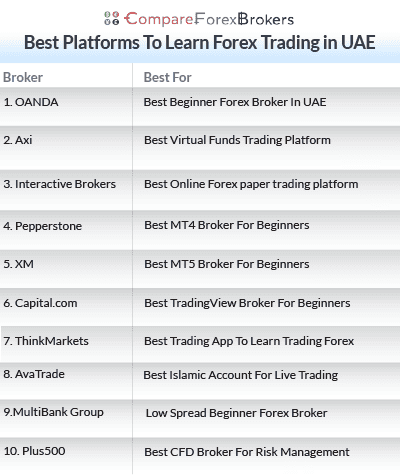

Best Platforms To Learn Forex Trading

We tested beginner-friendly forex platforms in the UAE, evaluating educational resources, demo account quality, risk management tools, and platform usability. Our analysis focused on which brokers help new traders learn effectively through structured courses, paper trading capabilities, and intuitive interfaces.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Best Platforms To Learn Forex Trading

- OANDA - Best Beginner Forex Broker In UAE

- Axi - Best Virtual Funds Trading Platform

- Interactive Brokers - Best Online Forex Paper Trading Platform

- Pepperstone - Best MT4 Broker For Beginners

- XM - Best MT5 Broker For Beginners

- Capital.com - Best TradingView Broker For Beginners

- ThinkMarkets - Best Trading App To Learn Trading Forex

- AvaTrade - Good Islamic Account For Live Trading

- Multibank Group - Low Spread Beginner Forex Broker

- Plus500 - Best CFD Broker for Risk Management

What forex brokers are best for beginners?

OANDA leads for beginner traders with their FxTrade platform combining commission-free trading, structured Trading Academy courses, and paper trading that mirrors live conditions. Pepperstone also suits beginners wanting multiple platform options (MT4, MT5, cTrader, TradingView) with Smart Trader Tools simplifying execution.

1. OANDA - Best Beginner Forex Broker In UAE

Forex Panel Score

Average Spread

EUR/USD = 0.89

GBP/USD = 1.54

AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA removes the complexity that trips up most beginners by offering commission-free trading where you’re looking at one simple number (0.89 pips on EUR/USD) rather than calculating spreads plus commissions. The FxTrade platform gives you guaranteed stop-loss orders that protect your position at the exact price you set, which matters when you’re still learning and markets gap overnight.

The Trading Academy provides structured learning paths progressing from basics through to complete trading strategies, with paper trading mirroring live conditions exactly so you’re prepared when switching to real money.

Pros & Cons

- Commission-free, simple pricing

- Guaranteed stop-losses

- Trading Academy with structured curriculum

- Paper trading mirrors live conditions

- Multi-regulator oversight (5 authorities)

- $0 minimum, no funding pressure

- No raw spread ECN option

- Limited to MT4 and FxTrade platforms

- Spreads wider than ECN brokers

- Education focuses mainly on forex

Broker Details

After testing OANDA’s proprietary trading platform, OANDA Trade, we can safely say it’s one of the best beginner platforms we’ve traded with.

Platform design for beginners

FxTrade’s order entry ticket displays your position size in both lots and dollar risk amount, calculates exactly how much you’ll lose if your stop gets hit, and shows your potential profit if price reaches your target before you confirm the trade.

The platform includes a position size calculator where you input your desired 1% or 2% risk per trade and it automatically calculates the proper lot size based on your stop distance and account balance.

TradingView charts integrate directly showing 100+ indicators, drawing tools for marking support and resistance levels, and multiple timeframe analysis without opening separate applications. The economic calendar flags high-impact events like FOMC decisions or GDP releases in red, displays previous results versus forecasts, and includes brief explanations of why each event affects specific currency pairs.

LOW SPREADS

Out of all the market maker brokers we’ve reviewed, OANDA has the lowest spreads of the lot, averaging 0.70 pips across the 5 major currency pairs. Not only that, OANDA recorded the lowest Standard account spreads of any broker, including those offering ECN-style execution like IC Markets and Fusion Markets.

We found OANDA’s low spreads were stable and helped reduce our slippage on trades when using both MT4 and the OANDA Trade platform, which will help you lower your trading costs as a beginner.

| Most Traded Average | Standard Spread | ||

|---|---|---|---|

| Broker | Major Pair Average Spread | Broker | Major Pair Average Spread |

| OANDA | 0.70 | Pepperstone | 1.40 |

| ThinkMarkets | 1.22 | Tickmill | 1.60 |

| Axi | 1.24 | FxPro | 1.62 |

| HYCM | 1.24 | XM | 1.72 |

| eToro | 1.30 | HF Markets | 1.76 |

| XTB | 1.36 | Plus500 | 1.86 |

| IG | 1.38 | Swissquote | 1.92 |

Educational resources built for learning

The Trading Academy organises content into clear learning paths starting with forex fundamentals like pip calculations and lot sizing, then progressing through technical analysis modules covering candlestick patterns, support and resistance, and trend identification.

Advanced sections tackle trading psychology including managing emotional responses to losses, risk management formulas calculating proper position sizes, and building complete trading plans with entry rules, exit criteria, and weekly review processes.

Educational content integrates with live market examples – for instance, showing how a double top pattern formed on EUR/USD during last week’s Fed announcement rather than textbook diagrams that never match real conditions. You get access to archived webinars covering specific topics like managing trades during high-impact news releases or using moving averages for trend confirmation.

Paper trading that prepares you

OANDA’s paper trading lets you choose realistic starting capital like $500 or $1,000 matching your actual planned deposit, rather than inflated $100,000 balances that let you ignore position sizing completely. The platform replicates live spreads averaging 0.89 pips EUR/USD, shows realistic slippage during volatile periods like NFP releases, and fills orders at market prices including spread widening during news events.

You can test guaranteed stop-loss orders during the paper account phase, seeing exactly how they close positions at your specified price during Sunday gaps when regular stops might slip 20+ pips. The demo account never expires and lets you reset your balance unlimited times, removing artificial pressure to go live before mastering risk management just because your 30-day trial ended.

Highly trusted broker

OANDA is a highly trusted broker with a strong reputation, which is why they are well-suited for beginners.

We scored OANDA a 10/10 for trust based on our methodology which includes regulations, age of the broker, and search volume on the web.

What impresses us the most is how heavily regulated OANDA is, especially by tier-1 regulators such as ASIC in Australia, the FCA in the UK and the NFA/CFTC in the U.S., which not many brokers can boast from our analysis.

Also, the fact that OANDA was established in 1996 and has built a solid reputation for itself over almost 30 years (evidenced by the broker’s many positive TrustPilot reviews), catches our eye.

2. Axi - Best Virtual Funds Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.2

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

Axi delivers the best virtual funds trading experience through unlimited demo accounts that never expire, letting you practice strategies without artificial time pressure forcing you to trade live before you’re ready.

The demo mirrors live trading conditions with the same 0.6 pip EUR/USD spreads in the Standard Account, or 0.0 pips with $3.50 commission in the Pro Account, avoiding sanitised demo fills that create unrealistic expectations.

You can create multiple demo sub-accounts testing different strategies simultaneously – running one account with the Standard’s commission-free 0.6 pip pricing while another tests the Pro Account’s raw spread structure.

The 90ms execution speeds work across 72 forex pairs and 37 crypto CFDs, plus Autochartist pattern recognition software identifying technical setups automatically. The MT4 NexGen package adds advanced order management, correlation matrices, and sentiment indicators.

Pros & Cons

- Unlimited demo account, never expires

- Multiple sub-accounts for testing strategies

- 90ms execution speeds

- Autochartist pattern recognition included

- MT4 NexGen enhancements

- MT4 only (no MT5, cTrader, TradingView)

- Standard Account spreads at 0.6 pips

- Elite Account requires $500 minimum

- Limited educational resources

Broker Details

Demo Account That Mirrors Live Conditions

Axi’s demo shows realistic spreads averaging 0.6 pips EUR/USD in the Standard Account or 0.0 pips in the Pro Account with $3.50 commission per side – exactly matching what you’ll pay when trading live.

You experience actual slippage during volatile periods like NFP releases rather than perfect fills, preparing you for the transition to funded accounts.

The platform replicates live market hours, showing how spreads widen during Asian sessions when liquidity drops and tighten during London-New York overlaps when volume peaks. You can reset your demo balance unlimited times without creating new accounts, removing the frustration of blowing up virtual funds and needing to re-register.

Multiple Sub-Accounts for Strategy Testing

The ability to create multiple demo sub-accounts lets you run simultaneous tests comparing different approaches. You might trade EUR/USD scalping on one account using 5-minute charts and 10-pip targets, while another account tests GBP/USD swing trading holding positions for days targeting 100-pip moves.

You compare Standard Account performance with its 0.6 pip spreads and zero commission against Pro Account results with 0.0 pips but $3.50 per side fees, seeing which pricing structure costs less based on your typical trade frequency.

Each sub-account tracks separate performance metrics including total profit/loss, win rate percentages, average risk-reward ratios, and maximum drawdown.

Autochartist and Pattern Recognition

Autochartist scans your watchlist continuously, identifying technical patterns like double tops, head and shoulders formations, triangle breakouts, and Fibonacci retracement levels without you manually drawing on charts for hours.

The software alerts you when EUR/USD forms a bullish flag pattern or GBP/USD breaks above resistance, providing trade ideas even during your demo phase.

The pattern recognition shows expected price targets based on historical pattern performance, helping you set realistic take-profit levels. You learn which patterns actually work versus textbook theory during your demo testing.

MT4 NexGen Platform Enhancements

The MT4 NexGen package transforms standard MetaTrader 4 with tools unavailable on vanilla MT4. You get advanced order management features like quick-close buttons for all positions simultaneously, mass stop-loss adjusters letting you modify multiple trades at once, and position sizing calculators ensuring you risk exactly 1-2% per trade.

The correlation matrix displays which currency pairs move together – showing you that EUR/USD and GBP/USD correlate 85% of the time, preventing you from accidentally doubling your EUR exposure. Sentiment indicators show what percentage of traders hold long versus short positions on each pair, providing contrarian signals.

3. Interactive Brokers - Best Online Forex Paper Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A GBP/USD = N/A AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers delivers the best paper trading platform through their Trader Workstation (TWS) providing institutional-grade simulation across 167 global exchanges, letting you practice forex, stocks, options, futures, and bonds with real-time pricing and Level II market depth.

The paper trading account mirrors live market data with actual order routing, preparing you for complex multi-asset strategies before risking capital.

You access the same TWS Desktop platform, Mobile apps, and FX Trader interface in paper trading mode as live accounts. The tiered commission structure in paper trading shows you precise costs – starting at 0.20 basis points decreasing to 0.08 basis points as simulated volume increases.

Pros & Cons

- Paper trading across 167 global exchanges

- TWS Desktop with institutional-grade tools

- Real-time market data and Level II pricing

- Practice multi-asset strategies

- Tiered commissions visible in simulation

- iBKR Campus education with 17+ webinar topics

- Steep learning curve for beginners

- Complex interface initially

- Higher minimum deposits required for live

- Wire transfer deposit fees apply

4. PEPPERSTONE - Best Forex Trading Platform In UAE

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

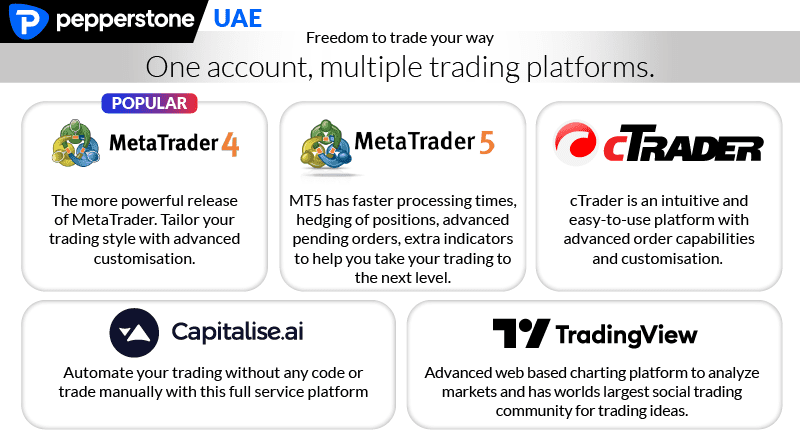

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone provides the best MT4 learning environment for beginners through Smart Trader Tools that transform standard MetaTrader 4 with features like Mini Terminal for one-click execution, Correlation Matrix showing which pairs move together, and Alarm Manager tracking price levels across multiple instruments.

The Razor Account delivers 0.0 pip raw spreads on EUR/USD with $3.50 per side commission and 77ms execution speeds.

The Standard Account offers simpler 1.0 pip spreads with zero commission if you’re not ready to calculate round-turn costs yet. The $0 minimum deposit lets you start learning with whatever capital you’re comfortable risking, and you access 93 forex pairs, 1,162 share CFDs, 26 indices, and 40 commodities through MT4.

Pros & Cons

- MT4, MT5, cTrader, TradingView platforms

- Smart Trader Tools simplify MT4 execution

- 0.0 pips raw or 1.0 pips Standard pricing

- 77ms execution speeds tested

- $0 minimum deposit requirement

- 1,475 instruments for diversification

- Commission calculations confuse beginners

- Standard Account 1.0 pip spreads

- Cannot fund directly with AED

- No guaranteed stop-loss orders

Broker Details

Though Pepperstone isn’t regulated in the UAE, the broker has always stood out to us for its fast execution speeds, competitive spreads and diverse range of forex trading platforms. It also has the best forex trading platform experience in the UAE, which will suit beginners.

100% ZERO PIP SPREADS

Everyone wants zero pip spreads and most brokers with RAW accounts advertise ‘spreads from zero.’ Well, from our testing, Pepperstone is one of those brokers that offers zero pip spreads 100% of the time.

When looking at data for hourly minimum spreads, by currency, for each broker, only Pepperstone and City Index achieved zero pip spreads 100% of the time for the 6 major currency pairs.

FAST EXECUTION SPEEDS

As a beginner, you want to lower your trading fees and one way to do that is through fast execution speeds to reduce slippage on trades. From our testing, Pepperstone has some of the fastest execution speeds out there.

Testing via the MT4 platform revealed Pepperstone achieved speeds of 77ms for limit orders and 100ms for market orders. This put the broker third overall out of more than 30 brokers tested, just behind BlackBull Markets and Fusion Markets.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| Axi | 15 | 90 | 8 | 164 | 25 |

| FxPro | 18 | 151 | 23 | 138 | 16 |

| IG | 23 | 174 | 26 | 141 | 19 |

| FP Markets | 25 | 225 | 32 | 96 | 8 |

| XM | 27 | 148 | 21 | 184 | 29 |

| FXCM | 28 | 108 | 28 | 189 | 30 |

| Avatrade | 29 | 235 | 33 | 145 | 21 |

| FXTM | 33 | 248 | 36 | 210 | 32 |

| HYCM | 36 | 241 | 35 | 268 | 37 |

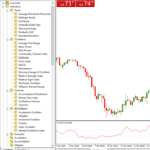

BEST FOREX TRADING PLATFORM

Pepperstone has a diverse range of trading platforms including MetaTrader 4, MetaTrader 5, cTrader and TradingView (a personal favourite).

From a beginner perspective, however, we think Pepperstone stands out in its MetaTrader 4 offering. Not only will you get the ease of use, charting tools (30 technical indicators, 21 analytical objects and 9 timeframes), and enormous range of Expert Advisors that we’ve come to expect from MT4, Pepperstone also offers the Smart Trader Tools MT4 add-on, an additional 28 smart trading apps, including expert advisors and indicators.

Some of our favourite apps for beginners include the session map, which highlights key economic events in red based on the 4 major trading regions (New York, London, Tokyo and Sydney) and the trade terminal.

While the trade terminal has several features, we particularly liked that you could easily select multiple orders and set take profit and stop loss orders 10,20 or 30 pips apart for each, without having to set them individually.

The remaining platforms Pepperstone offers (MT5, cTrader and TradingView) are all excellent and diverse forex trading platforms for different purposes.

MT5 is an upgrade of MT4 with more trading tools and the ability to trade on centralised exchanges, cTrader features DoM (depth of market) pricing and algorithmic trading tools, TradingView is one of our favourite standalone charting platforms with 100 pre-built indicators and Capitalise.ai allows you to automate your trading without knowledge of programming code.

5. XM - Best MT5 Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.5

AUD/USD = 0.8

Trading Platforms

MT4, MT5, XM App/Tablet

Minimum Deposit

$5

Why We Recommend XM

XM provides the best MT5 learning environment for beginners through their platform offering 38 technical indicators versus MT4’s 30, including advanced tools like Ichimoku Kinko Hyo and Fractals that help identify trend strength and reversal points.

The Ultra Low Account delivers 0.8 pip EUR/USD spreads with $1.60 commission per side, while the Standard Account offers simpler 1.6 pip spreads with zero commission and just $5 minimum deposit letting you start learning with minimal capital risk.

The XM App integrates TradingView charts directly into the mobile interface, providing access to 100+ indicators, drawing tools, and multi-timeframe analysis without switching between applications when monitoring positions away from your computer.

MT5’s economic calendar shows scheduled events like NFP and FOMC with historical data displaying previous results, forecasts, and actual impact on currency pairs, teaching you which releases matter most for the pairs you’re trading.

Pros & Cons

- MT5 with 38 indicators, 21 timeframes

- $5 minimum deposit across accounts

- XM App with TradingView integration

- Integrated economic calendar with history

- Social/copy trading features

- Ultra Low: 0.8 pips, $1.60 commission

- Standard Account 1.6 pips wider spreads

- 30:1 leverage limit (MENA regulation)

- Professional account needs verification

- Educational content mainly video-based

6. Capital.com - Best TradingView Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 1.3

AUD/USD = 0.6

Trading Platforms

MT4, MT5, TradingView, Capital.com Web Platform and CFD Trading App

Minimum Deposit

$20

Why We Recommend Capital.com

Capital.com integrates TradingView directly into their platform with 0.6 pip spreads and zero commission, giving beginners access to professional charting without paying separate TradingView subscription fees or calculating commission costs on top of spreads.

The AI-powered risk management system analyses your trading patterns and sends alerts when you’re overtrading, risking too much per position, or revenge trading after losses – behavioural issues that destroy beginner accounts before they learn proper discipline.

You get guaranteed stop-loss orders on their proprietary platforms protecting positions from slippage during volatile sessions like Brexit announcements or surprise central bank decisions when spreads widen to 10+ pips at other brokers.

The platform provides 4,500 markets spanning forex, commodities, indices, stocks, and crypto with educational content explaining how each asset class behaves differently, helping you understand why gold moves during inflation fears while tech stocks respond to interest rate changes.

Pros & Cons

- TradingView integration, 0.6 pips

- AI risk management alerts

- Guaranteed stops prevent slippage

- 4,500 markets for learning

- $0 minimum deposit

- Multi-asset educational content

- No raw spread ECN option

- Single account tier only

- GSLO only on proprietary platforms

- Professional needs €500K portfolio

7. ThinkMarkets - Best Trading App To Learn Trading Forex

Forex Panel Score

Average Spread

EUR/USD = 0.11

GBP/USD = 0.4

AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets delivers the most comprehensive mobile learning experience through their ThinkTrader app featuring 65 technical indicators including MACD, RSI, Stochastic Oscillator, Parabolic SAR, and Ichimoku Cloud – more than most desktop platforms offer.

The trading app provides nine chart types like Heikin Ashi for smoothing price action, Renko for filtering noise, and Kagi charts for identifying trend reversals, teaching you alternative ways to analyse markets beyond standard candlesticks.

Push notifications arrive 15 minutes before major releases like US Non-Farm Payrolls, FOMC interest rate decisions, and European Central Bank announcements, helping you learn which events create volatility worth trading versus minor data releases you can ignore.

The ThinkTrader Account offers 0.6 pip EUR/USD spreads with zero commission and $50 minimum deposit, while raw spreads from 0.11 pips with $3.50 commission suit you once comfortable calculating total costs across spread plus fees.

Pros & Cons

- 65 indicators on mobile platform

- Nine chart types (Heikin Ashi, Renko, Kagi)

- Pre-event push notifications (15 min warning)

- ThinkTrader: 0.6 pips, zero commission

- TradingView mobile integration

- 2,700+ stock CFDs available

- No MT4/MT5 in UAE entity

- ThinkTrader Account 0.6 pips minimum

- Offshore accounts lack UAE regulation

- $50 minimum deposit required

8. AvaTrade - Best Islamic Account For Live Trading

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade provides over 100 educational lessons organised into beginner courses like “Introduction to Forex Trading” covering pip calculations and order types, intermediate modules including “Technical Analysis Fundamentals” teaching moving averages and RSI interpretation, and advanced content like “Donchian Channels Strategy” explaining breakout trading systems.

The platform includes nearly 50 quizzes testing your knowledge on topics like risk management calculations, candlestick pattern recognition, and fundamental analysis interpretation, ensuring you actually understand concepts rather than passively watching videos.

Islamic accounts operate swap-free for 5 days before administrative fees apply, giving beginners practicing Sharia-compliant trading enough time to learn day trading and short-term strategies without overnight interest charges. The unique AvaProtect feature lets you insure positions up to $50,000 for premiums between 3-10%, teaching risk management through position insurance rather than just stop-losses.

Pros & Cons

- 100+ lessons with structured progression

- 50 quizzes testing comprehension

- Islamic accounts, 5-day swap-free period

- AvaProtect position insurance feature

- specialised courses (Donchian Channels)

- Multiple platforms (MT4, MT5, AvaOptions)

- Swap fees after 5-day period

- $100 minimum deposit required

- 30:1 retail leverage limit

- Professional account needs qualification

9. Multibank Group - Low Spread Beginner Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.5

AUD/USD = 0.4

Trading Platforms

MT4, MT5, WebTrader

Minimum Deposit

$50

Why We Recommend MultiBank Group

MultiBank Group helps beginners learn cost-effectively through their ECN account charging $3.00 round-turn commissions with 0.0 pip spreads.

The broker provides 15 structured courses including “Introduction to Trading” (6 lessons covering basics), “Trading Terms Glossary” (5 lessons explaining bid/ask, spreads, margin), “Advanced Trading Strategies” (7 lessons on breakouts, reversals, trend following), “Economics for Traders” (6 lessons on GDP, inflation, employment data), and “ECN Trading Explained” (4 lessons on direct market access).

You get 9 downloadable ebooks covering topics like “Risk Management Essentials,” “Technical Analysis Mastery,” and “Trading Psychology,” plus MetaTrader tutorials with 5 desktop lessons and 6 mobile-specific lessons teaching platform navigation, order placement, and indicator customisation.

The MultiBank-Plus App displays 5 levels of market depth showing exactly how much volume sits at each price, teaching you about liquidity and why some support levels hold while others break easily during news releases.

Pros & Cons

- $3.00 commissions vs $7.00 competitors

- 15 courses

- 9 downloadable ebooks on key topics

- 11 MetaTrader tutorial lessons

- 5-level market depth display

- 14,000 share CFDs for diversification

- ECN needs $10,000 minimum

- Standard Account 1.5 pips

- Only 11 crypto CFDs

- No Islamic account option

10. Plus500 - Best CFD Broker For Risk Management

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.6

AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 79% of retail CFD accounts lose money

Why We Recommend Plus500

Plus500 prioritises beginner risk management through guaranteed stop-loss orders included free across all 68 forex pairs, 25+ cryptocurrencies, and hundreds of stock CFDs, protecting you from weekend gaps when Bitcoin drops 15% between Friday close and Sunday open or EUR/CHF spikes 2000 pips during central bank interventions.

The proprietary platform sends real-time price alerts via push notifications when EUR/USD reaches 1.1000, Tesla stock hits $250, or crude oil breaks above $80, teaching you to set strategic levels and wait patiently rather than watching charts constantly throughout trading sessions.

Close at Loss and Close at Profit orders automatically exit positions when your stop or target gets hit, eliminating the emotional decision of whether to hold longer or take profits early – a common mistake causing beginners to turn winners into losers.

The platform displays spreads at 0.9 pips EUR/USD with zero commission under dual DFSA and SCA regulation, giving you straightforward cost calculations where one number represents your total trading expense per position.

Pros & Cons

- Free guaranteed stops all instruments

- Real-time price alerts

- Close at Loss/Profit automation

- 0.9 pips, zero commission structure

- Dual DFSA and SCA regulation

- 25+ crypto CFDs coverage

- No MT4/MT5 platform support

- Basic charting versus competitors

- $100 minimum to start

- No social/copy trading features