10 Best Gold Trading Platforms in Malaysia

I compared 32 regulated trading accounts to find the best gold trading platform in Malaysia. My process included opening accounts, running tests, and comparing trading fees on gold pairs like XAU/USD.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Best Gold Trading Platforms in Malaysia

- Eightcap - Best gold trading platform overall

- Pepperstone - Tight gold spreads from 0.05pts

- FP Markets - Trade gold vs USD, EUR and AUD

- IC Markets - Top range of platforms for gold

- Exness - Trade gold with instant execution

- FxPro - Good metals trading with cTrader

- Tickmill - Great leverage up to 1:1000 for gold

- Octa - Swap free trading with gold

- FBS - Trade gold with MT4 and MT5

- Blackbull Markets - Best copy trading apps for gold

Which platform is best for gold trading in Malaysia?

Pepperstone ranks highest for Malaysian gold traders with razor-sharp XAU/USD spreads, extensive platform choice including MT4, MT5, and cTrader, and execution speeds optimized for Asian market hours. Our methodology compared brokers accepting Malaysian clients on gold trading costs, platform reliability during Asian sessions, MYR funding options, and technical analysis tools to identify which broker delivers the most comprehensive gold trading platform experience for Malaysian traders.

1. Eightcap - Best Gold Trading Platform Overall

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why We Recommend Eightcap

I feel confident to recommend Eightcap as the best broker choice if you’re trading gold in Malaysia. The broker impressed me with spreads from just 0.12 pips on XAU/USD (with no commissions) and access to three trading platforms, these being MT4, MT5, and TradingView.

Beyond gold, Eightcap gives you 56 forex currency pairs, other precious metals, and a massive selection of 95 cryptocurrencies through MT5 and TradingView. Just note that if you use MT4 ‘only’ 79 crypto options are available but this is still more than most brokers offer.

Unless you use trade Forex with their RAW account, Eightcap doesn’t charge commission and you can leverage up to 1:500. If you are a Malaysian trader who wants a strong all-around broker that happens to be excellent for gold, Eightcap is a solid pick.

Pros & Cons

- Raw spreads from 0.12 pips on XAU/USD

- TradingView integration included

- No commission on gold trading

- Fast execution speeds

- High leverage up to 1:500

- Limited educational resources for metals

- Weekend funding not instant

- Demo account limited to 30 days

- Inactivity fee after 3 months

Broker Details

Eightcap Has Three Professional Trading Platforms

Eightcap offers three quality platforms for gold trading. These are MT4, MT5 and TradingView.

MetaTrader 4 is the most popular of the platforms and just does everything really well but lacks some of the fancy charts available with the other platforms. Still more people use this platform than any other and you can create custom indicators and algorithms using expert advisors so you can do a lot with this platform.

I personally prefer MT5 when trading gold because it handles more pending orders and has superior charting tools. The platform uses 64-bit processing, which lets you analyse more timeframes simultaneously through the Strategy Tester.

Their TradingView integration is quite impressive as you can execute trades directly from the charts. This will naturally save you a lot of time switching between analysis and execution, whilst keeping you focused during volatile gold moves.

All three platforms work without any issues on desktop, web, and mobile, with MT5 and TradingView being the better choices for crypto and stock trading.

More Than Just Gold

With Eightcap, you get 56 forex pairs and 95 cryptocurrencies if you’re using MT5 or TradingView. MT4 has sightly fewer crypto options but still you can choose from 79 crypto options which is still impressive.

Eightcap offers both Raw and Standard accounts. Commissions apply only when trading Forex on the Raw account; all other instruments are commission-free, meaning there’s no pricing difference between account types. So in the case of gold, minimum spreads are 1.2 pips with no commission.

| Minimum Spreads | Commission | Leverage | |

|---|---|---|---|

| Gold (XAUUSD) | 1.2 | $0 | 1:500 |

| Silver (XAGUSD) | 0.1 | $0 | 1:100 |

| Brent Crude Oil (UKOUSD) | 3.0 | $0 | 1:500 |

| WTI Crude Oil (USOUSD) | 3.0 | $0 | 1:500 |

| Wall Street 30 Cash (US30) | 16 | $0 | 1:200 |

| UK 100 Cash (UK100) | 12 | $0 | 1:200 |

| Bitcoin/USD (BTCUSD) | 170 | $0 | 1:20 |

| Ethereum/USD (ETHUSD) | 20 | $0 | 1:20 |

| EURUSD | 0.0 | $3.50 raw/$0 Standard | 1:500 |

| AUDUSD | 0.2 | $3.50 raw/$0 Standard | 1:500 |

| GBPUSD | 0.1 | $3.50 raw/$0 Standard | 1:500 |

Leverage goes up to 1:500 across all products. You can trade gold at 0.12 pips, switch to Bitcoin, then jump into EUR/USD without needing multiple brokers. This flexibility is great for traders who are involved in different markets.

Extra Trading Tools

Eightcap includes some exciting features beyond just their platforms, which I appreciate. Their Insights section has a Trade Zone for live market analysis, Labs are great for trading ideas, and you can also find regular events and webinars if you want to learn from other traders.

Another feature that I like is the AI-powered economic calendar that alerts you before major releases. One Fed announcement can move gold $30 in minutes, so this being on top of important economic events actually helps. The last feature to mention is Flashtrader which is an execution tool for scalping with low latency.

TradeSim lets you prop trade without risking your own money once you pass the qualification period. Prop trading is becoming increasingly popular and this is something not all brokers are offering at this time.

2. Pepperstone - Tight Gold Spreads From 0.05pts

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone offers the tightest gold spreads I found for Malaysian traders. The broker spreads for the XAU/USD pair at 0.05 pips for a Razor account, which is exceptional considering the fact that they don’t charge commission.

You also get the choice of five different online trading platforms including MT4, MT5, cTrader, TradingView and their own Pepperstone Trading app.

Beyond gold, Pepperstone gives you access to 93 forex pairs, 29 other commodities, 27 indices, and 37 cryptocurrencies. My colleague Ross Collins at CompareForexBrokers tested execution speeds across 20 brokers and found Pepperstone among the fastest. Combined with their tight pricing, this makes them strong for Malaysian retail traders who want a serious all-around broker.

Pros & Cons

- Spreads from 0.05 pips on XAU/USD

- Four trading top platforms available

- cTrader platform with depth of market

- Wide product range across markets

- No minimum deposit requirement

- Higher spreads on Standard account

- Demo limited to 30 days

- Gold spreads widen during volatility

- Commission charges on forex with Razor account

Broker Details

Pepperstone Offers Four Top Trading Platforms

I found that Pepperstone gives you more platform choice than most brokers. These being MT4, MT5, TradingView cTrader and Pepperstone trading app with each having their own strong points.

You can trade gold on MT4 if you prefer just the most functional charts as opposed to bells and whistle. 4 pending orders are available along with Interactive charts, 9 timeframe, 23 analytical objects and 30 technical indicators.

MT5 works better if you want advanced charting and more order types. An extra 2 order types are available along wih 11 more tieframes, 15 technical objects and 14 drawing tools. MT5 is also upgraded with 64-bit architecture so you can run complex strategies with multiple indicators simultaneously.

Pepperstone offers cTrader, which surprised me as many Malaysian brokers don’t support this. The cTrader platform has superior order execution and shows you depth of market pricing, helping you with entries.

TradingView integration is also available for chart-based trading. All four platforms connect to the same liquidity pool, meaning you get consistent spreads regardless of your choice.

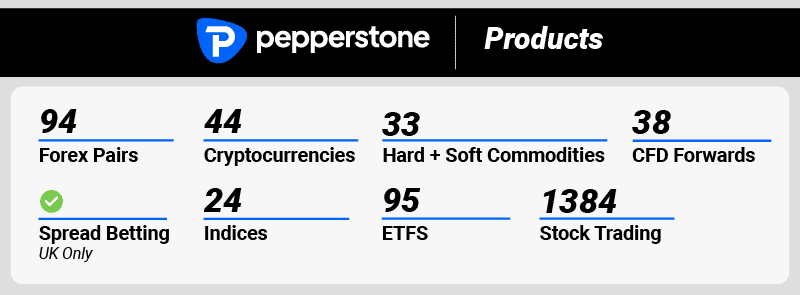

Wide Product Range

Pepperstone gives you access to more than just gold trading. You get 93 forex pairs, 37 cryptocurrencies, 29 hard and soft commodities, 27 indices, and over 1200 stocks to choose from. That’s a great variety for traders who want to diversify beyond precious metals.

Gold spreads start from 0.05 pips with zero commission. Silver comes in at 0.016 pips, also with no commission. Other commodities like crude oil and natural gas also have no commission charges in other words spreads stay the same whether you pick Razor or Standard accounts.

CompareForexBrokers tested their pricing across different sessions and the spreads stayed tight during London-New York overlap when liquidity peaks. Pepperstone sources from over 20 banks, which explains why their pricing holds up even when markets get busy.

Fast Execution

Pepperstone’s execution quality is strong. My colleague at CompareForexBrokers tested 20 brokers and found them among the fastest, ranking second for limit orders at 77ms.

I’ve watched their fills during busy sessions and rarely see slippage, orders get filled quickly whether you’re trading gold, forex pairs, or indices. Fast fills matters when price movements strike on news releases.

Fast executions and speedy fills help with any trading style. If you’re scalping for a few pips or entering positions during volatility, execution speed will directly impact your results.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|---|

| Blackbull Markets | 1 | 72 | 90 |

| Fusion Markets | 2 | 79 | 77 |

| Pepperstone | 3 | 77 | 100 |

| Octa | 4 | 81 | 91 |

| Oanda | 5 | 86 | 84 |

| Exness | 6 | 92 | 88 |

| Blueberry Markets | 7 | 88 | 94 |

| FOREX.com | 8 | 98 | 88 |

| Global Prime | 9 | 88 | 98 |

| Tickmill | 10 | 91 | 112 |

3. FP Markets - Trade Gold vs USD, EUR And AUD

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, Myfxbook, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets is high on this list because it allows you to trade gold against three major currencies. I like having the option to trade XAU/USD, XAU/EUR, or XAU/AUD depending on market conditions.

The broker offers two main account types. Standard accounts have slightly wider spreads but no commission. Raw accounts give you tighter spreads starting from 0.12 pips on gold but charge $3 commission per lot. I like having that choice based on how actively you trade.

Beyond gold, FP Markets gives you over 60 forex pairs, other commodities like silver and oil, plus major indices like the S&P 500 and NASDAQ. You also get access to individual stocks and ETFs if you want to diversify.

FP Markets supports MT4, MT5, cTrader, and TradingView for execution. They also integrate social trading through Signal Start and Myfxbook’s AutoTrade if you want to copy experienced traders.

Pros & Cons

- Three gold currency pairs available

- MT4, MT5,cTraderand TradingView supported

- Raw spread 0.12 pips on gold

- Low $100 minimum deposit to start

- Standard account has wider gold spreads

- $3 commission on raw accounts

- Limited to MT5 for some instruments

- Demo account expires after 30 days of inactivity

4. IC Markets - Top Range Of Trading Platforms For Gold

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView, ZuluTrade, Myfxbook, IC Markets App

Minimum Deposit

$200

Why We Recommend IC Markets

IC Markets offers a great platform range for gold trading. Gold vs 6 fiats are available along with Silver vs USD, Euro and AUD) and you can trade a further 20 commodities, 61 Forex pairs and 18 cryptos These products can be traded using MT4, MT5, cTrader, or TradingView depending on your needs.

I found IC Markets raw spread account offers excellent value with XAU/USD from just 0.2 pips (plus $3.50 commission each way). Similarly you can trade major Forex pairs from 0.0 pips with the same account and commission cost. Both products allow for leverage of 1:1000 These low costs is why IC Markets has high-frequency traders and scalpers.

IC Markets is excellent if you need cTrader or want advanced charting tools. They combine platform choice with institutional-grade execution quality.

Their strong reputation in the trading community gives me additional confidence. IC Markets has been operating since 2007 with consistent reliability across the trading community.

Pros & Cons

- Ultra-tight gold spreads from 0.2 pips

- Gold vs 6 types of fitas

- cTrader offers depth of market pricing

- Execution speeds under 40ms

- No restrictions on scalping gold

- Leverage up to 1:1000 for Malaysian traders

- $200 minimum deposit required

- $9 commission per lot on Raw accounts for FX

- Standard account doesn’t support cTrader

5. Exness - Trade Gold With Instant Execution

Forex Panel Score

Average Spread

EUR/USD = 0.63 GBP/USD = 0.74 AUD/USD = 0.62

Trading Platforms

MT4, MT5, Exness Trade App

Minimum Deposit

$200

Why We Recommend Exness

Exness is an excellent choice for traders who enjoy flexibility with their account types and high leverage. They offer up to 1:2000 leverage, which is among the highest you’ll find as a Malaysian trader.

I appreciate the fact that you get multiple account types, including zero spread accounts, if you’re trading actively.Their Pro account gives you forex spreads from 0.1 pips with zero commission. That’s low for a no-commission setup especially since it uses instant execution. The Zero Spread account does what it says – 0 pips on the top 30 instruments, though commission changes depending on what you’re trading, this account is top value in my opinion.

Beyond gold, you get forex pairs, indices, cryptos, and other commodities to trade. MT4 and MT5 are both available with one-click trading for quick entries.

Exness provides swap-free accounts for Muslim traders and processes withdrawals instantly. For Malaysian traders wanting high leverage and variety, Exness works well.

Pros & Cons

- Pro account with spreads from 0.1 pips

- Leverage up to 1:2000 on gold

- Zero spread accounts available

- Instant withdrawal processing

- Swap-free accounts for Muslim traders

- $10 minimum deposit for Standard accounts

- Leverage drops as equity increases

- Standard account spreads start from 20 pips

- Leverage capped at 1:200 during major new

6. FxPro - Good Metals Trading With cTrader

Forex Panel Score

Average Spread

EUR/USD = 0.15 GBP/USD = 0.58 AUD/USD = 0.55

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

FxPro offers good metals trading through cTrader. Gold spreads start from 1.2 pips on standard accounts with no commission. The cTrader account charges $3.50 commission on gold but tightens the spreads.

You can pick between MT4, MT5, and cTrader depending on your preference. I appreciate cTrader’s advanced order types and depth of market pricing for better entries.

FxPro gives you unlimited leverage. Their 0% stop out feature lets positions run until equity hits zero, which gives you more breathing room during volatile moves rather than getting stopped out early.

Pros & Cons

- cTrader platform with DOM

- Multiple precious metals available

- Offers MYR accounts for Malaysian traders

- Four trading platforms available

- Negative balance protection included

- Wider spreads than ECN brokers

- Commission on cTrader raw spreads

- $100 minimum deposit required

- $15 inactivity fee after 6 months

7. TickMill - Great Leverage Up To 1:1000 For Gold

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, Tickmill Mobile App CQG Agena Trader

Minimum Deposit

$100

Why We Recommend Tickmill

TickMill is great for traders who are after high leverage on gold positions as you can get leverage up to 1:1000. This is among the highest available to Malaysian traders.

Their pricing is competitive with typical spreads of 0.09 pips on gold. Pro accounts charge $3.50 commission on forex pairs, but there’s no commission on CFDs, indices, cryptocurrencies, oil, or bonds.

TickMill offers MT4, MT5, TradingView, and also their own Tickmill App featuring more than 60 technical indicators. You can get Islamic swap-free accounts and dedicated support in Bahasa Malaysia, which helps if you prefer communicating in your native language.

The tight spreads and high leverage are great for traders who understand position sizing and risk management well.

Pros & Cons

- Leverage up to 1:1000 for gold trading

- Tight spreads from 0.09 pips on XAU/USD

- Islamic swap-free accounts available

- Fast execution speeds (0.20 seconds)

- Dedicated Malaysian website with Malay support

- $3 commission per lot on Pro accounts

- Malaysian traders under FSA Seychelles regulation

- $100 minimum deposit requirement

- High leverage requires careful risk management

8. Octa - Swap Free Trading With Gold

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.9

AUD/USD = 1.9

Trading Platforms

MT4, MT5, OctaTrader

Minimum Deposit

$25

Why We Recommend Octa

I recommend Octa if you’re a Muslim trader in Malaysia looking for a broker that complies with Islamic principles. They offer swap-free accounts to everyone by default. Traders also get market-level spreads, so you’re not paying for this through inflated costs like most brokers do.

Their main platform is OctaTrader with over 80 instruments. It has Space analytics, AI chart patterns, and better security than standard platforms. MT4 gives you 74 instruments, MT5 has 230 including stocks. Octa doesn’t charge commission on anything you trade.

The broker also offers some incredible educational resources and a multilingual support team. Their copy trading integration also lets you follow experienced traders.

Pros & Cons

- Swap-free accounts available

- $25 minimum deposit

- Good educational resources

- Multilingual customer support

- Copy trading platform integrated

- Higher gold spreads at 2.8 pips average

- Three platforms but no cTrader option

- Malaysian traders under Comoros Union regulation

- Limited to 5 commodity instruments only

9. FBS - Trade Gold With MT4 And MT5

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.6 AUD/USD = 1.4

Trading Platforms

MT4, MT5, FBS App

Minimum Deposit

$5

Why We Recommend

FBS is a good broker for traders who want both MT4 and MT5 for gold trading, as well as extremely low entry requirements. You can open accounts starting from $1, which removes barriers for beginner traders who are just looking to test the market.

The broker surprised me with its variety of account types, such as cent accounts for testing strategies. I like their loyalty programme, which allows you to cashback on trades.

FBS works well whether you’re new to gold trading or an experienced trader. The broker offers leverage up to 1:3000 on certain accounts, which is great for traders who want higher position control.

They work particularly well if you’re starting with a smaller account balance. Their cent accounts let you test gold trading with minimal risk before scaling up.

Pros & Cons

- $5 minimum deposit available

- Both MT4 and MT5 supported

- Cent accounts for practice

- Loyalty cashback programme

- High leverage up to 1:3000

- Spreads vary significantly by account

- Complex account structure

- Withdrawal processing time varies

- Less tier-one regulation

10. BlackBull Markets - Best Copy Trading Apps For Gold

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.1 AUD/USD = 0.1

Trading Platforms

MT4, MT5, TradingView, cTrader, ZuluTrade, Myfxbook, Blackbull App

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Markets stands out for its integrated copy trading options specifically for gold traders. You get access to multiple platforms, including TradingView and Myfxbook AutoTrade, for automated strategies.

I found their ECN account provides tight spreads and fast execution for gold trades. You can combine copy trading with direct trading seamlessly on the same platform.Their BlackBull CopyTrader app is available on both iOS and Android, letting you monitor and manage your copied gold positions on the go.

You can choose to copy gold traders automatically or you can trade manually using the MT4, MT5, or TradingView platforms. All traders get professional execution speeds and competitive pricing, regardless of your experience level.

If you like to switch between copying experienced traders and trading gold manually, BlackBulls is a solid broker choice for you.

Pros & Cons

- Multiple copy trading options for gold

- Direct TradingView chart execution

- Competitive 0.12 pips on XAU/USD Prime

- MT4, MT5, cTrader and TradingView

- Islamic accounts available for gold

- High $2000 minimum for better spreads

- Commission charges on ECN accounts

- Limited educational resources for metals

- Malaysian traders under offshore regulation