FOREX.com vs OANDA: Which Broker is Better?

Our in-depth comparison of FOREX.com and OANDA analyses important factors such as trading costs, trading platforms, and regulations to help you select the right broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Futures 6.25:1

Minor Pairs 33:1

Minor Pairs 17:1

Minor Pairs 33:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the most important trading factors, but key differences between OANDA and FOREX.com stand out. FOREX.com is considered a trustworthy broker that’s been around for a long time – since 1999 – with a huge global presence and multiple regulations. OANDA is equally an old broker in the US, with a name established in 1996.

FOREX.com charges a $6.00 commission on its DMA account, whereas OANDA relies solely on spreads. While FOREX.com supports MetaTrader 4 and 5, OANDA offers MetaTrader 4 and integrates with TradingView. Both brokers are top-tier regulated, but OANDA gains more trust with an ASIC regulation.

1. Lowest Spreads And Fees – OANDA

FOREX.com offers variable spreads with no-commission and commission accounts, while OANDA is a market maker with a spread-only account. FOREX.com offers competitive spreads on its standard account, often lower than the industry average. On the other hand, OANDA’s spreads tend to be variable, with the potential to be lower during peak trading times. For more details on standard account spreads, you can check out this Standard Account Spreads testing.

OANDA has impressively low spreads across the board. For the EUR/USD pair, they offer a spread of 0.6, which is significantly lower than FOREX.com’s 1.2. This trend continues across most pairs, with OANDA consistently offering lower spreads. This suggests that OANDA could be a more cost-effective choice for traders.

FOREX.com, on the other hand, has higher spreads, but this doesn’t necessarily mean it’s a worse choice. Brokers often balance out their offerings, so while FOREX.com’s spreads are higher, they might offer other benefits such as superior trading platforms or customer service.

| Standard Account | FOREX.com Spreads | OANDA Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.45 | 1.2 | 1.6 |

| EUR/USD | 1.2 | 0.92 | 1.2 |

| USD/JPY | 1.1 | 1.2 | 1.4 |

| GBP/USD | 1.1 | 0.9 | 1.6 |

| AUD/USD | 1.7 | 1.1 | 1.5 |

| USD/CAD | 2 | 1.5 | 1.8 |

| EUR/GBP | 1.3 | 1.16 | 1.5 |

| EUR/JPY | 1.5 | 1.5 | 1.9 |

| AUD/JPY | 1.7 | 1.3 | 2.1 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

Comparing these brokers to the industry average, it’s clear that both are competitive. OANDA’s spreads are consistently below the average, while FOREX.com’s are slightly above in some cases but still in line with what’s typical in the industry.

OANDA seems to be the cheaper option. However, it’s essential to consider other factors such as the trading environment, platforms offered, and the broker’s trustworthiness.

Try our OANDA vs FOREX.com fee calculator below based on the most popular forex pairs and base currencies.

Other Fees

FOREX.com charges an inactivity fee of $15 per month after 12 months, while OANDA charges $10 per month after 12 months.

Our Lowest Spreads and Fees Verdict

FOREX.com and OANDA are closely matched. However, with lower spreads on the standard account and no inactivity fees, OANDA edges out as the broker with lower trading costs.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

2. Better Trading Platforms – FOREX.com

FOREX.com offers a range of trading platforms, including its proprietary platform, Advanced Trading, and the popular MetaTrader 4 and 5 platforms. OANDA offers its proprietary platform, OANDA Trade, and supports MetaTrader 4. For more on trading platforms, see this Best cTrader Brokers page.

| Trading Platform | FOREX.com | OANDA |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | No | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

MetaTrader 4 and 5

FOREX.com and OANDA support MetaTrader 4, the most popular forex trading platform. FOREX.com also offers MetaTrader 5, the newer and more advanced version.

cTrader and TradingView

FOREX.com does not support cTrader or TradingView. OANDA, on the other hand, does not support cTrader but offers integration with TradingView.

Social And Copy Trading

Neither FOREX.com nor OANDA offers 3rd party social or copy trading on their platforms however, it is possible with MetaTrader Signals if using MetaTrader 4 or 5.

VPS and Other Trading Tools

FOREX.com offers free VPS hosting for qualified clients and a range of other trading tools, including advanced charting and analysis tools. OANDA also offers advanced charting on its platform, as well as a range of tools for market analysis.

Our Better Trading Platform Verdict

When it comes to trading platforms, FOREX.com’s support for MetaTrader 5 and free VPS hosting gives it an edge over OANDA.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

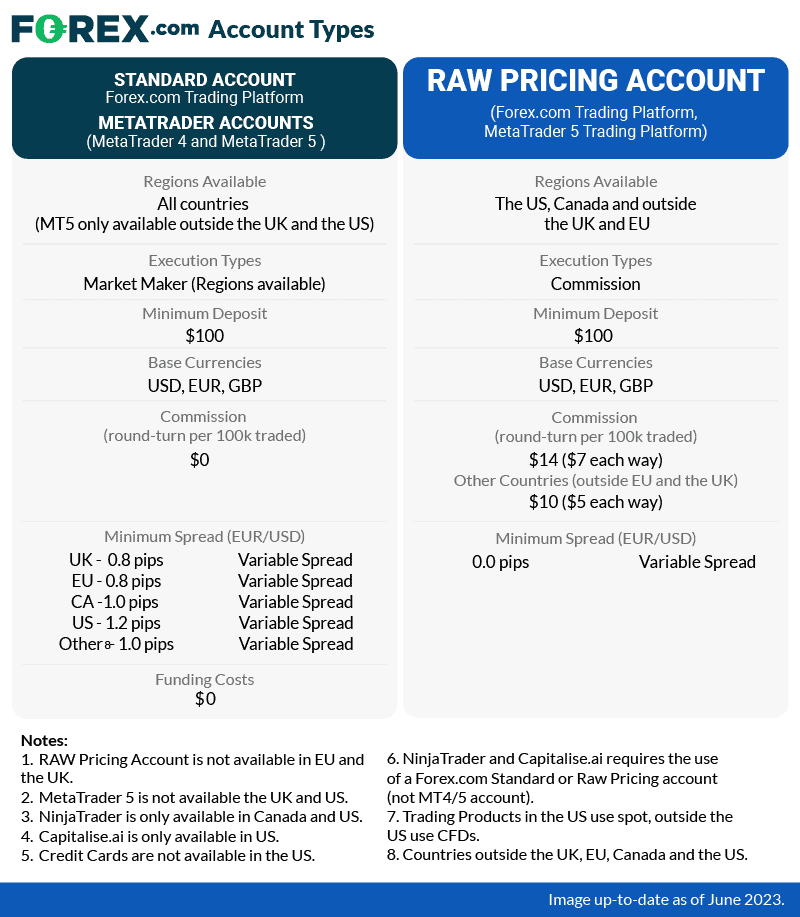

3. Superior Accounts And Features – FOREX.com

FOREX.com offers several account types, including a Standard Account, a Commission Account, and a Direct Market Access account. OANDA offers a standard account and a premium account for high-volume traders.

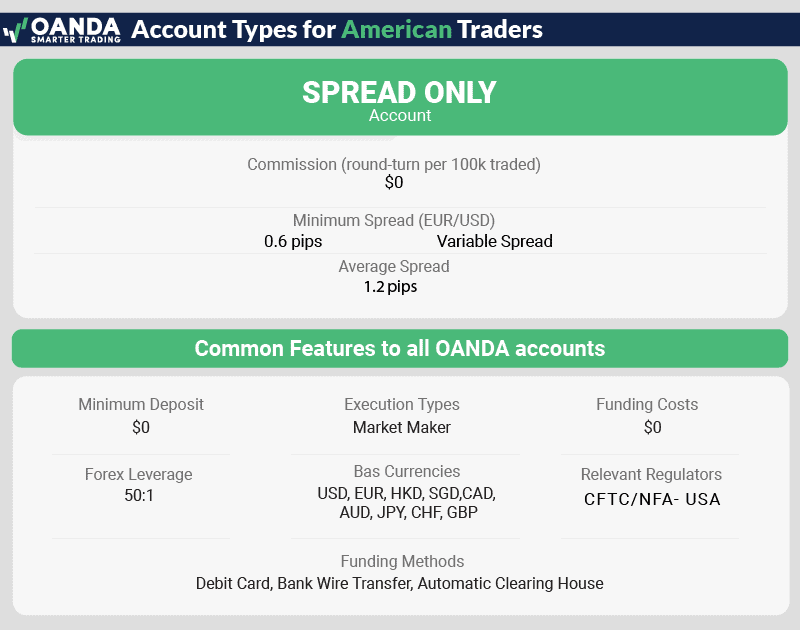

With OANDA, US traders are offered a single account type: the Spread Only account. This account has variable spreads with commissions, which makes trading costs clear and easy to predict.

| FOREX.com | OANDA | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

FOREX.com, with its wider range of account types, offers more flexibility for different types of traders compared to OANDA.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

4. Best Trading Experience – OANDA

OANDA is a market maker with an intuitive interface and lightning-fast execution speed, while FOREX.com is also a market maker, which executes trades fast as well.

According to our testing, OANDA is particularly user-friendly, making it a top pick for beginners. On the other hand, FOREX.com provides a more comprehensive range of platforms including MetaTrader 4 and 5, which can be a big deal for traders who like options.

- OANDA’s user interface is intuitive and easy to navigate.

- FOREX.com offers a wider range of trading platforms, giving you more choices.

- Our tests show that FOREX.com has a slight edge in execution speed.

Our Best Trading Experience and Ease Verdict

OANDA might be more your speed for a straightforward and easy-to-use platform. But if you’re looking for a range of platform options and slightly faster execution, FOREX.com could be the better fit.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – OANDA

OANDA has a higher trust score of 100 vs 84 from FOREX.com. We based our scoring on different factors: regulations, reputation, and reviews of each broker.

FOREX.com Trust Score

OANDA Trust Score

Regulation

FOREX.com is regulated by several financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, and the Commodity Futures Trading Commission (CFTC) in the US. OANDA is also regulated by top-tier authorities, including the FCA and the Australian Securities and Investments Commission (ASIC). Both brokers are considered safe for forex trading, with excellent trust scores. For more on trust and regulation, see this ASIC Regulated Brokers page.

| FOREX.com | OANDA | |

|---|---|---|

| Tier 1 Regulation | FCA (UK) CIRO (CANADA) NFA/CFTC (USA) CYSEC (Cyprus) | NFA/CFTC (USA) MAS (Singapore) CIRO (CANADA) FCA (UK) ASIC (Australia) |

| Tier 2 Regulation | JFSA (Japan) | JFSA (Japan) KNF (Poland) MFSA (Europe) |

| Tier 3 Regulation | CIMA (Cayman) | FSC-BVI |

Reputation

FOREX.com has existed since 1999, when it was founded in New Jersey, USA. OANDA, on the other hand, has roots in New York, which started in 1996.

Despite their years in the industry, FOREX.com has a low search volume of only 14,800 hits per month. OANDA seems quite popular among traders with over 550,000 Google hits monthly.

Reviews

FOREX.com has an excellent TrustPilot score of 4.6/5 from 565 reviews. OANDA has an average score compared to its competitors, scoring only 3.6 out of 5 from 497 reviews.

Our Stronger Trust and Regulation Verdict

Both FOREX.com and OANDA have strong regulatory oversight, but OANDA with its ASIC regulation, offers an additional layer of trust and security for traders.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

6. Most Popular Broker – OANDA

OANDA gets searched on Google more than FOREX.com. On average, OANDA sees around 550,000 branded searches each month, while FOREX.com gets about 22,200 — that’s 95% fewer.

| Country | FOREX.com | OANDA |

|---|---|---|

| United States | 6,600 | 49,500 |

| Germany | 720 | 40,500 |

| United Kingdom | 880 | 33,100 |

| India | 1,900 | 33,100 |

| Spain | 170 | 22,200 |

| France | 260 | 22,200 |

| Switzerland | 70 | 22,200 |

| Italy | 140 | 18,100 |

| Canada | 1,000 | 12,100 |

| Japan | 590 | 12,100 |

| South Africa | 590 | 12,100 |

| Portugal | 40 | 9,900 |

| Colombia | 140 | 9,900 |

| Philippines | 170 | 9,900 |

| Singapore | 90 | 9,900 |

| Brazil | 110 | 6,600 |

| Mexico | 210 | 6,600 |

| United Arab Emirates | 320 | 6,600 |

| Netherlands | 140 | 6,600 |

| Nigeria | 480 | 6,600 |

| Australia | 210 | 6,600 |

| Malaysia | 170 | 6,600 |

| Austria | 110 | 5,400 |

| Thailand | 140 | 4,400 |

| Argentina | 110 | 4,400 |

| Turkey | 320 | 4,400 |

| Sweden | 90 | 4,400 |

| Cyprus | 30 | 4,400 |

| Hong Kong | 90 | 4,400 |

| Kenya | 320 | 4,400 |

| Poland | 170 | 3,600 |

| Egypt | 90 | 2,900 |

| Ireland | 40 | 2,900 |

| Indonesia | 390 | 2,900 |

| Taiwan | 40 | 2,900 |

| Ghana | 90 | 2,900 |

| Vietnam | 170 | 2,400 |

| Peru | 70 | 2,400 |

| Saudi Arabia | 140 | 2,400 |

| Greece | 50 | 2,400 |

| Pakistan | 720 | 2,400 |

| Bangladesh | 210 | 2,400 |

| Mauritius | 20 | 2,400 |

| Morocco | 110 | 1,900 |

| Chile | 50 | 1,600 |

| Algeria | 90 | 1,600 |

| Jordan | 30 | 1,600 |

| Tanzania | 40 | 1,600 |

| New Zealand | 30 | 1,600 |

| Dominican Republic | 70 | 1,300 |

| Sri Lanka | 50 | 1,300 |

| Uganda | 70 | 1,300 |

| Ecuador | 40 | 1,000 |

| Costa Rica | 20 | 1,000 |

| Panama | 10 | 1,000 |

| Venezuela | 50 | 880 |

| Ethiopia | 110 | 880 |

| Bolivia | 20 | 720 |

| Cambodia | 40 | 590 |

| Botswana | 30 | 480 |

| Uzbekistan | 110 | 390 |

| Mongolia | 10 | 70 |

2024 Monthly Searches For Each Brand

FOREX.com - US

FOREX.com - US

|

6,600

1st

|

OANDA - US

OANDA - US

|

49,500

2nd

|

FOREX.com - Germany

FOREX.com - Germany

|

720

3rd

|

OANDA - Germany

OANDA - Germany

|

40,500

4th

|

FOREX.com - India

FOREX.com - India

|

1,900

5th

|

OANDA - India

OANDA - India

|

33,100

6th

|

FOREX.com - Italy

FOREX.com - Italy

|

140

7th

|

OANDA - Italy

OANDA - Italy

|

18,100

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with OANDA receiving 4,647,000 visits vs. 1,779,000 for FOREX.com.

Our Most Popular Broker Verdict

OANDA is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – FOREX.com

FOREX.com provides wider financial market access with more than 2,500 products than OANDA, which has only 100+.

They offer a more extensive range of CFDs than many other platforms, including commodities, indices, and shares. On the other hand, OANDA focuses more on forex pairs, which is great if you’re a currency trader.

| Feature | FOREX.com | OANDA |

|---|---|---|

| Forex Pairs | 80+ | 68 |

| Indices | 20+ | 15 |

| Commodities | 15+ | (Gold x 10) (Silver x 10) 3 Energies 4 Softs |

| Stocks | 300+ | No |

| ETFs | 10+ | No |

| Cryptocurrencies | 5+ | 4 |

| Bonds | 5+ | 5 |

| Options | Yes | No |

| Futures | Yes | No |

| Metals | 5+ | 3 |

FOREX.com offers a vast selection of 84 forex pairs. OANDA provides 68 currency pairs – 10 majors and 58 minors – which is slightly less than FOREX.com.

If you are in the US, you can also trade gold and silver with FOREX.com but note that these products are not leveraged. It is worth noting that while the overall offering of the broker in the US may appear limited, this is in line with similar brokers in the US market.

Our Top Product Range and CFD Markets Verdict

If you’re looking for a broader range of CFDs and markets, FOREX.com is the clear winner. OANDA is more focused on forex trading, so if that’s your main interest, it’s a solid choice.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

8. Superior Educational Resources – OANDA

OANDA provides a wide range of educational materials that cater to traders with different levels of expertise. FOREX.com isn’t too shabby either, but their focus is more on market analysis than educational content.

- OANDA provides a comprehensive set of webinars, articles, and tutorials.

- FOREX.com offers daily market analysis and reports.

- OANDA’s educational content is more beginner-friendly, making it ideal for those new to trading.

- FOREX.com has a decent range of video tutorials, but they are more geared towards intermediate traders.

- OANDA offers a demo account with a virtual balance of $100,000 for practice.

- FOREX.com’s demo account is also rich but comes with a virtual balance of $50,000.

Our Superior Educational Resources Verdict

If you’re looking to improve your trading skills, OANDA is the ideal choice thanks to its extensive educational resources designed for beginners.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

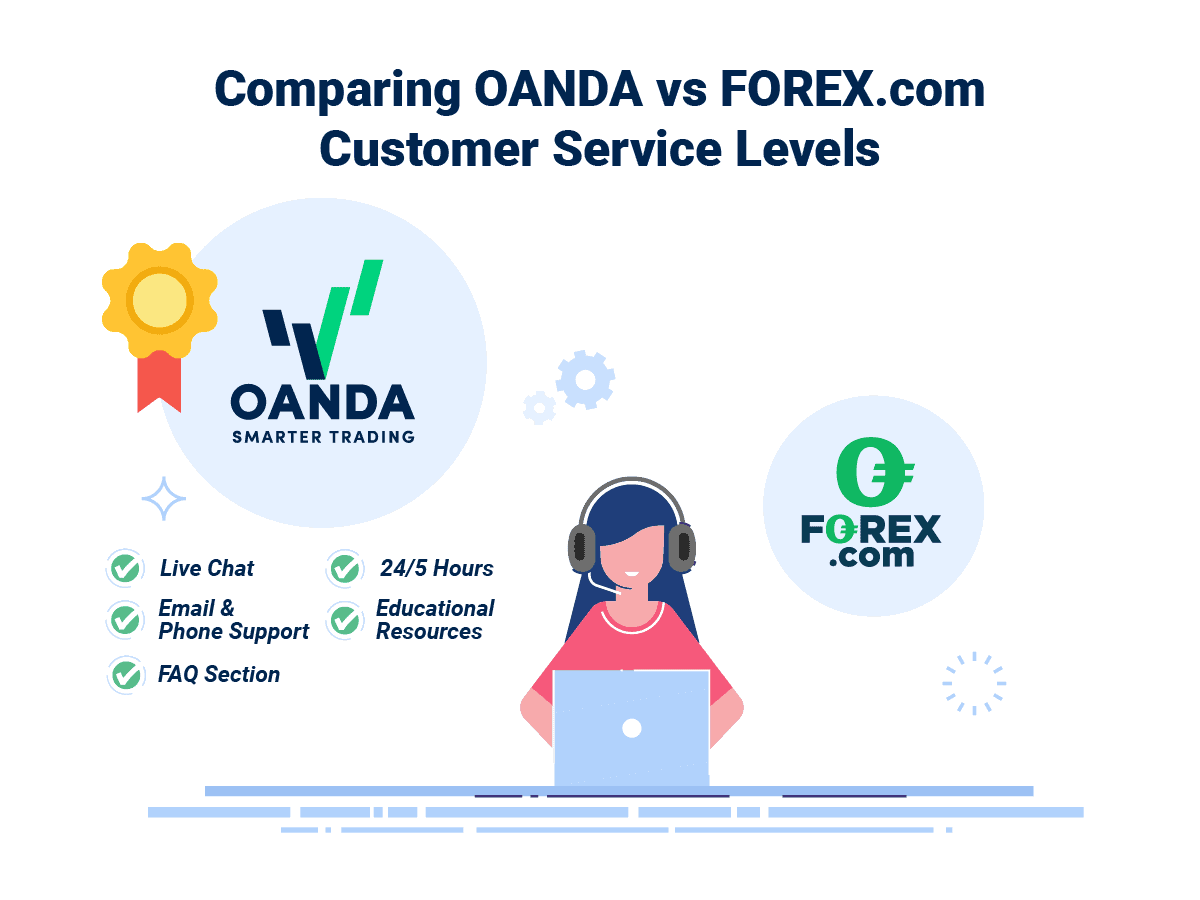

9. Better Customer Service – OANDA

Both FOREX.com and OANDA provide customer service via live chat, email, and phone 24/5, but only one has won more than one award.

OANDA has won the 2021 Telephone Customer Service Awards, TradingView Awards Most Popular Broker 2021, and Best Forex and CFD Broker 2021.

| Customer Service Feature | FOREX.com | OANDA |

|---|---|---|

| Live Chat Support | Available 24/5 | Available 24/5 |

| Customer Service Knowledge | Good | Excellent |

| FAQ Knowledge Base | Average | Average |

| Email/Social Media | Messenger, Twitter | Email, Twitter |

| Multilingual Support | Yes | Yes |

Regarding responsiveness, both brokers are fairly prompt. OANDA offers a more comprehensive FAQ section and educational resources as part of their customer service, which can be a big plus if you’re new to trading.

Our Superior Customer Service Verdict

If you’re looking for comprehensive customer service that includes resources for learning, OANDA is the best choice.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

10. More Funding Options – FOREX.com

FOREX.com accepts multiple forms of payment, including credit/debit cards, bank transfers, and even Skrill. OANDA, on the other hand, is a bit more limited but still provides the essentials like credit/debit cards and wire transfers.

| Funding Option | FOREX.com | OANDA |

|---|---|---|

| Credit/Debit Card | ✓ | ✓ |

| Bank Wire Transfer | ✓ | ✓ |

| PayPal | ✗ | ✗ |

| Skrill | ✓ | ✗ |

| Neteller | ✓ | ✗ |

| Rapid Pay EUR/GBP (5) | ✗ | ✗ |

| POLi / bPay AU/NZ (5) | ✗ | ✓ |

| Klarna (2) | ✗ | ✗ |

Our Better Funding Options Verdict

While both brokers don’t have PayPal as a payment method, FOREX.com is the better choice with its inclusion of Skrill and Neteller.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

11. Lower Minimum Deposit – OANDA

OANDA has a lower minimum deposit of $0 against the $100 minimum set by FOREX.com. Do note that the $0 requirement is only applicable on bank transfers. $25 is the minimum for other payment channels, as seen below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Trustly | £25 Minimum Deposit | $25 Minimum Deposit | €25 Minimum Deposit | $25 |

| Paypal | N/A | N/A | N/A | N/A |

FOREX.com, on the other hand, has a fixed $100 across different currencies and payment methods.

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | £100 | $100 | €100 | $100 |

| Neteller | £100 | $100 | €100 | $100 |

Our Lower Minimum Deposit Verdict

OANDA stands out as the winner in this category due to its minimum deposit requirement of $0.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

So is OANDA or FOREX.com the Best Broker?

OANDA is the winner because it offers a more user-friendly experience, lower minimum deposit, and superior educational resources. The table below summarizes the key information leading to this verdict:

| Criteria | OANDA | FOREX.com |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platforms | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| CFD Product Range And Financial Markets | ❌ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Better Customer Service | ✅ | ❌ |

| More Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

OANDA: Best For Beginner Traders

If you’re a beginner, OANDA is the better choice due to its lower minimum deposit, user-friendly platform, and extensive educational resources.

FOREX.com: Best For Experienced Traders

For experienced traders, FOREX.com offers a more comprehensive range of trading platforms and CFD markets, making it the better option.

FAQs

Does FOREX.com or OANDA Have Lower Costs?

OANDA takes the cake here with lower costs, offering spreads as low as 0.6 pips on major pairs. FOREX.com isn’t far behind, starting at 1 pip. For more on this, check out our lowest spread forex brokers.

Which Broker Is Better For MetaTrader 4?

Actually, neither OANDA nor FOREX.com offer social or copy trading. If that’s a deal-breaker for you, have a look at our best copy trading platforms.

Does Either Broker Offer Spread Betting?

Only FOREX.com offers spread betting, making it a tax-efficient option for UK traders. For more details, visit our best spread betting brokers.

What Broker is Superior For Australian Forex Traders?

From my perspective, OANDA is the superior choice for Aussies. They’re ASIC-regulated and offer a user-friendly platform. FOREX.com is also ASIC-regulated but was founded overseas. More details can be found on our Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

In my opinion, FOREX.com takes the lead for UK traders. They’re FCA-regulated and offer a wide range of trading platforms. OANDA is also FCA-regulated but was founded overseas. For more, check out our Best Forex Brokers In UK.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert