In this article, I will cover the best forex currency pairs to trade, which offer greater trading volume, volatility, and opportunities in the financial market, including major, minor, and exotic pairs such as EUR/USD, USD/JPY and GBP/USD.

Additionally, I will discuss important factors to consider before executing a trade.

What are Forex Currency Pairs?

A Forex pair (or currency pair) is a price quote of the exchange rate that shows how much one fiat currency is worth compared to another fiat currency. It’s written as two different currencies next to each other.

For example:

EUR/USD: This tells you how many US dollars you need to buy one Euro.

USD/JPY: This tells you how many Japanese yen you need to buy one US dollar.

How Forex Trading Works with Forex Pairs

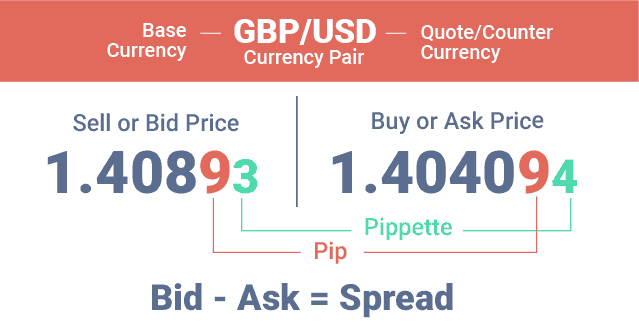

In Forex trading, you always trade currencies in pairs. The first currency is called the base currency, and the second is the quote currency (or counter currency). The base currency represents the sell or bid price and the quote currency represents the buy or ask price. The difference between the bid and ask price is known as the spread.

Currency pairs are used in foreign exchange markets. Unlike in stock trading, currencies are always traded in pairs since you are trading one pair against another. The rate at which the pairs are traded is known as the exchange rate which is affected by supply (liquidity) and demand.

For instance, in the EUR/USD pair, if you see a quote like ‘1.20’, it means 1 Euro is worth 1.20 US dollars.

Types of Best Forex Pairs

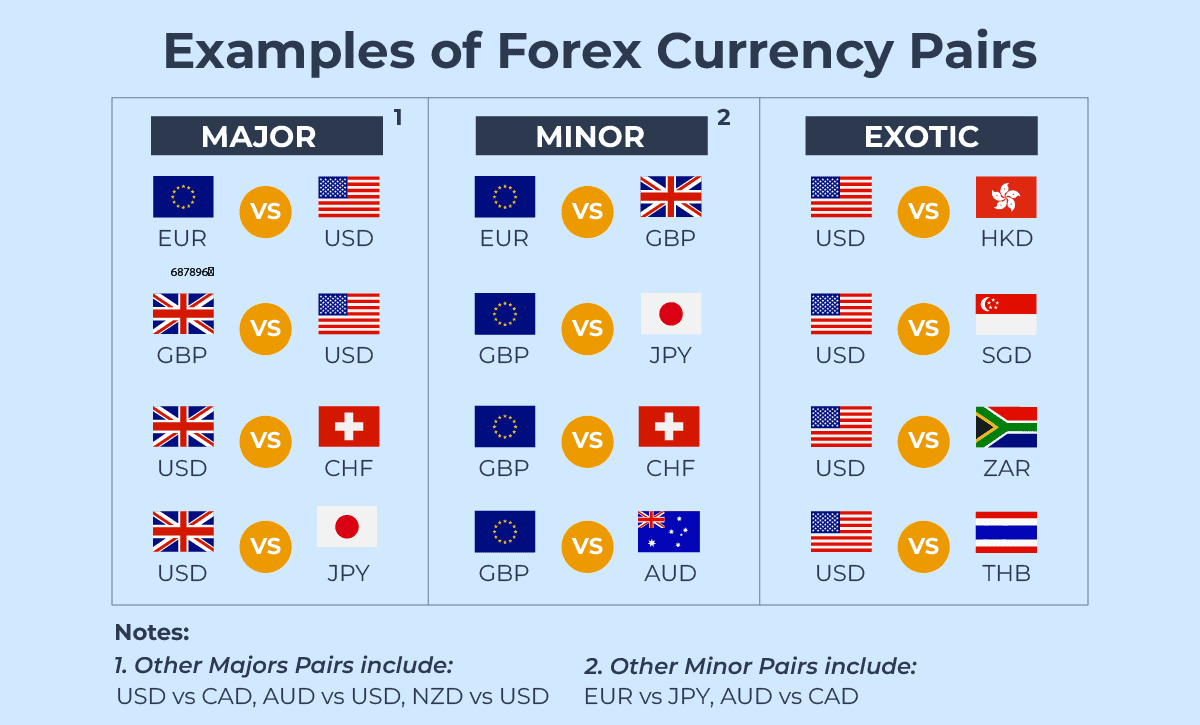

The best Forex pairs are further divided into four categories: the majors, the minors, the cross, and the exotics.

1. Major Pairs

These comprise some of the best forex currency pairs to trade, generally with high liquidity. For instance, EUR/USD (Euro over US Dollar).

If I expect the European economy to do better than the US economy over a given period, I would buy EUR/USD when the price is relatively low, and then, by the time the Euro outperforms the Dollar, I have the opportunity to cash in.

2. Minor Pairs

Minor pairs are less actively traded currency pairs compared to the major pairs, but they still consist of some major currencies. These pairs often have good liquidity and are among the best forex currency pairs to trade.

One example is the GBP/JPY pair. I might consider buying the GBP/JPY since if I believe that the GBP will outperform the JPY due to the market conditions.

3. Cross Pairs

Cross pairs are currency pairs that do not include the US dollar. These pairs involve two major currencies from different countries. Notable examples in this category are EUR/GBP and EUR/JPY.

4. Exotic Pairs

This type of pair includes one of the major currencies and one from a smaller economy or one that is seen as ‘emerging’.

Unlike trading relations of major pairs, these trading pairs are not as competitive and offer better trading opportunities due to less competition. For instance, USD/TRY, NOK/TRY, or TRY/RUB.

5. Commodity Pairs

Another less common term you might hear is commodity pairs. These fiat currency pairs involve countries with large amounts of commodity reserves, making such pairs sensitive to changes in commodity prices. Such pairs will usually be USD vs AUD, CAD, NZD and even Russian Rubles (RUB), Saudi Riyal (SAR) and Brazilian Real (BRL).

The Best Currency Pairs in the Forex Market

In trading accounts, forex traders have the option to trade an array of forex pairs. Below are the best forex currency pairs to trade and the reasoning behind it:

| Currency | Average Daily Range (Pips) | Share of total trades (%) |

|---|---|---|

| EUR/USD | 70-100 | 22.7 |

| USD/JPY | 40-70 | 13.5 |

| USD/CHF | 80-120 | 3.9 |

| GBP/USD | 80-120 | 9.5 |

| AUD/USD | 50-80 | 5.1 |

| USD/CAD | 60-90 | 5.5 |

| EUR/GBP | 30-50 | 2 |

| EUR/JPY | 60-90 | 1.4 |

| USD/MXN | 150-200 | 1.4 |

This table highlights the USD/MXN as the most volatile pair with a daily range of 150-200 pips, while the EUR/USD dominates the market with the highest trading volume share at 22.7%.

Major Currency Pairs:

EUR/USD

The Euro against the US Dollar is nicknamed the “fiber.” It is the most traded currency pair in trading sessions, known for its high liquidity and use in both short-term and long-term trading.

The fiver is also the most traded forex pair, generating numerous trading opportunities at tight spreads because it is the most liquid forex pair. Some brokers might even offer EUR/USD at zero spread due to its popularity.

This currency pair is best for traders who are active during the London session and have a lower risk-to-reward ratio trading strategy.

The advantage of a tight or zero spread makes the trade prone to breakeven, hence a higher winning probability.

USD/JPY

The US Dollar and Japanese Yen pair, known as the “Ninja,”is an extremely liquid and volatile pair, especially within Asian market hours. It combines the world’s largest currency with an Asian major, offering huge trading opportunities.

USD/JPY is a volatile pair and may provide traders with both potential risk and reward when capitalizing on short-term price movements.

USD/CHF

Swissy turns out the most stable pair on the market comes from one of the most stable and desirable investments around – the US Dollar and the Swiss Franc in the form of the USD/CHF currency pairing.

I’ve observed that the Swiss Franc, in particular, often becomes a ‘safe-haven’ when markets are showing signs of overall economic or political volatility. This makes the pair quite a liquid investment and also, given their stability, proven from its price movement history throughout major news events.

GBP/USD

“Cable” is the nickname for the British Pound and US Dollar pair. It is strongly influenced by economic data from both the US and UK economies. Despite this, it remains one of the most popular currency pairs to trade, offering numerous trading opportunities.

The GBP/USD isn’t as liquid as the major pairs, but GBP/USD has enough trading volume and can move enough during the London session in response to economic data, to generate a small fortune.

AUD/USD

Speculative forex traders wishing to bet on commodity markets will therefore often turn to another currency pair; the Australian Dollar/US Dollar, or known as ‘Aussie’ informally.

Its price is mainly driven by Australia news and tends to have a strong correlation with commodity prices like iron ore and gold.

AUD/USD also tends to have a clearer technical pattern in comparison to the other currency pairs, making it more friendly for beginner traders to capture pips in their initial trading stage.

USD/CAD

The US Dollar/Canadian Dollar (or Loonie), is influenced by oil prices as it is a commodity currency because Canada is a major exporter of oil, its economic performance is closely tied to the price of oil (crude oil and gas are Canada’s biggest exports).

Furthermore, Canada has deep economic ties to the US so that pair is also impacted. Which is suitable for crude oil trader who prefers trading during the New York timezone.

Minor Currency Pairs

EUR/GBP

Euros and Great British pound (or chunnel), it is one of the most popular minor pairs traded besides the majors, those five currency pairs which consist of the US dollar (USD). Both currencies belong to two of the major world markets.

Additionally, the close economic bond and trading relationship between these countries entails that political and economic events can impact the EUR/GBP exchange rate, offering news traders opportunities to profit from market volatility.

Also, EURGBP typically has tight bid-ask spreads, which translates to lower trading costs and enhances the profit potential of trades.

Cross Currency Pairs

EUR/JPY

The Euro and Japanese Yen pair, also known as “Yuppy,” offers unique trading opportunities. This combination is influenced by economic conditions in both the Eurozone and Japan.

Euro and Yen, commonly known as EUR/JPY, are branded as one of the most liquid and volatile pairs. EUR/JPY can have wider spreads and variable liquidity, impacting trading costs and execution.

However, I’ve noticed its active trading session is longer as it spreads through Asia to the European timezone, allowing traders with bigger risk-to-reward ratio trading strategies to actualize their target.

Exotic Currency Pairs

USD/MXN

The USD/MXN pair represents the exchange rate between the US Dollar and the Mexican Peso. It is known for its high volatility and strong reaction to economic data from both the US and Mexico.

Most of us focus on this pair for its potential to offer significant trading opportunities due to its responsiveness to political and economic events in North America.

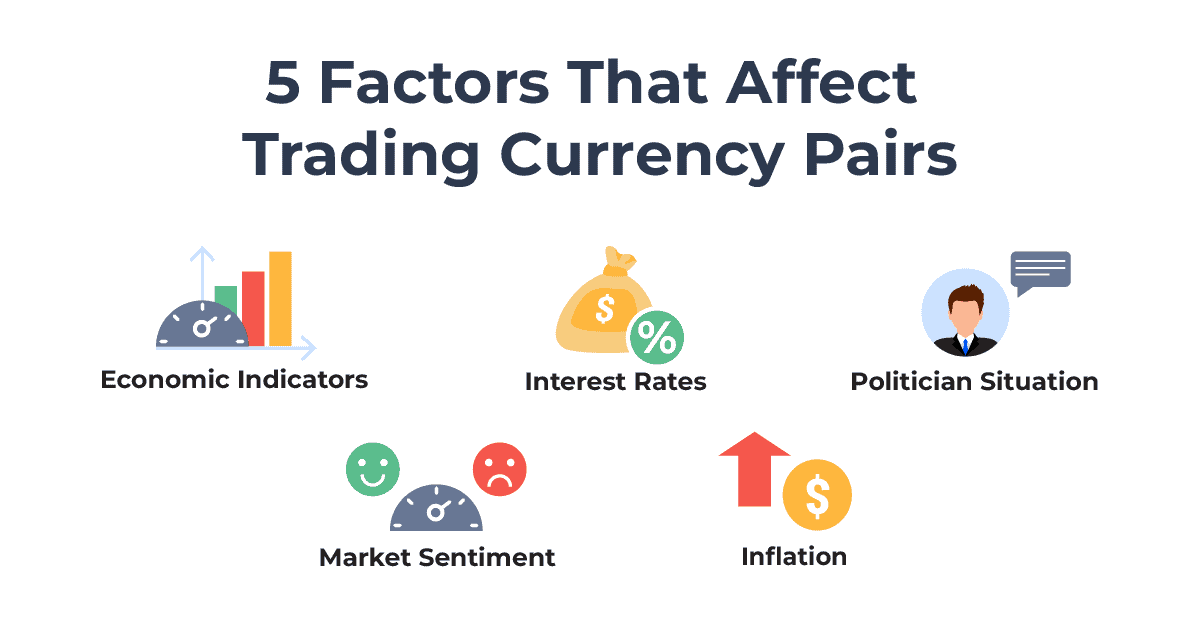

Factors That Affect Trading Currency Pairs

Several factors influence the price action of currency pairs in the forex market:

1. Economic indicators

The Economic indicators of GDP figures, employment rates, and inflation fluctuate and influence the value of all currencies – the stronger the economy, the stronger the currency.

2. Interest Rates

Interest Rates from Central bank policies that affect interest rates help to determine currency values. Higher interest rates can lead to greater foreign investment and, thus, a higher currency.

3. Political Situation

This involves Political Stability, Political events, elections, and even geopolitical tensions that can result in currency fluctuations. This is because political developments have a direct effect on economic stability.

4. Market Sentiment

Perceptions by investors worldwide, as well as macroeconomic trends, can influence the price of currencies and exchange rates. Sudden news, speculation, and fads can shift demand quickly.

5. Inflation

All else being equal, countries with lower inflation rates will see their currency strengthen relative to a country with higher inflation.

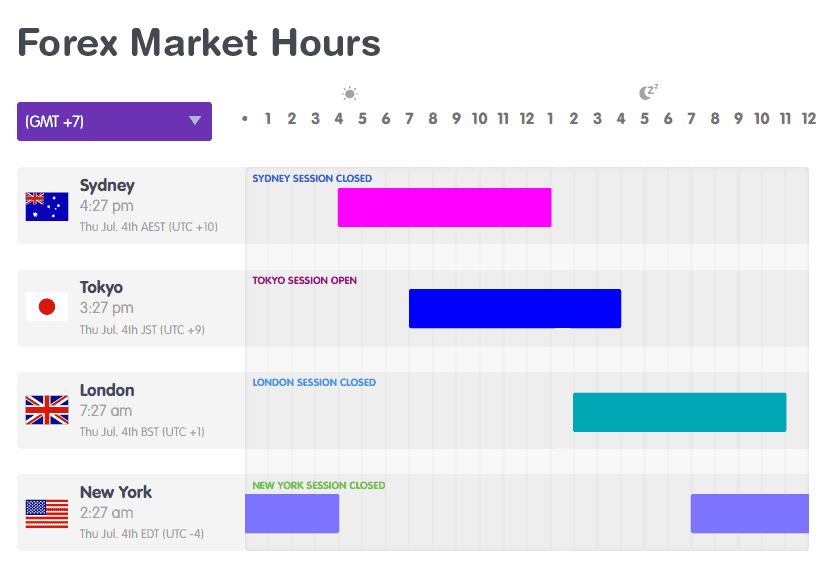

Market Time Zones and Their Impact on Currency Trading

The forex market is open 24 hours a day, split into four main trading sessions based on key financial hubs. These sessions are:

- Sydney: 10:00 PM to 7:00 AM UTC in summer (9:00 PM to 6:00 AM UTC in winter)

- Tokyo: 11:00 PM to 8:00 AM UTC all year

- London: 7:00 AM to 4:00 PM UTC in summer (8:00 AM to 5:00 PM UTC in winter)

- New York: 12:00 PM to 9:00 PM UTC in summer (1:00 PM to 10:00 PM UTC in winter)

Trading activity picks up during the overlaps between these sessions, which means more liquidity and price movement. Economic news and data releases are scheduled according to these time zones, affecting how currencies move.

By keeping track of these trading hours, you can better plan your trades and take advantage of the market’s fluctuations.

Identifying the Best Forex Currency Pairs to Trade

Very often forex traders ask or even wonder what is the best forex currency pair to trade. There is no easy answer, as there are so many factors to take into account to adopt a Forex pair into your trading style and goals.

Therefore, what is the best forex currency pair suited for your strategy? A higher liquidity pair generally means tighter spreads and less price slippage, which you can take advantage of for increased efficiency in implementation.

The major pairs are simply EUR/USD and GBP/USD. They are the most liquid, so you should usually find good trading opportunities.

Evaluate Volatility

Volatility measures the price fluctuations of a currency pair over time. Because higher volatility implies more opportunities for trading but also more risk, lower volatility pairs offer less volatile but more stable movements.

The smaller the pairing, relative to majors, the greater the volatility is likely to be. USD/TRY in this respect is likely to be more volatile than EUR/USD.

Consider Economic Correlations

Economic correlations involve the relationship between economic indicators and currency movements. An appreciation of how economic data might affect currency pairs will improve the quality of your trading decisions.

Pairs such as AUD/USD are sensitive to commodity prices while USD/JPY responds to a release of US and Japanese economic information.

Analyze Economic and Political Stability

Economic and political stability affects currency values and market confidence. Rock-solid economies and politics typically mean stable currencies.

Pairs against the more stable major currencies, such as USD/JPY, might give you better predictability than others against less-stable regions of the world.

Utilize Technical and Fundamental Analysis

As a forex trader, anticipating the direction and pace of forex movements is crucial. You should use various trading methods and approaches:

- Technical Analysis: This involves examining charts and price patterns to identify the best times and prices for buying or selling currencies.

- Fundamental Analysis: This approach focuses on analyzing economic indicators and market conditions to understand the underlying factors influencing currency movements.

Conclusion

In conclusion, selecting the best forex currency pairs to trade involves evaluating factors like volatility, liquidity, and economic conditions.

Whether you are trading a free demo account or depositing real capital into a CFDs broker to try your trading ideas, always continuously refine your strategies, and estimate your risk management system.

In my years of trading, I’ve learned that no single pair is universally “best” – it depends on your trading style, risk tolerance, and market conditions. The key is to understand the characteristics of different pairs and how they align with your trading goals.

Disclaimer

Forex trading is extremely risky and you should practice effective risk management and never trade with money you cannot afford to lose.

Forex education provided here is for general information purposes only and does not take into account your circumstance or suitability.

Ask an Expert

is the EURAUD a major or minor forex pair?

This is not a major pair, it would count as a minor pair

What is the best currency pair for scalping?

EUR/USD (Euro/US Dollar) is the best pair for scalping as it is highly liquid and as is very stable (meaning it does not have too much volatility).