Lowest Spread Forex Brokers

We shortlisted DFSA and SCA-regulated brokers in the UAE and compared their raw spreads and commission structures to find which platforms deliver the lowest all-in trading costs. Our team tests these spreads monthly as broker pricing changes frequently.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

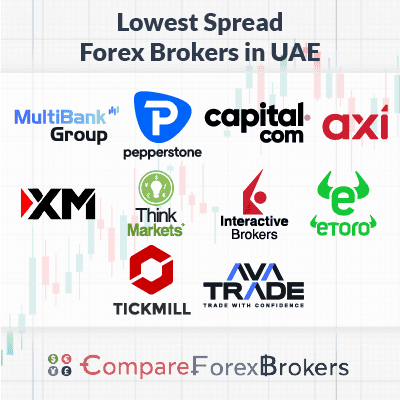

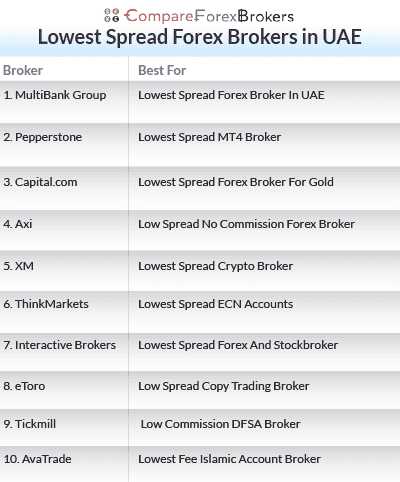

Lowest Spread Forex Brokers In UAE:

- MultiBank Group - Lowest Spread Forex Broker In UAE

- Pepperstone - Lowest Spread MT4 Broker

- Capital.com - Lowest Spread Forex Broker for Gold

- Axi - Low Spread No Commission Forex Boker

- XM - Lowest Spread Crypto Broker

- ThinkMarkets - Lowest Spread ECN Accounts

- Interactive Brokers - Lowest Spread Forex and Stockbroker

- eToro - Low Spread Copy Trading Broker

- Tickmill Group - Low Commission DFSA Broker

- AvaTrade - Lowest Fee Islamic Account Broker

What forex broker has the lowest spread?

MultiBank Group has the lowest all-in trading costs in the UAE. You get raw spreads from 0.0 pips on EUR/USD with $3.00 round-turn commissions ($1.50 per side), compared to $6-$7 at most other brokers. Their SCA regulation lets you trade with 500:1 leverage, and the MultiBank-Plus App shows you 5 levels of market depth so you can see exactly where liquidity sits before entering trades.

1. Multibank Group - Lowest Spread Forex Broker In UAE

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.5 AUD/USD = 0.4

Trading Platforms

MT4, MT5, WebTrader

Minimum Deposit

Why We Recommend Multibank Group

I recommend MultiBank Group for having the tightest all-in trading costs among UAE brokers. Their ECN account combines 0.0 pip raw spreads with $3.00 round-turn commissions, which is lower than most competitors’ charges.

The broker operates under SCA regulation, giving you access to 500:1 leverage compared to the 30:1 retail cap under DFSA. Their ECN account shows 5 price levels of market depth in real-time, letting you see available liquidity before entering trades.

3 accounts are available – Standard (with spreads from 1.5 pips), ECN (0.8 pips), Pro (0 pips) and available with MT4, MT5 and MultiBank apps. With these account you also get access to 14,000 share CFDs alongside 40 forex pairs and 23 indices.

Pros & Cons

- $3.00 total commission per round-turn

- 0.0 pip raw spreads on major pairs

- 14,000 share CFDs with 40 forex pairs

- 5-level market depth transparency

- Free VPS for automated strategies

- 20% deposit bonus up to $40,000

- $10,000 minimum for ECN access

- Standard Account costs 1.5 pips

- Only 11 crypto CFDs available

- No swap-free Islamic accounts

Broker Details

ECN Pricing Breakdown

MultiBank’s ECN pricing structure charges $1.50 per side on standard lots, totaling $3.00 to open and close a position. Compare this to Pepperstone at $7.00, Axi at $7.00, and ThinkMarkets at $7.00 round-turn.

The raw spreads start at 0.0 pips during liquid market hours on EUR/USD, GBP/USD, and other major pairs. This tight pricing comes from direct market access to their institutional liquidity providers without markup.

Your orders execute at the best available price across multiple liquidity sources rather than through a dealing desk, eliminating the conflicts of interest that occur when brokers trade against you.

Cost Comparison Across Instruments

Beyond forex, you can trade 14,000 share CFDs with the same ECN pricing structure, giving you low-cost access to US tech stocks, UK blue chips, European equities, and emerging market companies. This extensive selection means you’re not limited to just currency pairs when opportunities arise in equity markets.

Instruments with Multibank

| Instruments | Number | Max Leverage | Features |

|---|---|---|---|

| Forex | 40 | Up to 500:1 | Major, Minor, Exotics |

| Metals | 4 | Up to 500:1 | Gold, Silver |

| CFD Shares | 14,000 | Up to 500:1 | No Commission Wide range of global stock exchanges |

| Energies | 5 | Up to 500:1 | Global indices |

| Crypto | 11 | Up to 500:1 |

MultiBank offers a 20% deposit bonus up to $40,000 maximum, effectively reducing your net trading costs further. Combined with the lowest commission rates, this bonus provides additional capital for position sizing. The broker also supports UAE-focused funding through MyFatoorah payment gateway alongside standard methods like bank transfers and cards.

Educational Resources and Platform Access

You get 15 structured courses covering Introduction, Trading Terms, Advanced Strategies, Economics, and ECN trading specifics. Nine downloadable ebooks cover trading fundamentals, technical analysis, and risk management. This education helps you understand how to maximise the cost advantages of tight spreads through proper strategy execution.

MetaTrader 4 and MT5 provide full Expert Advisor support without restrictions on scalping or hedging strategies. The MultiBank-Plus mobile app adds ECN-specific features including 5-level market depth displays, integrated social trading to copy successful traders, and complimentary VPS hosting.

2. Pepperstone - Lowest Spread MT4 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone is great if you use MetaTrader 4 and want the lowest spreads available in the UAE. The Razor Account provides 0.0 pip raw spreads on EUR/USD during London and New York sessions with $3.50 per side commission ($7 round-turn).

While you get identical pricing across MT5, cTrader, and TradingView, Pepperstone’s MT4 stands out because of the Smart Trader Tools package that transforms how you interact with the platform. Hedging, Scalping are all permitted, alongside automation with expert advisors.

The Smart Trader Tools add Mini Terminal for one-click execution where you preset lot sizes and stop distances, eliminating manual form entries when you need speed. You also get Correlation Matrix showing which pairs move together and Alarm Manager tracking spread levels across multiple instruments simultaneously.

Pros & Cons

- 0.0 pips raw spreads on major pairs

- Smart Trader Tools exclusive to Pepperstone

- Five platforms with identical pricing

- 1,475 instruments including 93 forex pairs

- $0 minimum deposit on Razor Account

- Active Trader discounts reduce costs further

- $7 commission exceeds MultiBank’s $3

- Standard Account spreads start at 1.0 pips

- Cannot fund accounts using AED

- Commission structure increases costs vs spread-only accounts

Broker Details

Platform Flexibility Beyond MT4

While Pepperstone excels on MT4, you get the same 0.0 pip spreads across MetaTrader 5, cTrader, TradingView, and the Pepperstone mobile app. The cTrader platform actually reduces commissions to $6 round-turn versus $7 on MT4/MT5, making it more cost-effective if you’re comfortable switching.

TradingView integration gives you 100+ indicators and social features while maintaining the same raw spread pricing. The Pepperstone app provides mobile access with full charting capabilities when you’re away from your desktop.

Multi-Asset Spread Advantage

Beyond forex, you can trade 1,162 share CFDs with competitive spreads, letting you capitalise on tight pricing across individual stocks. The 26 global index CFDs and 40 commodities including gold, silver, and oil all benefit from Pepperstone’s pricing structure.

When opportunities arise in equities or commodities, you’re using the same account with consistent cost structure rather than switching brokers.

The 94 forex pairs extend beyond just majors into 28 minors and 37 exotics with raw spread pricing. Cryptocurrency CFDs on 44 digital assets use perpetual contracts eliminating expiry management. The 95 ETFs provide sector and regional exposure. This breadth means your tight spread advantage applies whether you’re trading EUR/USD or diversifying.

| Instrument | Number of products | Notes |

|---|---|---|

| Forex | 94 | Major, Minor, Exotics, CrossPairs |

| Cryptocurrencies | 44 | |

| Commodities | 33 | Hard and Soft including gold, silver, coffee, Cocoa |

| CFD Forwards | 38 | Forex, Agriculture |

| Indices | 24 | Global Indices |

| ETFs | 95 | |

| CFD Stocks | 1384 | 5 Global Exchanges |

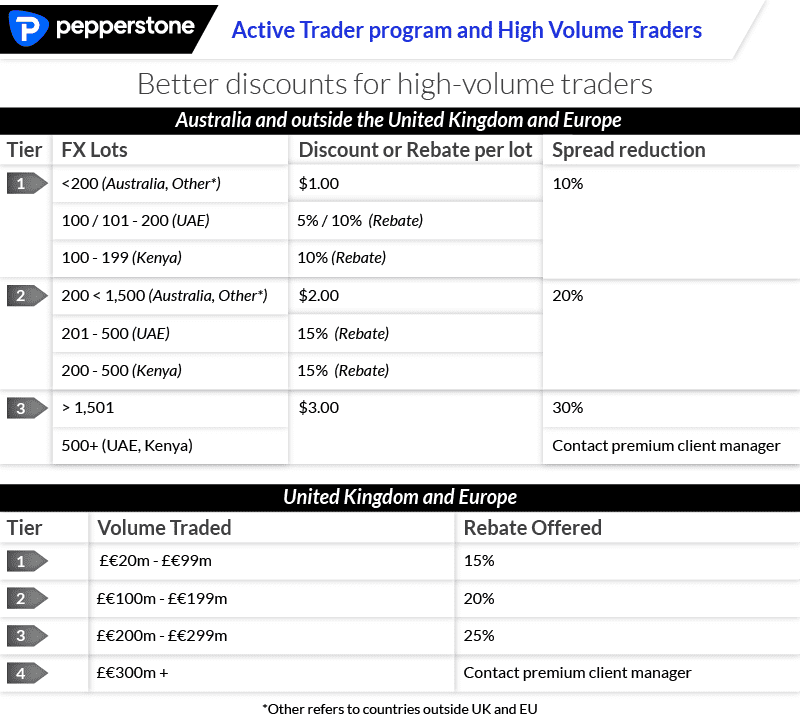

Cost Analysis for Different Trading Volumes

The Razor Account’s $7 round-turn makes sense when you execute 5+ lots daily. Below this threshold, the Standard Account’s 1.0 pip spread with zero commission might cost less. At 5 lots daily, you pay $700 in Razor commissions versus approximately $1,000 in Standard spread costs. The crossover point depends on your typical trade frequency and position sizes.

The Active Trader Program provides three discount tiers reducing costs as your monthly volume increases. These discounts apply across all platforms and instruments, meaning your MT4 forex trades, cTrader stock CFDs, and TradingView index positions all contribute toward volume thresholds.

If you trade heavily, you can significantly reduce your effective commission rates while maintaining access to 0.0 pip spreads.

3. Capital.com - Lowest Spread Forex Broker for Gold

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MetaTrader 4, TradingView, Capital.com's Trading App and Web Platform

Minimum Deposit

$50

Why We Recommend Capital.com

I recommend Capital.com for their 0.6 pip spreads on EUR/USD and gold with zero commission, making your all-in trading costs transparent. The guaranteed stop-loss orders on their proprietary platforms protect you from slippage during volatile movements, which is rare among UAE brokers.

Their gold spreads at 0.6 pips particularly stand out when combined with GSLO protection during geopolitical events or volatile precious metals sessions.

Capital.com’s SCA regulation allows 300:1 leverage versus the 30:1 DFSA retail limit, letting you control larger positions across 4,500 markets. You access extensive commodities including silver, oil, and agricultural products, plus global share CFDs, major indices, and cryptocurrencies through five platforms (MT4, MT5, TradingView, and proprietary web and mobile apps) with AI risk analysis.

The $0 minimum deposit and free deposits/withdrawals eliminate upfront costs.

Pros & Cons

- 0.6 pip gold spreads, zero commission

- Guaranteed stop-losses prevent slippage

- 300:1 leverage via SCA regulation

- 4,500 markets across all asset classes

- AI risk management on proprietary platforms

- $0 minimum deposit, free funding

- No raw spread ECN account option

- Single account tier (no volume discounts)

- GSLO only on Capital.com platforms, not MT4/MT5

- Professional account requires €500K portfolio

4. Axi - Low Spread No Commission Forex Boker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

Axi is a great option due to its Pro Account delivering 0.0 pip raw spreads with $3.50 commission per side ($7 round-turn) and 90ms execution speeds. The Elite Account maintains identical commission rates but requires $500 minimum deposit, qualifying you for 500:1 leverage versus the 30:1 retail limit if you meet professional criteria.

You get access to 69 forex pairs including majors, minors, and exotics, plus Autochartist pattern recognition identifying technical setups automatically across your watchlist.

What separates Axi is their unlimited demo account letting you test exact live conditions without expiry dates or time pressure. You can create multiple demo sub-accounts comparing Standard (0.6 pips, zero commission) versus Pro pricing to see which structure suits your trading frequency.

The MT4 NexGen package adds advanced order management, correlation matrices, and sentiment indicators, giving you institutional-grade tools before funding your live account.

Pros & Cons

- 0.0 pips with $3.50 per side

- 90ms execution speeds

- Unlimited demo, multiple sub-accounts

- Autochartist included

- Elite: 500:1 leverage, $500 minimum

- MT4 only (no MT5, cTrader, TradingView)

- Standard Account 0.6 pips

- Elite requires $500 minimum

- Limited education vs competitors

5. XM - Lowest Spread Crypto Broker

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM is a great broker if you trade cryptocurrency CFDs alongside forex because they offer competitive spreads across both asset classes from a single account. The Ultra Low Account delivers 0.8 pip EUR/USD spreads with $1.60 commission per side, while providing access to crypto CFDs without the wider spreads typical at brokers separating these markets.

You get MetaTrader 5 with 38 technical indicators, 21 timeframes, and an integrated economic calendar, plus the XM App with TradingView charts built directly into the mobile interface.

XM requires just $5 minimum deposit across all account types, making it accessible regardless of your starting capital. You access extensive stock CFD coverage from US, European, and Asian exchanges, commodities spanning precious metals and energies, equity indices including both cash and futures contracts, plus thematic indices tracking specific sectors.

The social and copy trading features let you mirror experienced traders if you’re still developing your own crypto and forex strategies.

Pros & Cons

- Competitive crypto CFD spreads

- $5 minimum deposit all accounts

- XM App with TradingView integration

- Social/copy trading available

- Standard Account 1.6 pips

- Professional needs verification

- 30:1 leverage (MENA regulation)

- Education primarily video-based

6. ThinkMarkets - Lowest Spread ECN Accounts

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets stands out with its ThinkZero ECN account delivering tight spreads with transparent commission structures optimised for active trading. The ThinkZero account delivers raw spreads from 0.0 pips with $3.50 per side commission, matching Pepperstone and Axi on cost structure.

What separates ThinkMarkets is the proprietary ThinkTrader platform providing institutional-level execution speeds and market depth visibility typically reserved for much larger accounts at competing brokers.

You access 42 forex pairs spanning all major crosses plus select emerging market currencies like Turkish Lira and Mexican Peso. Beyond forex, the broker offers over 2,700 stock CFDs from US, European, and Asian exchanges, letting you apply the same low-cost ECN structure to individual equities.

The mobile trading app called ThinkTrader includes full technical analysis capabilities with multiple chart types and dozens of indicators, plus TradingView integration if you prefer their interface and social trading features. Other useful features include Traders’ Gym and Trend Risk Scanner.

Pros & Cons

- Raw spreads from 0.0 pips on ECN

- $3.50 commission matches top competitors

- 2,700+ stock CFDs available

- ThinkTrader platform with depth display

- TradingView integration included

- MT4/MT5 only offshore (not UAE entity)

- Standard account charges 0.6 pips minimum

- $50 minimum deposit requirement

- Offshore accounts lack UAE regulation

7. Interactive Brokers - Lowest Spread Forex and Stockbroker

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers stands out by offering both tight forex spreads and direct stock ownership across 167 global exchanges, eliminating the need for separate accounts. While most UAE brokers only provide CFDs where you speculate on price movements, Interactive Brokers lets you actually own shares, receive dividends, and exercise voting rights.

The commission structure uses tiered pricing that decreases as your monthly volume grows, with rates falling from 0.20 basis points to as low as 0.08 basis points for the highest tier.

The trading platform selection includes Trader Workstation for desktop power users, mobile apps for on-the-go access, and a dedicated FX Trader interface optimised for currency trading.

Beyond forex and stocks, you get exposure to fixed income through bonds, diversification through mutual funds (42,000+ options), and sector coverage via ETFs. The iBKR Campus offers webinar-based education across 17+ investment topics, helping you understand how to use these different asset classes effectively within your portfolio strategy.

Pros & Cons

- Real stock ownership

- Tiered commissions decrease with volume

- Bonds, 42,000+ mutual funds, ETFs

- Multiple platforms: TWS, Mobile, GlobalTrader

- iBKR Campus education, 17+ topics

- Steep learning curve for beginners

- Complex tiered commission structure

- Higher minimum deposits required

- Wire transfer deposit fees apply

8. eToro - Low Spread Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$500

Why We Recommend eToro

eToro specialises in social and copy trading functionality, letting you browse thousands of verified traders and automatically replicate their positions in your account. You can filter by monthly returns, risk scores, preferred assets, and geographic location to find trading styles matching your goals.

The platform shows real-time feeds of what popular investors are buying and selling, giving you market sentiment insights before making your own decisions.

Spreads start at 1.0 pips on EUR/USD with zero commission, making costs predictable even if slightly higher than raw ECN pricing from other brokers. The trade-off comes through access to 932 ETFs for portfolio diversification, significantly more than competing platforms. You also get 65 forex pairs, extensive cryptocurrency options, global indices, and commodities spanning agriculture to precious metals.

The beginner-friendly interface removes complexity, while the eToro Academy provides structured courses helping you progress from basic concepts through advanced trading strategies.

Pros & Cons

- CopyTrader with verified track records

- Social feeds showing investor activity

- 932 ETFs for diversification

- Instant funding via multiple methods

- Beginner-friendly platform design

- No MT4/MT5 platform access

- 1.0+ pip spreads exceed ECN brokers

- $50 minimum deposit requirement

- Limited advanced charting capabilities

9. Tickmill - Low Commission DFSA Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, Tickmill Mobile App CQG Agena Trader

Minimum Deposit

$100

Why We Recommend Tickmill

Tickmill delivers some of the lowest commission rates available at $2.00 per side ($4.00 round-turn) on their Pro Account. When combined with raw spreads starting from 0.1 pips on EUR/USD, you get highly competitive all-in trading costs that are transparent and easy to calculate.

The platform selection includes MT4 and MT5 with full Expert Advisor support and zero restrictions on scalping or hedging strategies. You access 58 forex pairs spanning major crosses and emerging market currencies, plus CFDs on indices, commodities, and energy markets.

Tickmill provides complimentary VPS hosting for accounts meeting minimum balance requirements, eliminating latency issues when running automated trading systems. Educational resources include regular webinars, video tutorials, and daily market analysis helping you develop trading skills.

Pros & Cons

- $4.00 round-turn commission

- Raw spreads from 0.1 pips

- FCA and CySEC regulation

- Free VPS for qualifying balances

- MT4 and MT5 platform support

- $10 minimum deposit required

- Not regulated by UAE authorities

- Limited stock CFD selection

- No proprietary platform available

10. AvaTrade - Lowest Fee Islamic Account Broker

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade provides automatic swap-free Islamic accounts for UAE residents without requiring separate applications or approval processes. Your positions remain free of overnight interest charges for up to 5 days before administrative fees apply, giving you flexibility for short-term holds without Shariah compliance concerns.

The broker offers multiple account structures including fixed spreads at 0.8 pips for cost predictability or Professional accounts with 0.6 pips and $1.60 commission if you qualify for 400:1 leverage.

The unique AvaProtect feature lets you insure losing positions up to $50,000 for premiums between 3-10% based on trade duration, essentially buying protection against adverse price movements. You also get access to 44 forex options plus gold and silver options, providing defined-risk strategies unavailable at most UAE brokers offering only spot forex

Platform selection includes MT4, MT5, AvaOptions for trading options contracts, and AvaTradeGO mobile app, while AvaSocial and ZuluTrade integration enable copy trading functionality.

Pros & Cons

- Automatic Islamic accounts, ADGM regulated

- AvaProtect position insurance available

- 44 forex options for defined-risk

- Fixed spread 0.8 pips option

- Multiple platforms including AvaOptions

- Swap fees after 5-day period

- $100 minimum across all accounts

- 30:1 retail leverage (400:1 professional)

- Professional account needs qualification

Ask an Expert