How We Test Forex Fees And Trading Costs [2024]

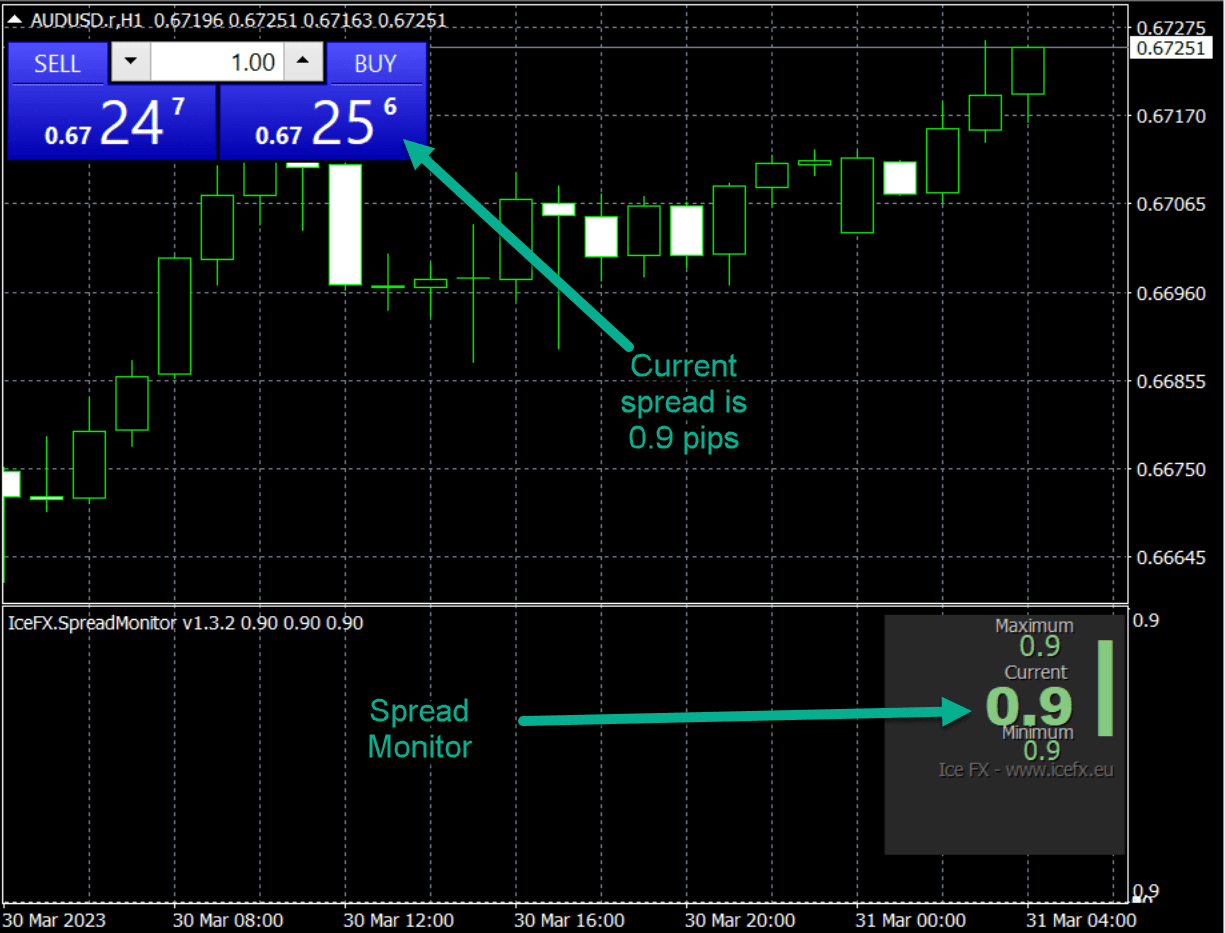

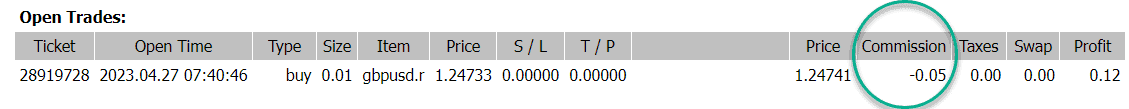

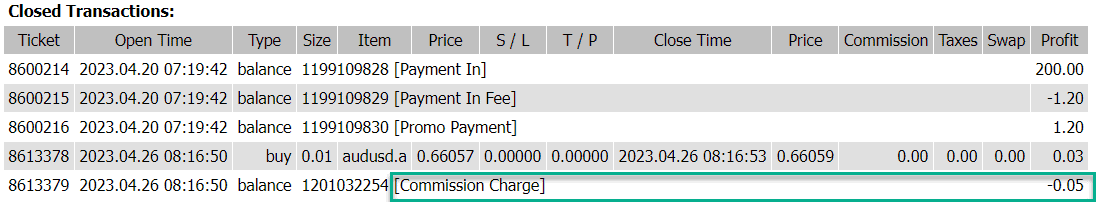

25% of our overall 2024 Forex Broker Score is devoted to Forex trading costs. Each month, we collate published data from brokers’ websites to compare trading costs across brokers. We also independently monitor Standard and RAW Account spreads over 24 hours to record and analyse actual average spreads.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert