Lowest Spread Forex Brokers In The UK

To determine the UK forex broker with the lowest spreads, we compared FCA-regulated brokers only based on their published January 2026 average spreads and commission rates. We also compared other trading accounts to determine the best no-commission account, the lowest commission broker and the best 0-pip spread forex broker.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

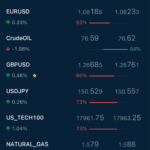

The January 2026 low spread comparison table below compares all the FCA-regulated forex brokers that publish their monthly average spreads across the most traded forex pairs. We update this table monthly, so it’s worth coming back periodically.

| UK Forex Broker | FCA Regulated | Average | EURUSD | USDJPY | GBPUSD | AUDUSD | USDCAD | EURGBP | EURJPY | AUDJPY |

|---|---|---|---|---|---|---|---|---|---|---|

| Eightcap | Yes | 0.30 | 0.06 | 0.23 | 0.23 | 0.27 | 0.20 | 0.30 | 0.59 | 0.49 |

| Tickmill | Yes | 0.33 | 0.10 | 0.10 | 0.30 | 0.10 | 0.20 | 0.40 | 0.50 | 0.90 |

| ThinkMarkets | Yes | 0.36 | 0.11 | 0.29 | 0.40 | 0.30 | 0.50 | 0.40 | 0.44 | 0.47 |

| Blackwell Global | Yes | 0.38 | 0.40 | 0.30 | 0.30 | 0.40 | 0.50 | 0.30 | 0.30 | 0.50 |

| Pepperstone | Yes | 0.40 | 0.10 | 0.20 | 0.20 | 0.10 | 0.40 | 0.20 | 1.10 | 0.90 |

| XTB | Yes | 0.49 | 0.09 | 0.14 | 0.14 | 0.13 | 0.18 | 0.14 | 1.40 | 1.70 |

| Forex.com | Yes | 0.50 | 0.17 | 0.35 | 0.29 | 0.30 | 0.65 | 0.42 | 0.68 | 1.11 |

| Axi | Yes | 0.50 | 0.20 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.60 | 0.70 |

| ATC Brokers | Yes | 0.51 | 0.30 | 0.30 | 0.60 | 0.40 | 0.50 | 0.50 | 0.50 | 1.00 |

| Vantage Markets | Yes | 0.52 | 0.18 | 0.35 | 0.14 | 0.60 | 0.45 | 0.36 | 0.85 | 1.19 |

| HF Markets | Yes | 0.56 | 0.10 | 0.20 | 0.40 | 0.80 | 0.80 | 0.40 | 0.80 | 1.00 |

| IG | Yes | 0.59 | 0.16 | 0.24 | 0.59 | 0.29 | 0.7 | 0.54 | 0.68 | 1.50 |

| FXCM | Yes | 0.68 | 0.30 | 0.60 | 0.90 | 0.40 | 0.60 | 0.70 | 0.80 | 1.10 |

Our list of the best low spread brokers for UK traders is:

- Eightcap - Lowest Spread Forex Broker

- Pepperstone - Best Forex Broker In The UK

- OANDA - Best Low Spread Broker For Beginners

- CMC Markets - Low Spread Across 338 Forex Pairs

- AvaTrade - Good Spreads For Day Trading

- City Index - Low Spread No Commission Forex Broker

- eToro - Low Spread Copy Trading Broker

- SpreadEx - Top Spread Betting Broker

- Blackbull Markets - High Leverage Forex Broker (500:1)

- Fusion Markets - Lowest Commission ECN Forex Broker

Which Forex Broker Has The Lowest Spread?

We found Eightcap has the lowest spread of any FCA regulated forex broker in the UK averaging 0.30 pips in January 2026. There are also fees on other tradable instruments such as shares, indices and commodities in which Pepperstone was the best.

1. Eightcap - UK's Lowest Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.23

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

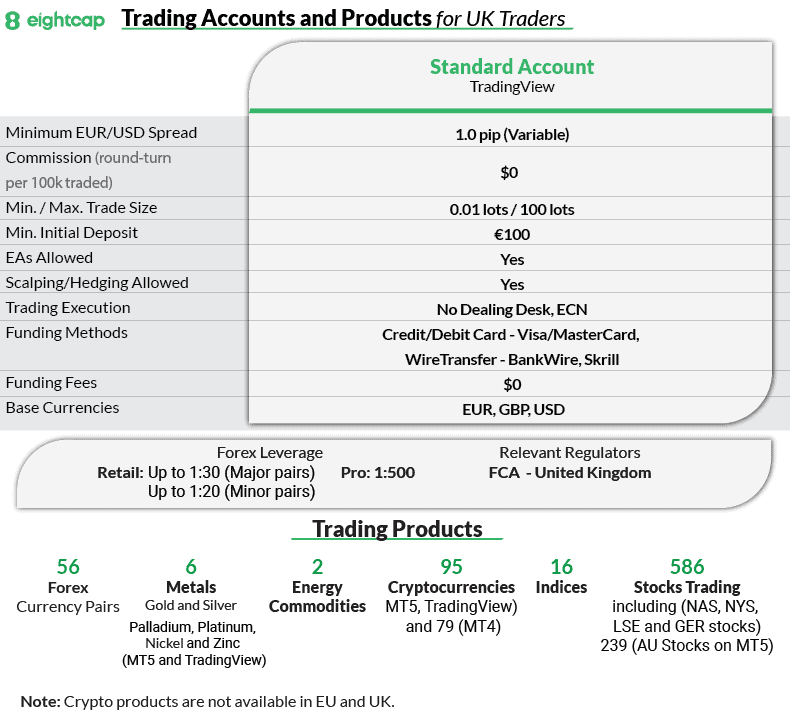

Since securing an FCA license in late 2024, Eightcap has immediately made an impression on the UK market. I’ve put the broker in second place, due to its lowest spreads on a wide range of markets in the UK.

I found that the broker’s Standard account offers competitive spreads across more than 800 instruments, while the EUR/USD averaged 1.16 pips in my tests. With access to TradingView to give you excellent charting tools, I think Eightcap is a great all-rounder if you choose to day trade.

Pros & Cons

- Tight spreads across all markets

- Excellent automated trading strategy tools

- Offers market research analysis for free

- Limited range of financial products

- The minimum deposit for the Standard account is £100

- Lacks copy trading tools

Broker Details

Cheap Spread-only Account

Eightcap offers its spread-only pricing model through the Standard account, meaning you only pay the spread with no commissions.

In my tests, the Standard account’s spreads were very competitive on the whole. While the EUR/USD came in at 1.16 pips – a touch higher than competitors like OANDA – Eightcap’s spreads were generally low across more than 800 markets. These markets include exotic pairs and commodities like silver.

The starting spreads were only 1 pip, compared to 1.9 pips on BlackBull Markets.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Cheap Trading Fees On All Markets

Other brokers I’ve tested seem to neglect traders who trade less popular markets, and hit these traders with inflated prices. I was impressed that Eightcap doesn’t do this, and instead provides a low-spread trading experience across all of its assets.

The broker offers low spreads on:

- 55 currency pairs

- 150 share CFDs

- 10 commodities including gold and silver

- 30 indices covering FTSE 100 and NASDAQ

To put things in perspective, I created this tool so you can see what your trading costs will be like with Eightcap:

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Access TradingView with Eightcap

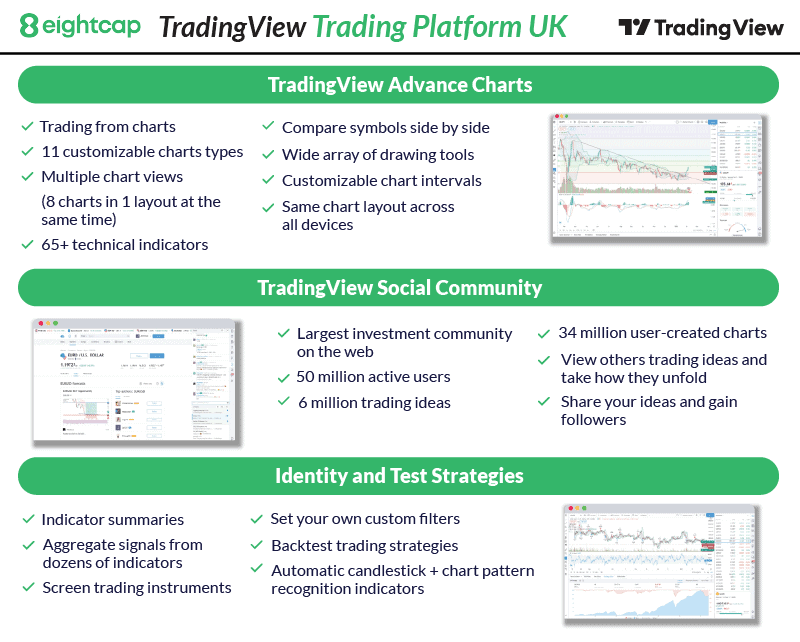

TradingView is the only trading platform for UK traders available on Eightcap. While the lack of variation is a pity, I’m still pleased to see support for TradingView – it’s my favourite platform for technical analysis.

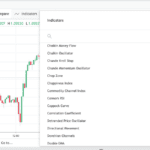

I like its growing catalogue of 110+ technical indicators, including Ichimoku and Pivot Points. Other highlights for me include the built-in Depth of Markets tool, and TradingView’s social trading features.

One tool that I use frequently is the asset screener. This tool automatically filters and scans selected markets based on your search criteria. While testing it out, I based my scans on candlestick patterns, moving average crossovers, and new highs formed.

Through TradingView, we found that Eightcap offers 56 currency pairs, 580+ stocks, 16 indices, and five commodities.

View Eightcap ReviewVisit Eightcap

Fund an Eightcap account and unlock a TradingView Plus plan worth £33.95 per month

*Your capital is at risk ‘74% of retail CFD accounts lose money’

2. Pepperstone - Best Forex Broker In The UK

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

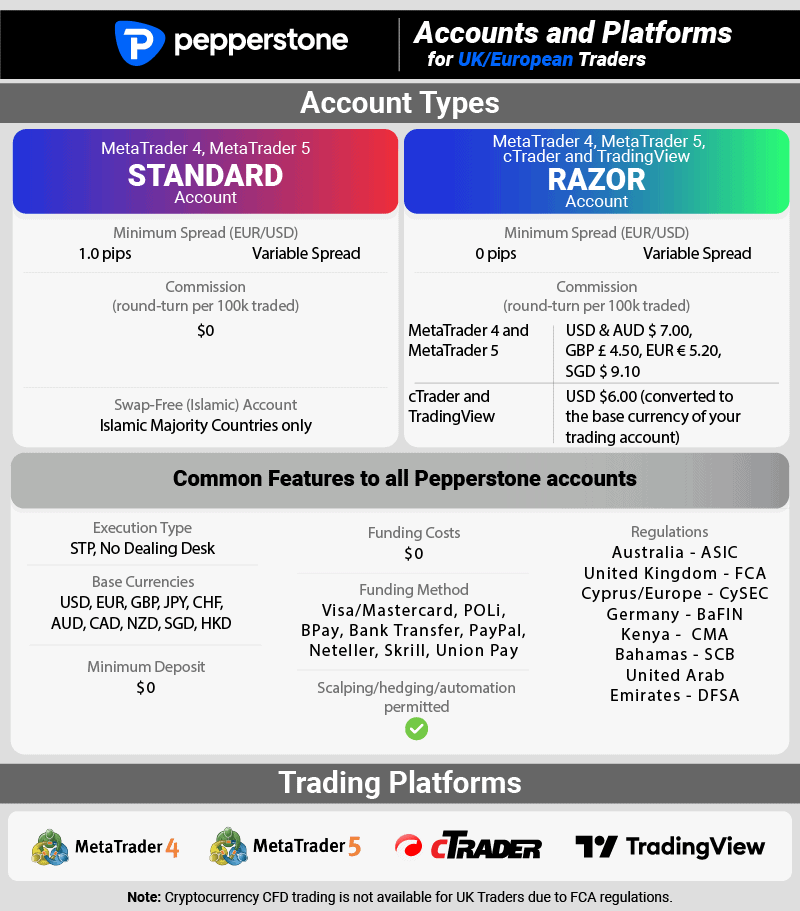

Pepperstone is my overall top-rated forex broker. I gave this broker a score of 98/100, after its Razor Account achieved 0 pip spreads 100% on major pairs – the lowest in spreads in the UK.

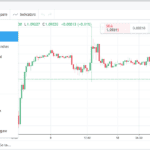

The broker’s trading conditions make it one of the best for day trading. It offers fast execution speeds (77ms) that reduce requotes and negative price slippage on its 1,500+ markets. You also have 5 excellent trading platforms – including TradingView, MT4, cTrader, and MT5. This means most traders are going to find their preferred platform is supported by Pepperstone.

Pros & Cons

- Low spreads on MT4

- Zero pip spreads 100% of the time on EUR/USD

- Diverse selection of trading platforms

- No cryptocurrency markets

- Can’t trade shares on MT4

- No guaranteed stop-loss orders

Broker Details

Zero-pip Spreads On Razor Account

Pepperstone delivered the best spreads in the UK in our tests. We found the broker offered zero-pip spreads on its Razor account, and that these spreads are extremely reliable.

CompareForexBrokers analyst Ross Collins tested this, using the SpreadMonitor EA to track and record the spreads of 15 brokers. Ross found that Pepperstone offered the EUR/USD at 0 pips 100% of the time (outside of rollover). Other majors remained at their minimum spread levels consistently too.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% |

| Blueberry Markets | 100.00% | 100.00% | 91.30% | 100.00% | 78.26% | 95.65% |

| Blackbull Markets | 100.00% | 100.00% | 95.65% | 95.65% | 65.22% | 65.22% |

| CMC Markets | 100.00% | 95.65% | 65.22% | 86.96% | 65.22% | 78.26% |

As you can see from the table, no other broker in the UK matches this. This should mean you keep more of your potential profits. Of course, profits are never guaranteed.

The Razor account’s commission fees are £2.25 per lot traded. On the zero-pip pairs, you won’t pay any more than this to trade. There are more than 1500 instruments and 93 forex markets to trade in total. And even outside of the zero-pip pairs, I found the spreads tend to be pretty good.

Fast Execution Speeds For Limit Orders

As Pepperstone is an ECN broker, the execution speed is fast, providing you with some of the best trading conditions in the UK. In Ross’ execution speed tests, Pepperstone came 3rd out of 36 brokers tested. This was thanks to an average limit order speed of 77ms and market order of 100ms.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| OANDA | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

| Trading.com | 13 | 98 | 14 | 138 | 15 |

| FBS | 14 | 135 | 17 | 118 | 12 |

| Axi | 15 | 90 | 8 | 164 | 25 |

| Eightcap | 16 | 143 | 19 | 139 | 17 |

| IC Markets | 17 | 134 | 16 | 153 | 22 |

| FxPro | 18 | 151 | 23 | 138 | 16 |

| Go Markets | 19 | 144 | 20 | 145 | 20 |

| Markets.com | 20 | 150 | 22 | 141 | 18 |

| EasyMarkets | 21 | 155 | 24 | 155 | 24 |

| Admirals | 22 | 132 | 15 | 182 | 28 |

| IG | 23 | 174 | 26 | 141 | 19 |

| CMC Markets | 24 | 138 | 18 | 180 | 26 |

| FP Markets | 25 | 225 | 32 | 96 | 8 |

| VantageFX | 26 | 175 | 27 | 154 | 23 |

| XM | 27 | 148 | 21 | 184 | 29 |

| FXCM | 28 | 108 | 28 | 189 | 30 |

| Avatrade | 29 | 235 | 33 | 145 | 21 |

| ThinkMarkets | 30 | 161 | 25 | 248 | 36 |

| Tradersway | 31 | 198 | 29 | 214 | 33 |

| Swissquote | 32 | 258 | 37 | 198 | 31 |

| FXTM | 33 | 248 | 36 | 210 | 32 |

| Libertex | 34 | 215 | 31 | 244 | 35 |

| ATC Brokers | 35 | 238 | 34 | 241 | 34 |

| HYCM | 36 | 241 | 35 | 268 | 37 |

Top Selection Of Trading Platforms

The broker supports platforms like TradingView, MT4, MT5, cTrader, and their own Pepperstone trading software.

Personally, I’d choose TradingView or MT4. These platforms give you decent technical analysis tools. If you want solid platforms for automating your trades, MT5 and cTrader are strong candidates. MetaTrader platforms are known for their Expert Advisors trading bots, while cTrader provides this functionality through its cBots.

*Your capital is at risk ‘72% of retail CFD accounts lose money’

3. OANDA - Best Low Spread Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.89

GBP/USD = 1.54

AUD/USD = 1.37

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

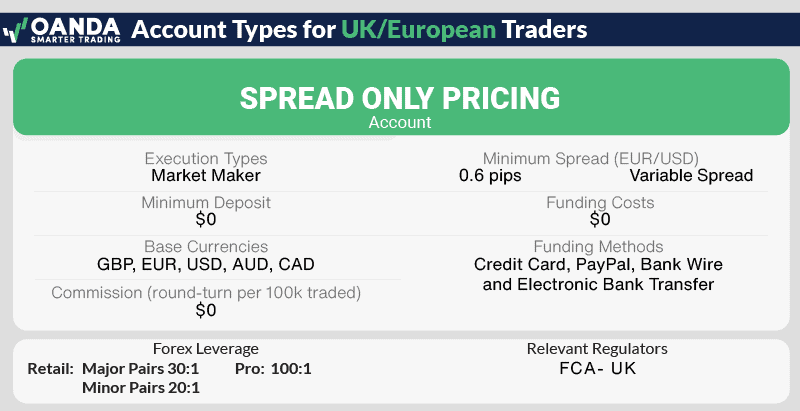

OANDA has excellent spreads on its Standard account, averaging 1.06 pips on EUR/USD. This makes them a top option if you want lower costs with no commissions.

The account pairs nicely with the OANDA Trade platform, delivering low trade sizes from just one unit. This, coupled with the guaranteed stop-loss orders, makes it a top account for beginners.

If you want more technical indicators or advanced tools, TradingView and MetaTrader 4 are great alternatives to the OANDA Trade platform. OANDA is also my most trusted broker, scoring 100/100 thanks to regulation through multiple Tier-1 authorities. This contributes to the broker’s overall 91/100 score.

Pros & Cons

- Tight spreads averaging 1.06 pips

- Low trade sizes ideal for beginners

- Guaranteed stop loss orders available on OANDA Trade

- Customer support is not 24/7

- Lacks share CFDs

- Doesn’t offer ECN/STP accounts

Broker Details

Spreads With OANDA

OANDA only offers a spread-only trading account with no commissions, which we think makes the broker ideal if you are a beginner. Compared to RAW pricing, Standard accounts are more straightforward with their pricing structure, as you don’t pay commission.

We collected the average spreads of the majors from OANDA, compared them with other brokers with spread-only accounts, and found that OANDA had the lowest spreads, averaging 0.7 pips.

| Broker | Average Spread For Major Pairs Tested by CompareForexBrokers |

|---|---|

| OANDA | 0.70 |

| Fusion Markets | 0.99 |

| AvaTrade | 0.90 (Fixed spreads) |

| Eightcap | 1.06 |

| CMC Markets | 1.24 |

| City Index | 1.24 |

| eToro | 1.30 |

| Pepperstone | 1.40 |

| BlackBull Markets | 1.42 |

The lowest average spreads are EUR/USD and USD/JPY, averaging 0.6 pips, and the highest being 0.9 pips on GBP/USD. These spreads are still cheaper than its competitor’s, making it a prime candidate for trading forex.

OANDA Trade Has Nice Features

Tight Spreads On OANDA’s Standard Account

OANDA’s Standard account is spread-only with no commissions. This is the only option available when you sign up with OANDA. I think Standard accounts are best suited for beginners – your trading costs are simplified as you do not pay a commission.

My Analyst, Ross, ran a test to find brokers with the lowest spread Standard accounts, using the IceFX SpreadMonitor EA. Applying this EA through his MT4 account helped him find the brokers’ average spreads.

Out of the 15 brokers tested, OANDA recorded some of the tightest spreads. They averaged 1.06 pips on EUR/USD, which is better than the industry average (1.11 pips).

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

OANDA Trade Has Beginner-Friendly Tools

One of the reasons I think OANDA is so great for beginners is their OANDA Trade platform. This software has excellent risk management features, built into an intuitive interface.

I liked that you can trade smaller position sizes, starting from 1 unit. Other brokers offer minimum position sizes of 1 mico-lot, which is 1,000 times the 1 unit minimum of OANDA. With OANDA, you can get started with only £0.03p, helping you build your confidence while limiting your financial risk.

You also have guaranteed stop-loss orders (GSLOs) to protect your open positions from negative price slippage. While GSLOs do carry a fee, you only pay the fee if you actually need to use the protection.

I did like that the OANDA Trade platform integrates with TradingView charting, giving you access to the best technical analysis tools available. You can use 50 drawing tools, 100+ indicators, 9 timeframes, and 11 chart types, allowing you to perform decent market analysis on the platform.

If you prefer trading on MetaTrader 4 or TradingView, these are both supported.

Don’t know which trading platform is best for you? I built a tool that you can use that will recommend which platform best fits your needs. Check it out:

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

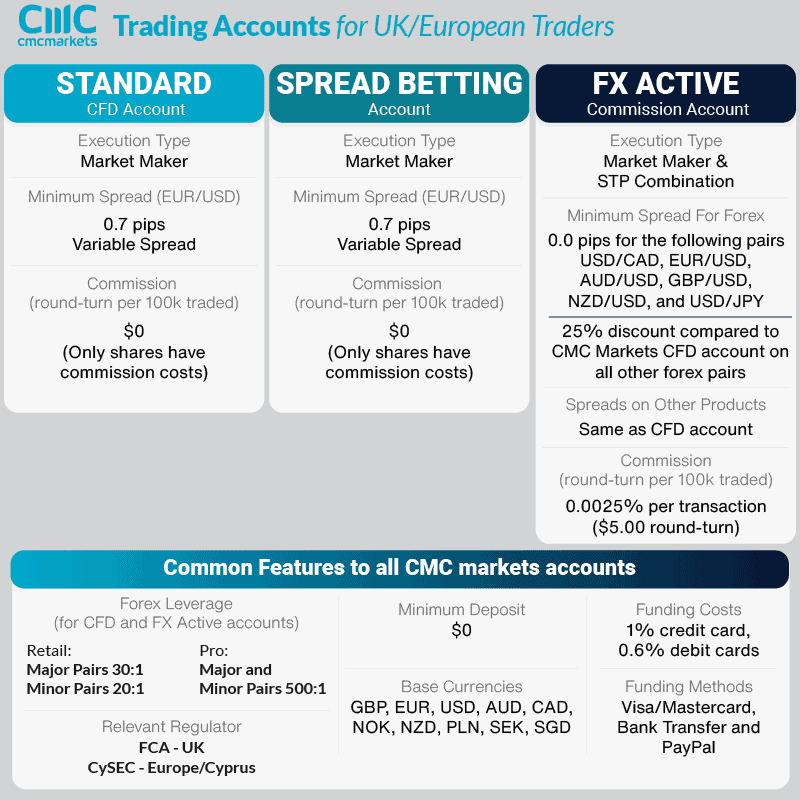

4. CMC Markets - Low Spreads Across 338 Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets offers impressive spreads on forex. Its Standard account averaged 0.80 pips on the EUR/USD pair – one of the lowest we recorded in our tests. The FX Active account provides tighter spreads, starting from 0.0 pips on the forex majors.

This makes FX Active my solid pick for forex trading, especially as CMC Markets offers 338 currency pairs – four times more than the average broker. I found pairing the FX Active account with the NGEN platform is a great choice, as you scan chart patterns to find forex trading opportunities automatically.

Pros & Cons

- Low spreads on Standard and FX Active accounts

- Solid charting tools with the NGEN trading platform

- Largest foreign exchange market choice (338)

- No live chat support

- No social trading tools

- Commissions are average

Broker Details

Widest Selection Of Currency Pairs

In my live account tests, CMC Markets offers the widest range of currency pairs with 338 markets. This is almost 3 times as many as IG Markets and 5 times the industry average of around 68 pairs.

FX Active Provides Lower Trading Costs For Forex Trading

I found CMC Markets offers the FX Active trading account with reduced spreads and commissions for forex markets only. This should lower your costs when trading forex. FX Active spreads start from 0 pips and feature relatively cheap commissions of $2.50 per lot traded – working out to about £2.00 in GBP.

The Standard account, which offers low spreads across all markets, is commission-free. Our analyst, Ross, found CMC Markets to be one of the best for the EUR/USD pair. The average spread of 0.80 pips is 27% below the industry average of 1.11 pips.

| EURUSD | SPREAD |

|---|---|

| IC Markets | 0.73 |

| CMC Markets | 0.8 |

| FXCM | 0.93 |

| TMGM | 1 |

| FusionMarkets | 1.01 |

| OANDA | 1.06 |

| EightCap | 1.16 |

| FP Markets | 1.19 |

| Pepperstone | 1.21 |

| Blackbull Markets | 1.34 |

| FXPro | 1.59 |

| Tested Industry Average: | 1.11 |

CMC Markets’ range of financial instruments is one of the largest in the UK with 12,000+ CFD markets available. You can trade 10,000+ stocks, 15+ commodities, 82+ indices, and the 338 forex pairs. This gives you plenty of day trading opportunities.

NGEN Platform Has Excellent Charting Tools

The default platform is the CMC Next Generation (NGEN) trading platform, which I found easy to use. It also offers many of the features you’d expect from more famous platforms like MT4 and TradingView.

The NGEN platform has 85+ indicators that cover the most popular indicators like Bollinger Bands and Ichimoku. It also offers a chart pattern screener.

I like this screener, as it scans the markets for chart patterns like wedges and triangles. It also alerts you when a market matches a pattern. As a day trader, I find this helpful in finding new trading opportunities, especially while I’m focusing on my own analysis.

*Your capital is at risk ‘69% of retail CFD accounts lose money’

5. AvaTrade - Good Spreads For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.2

AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade delivers fixed spreads from 0.90 pips on EUR/USD, which is cheaper than most variable spread brokers I tested. For me, this is impressive, as you’ll get the same spread even when the market becomes more volatile. Variable spread brokers will become more expensive during these periods.

I like that the broker offers fixed spreads on all its platforms – AvaTrade Web Trader, AvaTradeGO, MT4, and MT5 – so you aren’t locked into the broker’s proprietary platforms. With the trading sentiment indicators available and fixed spreads, I think AvaTrade is a top choice for day traders.

Pros & Cons

- Fixed spreads from 0.9 pips

- Decent selection of trading platforms

- Sentiment indicators and trading signals available

- No RAW spread accounts

- Not all products are available across each platform

- Has high inactivity fees

Broker Details

AvaTrade Has Fixed Spreads

AvaTrade has positioned itself as one of the only fixed-spread forex brokers in the UK, and I found them surprisingly competitive on forex spreads. Fixed spreads are a good alternative to variable spreads as they will not widen during increased volatility, making your trading costs stable regardless of market conditions.

EUR/USD spreads are fixed at 0.90 pips, which is cheaper than the industry average for variable spreads. I found that for major pairs, AvaTrade delivers spreads that beat most brokers. The 1.10 pip AUD/USD spread and 1.0 pip USD/JPY spread are some of the cheapest I’ve tested.

I’ve compared AvaTrade’s fixed spreads against variable spread accounts, for two reasons. One, to highlight the broker’s performance against variable spreads. And two, because there simply aren’t enough fixed spread brokers to provide a comprehensive analysis.

| Broker | Avg. EUR/USD Spreads | Variable/Fixed |

|---|---|---|

| OANDA | 0.92 | Variable |

| City Index | 0.70 | Variable |

| AvaTrade | 0.80 | Fixed |

| Fusion Markets | 0.89 | Variable |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| Pepperstone | 1.10 | Variable |

| BlackBull Markets | 1.10 | Variable |

| CMC Markets | 1.3 | Variable |

Trade 800+ Markets With Fixed Spreads

You’ll find fixed costs on all of the broker’s 800+ markets. For share CFDs, you’ll be paying a fixed percentage as a spread, instead of a fixed cost.

Advanced Charting With Multiple Trading Platforms

AvaTrade supports MetaTrader 5, MT4, AvaTraderGO (the mobile trading app), and AvaTrade Web Trader. I used AvaTradeGO in my tests, and it was one of the better mobile trading platforms I’ve tested.

AvaTradeGO has a decent range of 90+ trading indicators, like MACD and moving averages for market analysis. You can also use AvaTrade Trading Signals to find trading ideas for you.

Another feature I liked was the Market Trends tool. This tool monitors social trends from AvaTrade’s clients, helping you find buyer or seller market bias easily.

*Your capital is at risk ‘66% of retail CFD accounts lose money’

6. City Index - Top Low Spread No Commission Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 0.5

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

I found City Index’s Standard account is a good choice if you want tight spreads with no commissions. The spreads start from 0.70 pips on EUR/USD.

The broker has one of the largest market offerings with 13,500+ financial instruments, making them ideal for day trading strategies like breakout trading. The low spreads and range of trading instruments are available to trade on City Index Web Trader, TradingView, and MetaTrader 4.

Pros & Cons

- Tight spreads averaging 0.7 pips

- Sold range of markets

- Guaranteed stop loss orders with City Index Platform

- The product range is limited on MT4 (no shares)

- Has a minimum deposit requirement

- Doesn’t offer RAW spread account in the UK

Broker Details

Tight Spreads On Standard Account

In my tests, I found that City Index offers spreads from 0.70 pips on its Standard account, with no commissions. This makes it one of the cheapest Standard accounts on my list. The account offered low spreads for EUR/USD (0.70 pips), USD/JPY (0.60 pips), and GBP/USD (1.10 pips), providing good value for forex traders.

| Broker | EUR/USD | USD/JPY | GBP/USD |

|---|---|---|---|

| City Index | 0.70 | 0.60 | 1.10 |

| OANDA | 0.92 | 1.20 | 0.90 |

| Pepperstone | 1.10 | 1.30 | 1.30 |

| Eightcap | 1.00 | 1.20 | 1.20 |

| CMC Markets | 1.30 | 1.30 | 1.50 |

| eToro | 1.00 | 1.00 | 2.00 |

| BlackBull Markets | 1.10 | 1.40 | 1.40 |

| Fusion Markets | 0.89 | 1.20 | 1.11 |

You can enjoy low spreads across 13,500+ markets, including 84 forex pairs, 4,500+ share CFDs, 27 commodities, and 18 indices. Overall, it’s a solid multi-asset broker.

After opening my account, I found that City Index gives you a solid choice of trading platforms, including its own City Index Web Trader, MetaTrader 4, and TradingView.

Excellent Trading Tools On City Index Web Trader

I think the City Index Web Trader provides excellent features that can help improve your trading. Performance Analytics monitors your trading activity and generates feedback highlighting your strengths and weaknesses.

For example, I like that the tool gives you the best times of day to trade based on your history. It also tells you which assets you perform best with. As someone who likes to day trade, I really appreciated the automation – it helped me review and take action much faster.

Another way City Index can support you as a trader is through its Trading Central integration. This generates professional market analysis across forex, commodities, and indices. I like how Trading Central uses multiple technical indicators to find trading ideas using a variety of indicators, like chart and candlestick patterns.

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

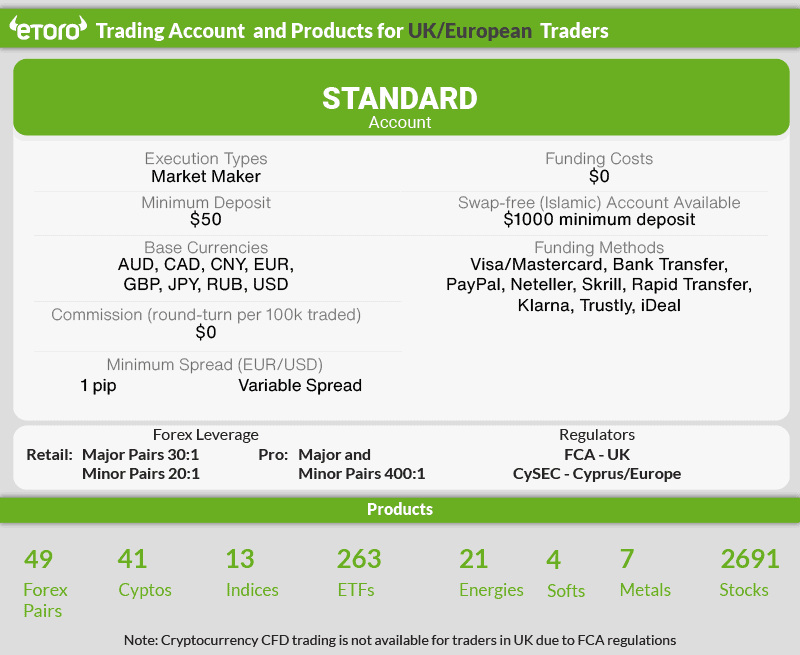

7. eToro - Great Spreads For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

For copy trading, I rated eToro as the best broker thanks to its excellent CopyTrader platform. This software simplifies social trading by automating the process and providing risk management tools. I found the broker doesn’t charge commission on its trades, making all the trading fees the same – regardless of the asset.

eToro’s spreads are only average compared to the wider industry, offering the EUR/USD from 1 pip. However, narrowing this down to copy trading platforms only, I found eToro was the cheapest in my testing. You can also copy trade on a large range of 7,000+ CFDs – one of the largest for mirror trading.

Pros & Cons

- Low spreads for copy trading

- No commissions when trading

- Large choice of markets to copy trade on

- Can only copy trade using CopyTrader

- Has withdrawal fees

- Does not offer ECN/STP accounts

Broker Details

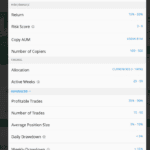

CopyTrader Is The Best Copy Trading Platform

I think eToro is the best platform when it comes to copy trading. The broker has simplified the whole process of finding and investing with a copy trader, and I could execute trades in just a few clicks.

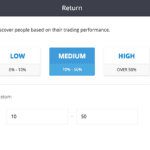

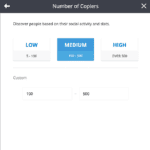

The broker makes analysing a trader’s performance easy, with accurate data updated daily. This includes running PnL, trading history, and risk score.

The risk score is eToro’s proprietary score based on a trader’s risk patterns, like trade frequency, losses, and assets traded. I think this is a great “catch-all” metric, andI personally like to use the follower growth tool. This lets me see if a trader is gaining or losing followers – a good real-time indicator of a trader’s performance.

I also picked eToro as the most transparent copy trading service. It provides both the broker and the platform, so eToro can track all trades and bar any fraudulent copy traders.

No-commission Trading Accounts

My tests confirmed that eToro offers no-commission trading on all of its 7,000+ assets, including shares. Everything is spread-only, which I think is a great idea for copy trading. I found that eToro’s EUR/USD and USD/JPY spreads average 1 pip, lower than the industry average.

This is achieved because eToro acts as both a platform and a broker, so it doesn’t share its revenue with third parties and offers tighter spreads. Other brokers who offer copy trading use 3rd-party services and share their revenue, which is why costs can be higher.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

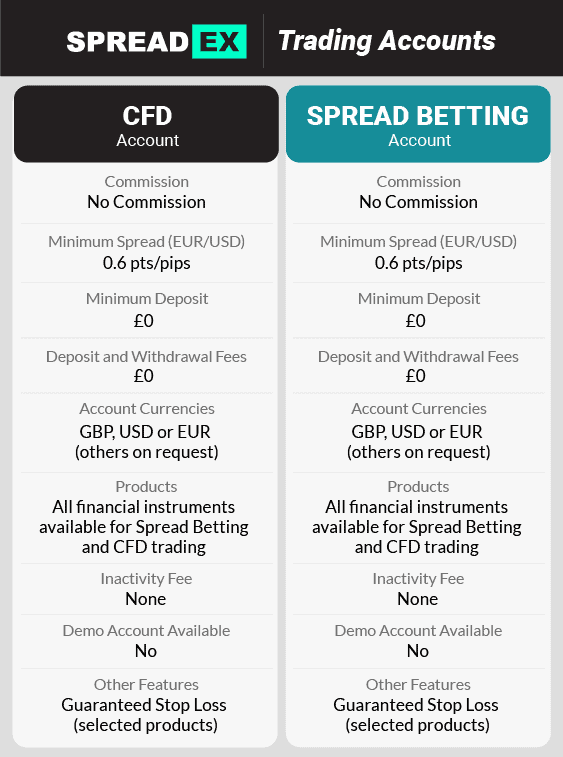

8. SpreadEx - Top Spread Betting from 0.8 points

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

TradingView, SpreadEX Trading Platform

Minimum Deposit

$0

Why We Recommend Spreadex

I awarded Spreadex 96/100 in my tests as the broker provides excellent financial spread betting conditions. Its low spreads start from just 0.80 pips. This means you benefit from spread betting tax-free exemption with low-cost trading across its 10,000 markets, making it a top broker for spread betting in my opinion.

The trading platform from Spreadex is decent. It’s got advanced charting tools with Pro Real Trend and Pattern Recognition tools, both of which are great for automating your technical analysis.

We offer a full list of the best UK spread bet platforms on our sister website Spread-Bet.co.uk.

Pros & Cons

- Tight spreads for spread betting

- Excellent trading platform with decent trading tools

- No minimum deposit

- Doesn’t support algorithmic trading

- Customer support is not 24/5

- No demo account is available

Broker Details

Tight Spreads For Spread Betting

Spread betting in the UK is a popular alternative to CFD trading thanks to its tax exemption on capital gains tax. During my time using Spreadex, I found the broker averaged 0.80 pips on its EUR/USD – one of the lowest for spread betting brokers.

| Brokers with Spread Betting | Average Spreads on EUR/USD |

|---|---|

| SpreadEx | 0.80 |

| Pepperstone | 0.80 |

| OANDA | 1 |

| CMC Markets | 1.3 |

| AvaTrade | 0.90 |

| City Index | 1.1 |

You can see in the table above that Spreadex’s spreads are competitive with CFD broker spreads. This is impressive as other brokers tend to widen their spread betting spreads.

Advanced Charting With Spreadex

I’m a fan of Spreadex’s trading platform. Its advanced charts offer 35+ trading indicators, with advanced tools to help automate your technical analysis. I like the platform’s Pro Trend lines tool, which automates trend lines or major and minor support and resistance levels. This helps you identify key breakout areas.

As a bonus, I found the platform has candlestick pattern recognition tools to alert you when specific candlesticks form, like the a hammer or engulfing pattern. I like that Spreadex provides multiple ways to assist your trading. Most day traders have had those moments when ideas just dry up, so these tools are great for inspiring you.

If you’d prefer to use a third-party platform, you’ve only got one option – TradingView. There’s no MT4 or MT5 here.

TradingView has more indicators than the 35 on the Spreadex platform, and also allows you to create custom indicators with its Pine Script language. If you’re an experienced trader, this is great for tailoring your strategy.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

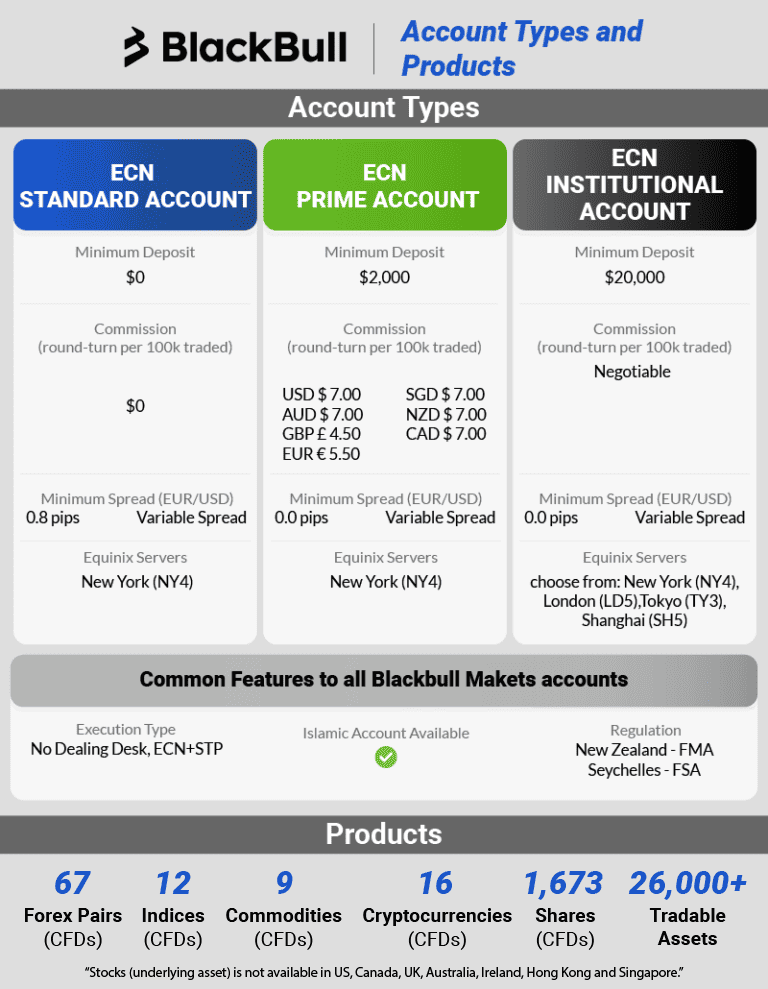

9. BlackBull Markets - High Leverage Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.1

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Market is not FCA regulated but has two unique features, which is why we have the broker on our UK list.

The first feature is the broker’s execution speed with the broker measured as a the fastest across both limit order and market order speeds. The respective speeds were 72 ms and 90 ms, respectively.

The second feature relates to the trading environment, which is ideal for scalping and automation. As the broker is regulated by the FMA in New Zealand (not the FCA) they can offer 500:1 leverage, and the trading fees are low. They also pay for your TradingView premium subscription if you’re an active trader – a really nice bonus in my view.

Pros & Cons

- Fast execution speeds from 77ms

- Decent spreads with ECN Prime account

- 24/7 client support

- Not FCA Regulated

- RAW Account has a minimum deposit

- Offers little market analysis research

Broker Details

BlackBull Markets Is The Fastest Forex Broker

My analyst, Ross Collins, tested the execution speeds of 36 brokers. He used the ExTest_ForExpat and Broker Latency Tester EAs to capture the average execution speeds for limit and market orders.

Ross found that BlackBull Markets is the fastest broker overall. It achieved an average limit order speed of 72 ms, and hit 90 ms for market order speed. Fast brokers like BlackBull Markets provide excellent trading conditions as you are less likely to suffer slippage and requotes, which can negatively impact your performance.

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 |

| Pepperstone | 3 | 2 | 77 | 10 | 100 |

| OANDA | 4 | 5 | 86 | 2 | 84 |

| Octa | 5 | 4 | 81 | 6 | 91 |

| Exness | 6 | 10 | 92 | 3 | 88 |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 |

| FOREX.com | 8 | 13 | 98 | 4 | 88 |

| Global Prime | 9 | 7 | 88 | 9 | 98 |

| Tickmill | 10 | 9 | 91 | 11 | 112 |

| TMGM | 11 | 11 | 94 | 13 | 129 |

| City Index | 12 | 12 | 95 | 14 | 131 |

BlackBull Markets Trading Costs

BlackBull Markets offers three trading accounts. The Standard account is spread-only, with spreads from 0.80 pips and no commissions. The ECN Prime features spreads from 0.10 pips and $3.00 commission for every lot traded.

To get the tightest spreads on BlackBull Markets, you have to deposit $20,000 and access the ECN Institutional account. If feel this is going to be out of the question for most retail traders, but if you can fund the account, it can be worth it. You get 0.0 pip spreads and $2.00 per lot traded commissions.

For my tests, I used the ECN Prime account. The spreads on this account fluctuated between 0.10 and 0.20 pips during the London trading session, which is pretty competitive. These spreads, combined with the fast execution speeds, make the ECN Prime account a solid option if you scalp the markets.

Free TradingView Premium

Another highlight for me is that BlackBull Markets will pay for your TradingView subscription as long as you are an active trader.

Interestingly, I found you don’t even need to be trading that much to qualify for this. You can qualify for the Essential tier with just 1 lot traded per month. Or, you can get full Premium for 10 lots p/m – giving you easy access to the top TradingView packages.

10. Fusion Markets - Best RAW Account Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.14

GBP/USD = 0.39

AUD/USD = 0.14

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

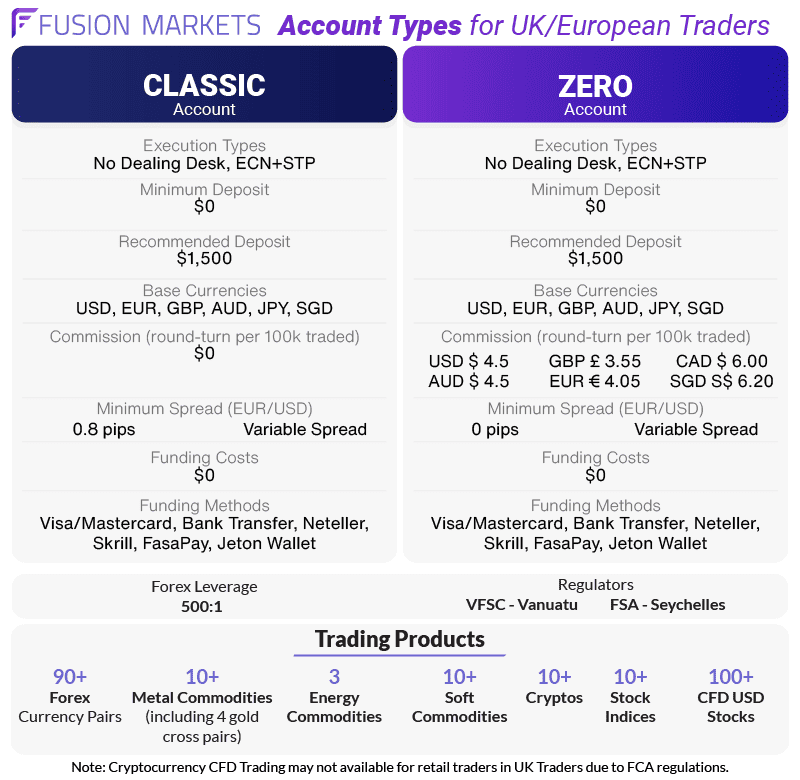

Fusion Markets is not FCA regulated but worldwide does offer the lowest commission rate so we included it on the list.

Their commission rate is USD $2.25 (approximately £1.67) which lower then the next cheapest broker (Go Markets) at £2.00. The broker offers 200+ markets, trading platforms like TradingView and MT5 and advanced charting and automation tools.

Pros & Cons

- Wide range of trading tools

- Tightest spreads with the Zero account

- Low trading commissions

- Not FCA Regulated

- Only offers US share CFDs

- Not the widest choice of markets

Broker Details

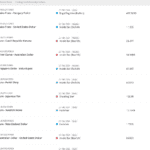

Lowest Trading Commissions

Something that really stood out to me was that Fusion Markets charged the lowest commissions we recorded. This is £1.78 per lot traded, saving you around 25% on the industry average of £2.44. This is a huge saving, especially if you are a high-frequency trader.

| Broker | USD | AUD | GBP |

|---|---|---|---|

| Fusion Markets | $2.25 | $2.25 | £1.78 |

| CMC Markets | $2.50 | $2.50 | £2.50 |

| Blackbull Markets | $3.00 | $4.50 | N/A |

| FP Markets | $3.00 | $3.50 | £2.25 |

| Pepperstone | $3.50 | $3.50 | £2.25 |

| EightCap | $3.50 | $3.50 | £2.25 |

| Axi | $3.50 | $3.50 | £2.25 |

| IC Markets | $3.50 | $3.50 | £2.50 |

| TMGM | $3.50 | $3.50 | N/A |

Excellent Choice Of Markets

Along with excellent trading costs, Fusion Markets gives you the choice of four platforms – MetaTrader 4, MT5, cTrader, and TradingView.

These are all top trading platforms, but I think cTrader pairs best with Fusion Markets, thanks to the platform’s 70 indicators, 26 timeframes, and 9+ chart types. I like the advanced tools like Depth-of-Market. This shows you the order books of the liquidity provider, helping you find hidden support and resistance levels and time your trades better.

Ask an Expert

Which broker here has the best mobile platform for scalping or quick trades?

I personally like Eightcap with the TradingView mobile app, which has access to one-click trading on the charts. As a bonus, your charts sync across the web and mobile app, so you’ll always have your technical analysis with you.