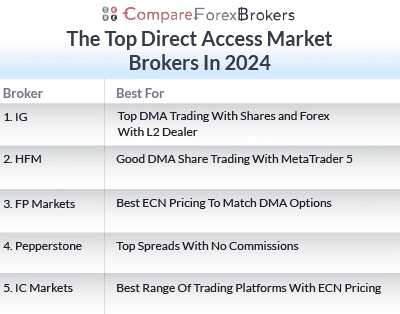

Best DMA Brokers

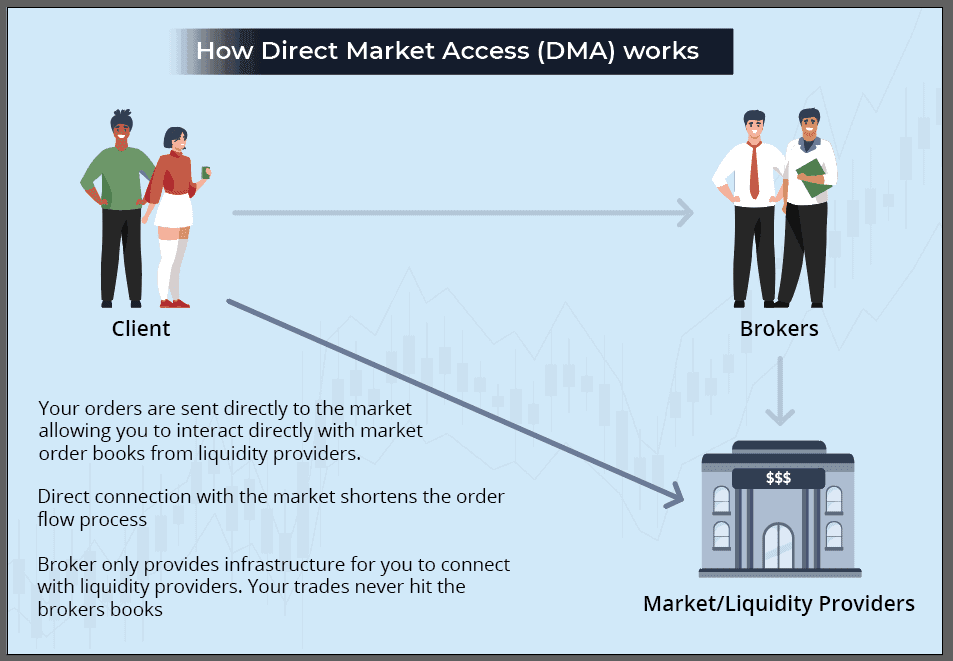

Direct Market Access Brokers (DMA) differ from types of brokerages like ECN and no dealing desk (NDD) as you can execute orders directly through electronic order books at the exchange. Below, we review the best DMA brokers for forex and shares.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. For more information, visit our About Us page.

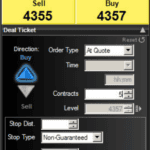

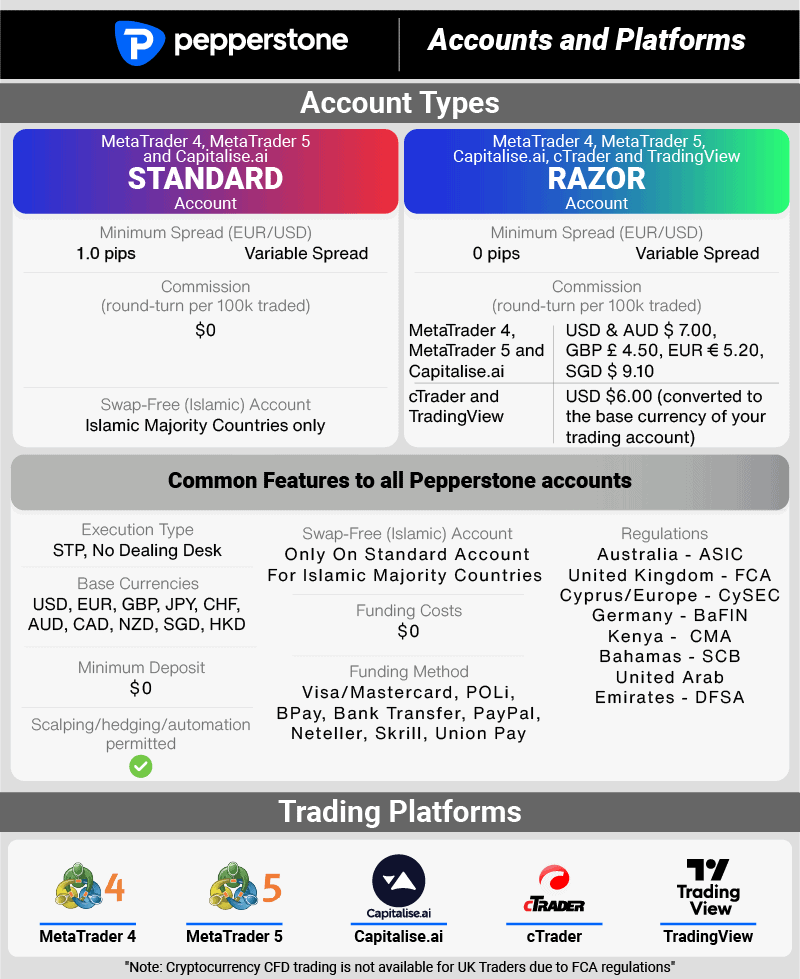

Pepperstone offers a commission-free standard account and uses an STP execution model, meaning your trades are executed with no dealing desk intervention. You should open this account if you want no-commission trading and use the MT4 or MT5 platform.

Pepperstone offers a commission-free standard account and uses an STP execution model, meaning your trades are executed with no dealing desk intervention. You should open this account if you want no-commission trading and use the MT4 or MT5 platform.

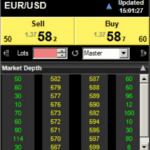

IC Markets offers three trading platforms with DMA access: MT4, MT5, and cTrader. In our opinion, they all work and function similarly, so it all comes down to preference for how they look and ease of access.

IC Markets offers three trading platforms with DMA access: MT4, MT5, and cTrader. In our opinion, they all work and function similarly, so it all comes down to preference for how they look and ease of access.

Ask an Expert