Best CFD Trading Platforms

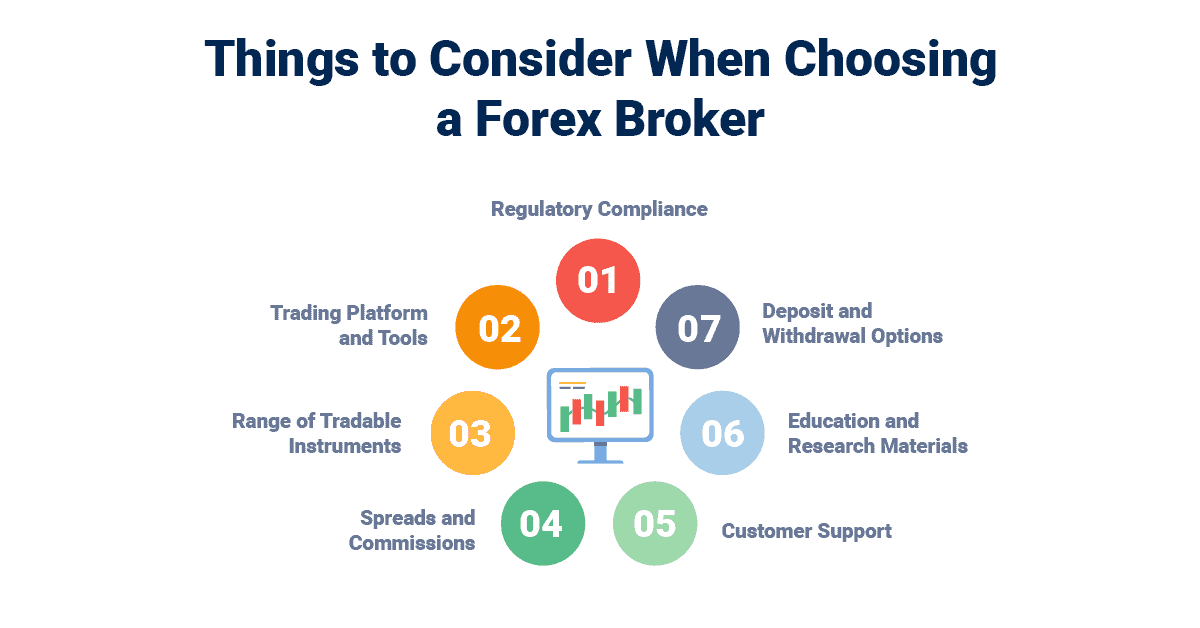

The best CFD Brokers in the UAE use one of the following 4 regulators, DFSA (Dubai), ADGM (Abu Dhabi), Central Bank of UAE, or the Securities and Commodities Authority (SCA). We look at the best-regulated forex brokers in the UAE for Forex and CFD traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

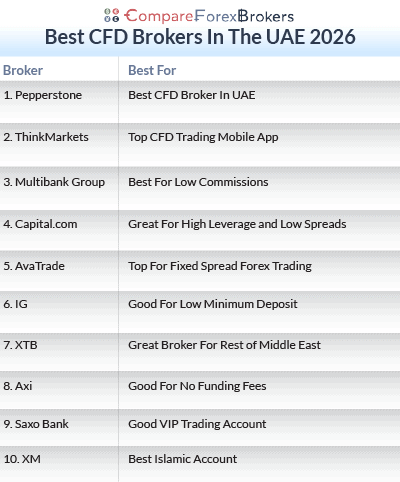

Our List Of The Best CFD Brokers Is:

- Pepperstone - Best CFD Broker In UAE

- ThinkMarkets - Top CFD Trading Mobile App

- Multibank Group - Best For Low Commissions

- Capital.com - Great For High Leverage and Low Spreads

- AvaTrade - Top For Fixed Spread Forex Trading

- IG Markets - Good For Low Minimum Deposit

- XTB - Great Broker For Rest of Middle East

- AxiTrader - Good For No Funding Fees

- Saxo Bank - Good VIP Trading Account

- XM - Best Islamic Account

Best CFD Broker For UAE Traders

We shortlisted brokers for UAE traders based on them having local DFSA regulation or at least tier 1 regulation. Each trading type was then matched to the best forex broker that caters for them factoring in trading fees, platforms and features.

1. PEPPERSTONE - Best CFD Broker In UAE

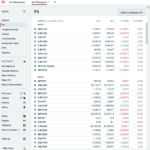

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

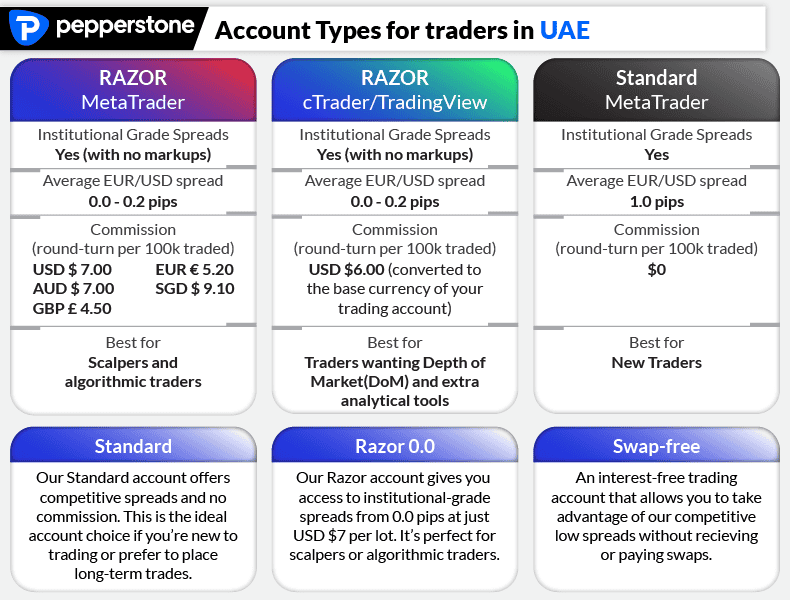

Pepperstone is a no-dealing desk broker that offers lightning-fast execution times (less than 30 ms) and small spreads by working with the finest available liquidity sources. It provides transactions with leverage of up to 30:1. Pepperstone offers 94 currency pairs, including the EUR/USD and other well-known ones, in addition to 20 CFDs on cryptocurrencies, 23 CFDs on indices, 900+ CFDs on equities, and over 30 CFDs on commodities.

Pros & Cons

- Ultra tight spreads

- Swap-free trading available

- Great forex trading platforms

- No digital wallet funding

- Low leverage for share CFDs

- Funding options limited

Broker Details

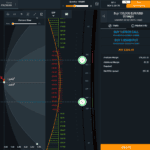

FAST EXECUTION SPEEDS

Pepperstone stands out with some of the fastest execution speeds out there, based on our testing. When we ran EAs using the popular MT4 trading platform for both limit and market orders, we found Pepperstone had fast execution speeds of 77ms for limit orders and 100ms for market orders.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| City Index | 12 | 95 | 12 | 131 | 14 |

| Axi | 15 | 90 | 8 | 164 | 25 |

| IC Markets | 17 | 134 | 16 | 153 | 22 |

| FxPro | 18 | 151 | 23 | 138 | 16 |

| IG | 23 | 174 | 26 | 141 | 19 |

| FP Markets | 25 | 225 | 32 | 96 | 8 |

| XM | 27 | 148 | 21 | 184 | 29 |

| Avatrade | 29 | 235 | 33 | 145 | 21 |

| FXTM | 33 | 248 | 36 | 210 | 32 |

| HYCM | 36 | 241 | 35 | 268 | 37 |

This put Pepperstone as the third fastest broker overall, just behind BlackBull Markets and Fusion Markets, but amongst the fastest forex brokers in the UAE.

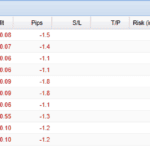

COMPETITIVE RAW SPREADS

Pepperstone has excellent spreads for both accounts, but we found the broker’s Razor Account stands out from our testing, averaging spreads of 0.1 pips for EUR/USD.

To highlight how low Pepperstone’s spreads are, we compared the commissions or ECN-style accounts of different brokers using a range of popular currency pairs. These spreads are taken from the broker’s websites and updated each month.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

ZERO-PIP SPREADS 100% OF THE TIME

Most brokers with RAW spreads advertise “spreads from zero,” so we took this into account when testing Pepperstone’s Razor account. Our results highlighted that only Pepperstone and City Index kept their minimum spreads at zero pips 100% of the time for all major currencies.

You can see how Pepperstone compared to other brokers from our zero-pip testing results below:

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| City Index | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| Eightcap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| Admiral Markets | 100.00% | 99.5% | 79.13% | 95.22% | 100.00% | 100.00% |

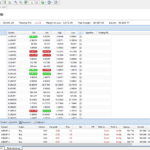

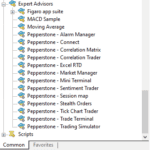

DIVERSE RANGE OF PLATFORMS

Pepperstone offers 4 diverse trading platforms, MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Where Pepperstone stands out, however, is in its range of sophisticated tools. We particularly like Smart Trader, an enhancement to the MetaTrader trading platforms that includes 28 trading apps covering everything from strategy to management tools to access to expert advisors.

Of the Smart Trader tools we tested, the highlight for us was the ability to use the Terminal to select all of our open orders and uniformly set take profit and stop loss orders for all of our positions.

2. ThinkMarkets - Top CFD Trading Mobile App

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

In my opinion, ThinkMarkets stands out for Dubai traders because of its powerful ThinkTrader app which is complemented with commission-free trading. I found the ThinkTrader app offers more features than many mobile apps which is especially useful for day-to-day trading. These tools include multiscreen charts, market scanners, mobile alerts and even daily trading signals. ThinkMarkets also offers TradingView if you prefer technical analysis and chart trading.

Beyond the platforms, ThinkMarkets’ overall setup is designed to be practical. There is only one account type with no commission and spreads from 1 pip. To sign up, no minimum deposit is required, and funding can be done with major cards or bank transfers. No fees apply. The broker’s product range is broad too, with thousands of CFDs across forex, indices, metals, energies, ETFs and global stocks.

Altogether, ThinkMarkets feels like a broker that fits local needs while still offering the scope of an international player.

Pros & Cons

- DFSA regulated in Dubai

- ThinkTrader great for Mobile trading

- Swap-free accounts available

- Only one account type

- Demo lasts just 14 days

- No MetaTrader in UAE

Broker Details

Accounts and Pricing

ThinkMarkets keeps things straightforward with its single ThinkTrader account, which is commission-free and works on both ThinkTrader and TradingView. That simplicity appeals to me because there’s no confusion with tiers or hidden fees.

Overall I found the spreads are competitive, and in our own tests the EUR/USD often came in tighter than what I’ve seen from other standard accounts. Below is a list of some of the minimum spreads available:

| Currency Pair | EUR/USD | USD/JPY | GBP/USD | AUD/USD | EUR/GBP |

|---|---|---|---|---|---|

| Minimum Spreads | 1.1 | 1.4 | 1.3 | 1.1 | 1.1 |

Leverage is capped at 30:1 (majors and 20:1 (minors) for retail traders, but professional clients can apply for up to 500:1.

Lastly, the availability of a swap-free option is also available for traders of Islamic faith. In addition to no swaps (also called overnight fees), you get six days without admin charges.

Platforms and tools

The ThinkTrader app is at the heart of their offer and feels designed with active traders in mind. I can run eight charts at the same time, set hundreds of alerts, and scan markets without switching apps. The built-in signal centre delivers daily trade ideas, while the risk scanner highlights potential exposures.

If I want to test strategies, the Traders Gym backtesting tool is there as well. This tool is exclusive to ThinkMarkets and allows you 50 different simulations at one time to test your strategies using 4,000 different instruments.

Lastly, TradingView integration is available for anyone who prefers to trade within a familiar charting environment and wants in-depth technical analysis. It’s worth noting that MT4 and MT5 are not offered, while I do find this unusual, ThinkTrader and TradingView are excellent platforms in their own right.

Funding and overall experience

In my testing I found funding is fast and painless. Bank wires take a couple of days, while card payments are instant, and there are no extra charges from ThinkMarkets. Supported currencies include USD, EUR, GBP, AUD and CHF, which cover most of your trading needs.

To help you decide if ThinkMarkets is right for you, demo accounts are available but limited to 14 days, so they are more suitable for testing the platforms than for long-term practice.

The last feature that I think makes ThinkMarkets stand out is the large product range that the broker offers. This range includes 42 forex pairs, 19 indices, 6 metals, 3 energies, 325 ETFs, and over 2,500 stocks (I know because I counted). In addition to strong DFSA regulation and swap-free trading, ThinkMarkets caters to the needs of regional traders while maintaining a global reach.

3. Multibank Group - Most Trusted Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.5

AUD/USD = 0.4

Trading Platforms

MT4, MT5, Multibank Social Trading

Minimum Deposit

$50

Why We Recommend Multibank Group

For CFD trading, I was impressed by MultiBank Group’s commitment to low commissions without sacrificing platform power. Their ECN account charges a $3.00 round-turn commission per lot, which is one of the lowest rates in the industry (the average being $7) and a significant advantage for high-volume traders.

You can access this pricing while trading forex, indices, and commodities on robust platforms like MetaTrader 4, MT5, or their own app, all with direct market access for the best possible trade execution. Being regulated by the UAE’s Securities and Commodities Authority (SCA), you can use high leverage up to 1:500.

Pros & Cons

- Low CFD trading costs

- Direct market access

- Great platform selection – MT4/MT5

- Strong local regulation

- Inactivity fee charged

- Product range is not the largest

Broker Details

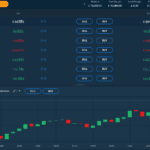

Low-Cost CFD Trading

MultiBank Group excels in making CFD trading affordable for active traders. Their ECN account provides raw spreads from 0.0 pips on major pairs like EUR/USD, charging a fixed commission of $3.00 per lot round-turn. This model is particularly advantageous for strategies like scalping as it directly impacts your bottom line over time. The table below highlights that MultiBank is the best broker for low commissions of UAE-regulated brokers.

| Broker | Commission per lot (each way) | Commission per lot (round-turn) |

|---|---|---|

| MultiBank Group | $1.50 | $3.00 |

| HYCM | $2.00 | $4.00 |

| HF Markets | $3.00 | $6.00 |

| Pepperstone | $3.50 | $7.00 |

| IC Markets | $3.50 | $7.00 |

| XM | $3.50 | $7.00 |

| ThinkMarkets | $3.50 | $7.00 |

| Axi | $3.50 | $7.00 |

| FxPro | $3.50 | $7.00 |

| ADSS | $3.50 | $7.00 |

The broker passes on raw spreads directly from liquidity providers, giving you a more competitive pricing environment for your forex and index CFD trades.

Trade on Premium Platforms

You have the freedom to pick between multiple standout trading platforms. MultiBank offers both MT4 and MT5, which are equipped with the tools you need for CFD analysis and execution. Furthermore, the Multibank-Pluss App lets you copy other top traders and uses an advanced 5-level Depth of Market model.

For CFDs, I prefer using MT5, as it provides 44 technical indicators, and 38 drawing tools for deep, multi-timeframe market analysis. You can also use Expert Advisors (EAs), allowing you to automate your trading across different CFD markets.

Regulated for Your Safety

Trading CFDs with MultiBank Group allows for leverage up to 1:500, making a broker’s reliability a top priority. This is more than other brokers regulated or the UAE since DFSA and ADGM keeps the leverage limits in line with Europe and UK where Forex is limited to 1:30.

Overall the broker is regulated by the Securities and Commodities Authority (SCA) in the UAE providing you strong fund protection. This regulation mandates that your funds are held in segregated accounts with top-tier banks, completely separate from the company’s own operating capital.

4. Capital.com - Low Spread No Commission Account

Forex Panel Score

Average Spread

EUR/USD = 0.6 GBP/USD = 1.3 AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$0

5. AVATRADE - Top Fixed Spread CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

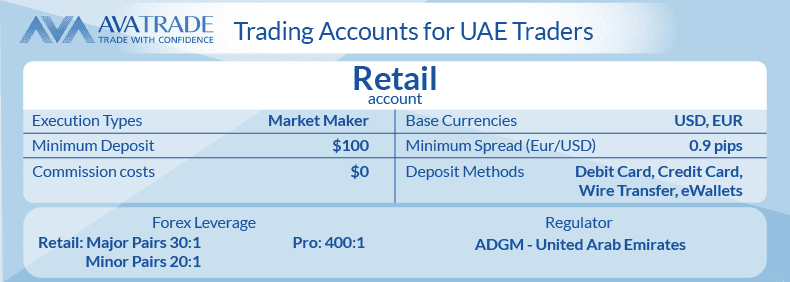

AvaTrade is a top forex broker in the UAE that caters to a diverse group of traders. Unlike Pepperstone and most other brokers, AvaTrade provides fixed-spread trading, which means that the broker sets prices using its own liquidity instead of relying on outside suppliers.

Pros & Cons

- Regulated by the DFSA and ADGM

- Great fixed-spread prices

- Offers good technical analysis research tools

- AvaProtect not available on MT4 platform

- Limited range of accounts

- High inactivity fees

Broker Details

COMPETITIVE FIXED SPREADS

We awarded AvaTrade one of the best forex brokers in the UAE because it offers the most competitive fixed-spread trading from our testing. When testing, we found AvaTrade offers stable fixed spreads of 0.9 pips while trading EUR/USD when using MT4, MT5 or AvaTradeGo trading platforms.

In fact, AvaTrade came out on top against 10 fixed spread brokers we tested, offering an average of 1.4 pips across the 7 most traded currency pairs. While you can obtain tighter spreads with an ECN-style account, AvaTrade’s fixed spreads are consistent enough to keep your trading costs low.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

GREAT TRADING PLATFORMS And Social Trading

Scoring AvaTrade an 8/10 for its trading platforms, we liked the broker’s solid combination of third-party and proprietary platforms.

The variety of AvaTrade’s platforms extends beyond the broker’s MT4/MT5 offering. You can also use Avatrade’s own excellent platform, AvaTradeGo, as well as speciality platform AvaOptions to trade options, to diversify your trading portfolio.

AvaTrade offers a range of copy trading options via third-party CFD trading platforms DupliTrade and ZuluTrade, or its own, AvaSocial where you can copy successful trading strategies. Only a few brokers can boast this range of social or copy trading options.

6. IG GROUP - Good CFD Broker Minimum Deposit Account

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

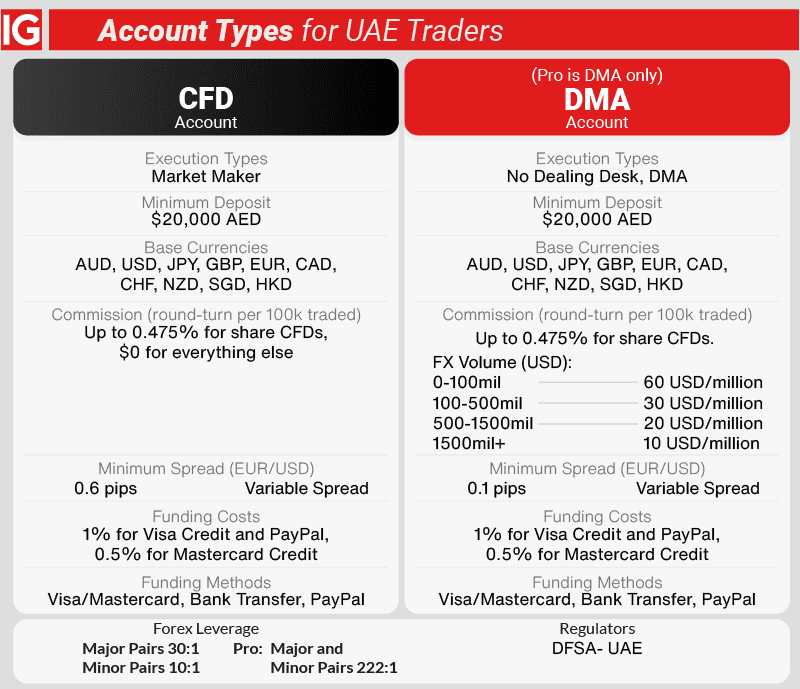

IG is one of the oldest trading firms, having been in business since 1974. It has launched in 15 countries across the globe and expanded to have over 300,000 traders, including those in the UAE. The broker’s standout offering is the low minimum deposit of just $0, which allows beginners and advanced traders alike to test out the platform without having to put in vast amounts of capital upfront.

Pros & Cons

- $0 minimum deposit

- Extensive selection of trading products

- Can access advanced trading and charting tools

- Lacks TradingView and MT5

- MT4 doesn’t have access to all trading products

- Customer service is limited over the weekend

Broker Details

HUGE RANGE OF CFD MARKETS

IG Group stands out in its huge CFD offering with over 17,000 markets available. You can trade forex (100 pairs), shares (over 12,000), indices (130), and cryptocurrencies (15), which no other broker offers from our analysis. We think this makes IG Group a good option if looking for products no other brokers offer.

As a bonus, you can choose from IG Trading platform, ProRealTime and MT4. IG Group offers a variety of platforms to trade on, such as MT4, L2 Dealer, and ProRealTime. The last two options are more advanced platforms, with L2 Dealer offering direct market access and ProRealTime with more sophisticated tools for market analysis.

| Products | Volume |

|---|---|

| Forex Pairs | 80+ |

| CFD Shares | 12,000+ |

| Indices | 130 |

| Energies | 7 |

| Metals | 11 |

| Soft Commodities | 23 |

| Bonds | 14 |

| ETFs | 6000+ |

| Cryptocurrencies | 15 |

| Options | 7000+ |

| Futures | Yes |

| Interest Rates | Yes |

| Spot Trading | Yes |

| Sectors | Yes |

COMPETITIVE NO-COMMISSION SPREADS

While IG Group only gives you one account option for trading CFDs, the broker does offer a direct market access account (which allows you to access market prices without intervention from liquidity providers) although with a steep minimum deposit of $20,000 AED.

Although IG Group is a market maker, we found its spreads to be very reasonable for its CFD account, averaging 1.13 pips for EUR/USD and 1.38 pips across the five major currency pairs.

These no-commission spreads were amongst the lowest in the UAE, with only eToro (1.30 pip average) and XTB (1.36 pip average) offering marginally tighter spreads.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

7. XTB - Great DFSA Regulated CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.09

GBP/USD = 0.14

AUD/USD = 0.13

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

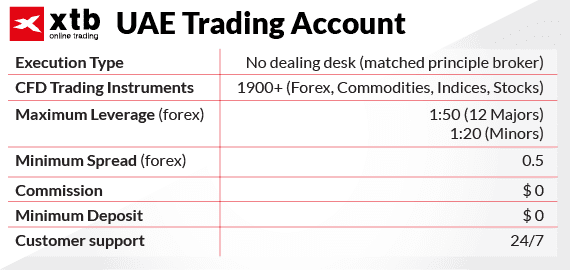

XTB is a broker that admits traders from Oman, Saudi Arabia, Bahrain, Qatar, and Kuwait, in addition to the United Arab Emirates. This makes it an excellent choice for traders from nearby areas that fit the same description.

Pros & Cons

- Good range of trading products

- Zero minimum deposit required

- Choice of trading platforms

- Doesn’t offer cryptocurrencies

- Lacks third-party trading tools

- Has an inactivity fee

Broker Details

XTB ACCEPTS TRADERS THROUGHOUT THE MIDDLE EAST

While all brokers on this list are great options for traders in the UAE, they’re not all as inclusive of neighbouring regions that fall under the same category. XTB is different since it accepts traders from Oman, Saudi Arabia, Bahrain, Qatar, and Kuwait, rather than solely focusing on the UAE.

COMPETITIVE MARKET MAKER SPREADS

As with IG Group, XTB is a market maker and only offers one retail investor account for trading CFDs, but spreads are competitive, averaging 0.9 pips for EUR/USD with no commission fees.

Overall, XTB compares with eToro and IG Group as the lowest spread brokers in the UAE, averaging 1.36 pips across the 5 major currency pairs, from our spread testing.

xStation 5 TRADING PLATFORM

Our testing of XTB’s platforms revealed that xStation 5 offers live data, market commentary and greater transparency than MT4. We particularly liked the additional trading tools that xStation 5 offered, including sentiment data that shows the percentage of XTB clients that are long or short for a given trading symbol.

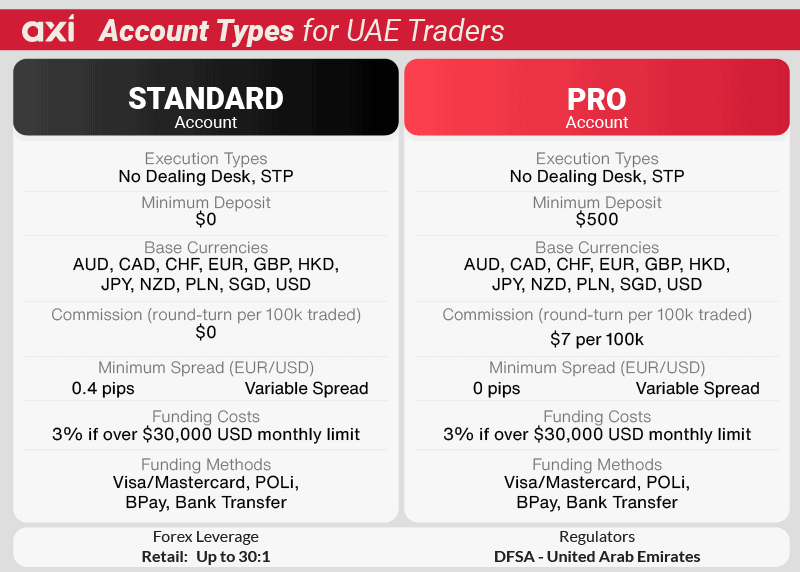

8. AXITRADER - Good CFD Broker With No Funding Fees

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend AxiTrader

When trading, it’s important to consider the costs for things like inactivity and financing your account, in addition to the spreads and commissions. AxiTrader excels in this regard, as it doesn’t charge any fees for funding your account using any of the 26 available methods, including Bitcoin and Skrill. Additionally, there are no inactivity fees and no deposit requirements.

Pros & Cons

- Tight spreads with low commission

- Offers a good range of crypto markets

- No withdrawal or deposit fees

- Limited client support over the weekend

- Inactivity fees

- Small range of trading instruments

Broker Details

LARGE RANGE OF FUNDING METHODS

With 26 funding methods (including Skrill and Bitcoin) and no funding fees, we are impressed the range of funding choices Axi lets you trade with. Plus, there are no inactivity fee or minimum deposits further saves you on trading costs.

MT4 ENHANCEMENT TOOL

Axi only offers the MetaTrader 4 trading platform so we think it’s a good thing it comes with extra features like their MT4 enhancement tool called MT4 NexGen. Useful expert advisors and indicators with MT4 NexGen include Correlation Trader and Alarm Manager.

You will get the option to use Autochartist (to find trading opportunities across different markets automatically) and PsyQuation (made by Axi and gives tailored advice based on your mistakes).

Fast VPS

Axi offers VPS hosting with ForexVPS, MetaTraderVPS, Commercial Network Services and BeekFX VPS. VPS hosting ensures you never have downtime when trading, which we find is ideal for automated trading when using Expert Advisors.

We tested VPS speeds when using ForexVPS and found Axi has a limit order speed of 107 ms and a market order speed of 154 ms makes placing the 1st of the DFSA brokers we tested.

| Broker | Overall Ranking | Limit Order Speed | Market Order Speed |

|---|---|---|---|

| Axi | 2 | 107 | 154 |

| Pepperstone | 6 | 158 | 168 |

| IG | 8 | 209 | 182 |

| Admiral Markets | 8 | 172 | 270 |

| IG | 17 | 174 | 19 |

| Tickmill | 14 | 186 | 397 |

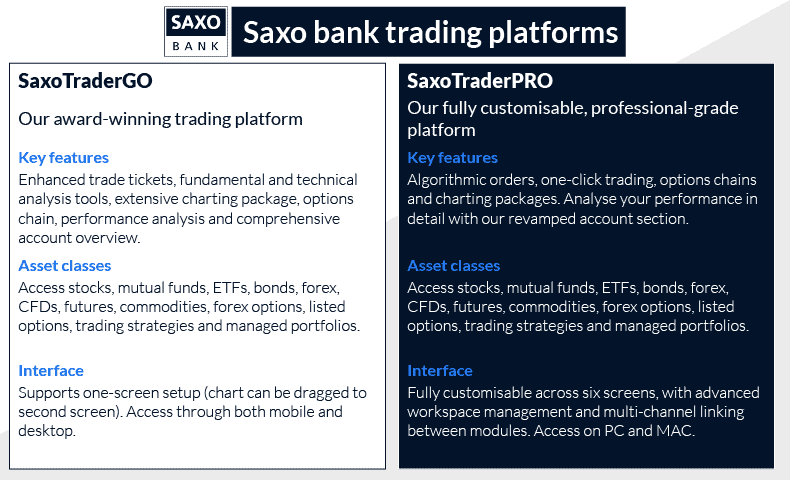

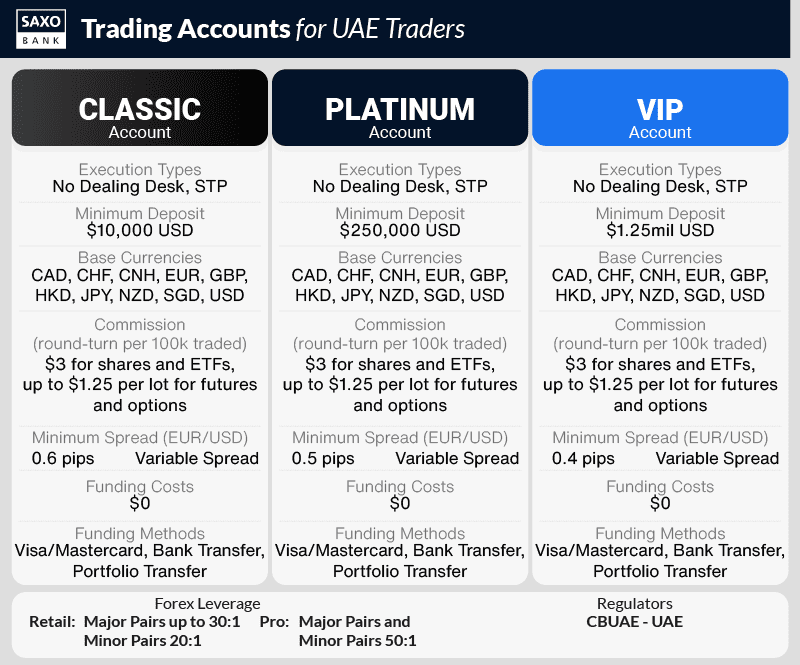

9. SAXO MARKETS - Good VIP Trading Account In Middle East

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.8

AUD/USD = 1.1

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$10,000 USD

Why We Recommend Saxo Markets

Saxo Bank is a significant player in the CFD trading industry, having been in business for more than 25 years and with 660,000 clients on its books. Leveraged products offer spot trading in addition to CFDs, and there are also conventional investment choices available. Powerful trading tools are included with these instruments, such as Saxo’s own trading platforms, trade signals, technical indicators, and risk management tools.

Pros & Cons

- Premium customer service

- Good for professional traders

- Lots of trading instruments

- High minimum funding

- High inactivity fees

- Customer support isn’t 24/7

Broker Details

TRADING ACCOUNTS + SPREADS

While Saxo Bank’s three accounts, Classic (USD $5,000), Platinum USD 250,000), and VIP (USD 1250,000), have higher minimum funding requirements than other brokers, you will have access to lower spreads and discounts with the Platinum and VIP accounts. The platinum for example has 30% lower spreads than the Classic, as such, we recommend Saxo Bank for high-volume traders.

RANGE OF PLATFORMS

Of Saxo Bank’s 3 trading platforms, SaxoTraderGO is designed for long-term investors and small or medium-volume traders, while SaxoTraderPRO is for high-volume active traders as it contains a wealth of customised features and tools to speed up your trading.

We tested SaxoTradeGo with their free 20 day demo account and found it has 64 technical indicators, 20 drawing tools, 19 timeframes and 9 chart types. With useful features like TradingView (which has over 50 million users for social networking), Autochartist and OpenAPI for Excel to customise your automation we thought the platform has some truly cutting-edge features.

HUGE RANGE OF CFD PRODUCTS

You can trade 9,500 instruments as CFDs in different asset classes, including 8,000+ stocks, 675 ETFs, 29 indices, 35 commodities, five government bonds, and 15 indexes

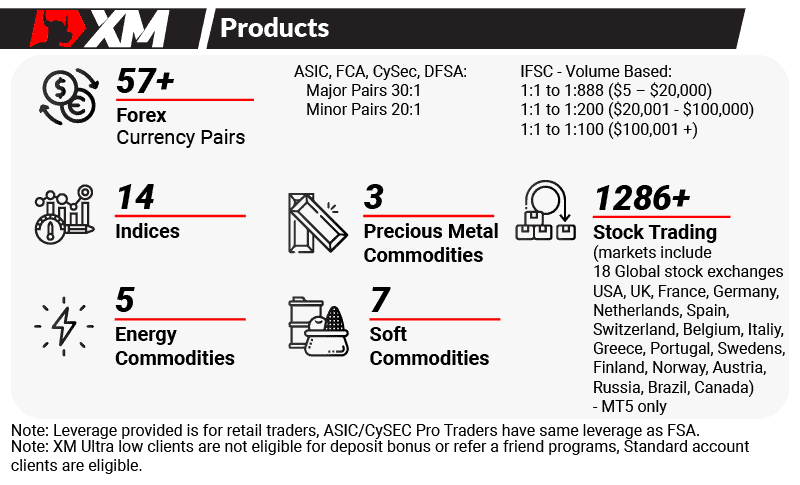

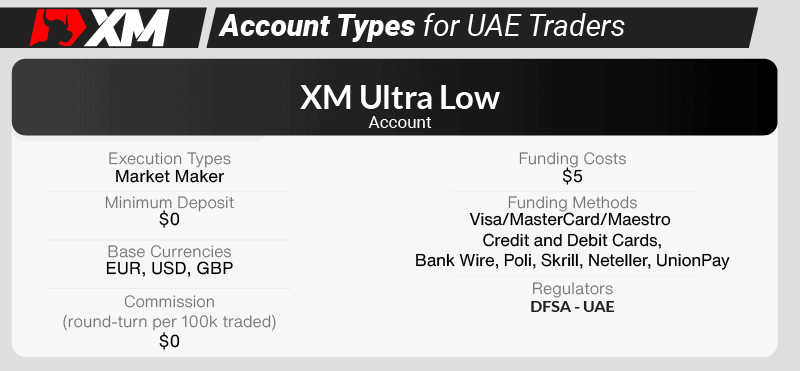

10. XM - Best Islamic Account

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.5

AUD/USD = 0.8

Trading Platforms

MT4, MT5,

XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM offers a Sharia-compliant swap-free account for Islamic traders, which is different from other brokers in that it does not charge additional fees to make up for the lack of swaps. This means that there are no administrative costs, service fees, commission costs, or artificially widened spreads.

Pros & Cons

- Customer service is 24/7

- Excellent research resources and trading tools

- Low minimum deposit

- High inactivity fee after 1 year

- Limited selection of forex pairs

- Lacks a proprietary trading platform

Broker Details

NO CHARGES ON ISLAMIC ACCOUNT

XM’s Islamic account is unique compared to other brokers in that it does not use other charges to cover the absence of swaps. This means no administration charges, no service fees, no commission costs, and the spreads themselves are not artificially widened.

As a trader, you are getting exactly the same spreads as a trader using an account with swaps regardless if you use MT4 or MT5 platform.

Best of all, the Islamic account is good for trading with all of XM’s over 1300 different trading instruments, including 57 Forex currency pairs and 1286 shares.

XM RESEARCH AND EDUCATION TOOLSWe love XM’s research and education tools, which include interactive webinars by seasoned traders and leaders in the industry, covering risk management, technical analysis and trading fundamentals. Very few brokers offer anything close to XM’s unique educational resources.

Ask an Expert