokers offer tax-free spread betting subaccounts for UK traders. For a detailed comparison of Pepperstone’s Razor and Standard accounts, check our full account types review.

Our Superior Accounts and Features Verdict

Pepperstone undoubtedly deserves recognition for its impressive array of account options, ranging from standard to RAW accounts, all tailored to benefit traders. Moreover, their SWAP-free account and special provisions for active traders set them apart from the competition. True to our assessment, Pepperstone emerges as the clear winner, thanks to their exceptional account offerings and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

In this section we will show how traders thrive on an exceptional trading experience that merges advanced platforms, swift execution speeds, competitive spreads, and strong customer support. Through our research, our team guarantees that these key elements empower traders to make informed decisions, execute trades effortlessly, and effectively manage their accounts. Additionally, a user-friendly interface, access to educational resources, and a diverse array of trading tools significantly enrich the trading experience, transforming it into a more enjoyable and profitable endeavor.

We can clearly see here that both Pepperstone and OANDA have their unique strengths in trading experience and ease of use. Pepperstone stands out with its variety of platforms, especially its award-winning MT4 offering. OANDA is recognized as the best for beginners, ensuring a smooth start for new traders.

- Pepperstone offers an award-winning MT4 platform, making it a top choice for many traders.

- OANDA is recognized as the best broker for beginners, ensuring a user-friendly experience.

- Pepperstone excels in automation, with tools like Capitalise.ai enhancing the trading process.

- Both brokers strive to offer seamless trades with fast execution speeds.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| OANDA | 86ms | 5/36 | 84ms | 2/36 |

Our Best Trading Experience and Ease Verdict

Based on the information presented from our team, it’s clear that Pepperstone is dedicated to enhancing the trading experience for its clients. While both brokers provide a solid trading environment, Pepperstone truly stands out with its impressive range of platform options and advanced automation tools.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

In this section, we will discuss how brokers having a strong foundation of trust and regulation is essential for establishing a secure and transparent trading environment in the industry of forex trading. Regulated brokers follow stringent standards that safeguard traders from fraud and malpractice, instilling confidence that encourages more active investment and trading. Trustworthy brokers, backed by solid regulatory oversight, naturally draw in a larger clientele, bolstering their reputation and presence in the market.

Pepperstone Trust Score

OANDA Trust Score

Trust and regulation are crucial when choosing a forex broker. Both Pepperstone and OANDA are globally recognized and regulated by major financial authorities. Pepperstone is regulated by ASIC, FCA, CySEC, BaFin, and DFSA. OANDA, being US-based, is governed by the NFA and also holds licenses from ASIC, FCA, CIRO, and FSA. Both brokers adhere to high standards, ensuring traders’ funds are safe and secure.

| Pepperstone | OANDA | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | NFA/CFTC (USA) MAS (Singapore) CIRO (CANADA) FCA (UK) ASIC (Australia) |

| Tier 2 Regulation | DFSA (Dubai) | JFSA (Japan) KNF (Poland) MFSA (Europe) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSC-BVI |

Our Stronger Trust and Regulation Verdict

Based on our team’s analysis, both brokers are well-regulated and adhere to high industry standards. However, Pepperstone has a slight edge due to its broader regulatory oversight from multiple major financial centers. This extensive regulation reinforces investor confidence and demonstrates Pepperstone’s commitment to transparency and security. Therefore, Pepperstone stands out as the more robust option.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

6. Most Popular Broker – OANDA

OANDA gets searched on Google more than Pepperstone. On average, OANDA sees around 550,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 80% fewer.

| Country | Pepperstone | OANDA |

|---|---|---|

| United States | 4,400 | 49,500 |

| Germany | 3,600 | 40,500 |

| United Kingdom | 5,400 | 33,100 |

| India | 2,900 | 33,100 |

| Spain | 1,900 | 22,200 |

| France | 1,000 | 22,200 |

| Switzerland | 320 | 22,200 |

| Italy | 1,900 | 18,100 |

| South Africa | 2,900 | 12,100 |

| Canada | 720 | 12,100 |

| Japan | 480 | 12,100 |

| Colombia | 3,600 | 9,900 |

| Singapore | 1,600 | 9,900 |

| Philippines | 880 | 9,900 |

| Portugal | 480 | 9,900 |

| Australia | 8,100 | 6,600 |

| Brazil | 6,600 | 6,600 |

| Malaysia | 4,400 | 6,600 |

| Mexico | 3,600 | 6,600 |

| Nigeria | 1,300 | 6,600 |

| United Arab Emirates | 1,000 | 6,600 |

| Netherlands | 880 | 6,600 |

| Austria | 320 | 5,400 |

| Kenya | 4,400 | 4,400 |

| Thailand | 4,400 | 4,400 |

| Hong Kong | 3,600 | 4,400 |

| Turkey | 1,600 | 4,400 |

| Argentina | 1,300 | 4,400 |

| Cyprus | 480 | 4,400 |

| Sweden | 390 | 4,400 |

| Poland | 720 | 3,600 |

| Indonesia | 1,600 | 2,900 |

| Taiwan | 1,000 | 2,900 |

| Egypt | 390 | 2,900 |

| Ireland | 260 | 2,900 |

| Ghana | 260 | 2,900 |

| Peru | 1,600 | 2,400 |

| Pakistan | 1,300 | 2,400 |

| Vietnam | 720 | 2,400 |

| Bangladesh | 390 | 2,400 |

| Saudi Arabia | 260 | 2,400 |

| Greece | 210 | 2,400 |

| Mauritius | 110 | 2,400 |

| Morocco | 720 | 1,900 |

| Chile | 1,000 | 1,600 |

| Tanzania | 720 | 1,600 |

| Algeria | 390 | 1,600 |

| Jordan | 260 | 1,600 |

| New Zealand | 170 | 1,600 |

| Dominican Republic | 880 | 1,300 |

| Uganda | 390 | 1,300 |

| Sri Lanka | 320 | 1,300 |

| Ecuador | 1,000 | 1,000 |

| Costa Rica | 480 | 1,000 |

| Panama | 320 | 1,000 |

| Venezuela | 390 | 880 |

| Ethiopia | 390 | 880 |

| Bolivia | 1,300 | 720 |

| Cambodia | 320 | 590 |

| Botswana | 390 | 480 |

| Uzbekistan | 140 | 390 |

| Mongolia | 1,900 | 70 |

2024 Monthly Searches For Each Brand

OANDA - US

OANDA - US

|

49,500

1st

|

Pepperstone - US

Pepperstone - US

|

4,400

2nd

|

OANDA - UK

OANDA - UK

|

33,100

3rd

|

Pepperstone - UK

Pepperstone - UK

|

5,400

4th

|

OANDA - India

OANDA - India

|

33,100

5th

|

Pepperstone - India

Pepperstone - India

|

2,900

6th

|

OANDA - Switzerland

OANDA - Switzerland

|

22,200

7th

|

Pepperstone - Switzerland

Pepperstone - Switzerland

|

320

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with OANDA receiving 4,647,000 visits vs. 1,273,000 for Pepperstone.

Our Most Popular Broker Verdict

OANDA is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

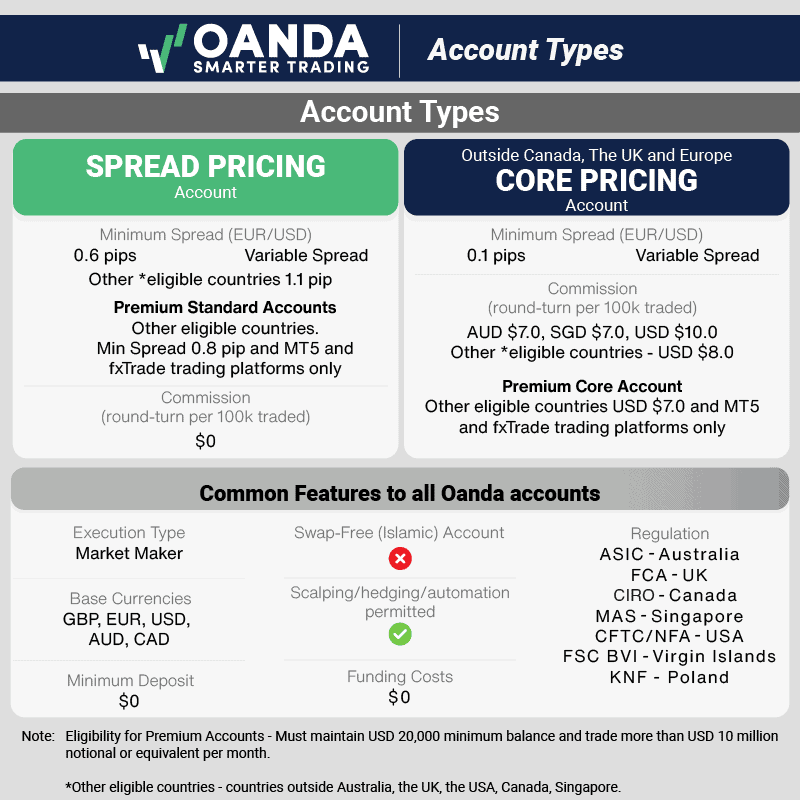

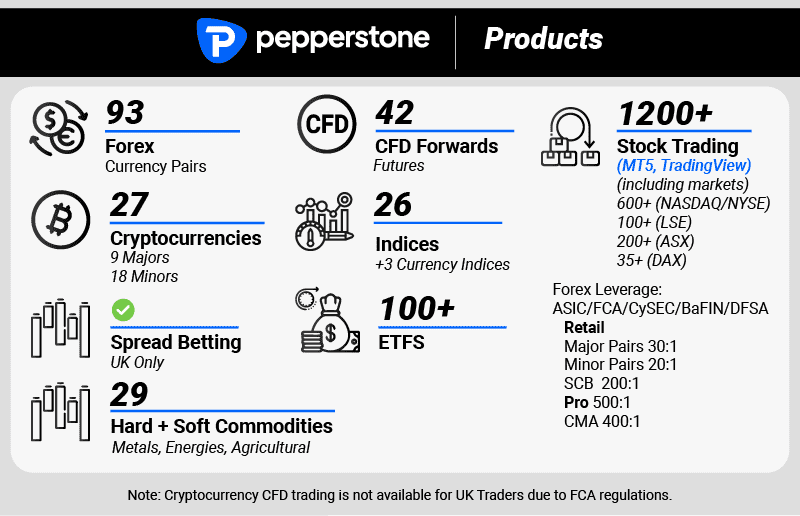

7. Top Product Range And CFD Markets – Pepperstone

Brokers that deliver an exceptional product range alongside a vast selection of CFD markets truly stand out in the industry. They empower traders to diversify their portfolios and seize opportunities across diverse market conditions. By providing an extensive array of financial instruments—spanning forex pairs, commodities, indices, and cryptocurrencies—these brokers open the door to greater profit potential. This rich variety not only enhances the trading experience but also makes it more dynamic and versatile, accommodating various trading strategies seamlessly.

When choosing your forex broker, you also need to consider the range of markets offered by your favourite forex broker. The variety of financial instruments offered by Pepperstone and OANDA are rich in CFD offerings, which means they can accommodate all types of traders.

The table below shows head-to-head the range of CFDs offered by Pepperstone and OANDA.

| CFDs | Pepperstone | OANDA |

|---|---|---|

| Forex Pairs | 93 | 68 |

| Indices | 26 | 15 |

| Commodities | 40 Commodities 15 Metals, 4 Energies, 16 Softs, 5 Hard | 3 Metals (Gold x 10) (Silver x 10) 3 Energies 4 Softs |

| Cryptocurrencies | 27 | 4 |

| Shares | 1,170 | No |

| ETFs | 108+ | No |

| Bonds/Treasuries | No | 5 |

| Other Products(Options,Futures) | No | No |

Pepperstone range of markets can give forex traders access to a multitude of asset classes, including:

- Forex currency pairs, including some exotic pairs

- Index CFDs

- Share CFDs

- Commodities

- Cryptocurrency including Bitcoin

- Cryptocurrency baskets (indices)

- Currency Index CFDs

By comparison, after we carried out our research, we found out that OANDA is offering a limited number of instruments available for trading. If you want to start trading with OANDA, be aware that you will NOT be able to trade:

- Share CFDs

- Bitcoin and other cryptocurrencies

- Currency index CFDs

Our Top Product Range and CFD Markets Verdict

As a result of our overall research of this portion, we can see OANDA has an edge over Pepperstone by offering Bonds CFDs trading, which Pepperstone does not. However, Pepperstone wins overall in this category with a larger number of CFD trading instruments, offering more than 700 options with low spreads.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

8. Superior Educational Resources – OANDA

Education is a cornerstone for any trader, be it a novice or an expert. High-quality educational resources are essential for forex trading, offering materials like webinars, articles, and courses. They equip traders with knowledge and skills for informed decisions and improved strategies, fostering continuous learning and long-term success.

If we base our observation through these data, we can see that both Pepperstone and OANDA have invested significantly in this area, ensuring their clients have access to top-notch educational resources. From the comparison page and our own testing, here’s how the two brokers stack up:

- Pepperstone offers a comprehensive educational section, including webinars, tutorials, and market analysis.

- OANDA, recognised as the best broker for beginners, provides a plethora of beginner-friendly resources.

- Pepperstone’s trading glossary is a valuable asset for traders looking to familiarise themselves with trading jargon.

- OANDA’s educational videos and articles are well-structured, catering to traders of all levels.

- Both brokers offer demo accounts, allowing traders to practice without risking real money.

- Pepperstone’s market insights give traders an edge with up-to-date news and analysis.

Our Superior Educational Resources Verdict

Our team’s test results indicate that OANDA surpasses Pepperstone in the field of educational resources. OANDA offers well-structured educational videos and articles that cater effectively to beginners, providing a comprehensive learning experience for users.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

9. Superior Customer Service – A Tie

Traders can be confident that brokers offering exceptional customer service in forex trading stand out in the market. In this section, we will explore how these brokers provide prompt support and expert guidance around the clock through responsive live chat, phone, and email services, all complemented by multilingual assistance. This commitment not only boosts trader satisfaction but also ensures rapid issue resolution and fosters trust in the broker-client relationship.

It’s a head to head for both brokers here. Pepperstone’s customer service outperforms OANDA’s, with multiple industry awards recognizing its excellent 24-hour support.

Here are our findings in terms of the similarities that can be found on both forex brokers:

- Several channels for support (live chat, email, phone)

- Multilingual support service

- FAQ Section

- Webinars

OANDA clients can contact the support team in several languages, including English, Spanish, German, Mandarin, and Russian. Compared with Pepperstone, OANDA falls behind, as again, the Australian-based forex broker supports 12 different languages, offering a much better experience to traders from around the world.

| Feature | Pepperstone | OANDA |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

The only feature that OANDA managed to gain some extra points was with its 24/6 customer support compared to Pepperstone’s 24/5 customer service.

OANDA’s customer support service stands out in the forex industry only when compared to forex brokers like FXCM, Forex.com or AvaTrade, as OANDA can be proud to offer far better customer service. However, OANDA has been recognised in the United States by winning the Highest Overall Client Satisfaction offered by Investment Trends – US Foreign Exchange Report.

Our Superior Customer Service Verdict

Our team found OANDA and Pepperstone provided positive customer service, with OANDA offering the best experience. Get a free demo account with $100,000 in virtual money to test the forex market.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

Brokers with better funding options in forex provide traders flexibility through methods like bank transfers, cards, digital wallets (PayPal, Skrill, Neteller), and cryptocurrencies. Multiple low or no-fee options allow efficient account management, enhancing the trading experience.

Forex traders can fund Pepperstone and OANDA trading accounts using a variety of deposit methods, including:

- Debit and credit cards

- Bank wire transfers

- Electronic Wallets

The head-to-head comparison revealed that Pepperstone offers 9 funding and withdrawal methods, including Visa, Mastercard, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay. On the other hand, OANDA has a much more limited range of deposit methods and only offers:

- Credit and debit Card

- PayPal

- Bank wire

- Electronic bank transfer

For Deposits And Withdrawal Fees, we can see that OANDA allows withdrawals only via the same method used for deposits. Credit and debit card deposits are capped at $10,000 per month, while PayPal deposits have no limits but only support GBP, USD, and EUR. There are no deposit fees, but credit card and bank transfer withdrawals incur a fee after the first free withdrawal each month.

Below, you have an overview of the types of withdrawal fees traders can expect from OANDA.

| Funding Option | Pepperstone | OANDA |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

On the other hand, Pepperstone offers convenient and fast withdrawal methods, providing you with first-class trading services. Unlike OANDA, Pepperstone doesn’t charge deposit and withdrawal fees. In our Pepperstone review process, the Australian forex trading broker took an extra point in this category and won our recognition.

Deposit Currency Supported

Both Pepperstone and OANDA offer multi-currency deposit solutions:

- Pepperstone supports 10 trading account currencies

- OANDA supports 9 trading account currencies

OANDA supports the following 9 currencies: CAD, AUD, EUR, CHF, GBP, HKD, JPY, SGD, and USD. On the other hand, Pepperstone offers 10 different base currencies for their two trading account types. With Pepperstone, you can make a deposit in your local currency using your preferred deposit method with zero transaction fees.

Our Better Funding Options Verdict

Our team of in-house industry experts has determined that Pepperstone is the standout leader in this category. OANDA follows closely in second place, thanks to the impressive standards set by this Australian-based FX broker, which offers an extensive range of currency options. Additionally, it’s worth noting that before making a deposit, you have the opportunity to open a demo account using virtual funds in your local currency.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

In this portion, we will discuss how brokers offering lower minimum deposits in forex trading make the market accessible to more traders, including beginners. This reduces financial barriers and encourages participation, allowing traders to gain experience without a significant upfront cost.

We can clearly see here that both Pepperstone and OANDA have a $0 minimum deposit requirement. Having said that, OANDA, unlike Pepperstone, vary their minimum deposit amounts according to regions and payment methods.

The table below highlights the figures to expect when making a deposit in OANDA.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Trustly | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Paypal | N/A | N/A | N/A | N/A |

Pepperstone sticks with its $0 requirement wherever you are, as shown in the table below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Paypal | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

While both brokers have a zero minimum deposit feature, they have their respective recommended amounts.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| OANDA | $0 | $25 |

Our Lower Minimum Deposit Verdict

In this segment, it’s clear that both Pepperstone and OANDA stand equally matched, resulting in a decisive draw. This equality stems from their minimum deposit requirements. While Pepperstone suggests an initial deposit of $200, OANDA proposes a significantly lower amount of just $25. Ultimately, the decision lies with the traders’ preferences, keeping in mind that it’s likely they will need to deposit additional funds to establish a trading position.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

Is OANDA or Pepperstone The Best Broker?

Pepperstone, clearly, outperforms the other because it offers a more comprehensive range of services, platforms, and tools, combined with its strong regulatory oversight and award-winning customer service. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | OANDA |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

OANDA: Best For Beginner Traders

OANDA is the preferred choice for beginner traders due to its user-friendly platform and comprehensive educational resources.

Pepperstone: Best For Experienced Traders

Pepperstone stands out for experienced traders, offering advanced tools, platforms, and a wider range of trading options.

FAQs Comparing Pepperstone Vs OANDA

Does OANDA or Pepperstone Have Lower Costs?

Pepperstone generally offers more competitive spreads and lower costs. For instance, they offer lower EUR/USD spreads starting from 0.0 pips. OANDA, while competitive, might have slightly higher spreads in some cases. For a detailed comparison of broker costs, you can check out this Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both OANDA and Pepperstone support MetaTrader 4, but Pepperstone is often recognised for its enhanced MT4 offerings, including advanced tools and faster execution speeds. If you’re particularly interested in MT4, this list of Best MT4 Brokers might be beneficial.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to copy strategies from experienced traders. OANDA, on the other hand, doesn’t have a prominent social trading platform. Social or copy trading can be a game-changer, especially for beginners. For more insights on this, you can explore the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for its UK clients, while OANDA does not have a prominent spread betting platform. Spread betting is a popular derivative product in the UK, allowing traders to speculate on the direction of financial markets without owning the underlying asset.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Founded in Melbourne, Australia, Pepperstone is ASIC regulated, ensuring a high level of trust and security for its clients. OANDA, while also ASIC regulated, is based overseas. Pepperstone’s deep roots in Australia, combined with its robust platform offerings and customer service, make it a top pick. For a broader perspective on Australian forex brokers, you can explore this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe OANDA has a slight edge. While both brokers are FCA regulated, ensuring the highest standards of conduct, OANDA’s global presence and diverse platform offerings cater well to the UK market. Pepperstone, although offering a robust trading experience, is originally from Australia. UK traders seeking a platform tailored to their specific needs might find this list of Best Forex Brokers In UK quite insightful.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does Pepperstone have a huge advantage over OANDA for scalping?

Unlike OANDA, Pepperstone has a RAW spread account which has lower spreads compared to a spread-only account. Such accounts tend to be popular with scalpers due to their lower cost. Scalpers also tend to prefer automated trading and while both allow automation with EAs on MetaTrader signals, Pepeprstone has other options such as Capitalise.ai an social trading,

Can beginners trade with Pepperstone?

Yes, beginners can trade with Pepperstone. We advise starting with a demo account and only trading small amounts once you start trading.